21 March 2023 Afternoon Session Analysis

Euro appreciated after Lagarde’s optimistic speech.

The Euro dollar, which is one of the most popular traded currencies, continued to be favorable by global investors after Europe Central Banks (ECB) president Lagarde’s optimistic speech on Eurozone banking sectors. Before that, Christine Lagarde has acknowledged that turmoil in the banking sector could force the ECB to stop raising interest rates as the market jitters hit the Eurozone’s business and consumer spending. The total amount of lending in the Eurozone from banks in the bloc contracted by €61bn from January to February. However, Lagarde mentioned that the Eurozone banks had limited exposure to Credit Suisse after the joint efforts by Swiss National Banks (SNB) and UBS of taking over the bank. She also said Eurozone lenders were “well supervised”, with more than 2200 banks in Europe covered by Basel III rules requiring them to maintain a minimum 7% capital requirement. Additionally, Euro continued to benefit from the weakening of the dollar. The US Federal Reserve and other major central banks joint action of increasing the frequency of maturity operations from weekly to daily has improved the liquidity of the currencies. As a result, the joint plan has weakened the US dollar. As of writing, the EUR/USD pair slipped -0.12% to $1.0706, while the market participants are waiting for more cues from Germany’s ZEW Economic Sentiment.

In the commodities market, crude oil prices were traded down by -1.03% to $67.10 per barrel as the uncertainty of the Fed interest rate decision. Besides, gold prices depreciated by -0.32% to $1976.70 per troy ounce as the Fed meeting looms.

Today’s Holiday Market Close

Time Market Event

All Day JPY Vernal Equinox

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Mar) | 28.1 | 16.4 | – |

| 20:30 | CAD – Core CPI (MoM) (Feb) | 0.3% | – | – |

| 22:00 | USD – Existing Home Sales | 4.00M | 4.17M | – |

Technical Analysis

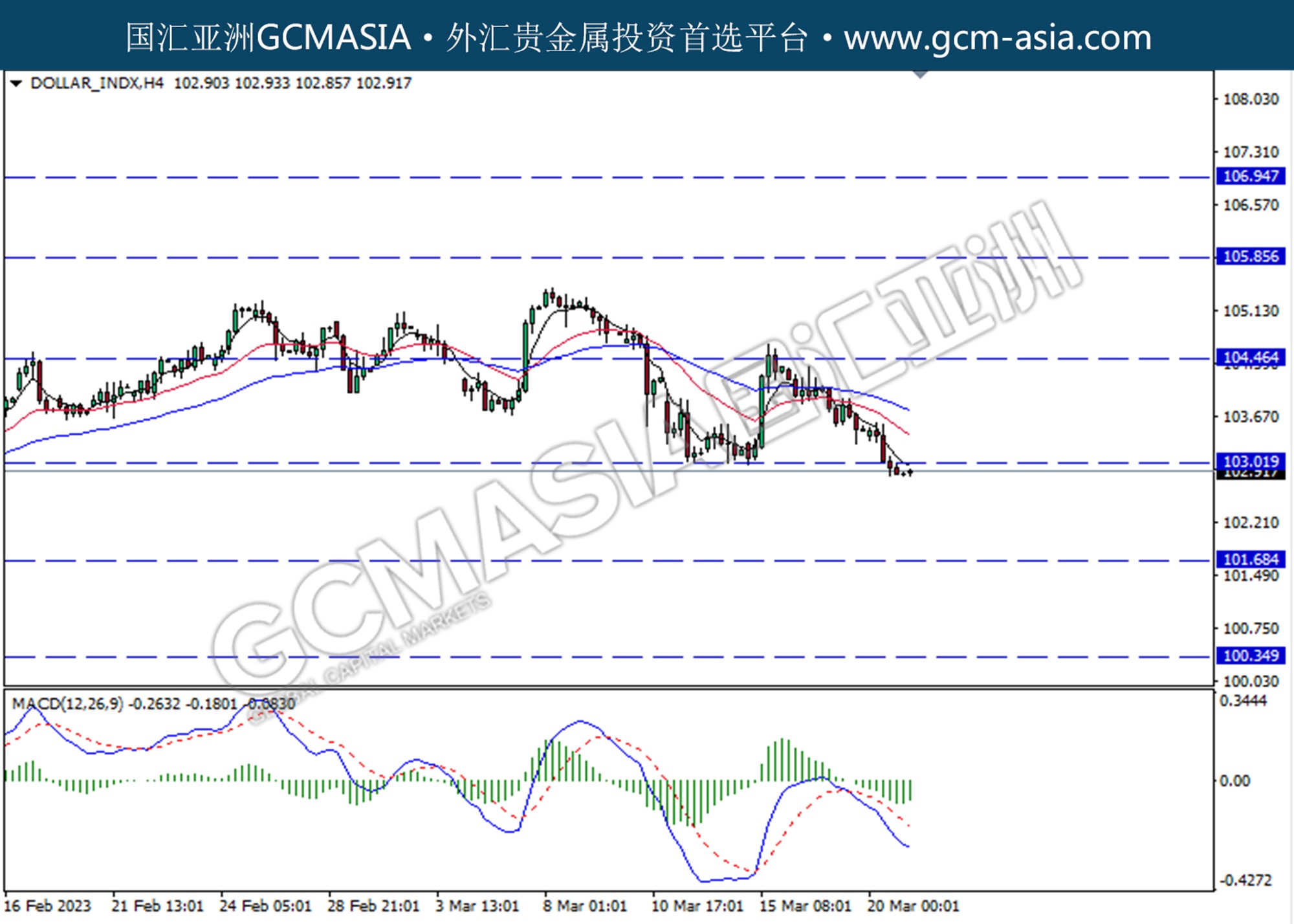

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in the short term.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

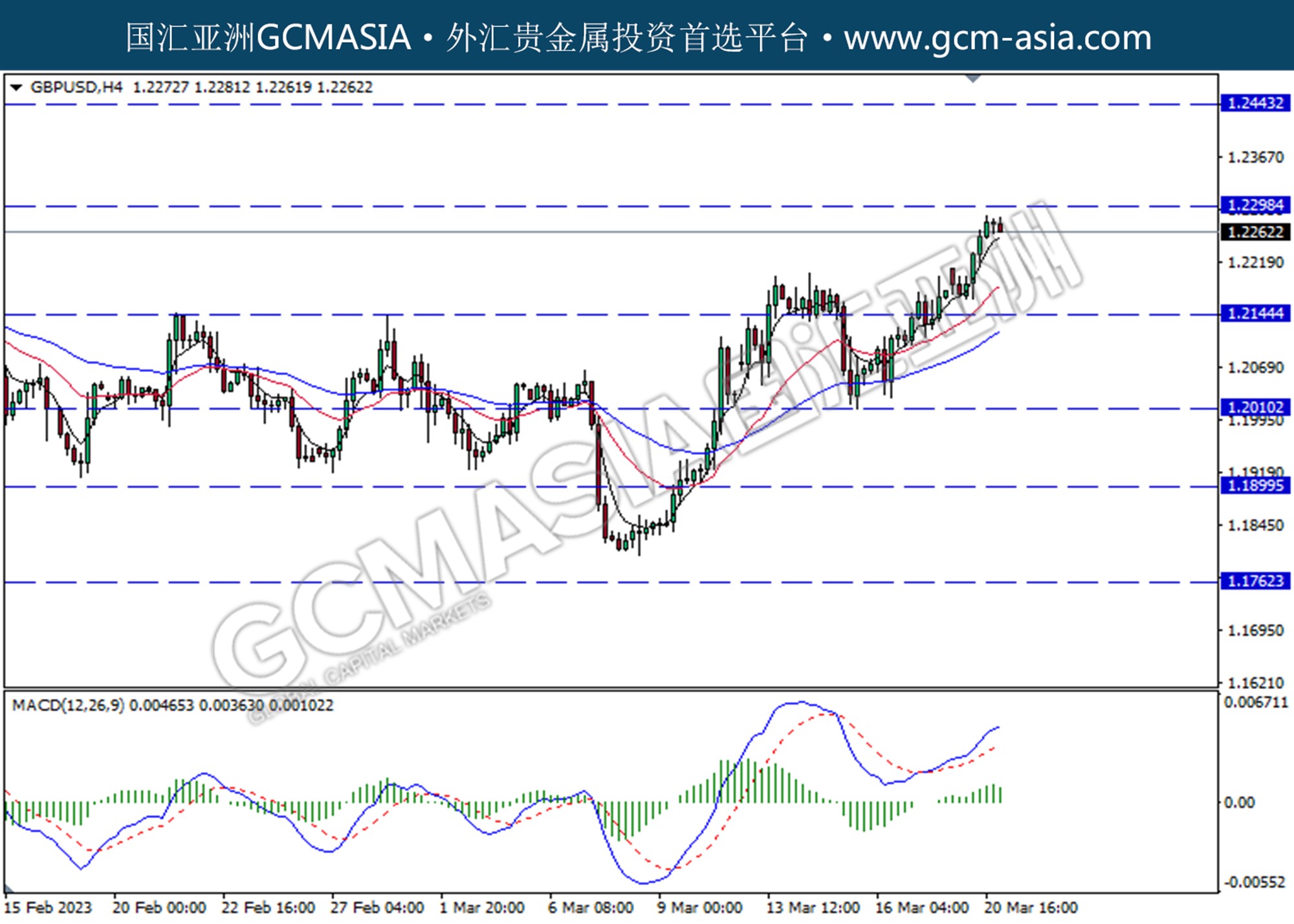

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2145.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

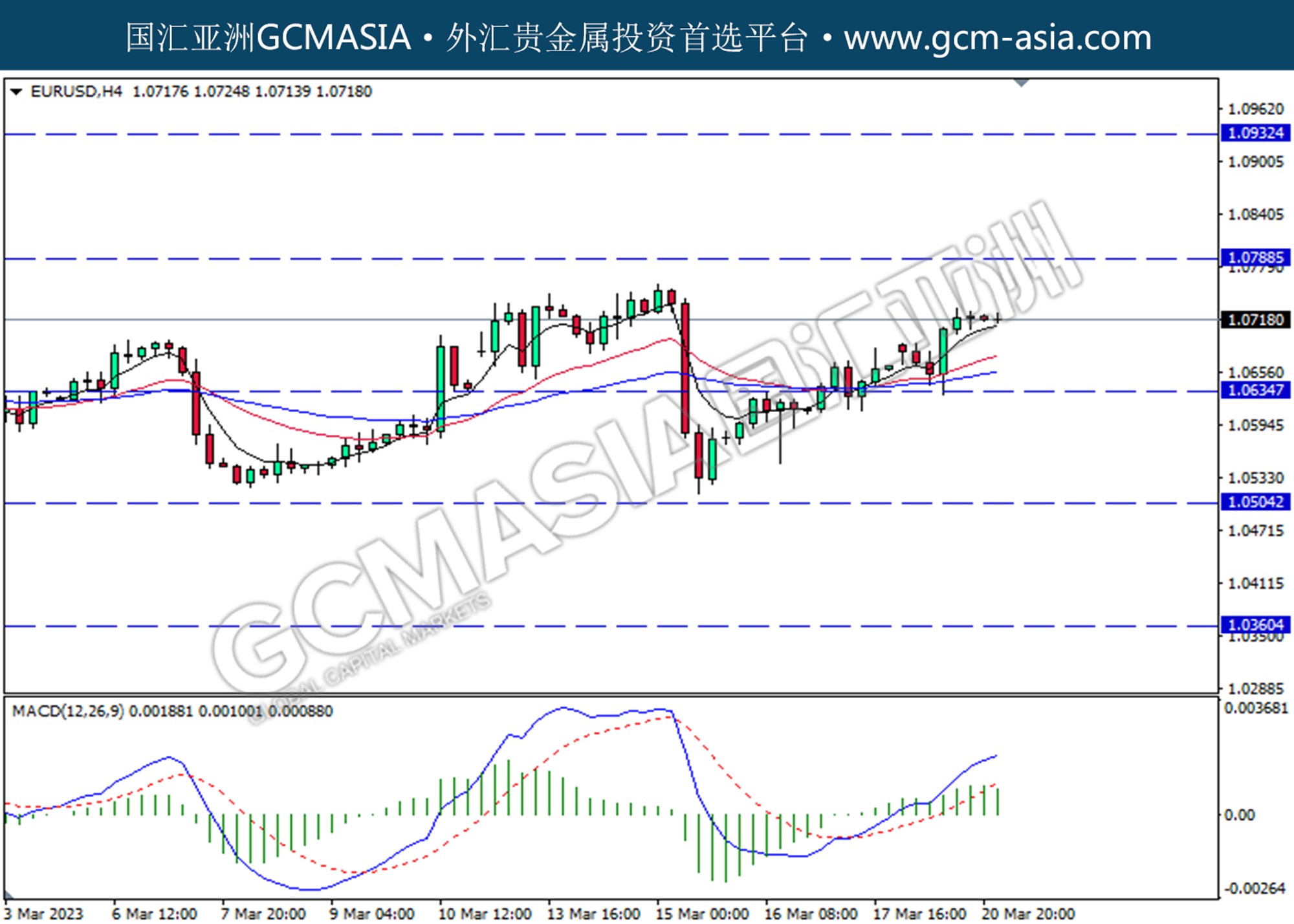

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0365.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

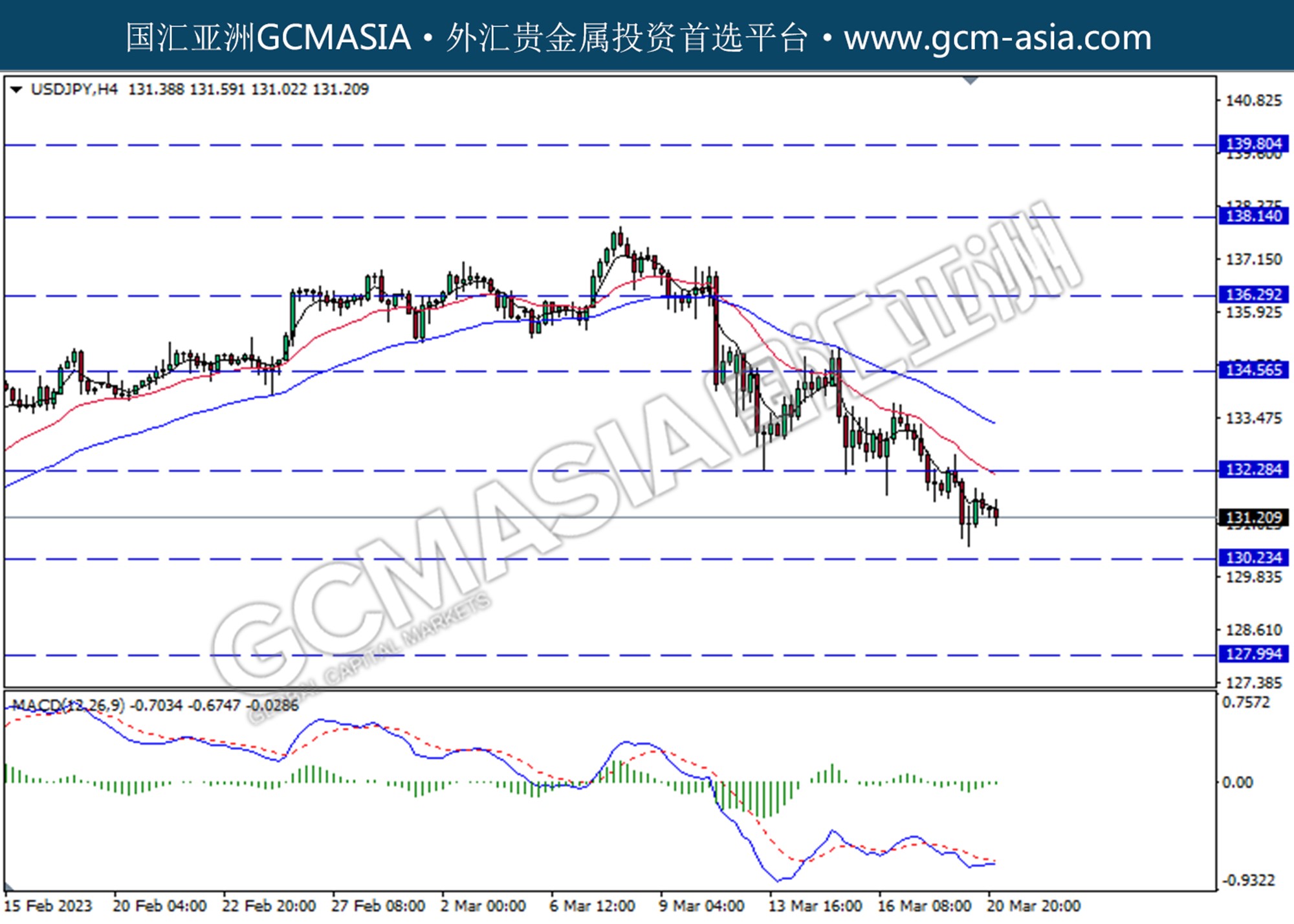

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

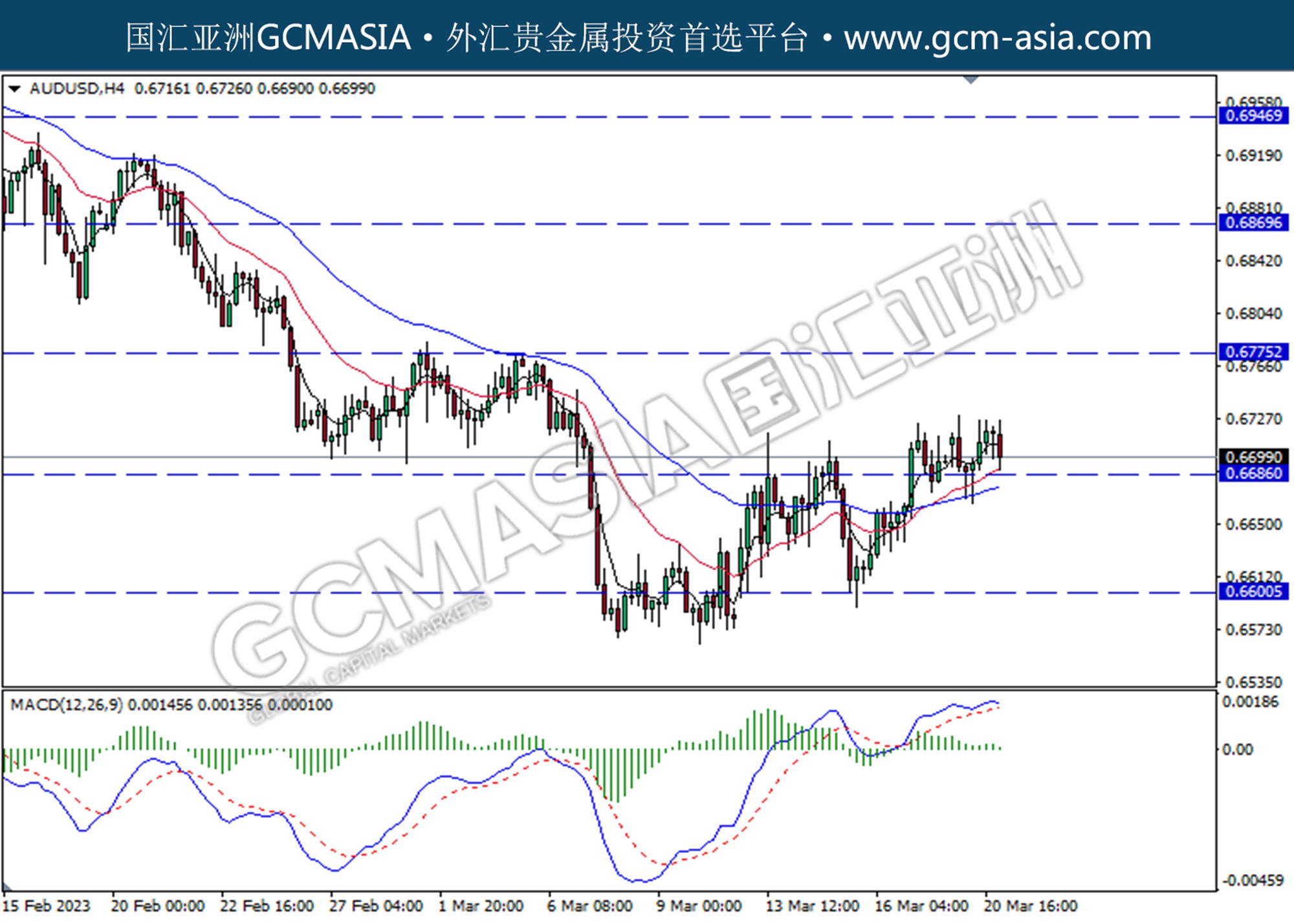

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6685. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully break below the support level.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

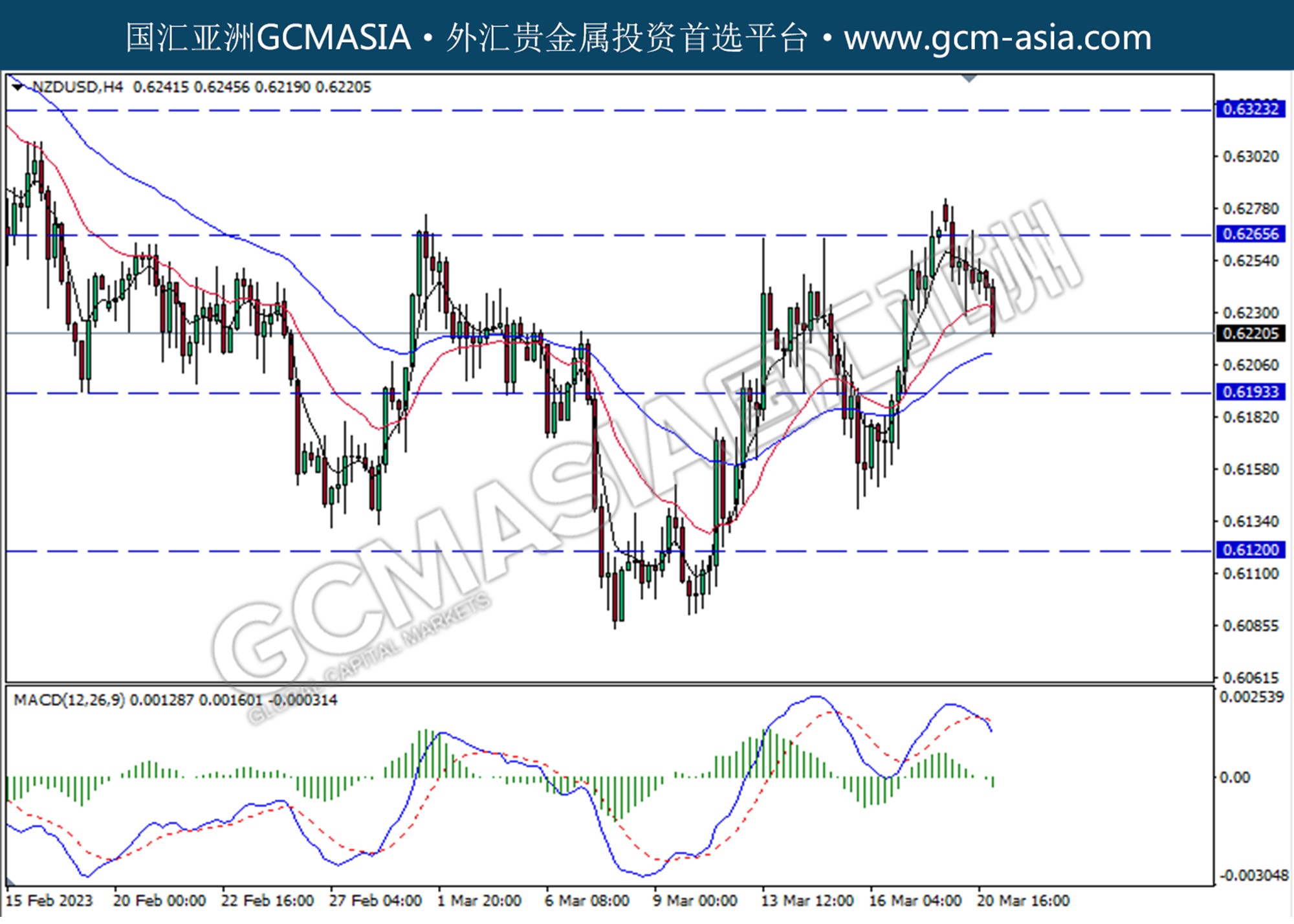

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6265. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

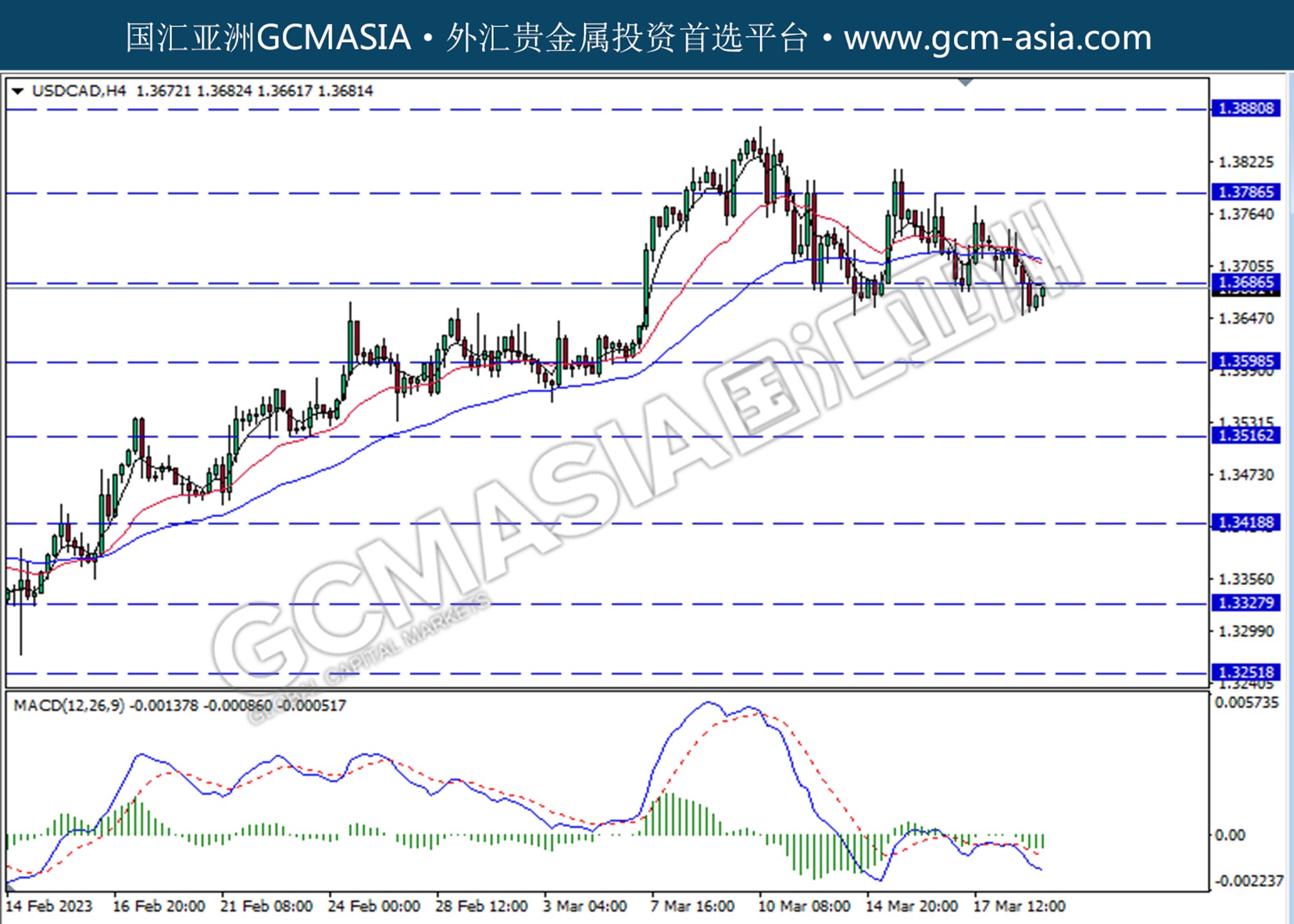

USDCAD, H4: USDCAD was traded higher while currently testing for the resistance level at 1.3685. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

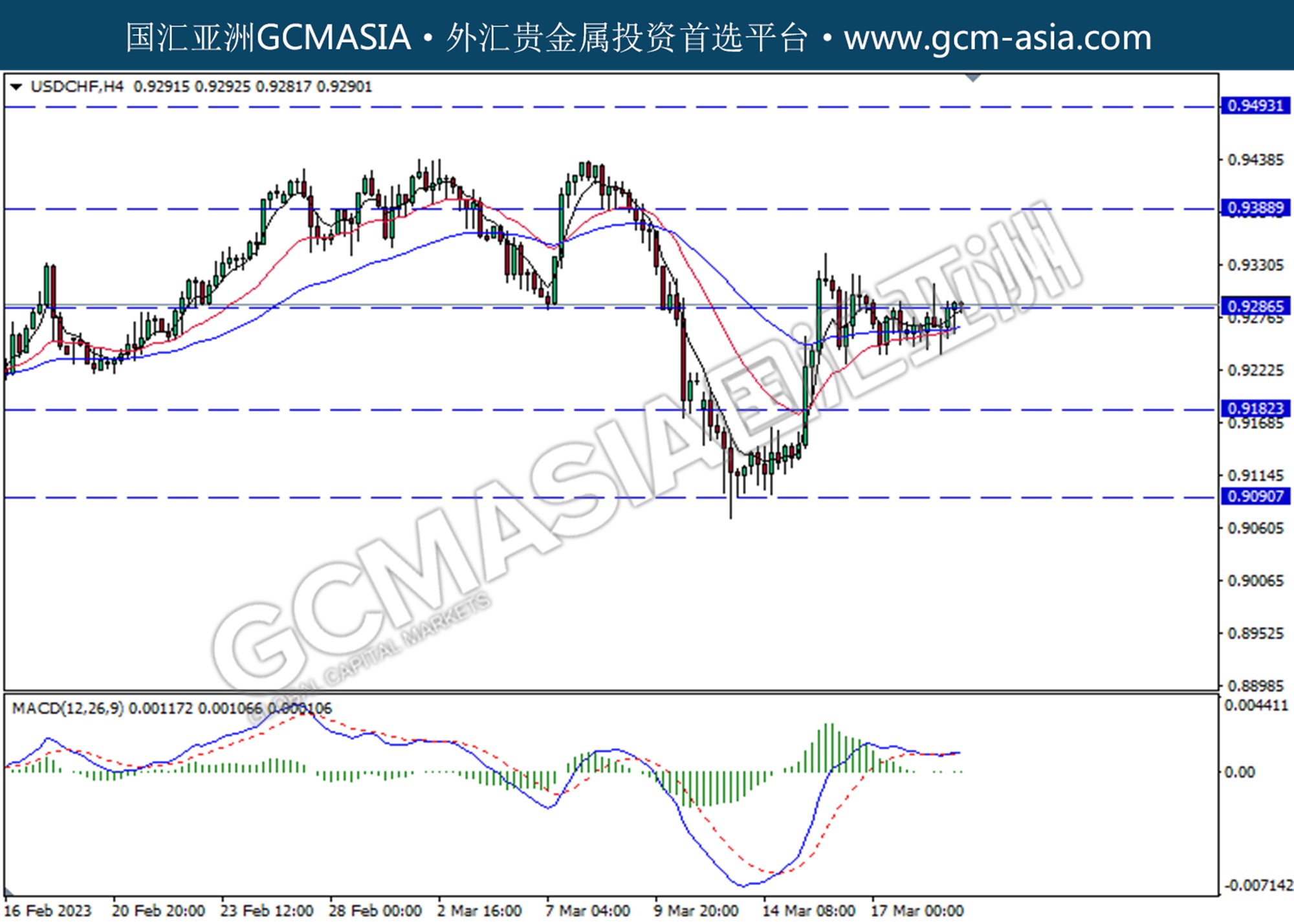

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9285. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 0.9320, 0.9475

Support level: 0.9225, 0.9070

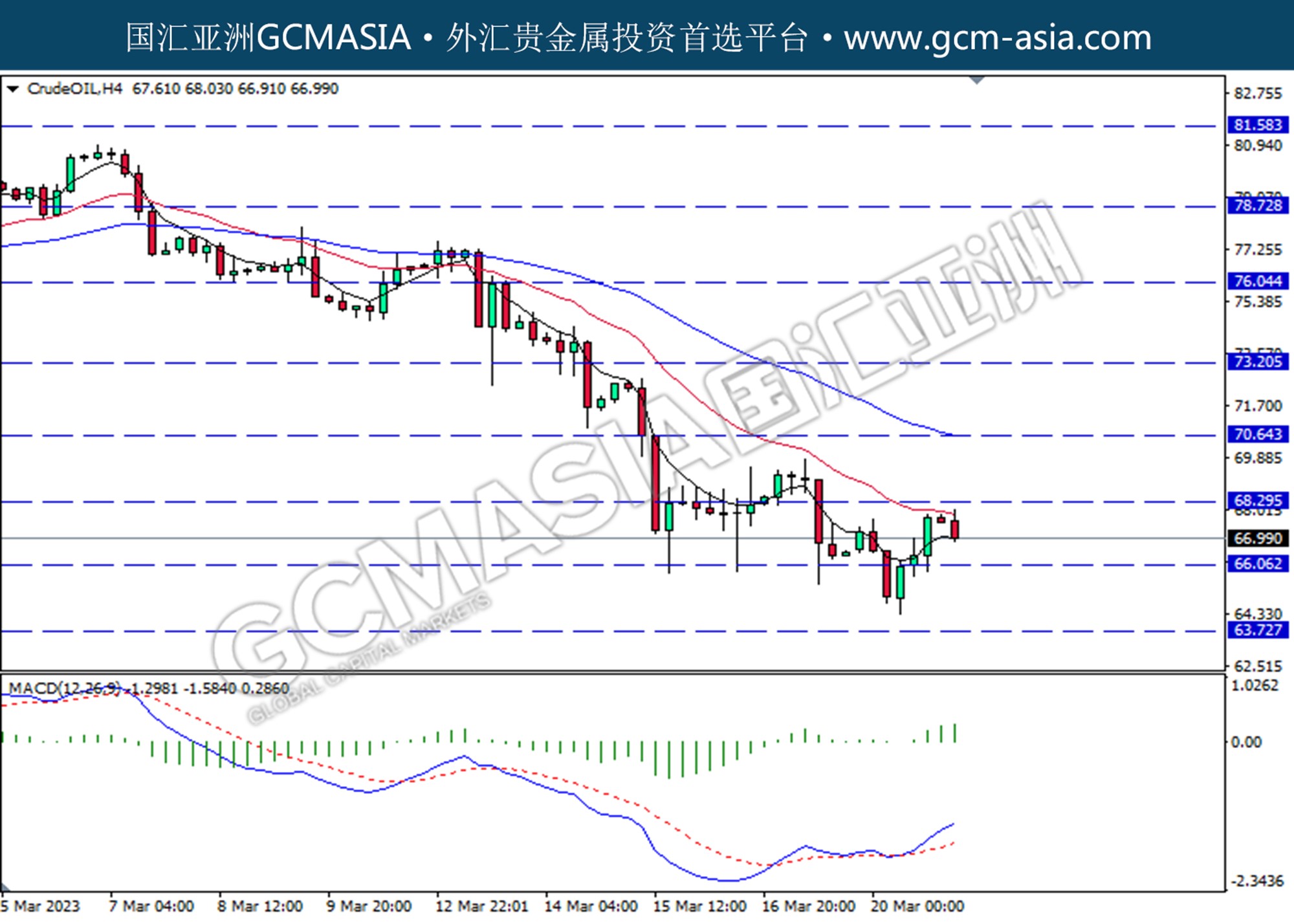

CrudeOIL, H4: Crude oil price was traded lower following retracement from the higher level. However, MACD which illustrated bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 68.30, 70.65

Support level: 66.05, 63.70

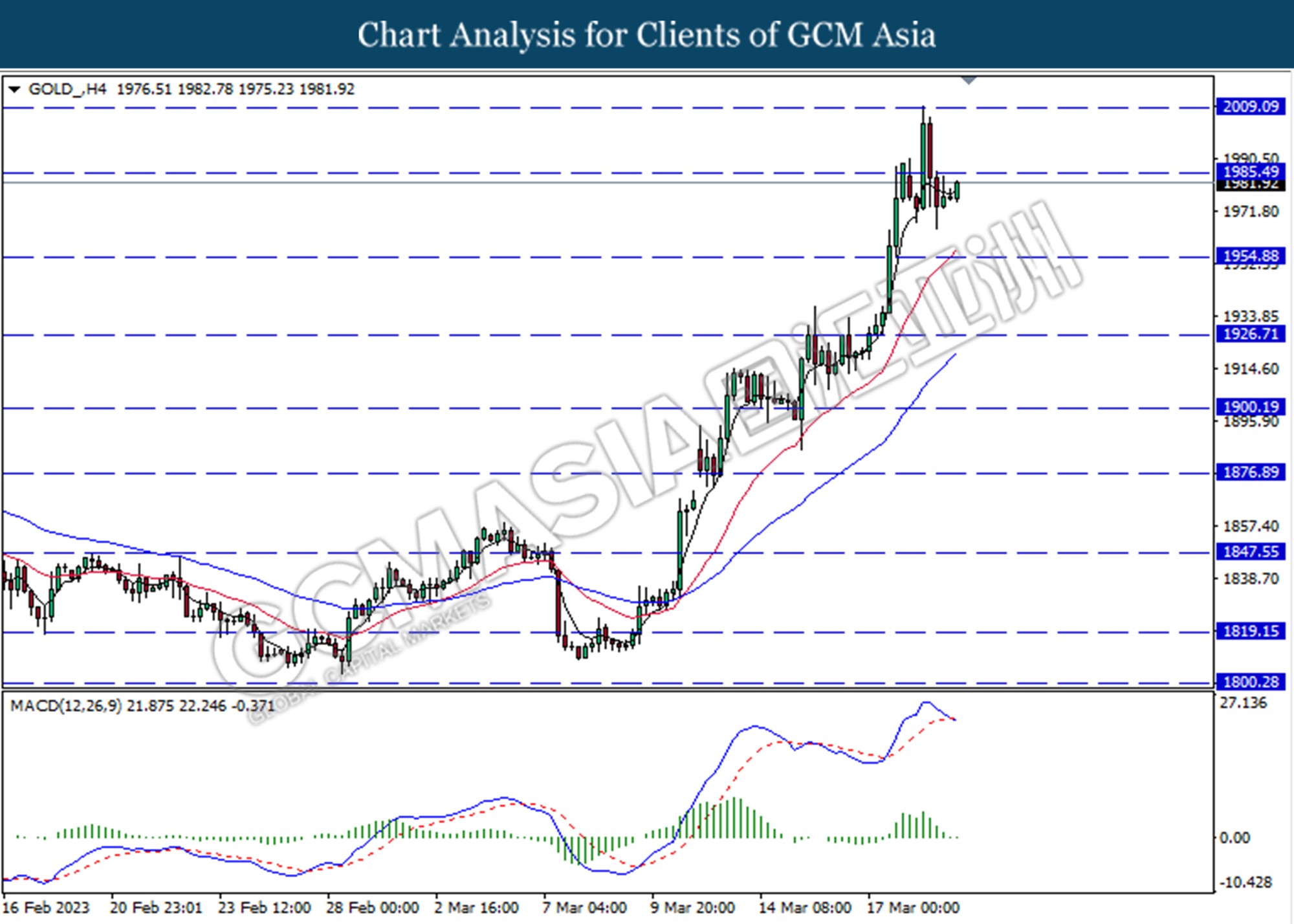

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70