21 April 2017 Daily Analysis

Jittery market awaits French poll.

US dollar and Euro was held steady during early Asian trading hours on Friday following prior suspected terrorist shooting in Paris ahead of this weekend’s French presidential election. One policemen were killed while two others were injured after a gunman opened fire in the central of Paris on Thursday night. Dollar index nudged up 0.01% and last quoted at 99.66 against six major peers. On the other hand, EUR/USD was held stable at around $1.0720. “Political uncertainty will remain as a recurrent theme in Eurozone. Previous uptrend on the euro may be utilized by longer-term bears to send the price lower in the event of major news,” research analyst said in a note. As for the greenback, overnight’s disappointing economic data namely Initial Jobless Claims and Philadelphia Fed Manufacturing Index adds further downside to the dollar, capping its current gains. Market participants will look forward to a series of data from several nations due later today before shifting their focus to the first round of French presidential election on Sunday.

Looking into the commodities, crude oil price seesawed on Friday as cautious investors weighs upon the ability of OPEC to curb oversupply glut and the rebound of US shale production. Otherwise, gold price was held weaker on Friday, easing 0.07% to $1,280.95 as market participants remains cautious ahead of French polls.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Apr) | 58.3 | 58.0 | – |

| 16:30 | GBP – Retail Sales (MoM) (Mar) | 1.4% | -0.2% | – |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.4% | – | – |

| 22:00 | USD – Existing Home Sales (Mar) | 5.48M | 5.60M | – |

| 01:00 | Crude Oil – US Baker Hughes Oil Rig Count | 683 | – | – |

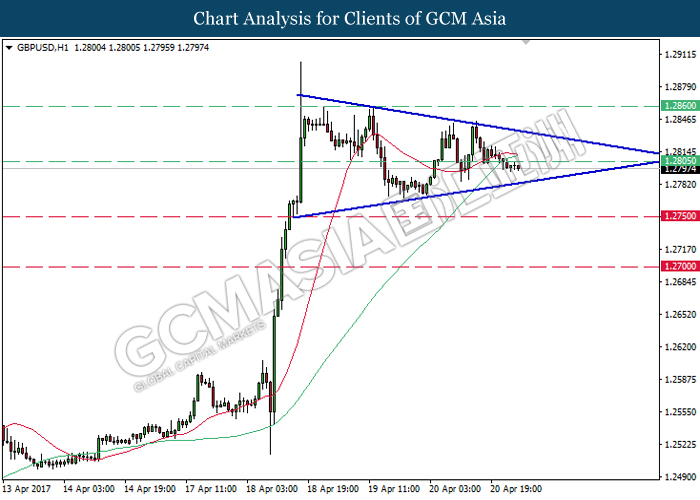

GBPUSD

GBPUSD, H1: GBPUSD remains traded within a narrowing triangle following prior retracement from the top level of the triangle. It is expected to advance further down, towards the lower level of the triangle in short-term. Long-term trend direction could only be determined after a successful breakout from either side of the triangle.

Resistance level: 1.2805, 1.2860

Support level: 1.2750, 1.2700

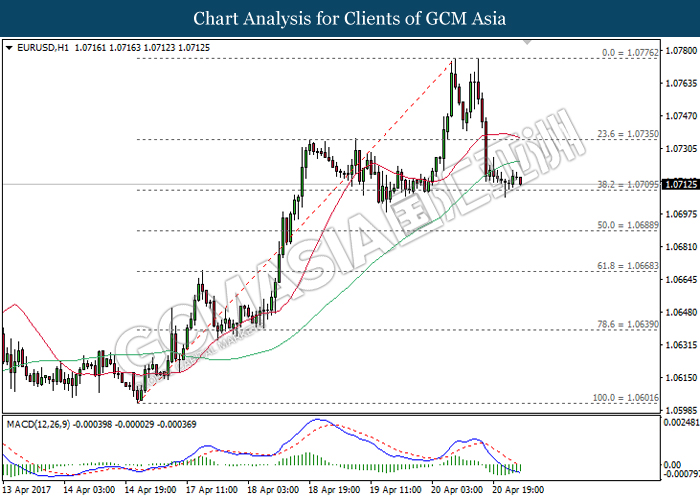

EURUSD

EURUSD, H1: EURUSD was traded lower following prior retracement from previous high of 1.0775. With regards to the MACD histogram which illustrates moderate downward signal and momentum, EURUSD is expected to move further downwards after breaking the support level of 1.0710.

Resistance level: 1.0735, 1.0775

Support level: 1.0710, 1.0690

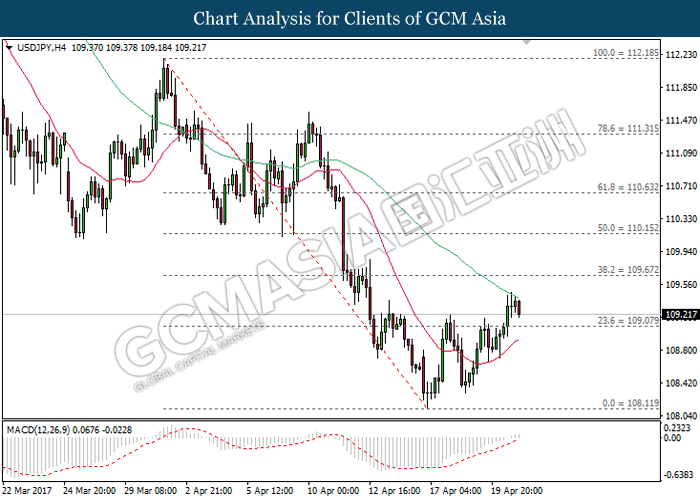

USDJPY

USDJPY, H4: USDJPY was traded higher following prior rebound from the 20-moving average line (red). Referring to the MACD indicator which continues to hover outside of upward momentum, USDJPY is suggested to be traded lower in short-term as technical correction. Otherwise, long-term trend direction still suggests USDJPY to advance further upwards.

Resistance level: 109.65, 110.15

Support level: 109.10, 108.10

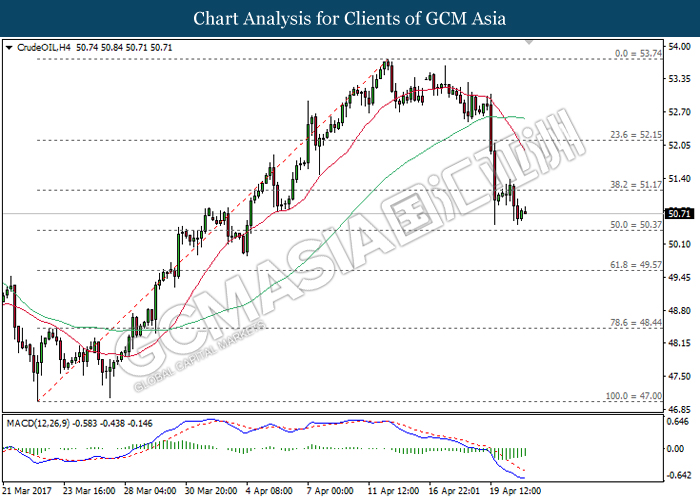

CrudeOIL

CrudeOIL, H4: Crude oil price was traded higher following prior rebound near the support level at 50.40. As the downward momentum from MACD histogram continues to subside, crude oil price may be traded higher in short-term as technical correction. Long-term trend direction suggests crude oil price to move further downwards as both MA line continues to expand downwards after the formation of death cross.

Resistance level: 51.20, 52.15

Support level: 50.40, 49.60

GOLD

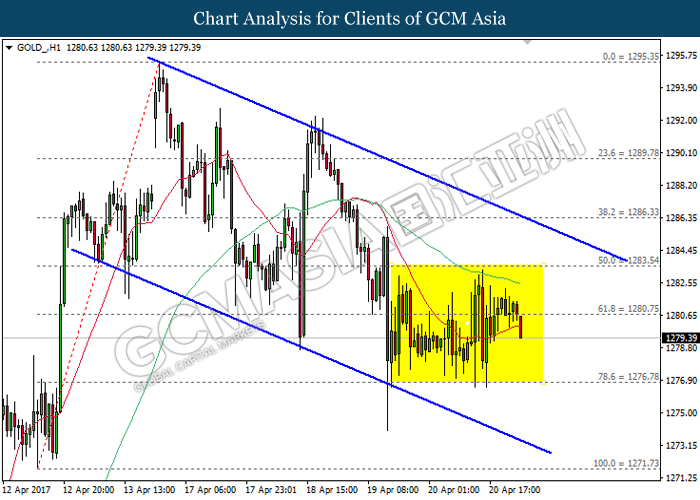

GOLD_, H1: Gold price remains traded within a range of 1283.55 and 1276.80 following prior retracement from the upper level of the range. It is expected to advance further down, towards the lower level of the range at the support level of 1276.80. The overall trend of gold price still remains traded within a downward channel.

Resistance level: 1280.75, 1283.55

Support level: 1276.80, 1271.75