22 March 2017 Daily Analysis

Greenback in focus as Fed member speaks.

Greenback drifts higher in Asia as market participants noted hawkish view from a key Fed policymaker concerning future interest hike outlook. Cleveland Fed President Loretta Mester postulate that she envisions more than three rate hike for this year as the economy is estimated to be stronger than median forecast. As of this morning, the dollar index was held steady around 99.58, halting overnight’s slump after being dragged down by stronger pound and euro. In other region, euro depreciates by 0.10% to $1.0799 against the dollar counterpart as investors begin to cash in their profits after reaching seven-weeks high of $1.0819. The common currency received broad support amid growing optimism over centrist Emmanuel Macron fending off its main opponent, Marine Le Pen during first round of French presidential election.

Otherwise, crude oil price dipped 8 cents to $48.16 a barrel following a larger-than-expected swell in US crude stockpiles by 4.53 million barrels last week. Concurrently, gold price was down 0.10% to $1,244.82 during Asian trading hours as investors begin to cash in their profit after surging 1.18% overnight.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

04:00 NZD RBNZ Rate Statement

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Existing Home Sales (Feb) | 5.69M | 5.57M | – |

| 22:30 | Crude Oil – Crude Oil Inventories | -0.237M | 2.801M | – |

| 04:00 | NZD – RBNZ Interest rate Decision | 1.75% | 1.75% | – |

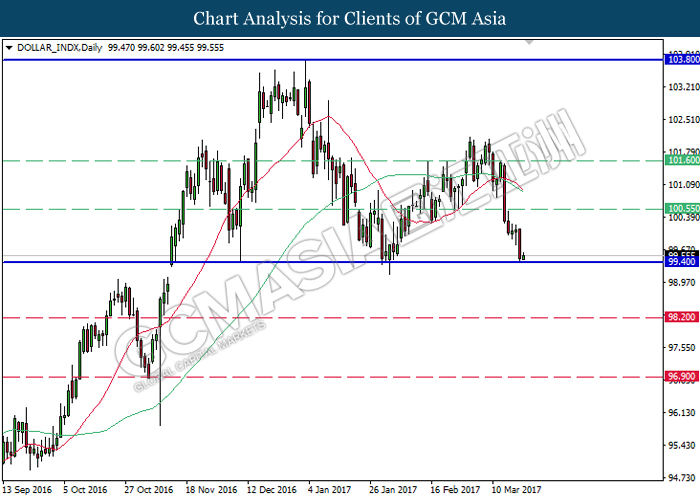

DOLLAR_INDX

DOLLAR_INDX, Daily: Dollar index has recently formed a head and shoulder formation following prior retracement from the resistance level at 101.60. Currently, it is testing at the neckline of support level at 99.40. A successful closure below this level would suggest an extension of downward momentum towards the next target of support level at 98.20. Otherwise, a rebound from the neckline would suggest dollar index to be traded higher in the short-term thereafter.

Resistance level: 100.55, 101.60, 103.80

Support level: 99.40, 98.20, 96.90

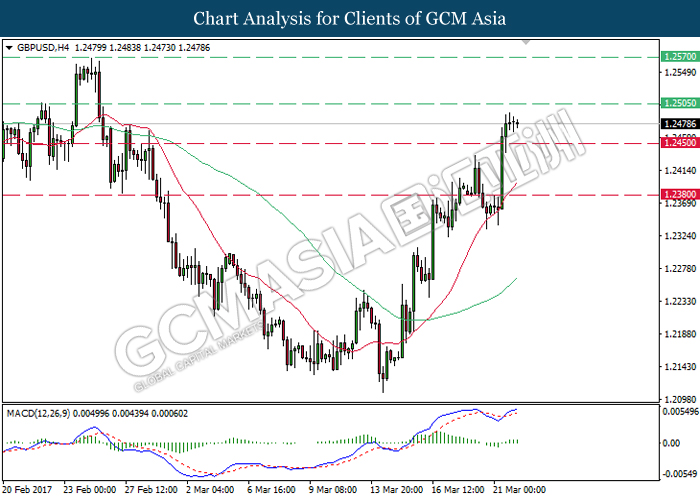

GBPUSD

GBPUSD, H4: GBPUSD advanced higher following prior rebound from the 20-moving average line (red). With regards to the MACD histogram which illustrates upward signal and momentum while both moving average line continues its upward expansion after the formation of golden cross, GBPUSD is expected to extend its uptrend after a closure above the resistance level of 1.2505.

Resistance level: 1.2505, 1.2570

Support level: 1.2450, 1.2380

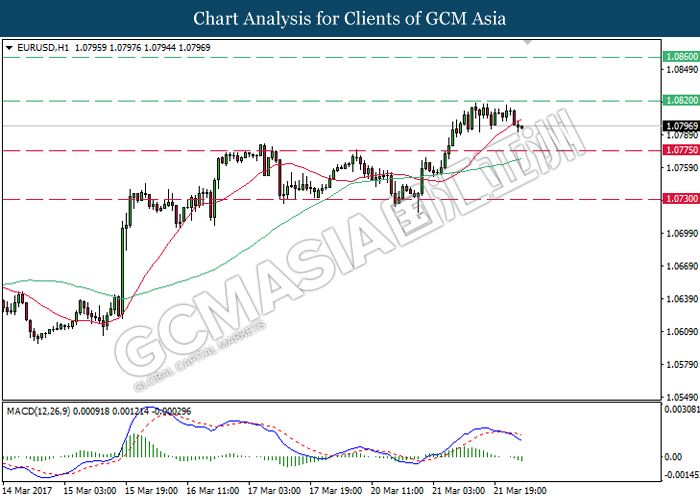

EURUSD

EURUSD, H1: EURUSD was traded lower following a retrace from the strong resistance level of 1.0820. Referring to the MACD histogram, recent formation of downward signal and momentum suggests EURUSD to be traded lower, towards the target of support level at 1.0775.

Resistance level: 1.0820, 1.0860

Support level: 1.0775, 1.0730

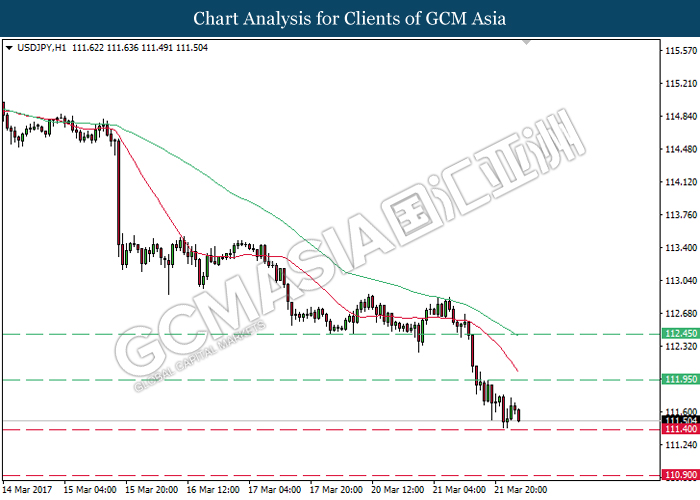

USDJPY

USDJPY, H1: USDJPY has extended its losses following prior closure below the strong support level at 112.45. Referring to both moving average line which continues to expand downwards after the formation of death cross, USDJPY is expected to extend its downtrend after breaking the support level of 111.40.

Resistance level: 111.95, 112.45

Support level: 111.40, 110.90

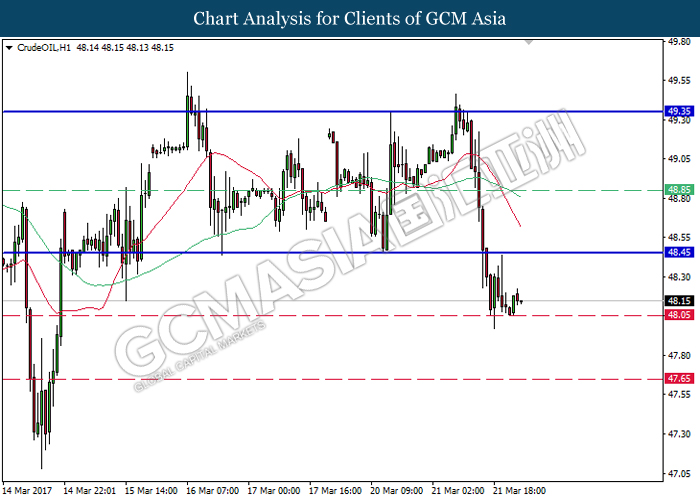

CrudeOIL

CrudeOIL, H1: Crude oil price has recently breakout from the bottom level of sideways channel, signaling a change in trend direction to move further downwards. As both moving average line extends its downward expansion after the formation of death cross, it is expected to move further down after a successful closure below the strong support level of 48.05.

Resistance level: 48.45, 48.85, 49.35

Support level: 48.05, 47.65

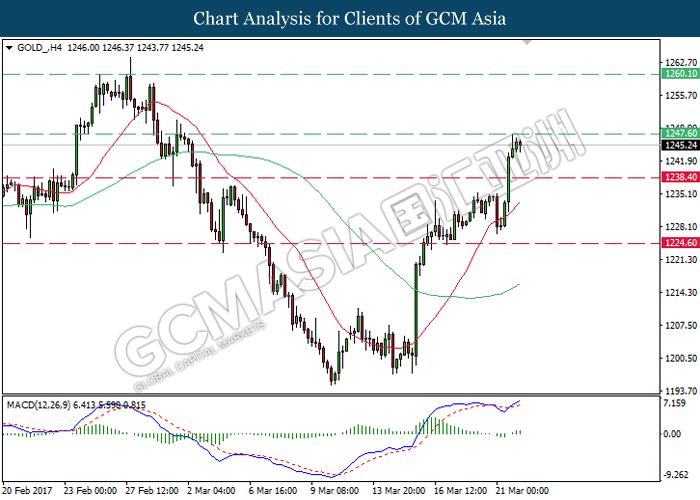

GOLD

GOLD_, H4: Gold price extended its uptrend following prior rebound from the 20-moving average line (red). Referring to the MACD histogram which illustrates upward signal and momentum above the threshold of 0, gold price is expected to move further upwards after a successful breakthrough from the resistance level of 1247.60.

Resistance level: 1247.60, 1260.10

Support level: 1238.40, 1224.60