21 July 2023 Afternoon Session Analysis

Japanese Yen keep on bull as trade balance shocked investor

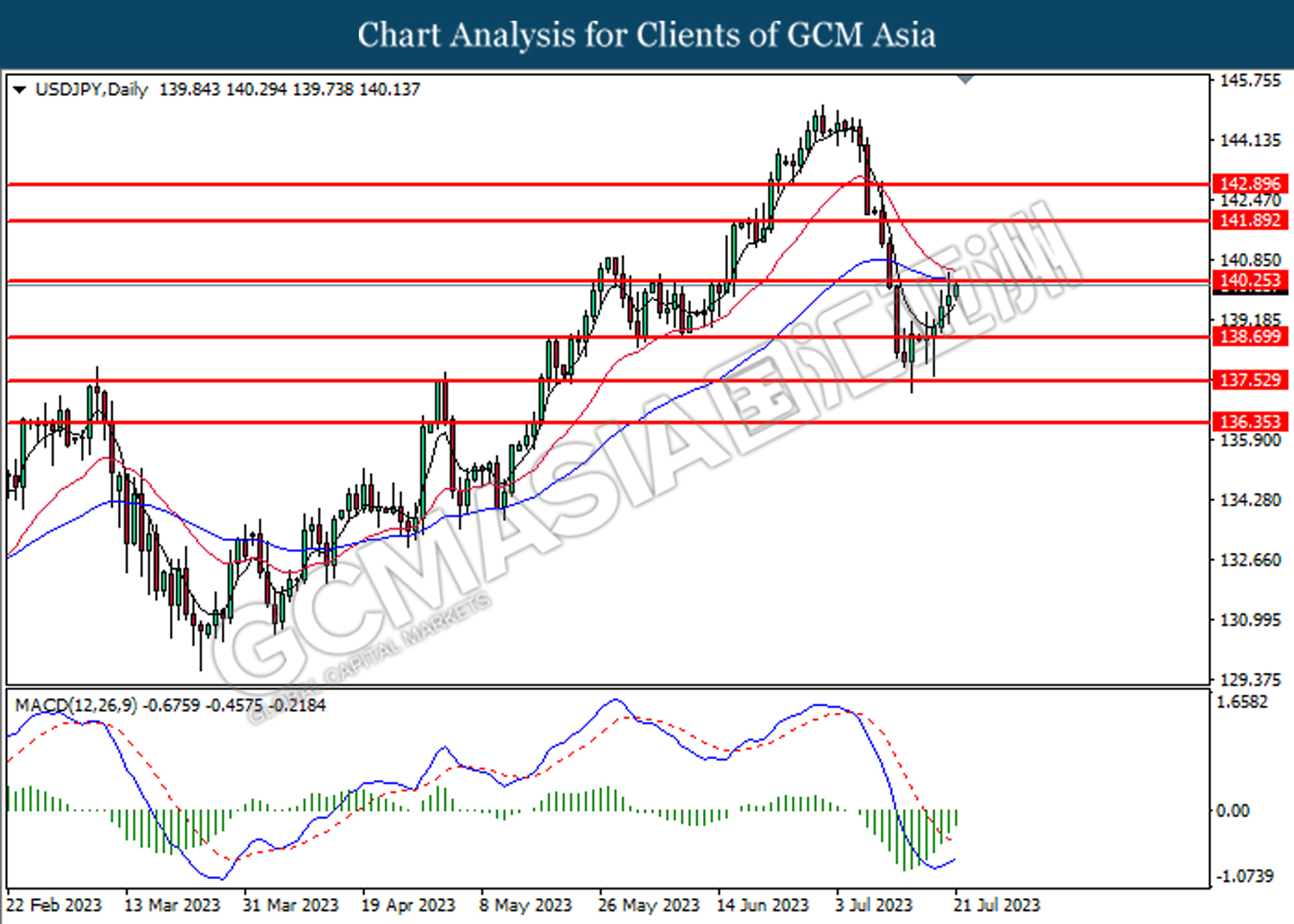

Japanese Yen, which was widely traded by global investors, spiked as Japan’s trade balance unexpectedly flipped to its first surplus since July 2021. According to the Ministry of Finance Japan, the trade balance (Jun) rose to 43 billion from the prior reading’s -1381.9 billion, highly exceeded the market forecast of -46.7 billion. The trade balance is the difference between imported and exported goods and services. Besides that, export for Japan jumped from 0.6% to 1.5%, but slightly below the market forecast at 2.2%. Meanwhile, imports for Japan dropped further from -9.8% to -12.9%, missing the market forecast at -11.3%. Based on the data above, it proven that the demand for Yen increased but the outflow of Yen decreased. Apart from that, Japan’s CPI inflation grow slightly in June, and core CPI remained sticky. According to the Statistics Bureau, Japan’s National core CPI grew to 3.3% from 3.2%, which matched with market forecast. Although the CPI inflation is slightly above 3% and remains above the Bank of Japan (BOJ) target of 2%, BOJ Governor Kazuo Ueda said no plan to tighten the policy. As of writing, the pair of USD/JPY 0.07% to 140.15.

In the commodities market, crude oil prices rose by 0.79% to $76.20 per barrel due to China’s imported crude oil from Russia reach record high of 2.6 million barrels per day. Besides, gold prices rose 0.04% to $1970.17 amid the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

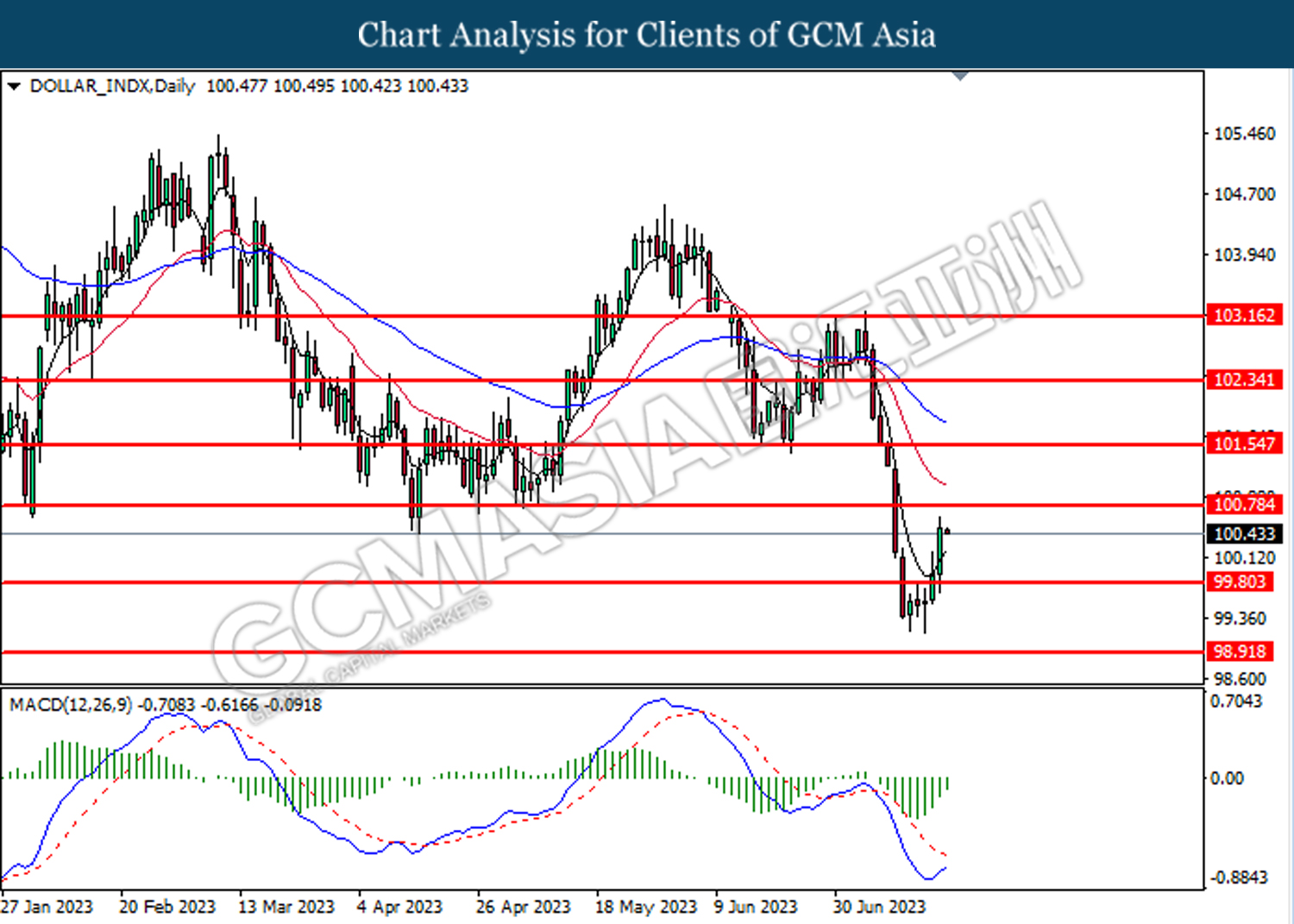

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 99.80. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 100.80.

Resistance level: 100.80, 101.55

Support level: 99.80, 98.90

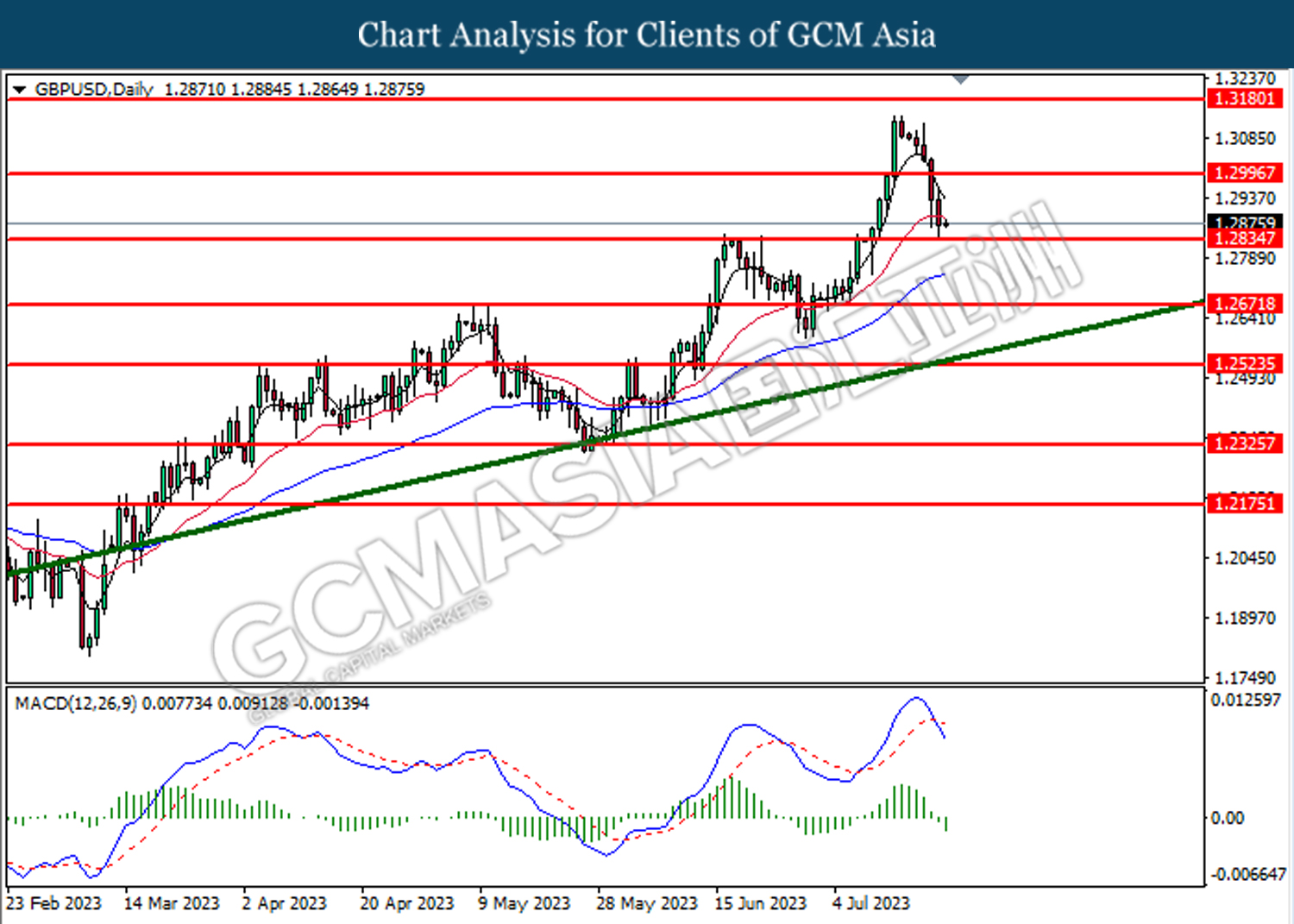

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.3000. MACD which illustrated increasing bearish momentum suggest the pair to extend it losses toward the support level at 1.2835.

Resistance level: 1.3000, 1.3180

Support level: 1.2835, 1.2670

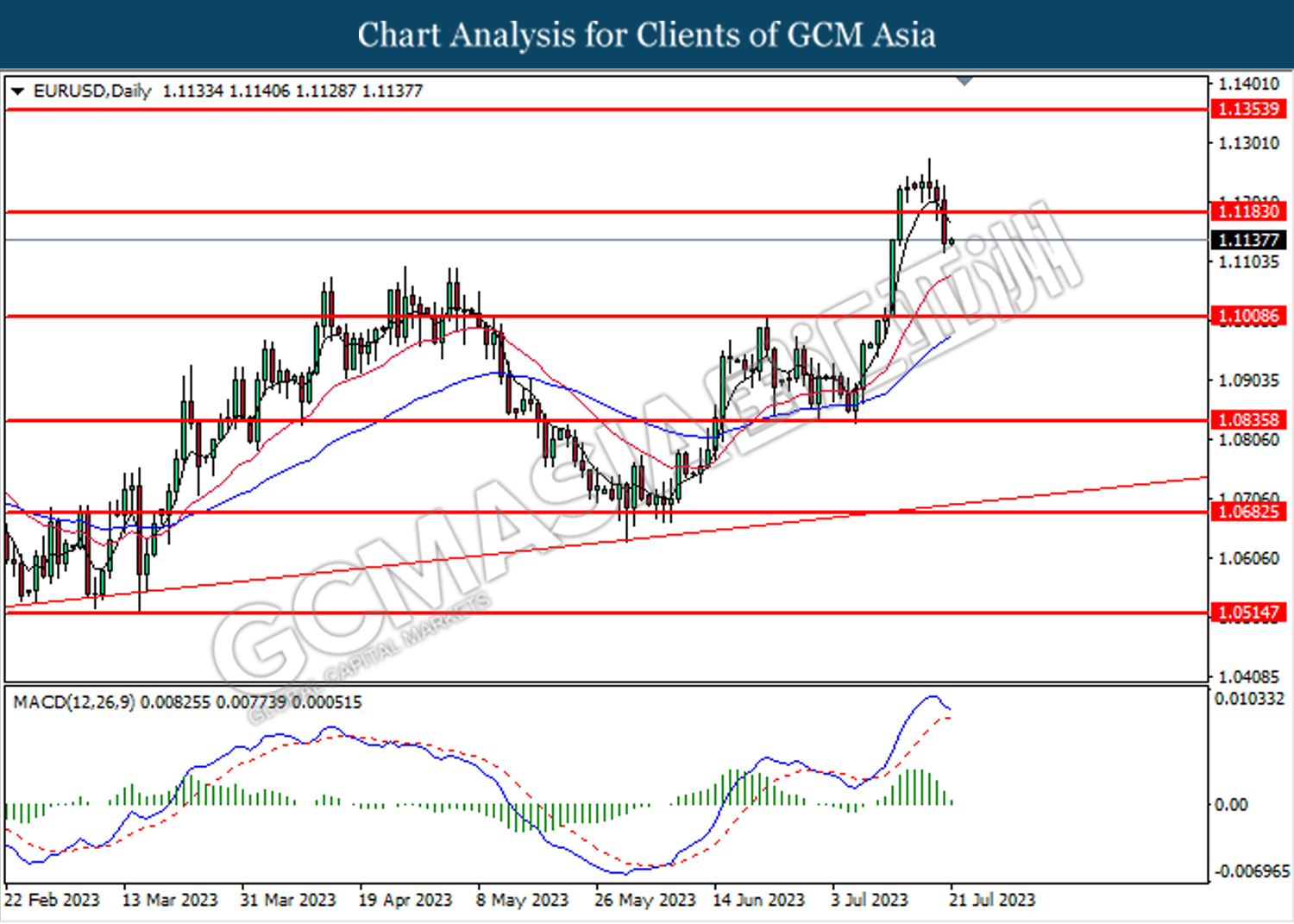

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1185. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1010

Resistance level: 1.1185, 1.1355

Support level: 1.1010, 1.0835

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 140.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 140.25, 141.90

Support level: 138.70, 137.50

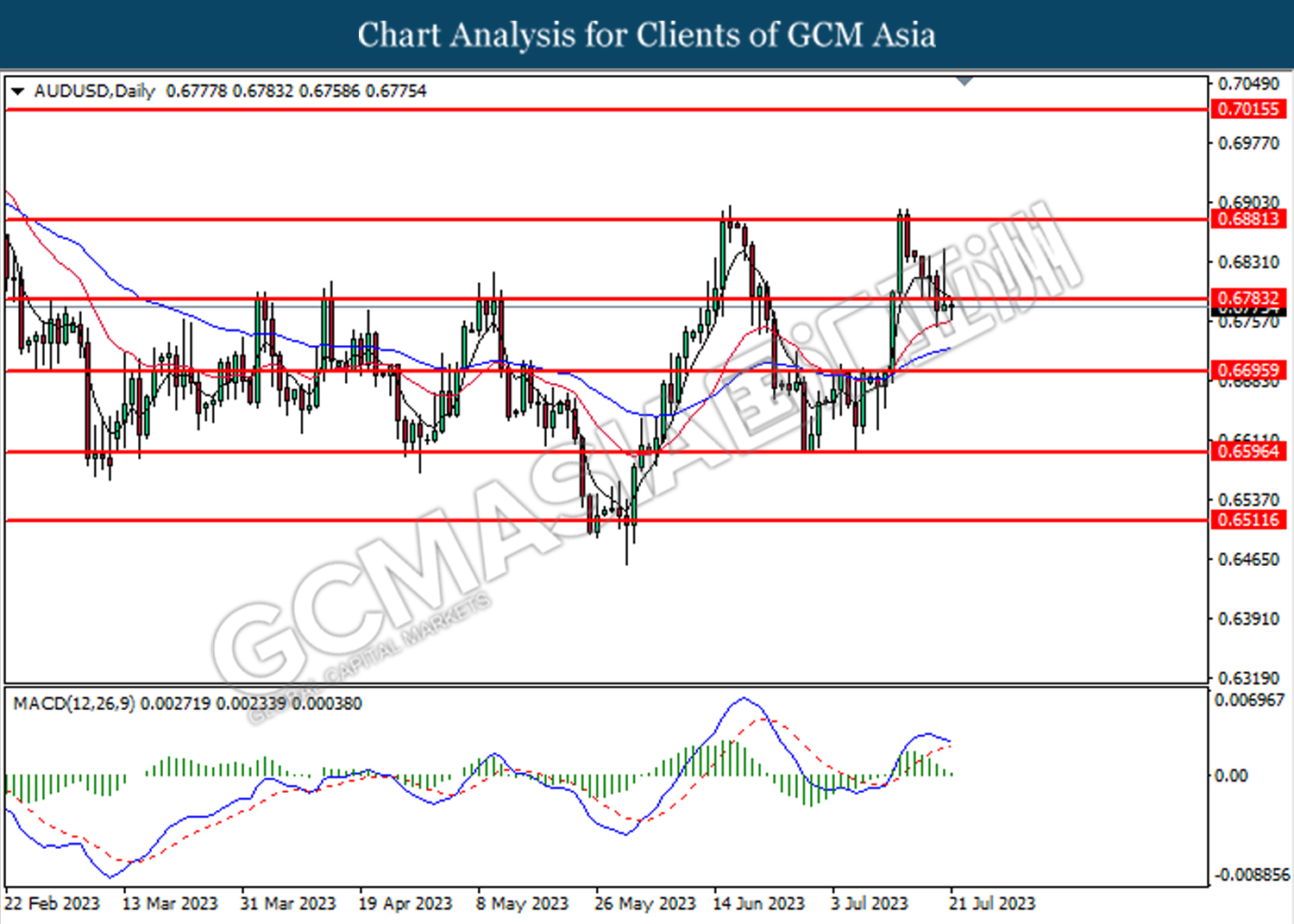

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6785. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward its support level at 0.6695.

Resistance level: 0.6880, 0.7015

Support level: 0.6785, 0.6695

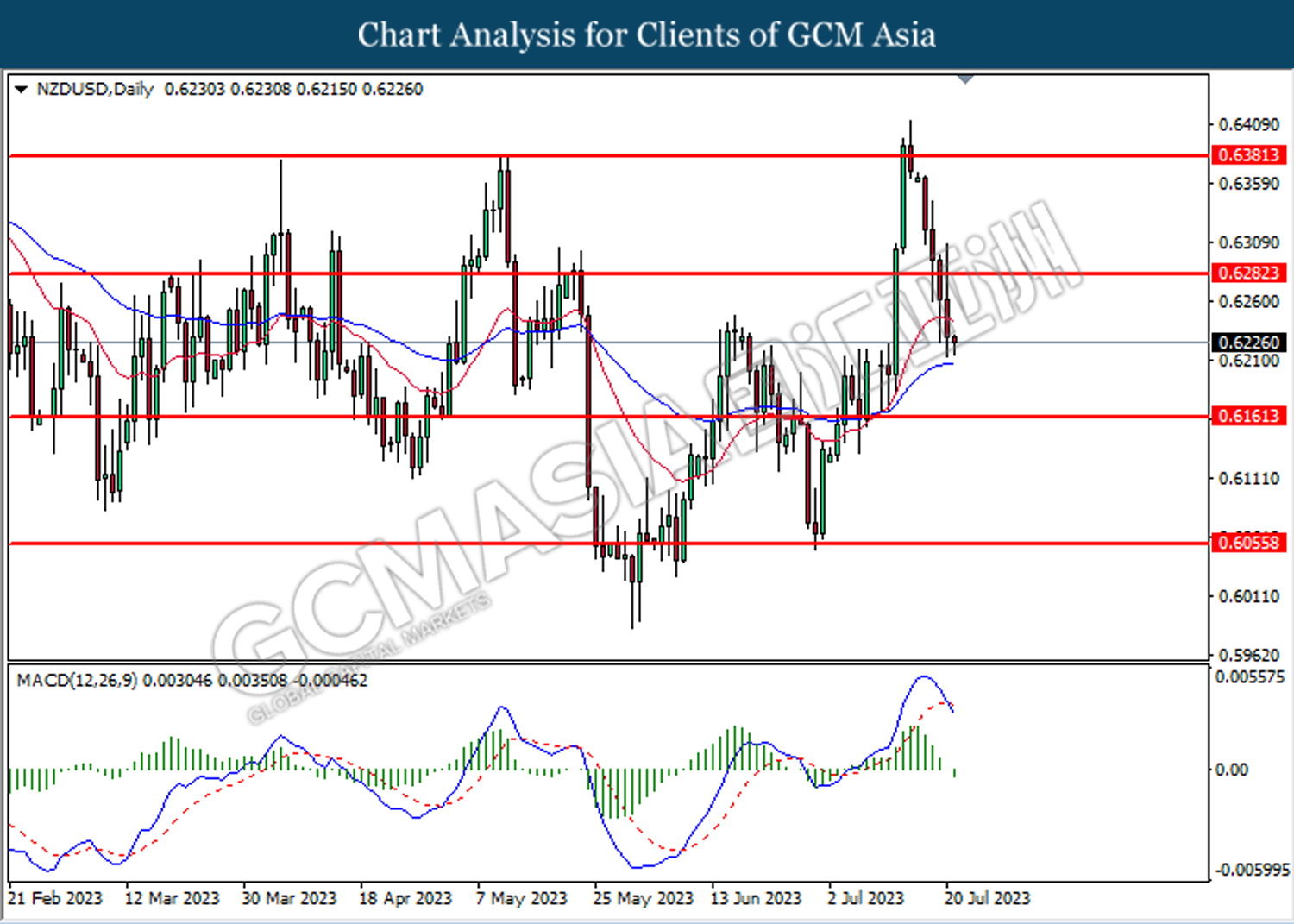

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6280. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6160.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

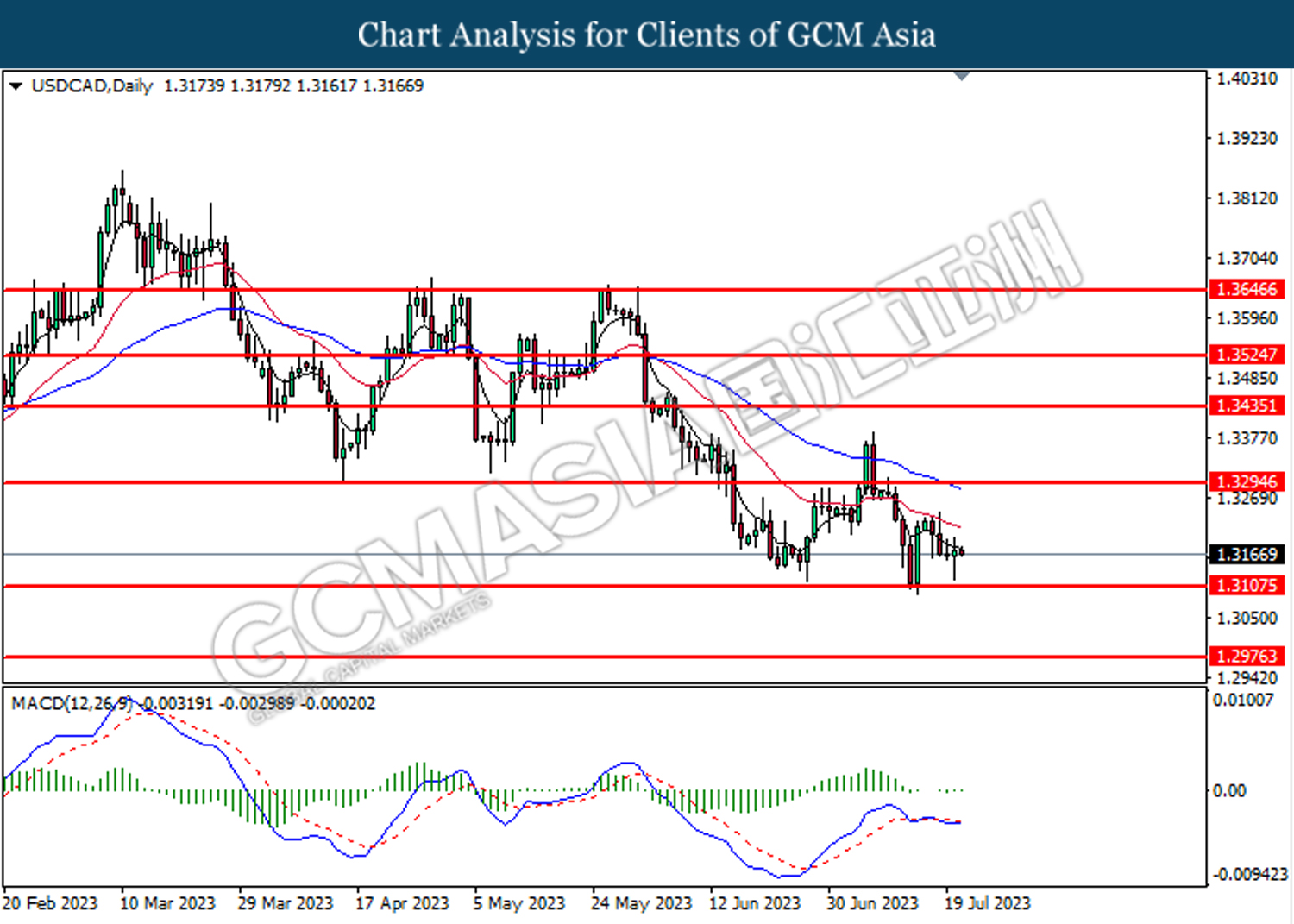

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3110. MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

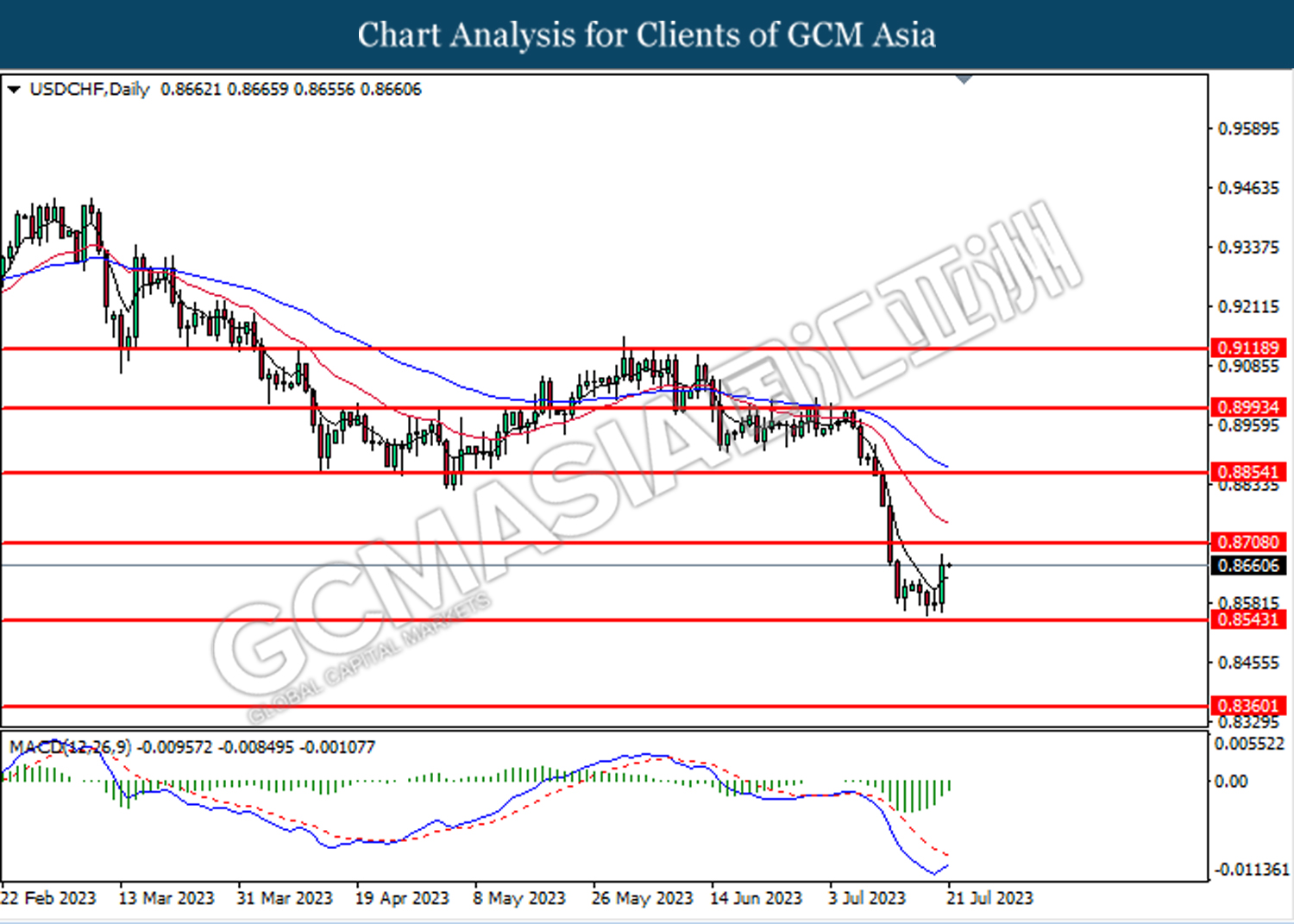

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8545. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.8710

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

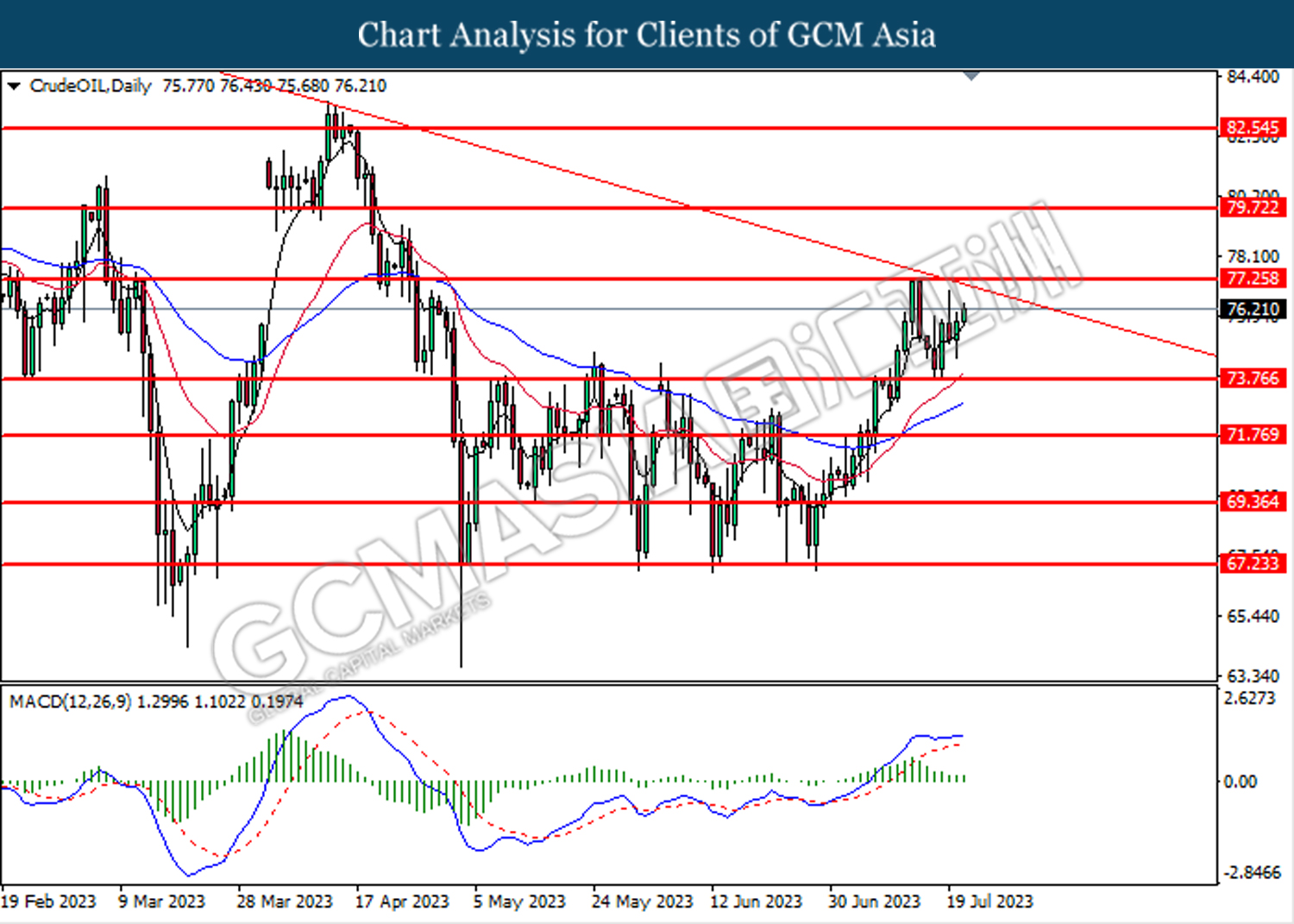

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 73.75. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 77.25, 79.70

Support level: 73.75, 71.80

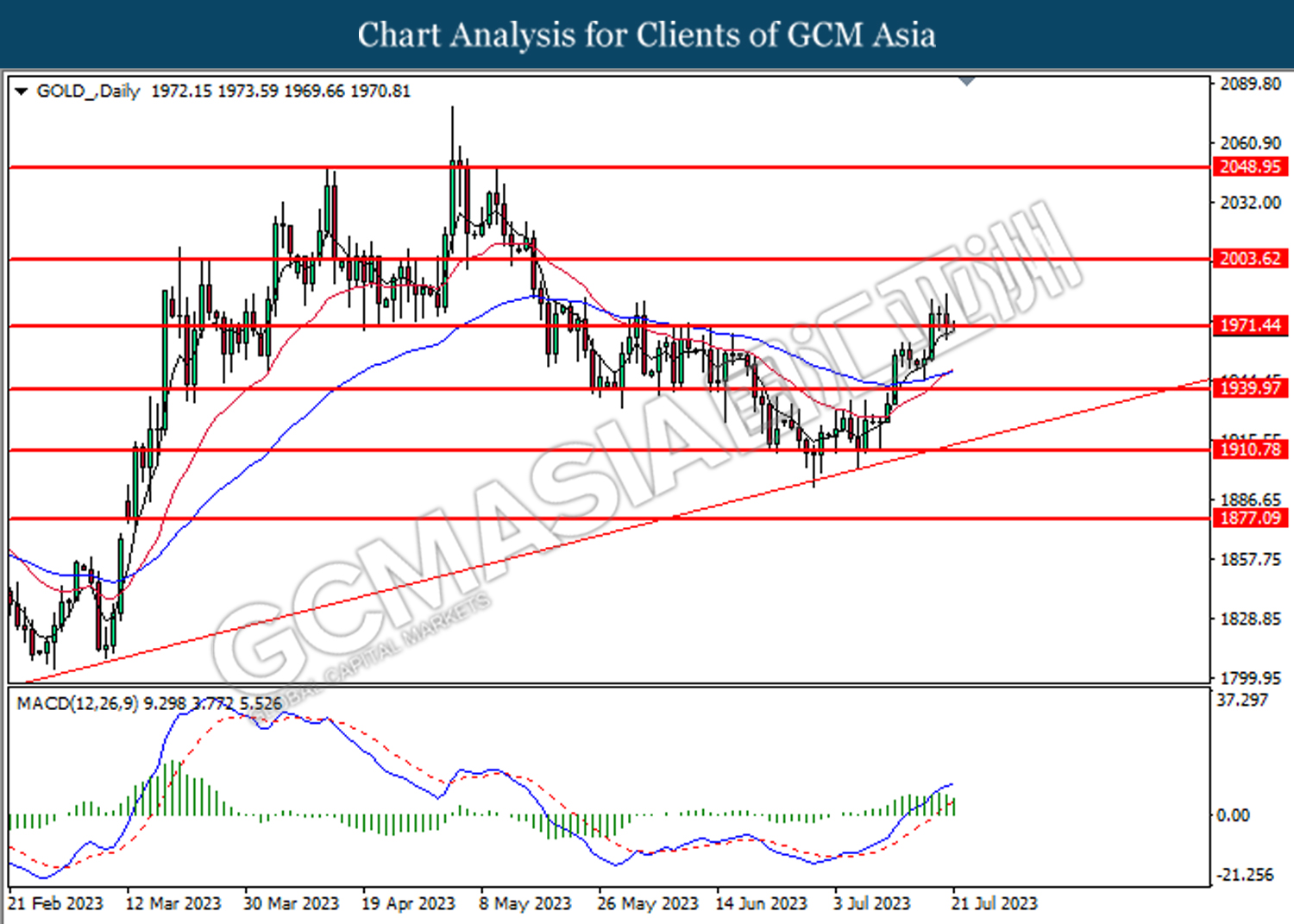

GOLD_, Daily: Gold price was traded lower following the prior while testing the support level at 1971.40. MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 2003.60, 2048.95

Support level: 1971.40, 1940.00