21 January 2021 Afternoon Session Analysis

Loonie soars following BoC rate decision.

During late Asian session, the Canadian dollar which traded against the greenback and its peers have jumped following recent rate decision and hawkish note from Band of Canada. The Bank of Canada has maintained its interest rate unchanged at 0.25% as expected and stated that inflation is set to return to 2% in a sustainable manner by 2023. In terms of bond-buying scheme, BoC stated that it would adjust the program as the economy recovers. Following signals of further tapering down, the Loonie experience a surge in demand. At the same time, the central bank also upbeat on its economic outlook and noted that the outlook is now stronger and secure thanks to earlier-than-expected availability of vaccines and significant ongoing policy stimulus. At the time of writing, USD/CAD fell 0.11% to 1.2613.

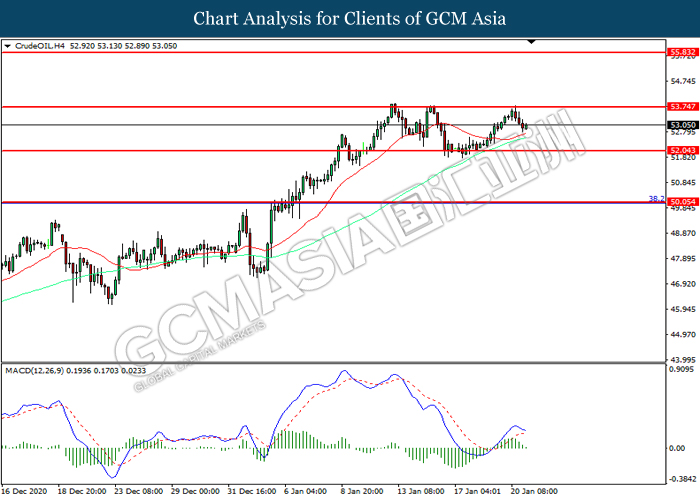

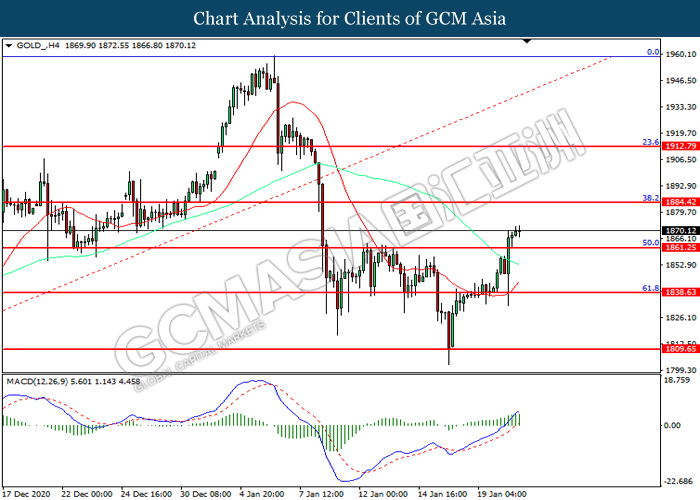

In the commodities market, crude oil price extends its retreat and fell 0.02% to $53.05 per barrel as of writing following IEA adjust its expectation on demand outlook. IEA expects crude oil demand to increase by 5.5 million barrels a day for 2021, 0.3 million lesser than previously forecast. The IEA has lowered their forecast following the tightening of movement control orders in the European zone as well as some districts in China that could affect economic activity and crude oil demand. On the other hand, gold price rose 0.02% to $1872.30 a troy ounce at the time of writing following ongoing dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

11:00 JPY BoJ Outlook Report (YoY)

11:00 JPY BoJ Press Conference

23:00 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 20:45 | EUR – ECB Interest Rate Decision (Jan) | 0.00% | 0.00% | – |

| 21:30 | USD – Building Permits (Dec) | 1.635M | 1.604M | – |

| 21:30 | USD – Initial Jobless Claims | 965K | 868K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Jan) | 9.1 | 12.0 | – |

Technical Analysis

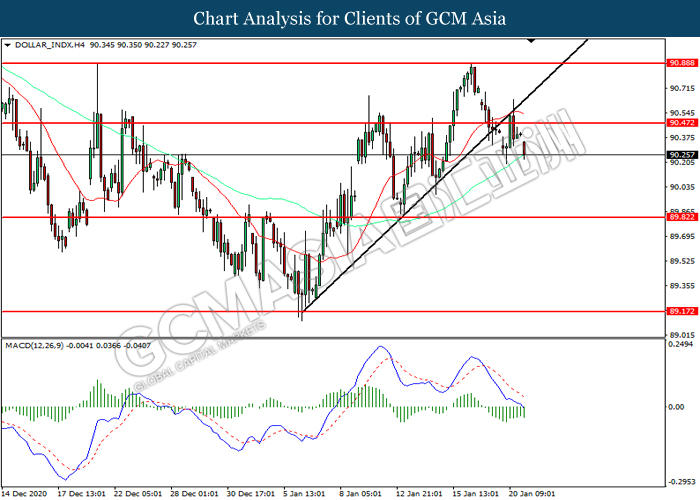

DOLLAR_INDX, H4: Dollar index was traded lower following retracement from the resistance level at 90.45. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 89.80.

Resistance level: 90.45, 90.90

Support level: 89.80, 89.15

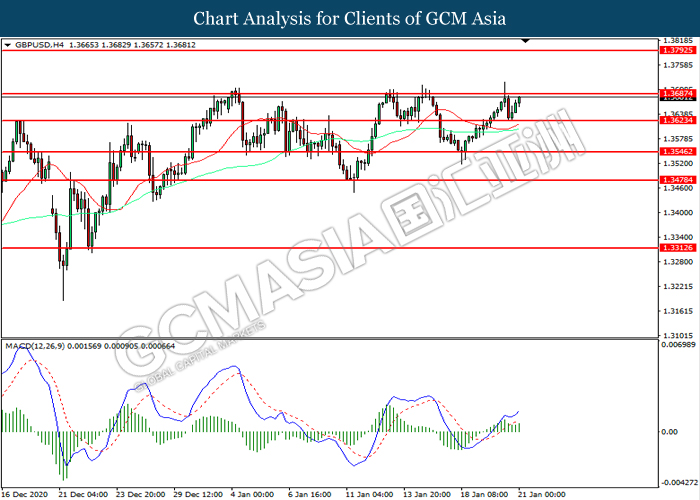

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3685. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3685, 1.3795

Support level: 1.3625, 1.3545

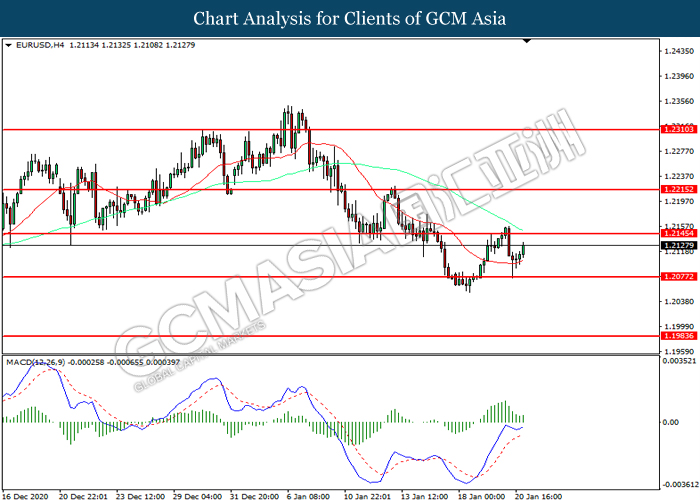

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2075. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2145, 1.2215

Support level: 1.2075, 1.1985

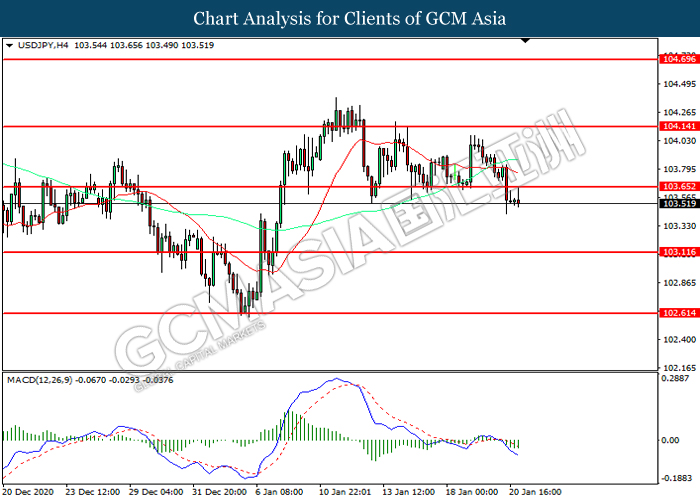

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 103.65. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 103.10.

Resistance level: 103.65, 104.15

Support level: 103.10, 102.60

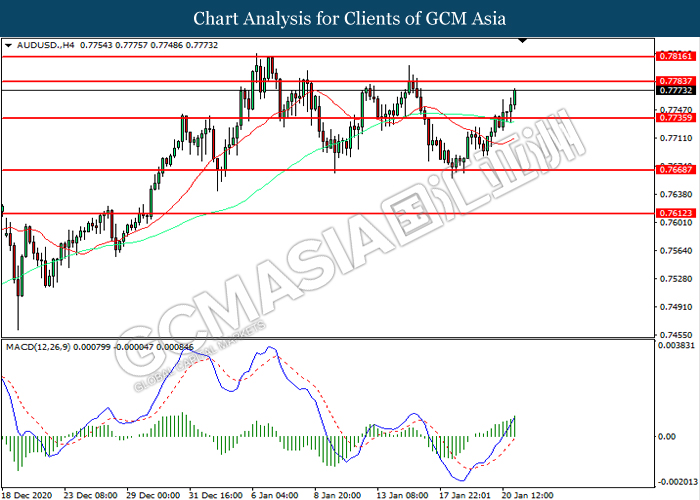

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7785. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7785, 0.7815

Support level: 0.7735, 0.7670

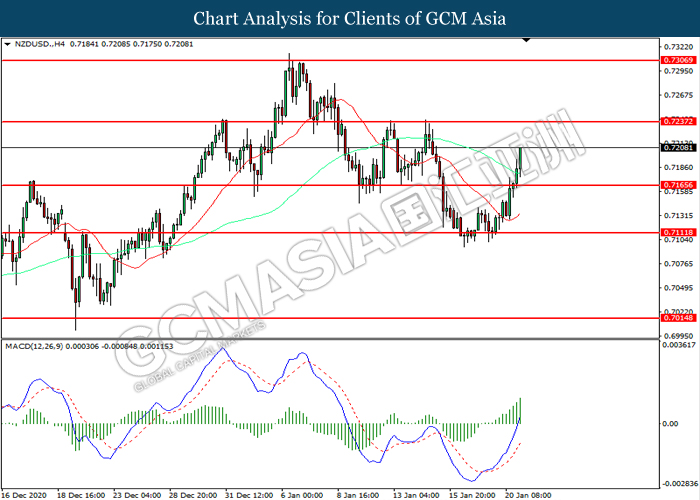

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.7165. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7235.

Resistance level: 0.7235, 0.7305

Support level: 0.7165, 0.7110

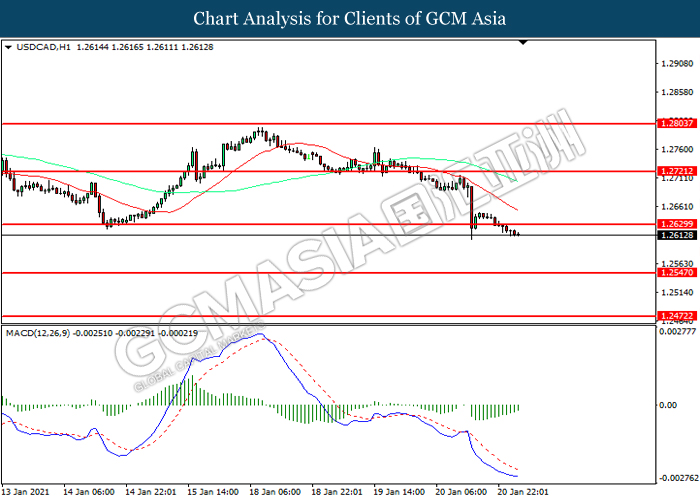

USDCAD, H1: USDCAD was traded lower following prior breakout below the previous support level at 1.2630. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2630, 1.2720

Support level: 1.2545, 1.2470

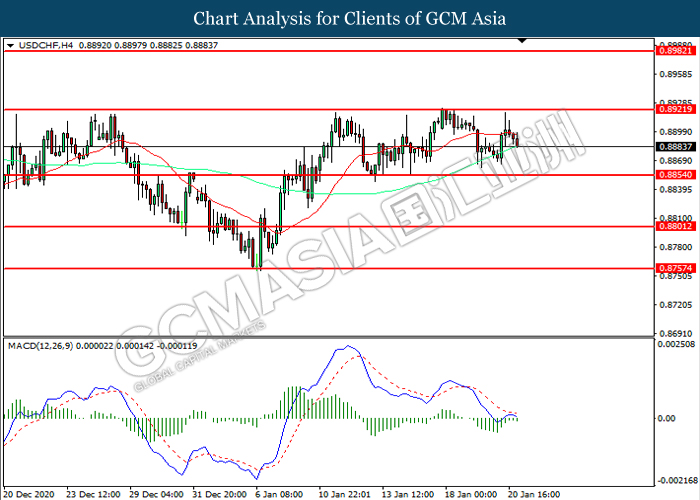

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8920. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.8855.

Resistance level: 0.8920, 0.8980

Support level: 0.8855, 0.8800

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 53.75. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 52.03.

Resistance level: 53.75, 55.85

Support level: 52.05, 50.05

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1861.25. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1884.40.

Resistance level: 1884.40, 1912.30

Support level: 1861.25, 1838.65