21 July 2021 Afternoon Session Analysis

Aussie fell following increasing covid cases.

The Australian dollar which traded against the dollar and other currency pairs remains pressured and fell as Australia covid infections hit 10 months high and triggering concerns for Australia’s economy recovery. Following latest development, Australia’s New South Wales have recorded the highest daily infections at 122 since the outbreak began in June. With the coronavirus situation escalate in the NSW, neighboring states such as Queensland have already planned to close its border to NSW and reimposed social distancing rules. New South Wales Premier Gladys Berejiklian also warned that the number of cases could go even higher. On data front, downbeat data also further added selling pressure for the pair. The NAB Business Confidence for the second quarter have eased to 17, lower than market expectation of 21. At the time of writing, AUD/USD fell 0.11% to 0.7345.

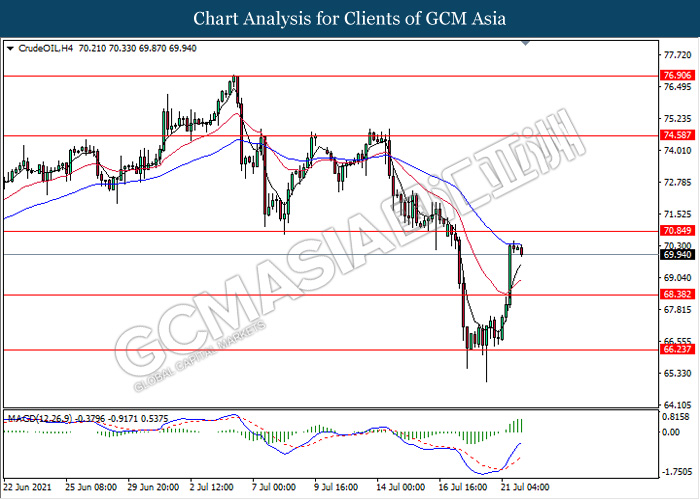

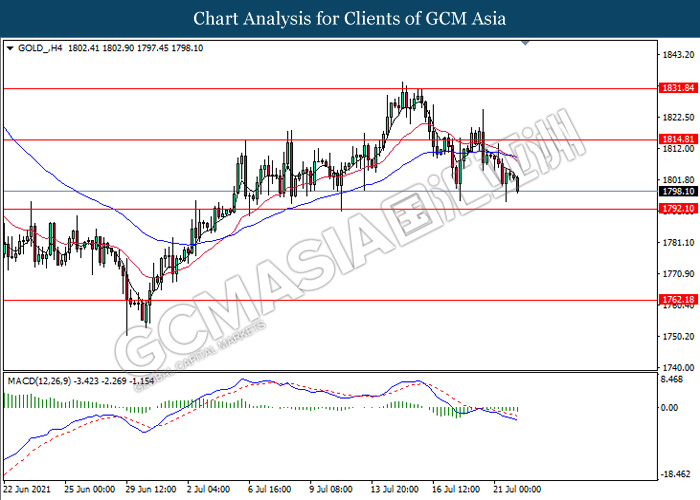

In the commodities market, crude oil price rose 0.11% to $70.01 per barrel as of writing despite with a surprise build in U.S oil inventories. According to EIA, crude oil inventories rose 2.108 million barrels, completely opposite from market expectation with a decrease of -4.466 million barrels. Despite that, market remains hopeful and continue to bet on fuel consumption recovery. On top of that, JPMorgan also expect the crude oil demand will hover at 99.6 million barrels per day which is higher than the first quarter. On the other hand, gold price slips 0.31% to $1797.95 a troy ounce at the time of writing following dollar rebound.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19.45 EUR ECB Monetary Policy Statement

20.30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19.45 | EUR – Deposit Facility Rate (Jul) | -0.50% | -0.50% | – |

| 19.45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19.45 | EUR – ECB Interest Rate Decision (Jul) | 0.00% | 0.00% | – |

| 20.30 | USD – Initial Jobless Claims | 360K | 350K | – |

| 22.00 | USD – Existing Home Sales (Jun) | 5.80M | 5.90M | – |

Technical Analysis

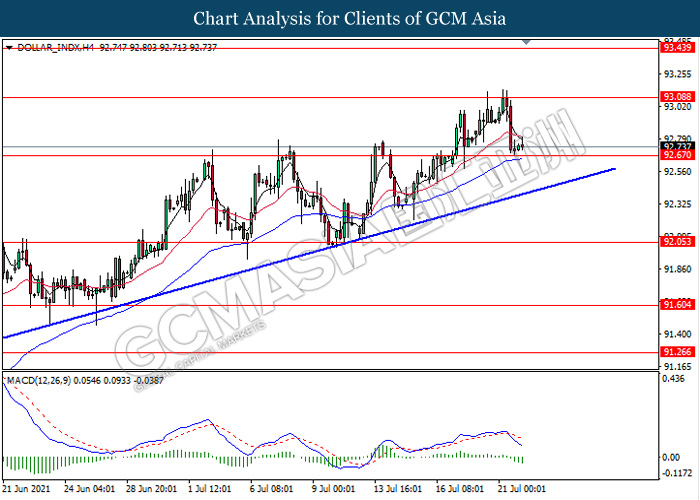

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 92.65. MACD which illustrate bearish momentum signal with the recent formation of death cross suggest the dollar to extend its losses after it breaks below the support level.

Resistance level: 93.10, 93.45

Support level: 92.70, 92.05

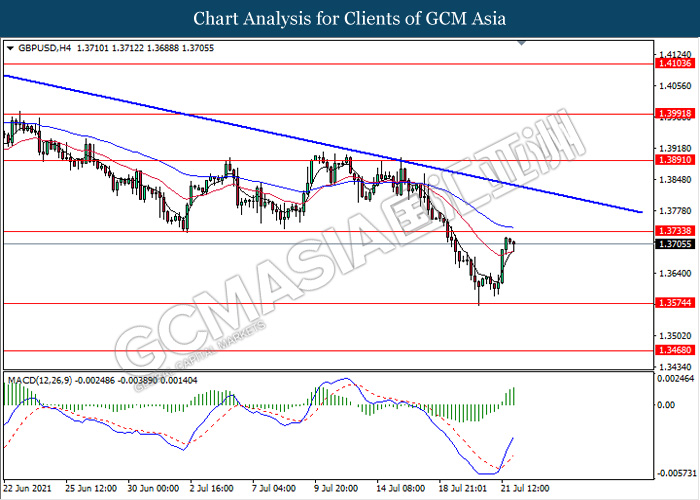

GBPUSD, H4: GBPUSD was traded higher while currently testing near the resistance level 1.3735. MACD which illustrate bullish bias signal with the recent formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 1.3735, 1.3890

Support level: 1.3575, 1.3470

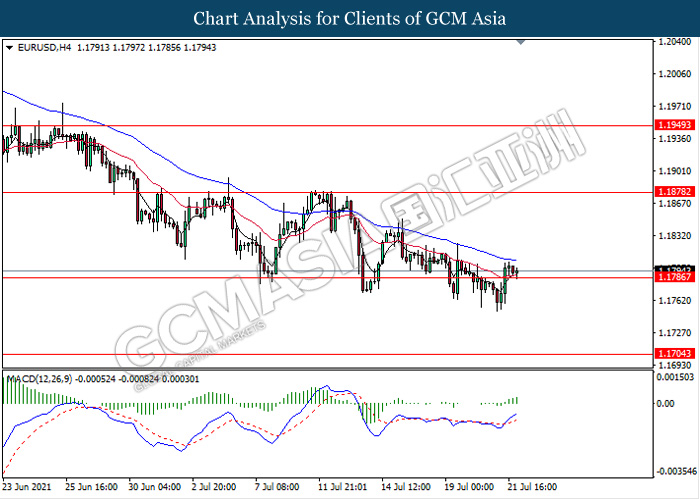

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level 1.1785. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.1880.

Resistance level: 1.1880, 1.1950

Support level: 1.1785, 1.1705

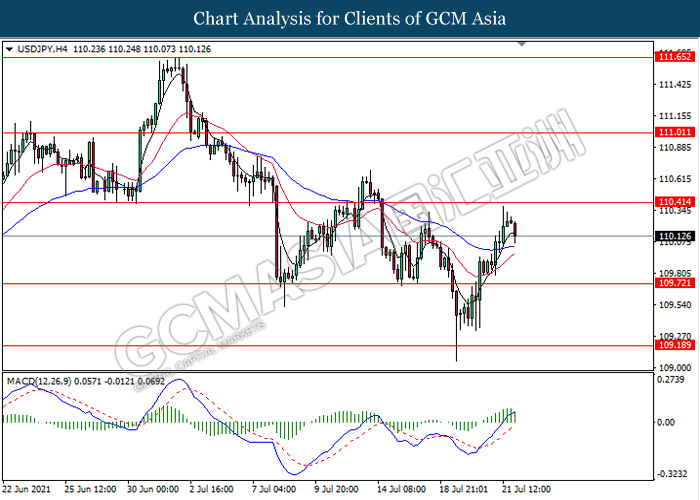

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level 110.40. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 109.70.

Resistance level: 110.40, 111.00

Support level: 109.70, 109.20

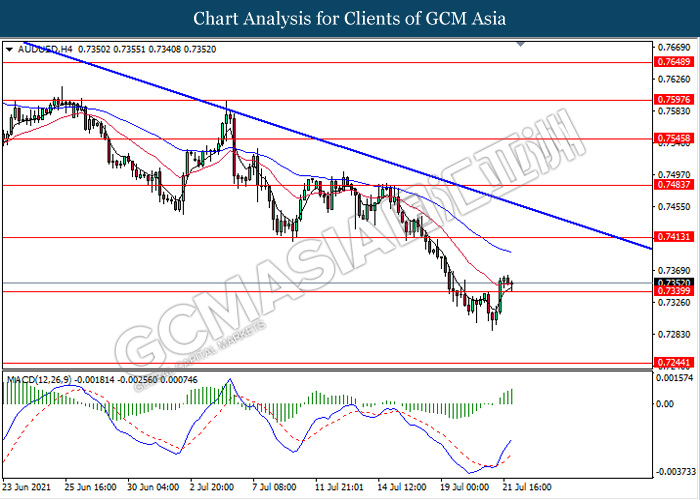

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level 0.7340. MACD which illustrate bullish momentum signal with the recent formation of golden cross suggest the pair to extend its gains towards the resistance level 0.7415.

Resistance level: 0.7415, 0.7485

Support level: 0.7340, 0.7245

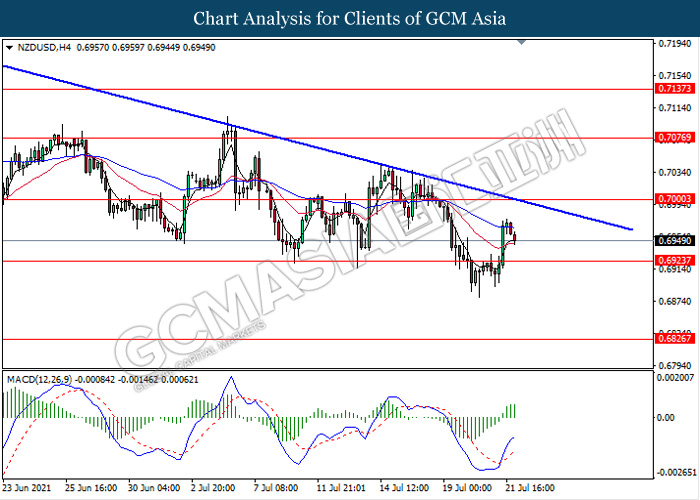

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6925. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.7000.

Resistance level: 0.7000, 0.7075

Support level: 0.6925, 0.6825

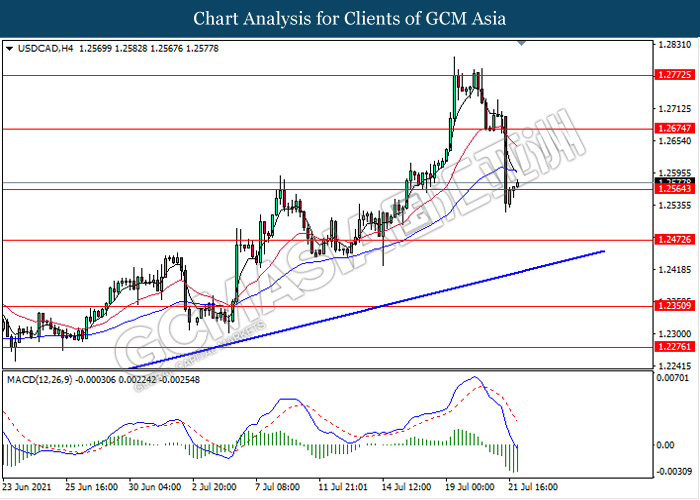

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.2565. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 1.2675.

Resistance level: 1.2675, 1.2770

Support level: 1.2565, 1.2470

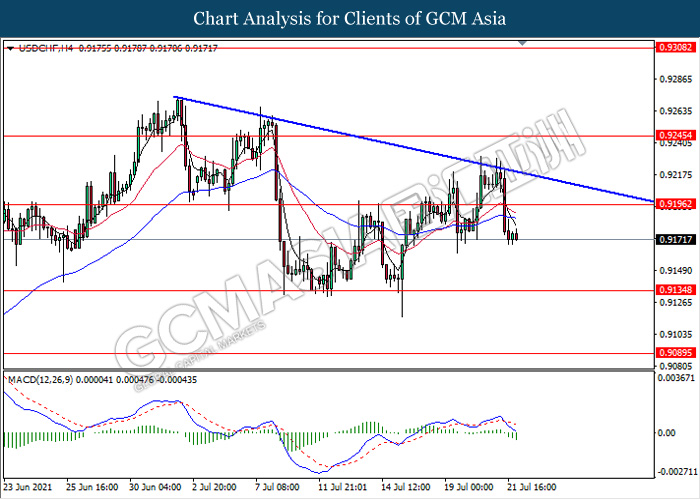

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level 0.9195. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 0.9135.

Resistance level: 0.9195, 0.9245

Support level: 0.9135, 0.9090

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level 70.85. MACD which illustrate bullish bias signal suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 70.85, 74.60

Support level: 68.40, 66.25

GOLD_, H4: Gold price was traded lower while currently testing near the support level 1792.10. MACD which illustrate bearish momentum signal suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 1814.80, 1831.85

Support level: 1792.10, 1762.20