21 January 2021 Morning Session Analysis

Canadian dollar surged amid BoC positive tone toward economic outlook.

The Canadian dollar received huge buy-in momentum yesterday as Bank of Canada (BoC) decided to maintain their interest rate at current level while adopting a positive tone on the economy’s future outlook. In the BoC meeting, board members of the central bank unanimously agreed to remain its interest rate at historic low level as the economic recovery were still interrupted by the resurgence of virus. The spread of Covid-19 virus becoming more serious not only in Canada but around the world, thus the timeline for effective vaccination programme plays an important role on saving the economy from further downfall. Besides, the Governor of BoC Tiff Macklem revealed that the earlier-than anticipated arrival of vaccine were potentially able to save lives and limits the fast-spreading virus, therefore the exceptional degree of monetary stimulus currently in place is appropriate for the nation. Besides, The bank of Canada also unfolded their growth forecast for year 2021, stating that contraction would be seen in first quarter of 2021 but expecting the economic activity will recover to pre-pandemic level in late 2021. As of writing, the pair USD/CAD fall by 0.10% to 1.2617.

In the commodities market, the crude oil price appreciated by 0.17% to $52.97 per barrel as of writing amid surprise build in recent inventory level. According to the API, US Crude Oil Inventories data came in at 2.562M, higher than the economist forecast at -0.300M, such unexpectedly build dragged down the appeal of this black commodity market. Besides, gold price rose 0.03% to $1871.40 per troy ounce amid weakening of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

11:00 JPY BoJ Outlook Report (YoY)

11:00 JPY BoJ Press Conference

23:00 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 20:45 | EUR – ECB Interest Rate Decision (Jan) | 0.00% | 0.00% | – |

| 21:30 | USD – Building Permits (Dec) | 1.635M | 1.604M | – |

| 21:30 | USD – Initial Jobless Claims | 965K | 868K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Jan) | 9.1 | 12.0 | – |

Technical Analysis

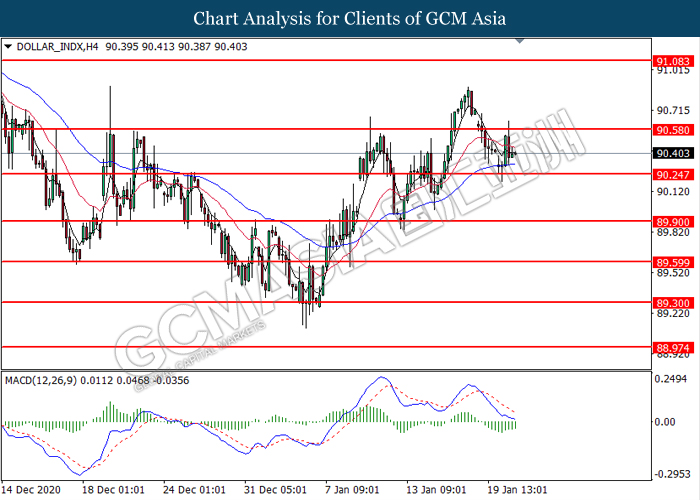

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 90.60. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 90.25.

Resistance level: 90.60, 91.10

Support level: 90.25, 89.90

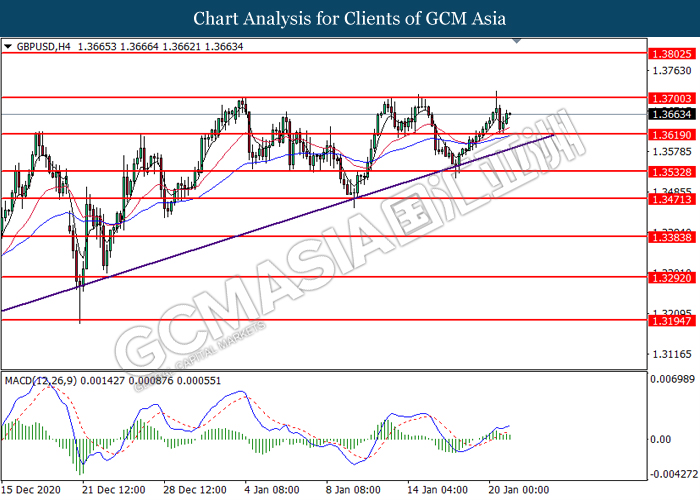

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3700.

Resistance level: 1.3700, 1.3805

Support level: 1.3620, 1.3535

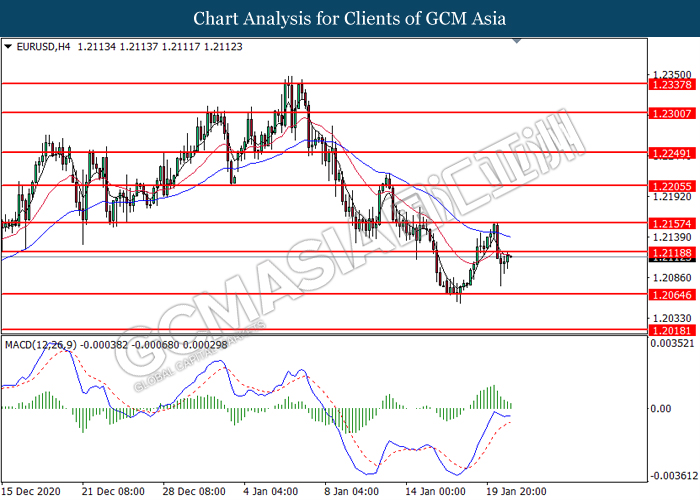

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.2120. However, MACD which illustrated diminishing bullish momentum suggest the pair undergo technical correction in short term.

Resistance level: 1.2120, 1.2155

Support level: 1.2065, 1.2020

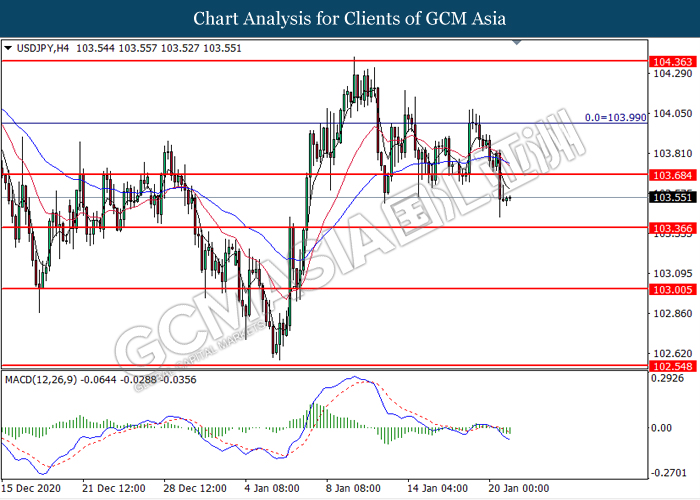

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 103.70. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the 103.35.

Resistance level: 103.70, 104.00

Support level: 103.35, 103.00

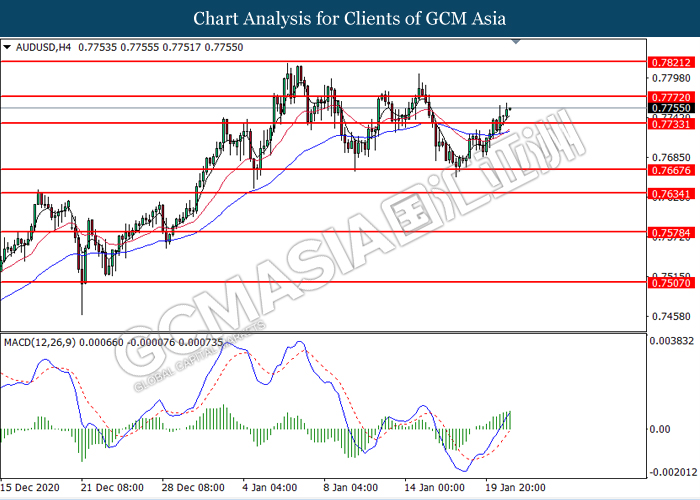

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7735. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7770.

Resistance level: 0.7770, 0.7820

Support level: 0.7735, 0.7670

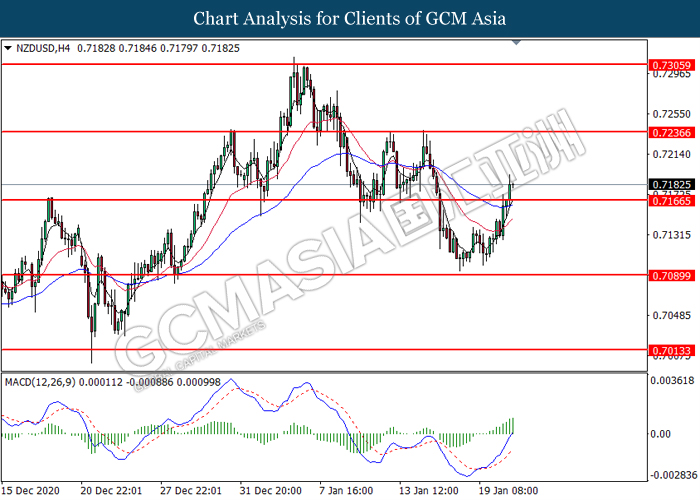

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.7165. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7235.

Resistance level: 0.7235, 0.7305

Support level: 0.7165, 0.7090

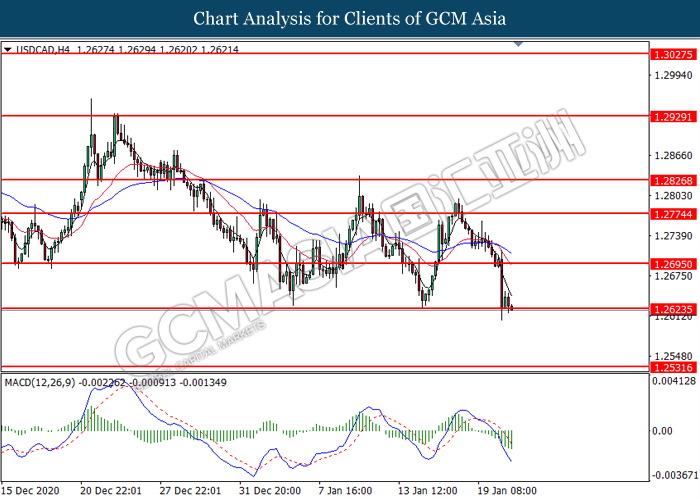

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2625. MACD which illustrate bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2695, 1.2775

Support level: 1.2625, 1.2530

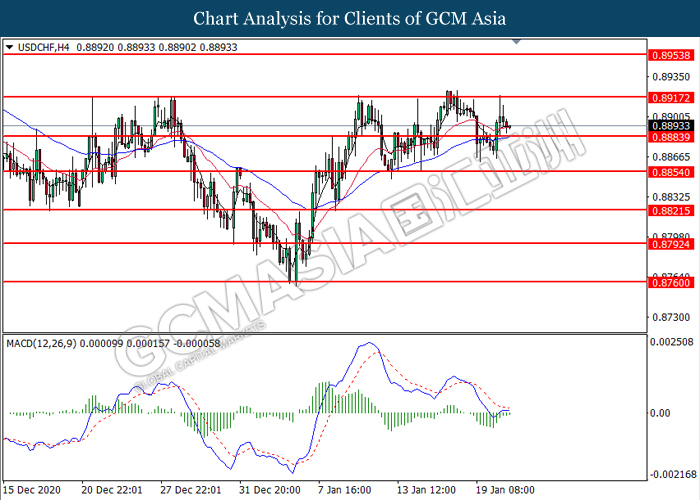

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term toward higher level.

Resistance level: 0.8915, 0.8955

Support level: 0.8885, 0.8855

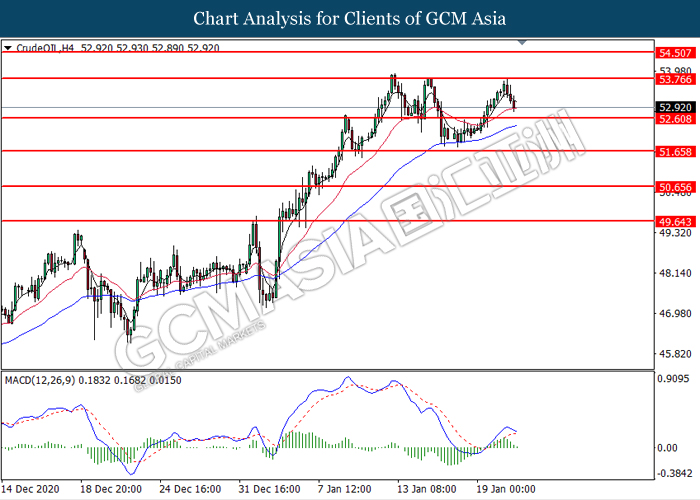

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 53.75. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 52.60.

Resistance level: 53.75, 54.50

Support level: 52.60, 51.65

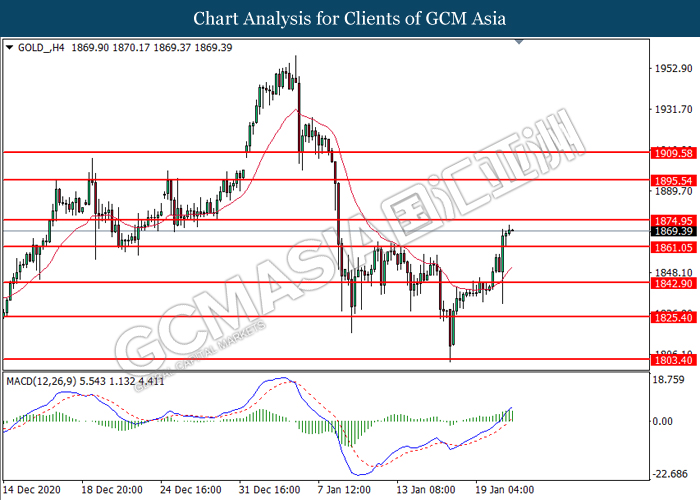

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1861.05. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1874.95.

Resistance level: 1874.95, 1895.55

Support level: 1861.05, 1842.90