21 July 2023 Morning Session Analysis

The dollar index rose after labour data showed resilience conditions.

The dollar index, which traded against a basket of six major currencies, extended its gains after the US treasury yields rose on Thursday following the initial jobless claim and Philadelphia release. The initial jobless claims released on Thursday reduced to 228K from 237K, lower than economists’ estimation of 242K. It suggests the labour market continued to remain strong amid high-interest rates. This data also fueled investors’ bet on whether the Fed is nearing the end of its tightening cycle. According to FedWatch Tools, the chances of a further 25 basis points hike in September are priced at 14% and in November at 29%. Therefore, the 2-year treasury year increased by 7.1 basis points to 4.825%, while the 10-year bond yields rose by 10.4 basis points to 3.846%, and the dollar index rose afterwards. Meanwhile, Philadelphia’s manufacturing survey continued to decline and showed further signs of its softening. It recorded at -13.5, lower than expected at -10.0. At this moment, investors will focus on the FOMC meeting next week, while the Fed is widely expected to hike rates a further 25 basis points. As of writing, the dollar index edged up by 0.51% to 100.79.

In the commodities market, crude oil prices traded up by 0.17% to $75.78 per barrel Saudi production cuts continued to weigh on the market. On the other hand, the gold price recovered by 0.11% to 1971.10 following the dollar strengthening in the previous trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

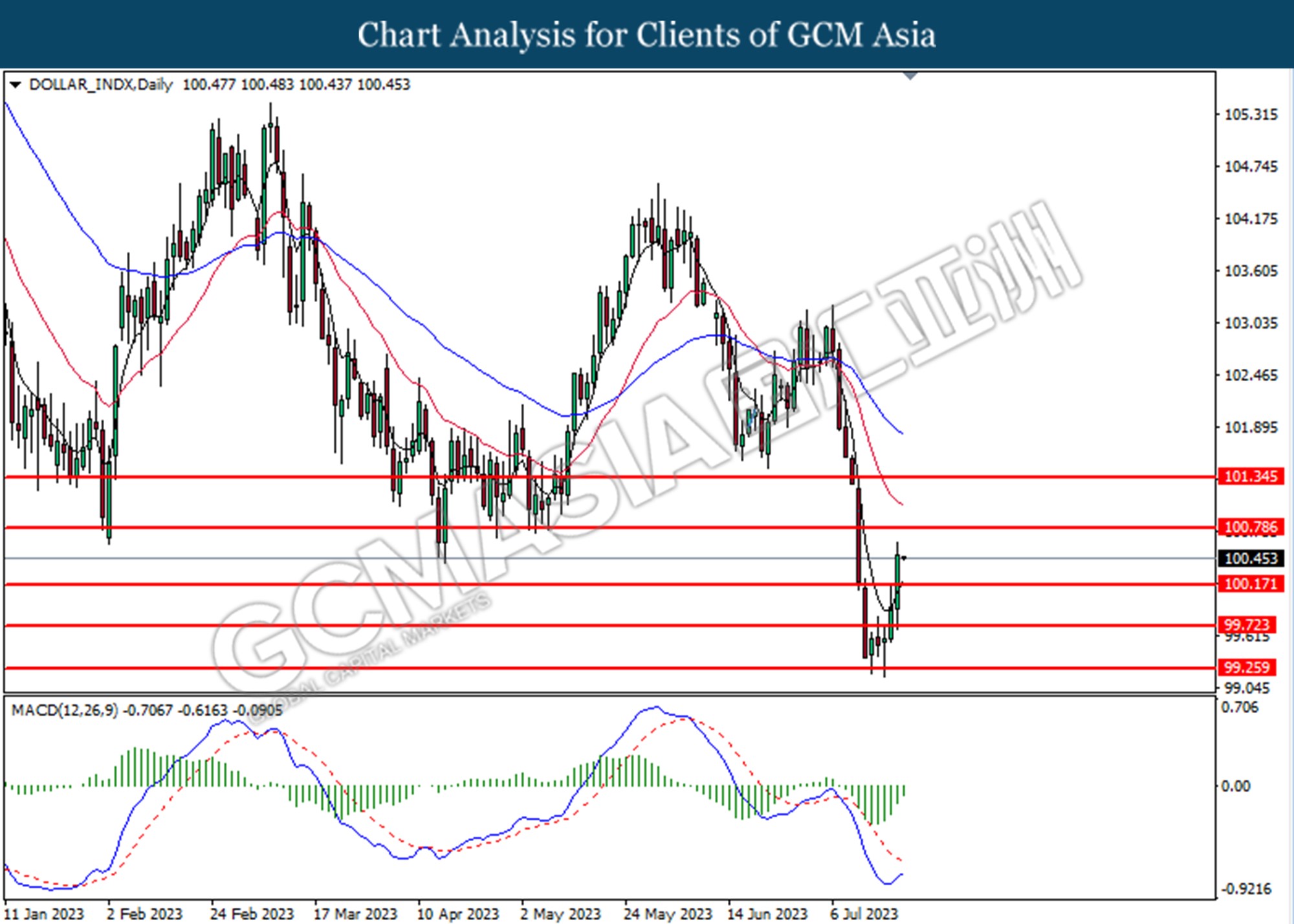

DOLLAR_INDX, DAILY: Dollar index was traded higher following the prior breaks above from the previous resistance level at 100.20. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 100.80.

Resistance level: 100.80, 101.35

Support level: 100.20, 99.70

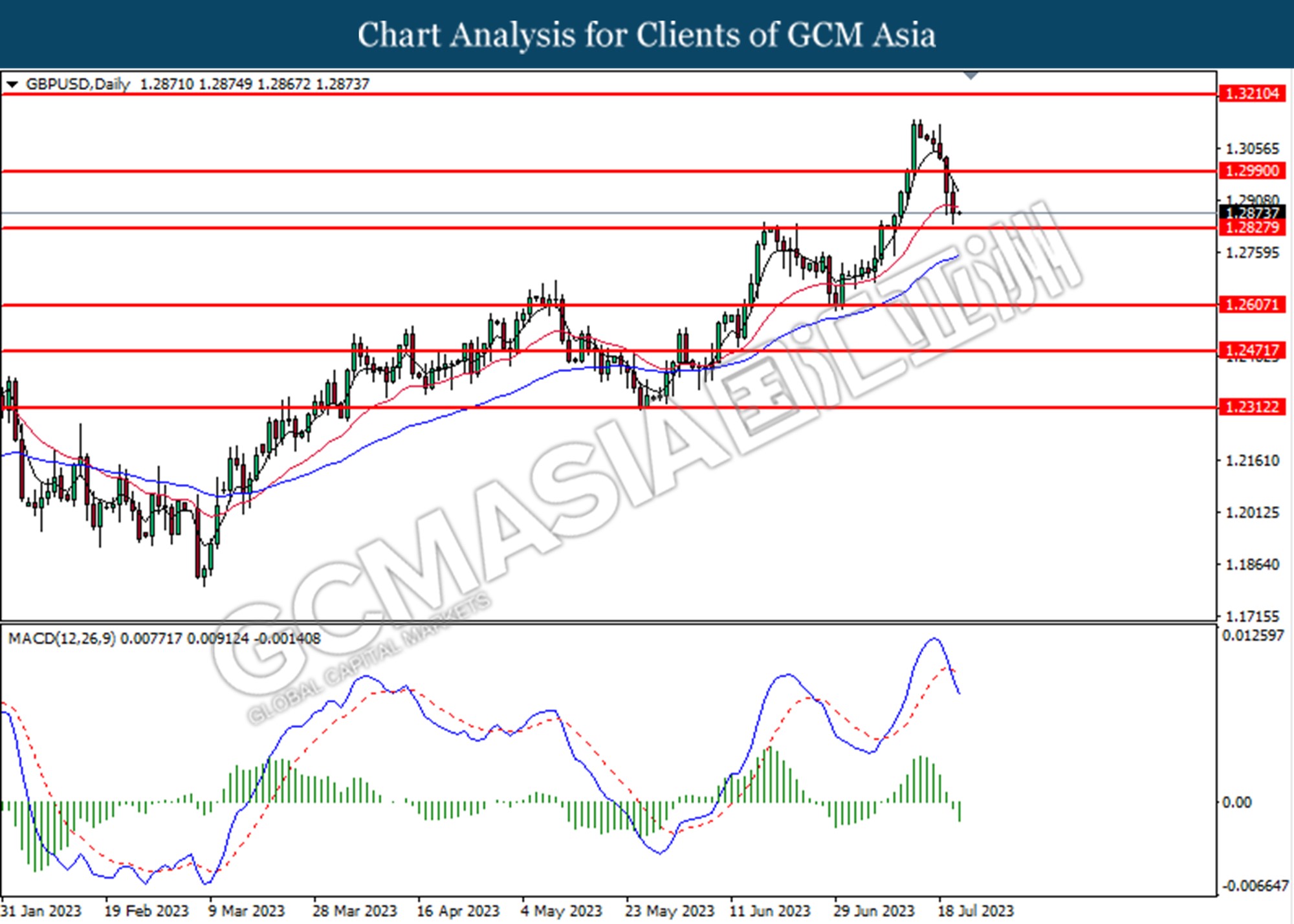

GBPUSD, DAILY: GBPUSD was traded lower following the prior breaks retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2830.

Resistance level: 1.2990, 1.3210

Support level: 1.2830, 1.2610

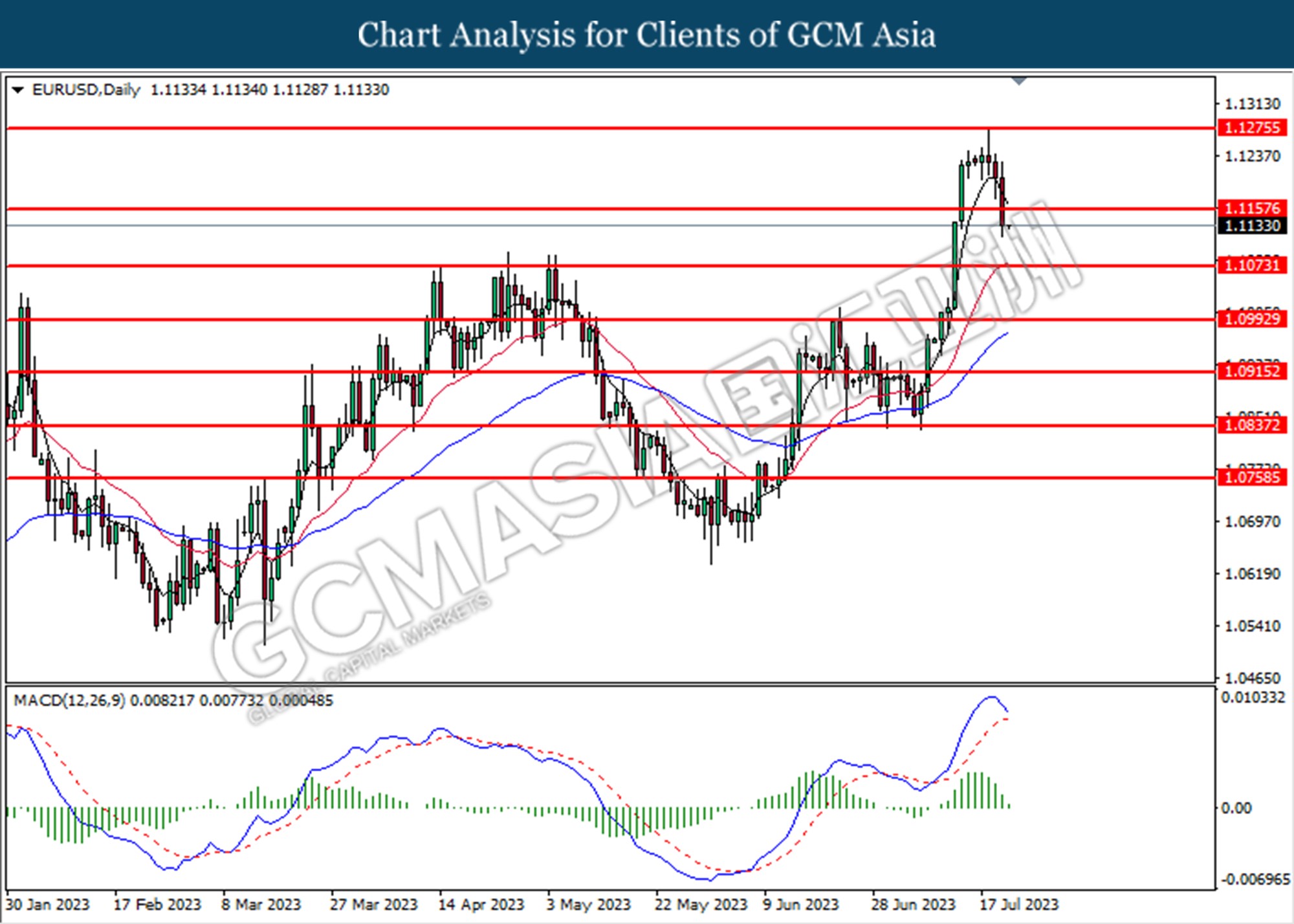

EURUSD, DAILY: EURUSD was traded lower following the prior breaks below the previous support level at 1.1160. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 1.1075.

Resistance level: 1.1160, 1.1275

Support level: 1.1075, 1.0990

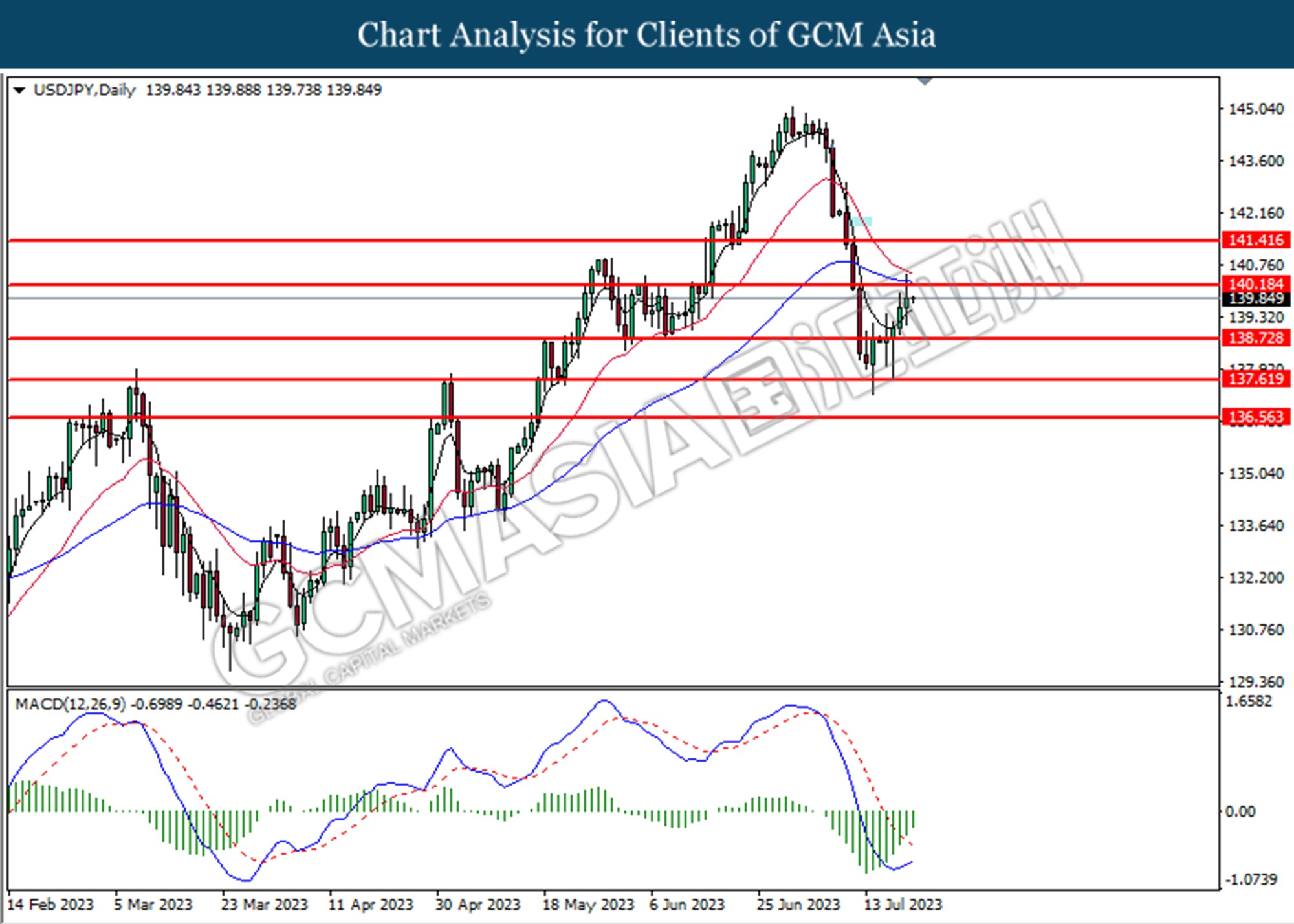

USDJPY, DAILY: USDJPY was traded higher following the prior rebound from the from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 140.20

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

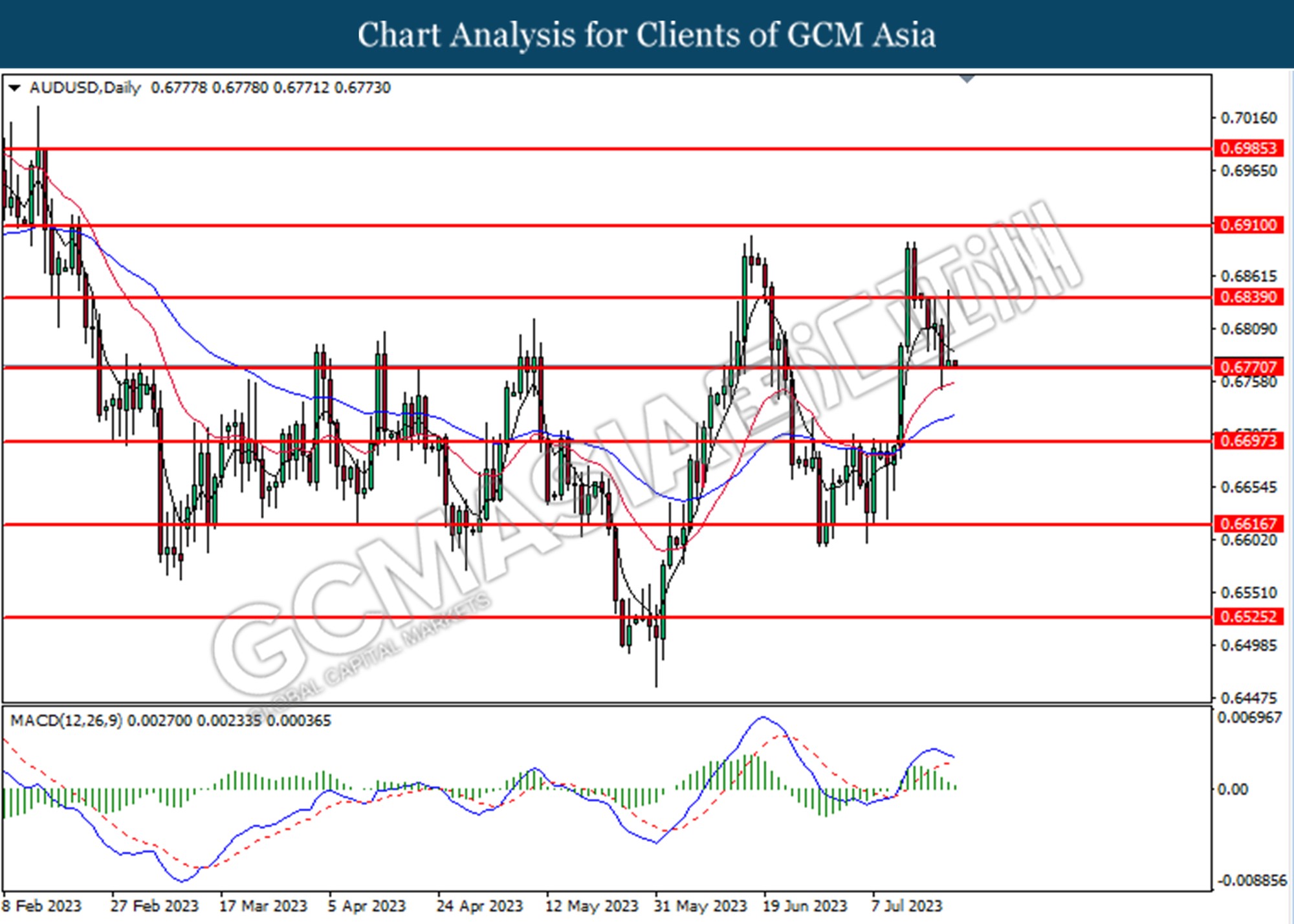

AUDUSD, DAILY: AUDUSD was traded lower while currently testing for the support level at 0.6770. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses after it successfully breaks below the support level.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

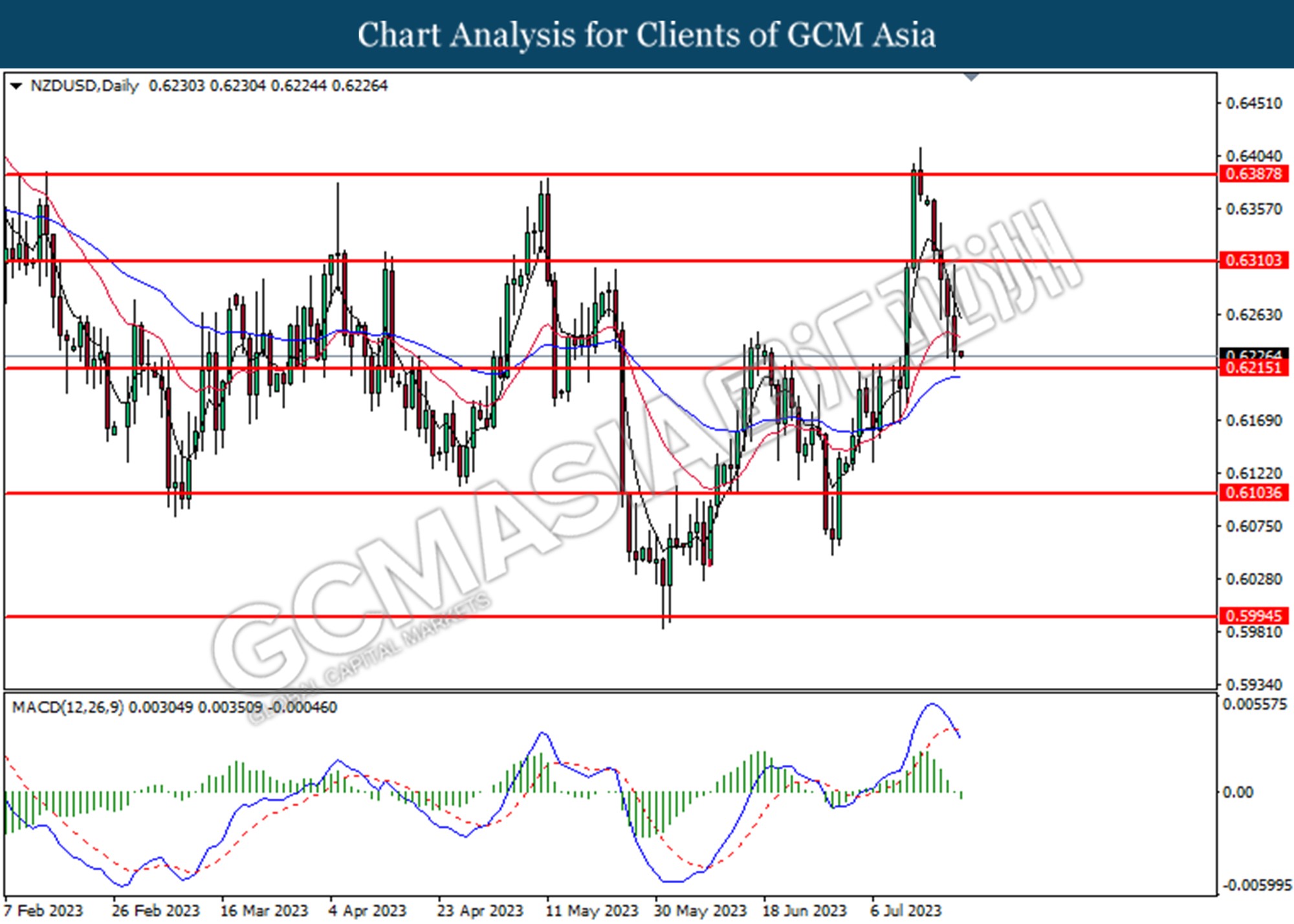

NZDUSD, DAILY: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6215.

Resistance level: 0.6310, 0.6390

Support level: 0.6215, 0.6105

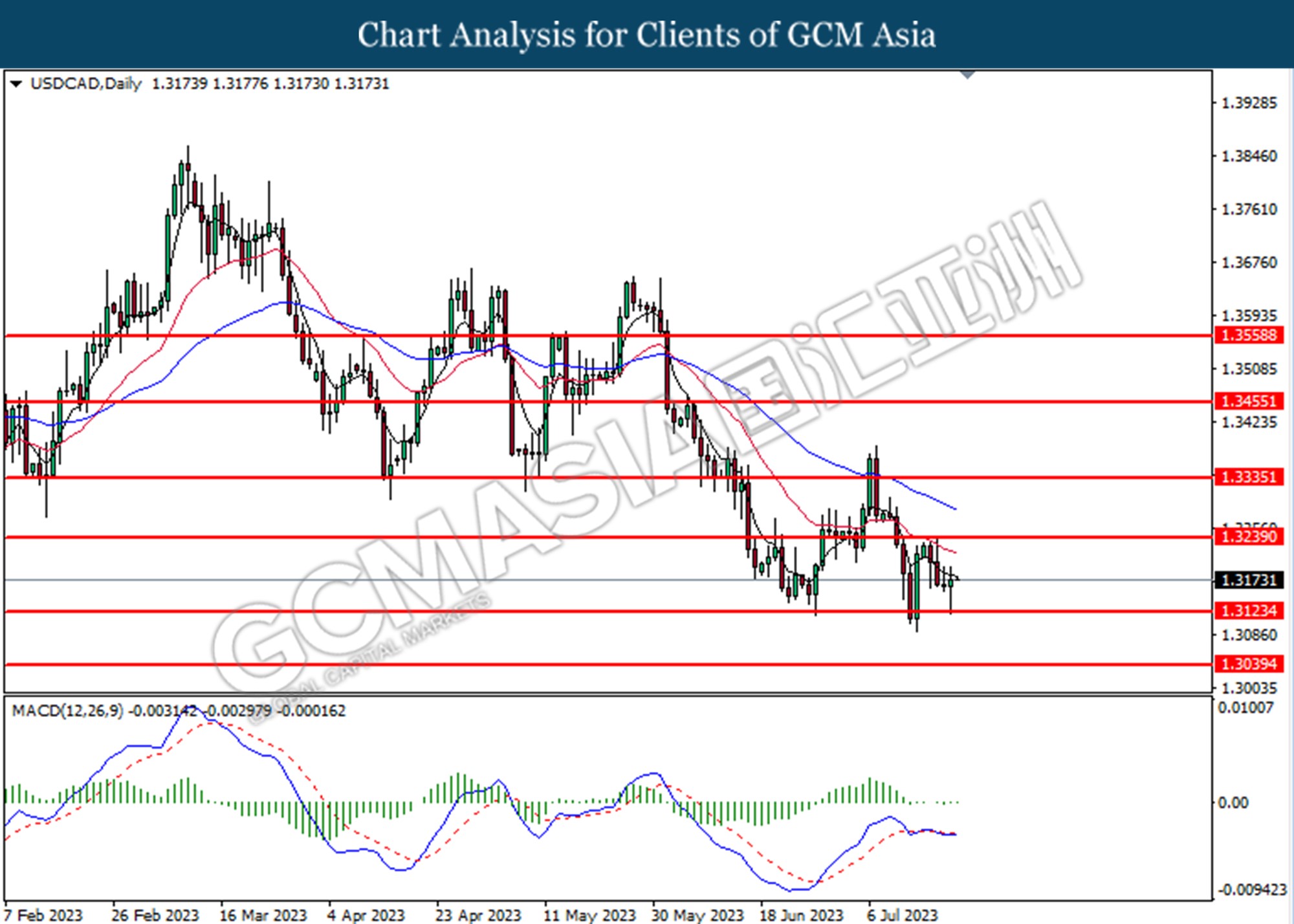

USDCAD, DAILY: USDCAD was traded higher following the prior rebound from the support level at 1.3125. However, MACD is not showing any signal, is recommended to wait until further breakout.

Resistance level: 1.3240, 1.3335

Support level: 1.3125, 1.3040

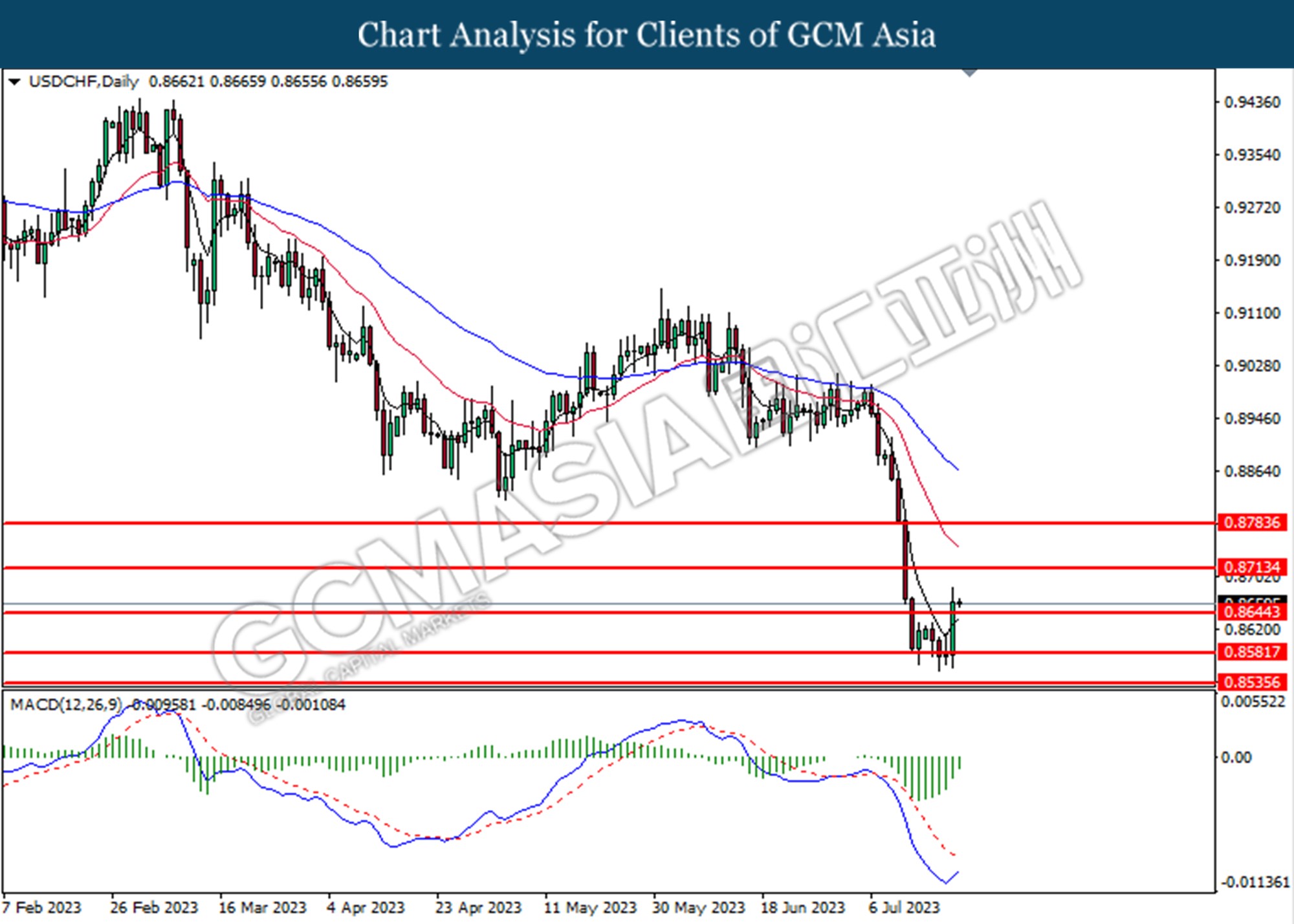

USDCHF, DAILY: USDCHF was traded higher following the prior breaks above the previous resistance level at 0.8645. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.8715, 0.8785

Support level: 0.8645, 0.8580

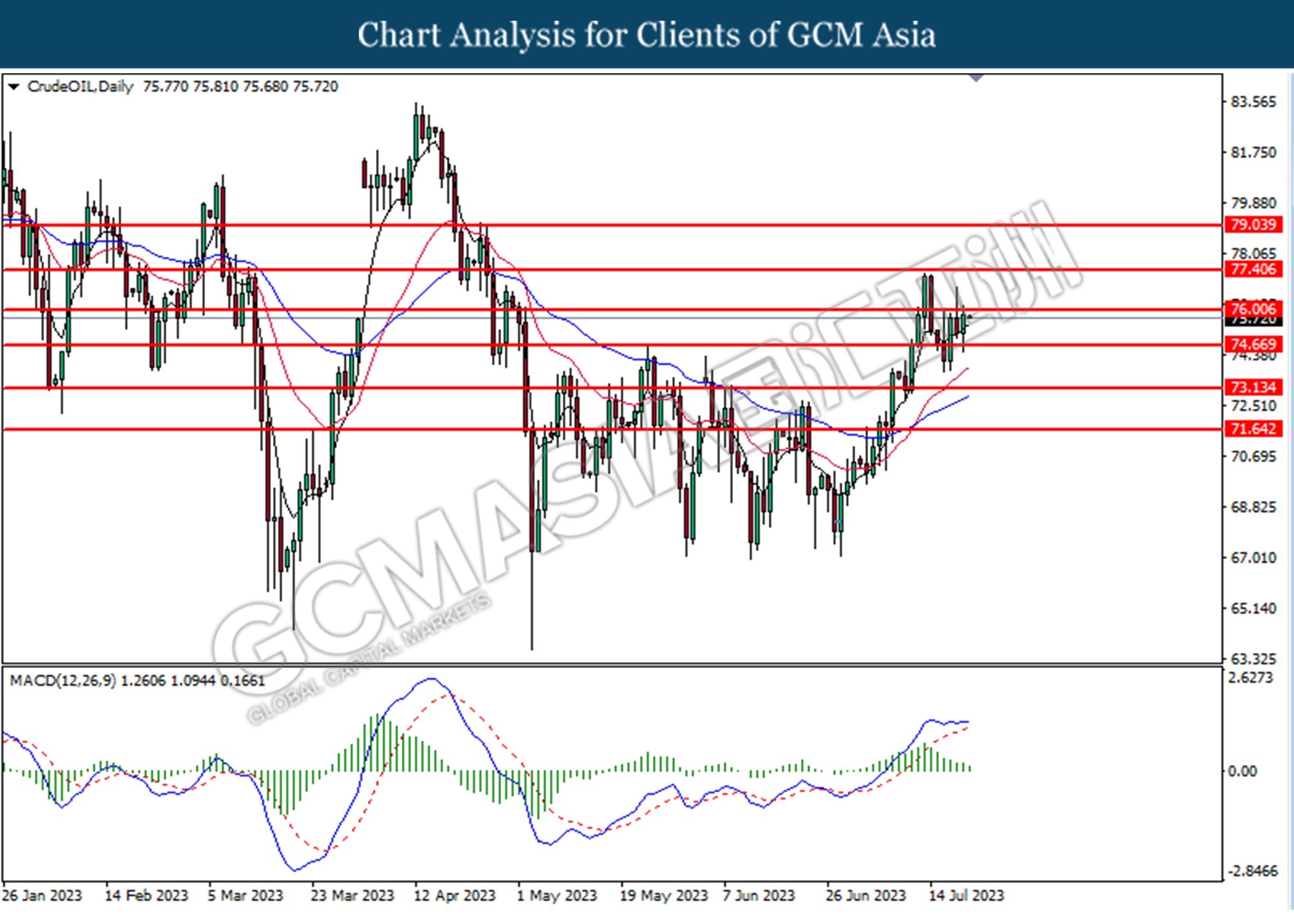

CrudeOIL, DAILY: Crude oil price was traded higher following the prior rebound from the support level at 74.65. However, MACD which illustrated diminishing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 76.00, 77.40

Support level: 74.65, 73.15

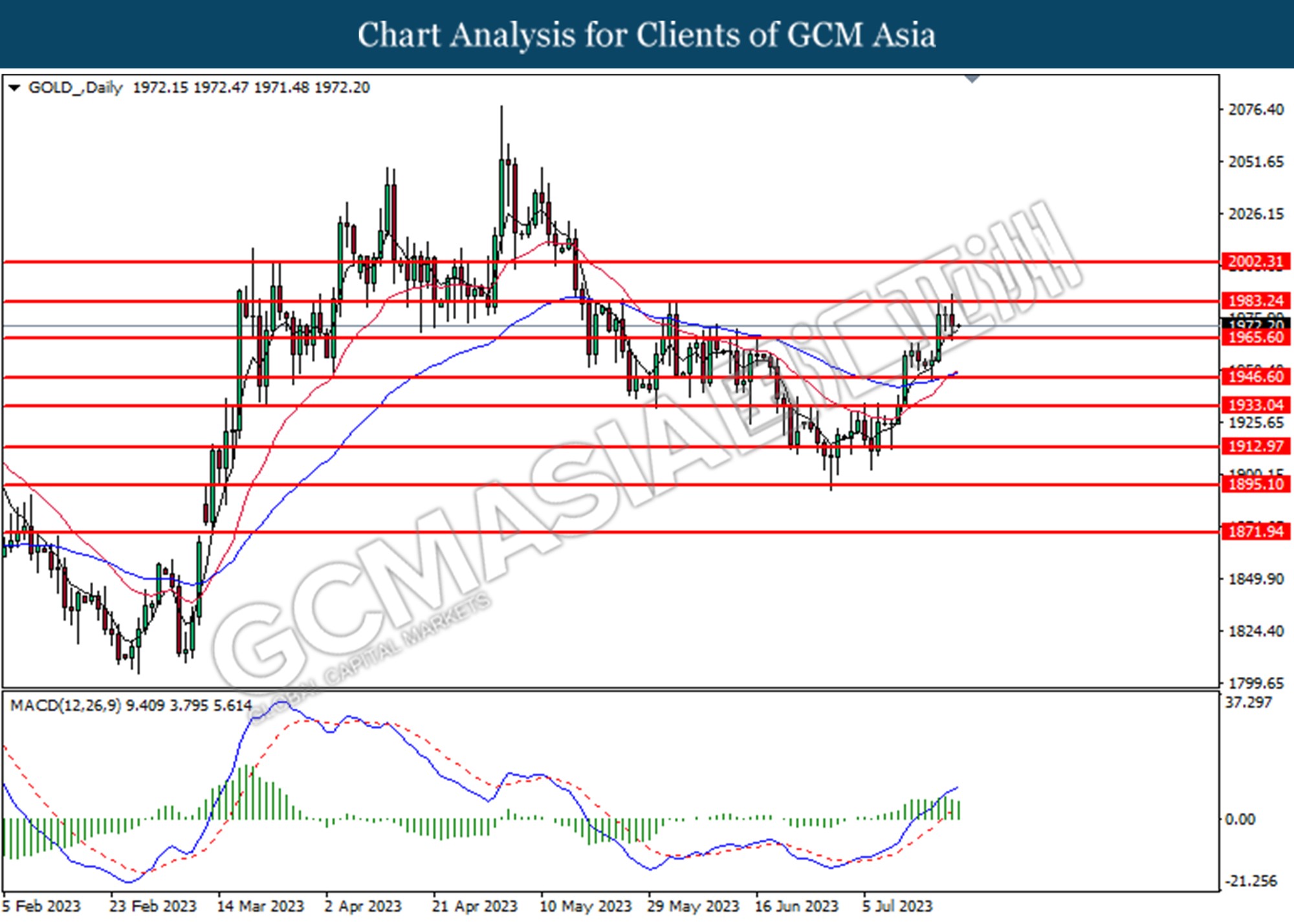

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1983.25. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses towards the support level at 1965.60.

Resistance level: 1983.25, 2002.30

Support level: 1965.60, 1946.60