21 October 2020 Morning Session Analysis

Dollar plunged while markets continue eye on stimulus talk.

Dollar index which gauges its value against a basket of six major currencies faced huge threw-off pressure while hitting the one month low level after House of Speaker Nancy Pelosi revealed that she was still optimistic toward the stimulus plan can be unveiled by early next month. Earlier this week, a limit of 48 hours was set by Nancy Pelosi where an agreement must be reached between US two biggest parties if they want to pass a stimulus relief bill before US Presidential Election Day. In the latest round of talk, White House and Congressional Democrats claimed enough progress in the talks regarding to the new stimulus aid plan, while promising that they will speak again on Wednesday. Besides, Deputy Chief of Staff Drew Hammill have also said that both parties were ‘serious’ to seal a plan, while both parties are moving closer to a consensus. Despite, he also added that there are still some disagreements on certain affair to be resolved in the upcoming talks. During Asian early trading session, dollar index dropped by 0.37% to 93.10.

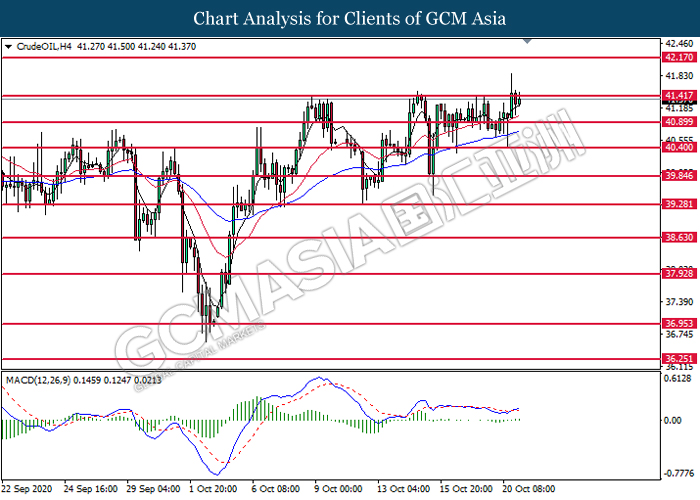

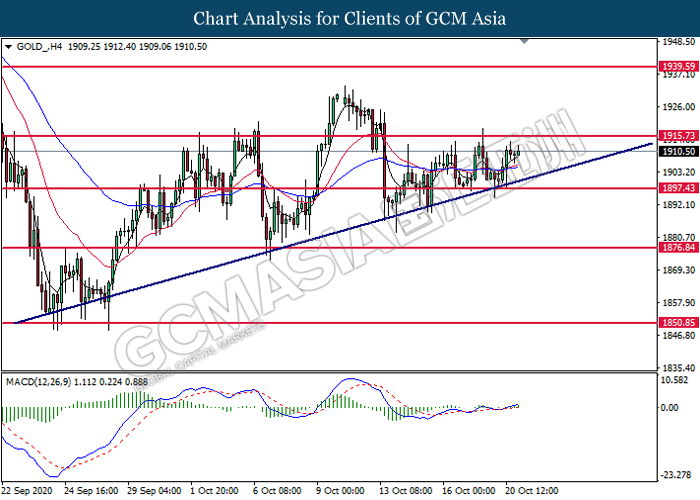

In the commodities market, the crude oil price depreciated by 0.60% to $41.40 per barrel following surprise build in US oil inventories. According to API, US API Weekly Crude Oil Stock was came in at 0.584M, unexpectedly higher than the economist forecast at -1.900M, lifting up the market worries over the supply glut while economy is still being haunted by the pandemic of Covid-19. Besides, gold price rose 0.31% to $1911.90 a troy ounce amid optimism of US stimulus‘s talk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY)(Sep) | -0.4% | 0.5% | – |

| 20:30 | CAD – Core Retail Sales (MoM)(Aug) | -0.4% | 0.9% | – |

| 20:30 | CAD – Core CPI (MoM)(Sep) | 0.0% | – | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.818M | -1.021M | – |

Technical Analysis

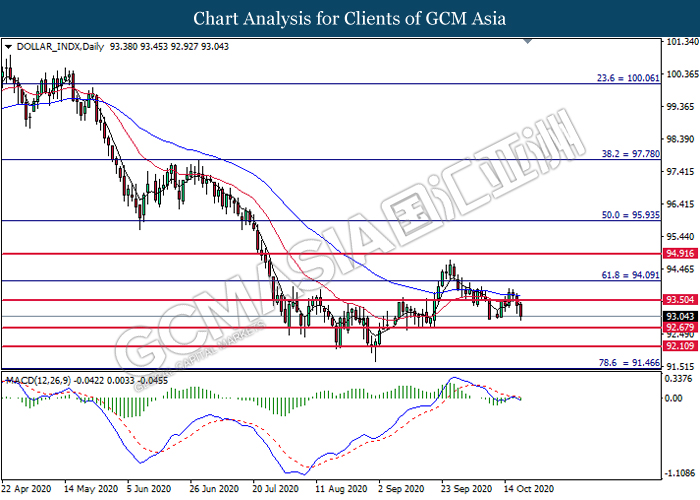

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 93.50. MACD which illustrate bearish bias momentum signal suggest the dollar to extend its losses toward the support level at 92.70.

Resistance level: 93.50, 94.90

Support level: 92.70, 92.10

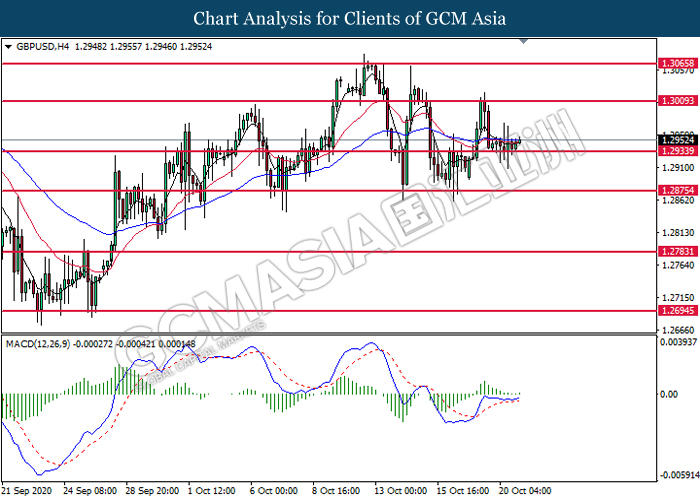

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2935. MACD which illustrates bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3010.

Resistance level: 1.3010, 1.3065

Support level: 1.2935, 1.2875

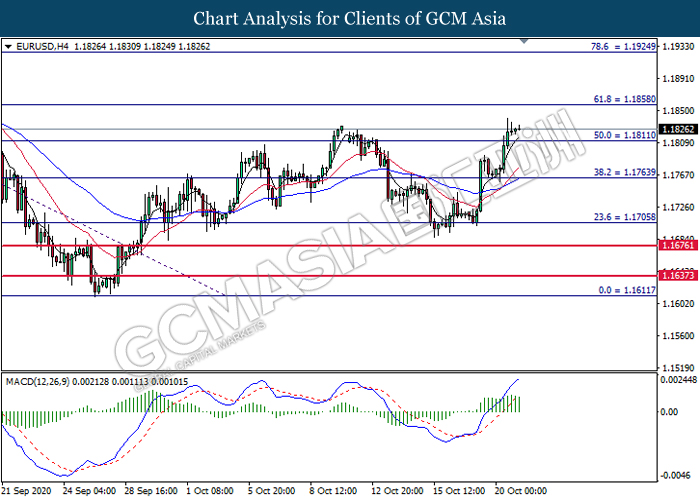

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1810. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.1860.

Resistance level: 1.1860, 1.1925

Support level: 1.1810, 1.1765

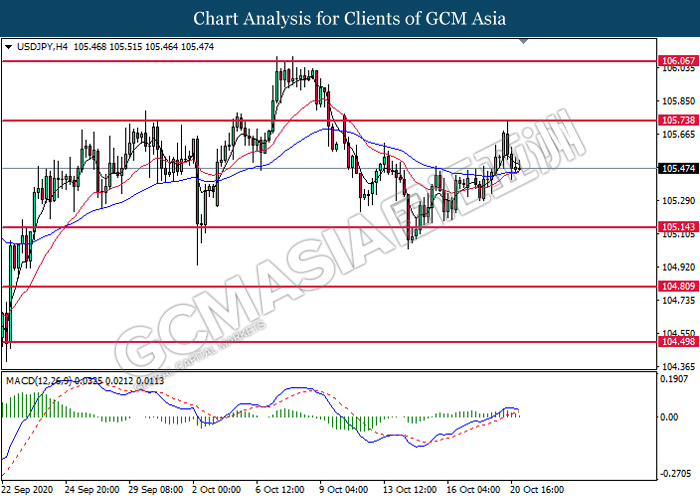

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 105.75. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement toward the support level at 105.15.

Resistance level: 105.75, 106.05

Support level: 105.15, 104.80

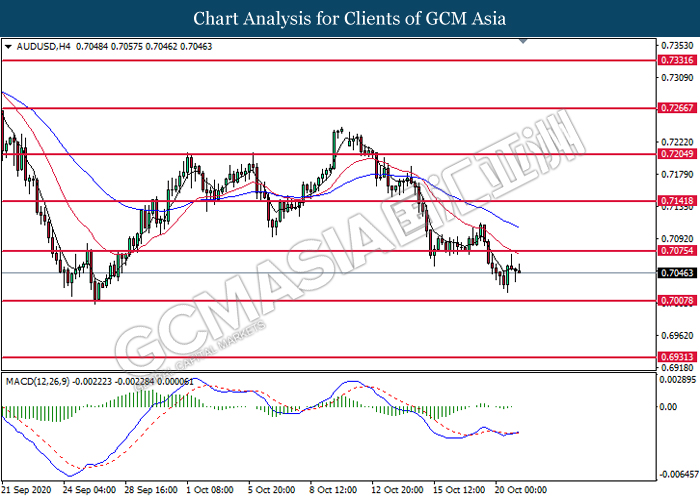

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7075. Due to lack of signal, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 0.7075, 0.7140

Support level: 0.7010, 0.6930

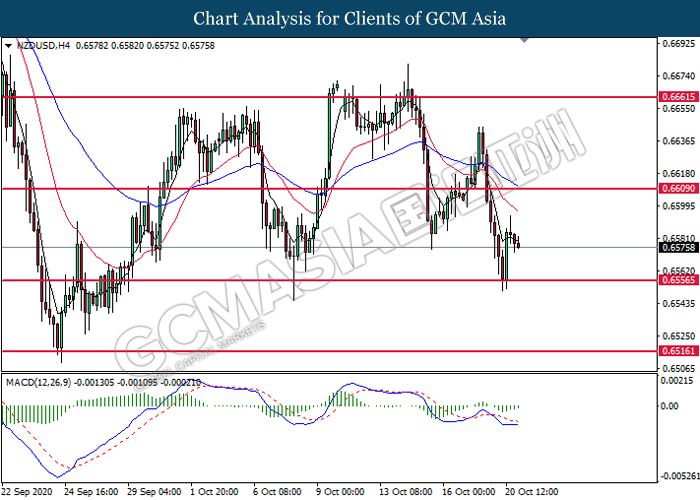

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the higher level. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to undergo technical correction in short term toward higher level.

Resistance level: 0.6610, 0.6660

Support level: 0.6555, 0.6515

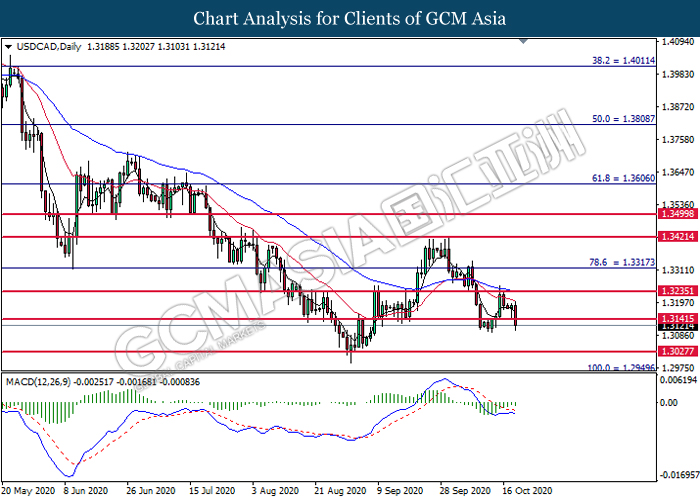

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3140. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 1.3235, 1.3315

Support level: 1.3140, 1.3025

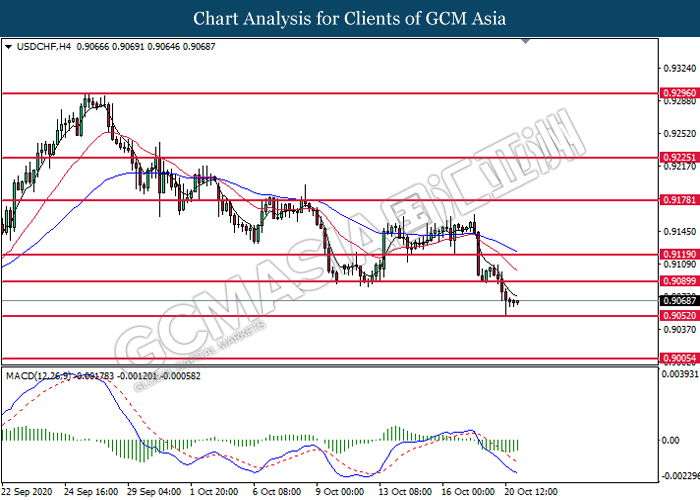

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9090. However, MACD which display diminishing bearish momentum signal suggest the pair to undergo technical rebound in short term.

Resistance level: 0.9090, 0.9120

Support level: 0.9050, 0.9005

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level at 41.40. However, MACD which illustrate bullish momentum signal suggest the commodity to be traded higher after it successfully breakout above the resistance level.

Resistance level: 41.40, 42.15

Support level: 40.90, 40.40

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1897.45. MACD which illustrate bullish bias momentum signal suggest the commodity to extend its gains toward the resistance level at 1915.75.

Resistance level: 1915.75, 1939.60

Support level: 1897.45, 1876.85