20 October 2020 Afternoon Session Analysis

Aussie plunged following dovish RBA minutes.

The Australian dollar which traded against the dollar and other currency pairs continue to extend its drop during late Asian session following dovish statement from RBA minutes. According to the minutes, RBA members have discussed an considered for more additional monetary easing to support jobs and overall economy. RBA’s Assistant Governor Christopher Kent stated that there is still some room to cut the cash rate further and compress short-term rates. The central bank is expected to reduce its interest rate to a new record low of 0.1% from the current 0.25%. He also added that the rates could move into negative territory in case of further RBA easing. Following the dovish note from RBA, the Aussie dollar break support and continue its path to the downside. At the time of writing, AUD/USD drop 0.32% to 0.7043.

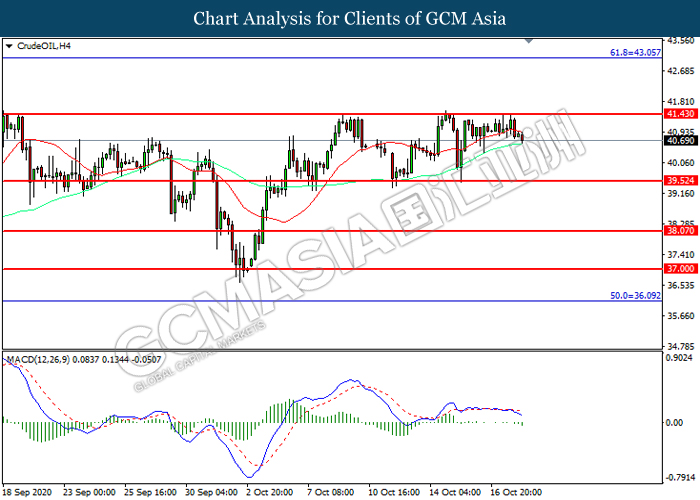

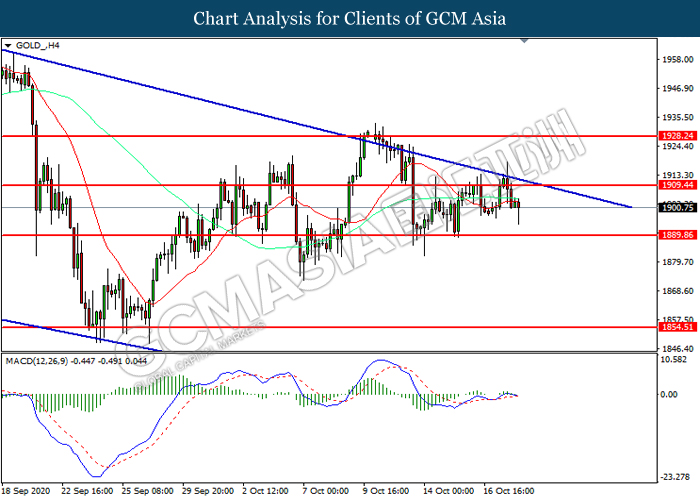

In the commodities market, crude oil price slips 0.44% to $40.70 per barrel as of writing following COVID-19 concerns intensified. COVID-19 cases have soared over 40 million on Monday, adding further concern that whether the oil demand is able to recover fully. At the same time, news of Libya rising output also continue to added pressure for the commodity. On the other hand, gold price also fell 0.24% to $1899.68 a troy ounce at the time of writing amid a new U.S stimulus remains elusive which weigh on the yellow metal.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Sep) | 1.476M | 1.520M | – |

| 04:30

(21st) |

CrudeOIL – API Weekly Crude Oil Stock | -5.422M | – | – |

Technical Analysis

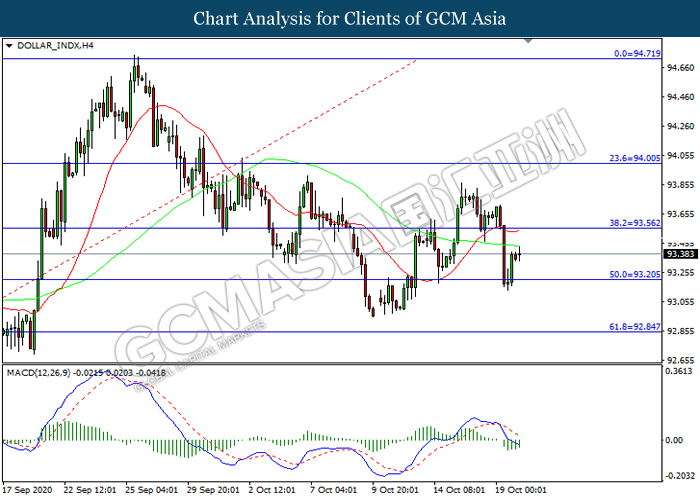

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 93.20. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level at 93.55.

Resistance level: 93.55, 94.00

Support level: 93.20, 92.85

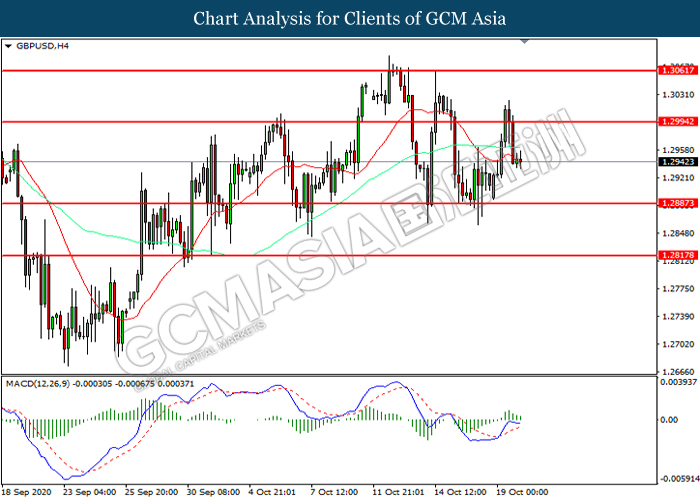

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2995. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.2885.

Resistance level: 1.2995, 1.3060

Support level: 1.2885, 1.2815

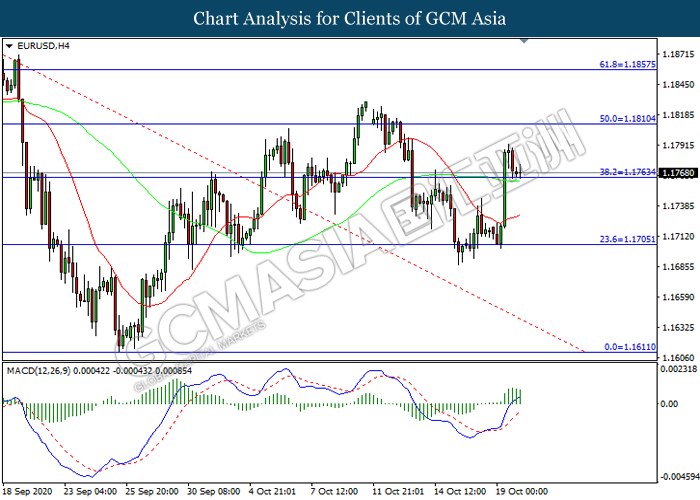

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1810, 1.1855

Support level: 1.1765, 1.1705

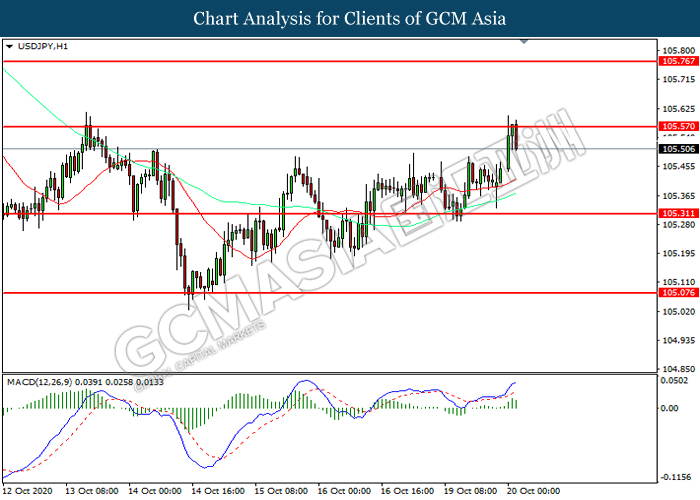

USDJPY, H1: USDJPY was traded lower following prior retracement from the resistance level at 105.55. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 105.30.

Resistance level: 105.55, 105.75

Support level: 105.30, 105.05

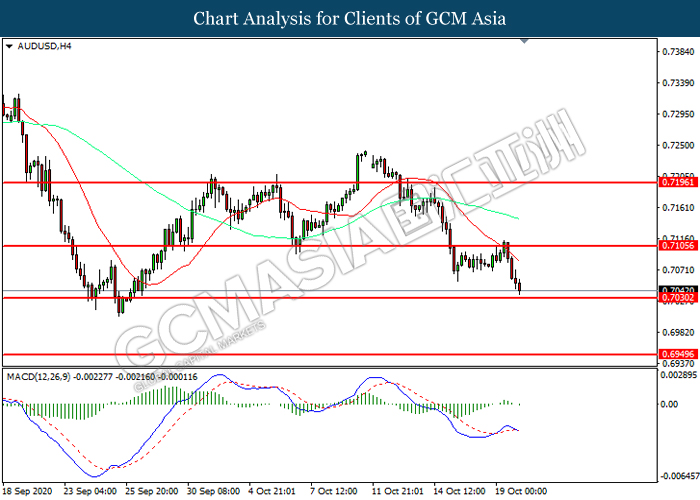

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7030. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7105, 0.7195

Support level: 0.7030, 0.6950

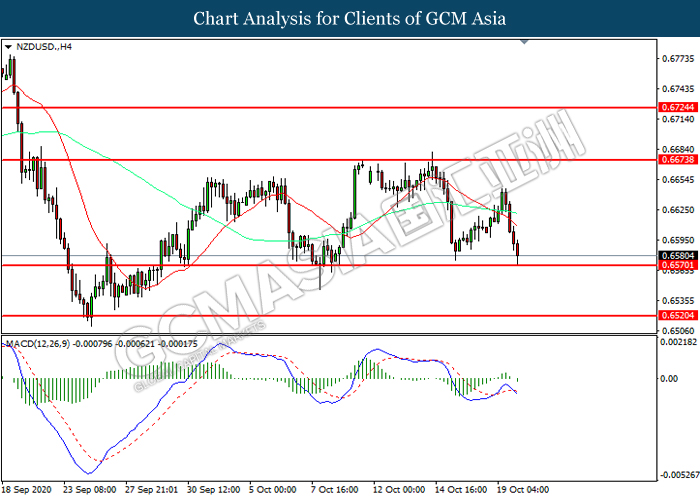

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6570. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6725

Support level: 0.6570, 0.6520

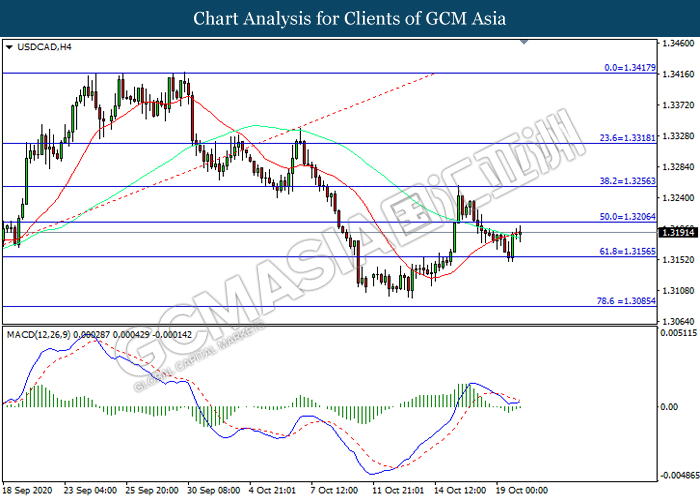

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3205. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3205, 1.3255

Support level: 1.3155, 1.3085

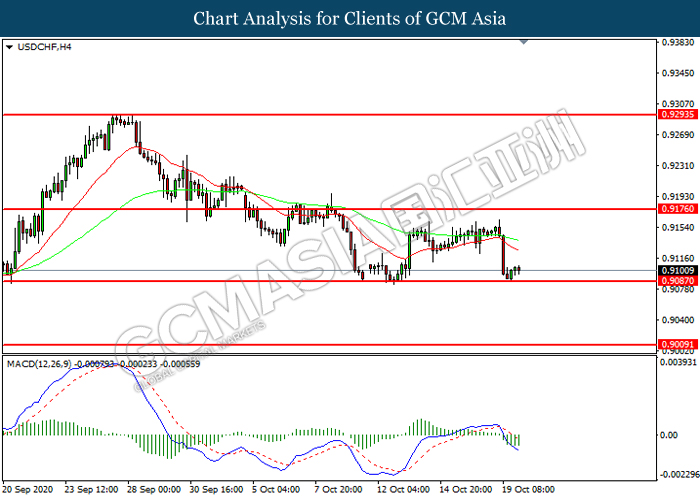

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9085. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9175, 0.9295

Support level: 0.9085, 0.9010

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 41.45. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 39.50.

Resistance level: 41.45, 43.05

Support level: 39.50, 38.05

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level 1909.45. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1889.85.

Resistance level: 1909.45, 1928.25

Support level: 1889.85, 1854.50