22 January 2021 Afternoon Session Analysis

Aussie slips amid weak data.

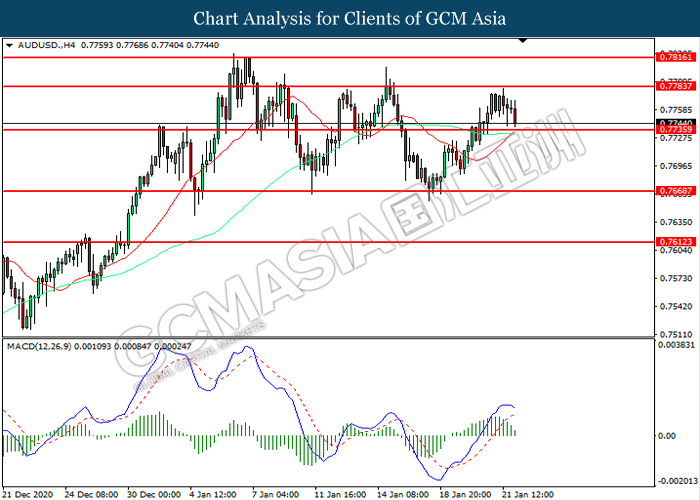

During late Asian session, the Australian dollar which traded against the greenback and other currency pairs have fell following the release of a weaker-than-expected Retail Sales data recently. According to the Australian Bureau of Statistic, Australia’s consumer spending which is represented by Retail Sales have fell by 4.2% in December, lower than market expectation for a 1.5% drop and previous reading of 7.1%. The decline in consumer spending in the holiday season have raise doubts on the strength of recovery from coronavirus and support the RBA’s dovish stance, thus exerting pressure for the pair. At the time of writing, AUD/USD fell 0.21% to 0.7744.

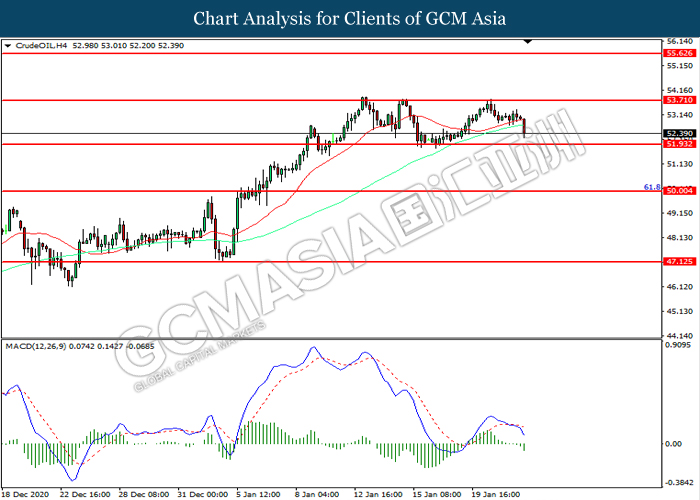

In the commodities market, crude oil price fell 1.34% to $52.23 per barrel as of writing following worries on new COVID-19 cases in China. Following latest development, the commercial hub of Shanghai reported its first locally transmitted cases in two months on Thursday. Concerns towards new pandemic restrictions in China due to rising new cases will curb fuel demand in the world’s biggest oil importer, thus dragging the value of the commodity. On the other hand, gold price remains steady and edge higher 0.12% to $1861.65 a troy ounce at the time of writing following ongoing dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM)(Dec) | -3.8% | 1.2% | – |

| 16:30 | EUR – German Manufacturing PMI (Jan) | 58.3 | 57.5 | – |

| 17:30 | GBP – Composite PMI (Jan) | 50.7 | 50.7 | – |

| 17:30 | GBP – Manufacturing PMI (Jan) | 57.3 | 57.3 | – |

| 17:30 | GBP – Services PMI (Jan) | 49.9 | 49.9 | – |

| 21:30 | CAD – Core Retail Sales (MoM)(Nov) | 1.0% | 0.3% | – |

| 23:00 | USD – Existing Home Sales(Dec) | 6.69M | 6.55M | – |

Technical Analysis

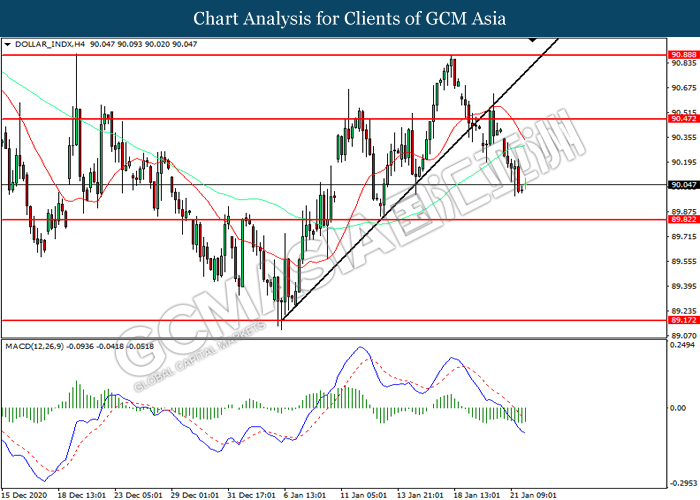

DOLLAR_INDX, H4: Dollar index was traded lower following retracement from the resistance level at 90.45. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 89.80.

Resistance level: 90.45, 90.90

Support level: 89.80, 89.15

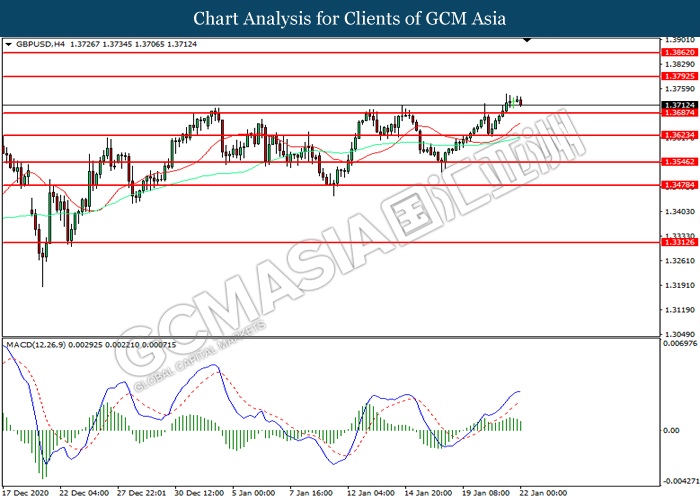

GBPUSD, H4: GBPUSD was traded within a range while currently testing the support level at 1.3685. MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower after it successfully breakout below the support level.

Resistance level: 1.3795, 1.3860

Support level: 1.3685, 1.3625

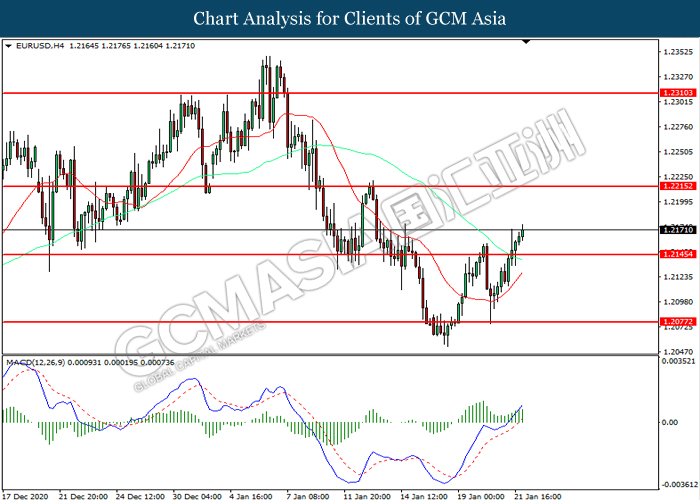

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.2145. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2215.

Resistance level: 1.2215, 1.2310

Support level: 1.2145, 1.2075

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 103.40. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 103.65.

Resistance level: 103.65, 104.15

Support level: 103.40, 103.00

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7735. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7785, 0.7815

Support level: 0.7735, 0.7670

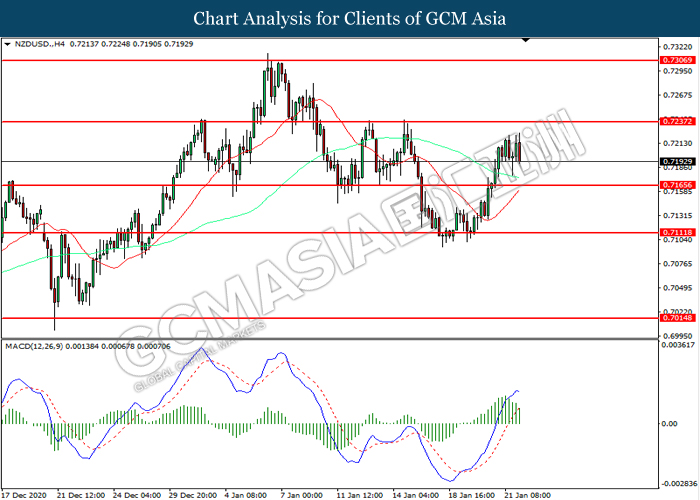

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.7165. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7235, 0.7305

Support level: 0.7165, 0.7110

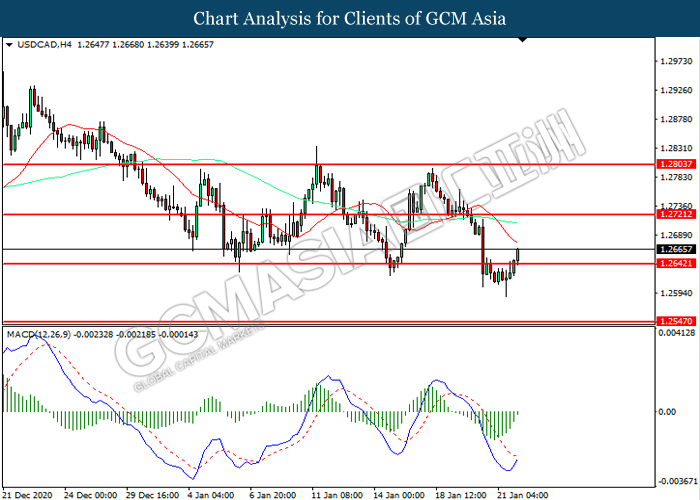

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2640. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2720.

Resistance level: 1.2720, 1.2805

Support level: 1.2640, 1.2545

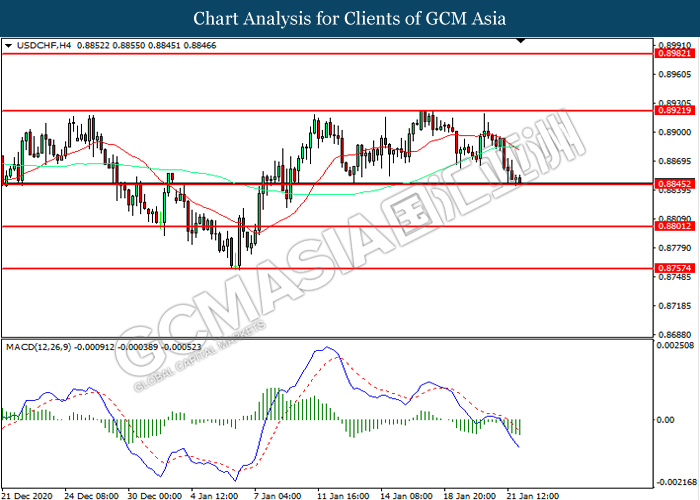

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.8845. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.8920, 0.8980

Support level: 0.8845, 0.8800

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 53.70. MACD which illustrated increasing bearish suggest the commodity to extend its losses toward support level at 51.95

Resistance level: 53.70, 55.65

Support level: 51.95, 50.00

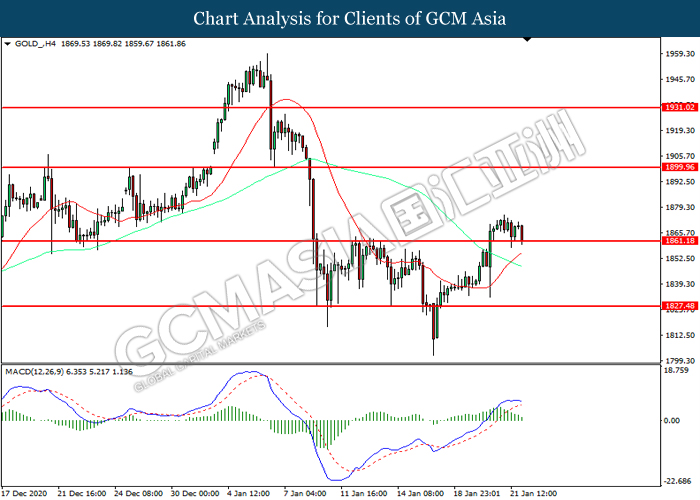

GOLD_, H4: Gold price was traded within a range while currently testing the support level at 1861.20. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower after it successfully breakout below the support level.

Resistance level: 1899.95, 1931.00

Support level: 1861.20, 1827.50