21 October 2020 Afternoon Session Analysis

Aussie recoup losses following Retail Sales data.

During late Asian session, the Aussie dollar which traded against the greenback and other currency pairs have manage to bounced off from one-month low and rose amid recent release of Australia Retails Sales added into the broad risk-on mood. According to the Australian Bureau of Statistics, the retail sales data came in lesser than market expectation of 1.5% against -4.4% expectation. Despite that, the data suggest that the consumer activities in the Australia have recovered and climbed back into positive territory, thus benefiting the value of the Aussie. At the same time, market risk-on mood also further backed by comments from U.S House Speaker Nancy Pelosi where she remains “optimistic” about the progress in discussion with Treasury Secretary Steven Mnuchin regarding to the U.S stimulus deal. At the time of writing, AUD/USD rose 0.46% to 0.7077.

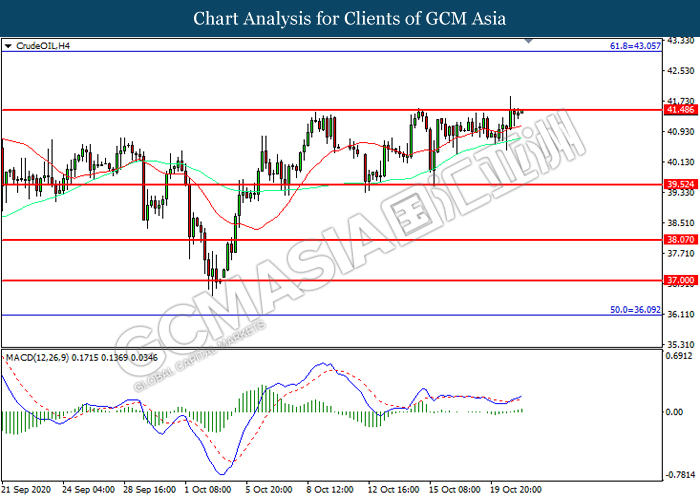

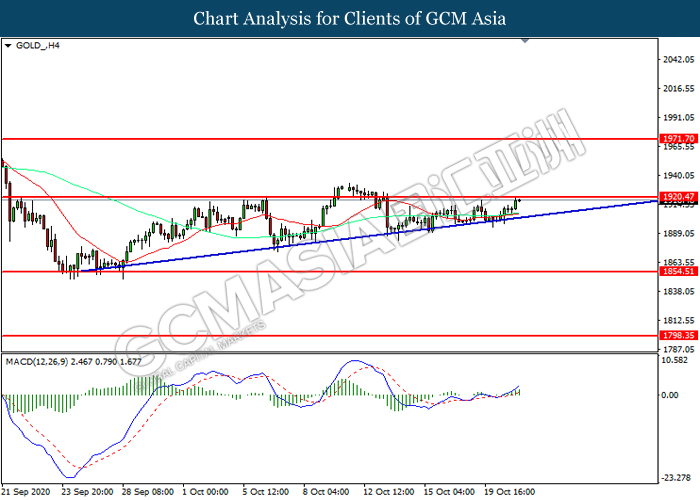

In the commodities market, crude oil price remains stable and edge higher 0.68% to $41.43 per barrel as of writing as market remain convinced and optimistic that the U.S lawmakers may break a month-long impasse and negotiate a potential aid package to boost economic recovery which would help increased the consumption of oil and fuel. On the other hand, gold price soars 0.63% to $1918.02 a troy ounce at the time of writing amid dollar weakness which driven by optimism in U.S stimulus.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY)(Sep) | -0.4% | 0.5% | – |

| 20:30 | CAD – Core Retail Sales (MoM)(Aug) | -0.4% | 0.9% | – |

| 20:30 | CAD – Core CPI (MoM)(Sep) | 0.0% | – | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.818M | -1.021M | – |

Technical Analysis

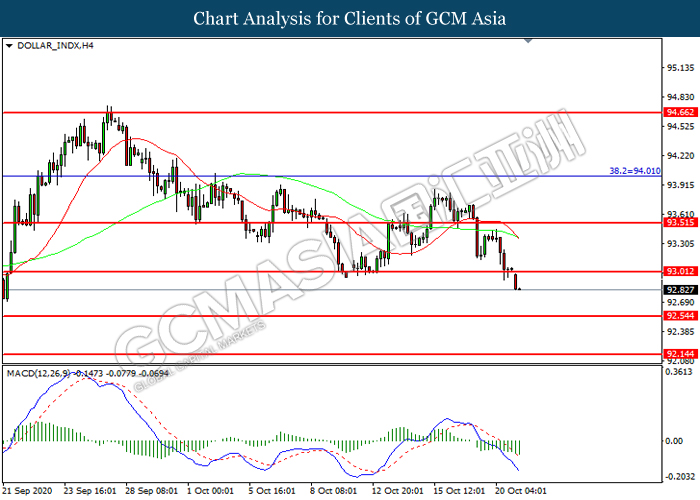

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 93.00. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 92.55.

Resistance level: 93.00, 93.50

Support level: 92.55, 92.15

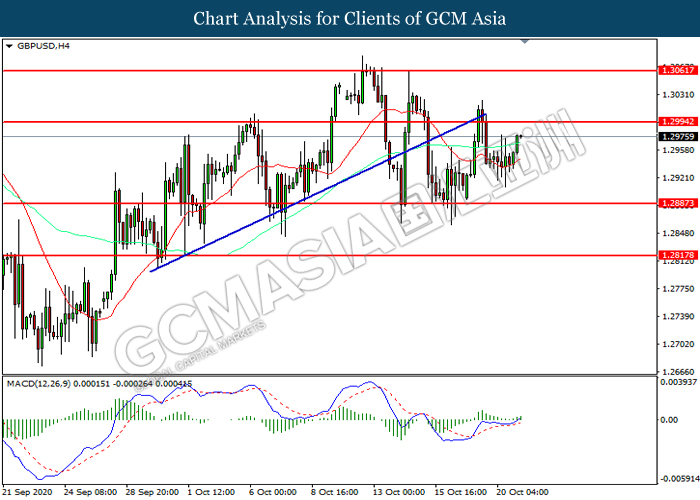

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2885. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2995.

Resistance level: 1.2995, 1.3060

Support level: 1.2885, 1.2815

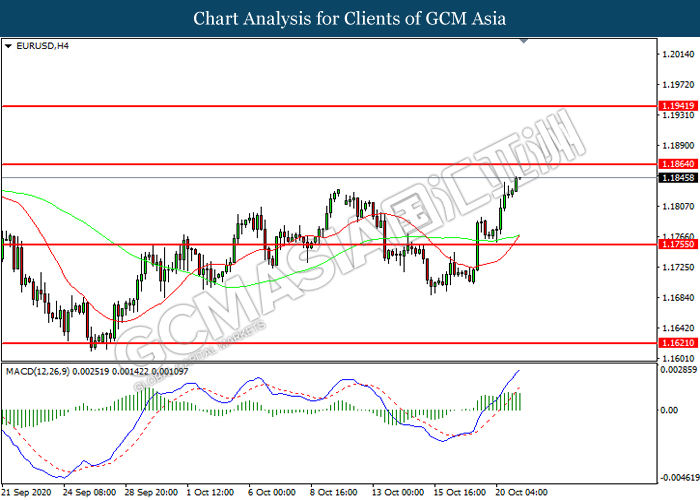

EURUSD, H4: EURUSD was traded higher while currently near the resistance level at 1.1865. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1865, 1.1940

Support level: 1.1755, 1.1620

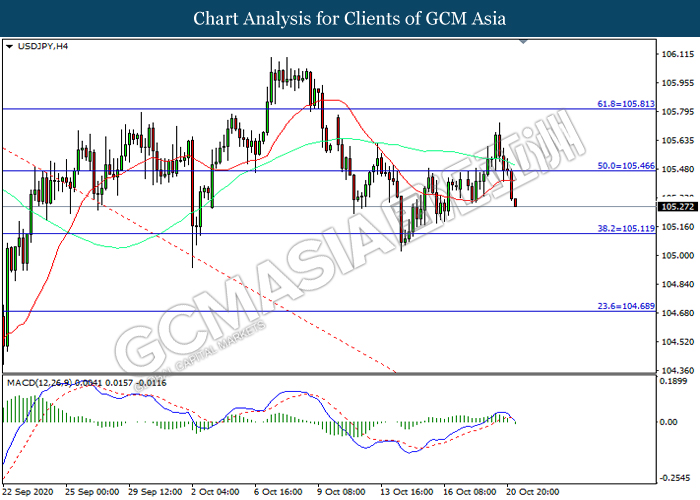

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 105.45. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 105.10.

Resistance level: 105.45, 105.80

Support level: 105.10, 104.70

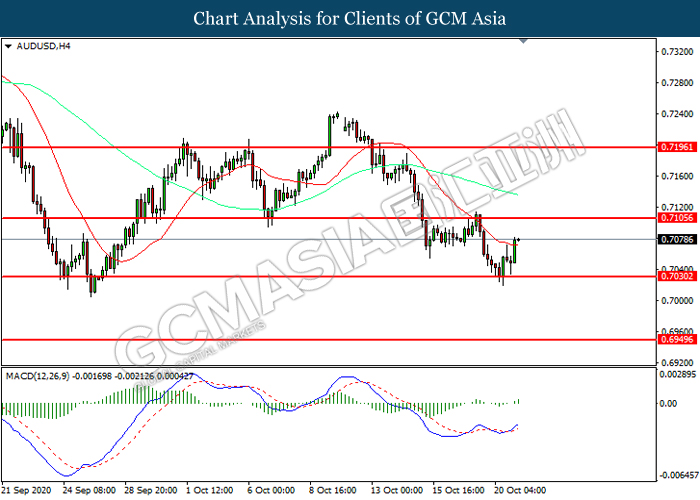

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7030. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7105.

Resistance level: 0.7105, 0.7195

Support level: 0.7030, 0.6950

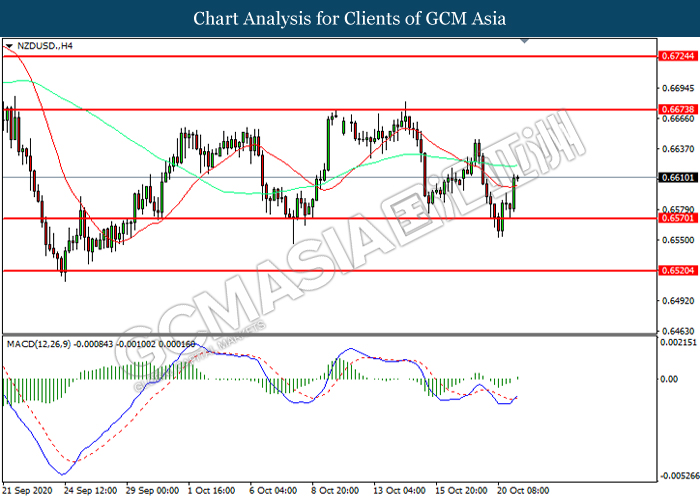

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6570. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6675.

Resistance level: 0.6675, 0.6725

Support level: 0.6570, 0.6520

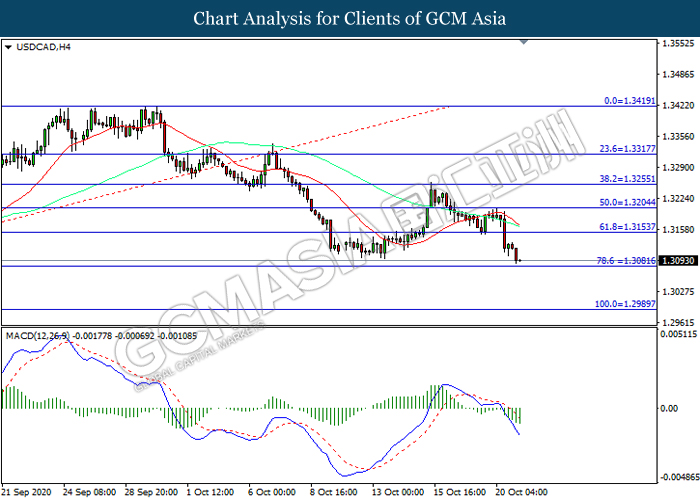

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3080. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3155, 1.3205

Support level: 1.3080, 1.2990

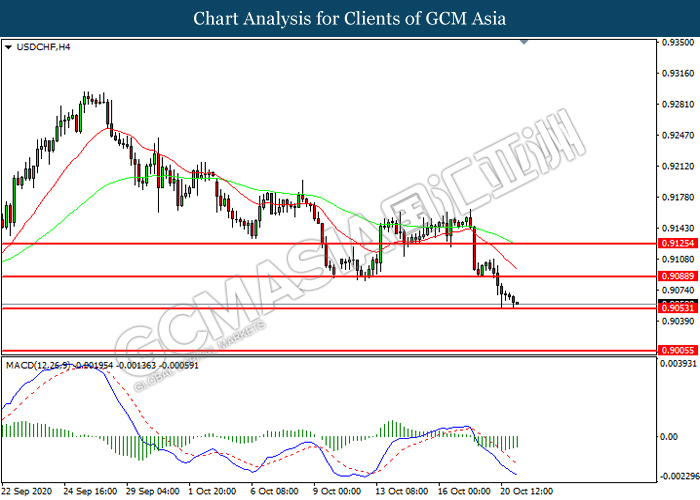

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9055. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9090, 0.9125

Support level: 0.9055, 0.9005

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 41.50. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 41.50, 43.05

Support level: 39.50, 38.05

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1920.45. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1920.45, 1971.70

Support level: 1854.50, 1798.35