22 January 2021 Morning Session Analysis

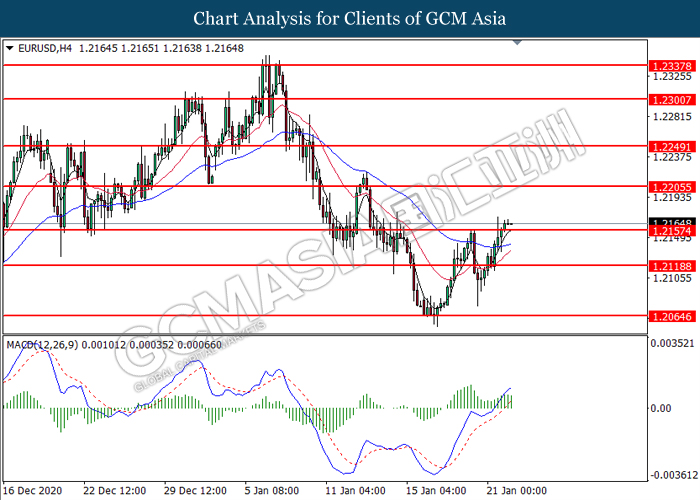

Euro ticked up following the neutral stance of view given by ECB.

The single currency of European Union lingered around the highest level in one week after European Central Bank (ECB) decided to remain its unfold monetary policy in the yesterday meeting. First, ECB maintained its interest rate at 0.00% as expected, while continue the purchases under the pandemic emergency purchase programme (PEPP) with a total amount of €1,850 billion until at least end of March 2022. Besides, ample of liquidity will be provided to the bank through the third series of targeted longer term refinancing operations (TLTRO III) in order to support bank for lending firms and households. Besides, the chairman of ECB Christine Lagarde reiterated that the ongoing coronavirus pandemic is still posing “serious risk” to the euro zone economy, as lockdown measure are tightened across the region which halted the large part of economic activity. Christine Lagarde also emphasized that future outlook of economy remained vulnerable and weak as the rollout of vaccines has proven to be challenging, and behind-scheduled vaccination progress has slowed down the recovery pace of economy. Hence, ECB did not rule out the possibility of further support will be unveiled if it is necessary to the EU economy. During Asian early trading session, the pair of EUR/USD up 0.05% to 1.2168.

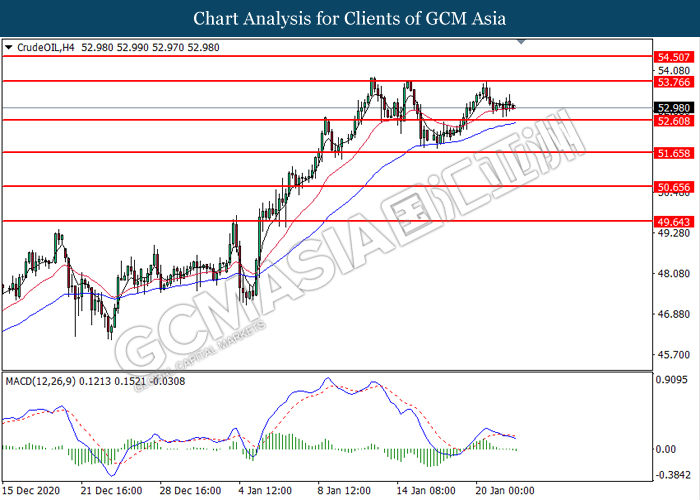

In the commodities market, the crude oil price appreciated by 0.08% to $52.98 per barrel as of writing while market awaiting for further catalyst such as US inventory data in order to gauge the further direction of oil price. Yesterday, Biden administration pauses federal drilling program in the latest series of executive order aimed to fight against climate change. Besides, gold price up 0.01% to $1870.40 a troy ounce amid weakening of dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM)(Dec) | -3.8% | 1.2% | – |

| 16:30 | EUR – German Manufacturing PMI (Jan) | 58.3 | 57.5 | – |

| 17:30 | GBP – Composite PMI (Jan) | 50.7 | 50.7 | – |

| 17:30 | GBP – Manufacturing PMI (Jan) | 57.3 | 57.3 | – |

| 17:30 | GBP – Services PMI (Jan) | 49.9 | 49.9 | – |

| 21:30 | CAD – Core Retail Sales (MoM)(Nov) | 1.0% | 0.3% | – |

| 23:00 | USD – Existing Home Sales(Dec) | 6.69M | 6.55M | – |

Technical Analysis

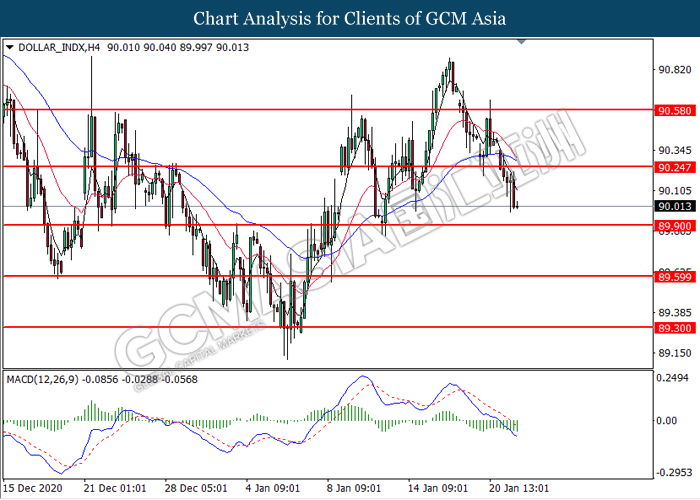

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 90.25. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 89.90.

Resistance level: 90.25, 90.60

Support level: 89.90, 89.60

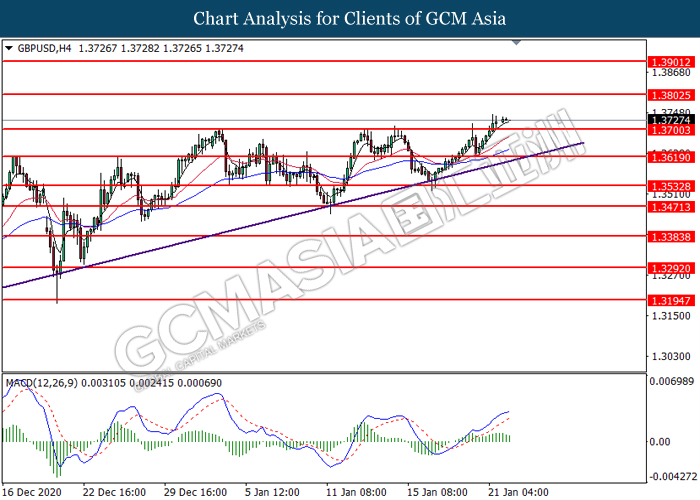

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3700. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.3800, 1.3900

Support level: 1.3700, 1.3620

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.2155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2205.

Resistance level: 1.2205, 1.2250

Support level: 1.2155, 1.2120

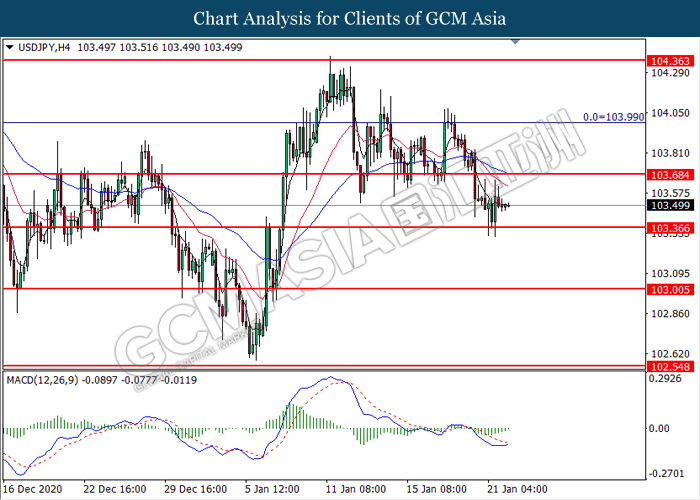

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 103.35. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 103.70.

Resistance level: 103.70, 104.00

Support level: 103.35, 103.00

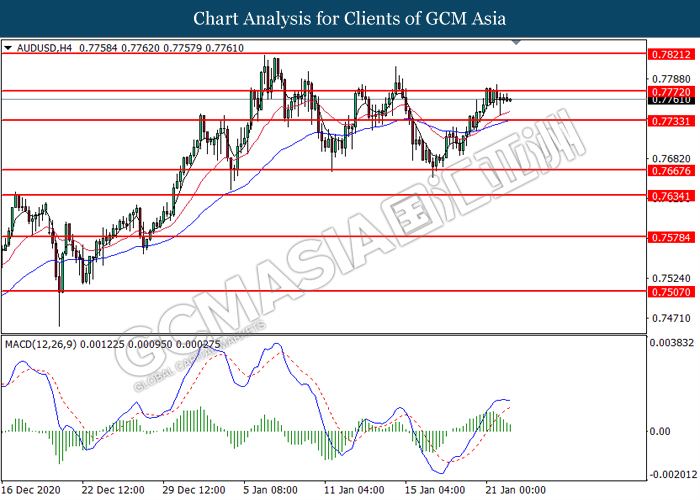

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7770. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.7735.

Resistance level: 0.7770, 0.7820

Support level: 0.7735, 0.7670

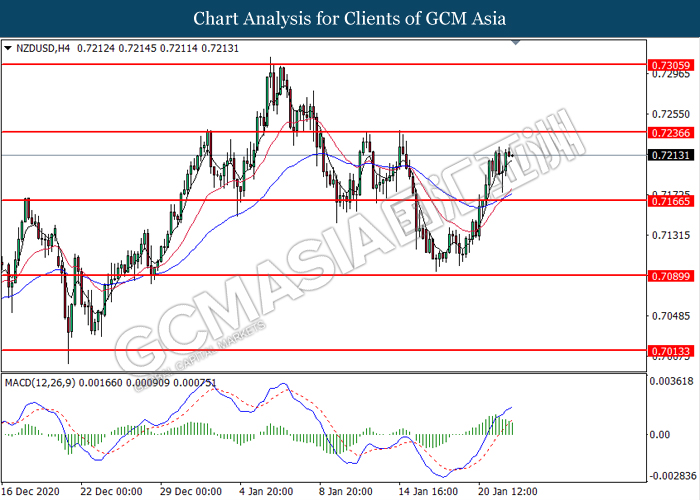

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.7165. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7235.

Resistance level: 0.7235, 0.7305

Support level: 0.7165, 0.7090

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2625. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2695.

Resistance level: 1.2695, 1.2775

Support level: 1.2625, 1.2530

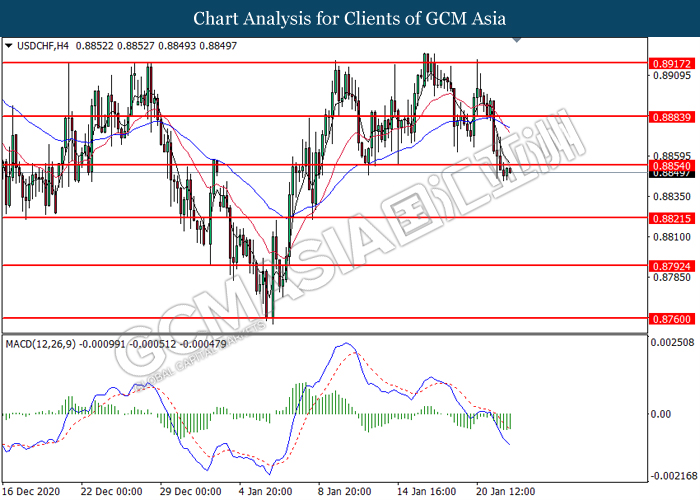

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.8855. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8820.

Resistance level: 0.8855, 0.8885

Support level: 0.8820, 0.8795

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 53.75. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 52.60.

Resistance level: 53.75, 54.50

Support level: 52.60, 51.65

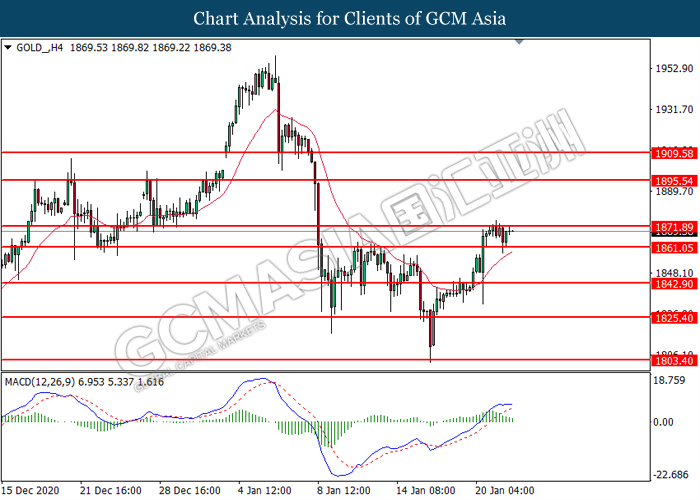

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1861.05. MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1871.90, 1895.55

Support level: 1861.05, 1842.90