22 June 2022 Morning Session Analysis

US Dollar rallied after upbeat data was released.

The Dollar Index which traded against a basket of six major currencies edged up on Tuesday after the bullish economic data was unleashed. According to National Association of Realtors, the US Existing Home Sales for May came in at the reading of 5.41M while exceeding the market forecast of 5.39M. The data used to measure the change in the annualized number of existing residential buildings that were sold during the previous month. The higher-than-expected reading indicated that the recovery in US housing market, which brought positive prospects toward the economic progression in US. Besides, the slump of Japanese Yen was had also spurred further bullish momentum on the US Dollar. Bank of Japan keep remaining its ultra-loose monetary policy would likely to diminish the risk-free return of investors in Japan, which prompted the shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, the Dollar Index depreciated by 0.29% to 104.18.

In the commodities market, crude oil price eased by 0.37% to $109.12 per barrel as of writing. Nonetheless, the overall trend of oil price remained bullish following the high summer fuel demand while supplies remained tight because of sanctions on Russian oil. On the other hand, gold price depreciated by 0.33% to $1832.90 per troy ounce as of writing amid the surging of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (May) | 9.0% | 9.1% | – |

| 20:30 | CAD – Core CPI (MoM) (May) | 0.7% | 0.4% | – |

Technical Analysis

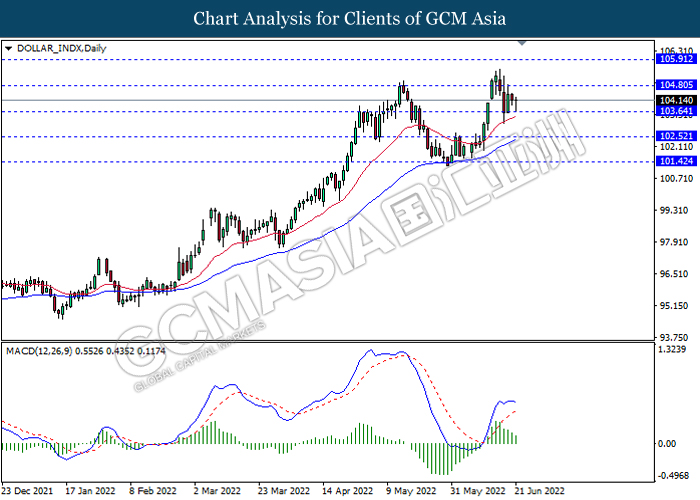

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

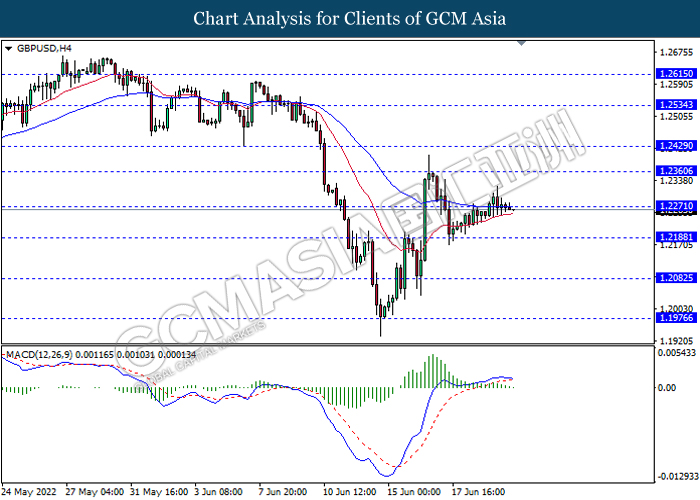

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

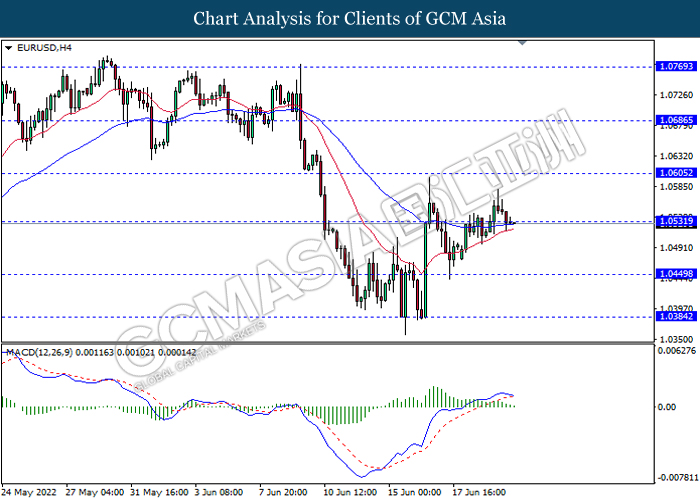

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0530, 1.0605

Support level: 1.0450, 1.0385

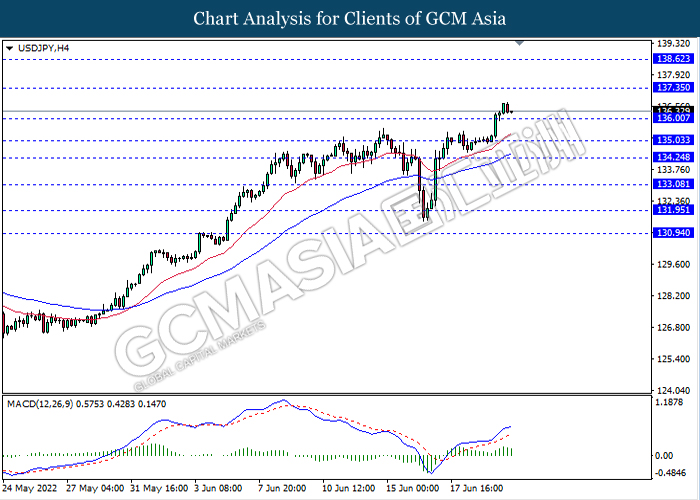

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.35, 138.60

Support level: 136.00, 135.05

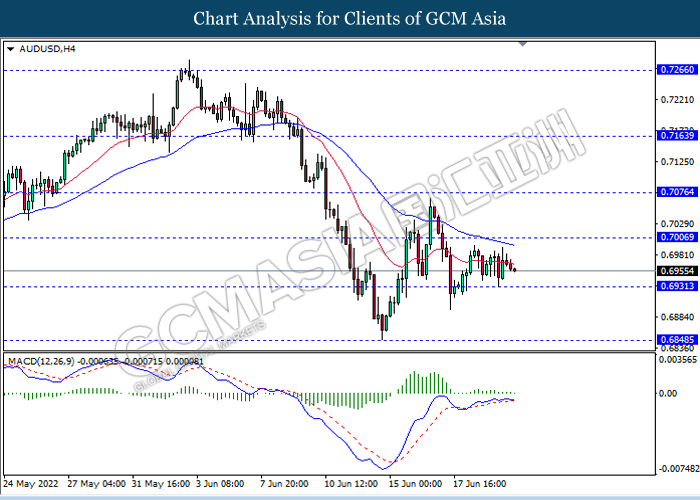

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

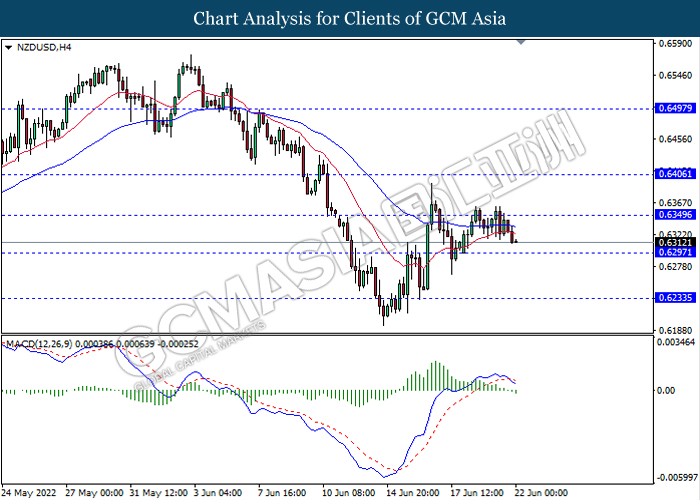

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6350, 0.6405

Support level: 0.6295, 0.6235

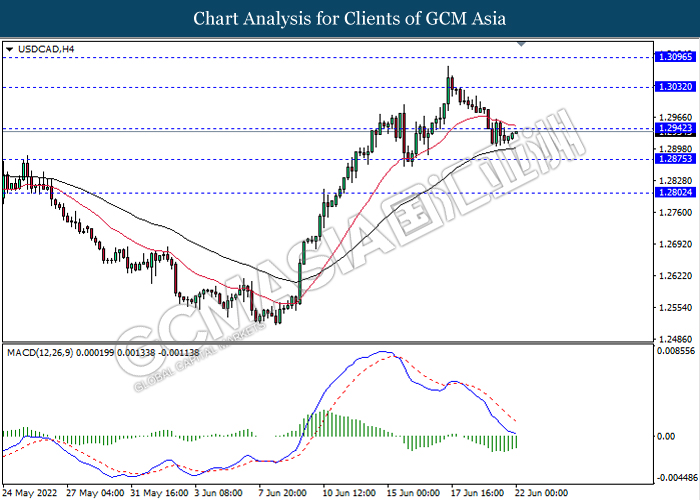

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2940, 1.3030

Support level: 1.2875, 1.2800

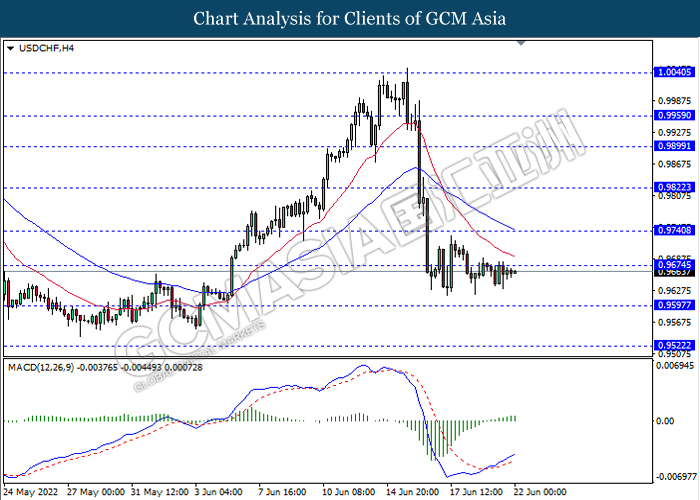

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

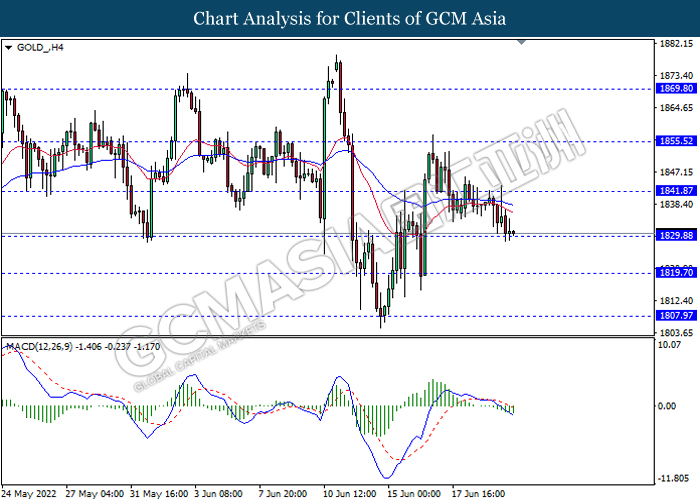

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1841.85, 1855.50

Support level: 1829.90, 1819.70