20 July 2023 Morning Session Analysis

Dollar index steady as UK & EU CPI data release.

The dollar index, which traded against a basket of six major currencies, steadied near 100.00 after hitting its lowest ground from the 15-month low. Before that, the dollar index rebounded after the release of the US retail sales data for June. The figure is down to 0.2% from 0.5% after the prior month’s reading adjusted from 0.3%, while the economist polled by Reuters expected the reading to rise to 0.5%. Meanwhile, the core retail sales in June remain solid by growing to 0.2% in June, slightly lower than 0.3% in the prior month’s reading. Although the reading is downbeat the market expectations after the prior month revised higher, it still suggesting US consumers continued to show resilience conditions. Nonetheless, retail sales data in June did not change the expectations that the Fed would raise the interest rate by 25 bp at the end of July. Besides, the greenback extended its gains after the UK Consumer Price Index (CPI) showed some cooling in price pressure after the figure fell more than expected, and the GBP shrank afterwards. Following that, the gains of the dollar index were limited after the Europe zone Core CPI remained elevated and EUR strengthened. As of writing, the dollar index ticked up by 0.34% to 100.30.

In the commodities market, crude oil prices slipped by -0.16% to $75.19 per barrel as US crude inventories fell by -0.708M less than expected of -2.440M. On the other hand, the gold price rally cools and edged up by 0.01% to 1977.15 as investors await whether the Fed was close to endings its tightening cycle.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 237K | 242K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -13.7 | -10.4 | – |

| 22:00 | USD – Existing Home Sales (Jun) | 4.30M | 4.23M | – |

Technical Analysis

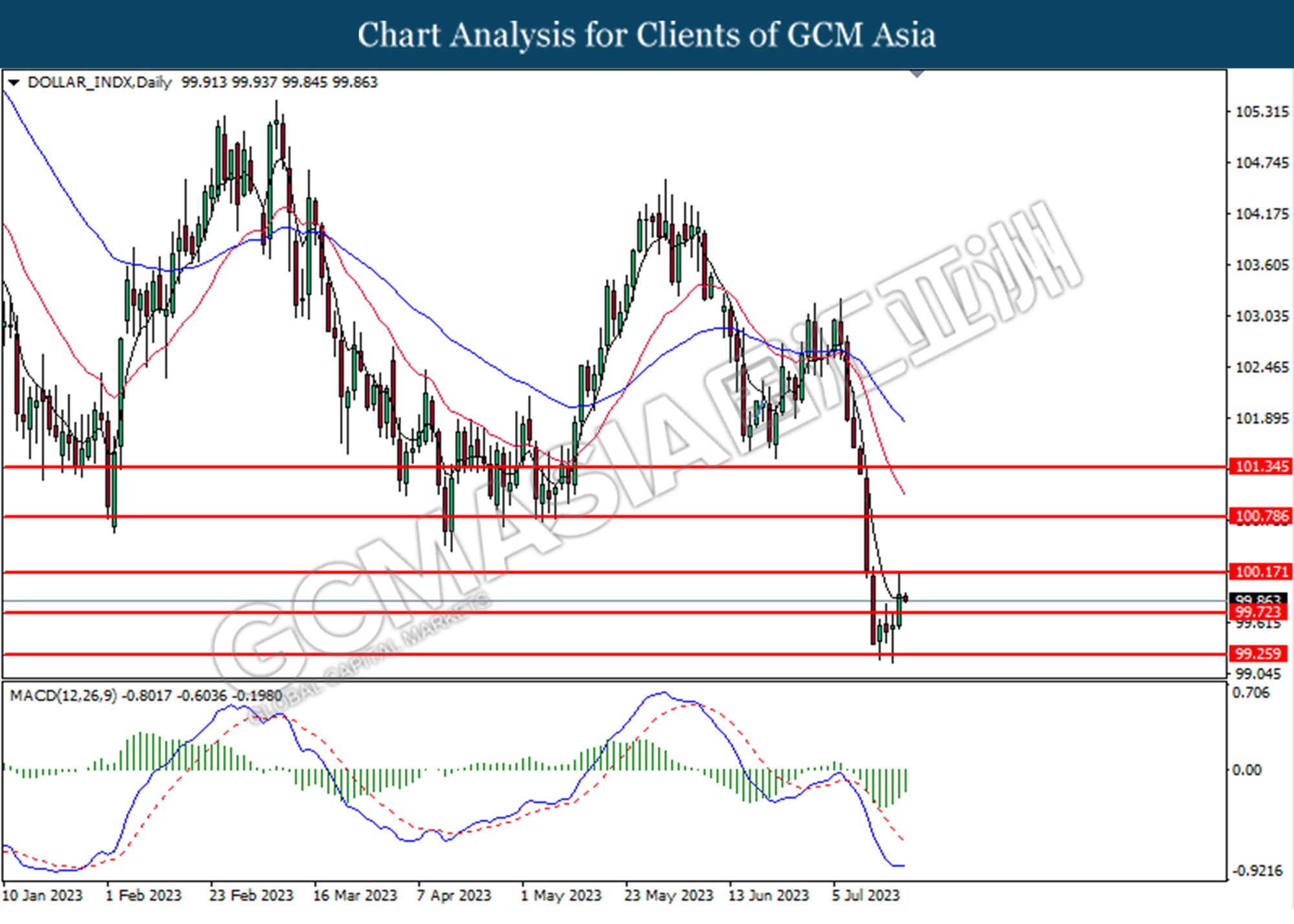

DOLLAR_INDX, DAILY: Dollar index was traded higher following the prior breaks above from the resistance level at 99.70. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 100.20.

Resistance level: 100.20, 100.80

Support level: 99.70, 99.25

GBPUSD, DAILY: GBPUSD was traded lower following the prior breaks below the previous resistance level at 1.2990. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 1.2830.

Resistance level: 1.2990, 1.3210

Support level: 1.2830, 1.2610

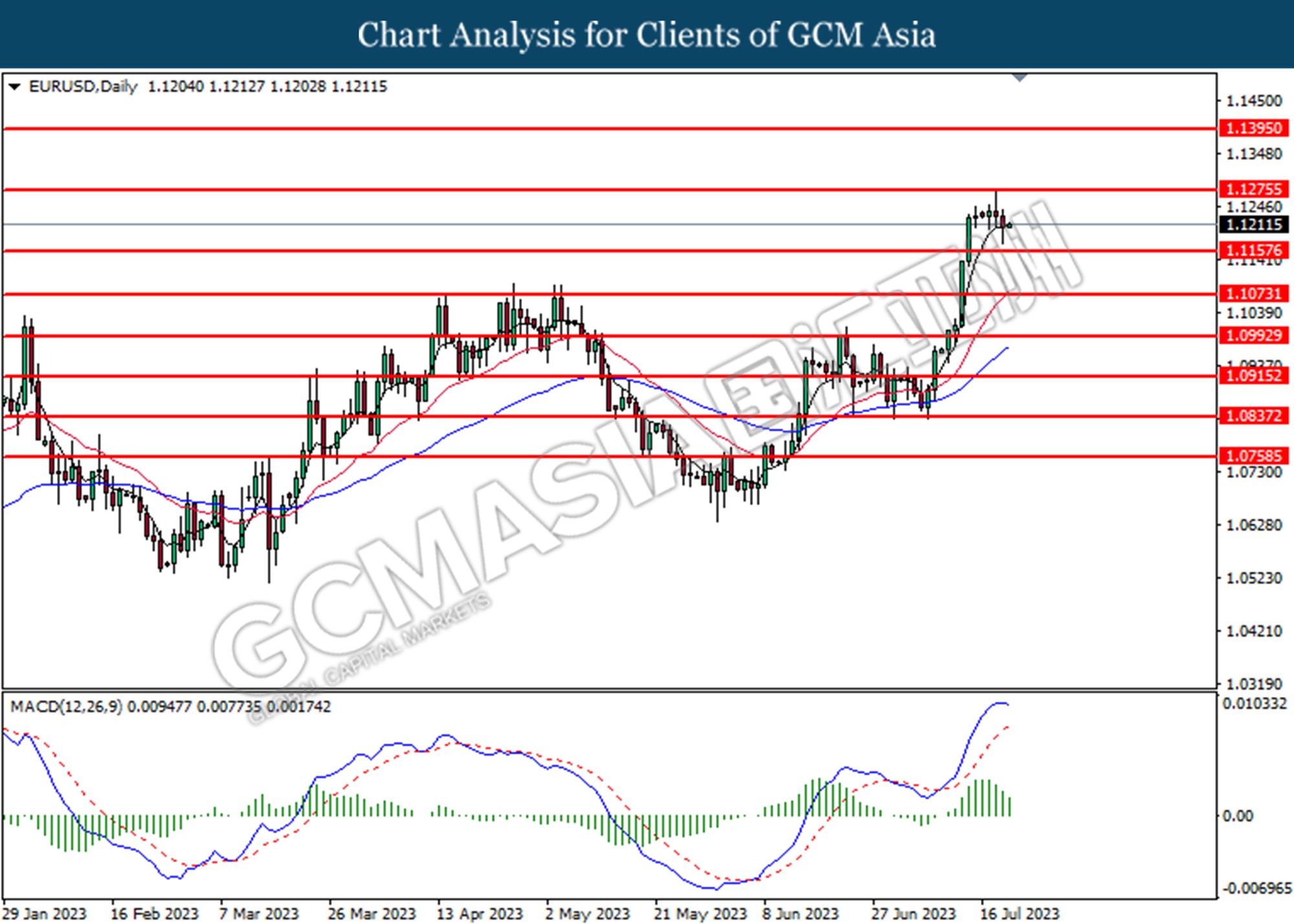

EURUSD, DAILY: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 1.1160.

Resistance level: 1.1275, 1.1395

Support level: 1.1160, 1.1075

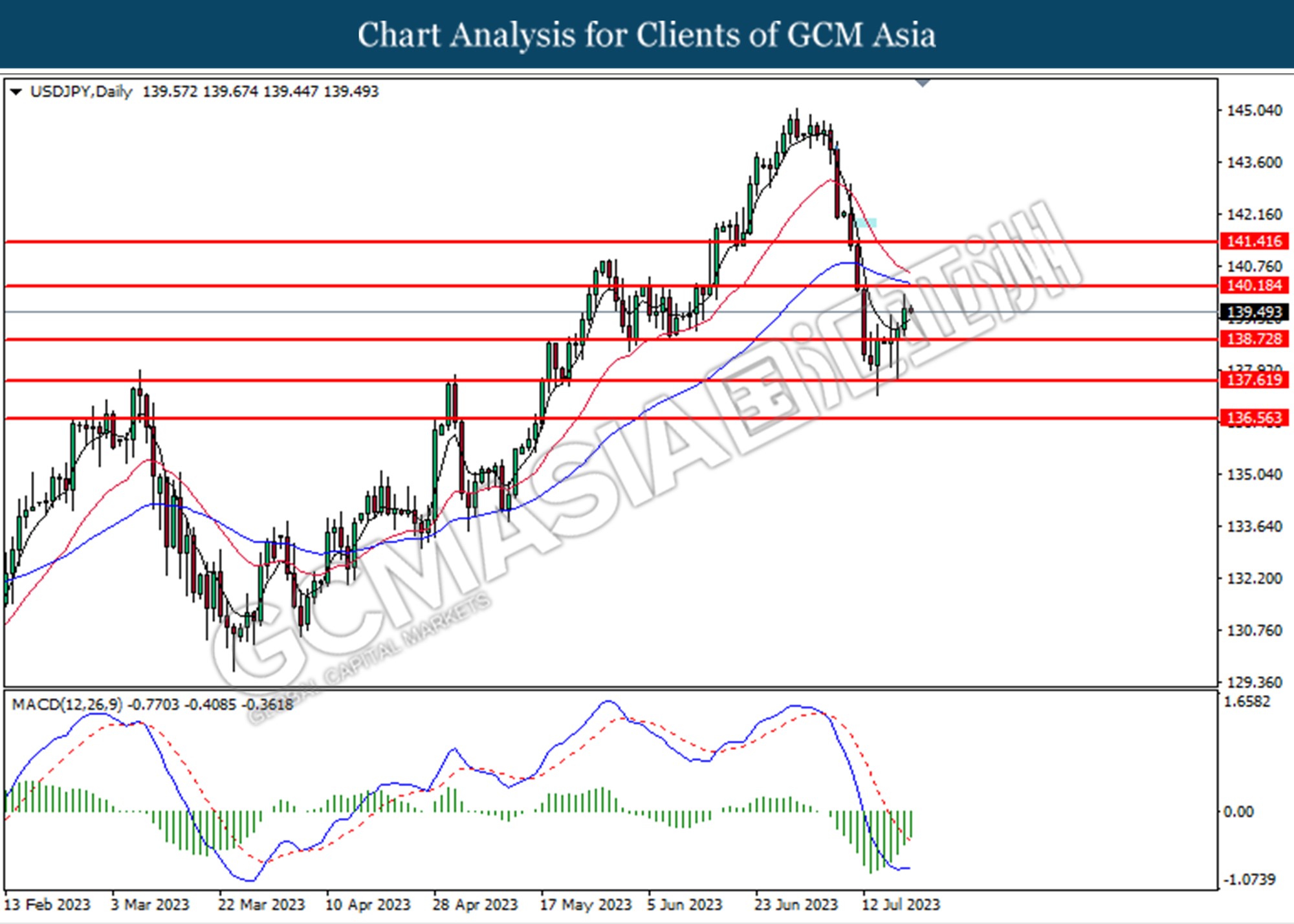

USDJPY, DAILY: USDJPY was traded higher following the prior rebound from the support level at 138.70. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 138.70

Resistance level: 138.70, 140.20

Support level: 137.60, 136.55

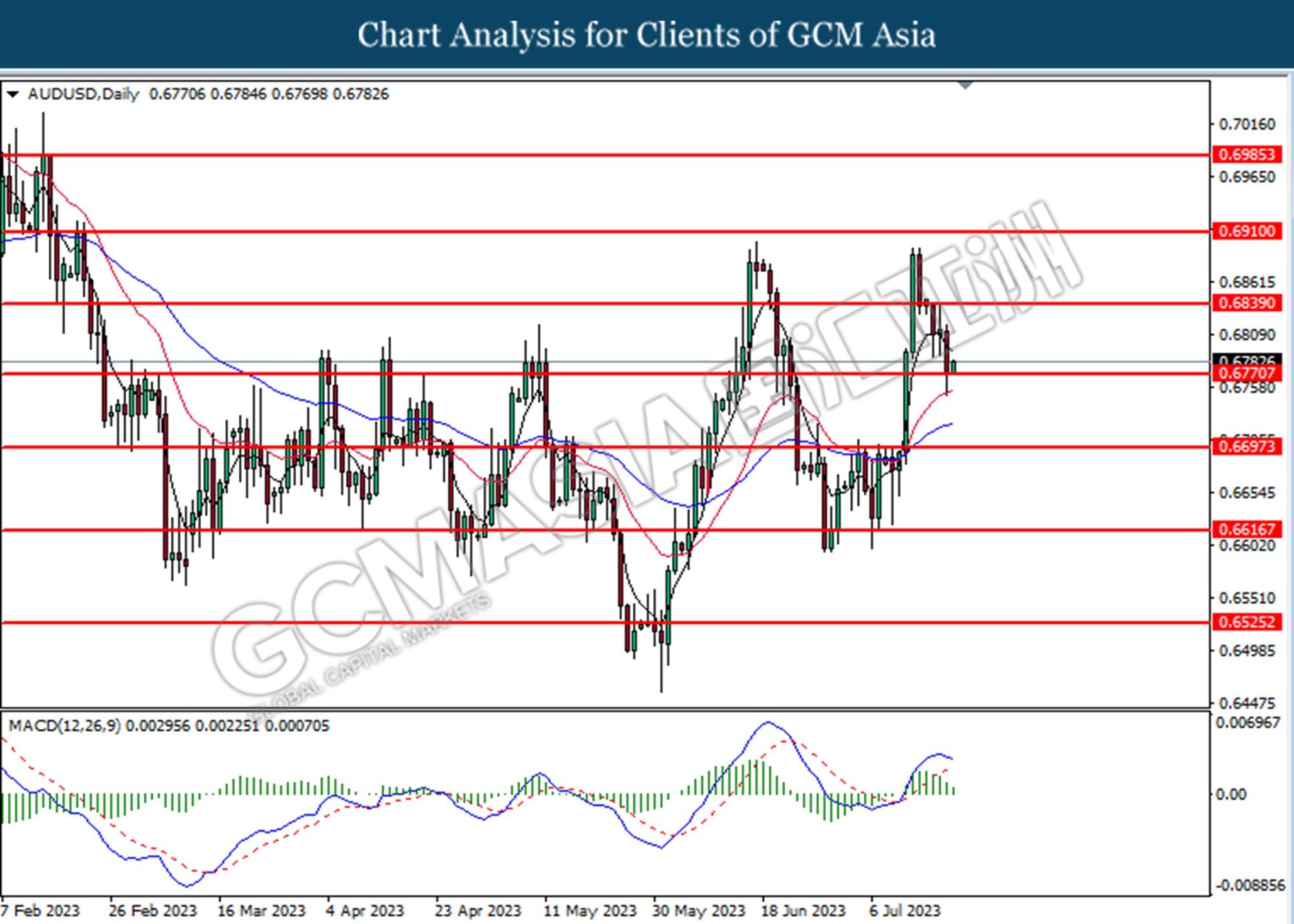

AUDUSD, DAILY: AUDUSD was traded higher following the rebound from the support level at 0.6770. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

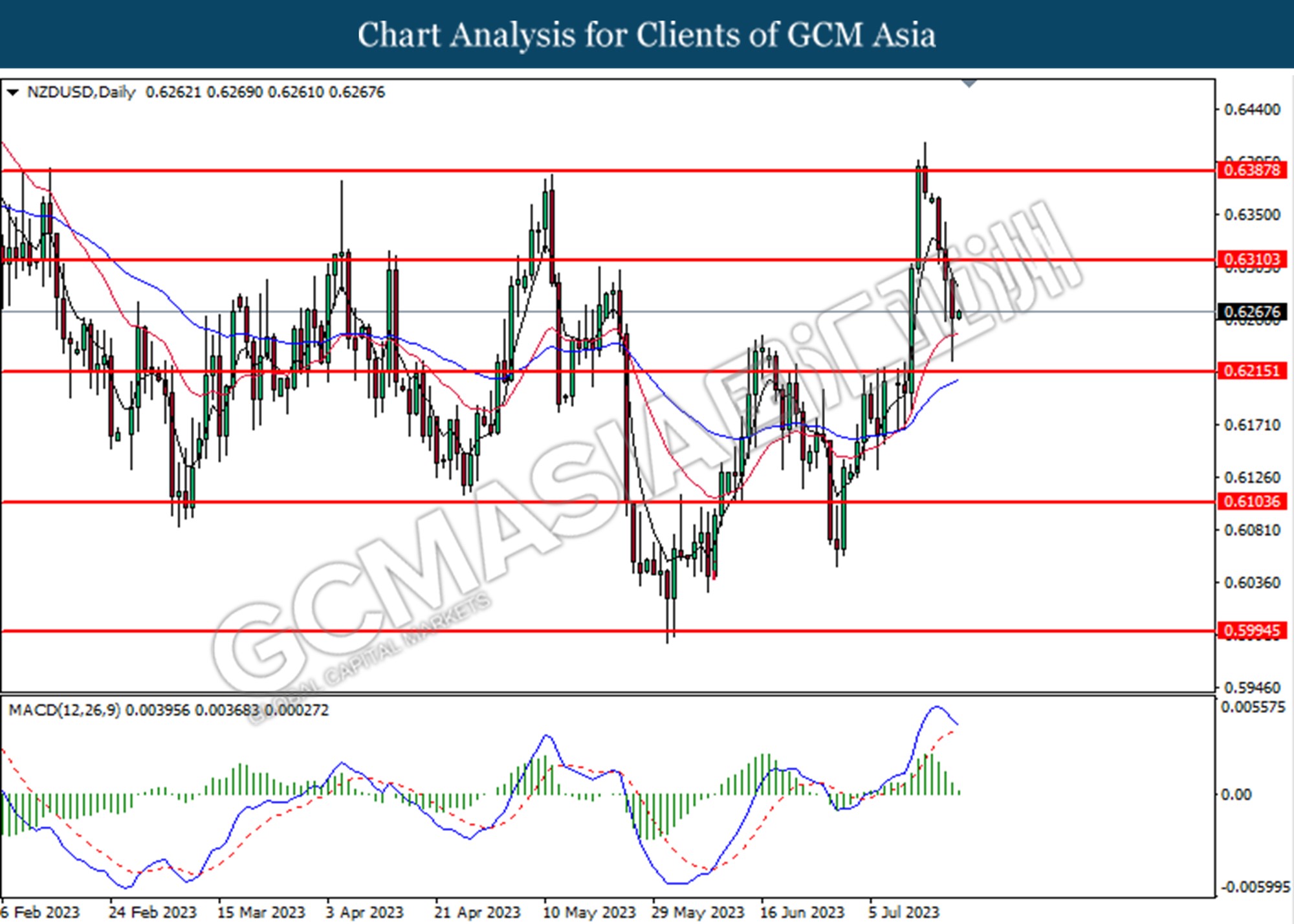

NZDUSD, DAILY: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6215.

Resistance level: 0.6310, 0.6390

Support level: 0.6215, 0.6105

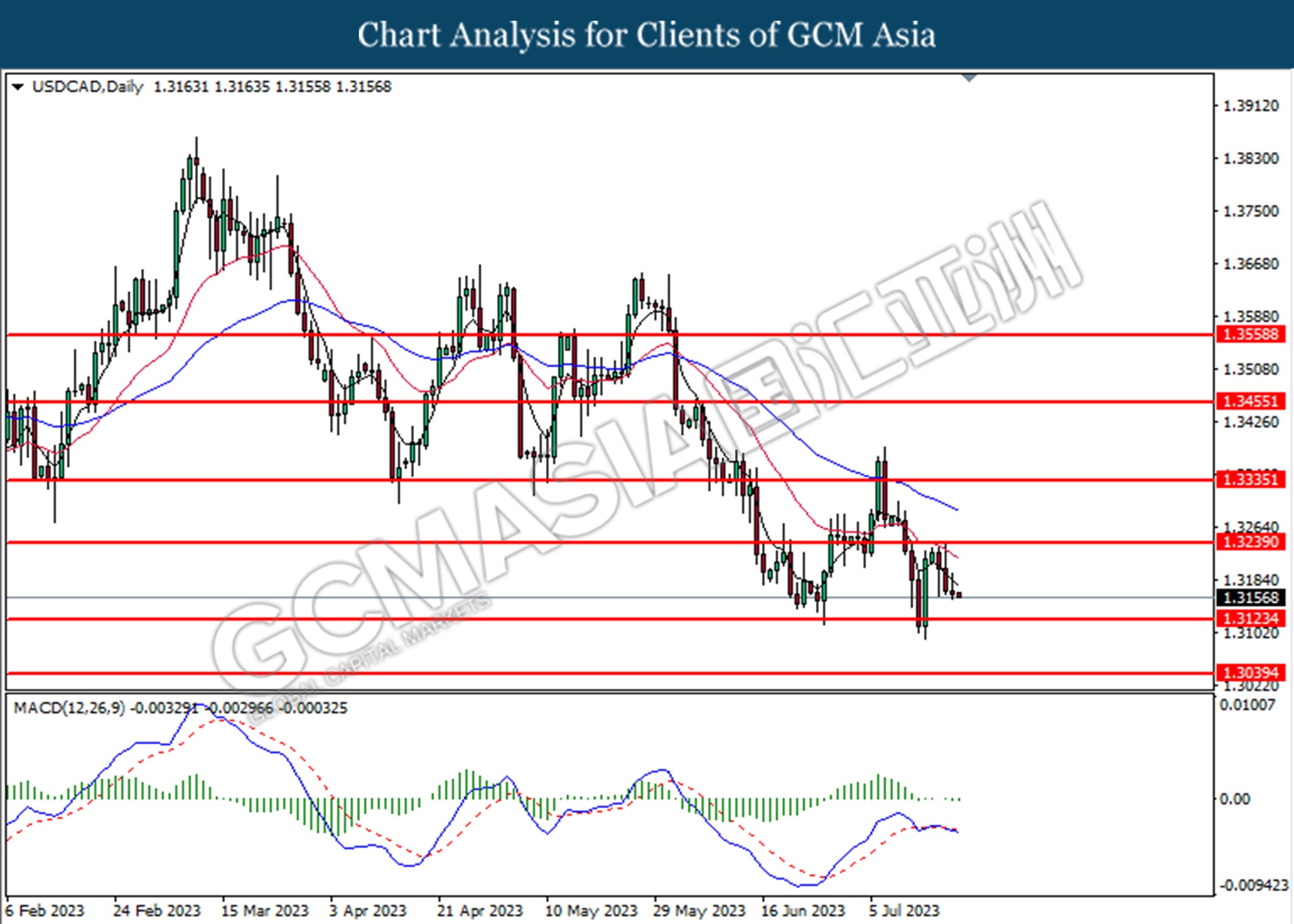

USDCAD, DAILY: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 1.3125.

Resistance level: 1.3240, 1.3335

Support level: 1.3125, 1.3040

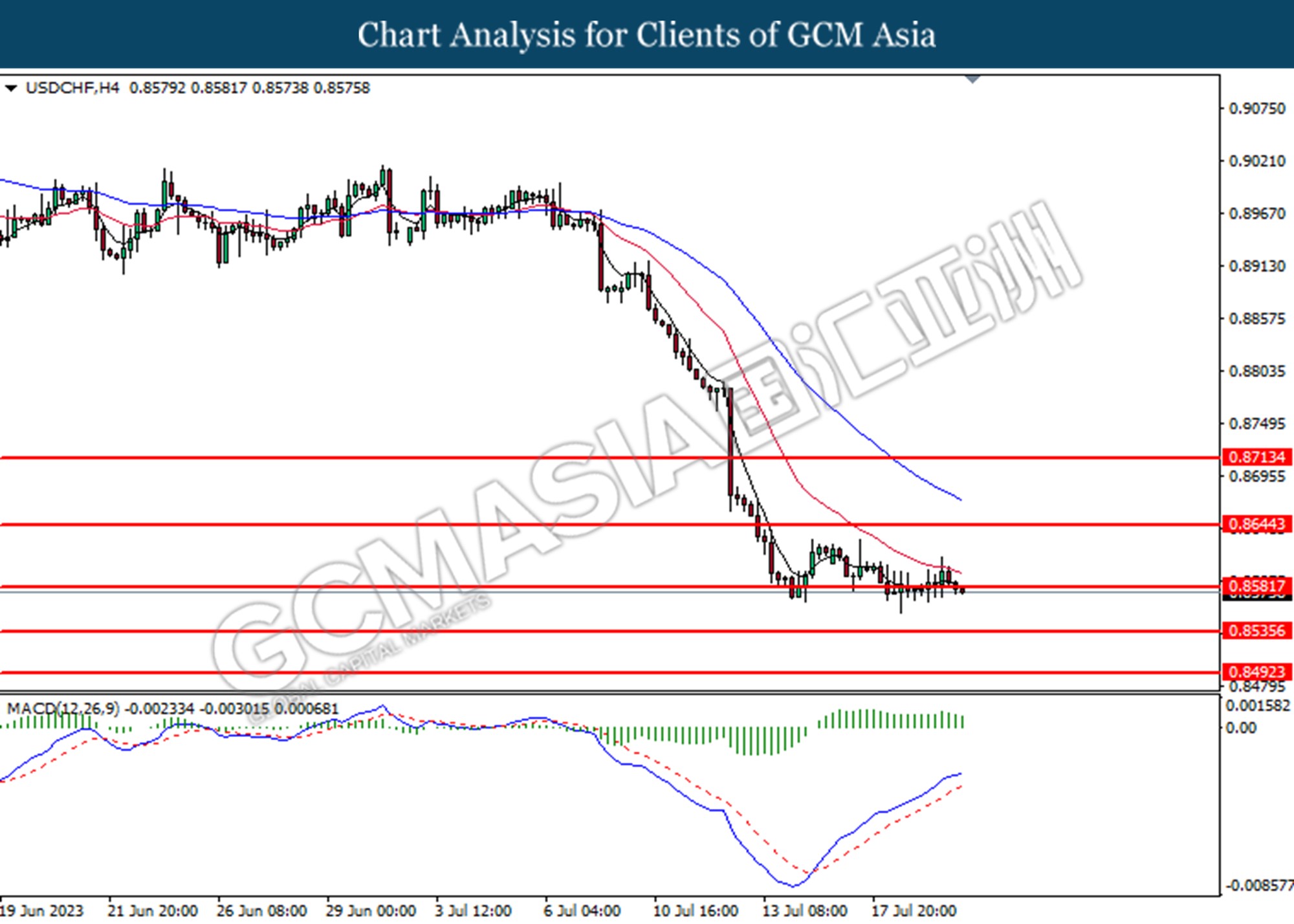

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8580. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8580, 0.8645

Support level: 0.8535, 0.8490

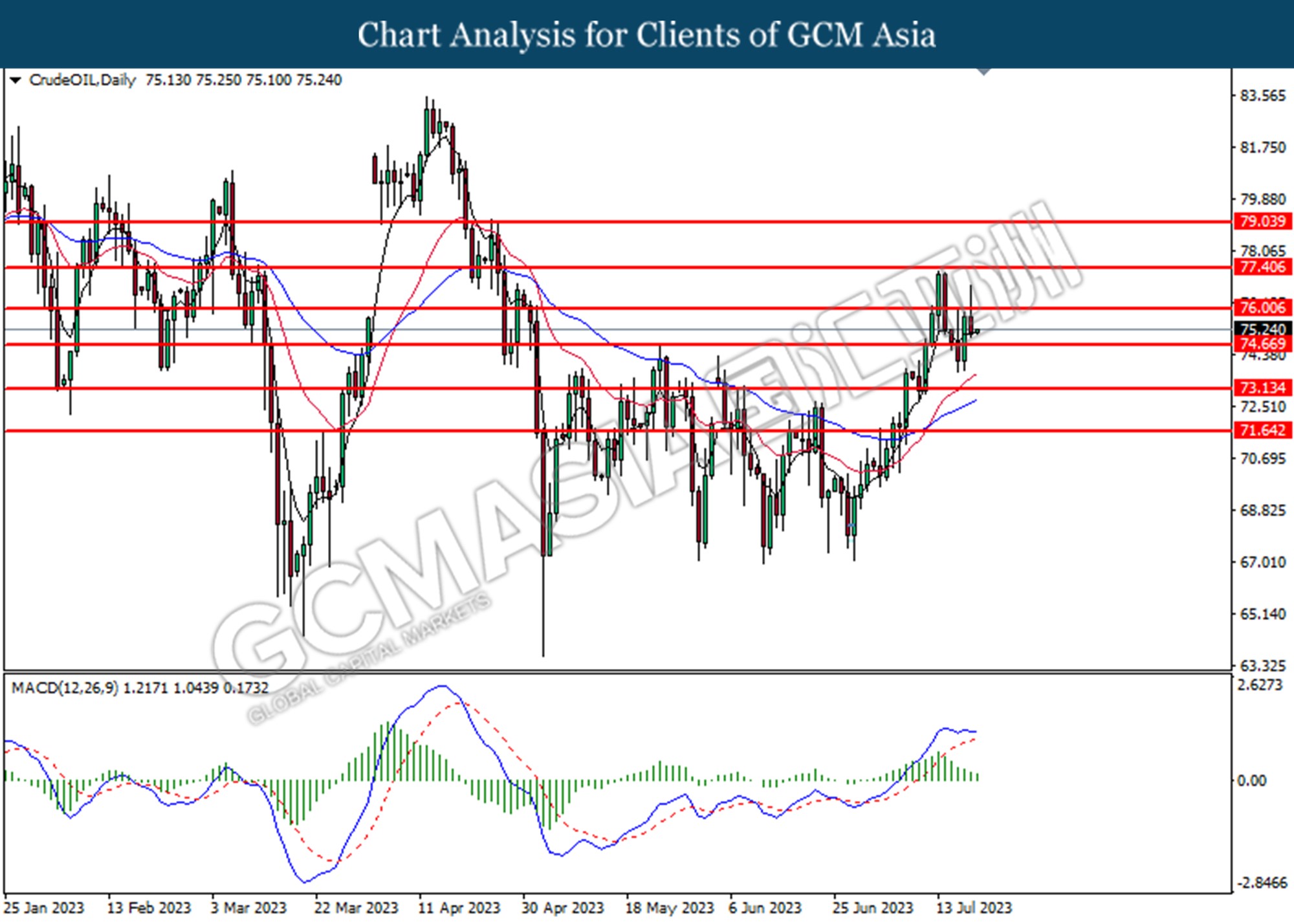

CrudeOIL, DAILY: Crude oil price was traded lower following the prior breaks below the previous support level at 76.00. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 74.65.

Resistance level: 76.00, 77.40

Support level: 74.65, 73.15

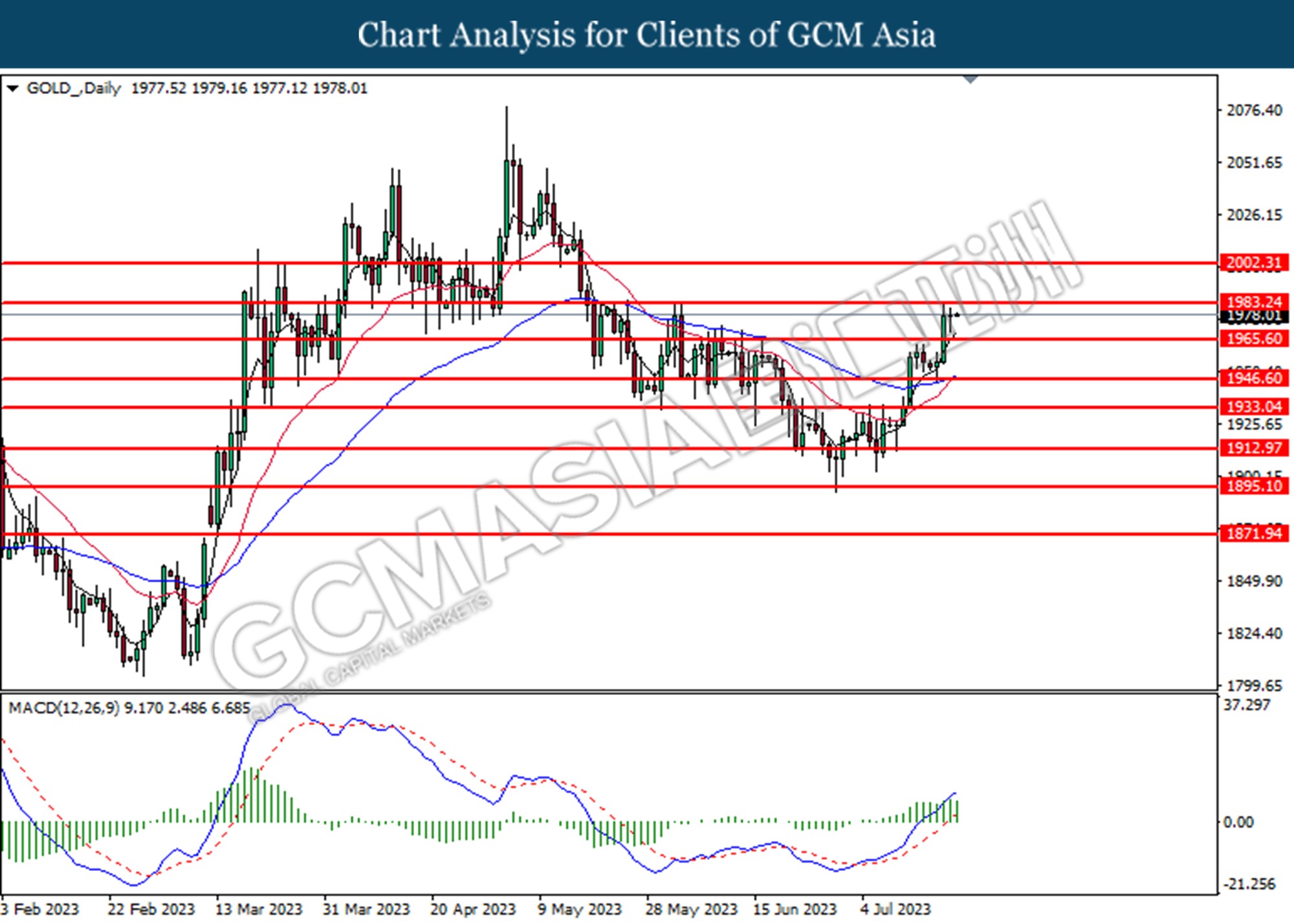

GOLD_, Daily: Gold price was traded higher following the prior breaks above the previous resistance level at 1965.60. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains towards the resistance level at 1983.25.

Resistance level: 1983.25, 2002.30

Support level: 1965.60, 1946.60