22 June 2020 Morning Session Analysis

Dollar surged amid fears over second wave of virus heightened.

Dollar index which gauges its value against a basket of six major currencies soars as the appeal of dollar as a safe haven currency has overshadowed the market concern over the recovery of US economy. Since the outbreak of Coronavirus, the global economy has been sent into an unprecedented recession stage where economic activity was being forced to halt, as a measure to mitigate the fallout of virus. However, the recent significant uptick of daily new coronavirus cases in US and some of other countries such as Germany has increased the market worries over the outbreak of second wave of virus. Later last week, US country has reported more than 30,000 new cases which has refreshed the highest daily new cases record since 1st of May while Florida has the highest number of new cases among all the states. Moreover, new cluster of virus has also been detected in country such as China and Germany which had successfully controlled the spread of virus over recent months, raised the fears of a resurgence of the virus in these countries. Hence, market participants chose to flee into safe haven currencies to avoid the risk of economic downturn which might be caused by the potential outbreak of another virus’s wave. As of writing, dollar index rose 0.04% to 97.65.

In the commodities market, crude oil price increased by 0.05% to $39.85 per barrel amid market optimism toward the OPEC+ supply cut. In the recent meeting, Iraq and Kazahkstan have agreed to comply better with oil cut, indicating that the issue of supply glut might be resolved along the production cut. Besides, gold price surged 0.19% to $1747.40 a troy ounce amid raising of market fears over the outbreak of another virus’s wave.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Existing Home Sales (May) | 4.33M | 4.10M | – |

Technical Analysis

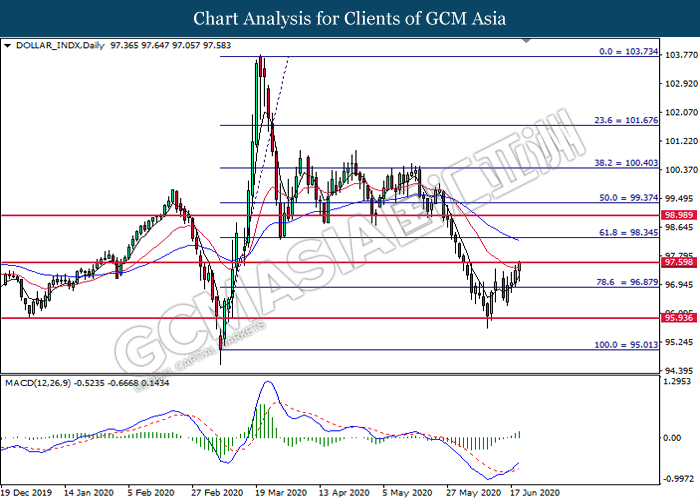

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 97.60. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it successfully breakout above the resistance level at 97.60.

Resistance level: 97.60, 98.35

Support level: 96.85, 95.95

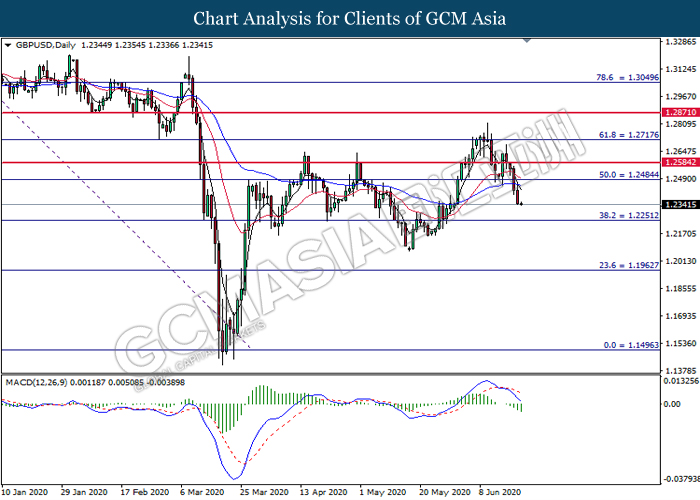

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2485. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2250.

Resistance level: 1.2485, 1.2585

Support level: 1.2250, 1.1965

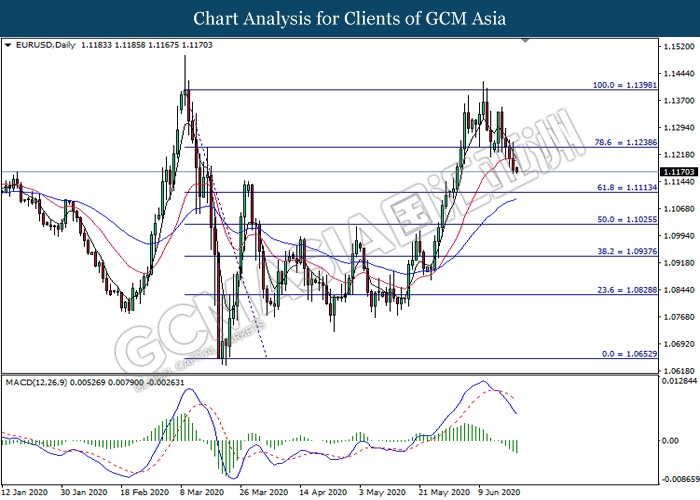

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1240. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 1.1115.

Resistance level: 1.1240, 1.1400

Support level: 1.1115, 1.1025

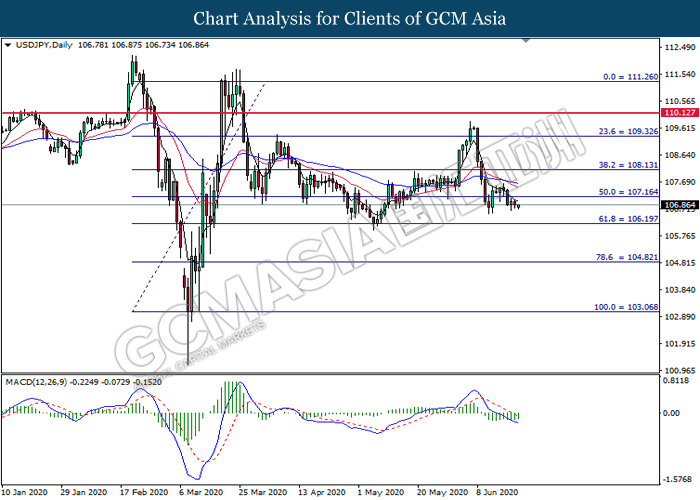

USDJPY, Daily: USDJPY was traded higher following prior rebound from the lower level. MACD which illustrate diminishing bearish momentum signal suggest the pair to rebound from the lower level.

Resistance level: 107.15, 108.15

Support level: 106.20, 104.80

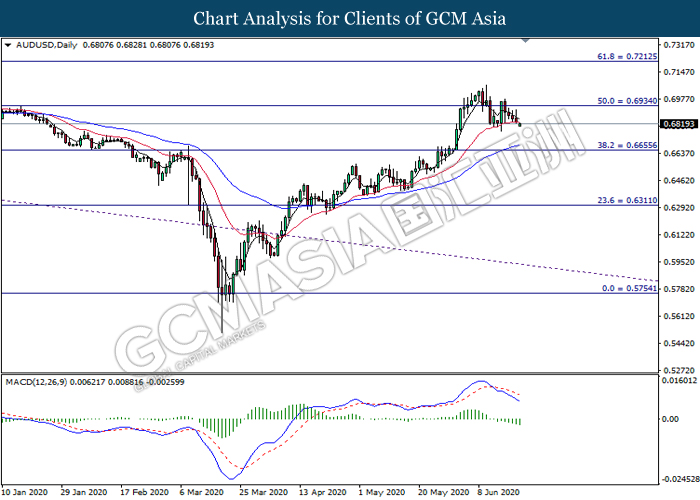

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6935. MACD which display bearish bias momentum signal suggest the pair to extend its losses toward the support level at 0.6655.

Resistance level: 0.6935, 0.7215

Support level: 0.6655, 0.6310

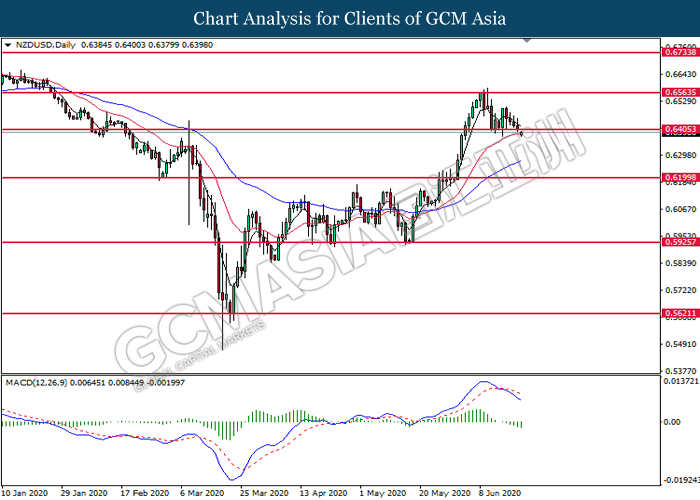

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6405. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 0.6200.

Resistance level: 0.6405, 0.6565

Support level: 0.6200, 0.5925

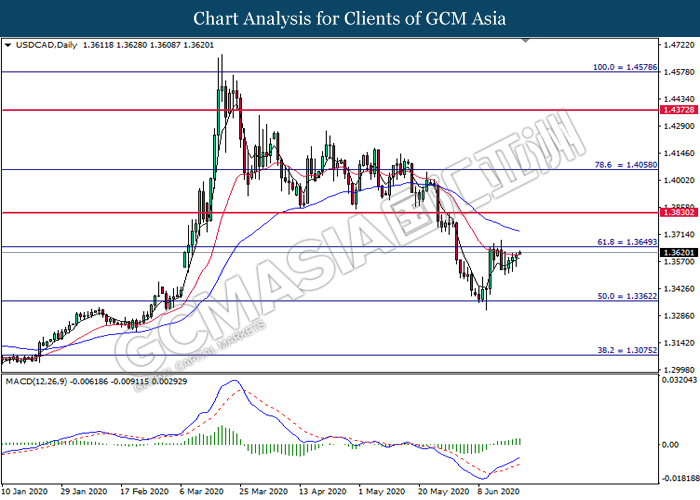

USDCAD, Daily: USDCAD was traded higher following prior rebound from the lower level. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.3650.

Resistance level: 1.3650, 1.3830

Support level: 1.3360, 1.3075

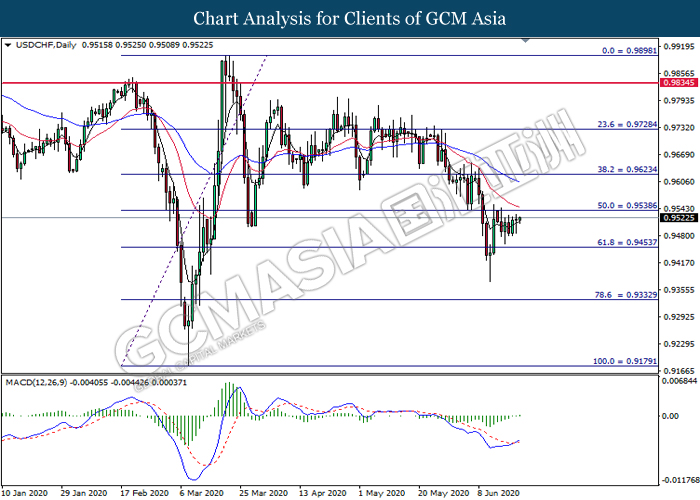

USDCHF, Daily: USDCHF was traded higher following prior rebound from the lower level. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its gains toward the resistance level at 0.9540.

Resistance level: 0.9540, 0.9625

Support level: 0.9455, 0.9335

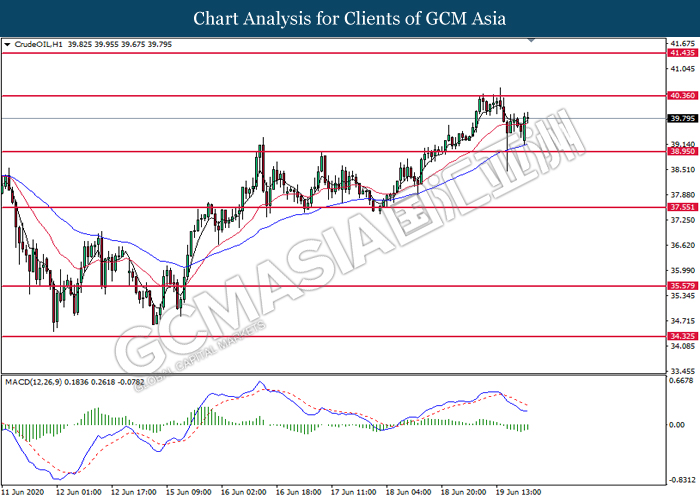

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 38.95. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains toward the resistance level at 40.35.

Resistance level: 40.35, 42.40

Support level: 38.95, 37.55

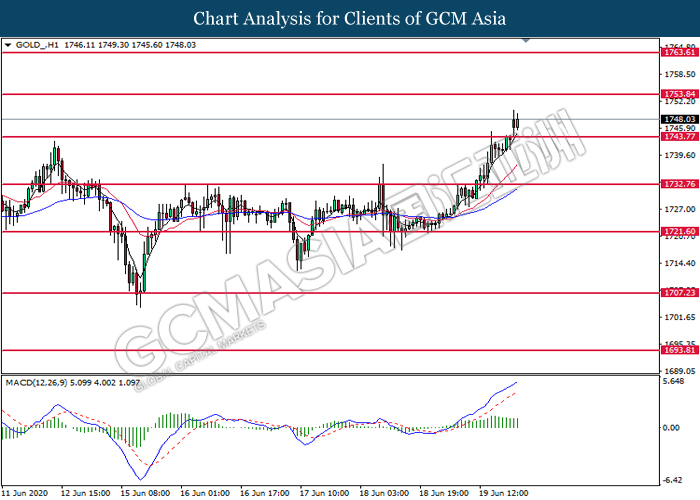

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level at 1743.75. MACD which illustrate bullish momentum signal suggest the pair to extend its gains toward the resistance level at 1753.85.

Resistance level: 1753.85, 1763.60

Support level: 1743.75, 1732.75