30 January 2023 Morning Session Analysis

US Dollar found its ground amid positive economic data.

The Dollar Index which traded against a basket of six major currencies regained its luster on last Friday following the upbeat economic data has dialed up the market optimism toward economic progression in the US. Last week, a series of data such as US Core Durable Goods Orders MoM, US Gross Domestic Product (GDP) QoQ and US Initial Jobless Claims had given the reading that better than market expectation, while it shown that the US economy was not entering into recession yet. Prior to that, most of market participants was speculating that the US might face economy soft landing in 2023. Besides that, the inflationary data has also brought positive impact for the rally of US Dollar. According to Bureau of Economic Analysis, the US Core PCE Price Index MoM notched up from the previous reading of 0.2% to 0.3%, indicating a signs that inflation is starting to rise again. With that, the likelihood of aggressive rate hike move from Fed would likely to be increased. Going forward, investors would continue to scrutinize the Fed’s interest rate decision in order to receive further trading signals. As of writing, the Dollar Index edged up by 0.01% to 101.73.

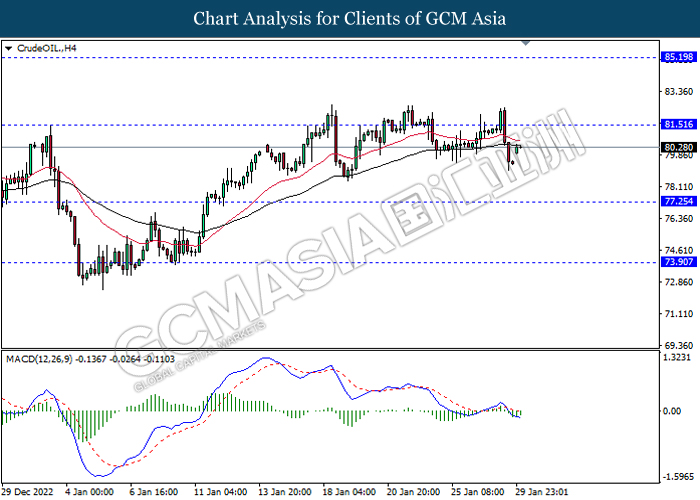

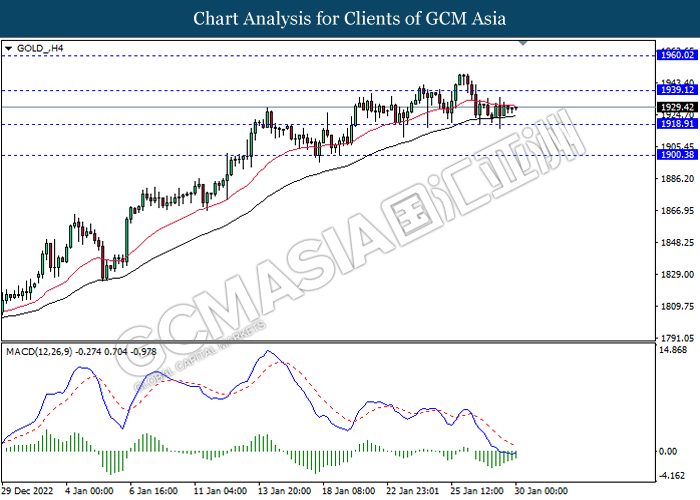

In the commodity market, the crude oil price appreciated by 0.88% to $80.39 per barrel as of writing following the bullish optimism over China oil demand. On the other hand, the gold price depreciated by 0.83% to $1928.93 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German GDP (QoQ) (Q4) | 0.40% | 0.00% | – |

Technical Analysis

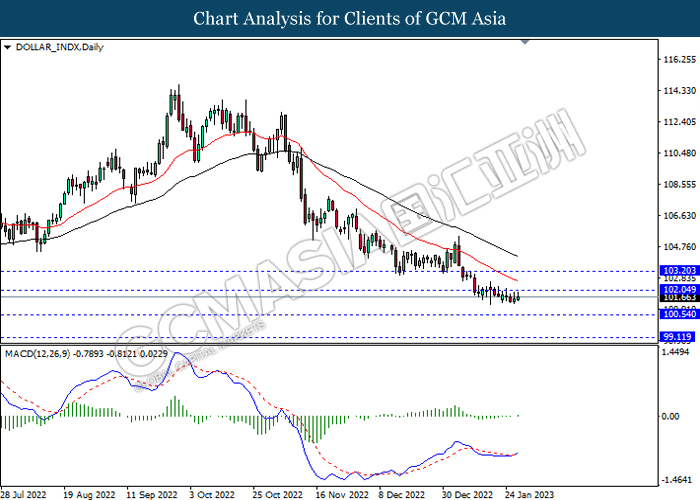

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

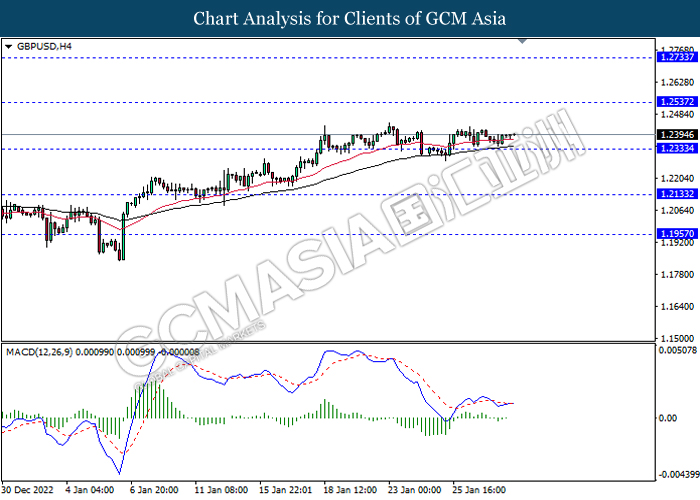

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2535, 1.2735

Support level: 1.2335, 1.2135

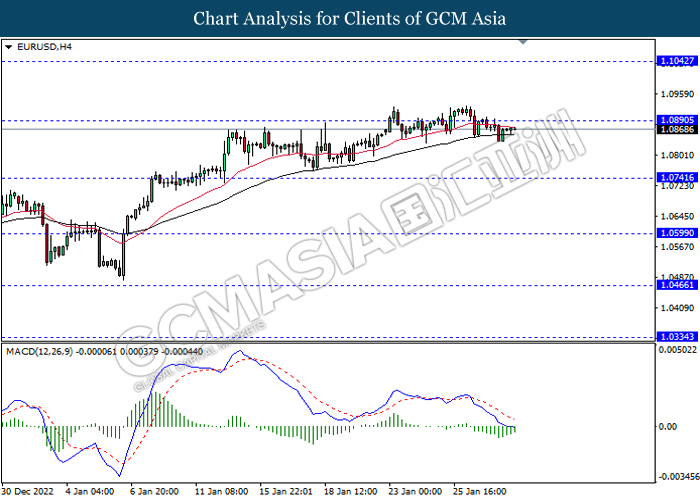

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0890, 1.1040

Support level: 1.0740, 1.0600

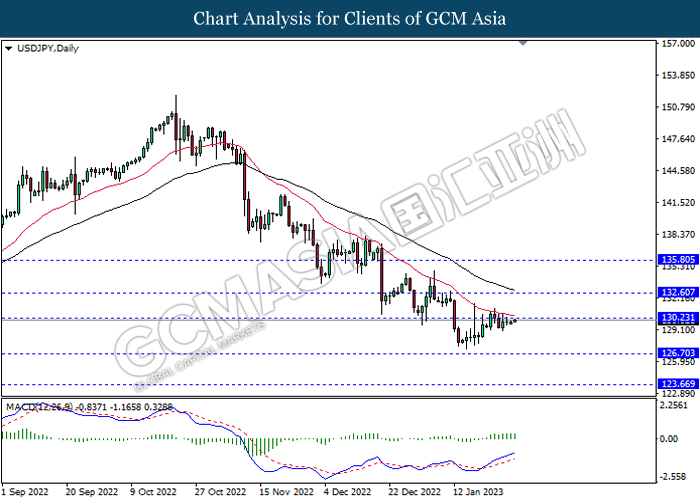

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 130.35, 132.60

Support level: 126.70, 123.65

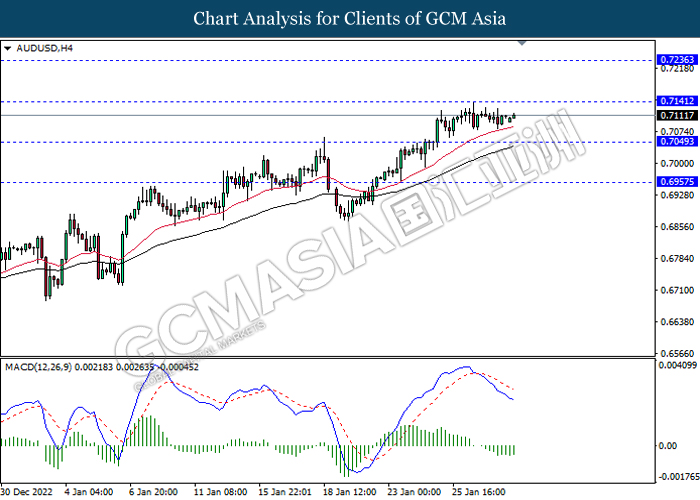

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7140, 0.7235

Support level: 0.7050, 0.6955

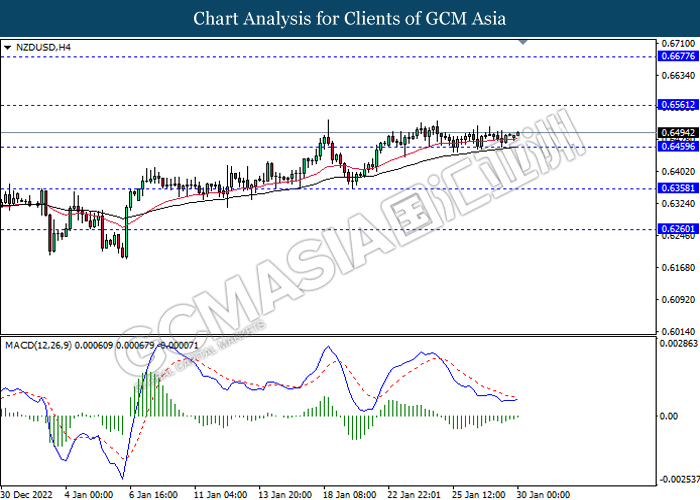

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6560, 0.6675

Support level: 0.6460, 0.6360

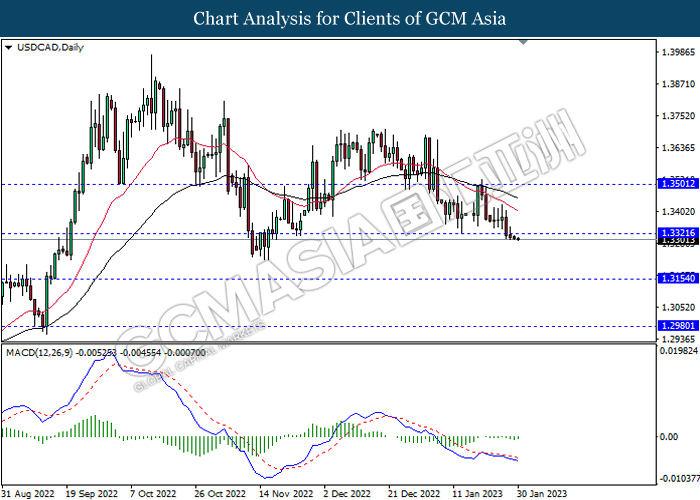

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher ad technical correction.

Resistance level: 1.3320, 1.3500

Support level: 1.3155, 1.2980

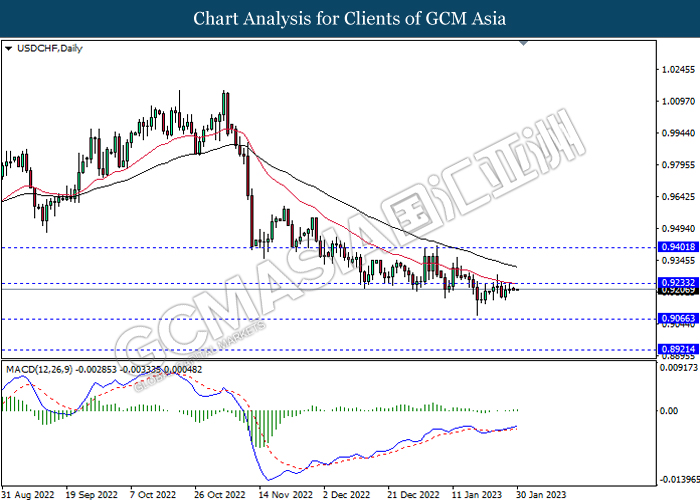

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1939.10, 1960.00

Support level: 1918.90, 1900.40