21 March 2023 Morning Session Analysis

Greenback slumped amid ongoing woes in US banking sector.

The dollar index, which traded against a basket of six major currencies, lost its ground while teetering near the brink of collapse as the ongoing banking sector woes coaxed investors to stay away from the dollar market. Yesterday, the US Federal Reserve and other major central banks took joint action for dollar liquidity to support the country’s tide through the banking crisis. In detail, the central banks, which include the Federal Reserve, the Bank of Canada, the Bank of England, the Bank of Japan, and the European Central Bank, have enhanced the swap lines’ effectiveness in providing US dollar funding, where all of them agreed to increase the frequency of 7-day maturity operations from weekly to daily and continuing at least until the end of April. The swap lines agreement was initially introduced during the era of the 08’ Lehman Crisis, when the Fed provided temporary dollar liquidity swaps to overseas central banks to address short-term dollar liquidity shortages outside the U.S. Against the backdrop, the action from the central banks dragged down the dollar value. On top of that, with the increasing expectation of a rate hike pause from the Fed, the appeal of the dollar index dropped further. As of writing, the dollar index edged down -0.39% to 103.30.

In the commodities market, crude oil prices were down by -0.19% to $67.35 per barrel as the uncertainty risk continued to linger in the market. Besides, gold prices ticked down by -0.02% to $1978.00 per troy ounce amid profit-taking by the traders.

Today’s Holiday Market Close

Time Market Event

All Day JPY Vernal Equinox

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Mar) | 28.1 | 16.4 | – |

| 20:30 | CAD – Core CPI (MoM) (Feb) | 0.3% | – | – |

| 22:00 | USD – Existing Home Sales | 4.00M | 4.17M | – |

Technical Analysis

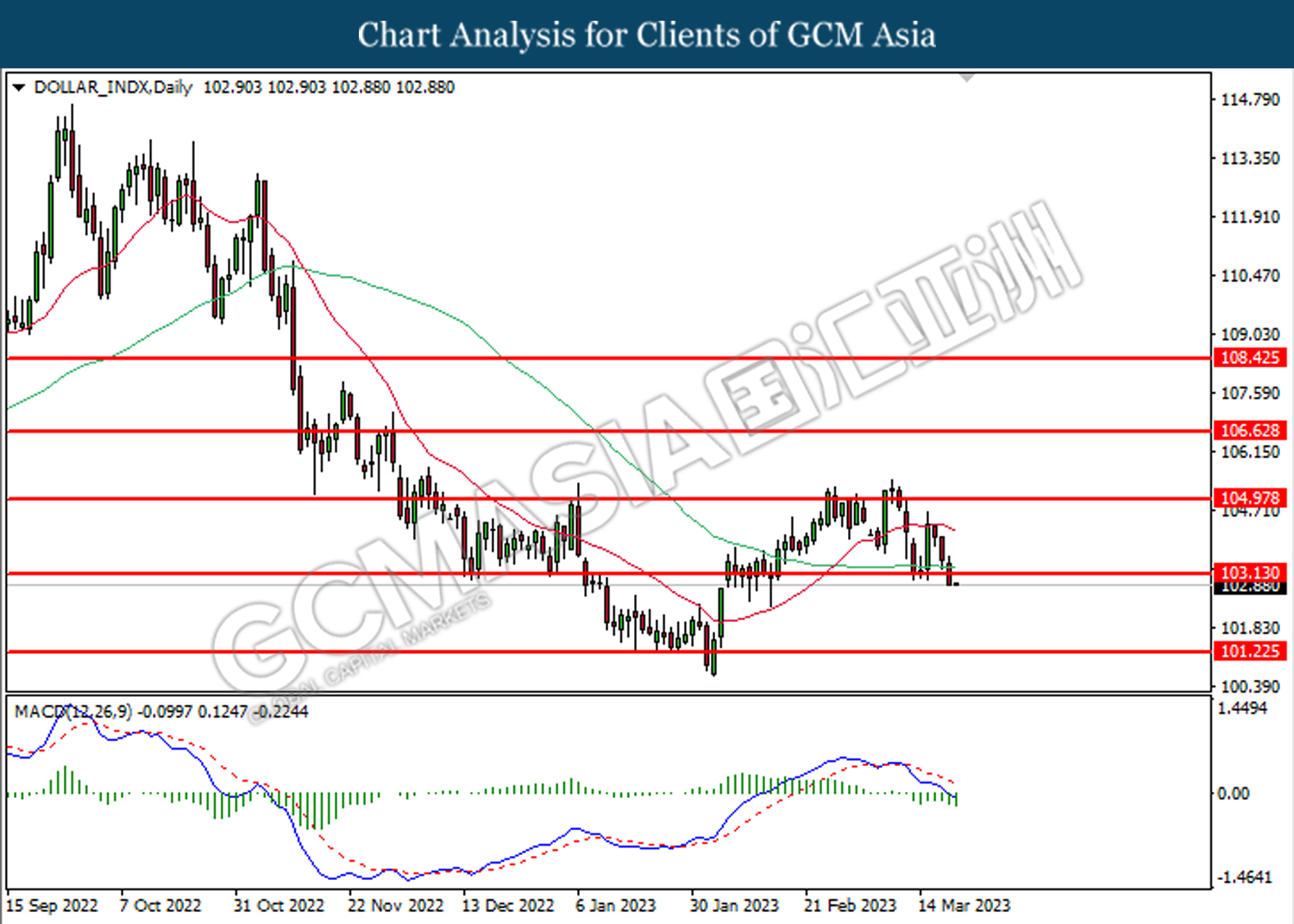

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

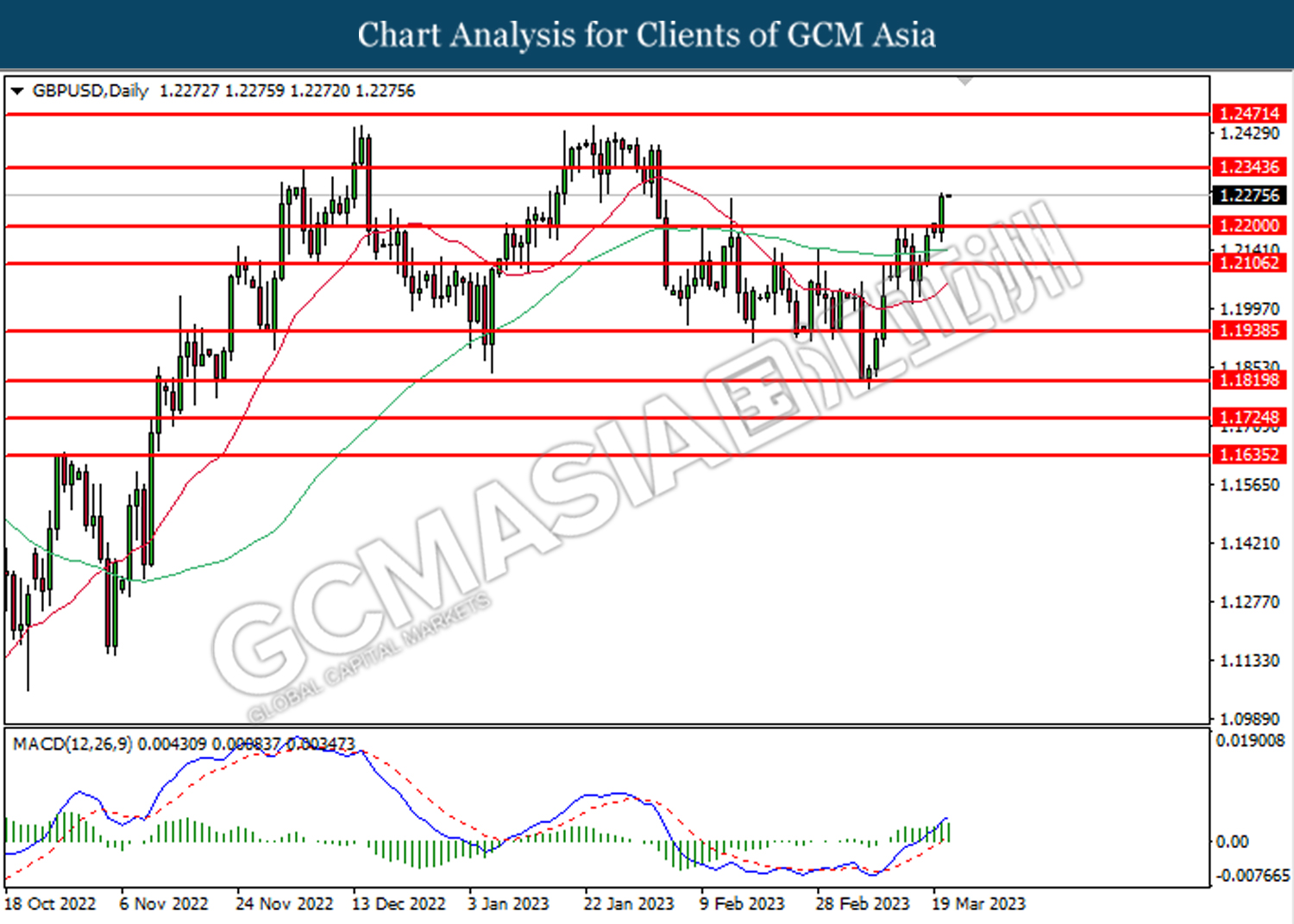

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

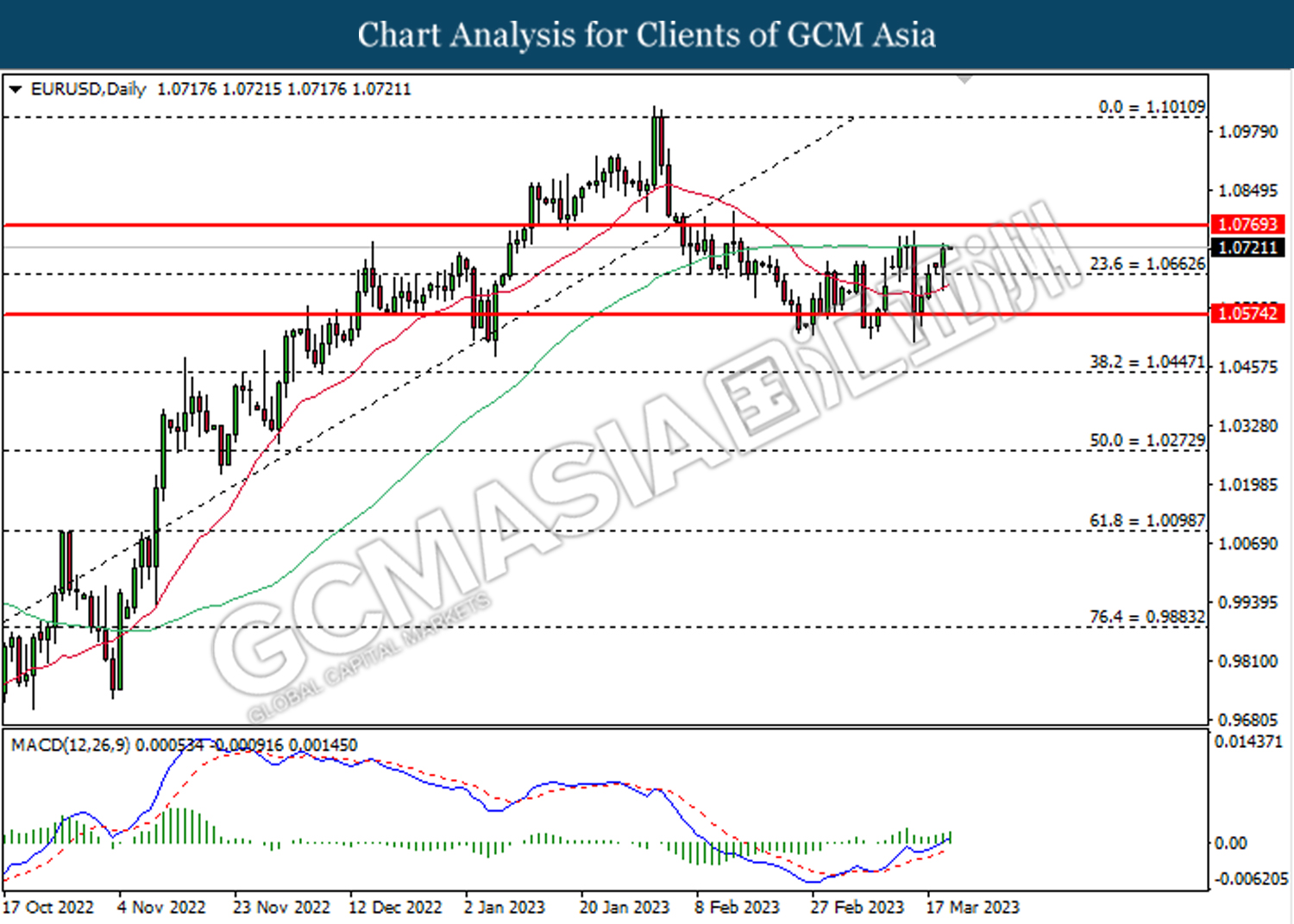

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

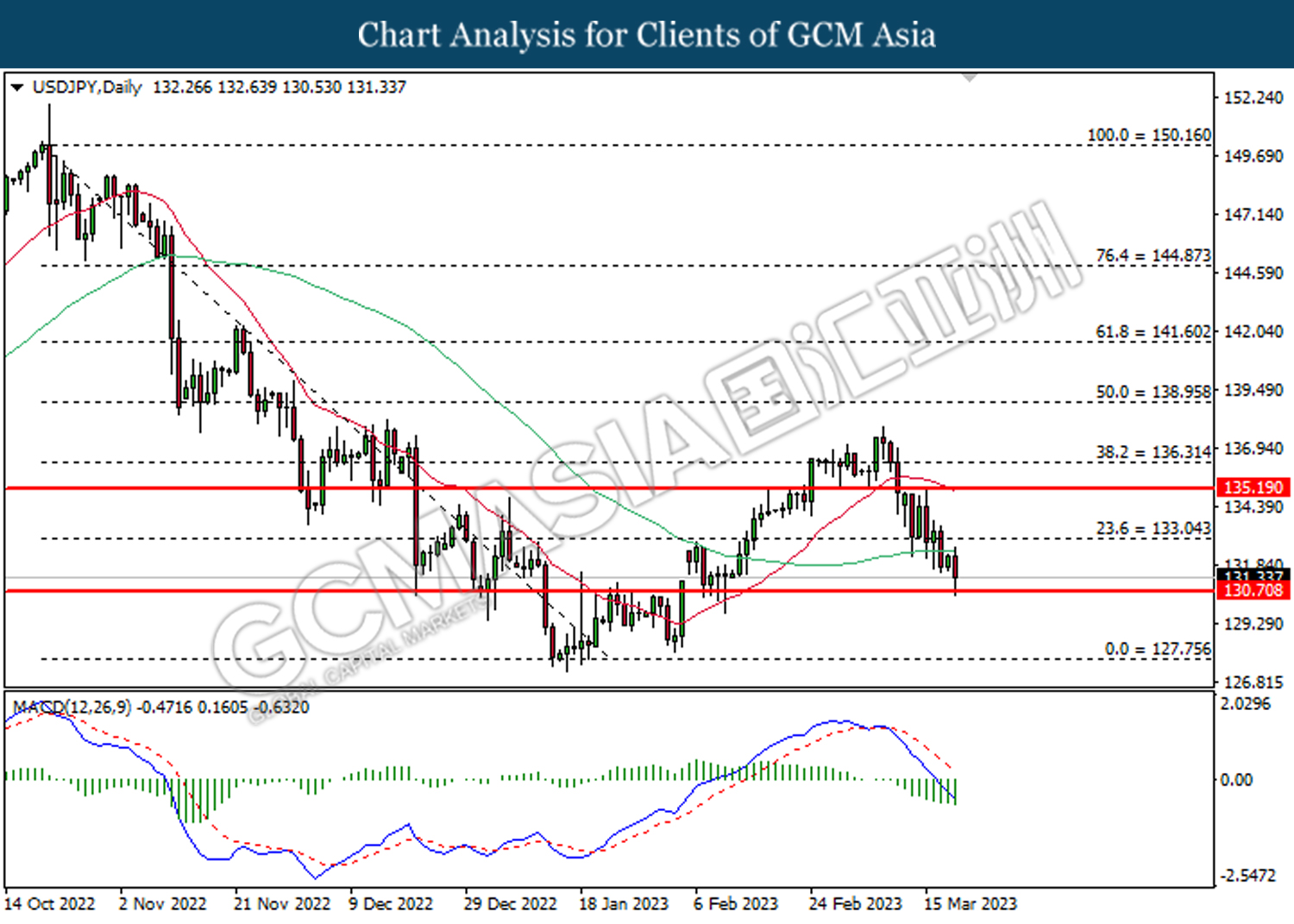

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 130.70.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

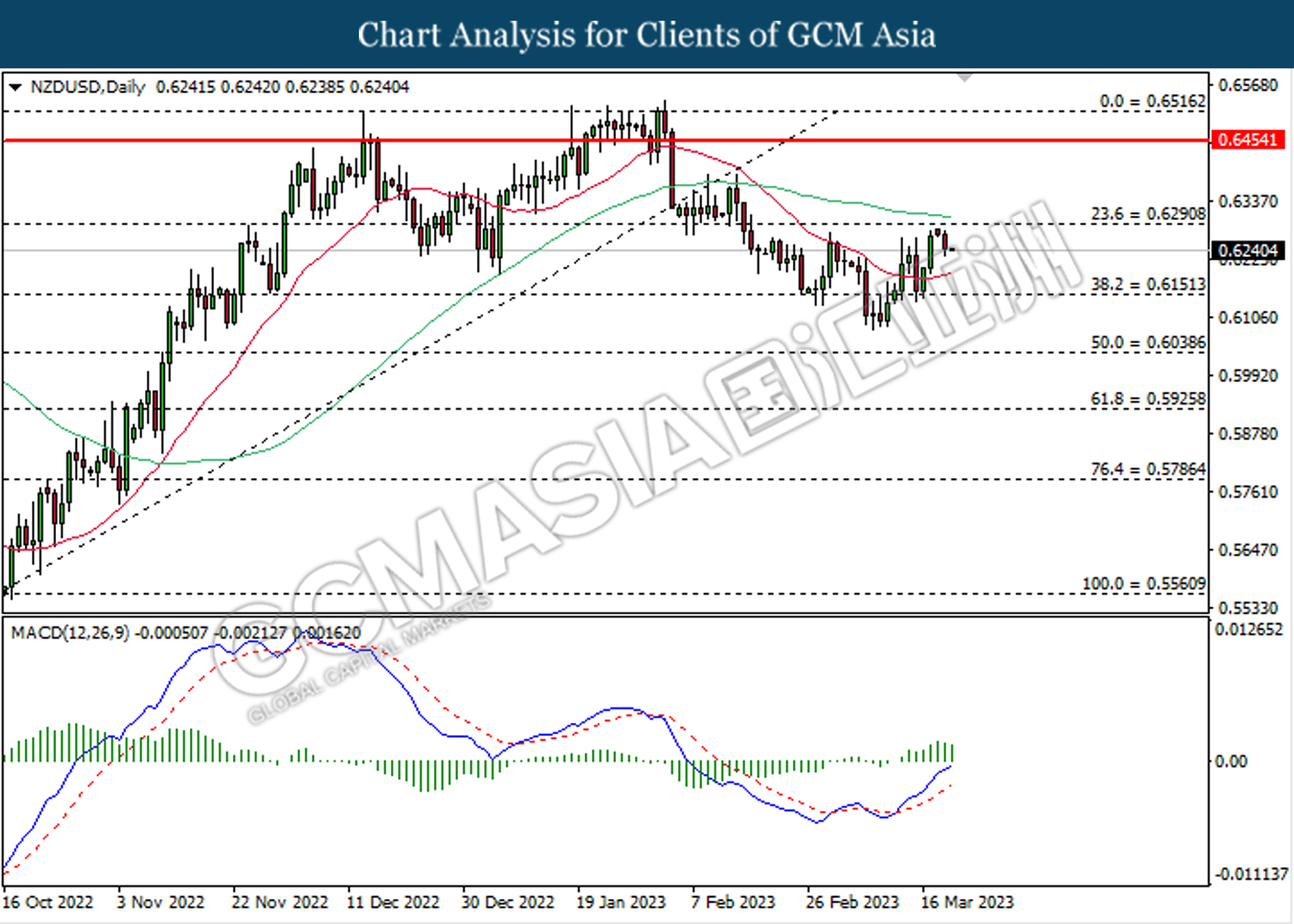

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

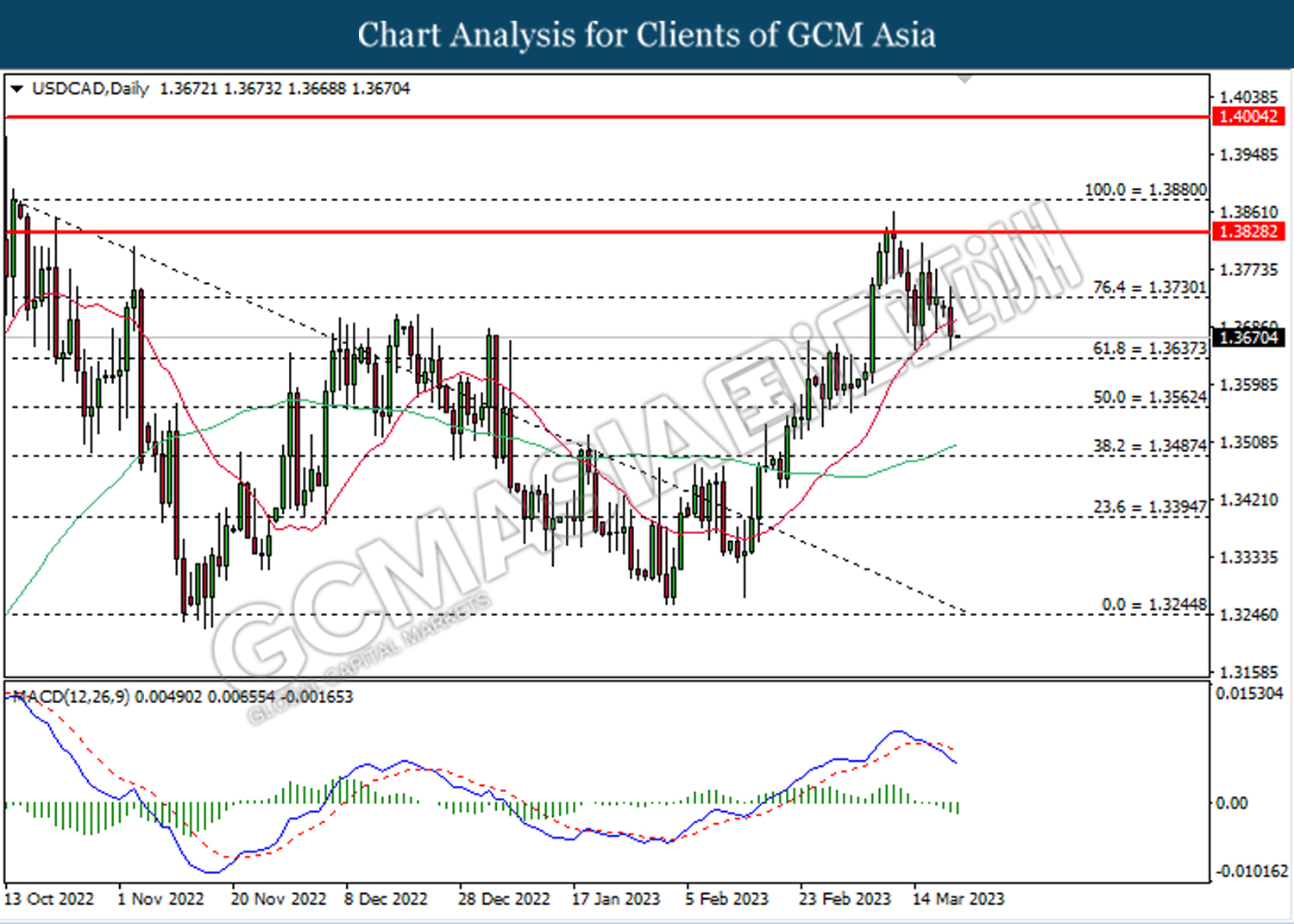

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3730. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

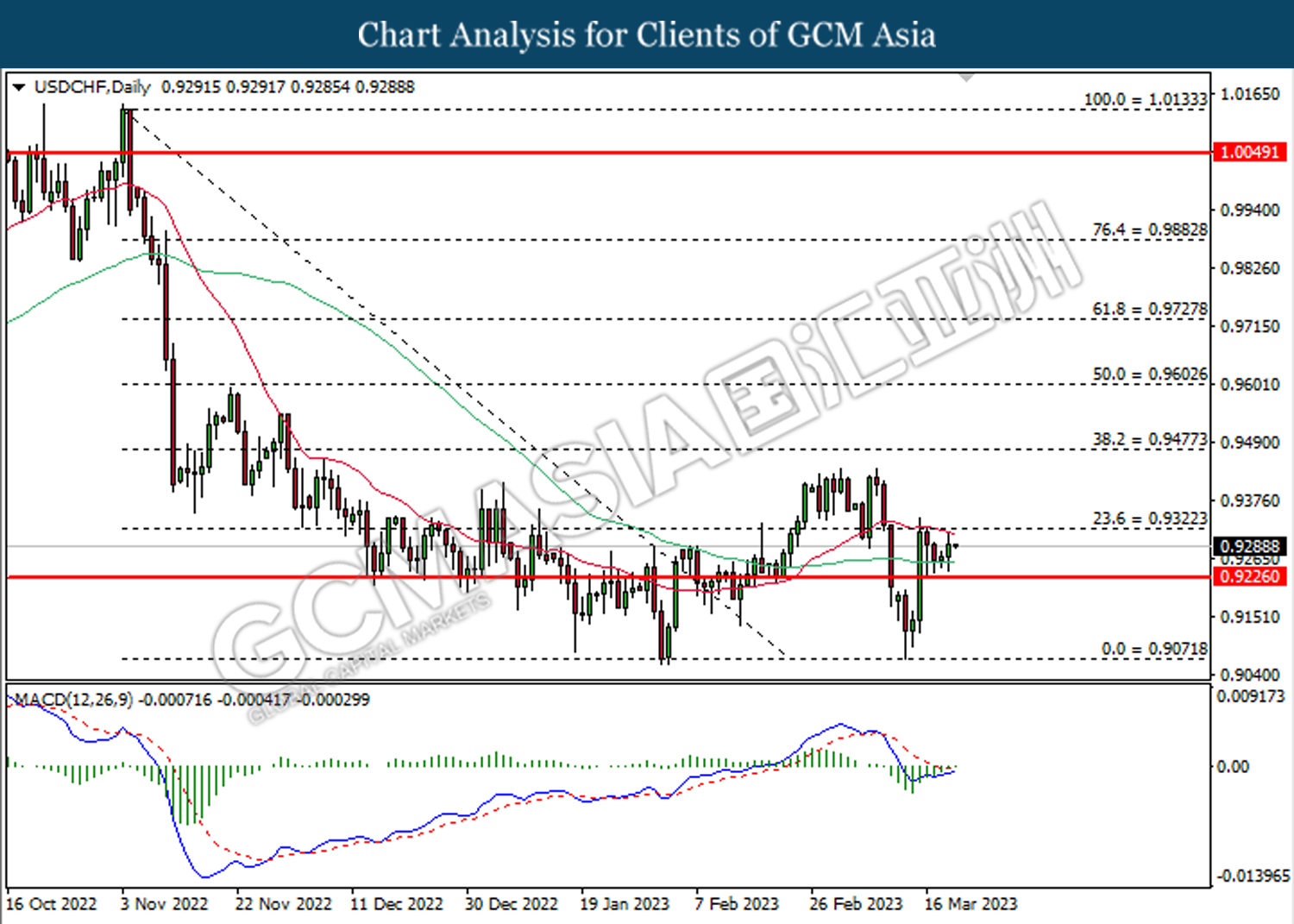

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9320. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9320.

Resistance level: 0.9320, 0.9475

Support level: 0.9225, 0.9070

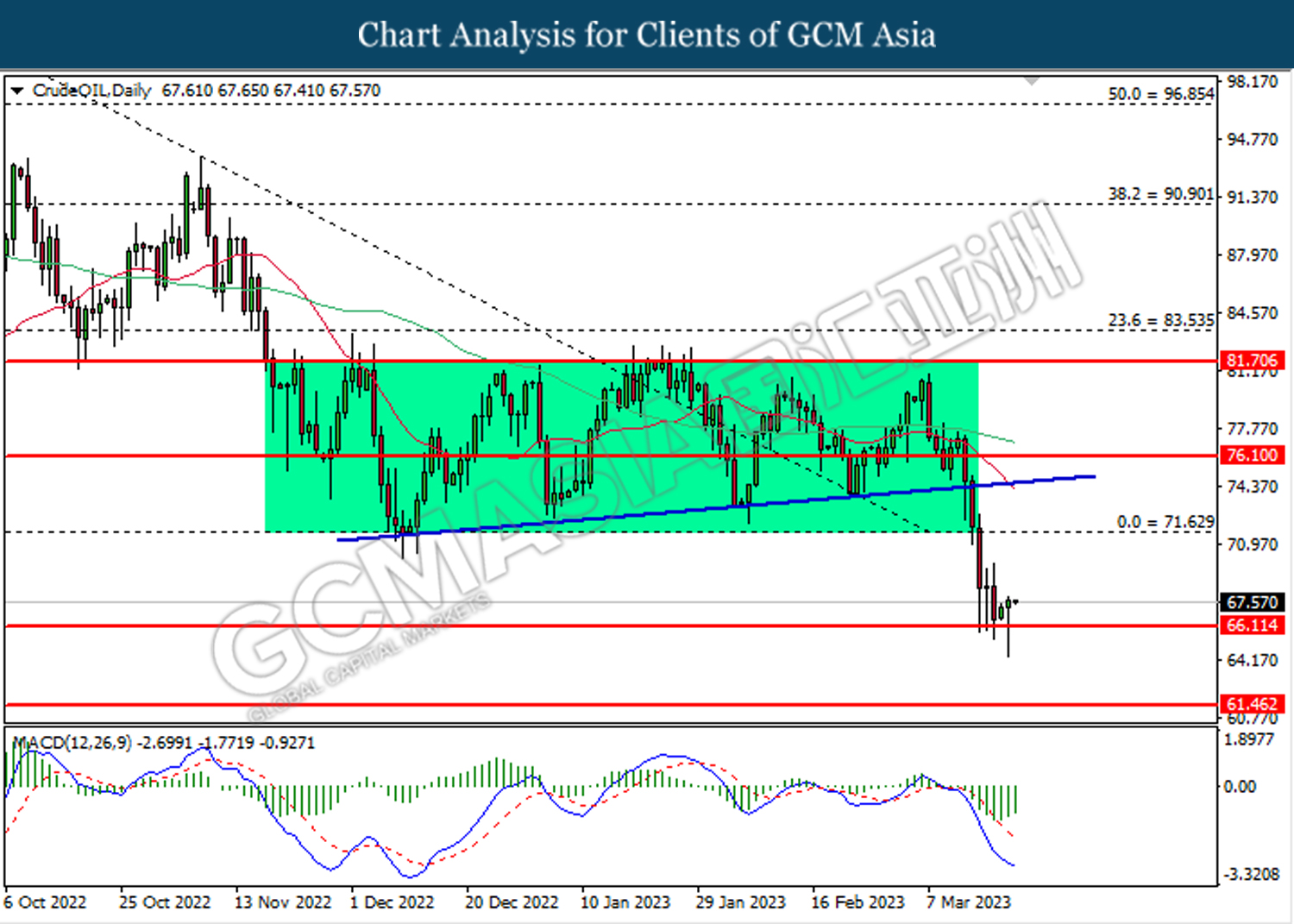

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

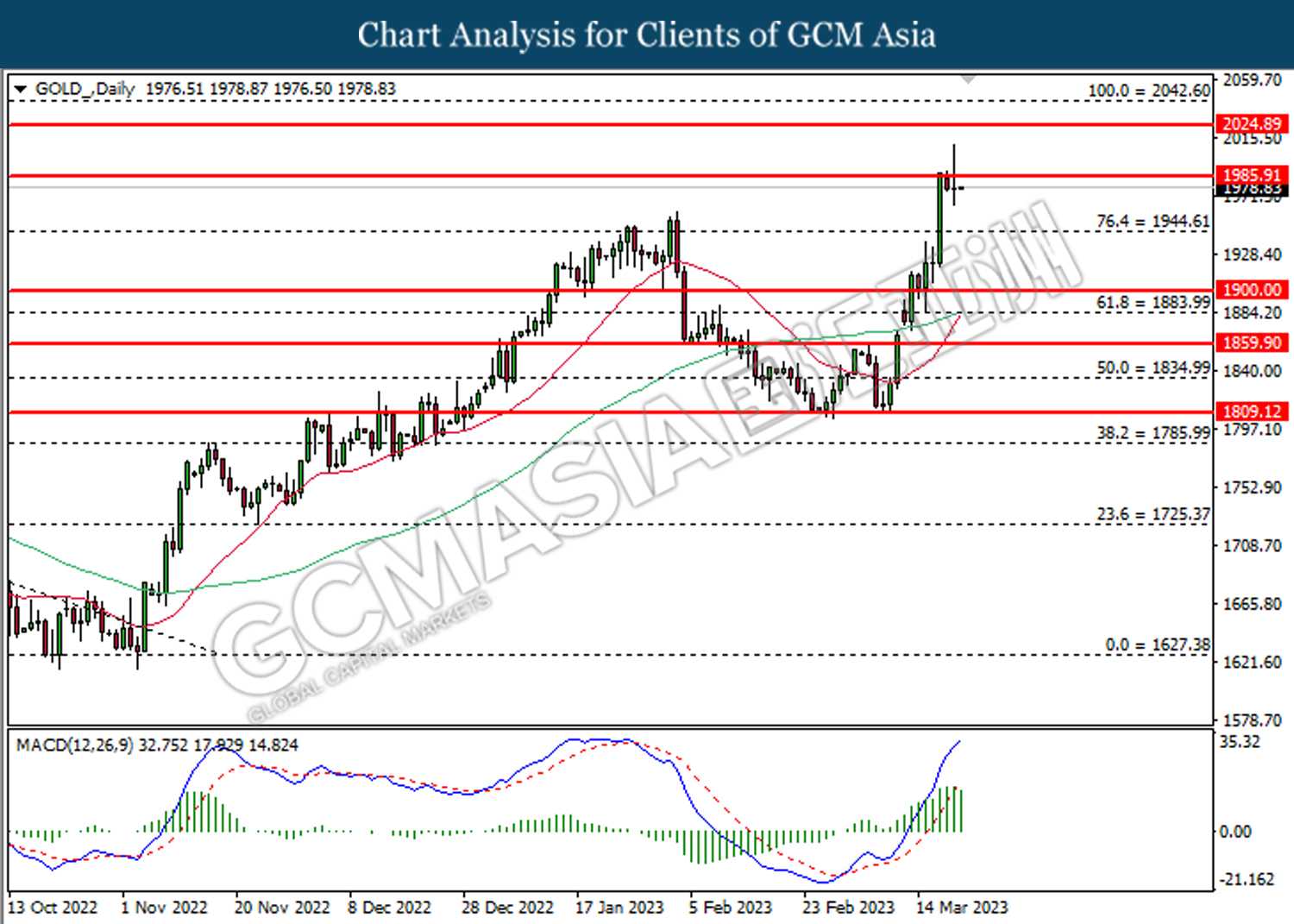

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1985.90. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.90, 2042.60

Support level: 1944.60, 1900.00