22 March 2023 Afternoon Session Analysis

Loonie slipped as inflation slows in peace.

The Loonie, one of the most traded currencies for global investors, slipped as inflation slows in peace in February. Canadian February yearly basis inflation slowed to 4.7% compared with economists’ estimation of 4.8%. Inflation slowed for the fifth straight month and was the largest deceleration since April 2020. According to Statistics Canada. The decline in CPI in February was due to a steep monthly increase in price in February 2020 when the global supply was significantly affected by the Russian invasion of Ukraine. Furthermore, Investors are anticipated that the Bank of Canada will pause its interest rate hike as inflation slowdown in peace. Part of the analyst also argued that Canada’s economy is more sensitive to interest rate hikes than the US economy, amid Canadians’ participation in the hot housing market in recent years and the shorter Canadian mortgage cycle. A statistic announced by the National Bank of Canada that interest rate sensitive demand in Canada’s economy was 26% of final domestic demand when compared with 21% of the United States. Besides, Lonnie continues to slip ahead of the Fed interest rate decision as investors await more cues from the meeting. As of writing, the USD/CAD pairs depreciation by -0.08% to $1.3700.

In the commodities market, crude oil prices edged down by -0.89% to $69.05 per barrel as the market awaits interest rate decision looms. Besides, gold prices ticked up by 0.25% to $1945.95 per troy ounce amid the uncertainty about the Fed monetary policy decision.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 EUR ECB President Lagarde Speaks

02:00 USD FOMC Economic Projections

(23th)

02:00 USD FOMC Press Conference

(23th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.550M | -1.565M | – |

| 02:00

(23th) |

USD – Fed Interest Rate Decision | 4.75% | 5.00% | – |

Technical Analysis

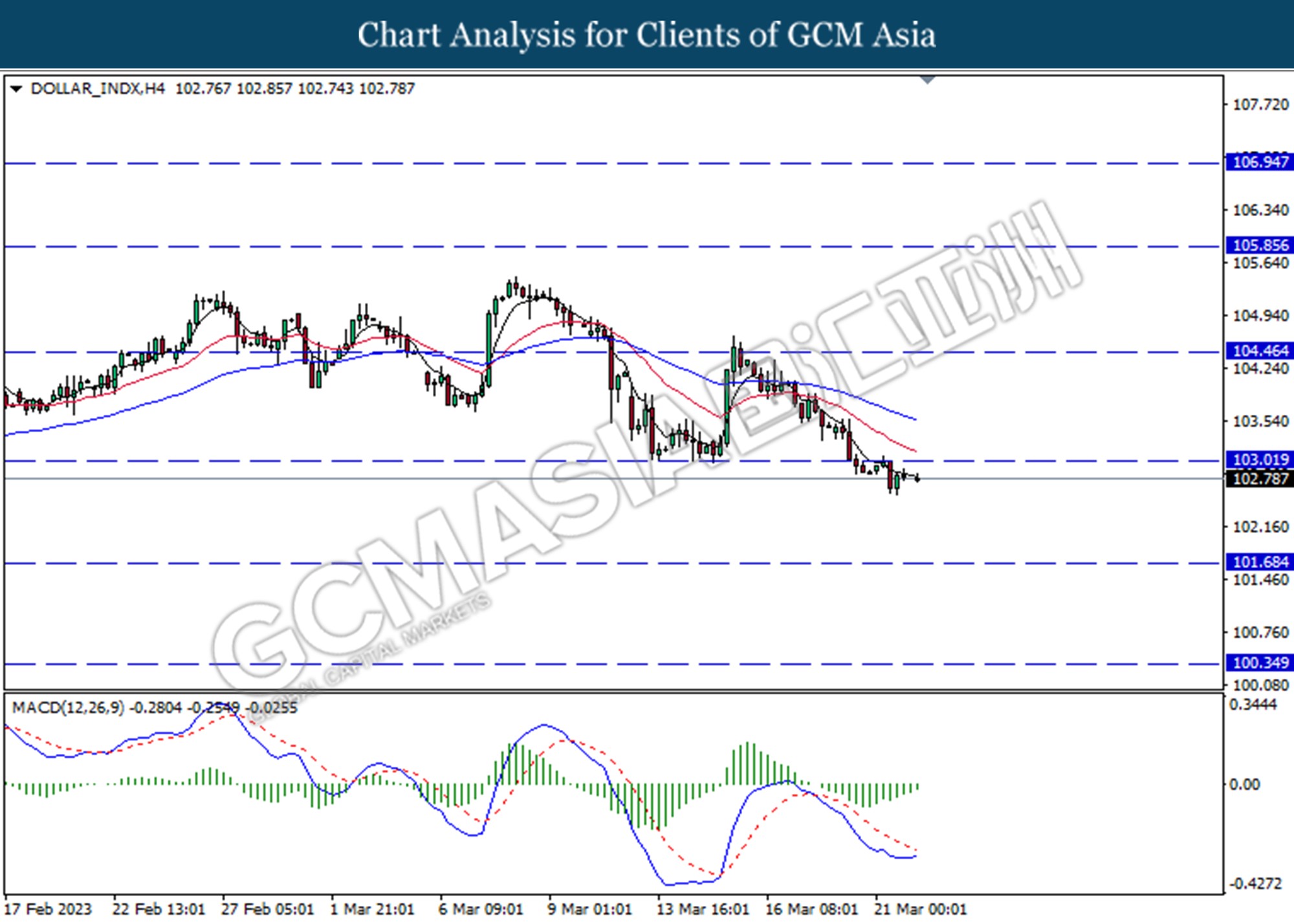

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to traded higher as technical correction.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

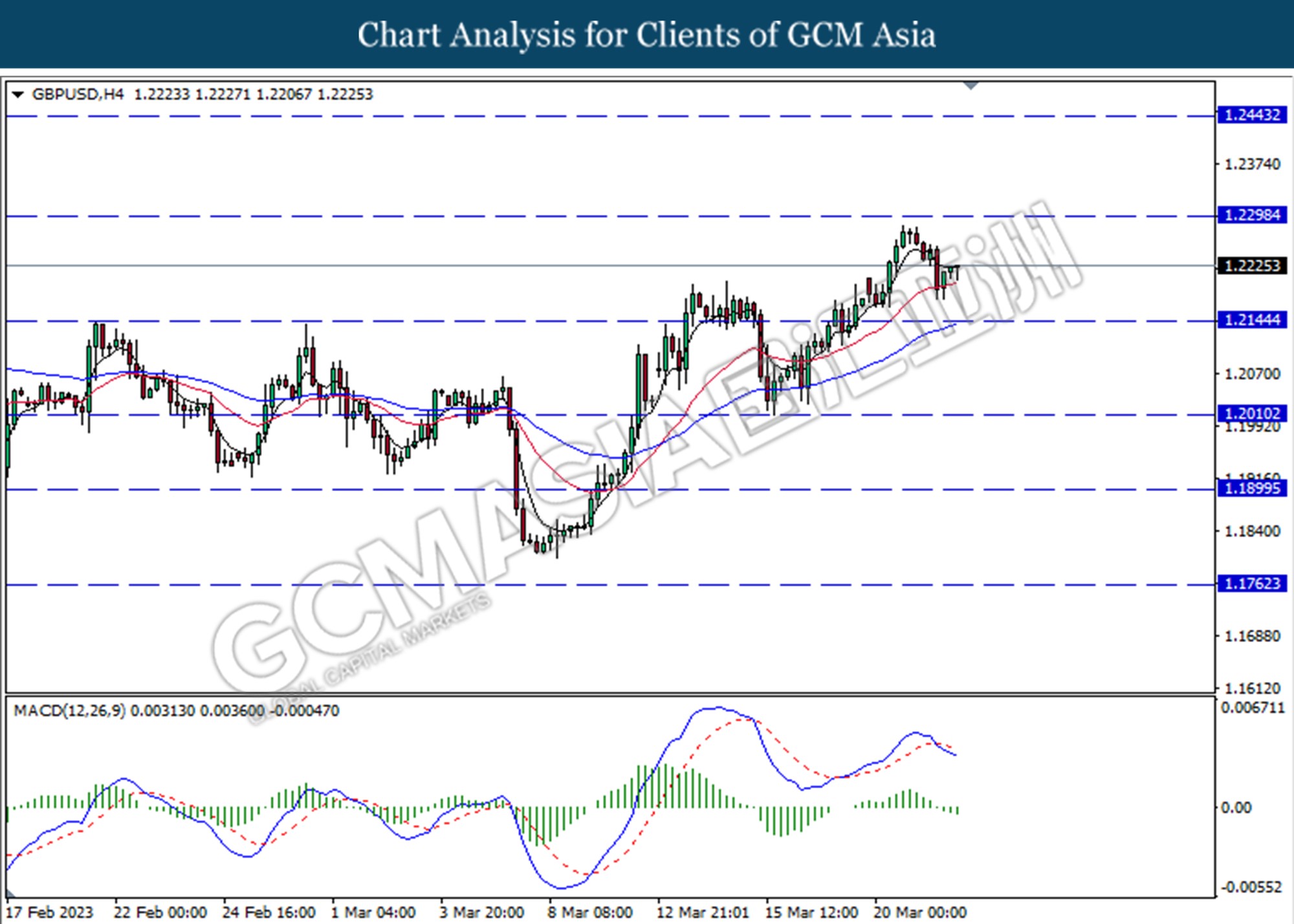

GBPUSD, H4: GBPUSD was traded higher following the rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggest the pair to undergo technical correction in the short term.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

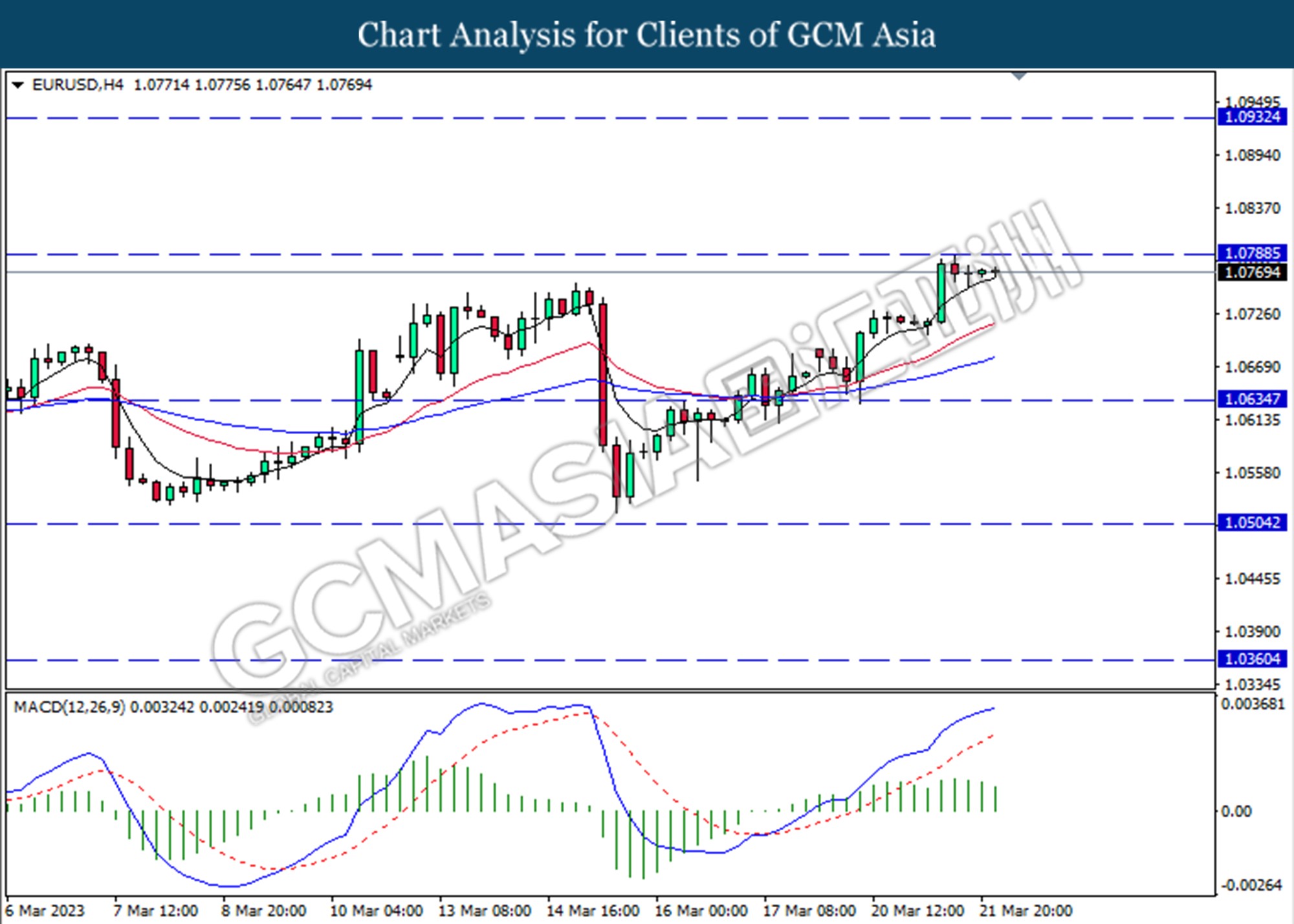

EURUSD, H4: EURUSD was traded higher following rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in the short term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

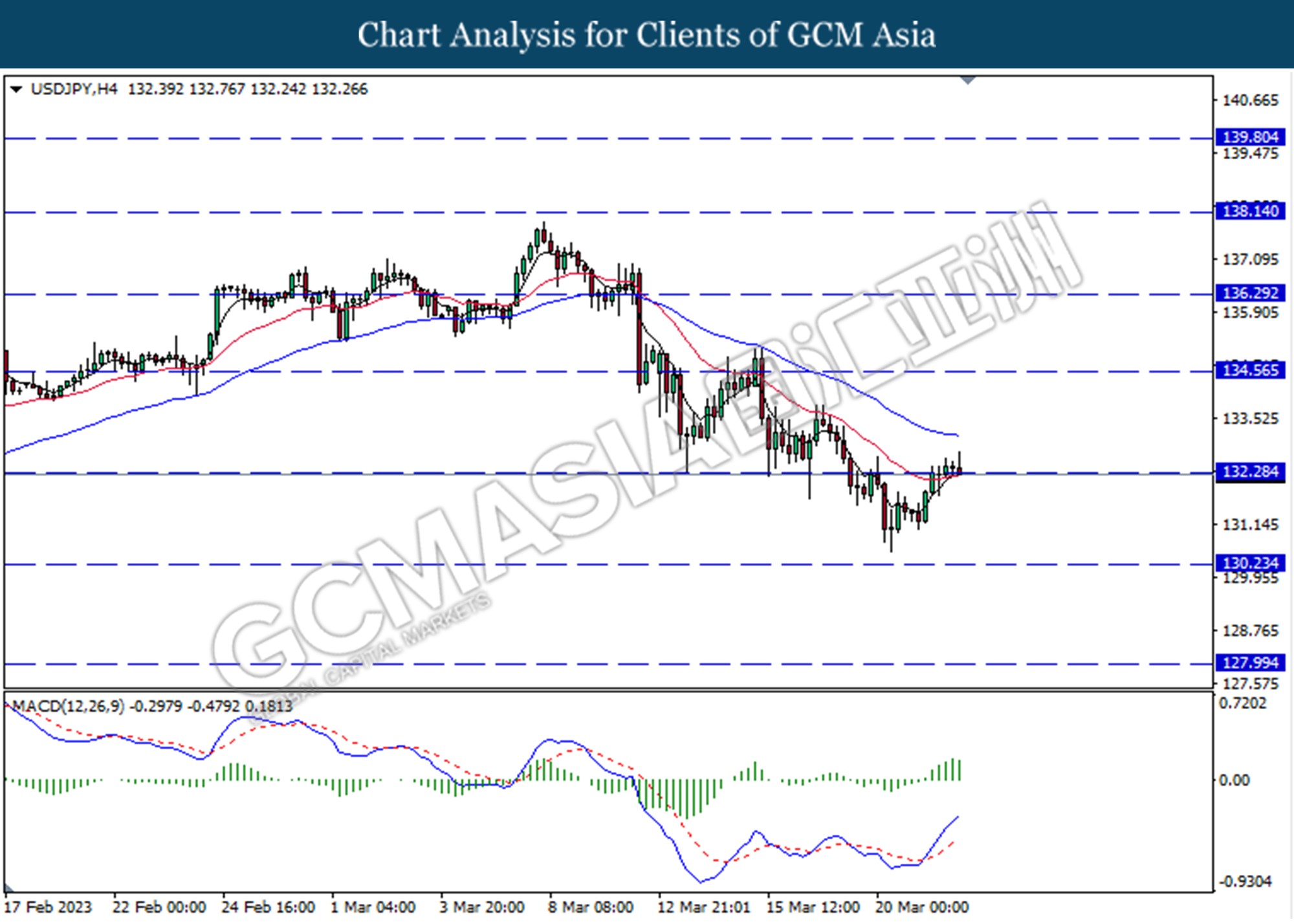

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 132.30. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses if successfully break below the support level.

Resistance level: 134.60, 136.30

Support level: 132.30, 130.25

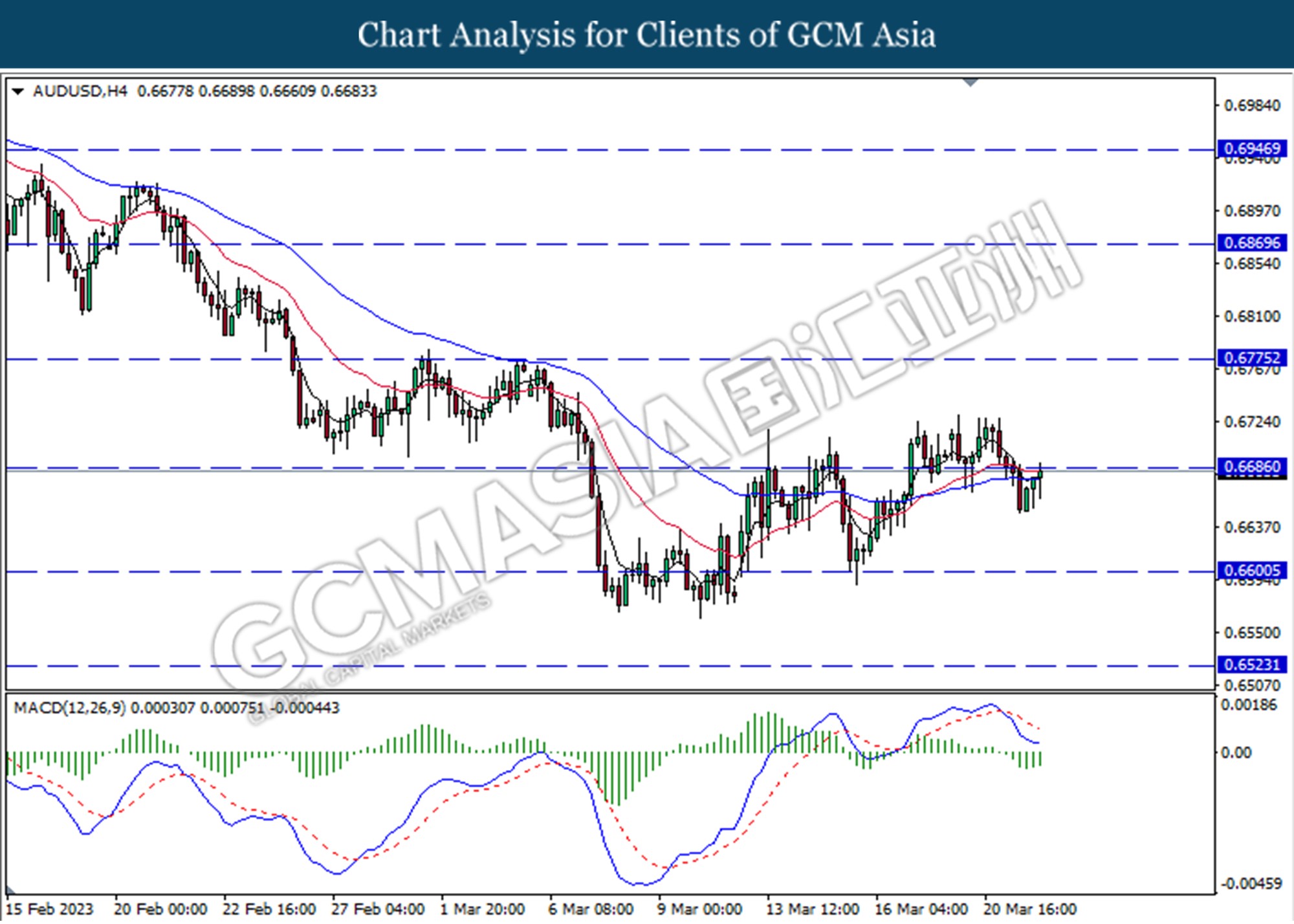

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.6685. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains if successfully break above the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

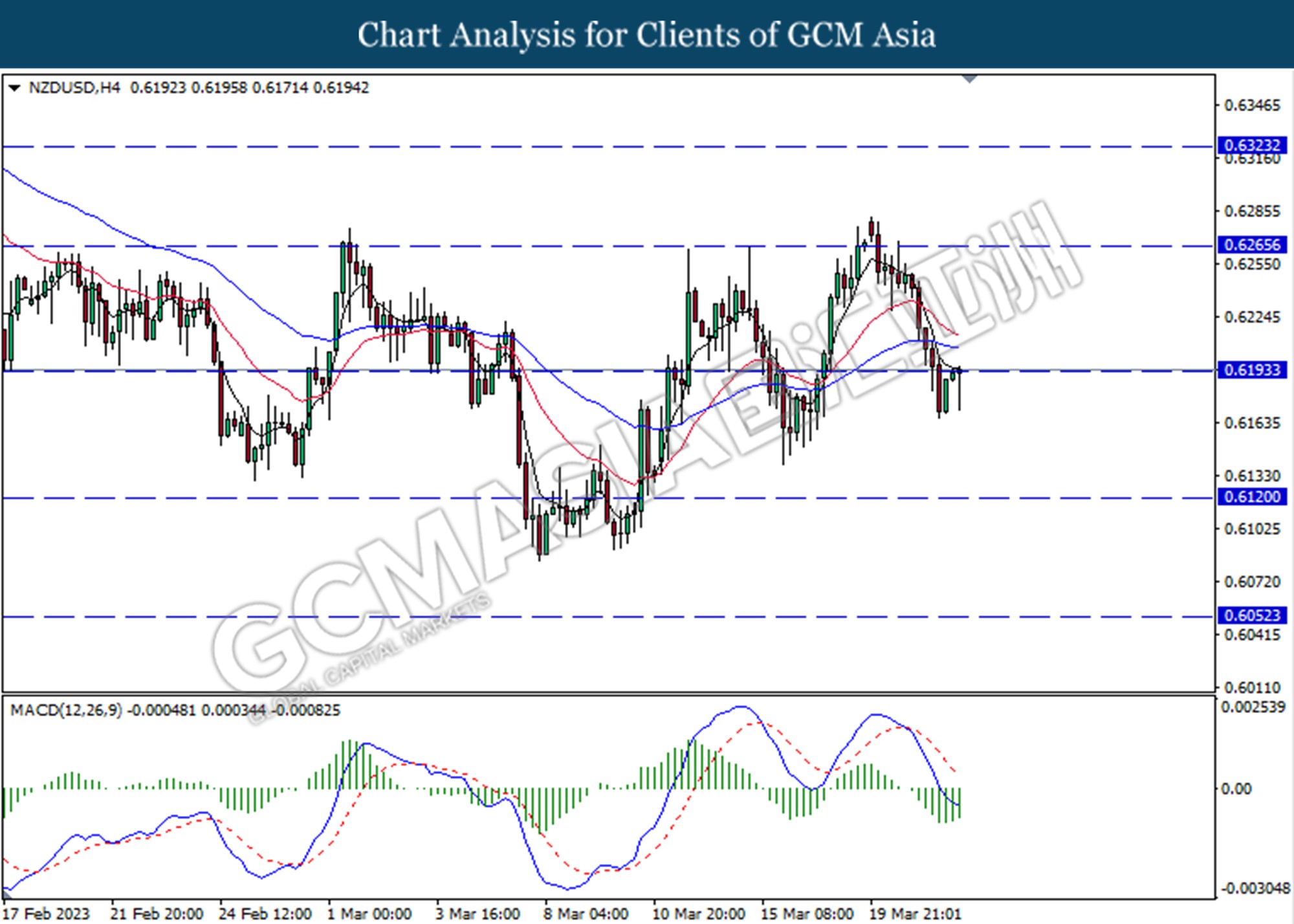

NZDUSD, H4: NZDUSD was traded higher while currently testing for the resistance level at 0.6195. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains if breaks above the resistance level.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

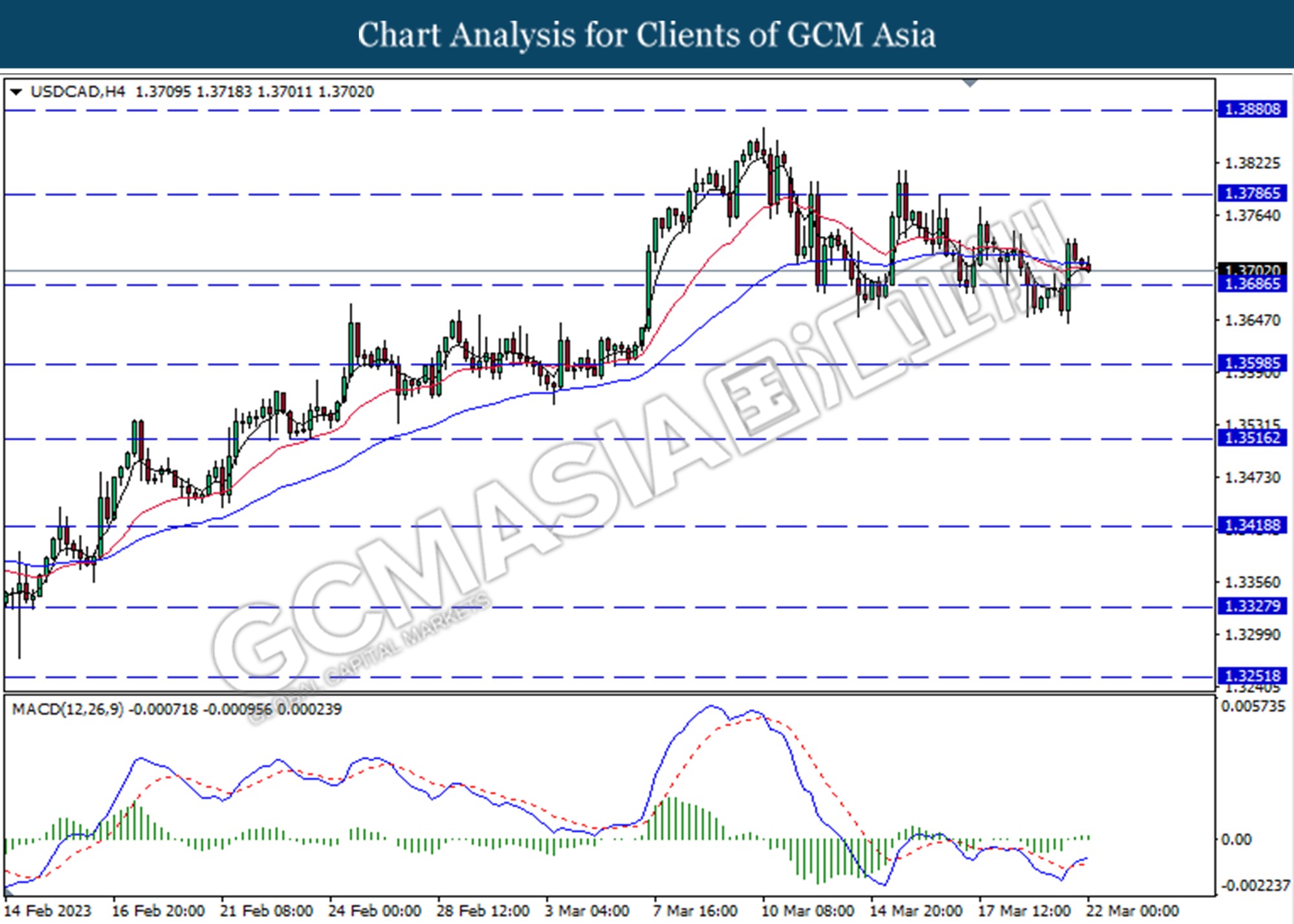

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

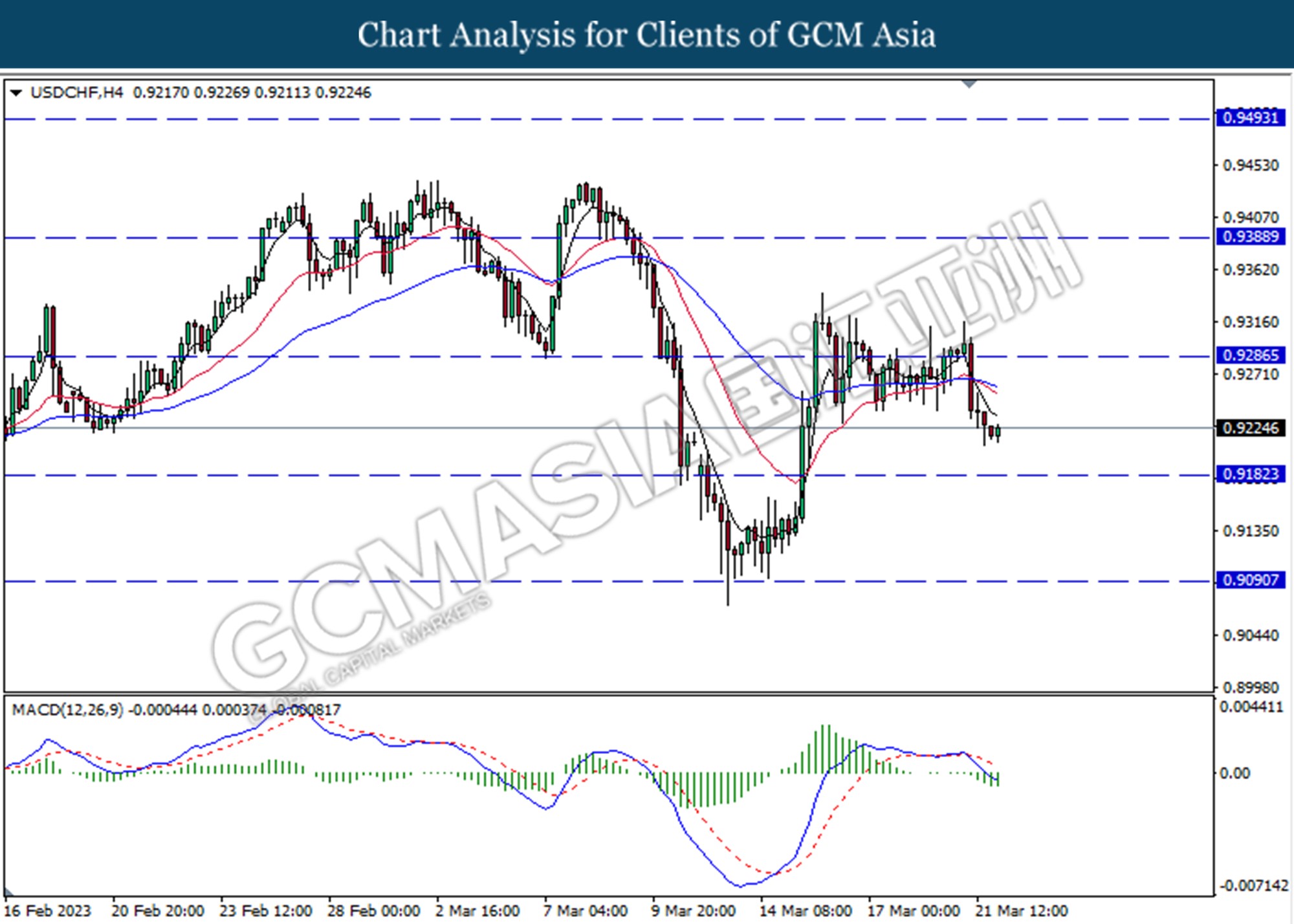

USDCHF, H4: USDCHF was traded lower following a prior break below the previous support level at 0.9285. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 0.9180

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

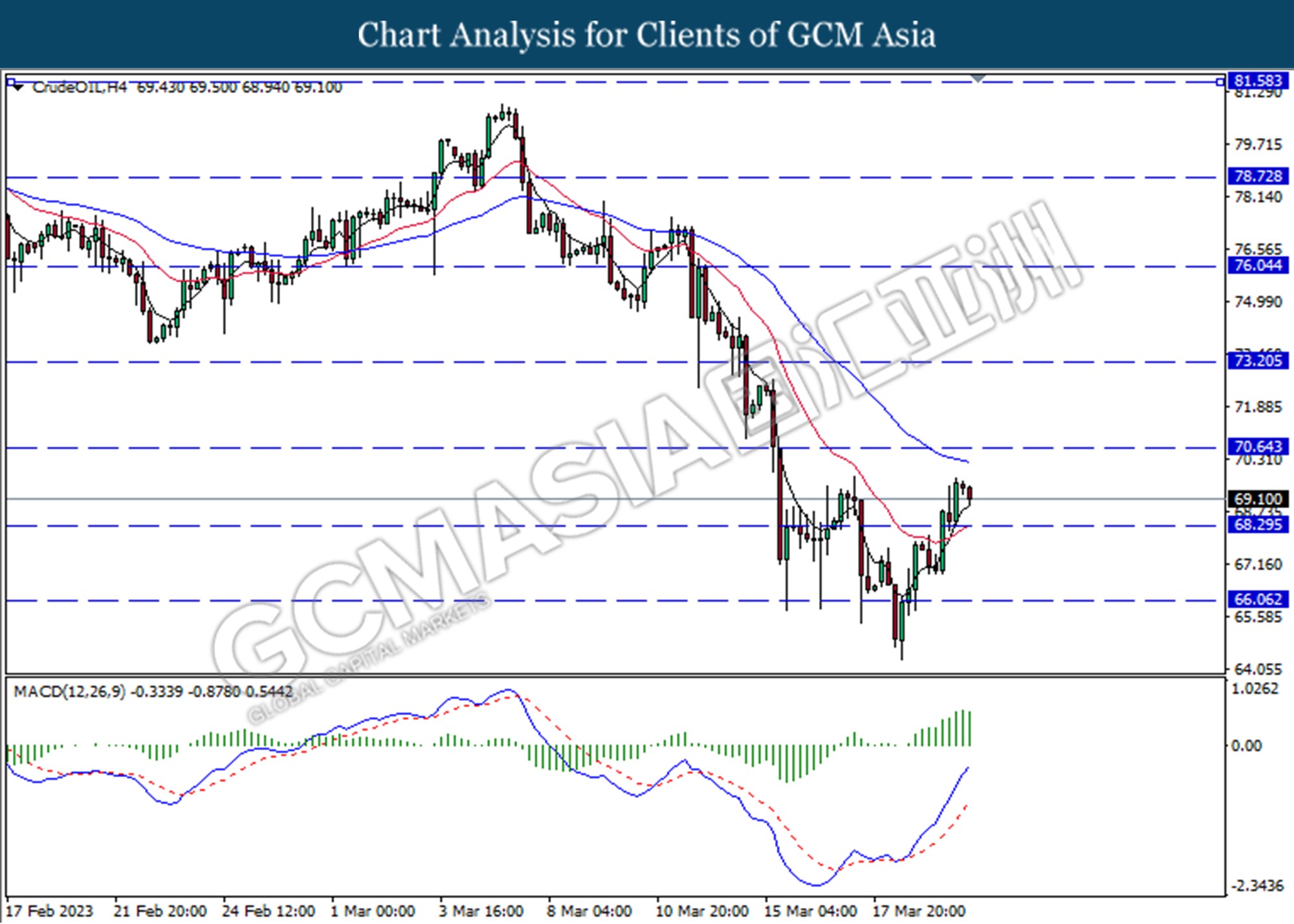

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 68.30.

Resistance level: 70.65, 73.20

Support level: 68.30, 66.05

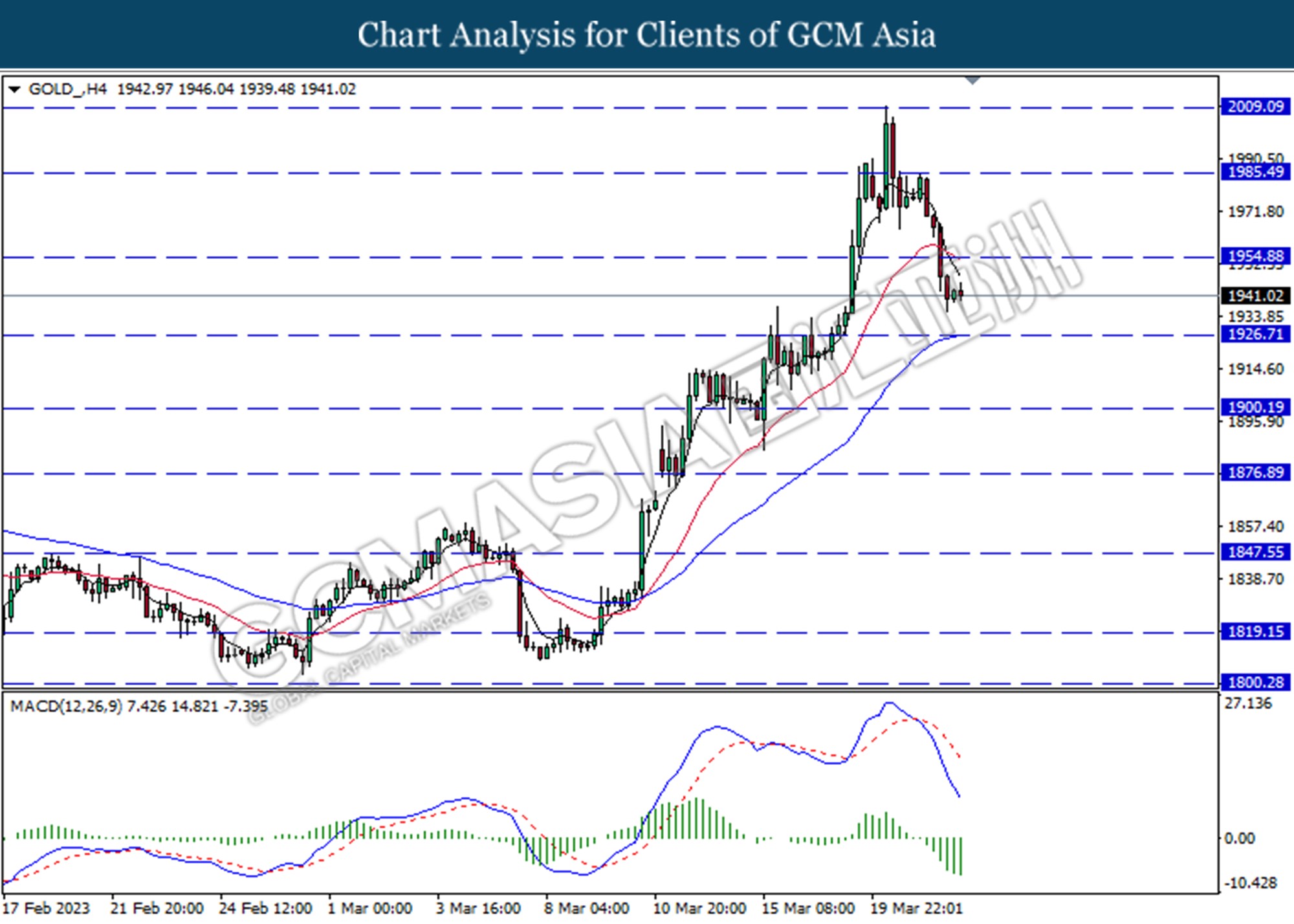

GOLD_, H4: Gold price was traded lower following a prior break below the previous support level at 1954.90 MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1926.70.

Resistance level: 1954.90, 1985.50

Support level: 1926.70, 1900.20