19 July 2021 Afternoon Session Analysis

Pound plunged amid Covid and Brexit woes.

The pound sterling has fell against the dollar and other currency pairs following fears of rapid spread of the Delta variant. The number of infections has soared due to rapid spread of highly contagious Delta variant coronavirus as UK had reported an increase of 39,950 new covid-19 daily cases. Resurgence of covid-19 in UK despite all social restrictions been lifted on Monday kept the investors to rethink of UK’s economic recovery which resulted in strong selling around the pair of GBP/USD and prompting investors to shift their portfolio to safe-haven US dollar. Meanwhile, pound sterling extended its losses from Brexit woes amid reports that the UK will threaten to deviate from the Northern Ireland Protocol of the Brexit deal which could impact on the export of British’s food staples to Northern Ireland. Moreover, investors would continue to scrutinize on the update from Bank of England’s meeting on 5th of August and a dovish hold is expected after dovish comments from Monetary Policy Committee member Jonathan Haskel, who prefers refraining from tightening policy. The mentioned issues had further dialed down investors’ optimisms toward the pound sterling as it may pose as a threat upon UK’s economic recovery. As of writing, GBP/USD was down 0.13% to 1.3616.

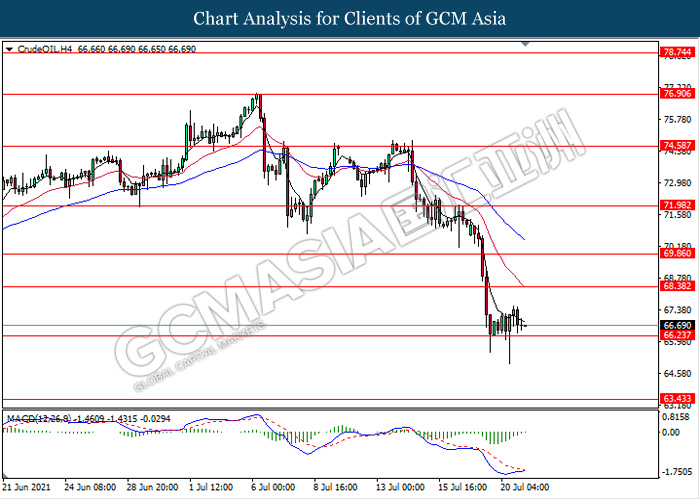

In the commodities market, the crude oil price depreciated 0.01% to $66.52 per barrel as of writing amid concerns of rising number of Delta variants coronavirus and agreement between the United Arab Emirates and Saudi Arabia. On the other hand, the gold price slumped 0.05% to $1808.44 a troy ounce as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:30 | CrudeOIL – Crude Oil Inventories | -7.897M | -4.466M | – |

Technical Analysis

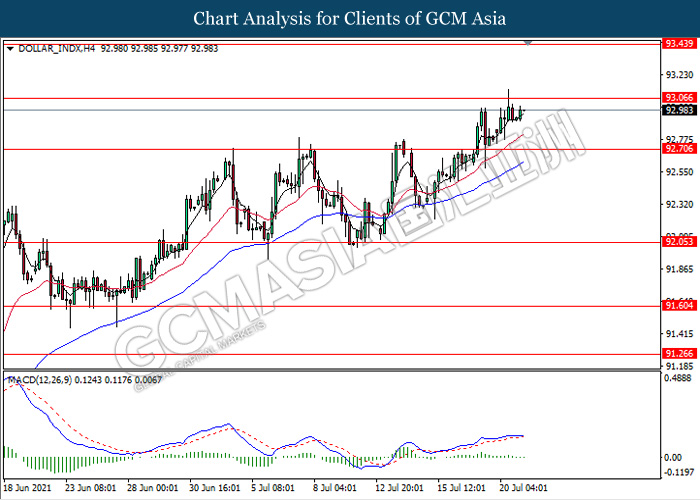

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level 92.70. However, MACD which illustrate diminishing bullish momentum signal suggest the dollar to experience a technical correction towards the support level 92.70.

Resistance level: 93.05, 93.45

Support level: 92.70, 92.05

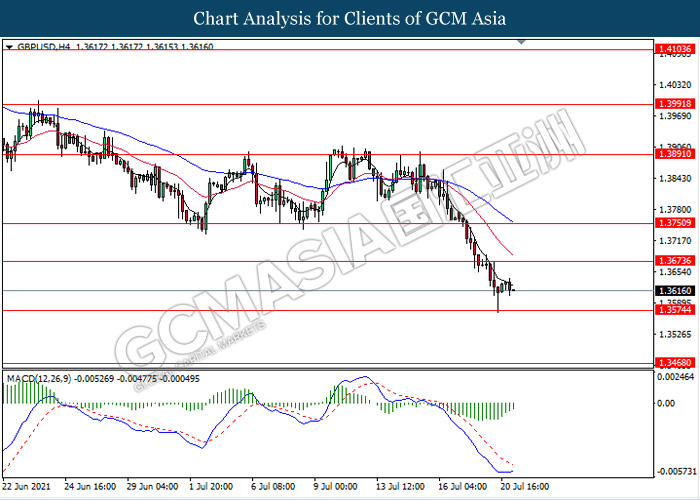

GBPUSD, H4: GBPUSD was traded lower while currently testing near the support level 1.3575. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher as a technical correction towards the resistance level 1.3675.

Resistance level: 1.3675, 1.3750

Support level: 1.3575, 1.3470

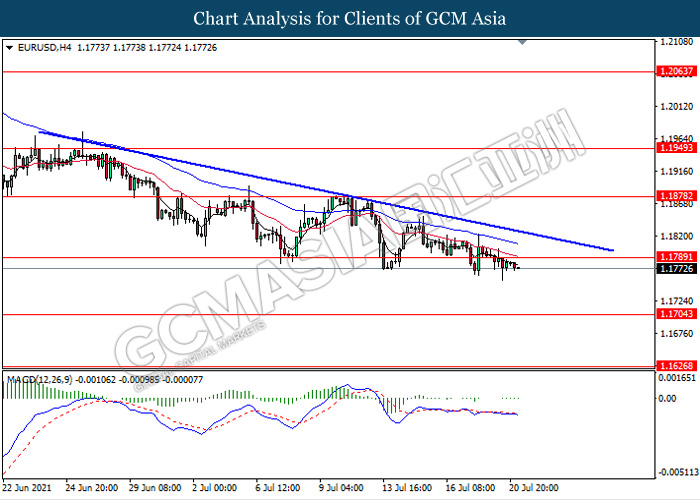

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1790. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 1.1705.

Resistance level: 1.1790, 1.1880

Support level: 1.1705, 1.1625

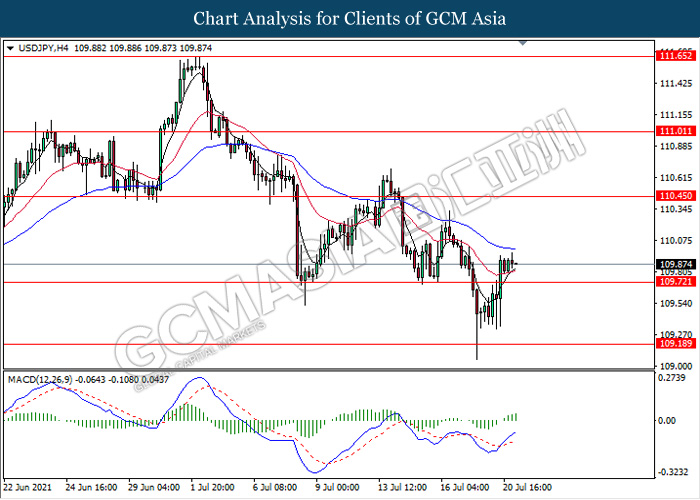

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 109.70. MACD which illustrate bullish bias signal with the recent formation of golden cross suggest the pair to extend its gains towards the resistance level 110.45.

Resistance level: 110.45,111.00

Support level: 109.70, 109.20

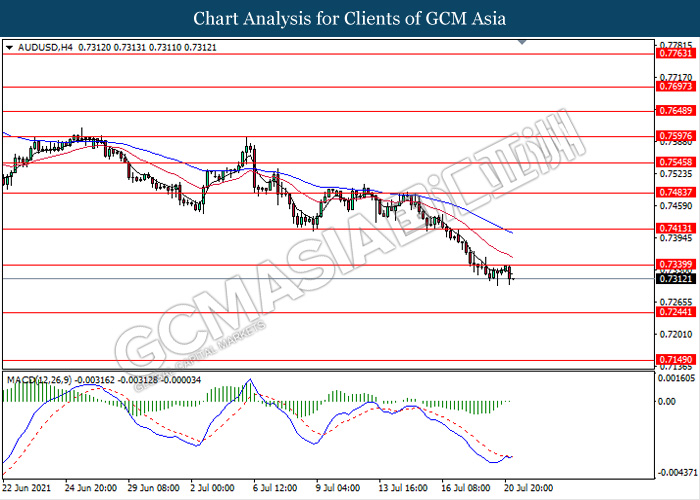

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7340. MACD which illustrate continuation of bearish momentum signal suggest the pair to extend its losses towards the support level 0.7245.

Resistance level: 0.7340, 0.7415

Support level: 0.7245, 0.7150

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6925. However, MACD which illustrate continuation of bearish momentum signal suggest the pair to be traded lower towards the support level 0.6825.

Resistance level: 0.6925, 0.7000

Support level: 0.6825, 0.6725

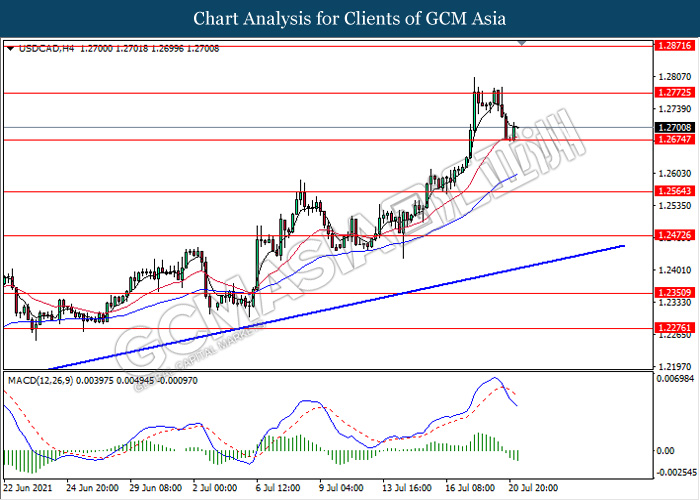

USDCAD, H4: USDCAD was traded lower while currently testing near the support level 1.2675. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.2770, 1.2870

Support level: 1.2675, 1.2565

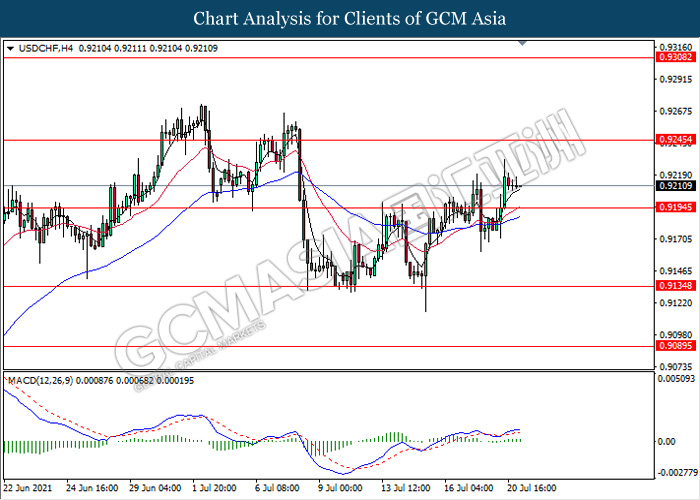

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level 0.9195. MACD which illustrate bullish momentum signal suggest the pair to extend its gains towards the resistance level 0.9245.

Resistance level: 0.9245, 0.9305

Support level: 0.9195, 0.9135

CrudeOIL, H4: Crude oil price was traded flat while currently testing near the support level 66.25. However, MACD which illustrate diminishing bearish momentum signal with the starting formation of golden cross suggest the commodity to be traded higher towards the resistance level 68.40.

Resistance level: 68.40, 69.85

Support level: 66.25, 63.45

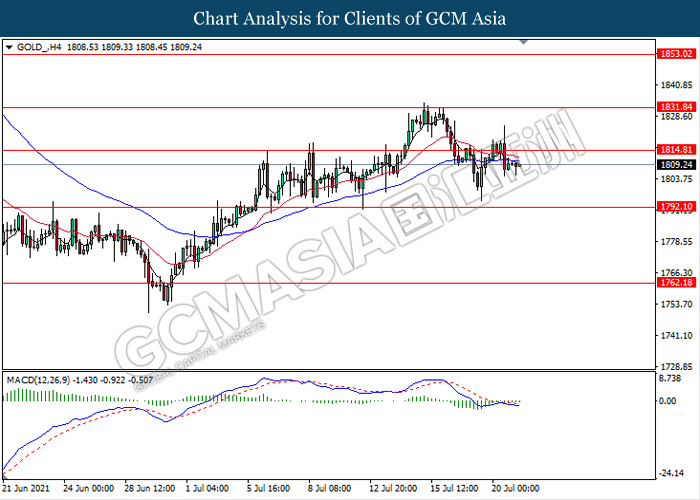

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level 1814.80. MACD which illustrate bearish bias signal suggest the commodity to extend its retracement towards the support level 1792.10.

Resistance level: 1814.80, 1831.85

Support level: 1792.10, 1762.20