21 January 2022 Afternoon Session Analysis

US Dollar dived following US Treasury yield eased.

The Dollar Index which traded against a basket of six major currency pairs slumped over the backdrop of a string economic data. According to Department of Labor, US Initial Jobless Claims notched up significantly from the previous reading of 231K to 286K, missing the market forecast at 220K. Besides, US Existing Home Sales came in at 6.18M, which also fared worse than market expectation at 6.44M. As both crucial economic data came in at negative reading, which dialing down the market optimism toward the economic progression in the United States while reducing the odds for the Federal Reserve to reduce interest rate. The US Treasury yields retreated from multi-year high, dragging down the appeal for the US Dollar. Nonetheless, investors would continue to scrutinize the latest updates with regards of monetary policy statement from Fed to receive further trading signal. As of writing, the Dollar Index depreciated by 0.05% to 95.70.

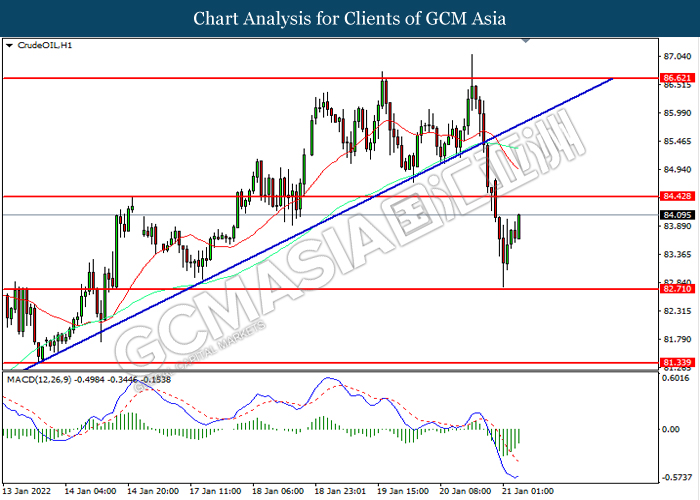

In the commodities market, the crude oil price depreciated by 0.93% to $84.35 per barrel as of writing. The crude oil price edged lower amid the profit-taking following the released of bearish US Inventory data. According to Energy Information Administration (EIA), the US Crude Oil Inventories came in at 0.515M, missing the market forecast at -0.938M. On the other hand, the gold price appreciated by 0.07% to $1840.80 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Dec) | 1.40% | -0.60% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 1.30% | 1.30% | – |

Technical Analysis

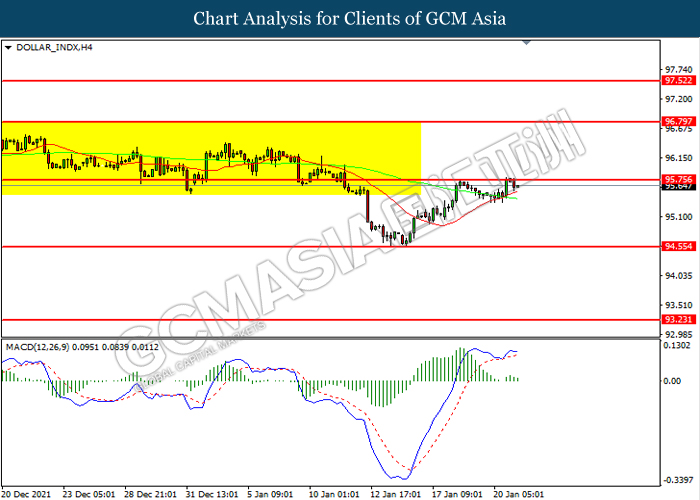

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 95.60. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

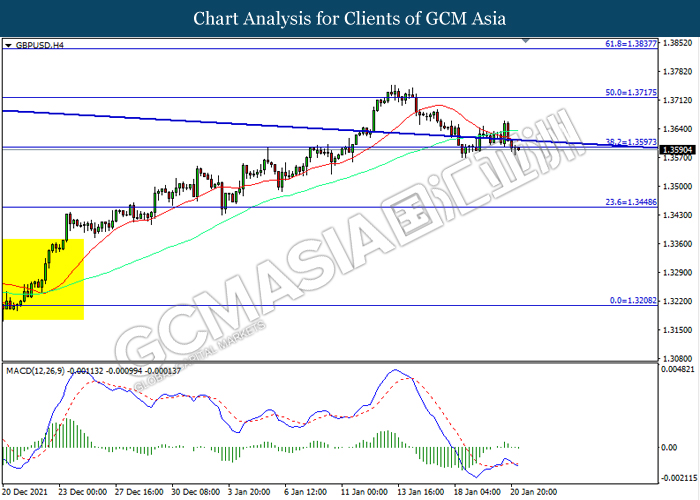

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3595. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

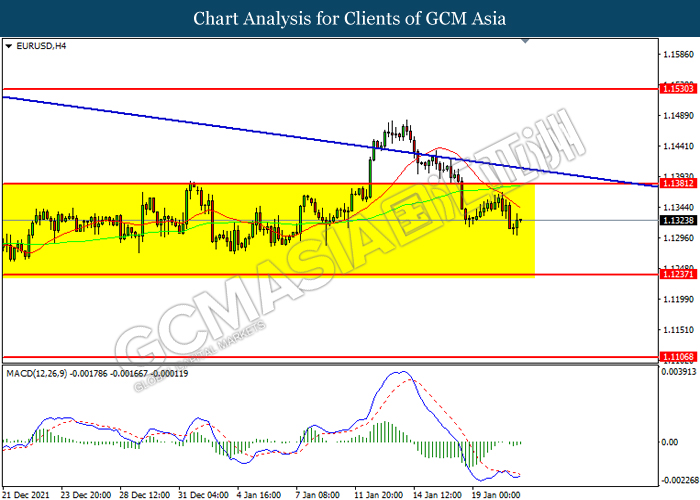

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

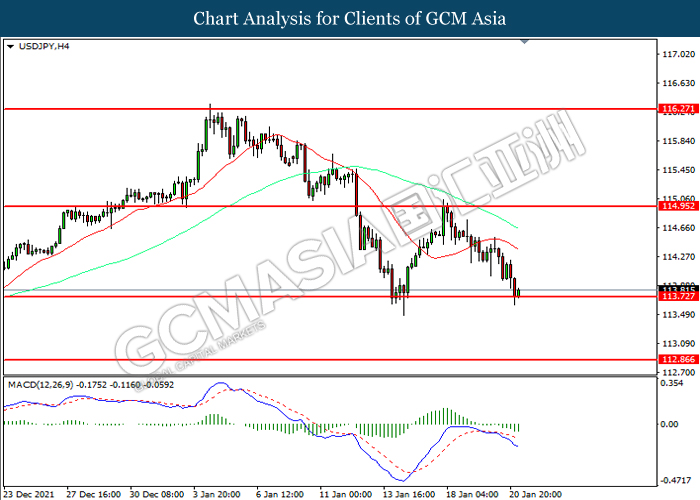

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.75. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.75, 112.85

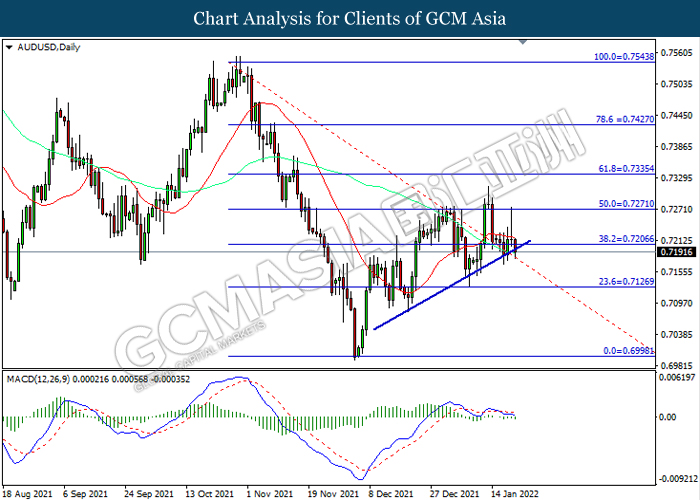

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 07205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7000

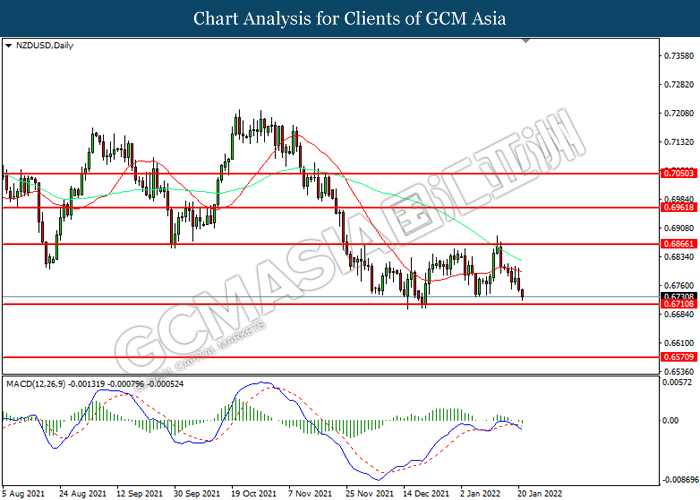

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

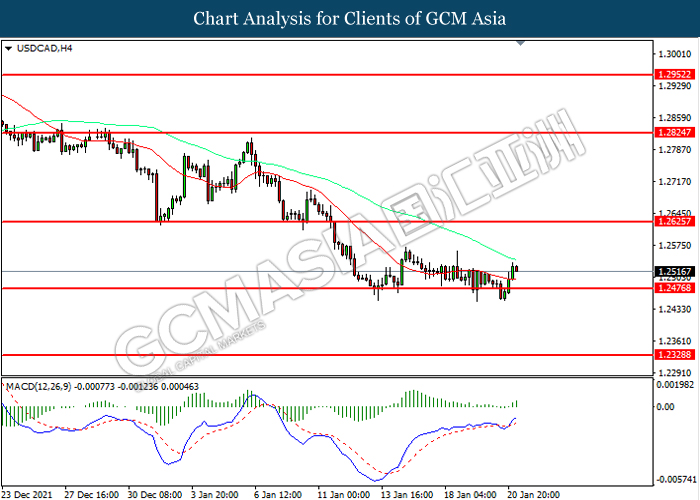

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2475. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2625.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9180. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 82.70. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 84.45.

Resistance level: 84.45, 86.60

Support level: 82.70, 81.35

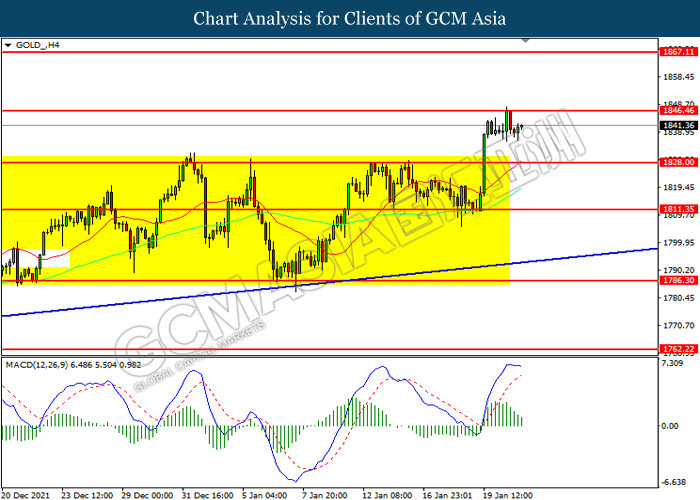

GOLD_, H4: Gold price was traded within a range while currently testing the resistance level at 1846.45. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1846.45, 1867.10

Support level: 1828.00, 1811.35