22 March 2023 Morning Session Analysis

US dollar lingered ahead of Fed interest rate decision.

The dollar index, which traded against a basket of six major currencies, hovered near the 6 weeks low as the market participants were waiting for the interest rate decision from the Federal Reserve. In this week, there will be a slew of central bank meetings due, whereby the Fed rate decision was the spotlight among them. At the point in time, the CME FedWatch Tool shows that the probability for a rate hike of 25 basis point stands at 87.1%, whereas the remainders is the chances of Fed maintaining the interest rate at current level. Prior to that, majority of the investors bet that the Fed will take a step back from its tightening path amid the fallout of banks. However, the table was flipped over after the Federal Reserve offered a series of support to the banking sector. The Fed has come into a consensus with other major central banks on implementing swap lines to head off crisis, where the central banks offer 7-day US dollar operations on daily basis. Before that, the Federal Reserve has also widened its balance sheet by offering additional new funding to the short-cash banks tide through the hardship. In overall, the market participant’s remains divided in regards to the rate hike decision of Fed. As of writing, the dollar index dropped -0.06% to 103.20.

In the commodities market, crude oil prices appreciated by 2.39% to $69.30 per barrel as the market fears over the banking crisis subsided. Besides, gold prices ticked up by 0.05% to $1941.55 per troy ounce while the investors are waiting for the Fed interest rate decision.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 EUR ECB President Lagarde Speaks

02:00 USD FOMC Economic Projections

(23th)

02:00 USD FOMC Press Conference

(23th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Feb) | 10.1% | 9.9% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.550M | -1.565M | – |

| 02:00

(23th) |

USD – Fed Interest Rate Decision | 4.75% | 5.00% | – |

Technical Analysis

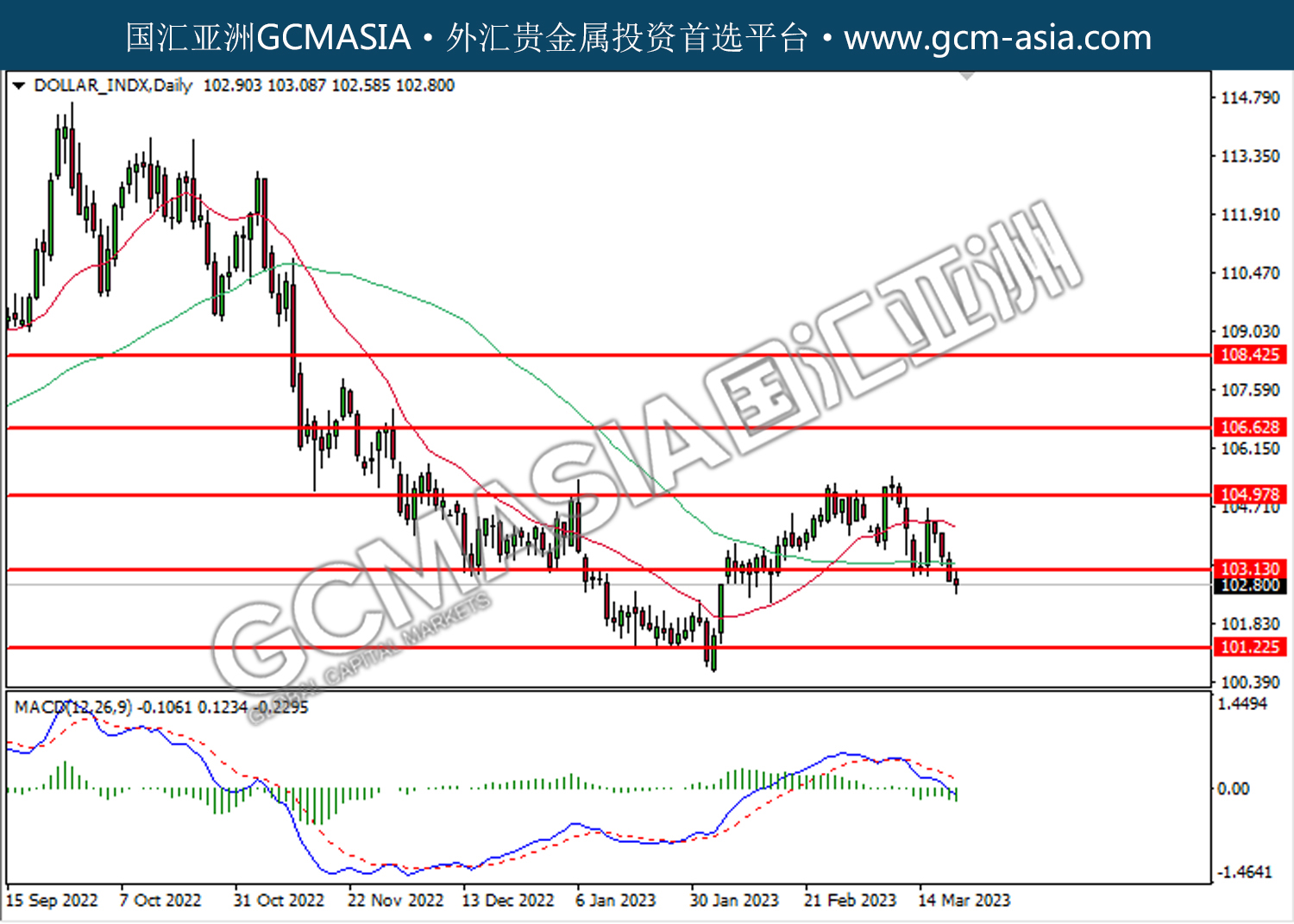

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

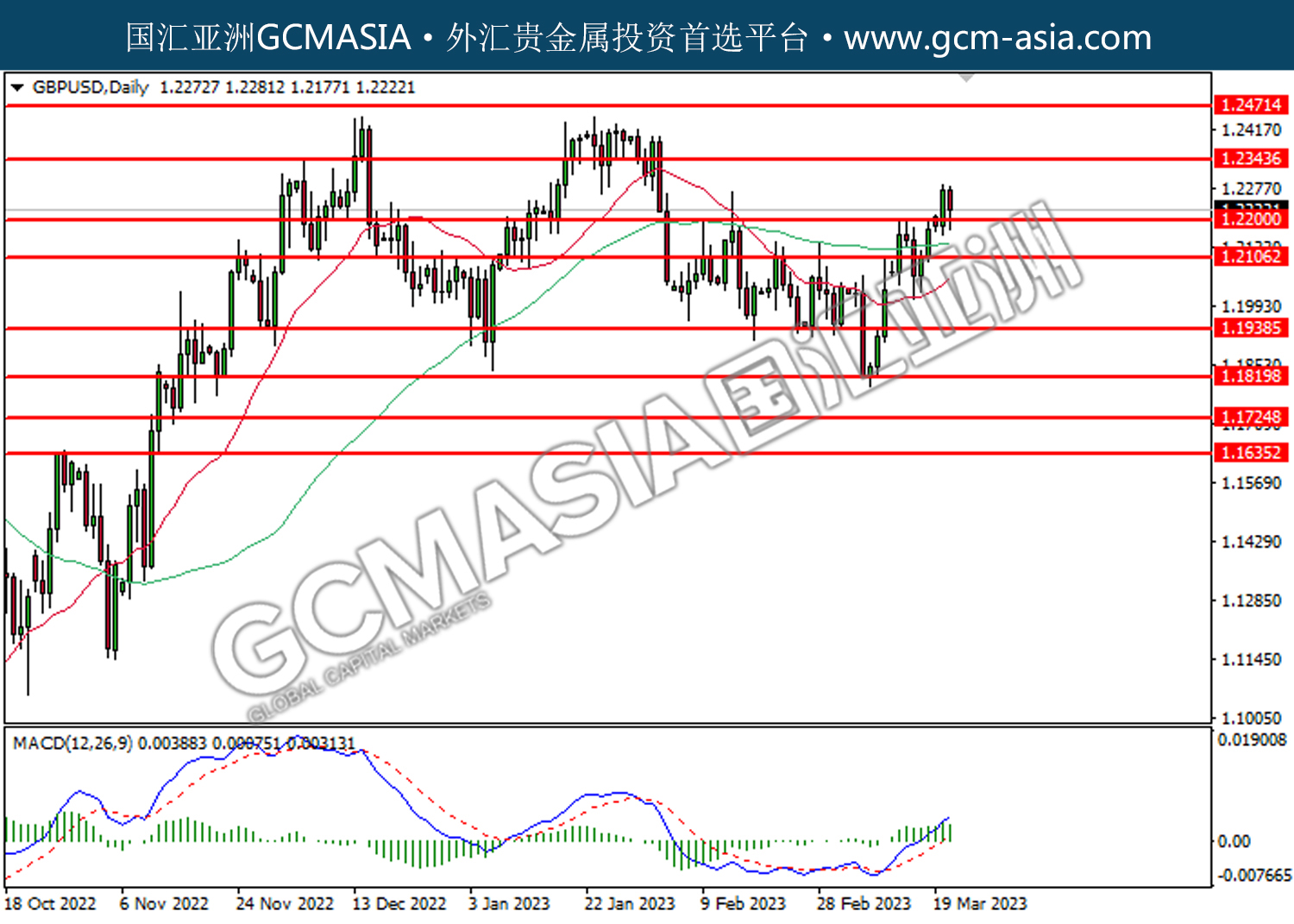

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

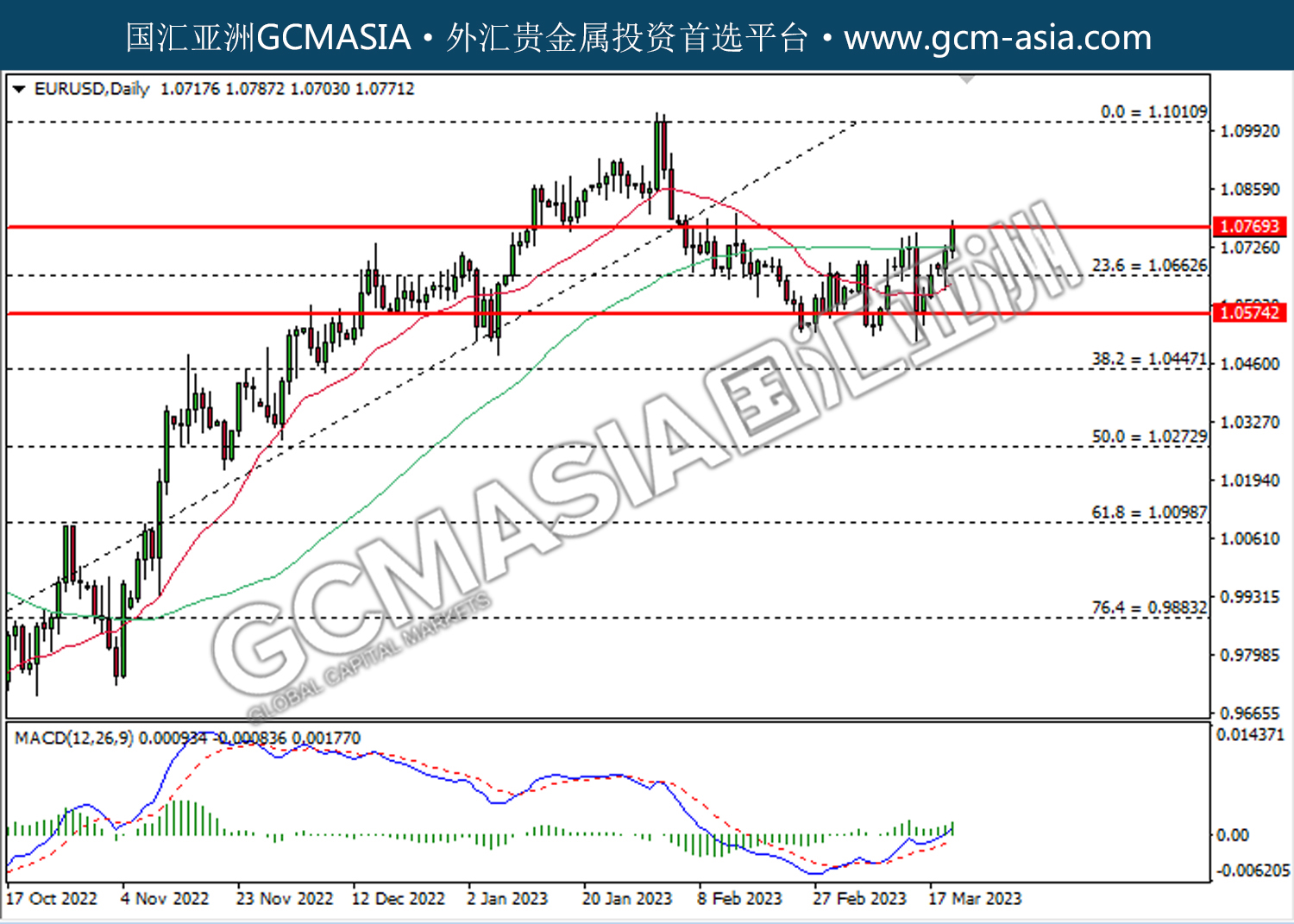

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

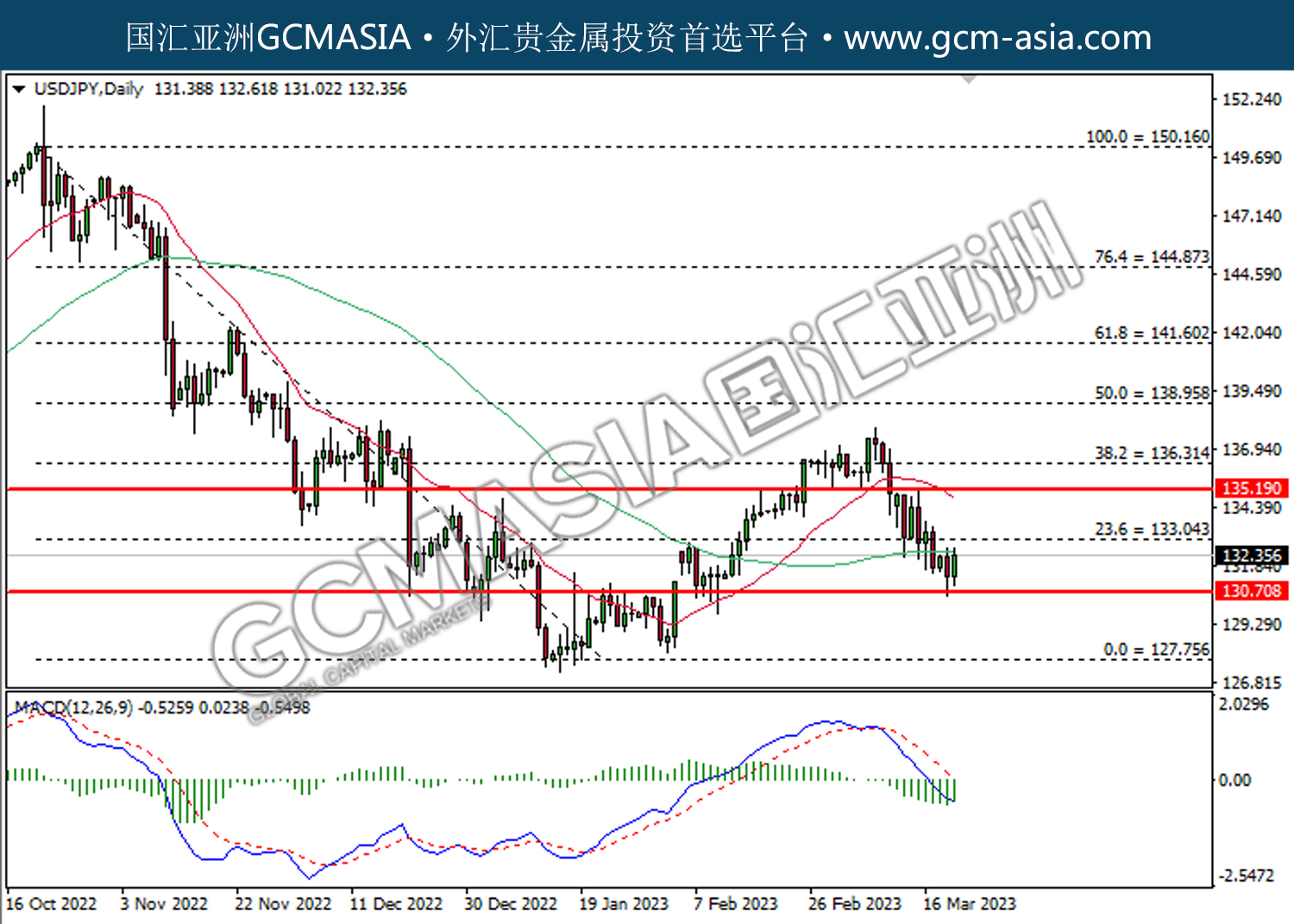

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 130.70. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 133.05.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

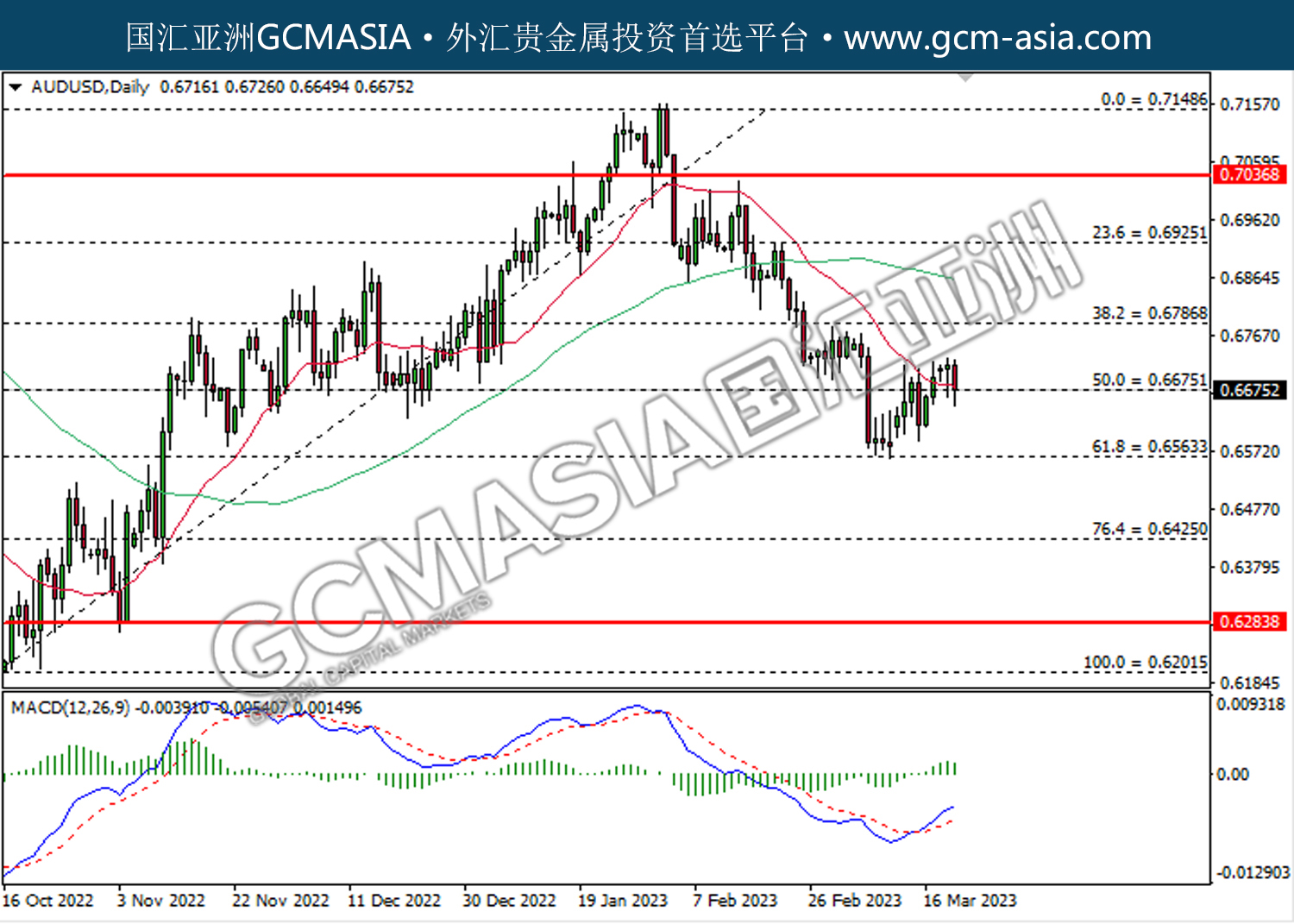

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

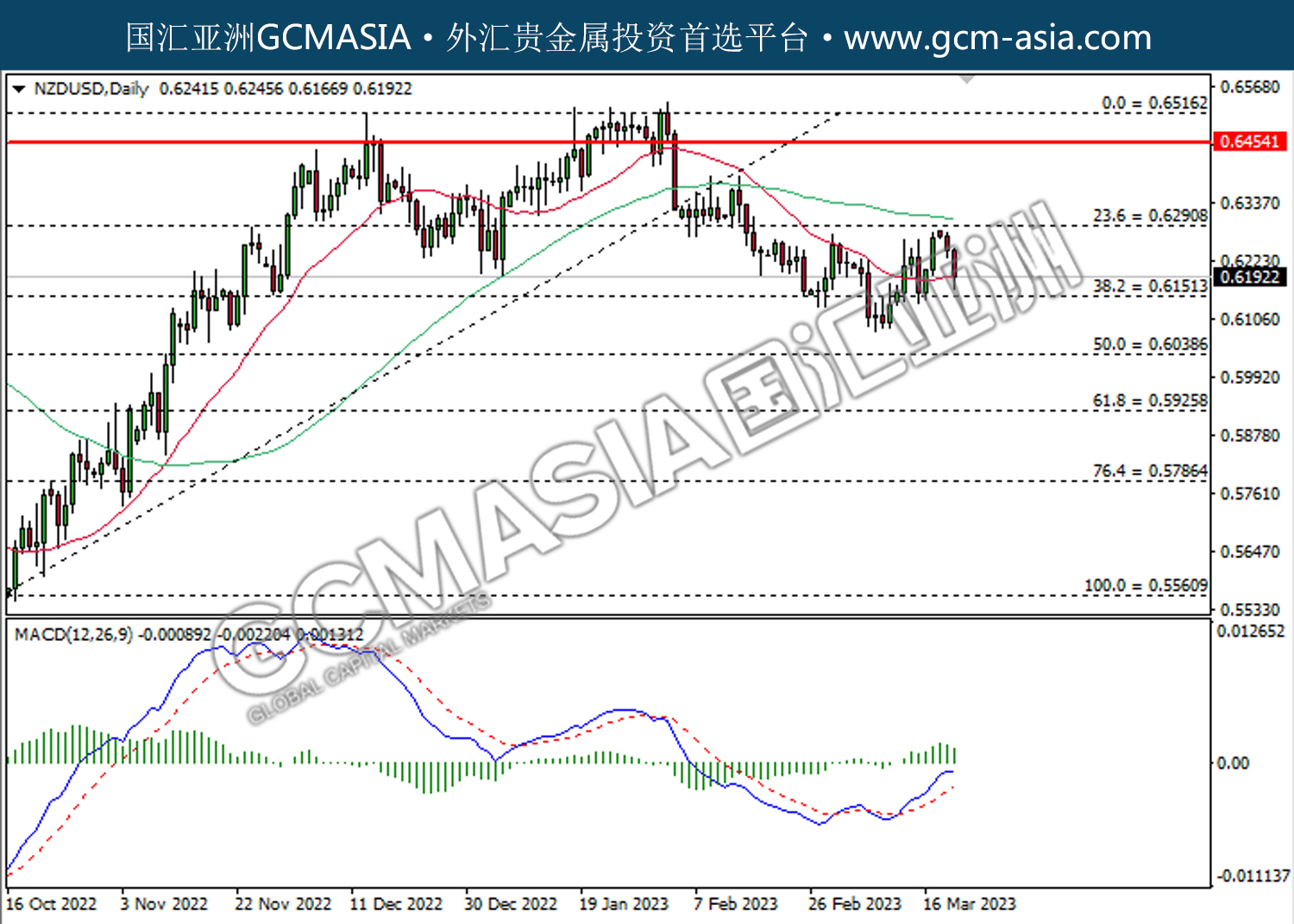

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

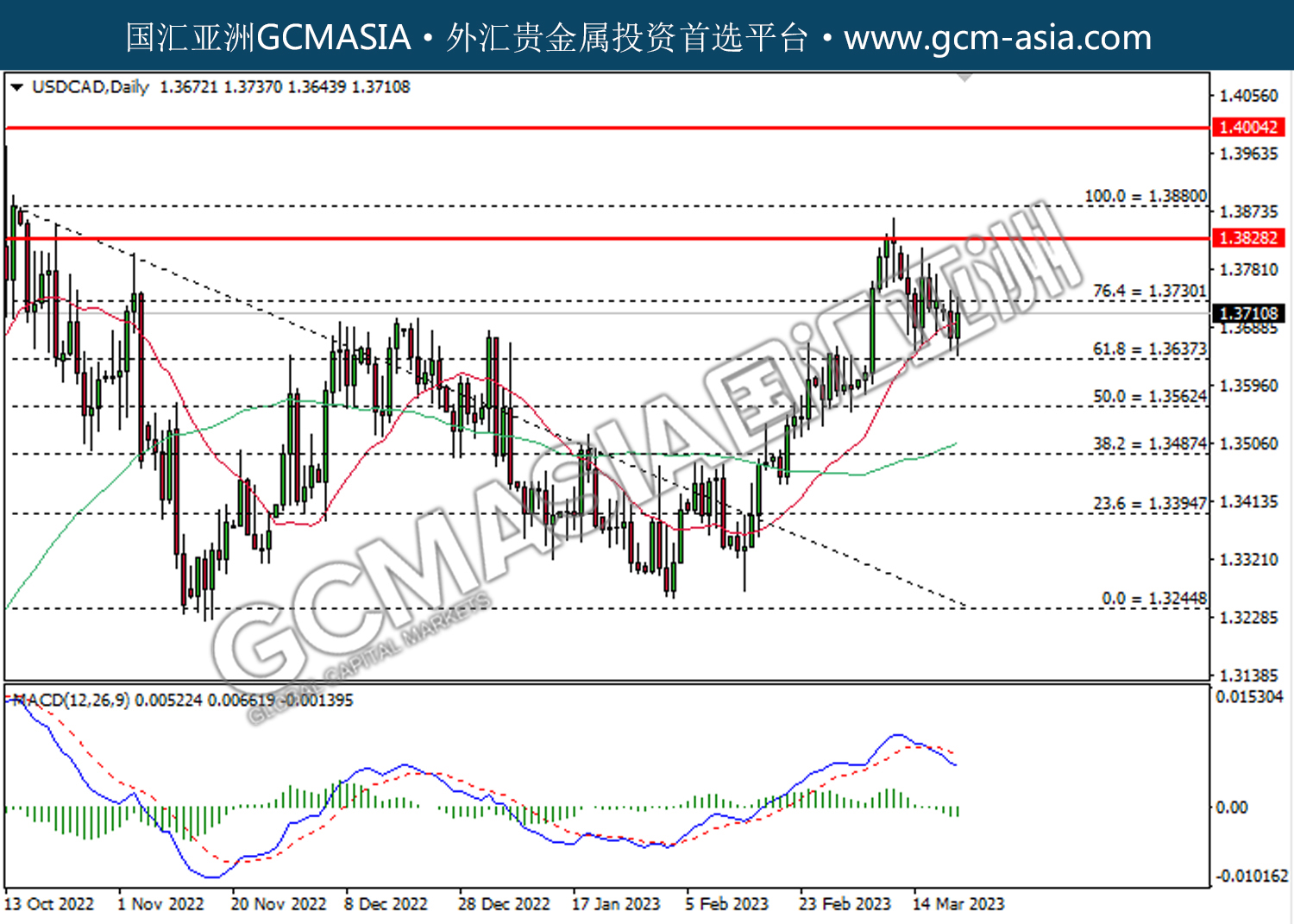

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3635. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3730.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

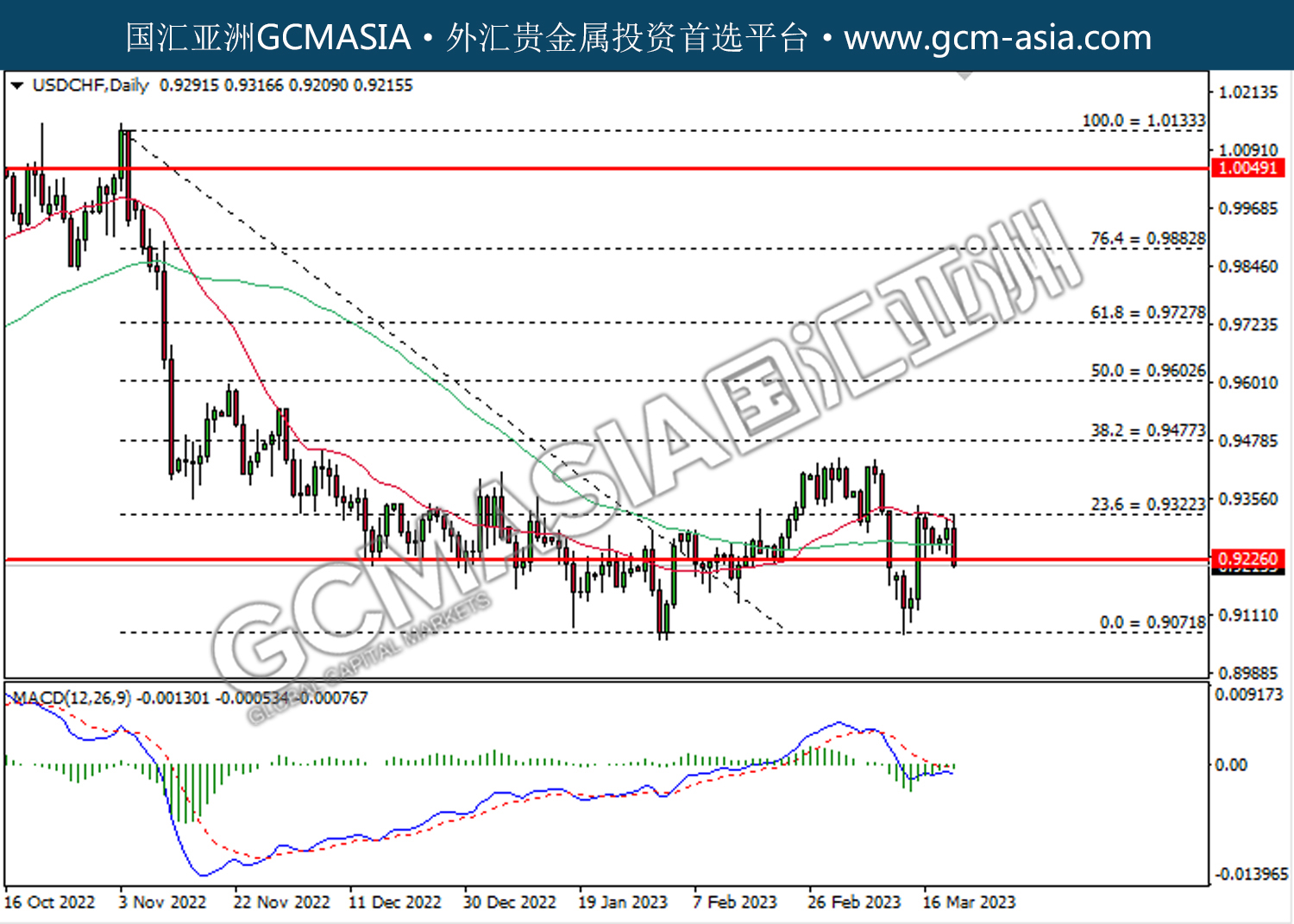

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9320, 0.9475

Support level: 0.9225, 0.9070

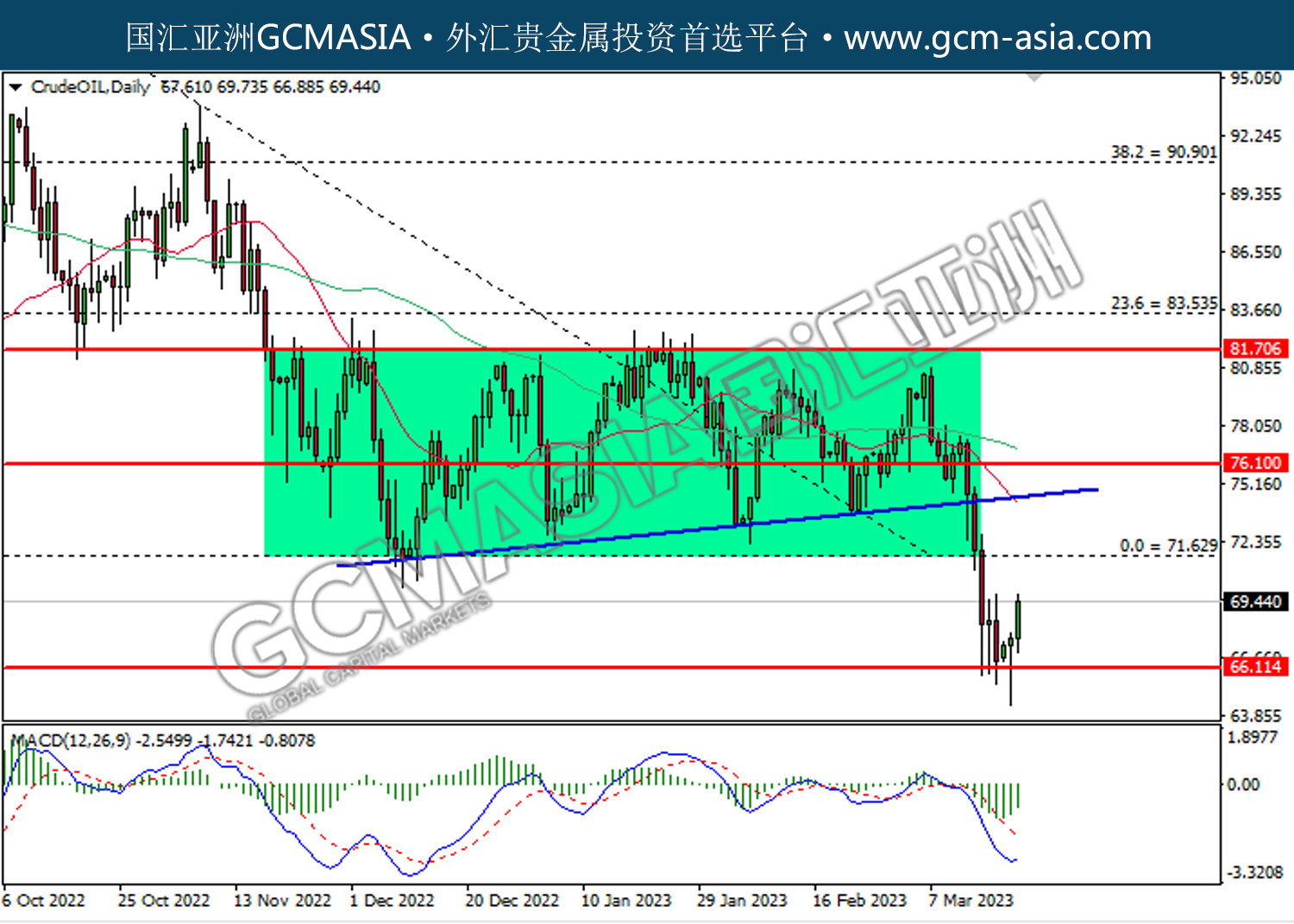

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 66.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 71.65.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

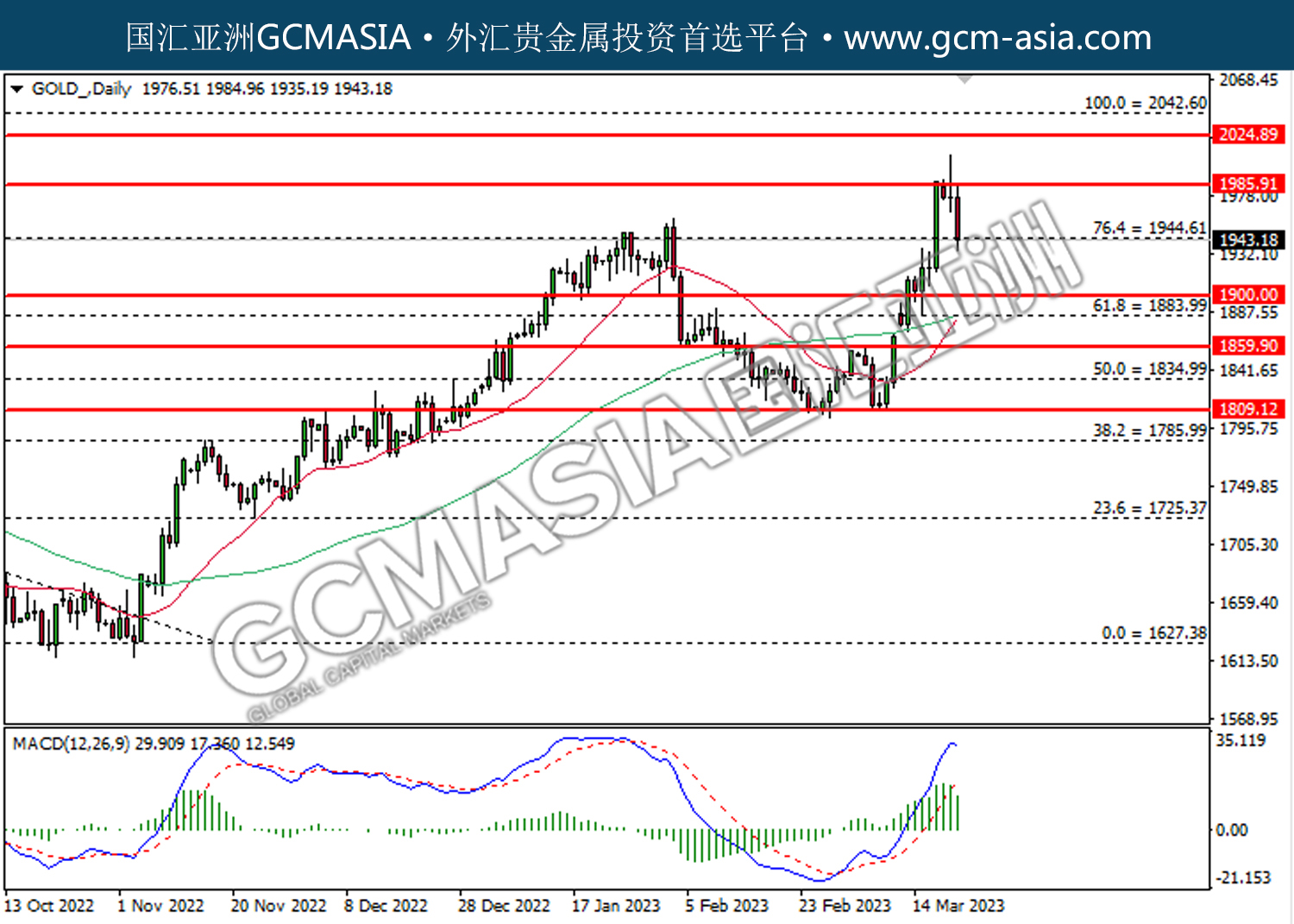

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1944.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 1944.60.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00