22 June 2020 Afternoon Session Analysis

Aussie held gains following PBoC rate decision.

The Aussie dollar which traded against the greenback and other currency pairs remains in bid after the People’s Bank of China’s (PBOC) rate decision. According to PBoC, the central bank have kept its 1 year and 5 year prime loan rates unchanged at 3.85% and 4.65% respectively as expected. Besides that, praises from RBA Governor Lowe also help improved the market sentiment. According to reports, Governor Phillip Lowe stated that Australia emerged pretty strong from the coronavirus crisis when compared to many other economies. He also mention that the economic downturn in Australia is not as severe as he is expected and has done remarkably well compared to many other countries. However, the tension between the U.S and China continue to weigh on the pair and potential may limited further upside potential while market awaits further development. As of writing, AUDUSD edge higher 0.18% to 0.6842.

In the commodities market, crude oil price rose 2.50% to $40.03 per barrel at the time of writing following tightening supply outlook. In the U.S and Canada, the number of operating oil rigs fell to a record low to 189 and 17 respectively. On top of that, promises of complying with oil production cuts by Iraq and Kazakhstan also continue to provide support for the black commodity. On the other hand, gold price soars 0.62% to $1754.91 a troy ounce as of writing following uncertainty in US-China tension and fears of second wave coronavirus pushing high demand for safe-haven market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Existing Home Sales (May) | 4.33M | 4.10M | – |

Technical Analysis

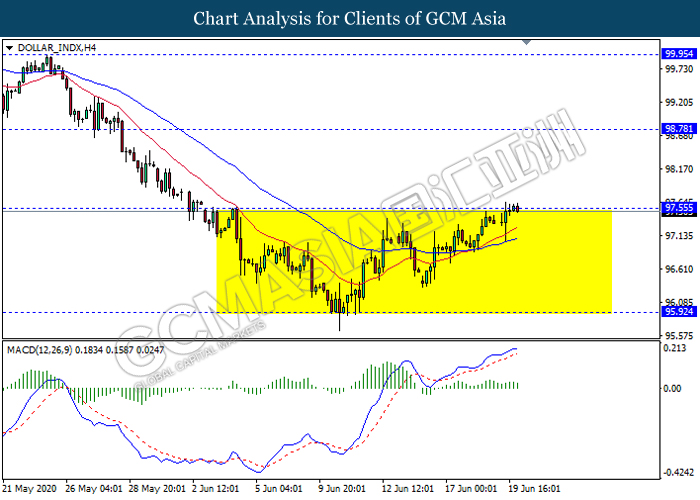

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level 97.55. However, MACD which illustrate diminishing bullish momentum signal suggest the dollar to experience a technical correction towards the support level 95.90.

Resistance level: 97.55, 98.80

Support level: 95.90, 94.65

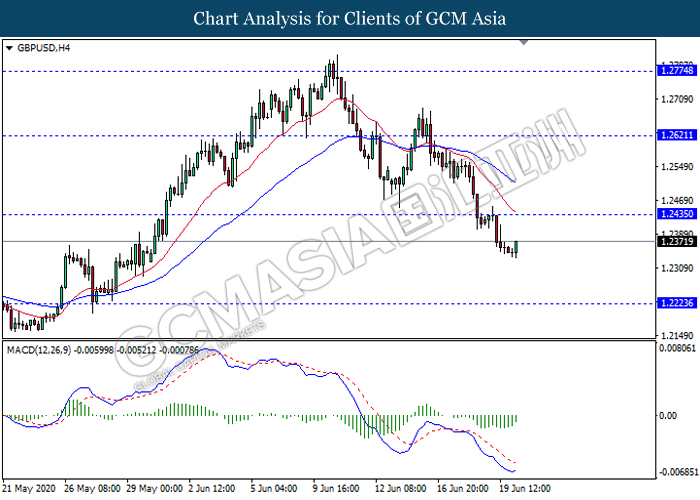

GBPUSD, H4: GBPUSD was traded lower following recent breakout below the support level 1.2435. However, MACD which illustrate diminishing bearish momentum signal suggest the pair may experience a short term pullback towards the resistance level 1.2435.

Resistance level: 1.2435, 1.2620

Support level: 1.2225, 1.1995

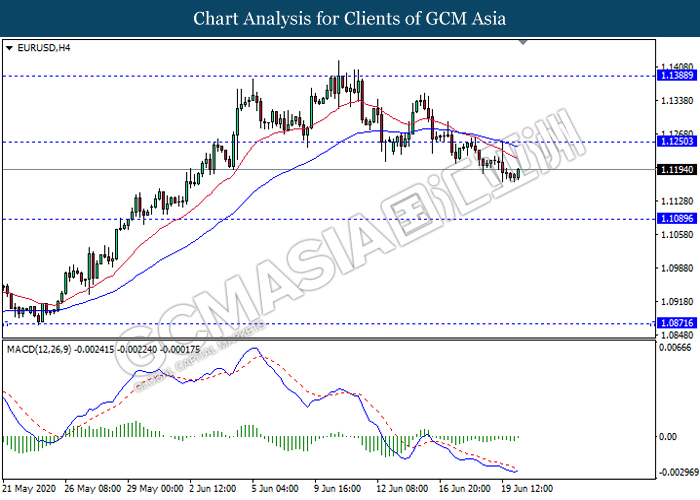

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1250. However, MACD which illustrate diminishing bearish bias signal with the starting formation of golden cross suggest the pair to experience a technical correction in short term towards the current resistance level 1.1250.

Resistance level: 1.1250, 1.1390

Support level: 1.1090, 1.0870

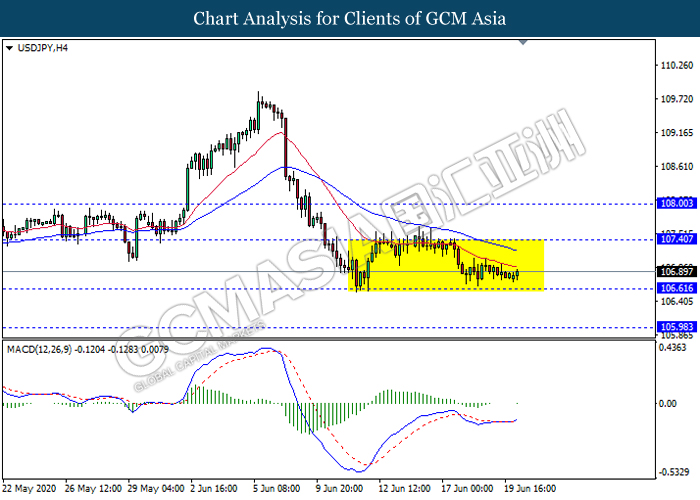

USDJPY, H4: USDJPY remain traded flat in a sideway channel. Due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 107.40, 108.00

Support level: 106.60, 106.00

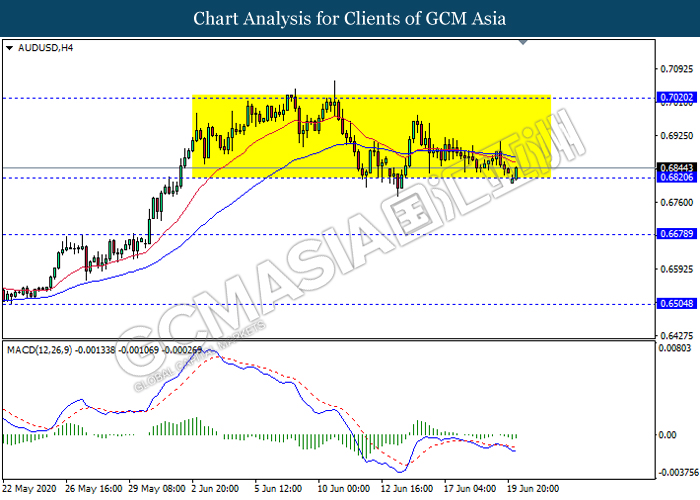

AUDUSD, H4: AUDUSD remain traded in a sideway channel while currently testing the support level 0.6820. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher as a pullback towards the resistance level 0.7020.

Resistance level: 0.7020, 0.7195

Support level: 0.6820, 0.6680

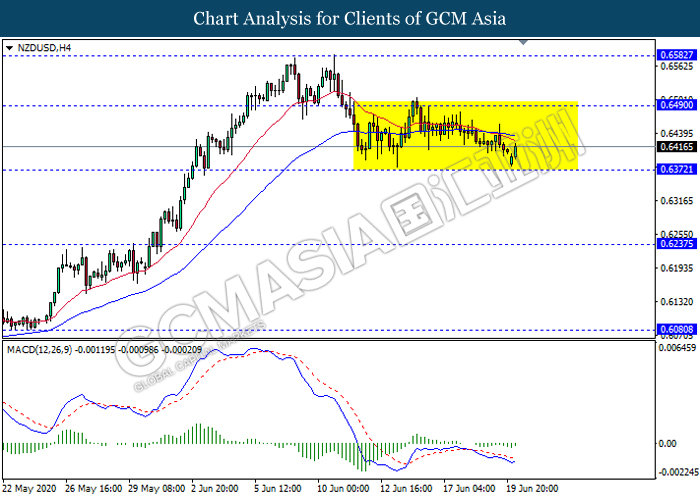

NZDUSD, H4: NZDUSD remain traded in a sideway channel following recent rebound from the support level 0.6370. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound in short term towards the resistance level 0.6490.

Resistance level: 0.6490, 0.6580

Support level: 0.6370, 0.6235

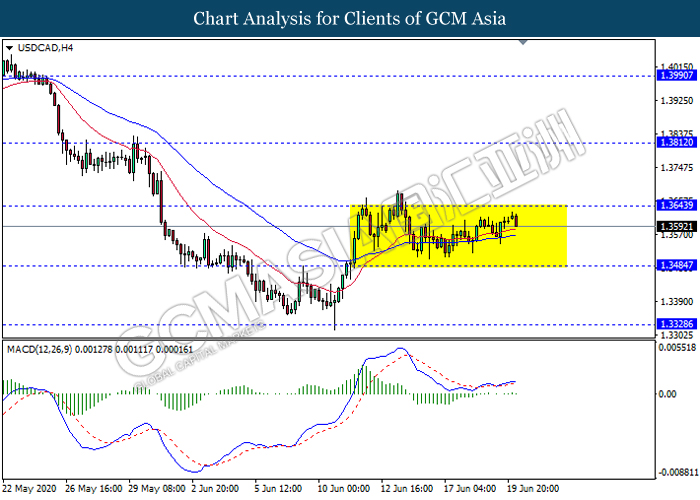

USDCAD, H4: USDCAD remain traded in a sideway channel following recent pullback from the resistance level 1.3645. However, due to lack of clear direction and momentum from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 1.3645, 1.3810

Support level: 1.3485, 1.3330

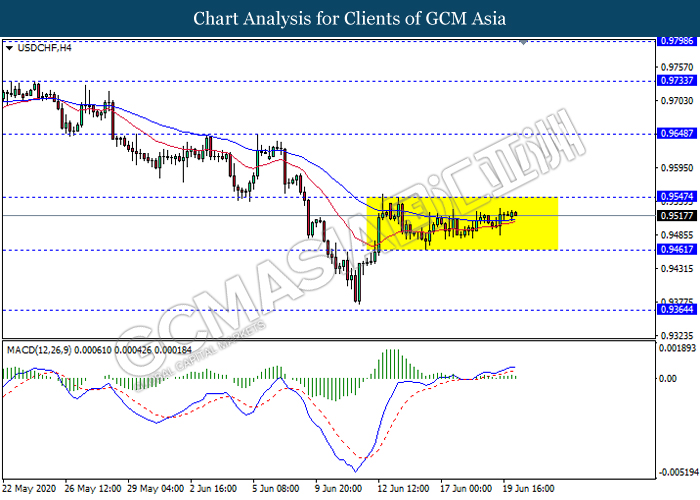

USDCHF, H4: USDCHF remain traded flat in a sideway channel. Due to lack of momentum and clear direction, it is suggested to wait until further signal appear before entering the market.

Resistance level: 0.9545, 0.9850

Support level: 0.9460, 0.9365

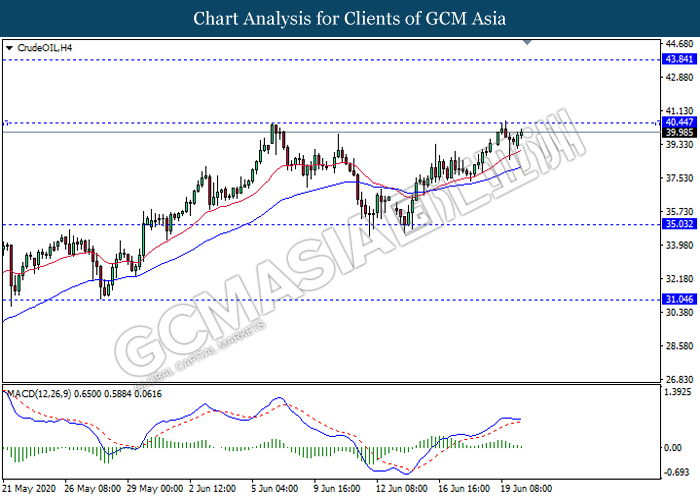

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 40.45. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to experience a technical correction towards the support level 35.05.

Resistance level: 40.45, 43.85

Support level: 35.05, 31.05

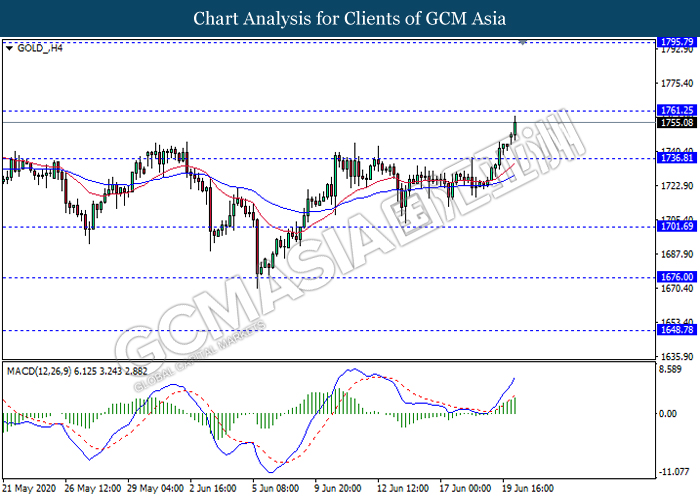

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level 1761.25. MACD which illustrate ongoing bullish momentum suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 1761.25, 1795.80

Support level: 1736.80, 1701.70