21 January 2022 Morning Session Analysis

Euro tumbles as doves emerges.

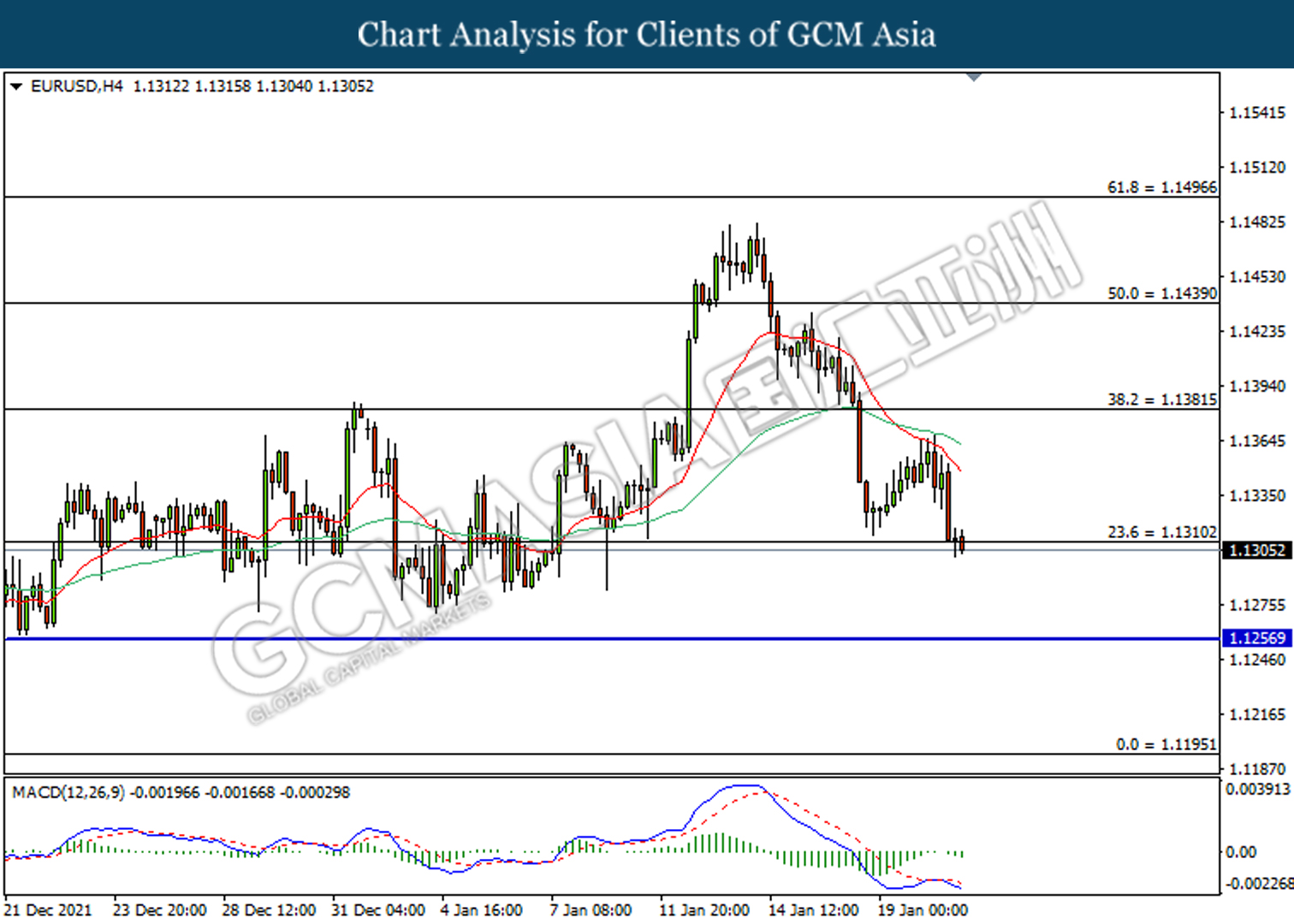

Euro halts is recent recovery and tumbles further after European Central Bank reemphasize their dovish views upon recent inflation appreciation. According to meeting minutes, several ECB members has voiced out their views that current appreciation in inflation is temporary and will likely depreciate throughout the year of 2022. Their view came in as market is previously speculating for a change in monetary policy strategy after EU inflation rose to 5.0%, its highest level in 30 years. Following the release of minutes, ECB President Christine Lagarde emphasize that it is too early to initiate a rate hike as it may jeopardize economic recovery momentum. She also reiterates the differences of economic fundamental in between US and EU and Federal Reserve could initiate a rate hike earlier due to strong economic recovery. As of writing, EUR/USD was down 0.02% to 1.1312.

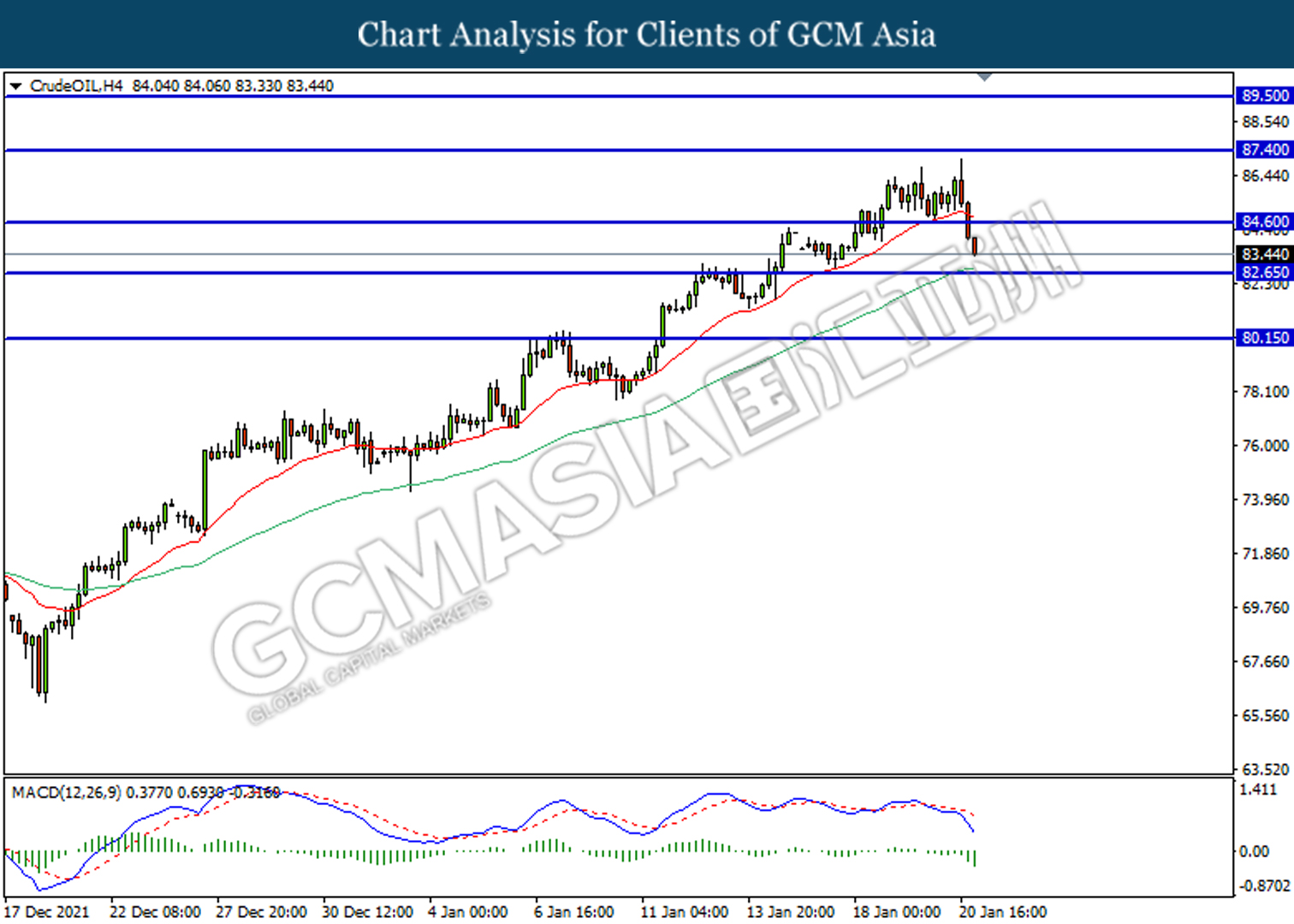

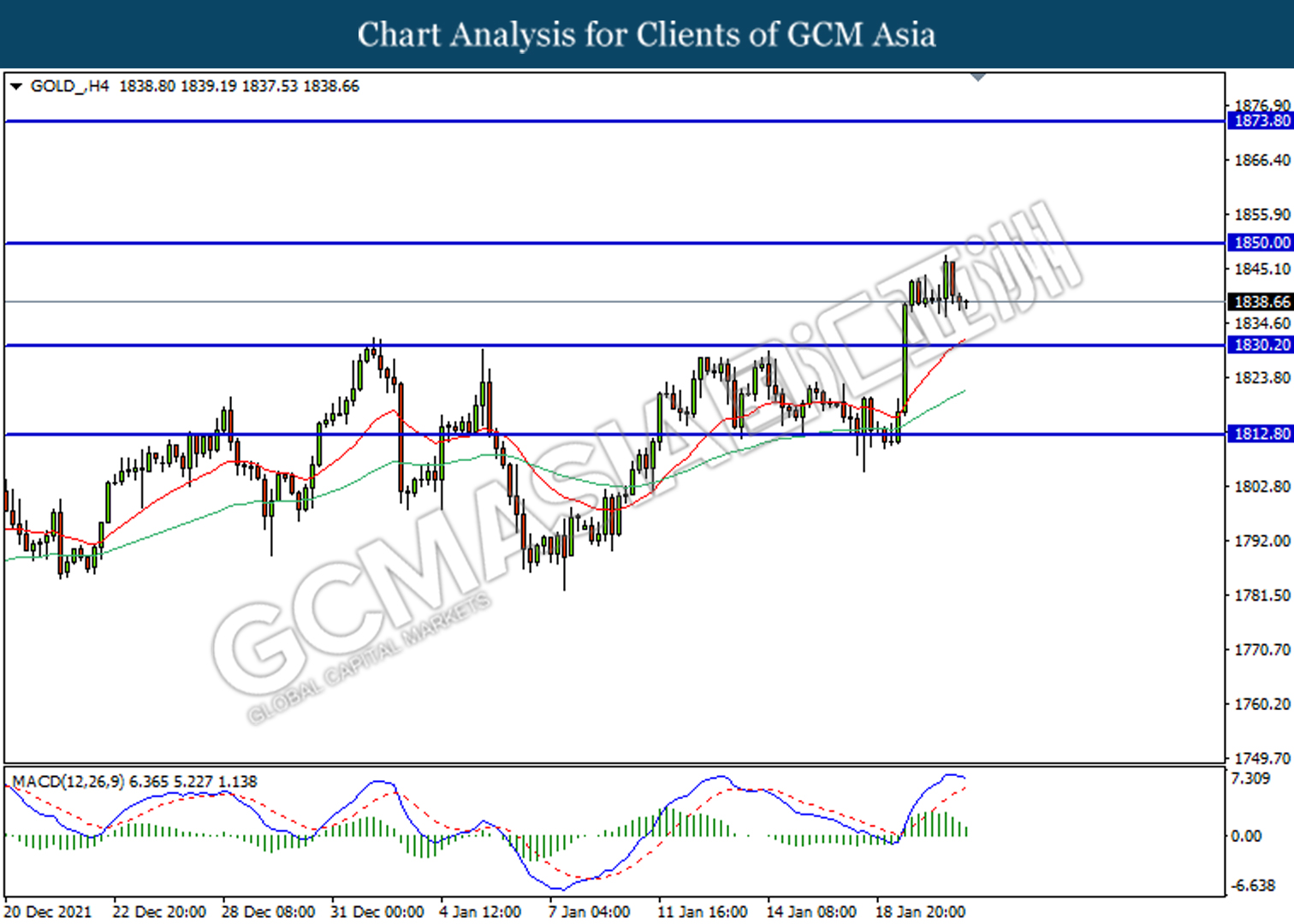

In the commodities market, crude oil price was down by 0.58% to $84.15 per barrel following the release of US inventory data. Last week, crude oil inventory was up by 0.5 million barrels, significantly higher than forecasted reading to decrease by 0.9 million barrels. Likewise, gold price was down by 0.01% to $1,838.10 a troy ounce due to a rebound in US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Dec) | 1.40% | -0.60% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 1.30% | 1.30% | – |

Technical Analysis

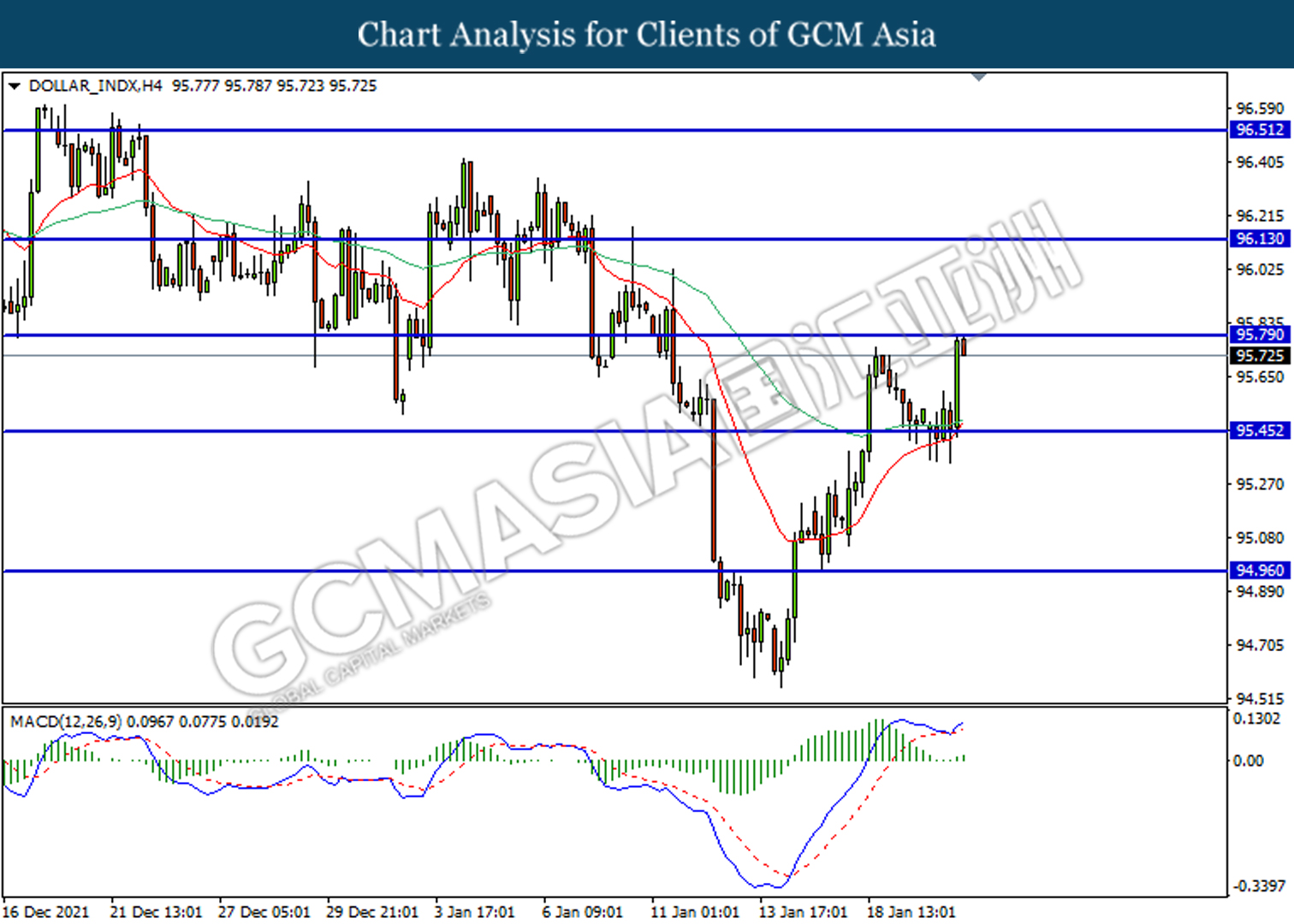

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.15

Support level: 95.45, 94.95

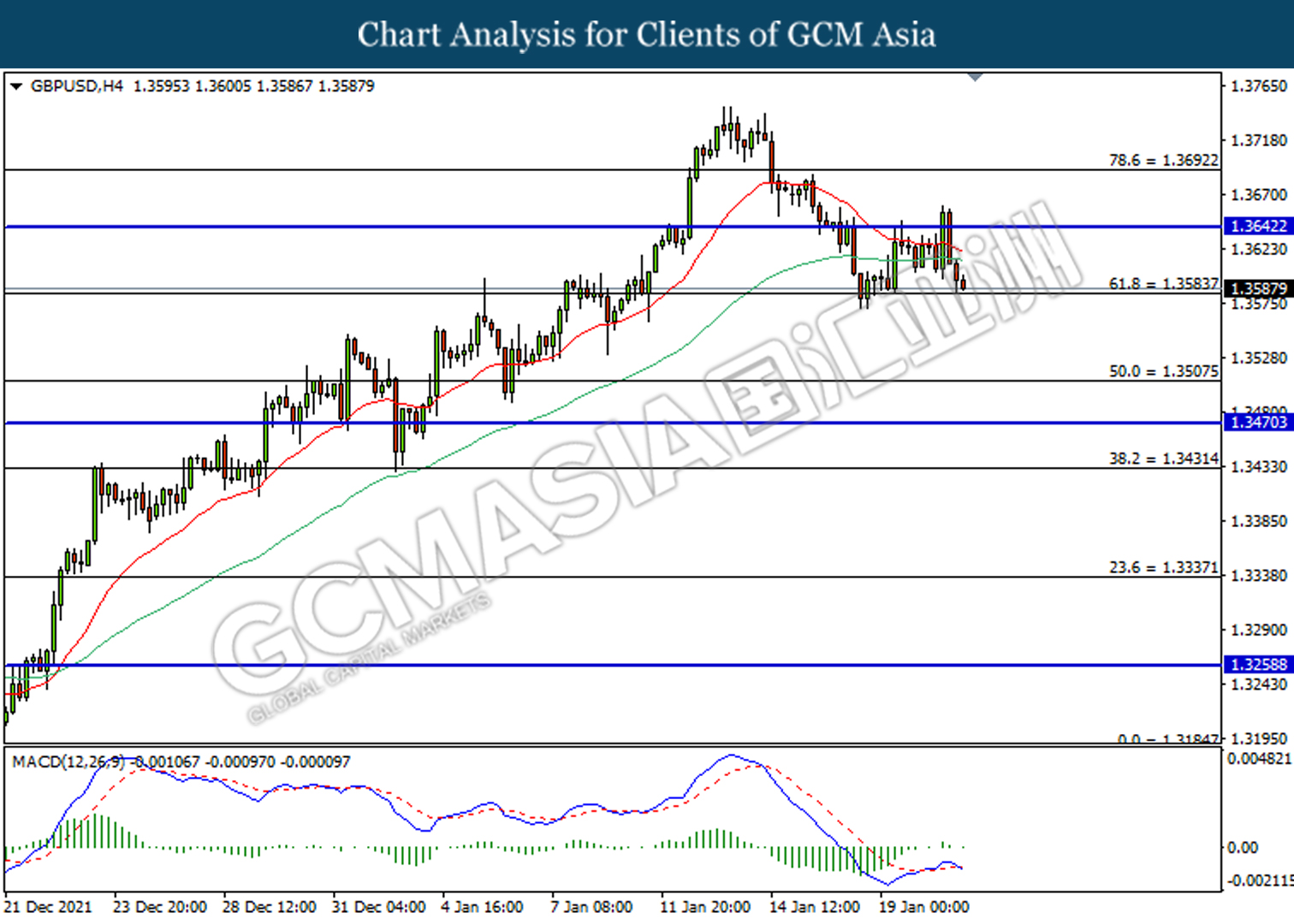

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.3640, 1.3690

Support level: 1.3585, 1.3510

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1380, 1.1440

Support level: 1.1310, 1.1260

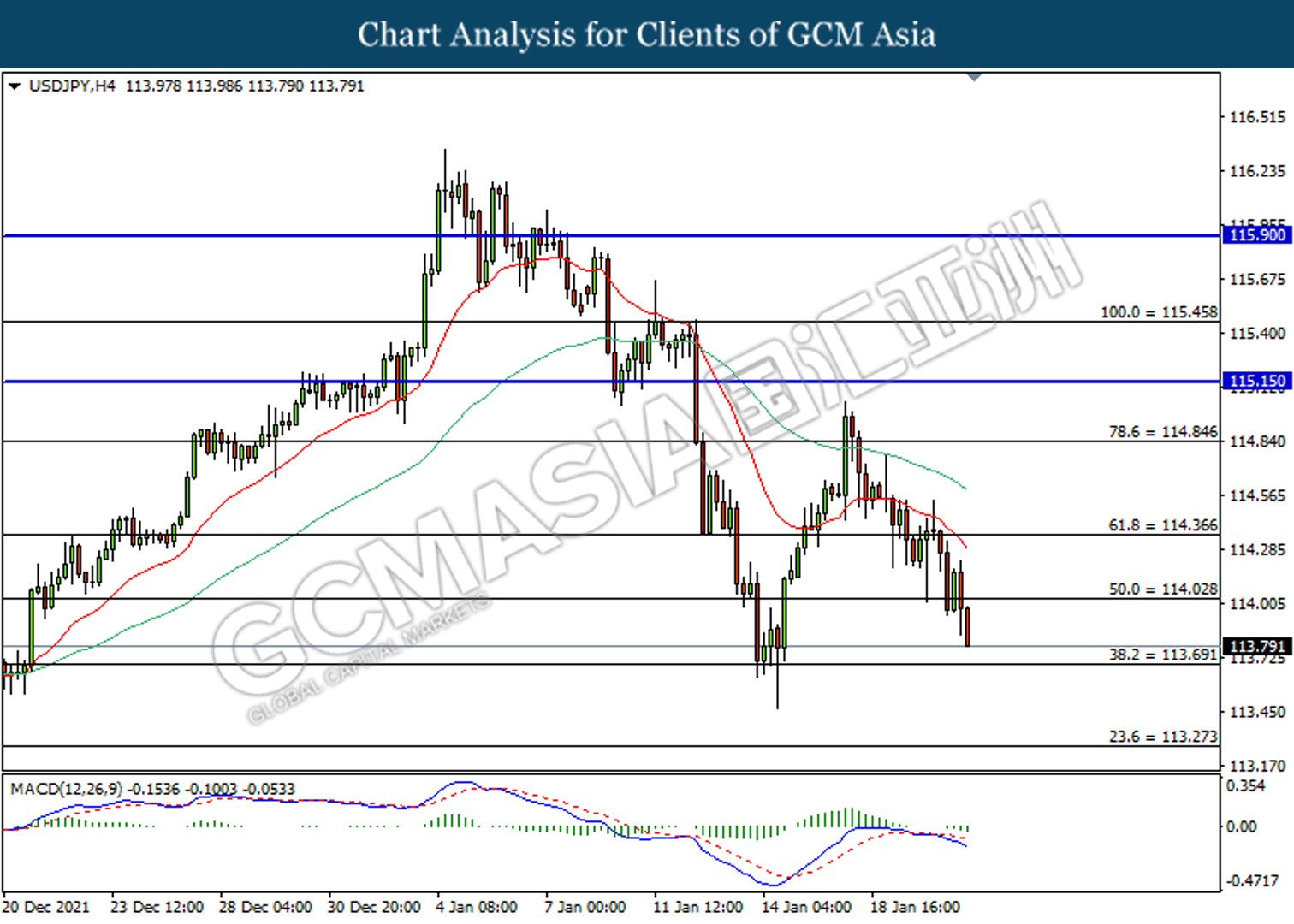

USDJPY, H4: USDJPY was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.00, 114.35

Support level: 113.70, 113.30

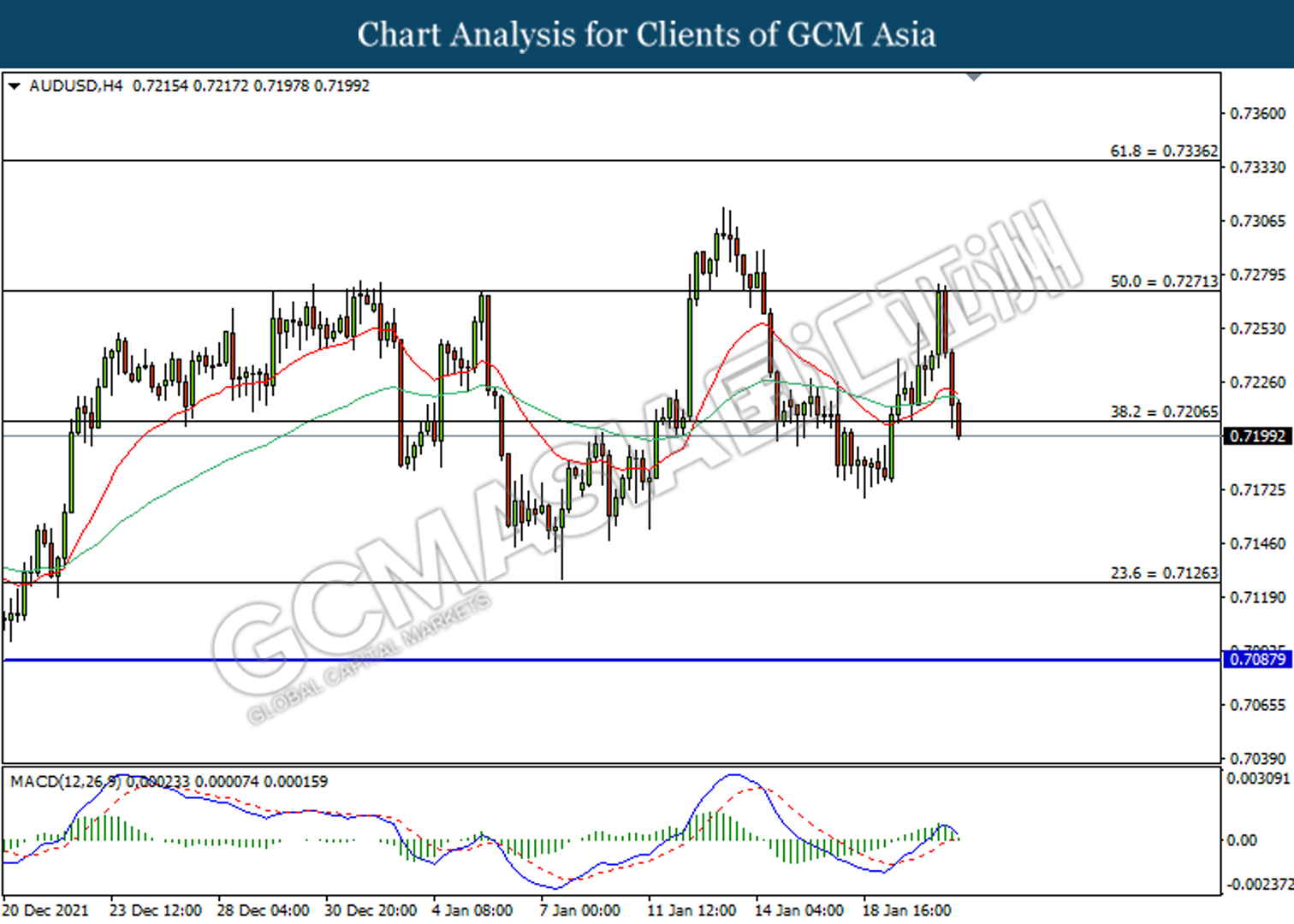

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.7270, 0.7335

Support level: 0.7210, 0.7125

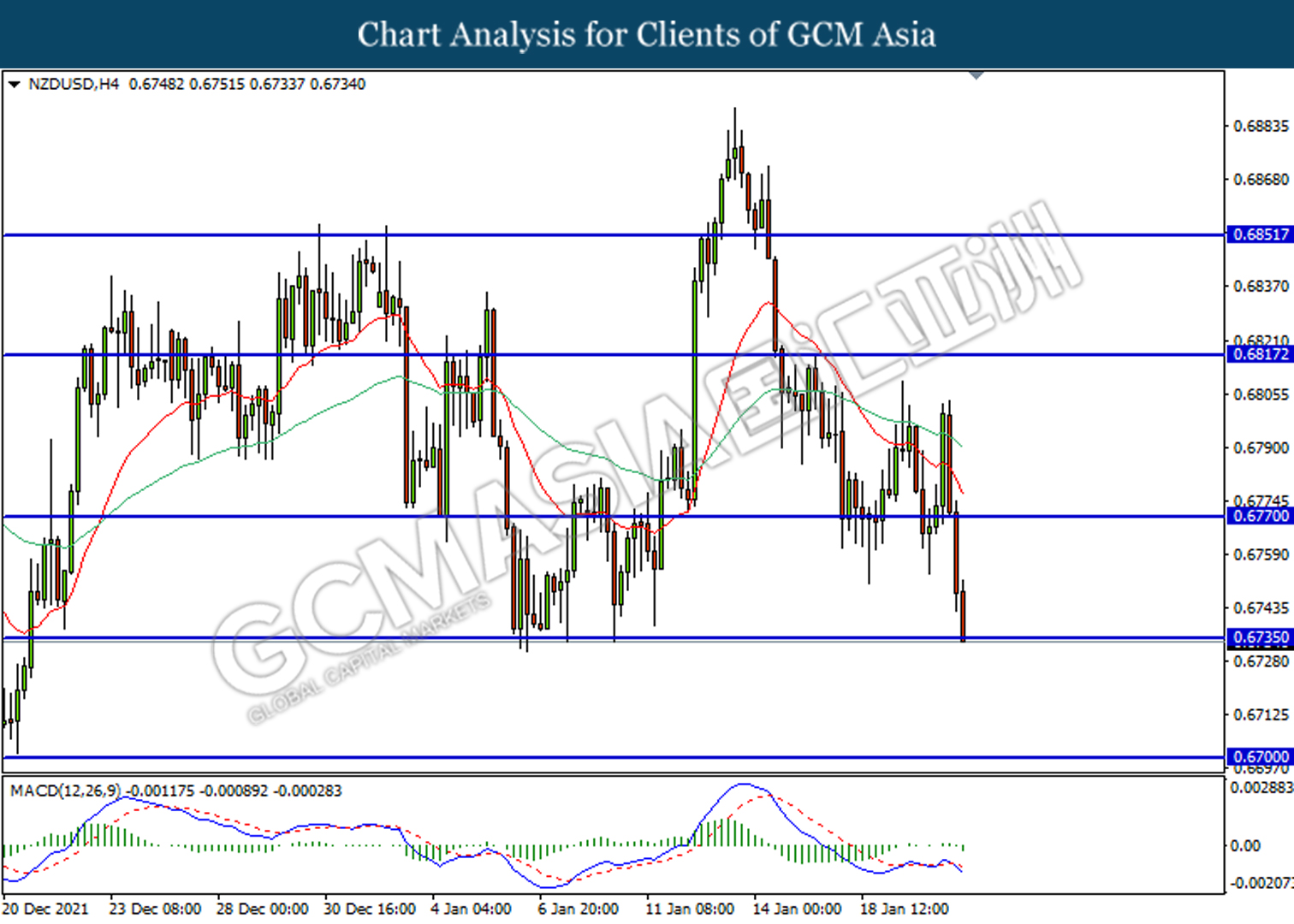

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.6770, 0.6820

Support level: 0.6735, 0.6700

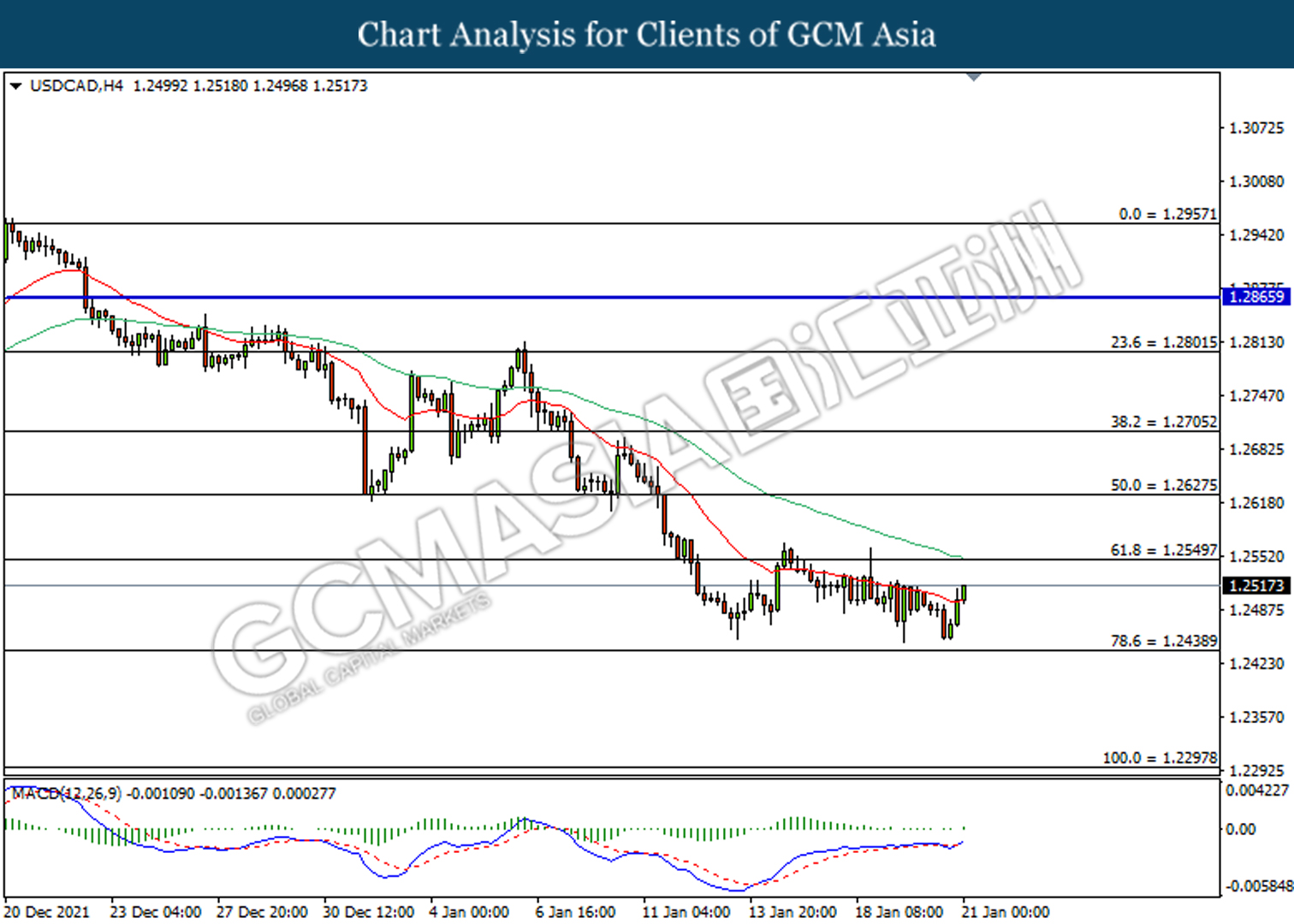

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded in short-term.

Resistance level: 1.2550, 1.2630

Support level: 1.2440, 1.2300

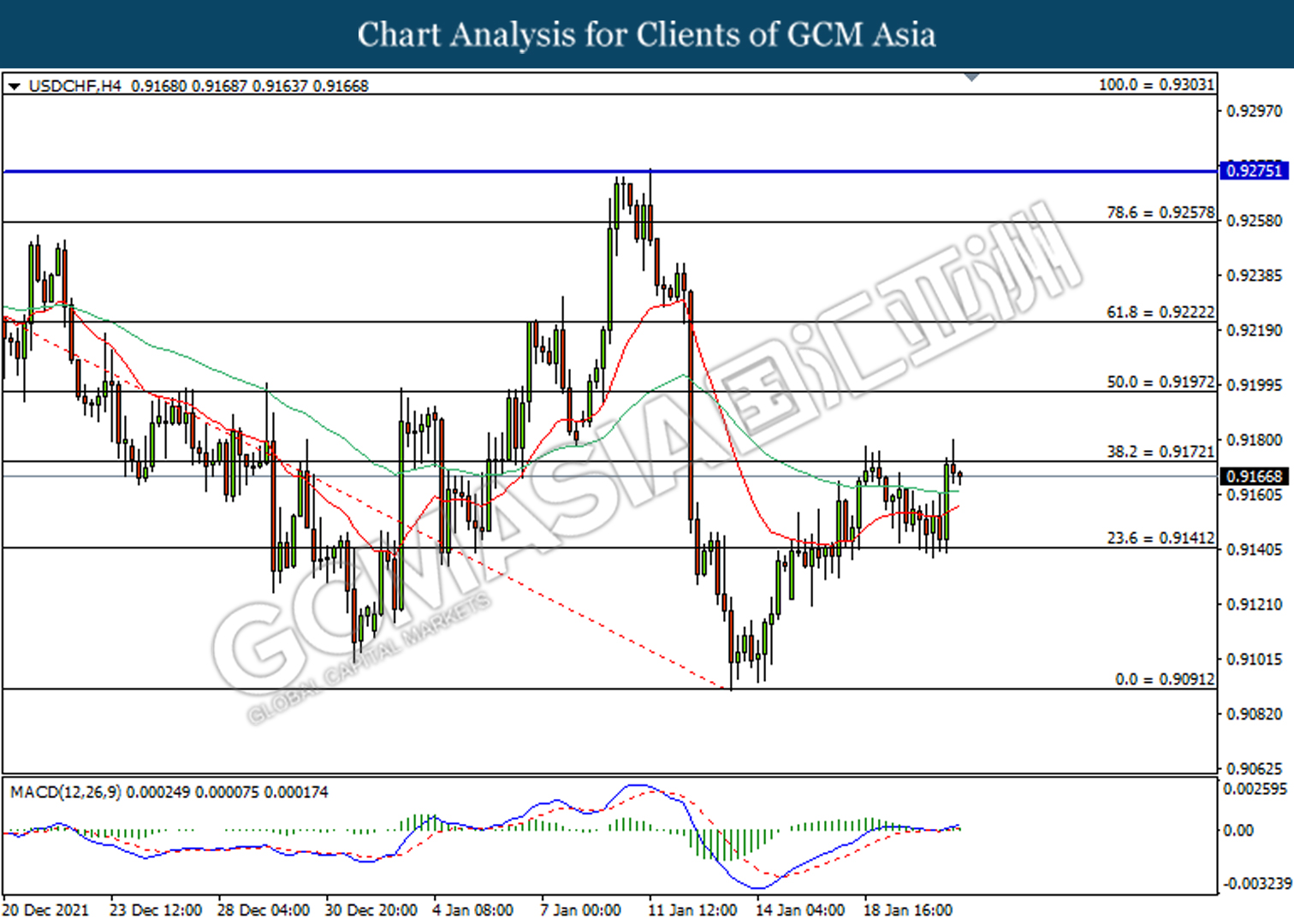

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 0.9170, 0.9200

Support level: 0.9140, 0.9090

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded in short-term.

Resistance level: 84.60, 87.40

Support level: 82.65, 80.15

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80