22 June 2022 Afternoon Session Analysis

Euro slumped amid recession risk continue linger in financial market.

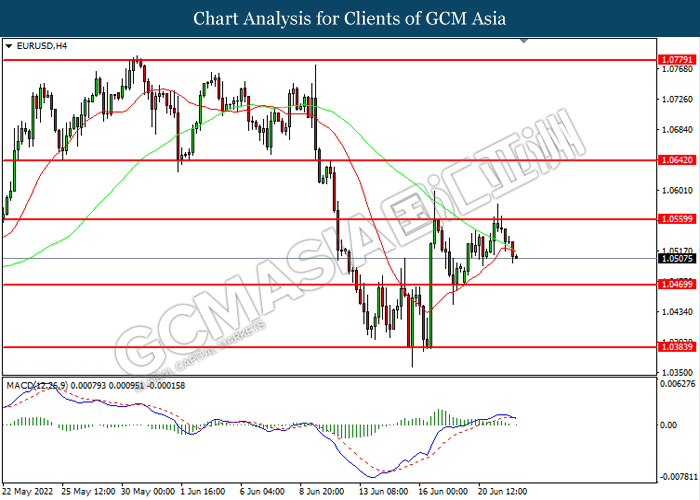

The Euro retreated from its higher level amid market participants worried that the Germany would likely to faces certain recession risk if Russian gas supplies stop completely. Currently, the EU relied on Russia for as much as 40% while 55% for Germany. Gas prices currently have hit record levels, driving a significant spike in inflation risk and adding further challenges for policymakers trying to haul Europe back from an economic precipice. Despite the Europe is seeking more gas supplies from its own producers from Norway and other states, though most producers are already pushing the limits of output. The supply disruption following the rising tensions between Russia-Ukraine had continued to spark further stagflation risk in future. Germany’s BDI industry association on Tuesday downgraded its economic growth forecast for 2022 to 1.5% from the 3.5% expected before the war began on 24th February. As of writing, EUR/USD depreciated by 0.14% to 1.0510.

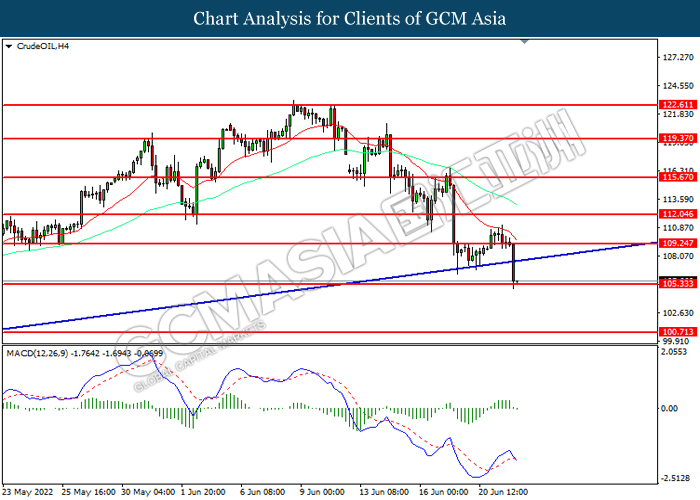

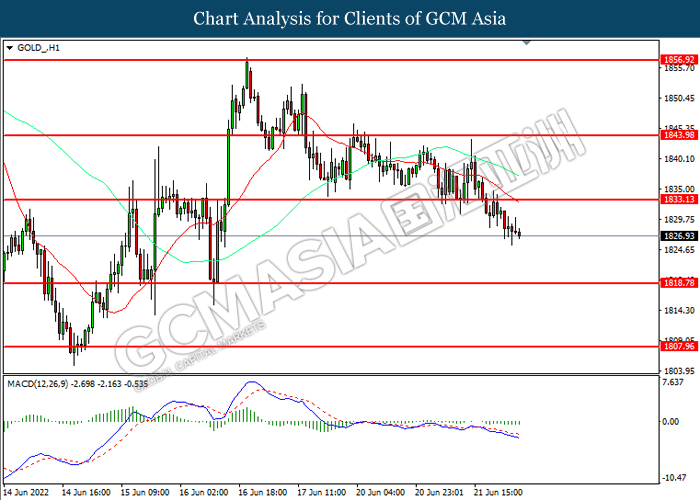

In the commodities market, the crude oil price slumped 3.84% to $105.50 per barrel as of writing following US President Joe Biden vowed that he will try to bring down soaring fuel costs, including applying pressure on major US oil firms to help ease the pain from the rising oil price recently. On the other hand, the gold price depreciated by 0.28% to $1828.85 per troy ounces as of writing following the Federal Reserve unleashed their hawkish tone toward the economic progression in the United States.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (May) | 9.0% | 9.1% | – |

| 20:30 | CAD – Core CPI (MoM) (May) | 0.7% | 0.4% | – |

Technical Analysis

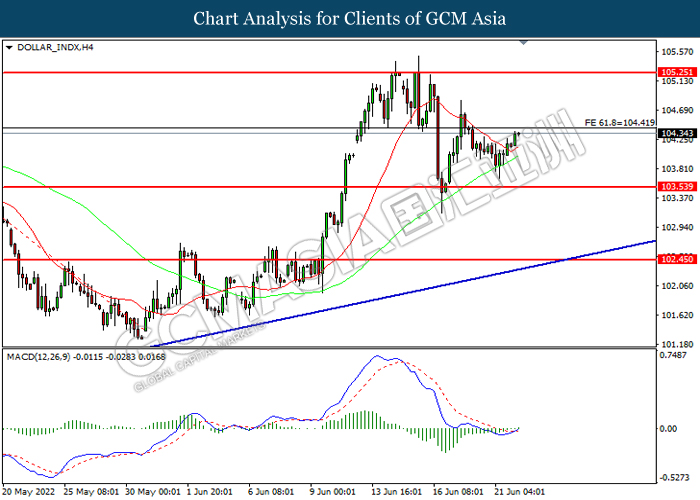

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

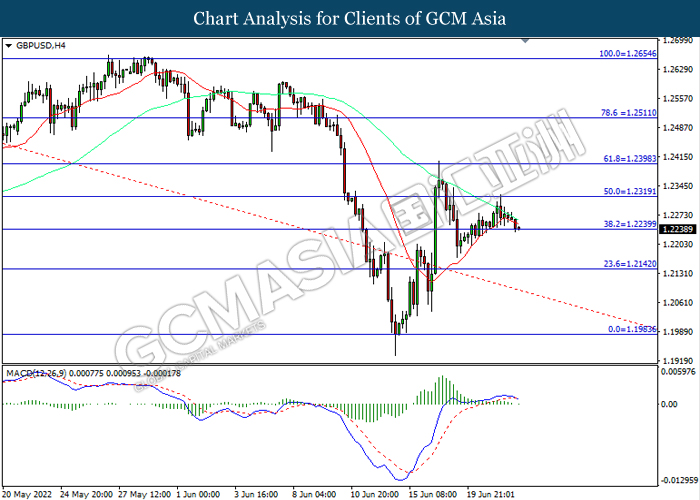

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2320, 1.2400

Support level: 1.2240, 1.2140

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0560, 1.0640

Support level: 1.0470, 1.0385

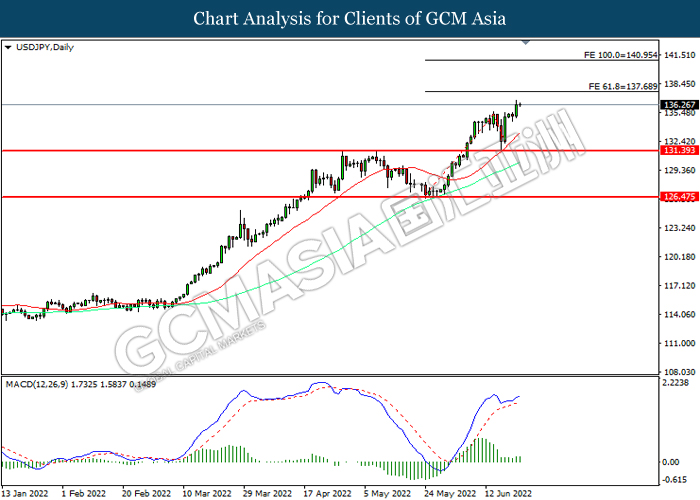

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 137.70, 140.95

Support level: 1331.40, 126.45

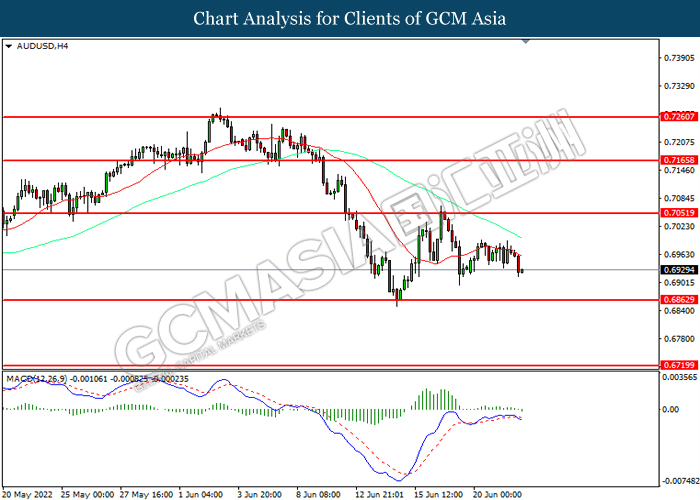

AUDUSD, H4: AUDUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

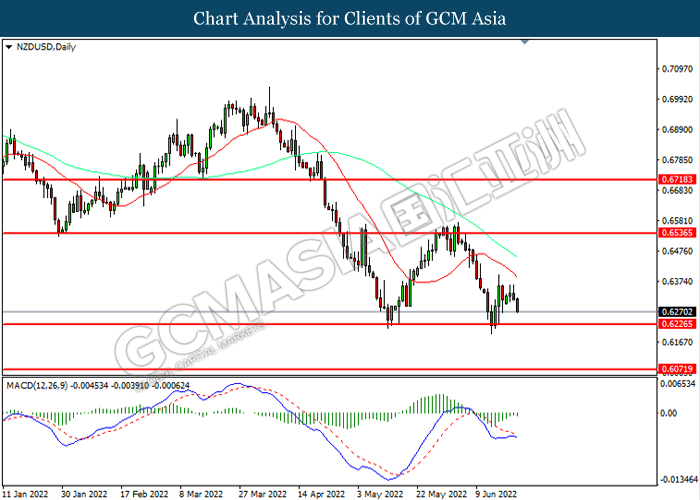

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

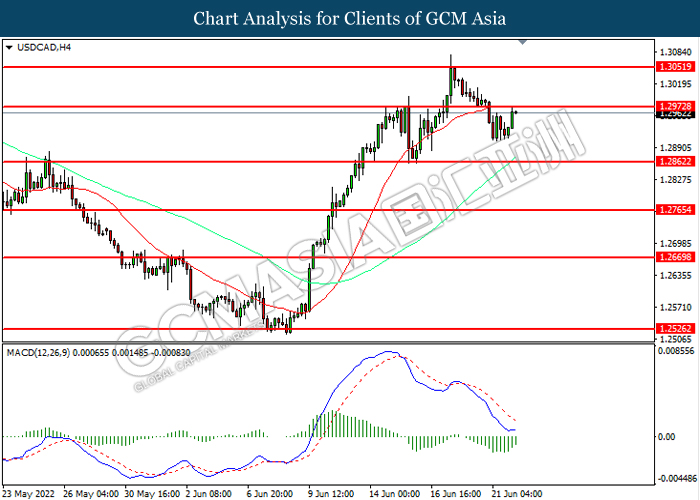

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

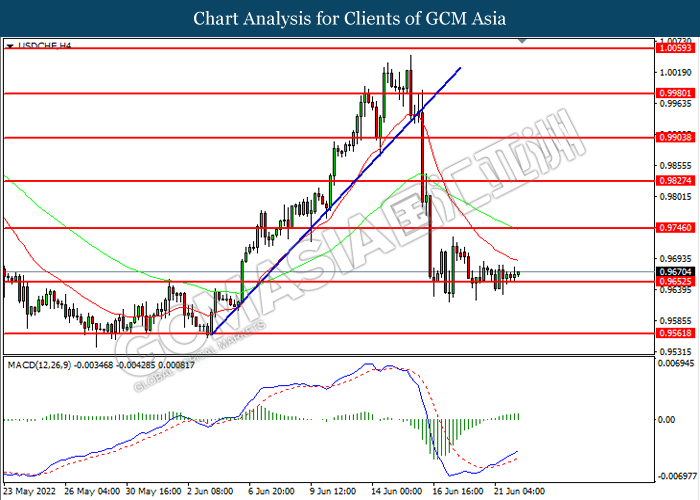

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9745, 0.9825

Support level: 0.9655, 0.9560

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 109.25, 112.05

Support level: 105.35, 100.70

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1833.15, 1844.00

Support level: 1818.80, 1807.95