20 July 2023 Afternoon Session Analysis

UK inflation cooling down in June, Pound dropped.

Pound Sterling (GBP), which was widely traded by the global investors, plunged as the UK inflation for the month of June came at its slowest pace in over a year. According to Office for National Statistics, UK’s annual Consumer Price Index (CPI) stood at 7.9% in June, dropping from 8.7%, while also below the market forecast of 8.2%. Although the inflation remains high above the BoE 2% target, but it showed some sign that the inflation continued to ease amid the BoE’s aggressive monetary policy. The current UK inflation remains at a higher level due to high food prices and high wages paid. Therefore, the investors forecast that the BoE will more likely to hike 25 basis points (bps) interest rate, instead of a 50bps move in August. Besides that, the UK also released Producer Price Index (PPI) by Office for National Statistics stood at -1.3% from -1.2%, also below than market forecast -0.3%. This represented the change in the price of goods and raw materials purchased by manufacturers has decreased. With that, the prices of goods and services will likely to revert from its prior significant increasing pace. As of writing, GBP/USD has risen 0.12% to 1.2955.

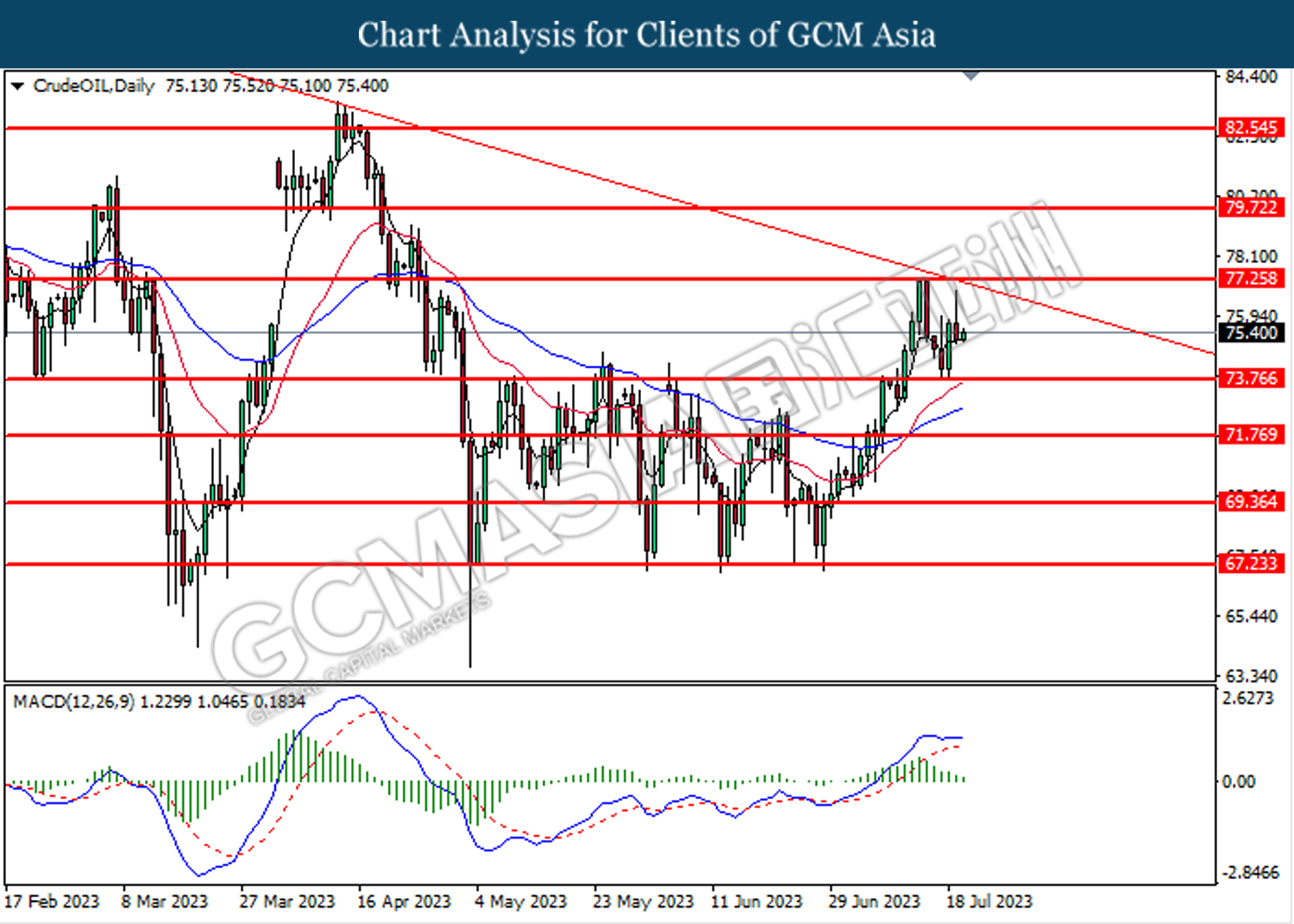

In the commodities market, crude oil prices rose by 0.12% to $75.38 per barrel due to Energy Information Administration’s (EIA) Crude Oil Inventories have reduced to -0.708 million from 5.946 million, although it was slightly above the market expectation of -2.440 million. Besides, gold prices rose 0.44% to $1985.44 per troy ounce as the expectation of a less hawkish Federal Reserve stance attracted some selling pressures toward the US dollar market and spurred the gold price.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 237k | 242k | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -13.7 | -10.4 | – |

| 20:30 | USD – Existing Home Sales (Jun) | 4.3M | 4.21M | – |

Technical Analysis

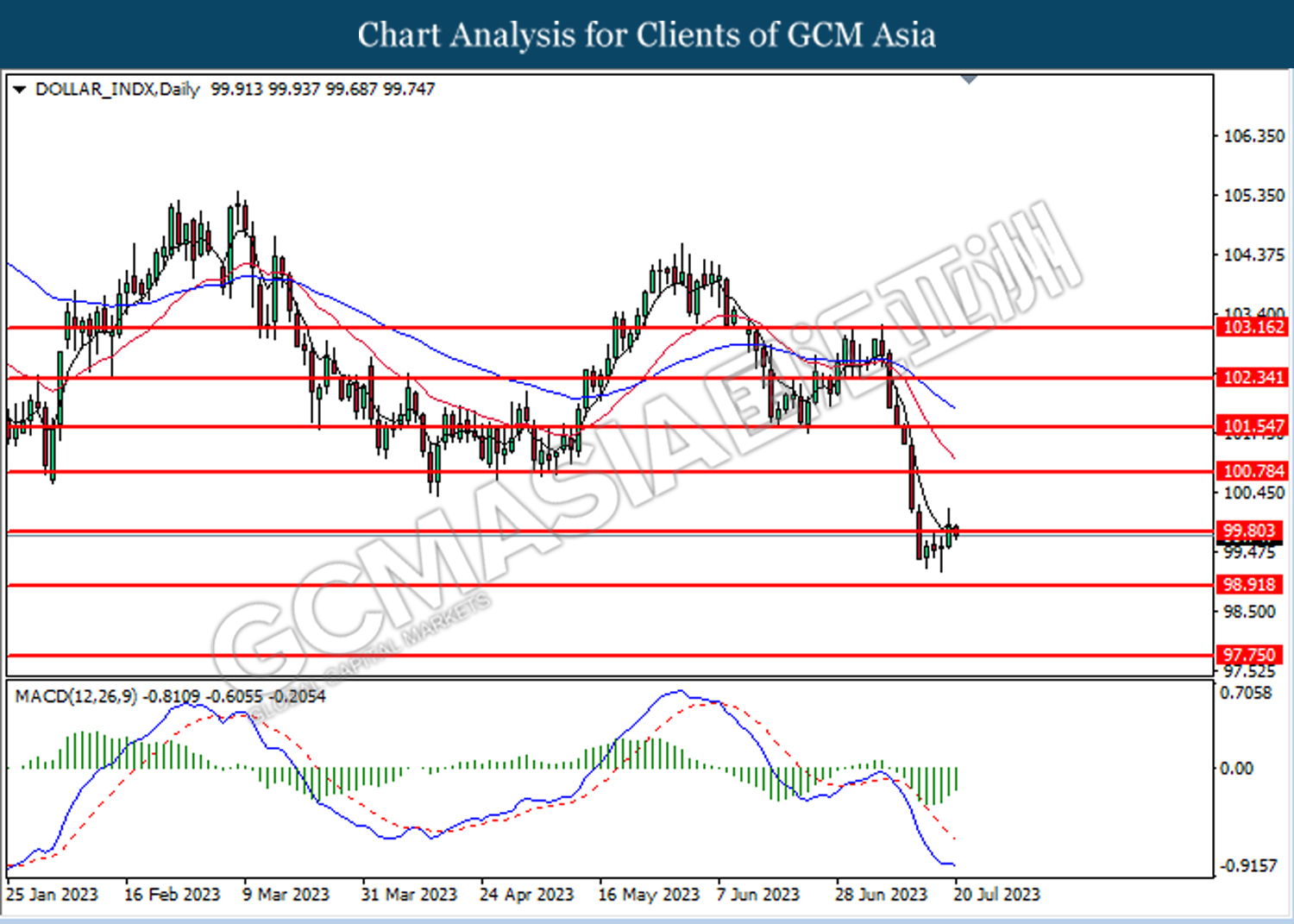

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior while testing the resistance level at 99.80. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains if breakout the resistance level.

Resistance level: 99.80, 100.80

Support level: 98.90, 97.75

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.3000. MACD which illustrated diminishing bullish momentum suggest the pair to extend it losses toward the support level at 1.2835.

Resistance level: 1.3000, 1.3180

Support level: 1.2835, 1.2540

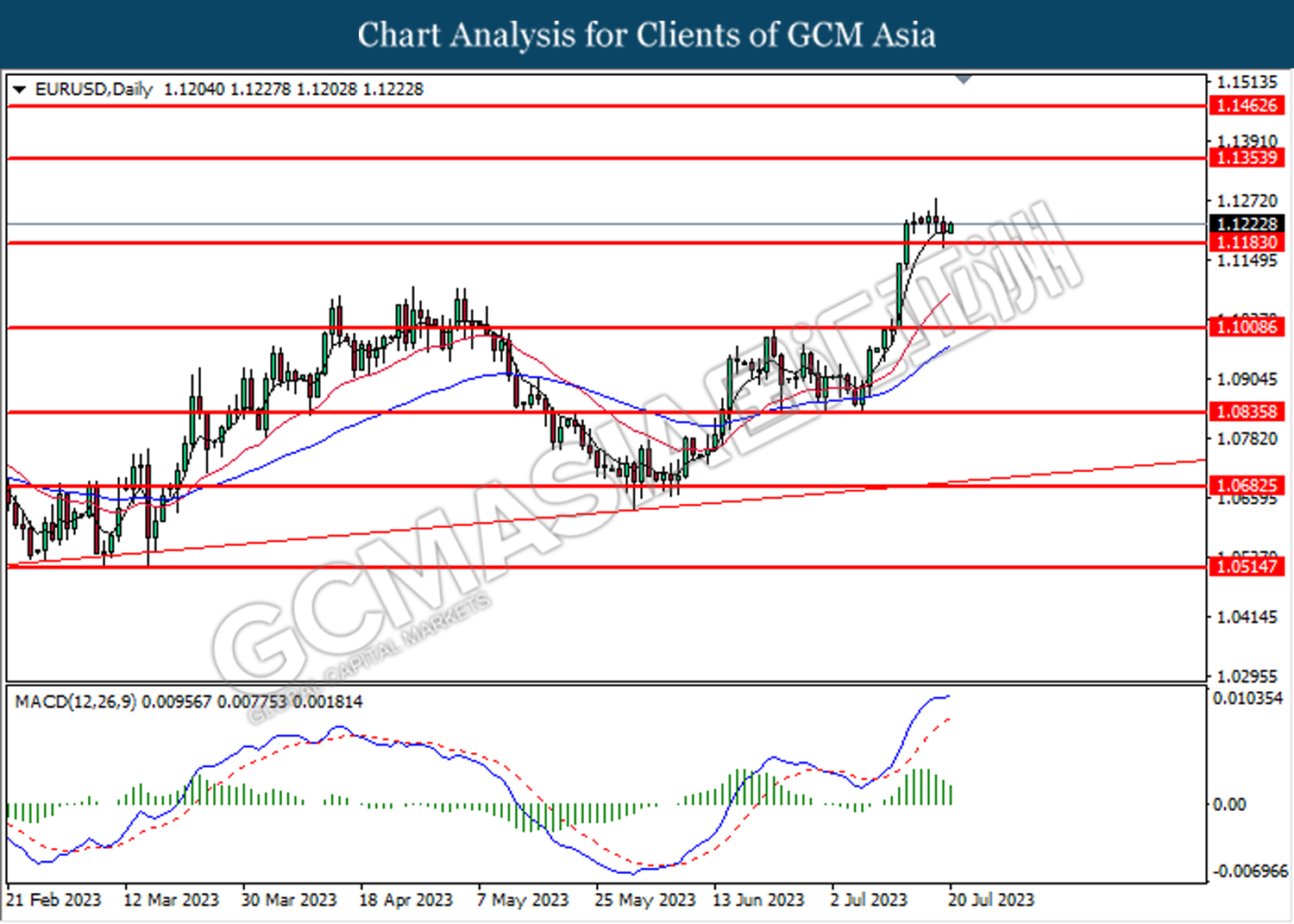

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.1185. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1355, 1.1460

Support level: 1.1185, 1.1010

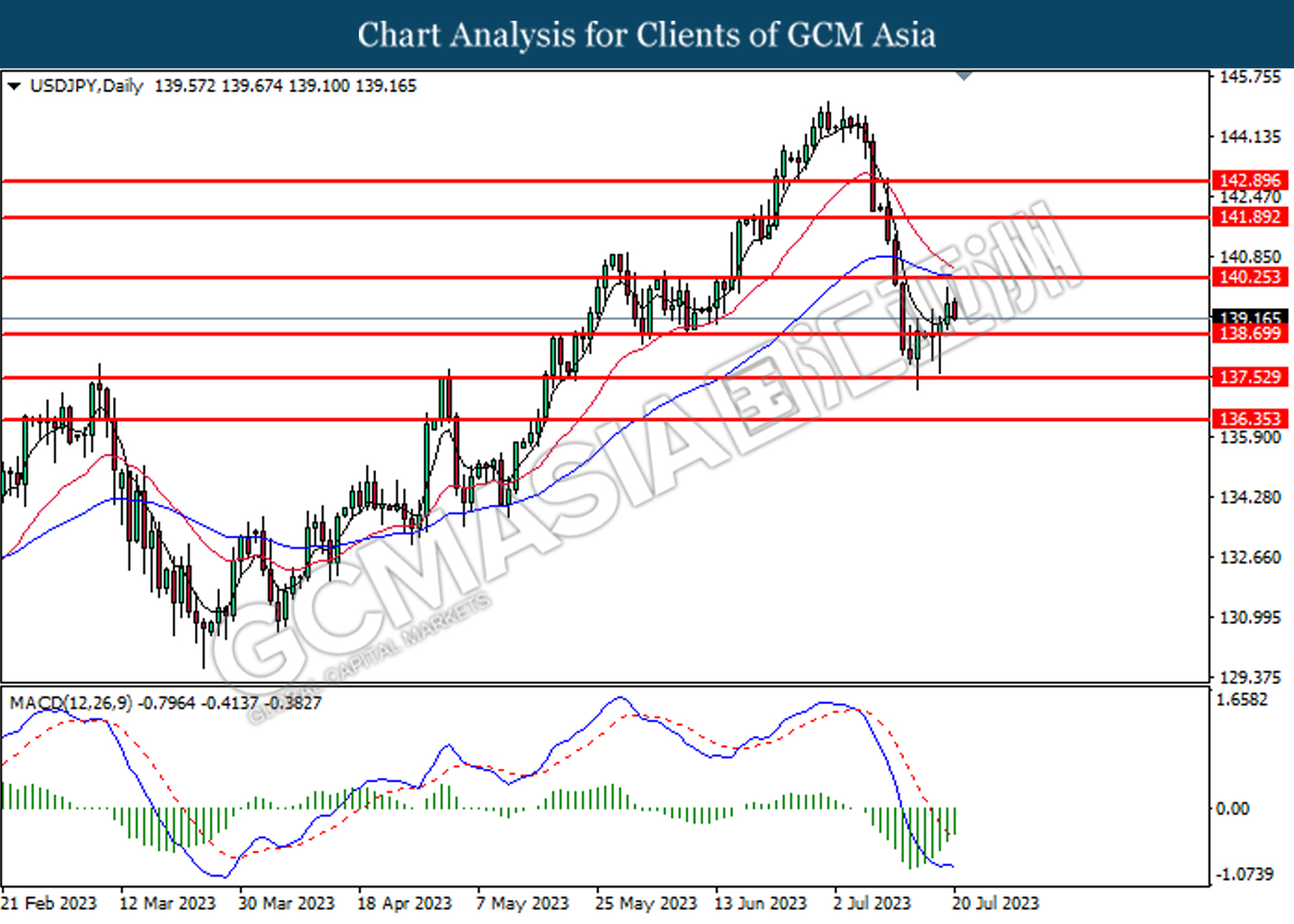

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 138.70. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 140.25.

Resistance level: 140.25, 141.90

Support level: 138.70, 137.50

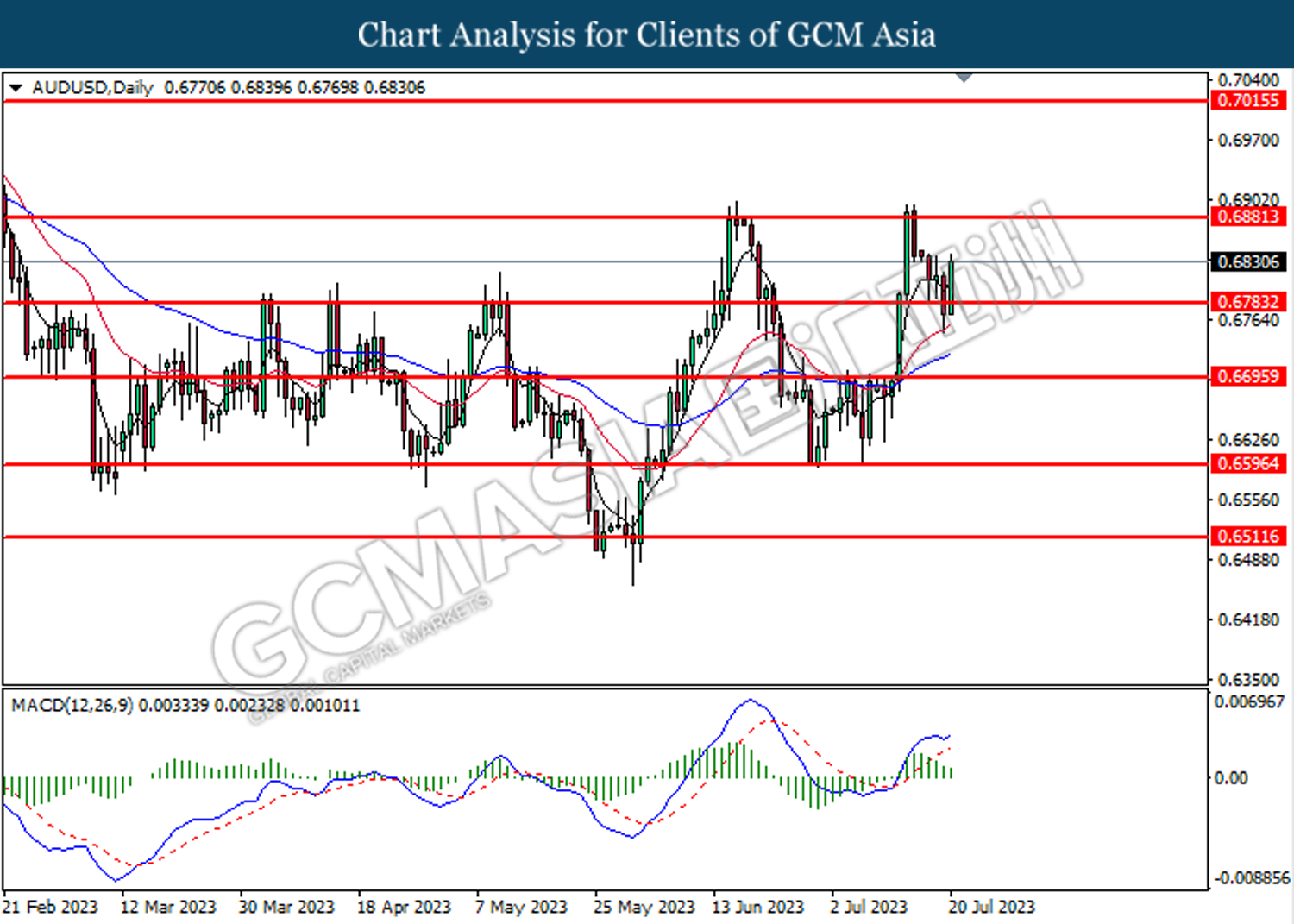

AUDUSD, Daily: AUDUSD was traded lower following the prior while testing the support level at 0.6785. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it breakout the support level.

Resistance level: 0.6880, 0.7015

Support level: 0.6785, 0.6600

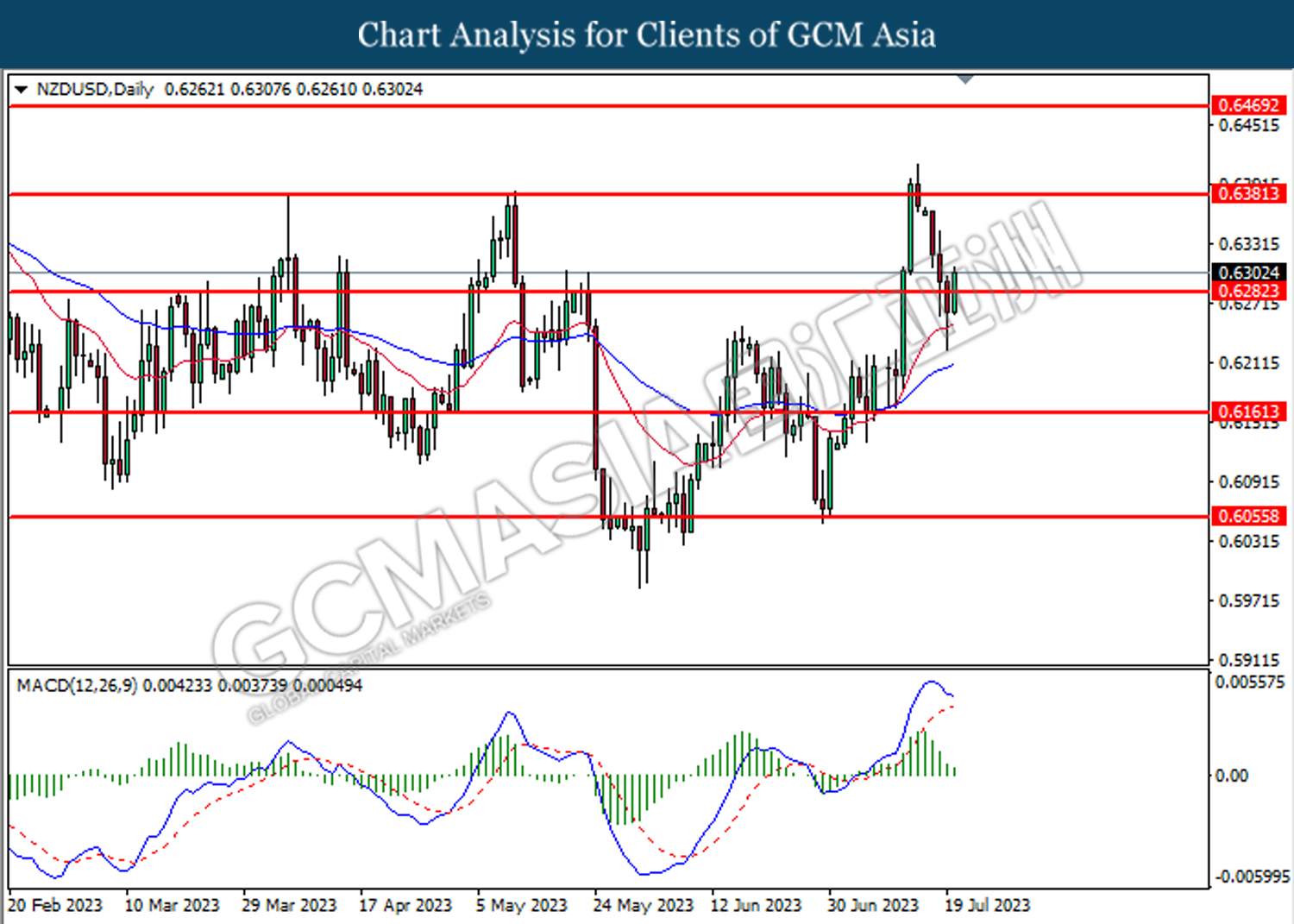

NZDUSD, Daily: NZDUSD was traded lower following the prior while testing the support level at 0.6280. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it breakout the support level.

Resistance level: 0.6380, 0.6470

Support level: 0.6280, 0.6160

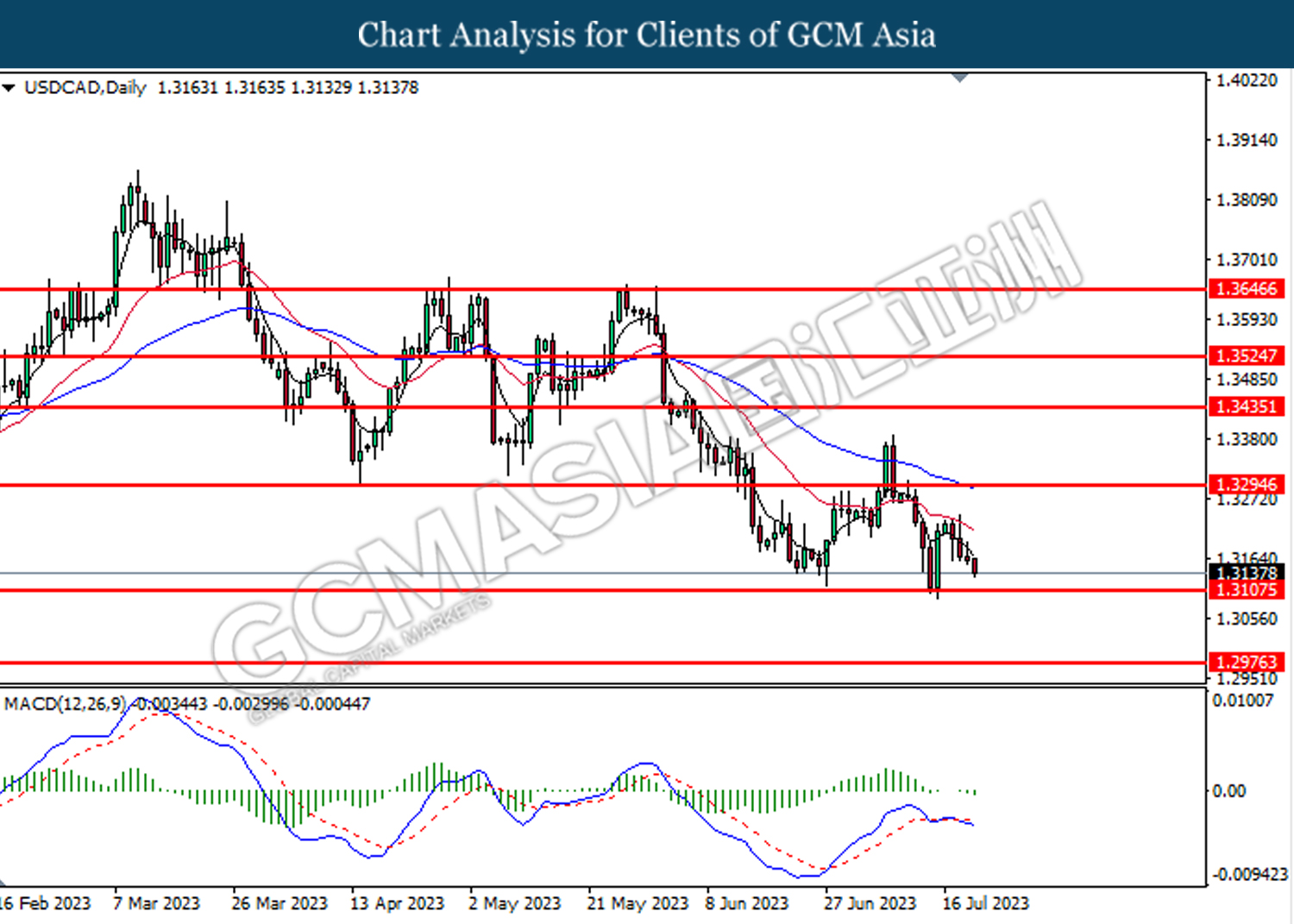

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3110

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

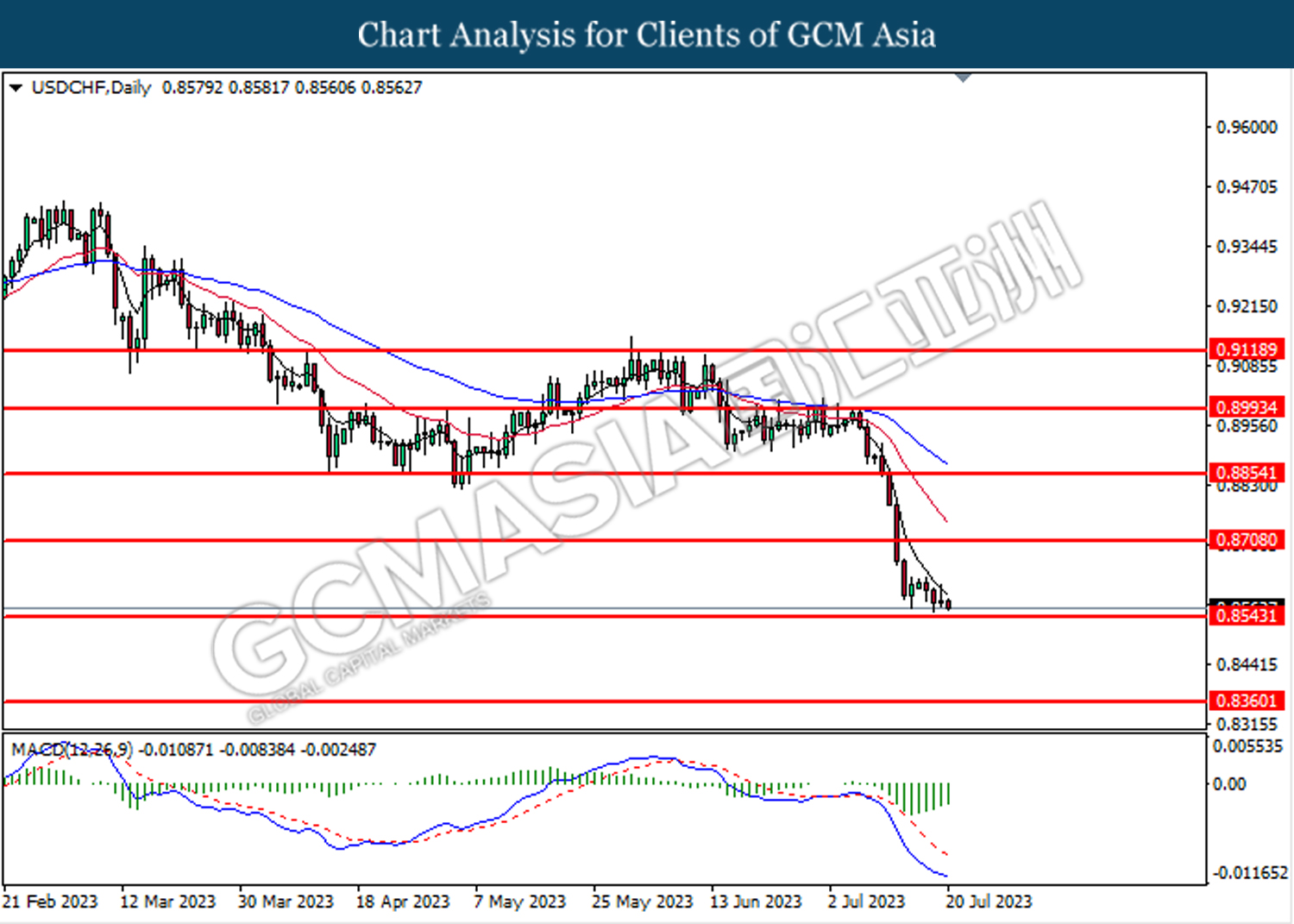

USDCHF, Daily: USDCHF was traded lower following the prior while testing the support level at 0.8545. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 73.75. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 77.25, 79.70

Support level: 73.75, 71.80

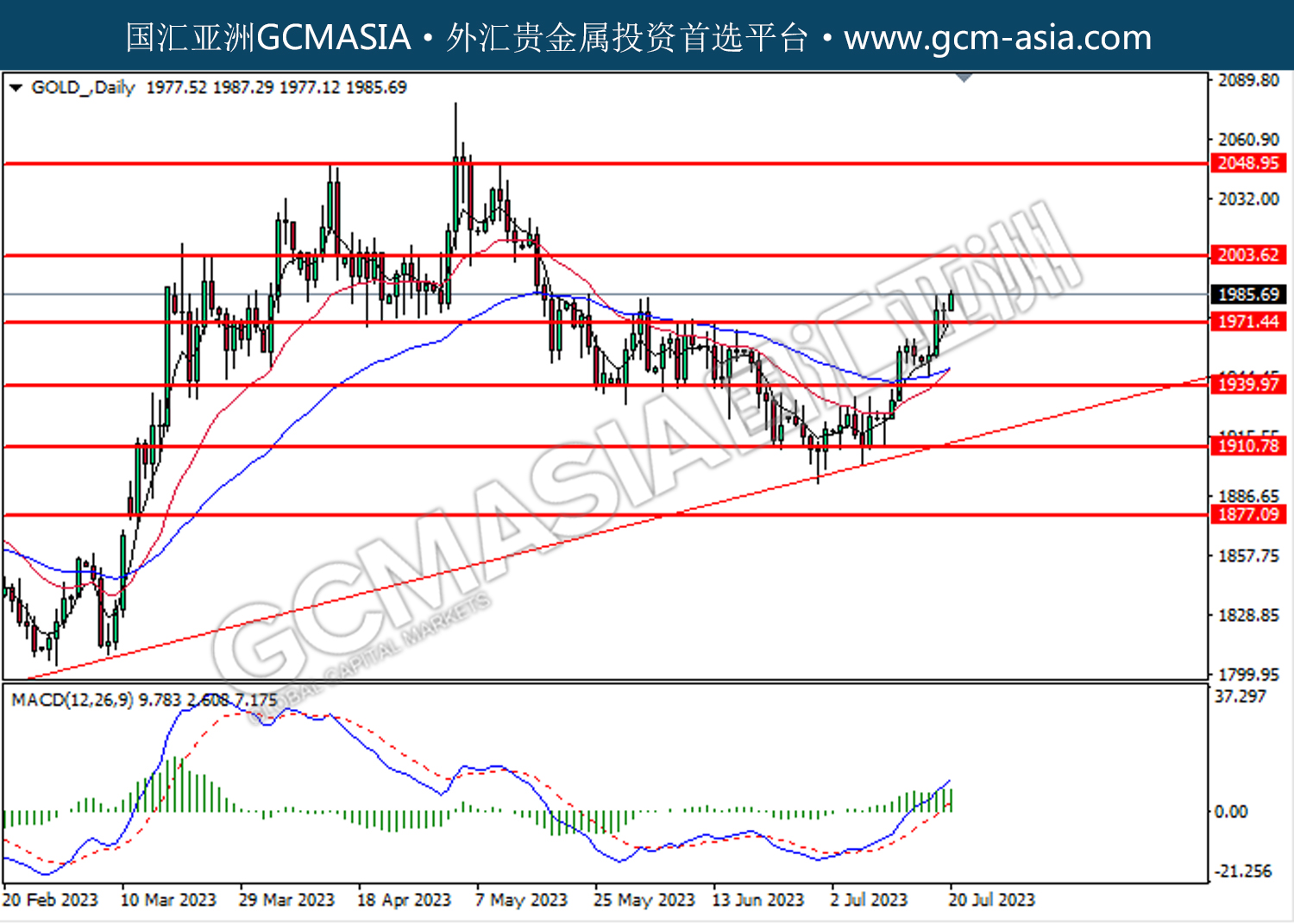

GOLD_, Daily: Gold price was traded higher following the prior breakout from the previous resistance level at 1971.40. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 2003.60.

Resistance level: 2003.60, 2048.95

Support level: 1971.40, 1940.00