21 June 2017 Daily Analysis

Low oil price pauses dollar-bull.

US dollar hovers near one-month high while pound sterling threaded water at two-months low after Bank of England Governor Mark Carney shot down hopes for an interest rate hike in the near-term. The dollar index was last quoted around 97.33. Overnight, the greenback extended its prior gains following higher expectation that US Federal Reserve will follow through their plan for another rate hike at the end of the year. However, its bullish advance was stalled as US Treasury yields losses its momentum following a big drop in oil prices. “Lower crude prices could weaken inflationary pressure and in turn would halt the rise in US yields,” said Junichi Ishikawa, senior forex strategist. “US inflation indicators have not been strong to start with. Now that oil prices are falling, it could add further pressure to the dollar by weakening overall sentiment towards US energy sector.” In the other region, pound sterling was down 0.05% to $1.2625 not far from two-months low of $1.2600. Sterling took a hit after BoE’s Carney said that it is not the time to raise the benchmark rates due to mixed signals from their economy and subdued wage growth.

In the commodities market, crude oil price held steady around seven-months low at $43.49 while investors remained unconvinced with OPEC’s effort due to continuous rise in the US shale industry. Otherwise, gold price rose 0.33% to $1,245.05, supported by sell-offs in the equity market. However, upside bias for gold price remained limited due to rising expectations that the Federal Reserve would raise their interest rates by year-end.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Public Sector Net Borrowing (May) | 9.65B | 7.00B | – |

| 22:00 | USD – Existing Home Sales (May) | 5.57M | 5.55M | – |

| 22:30 | Crude Oil – Crude Oil Inventories | -1.661M | -2.106M | – |

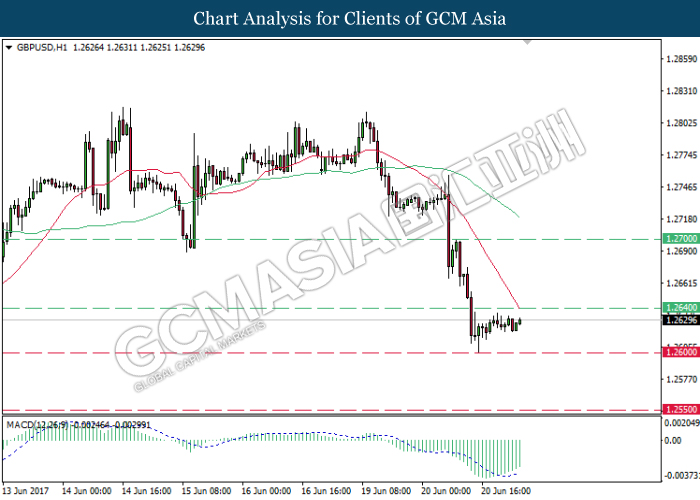

GBPUSD

GBPUSD, H1: GBPUSD was thinly traded following prior rebound from the support level of 1.2600. As the MACD indicator suggests diminished downward momentum, GBPUSD may be traded higher in short-term as technical correction. Long-term trend direction suggests it to extend its downtrend after breaking the support level of 1.2600.

Resistance level: 1.2640, 1.2700

Support level: 1.2600, 1.2550

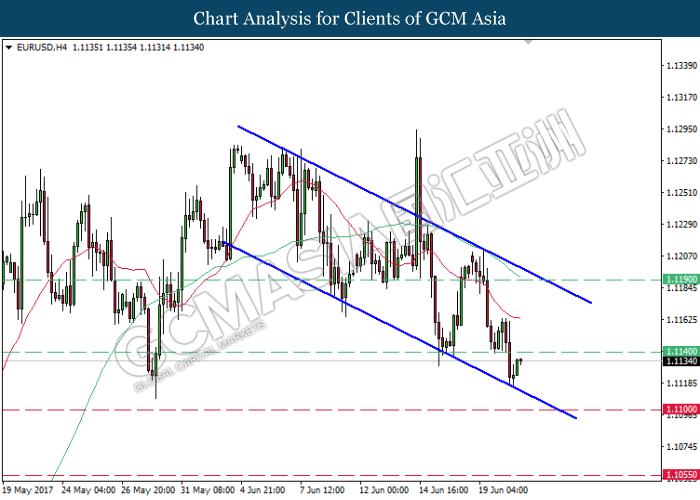

EURUSD

EURUSD, H4: EURUSD remained traded within a downward channel following prior rebound from the bottom level. It is suggested to be traded higher in short-term, towards the resistance level of 1.1140. EURUSD is expected to be traded within the downward channel unless a breakout occurs from either side of the channel.

Resistance level: 1.1140, 1.1190

Support level: 1.1100, 1.1055

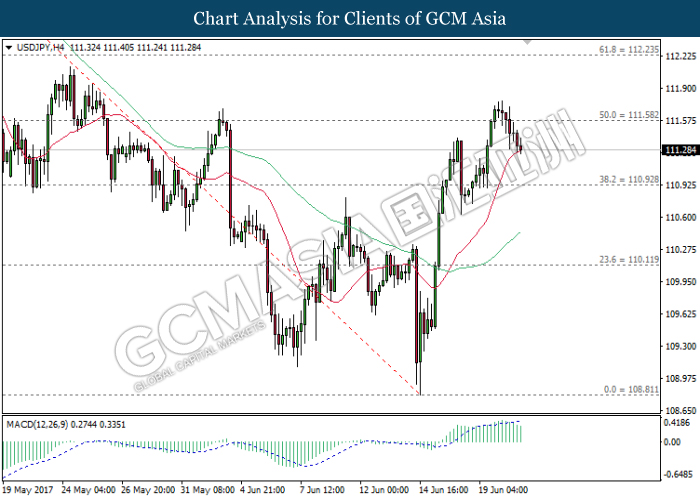

USDJPY

USDJPY, H4: USDJPY was traded lower following prior retracement and closure below the support level of 111.60. As the MACD indicator suggests weak upward momentum, a closure below the 20-moving average line would suggest USDJPY to extend its technical correction towards the support level of 110.90.

Resistance level: 111.60, 112.25

Support level: 110.90, 110.10

CrudeOIL

CrudeOIL, Daily: Crude oil price extended its losses following prior retracement from the resistance level of 45.30. With regards to both MA lines which continues to expand downwards, it suggests higher possibility for a breakout from the bottom level of the downward channel and may signal a change in trend direction thereafter.

Resistance level: 45.30, 48.30

Support level: 43.00, 41.00

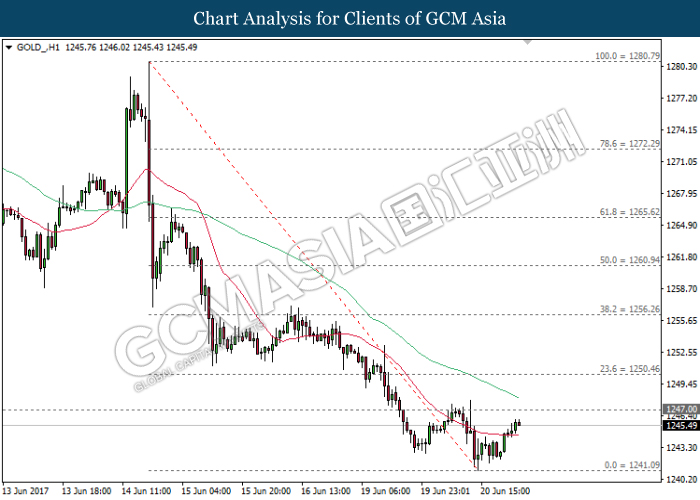

GOLD

GOLD_, H1: Gold price was traded higher following prior rebound from the strong support level of 1241.10. A closure above the resistance level of 1247.00 would suggests gold price to extend its technical correction towards the 23.6 Fibonacci level of 1250.45.

Resistance level: 1247.00, 1250.45

Support level: 1241.10, 1237.55