22 July 2021 Morning Session Analysis

Dollar slumped amid risk-on sentiment.

The Dollar Index which traded against a basket of six major currency pairs retraced from its recent high following the global stock market rebounded significantly, which spurring risk appetite in the global financial market while diminishing market demand on the safe-haven US Dollar. In earlier, the spiking numbers of the Delta variant had increased the investors’ concern, which prompting the global stock markets to drop sharply on Monday. Nonetheless, the losses experienced by the US Dollar was limited amid optimism toward the new infrastructure spending bill from US President Joe Biden. US Senate, Democratic Senator Joe Manchin claimed that they are very close to achieve on the bipartisan infrastructure plan. Analysts speculated that such infrastructure plan would able to enhance the economic momentum in the United States. As for now, investors would continue to scrutinize updates with regards of Covid-19 development as well as further economic data to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index surged 0.06% to 92.80.

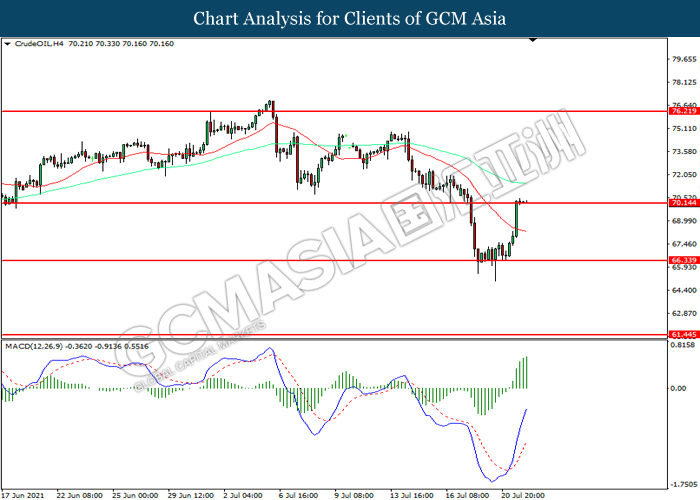

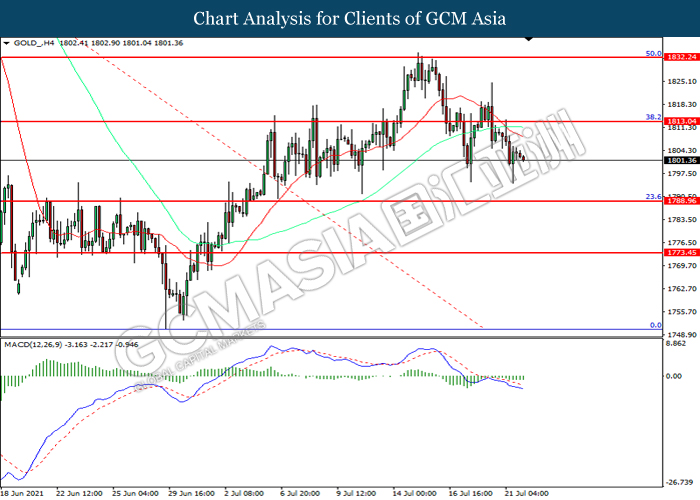

In the commodities market, the crude oil price appreciated by 0.14% to $70.60 per barrel as of writing. The crude oil price surged significantly yesterday amid technical correction following it suffered huge drop in the earlier this week. Market participants remained optimism that the rapid process of the vaccination would able to enhance the oil demand in future. On the other hand, the gold price appreciated by 0.01% to $1802.20 per troy ounces amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | -1.40% | 0.50% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul) | 65.1 | 64.1 | – |

| 16:30 | GBP – Manufacturing PMI | 63.9 | 62.7 | – |

| 16:30 | GBP – Services PMI | 62.4 | 62 | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | -7.20% | -2.00% | – |

Technical Analysis

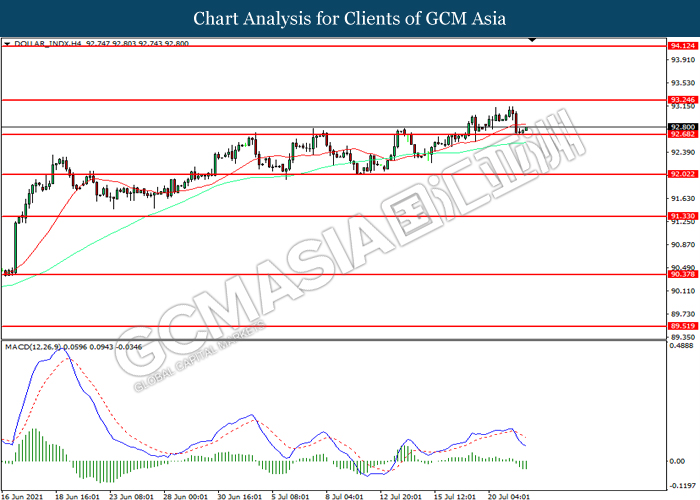

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 92.70. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 93.25, 94.10

Support level: 92.70, 92.00

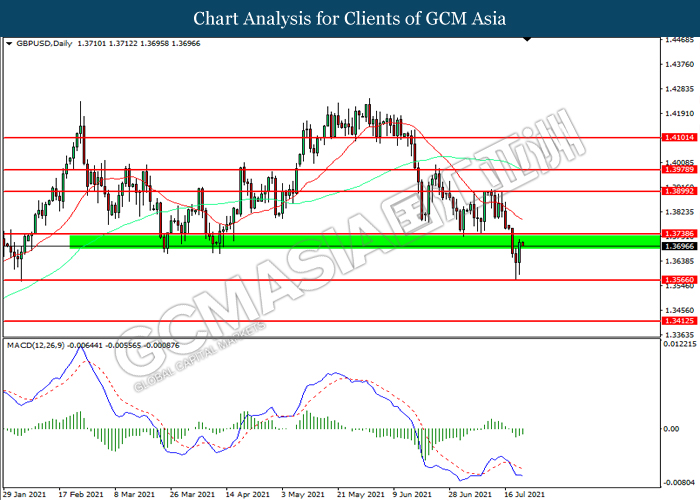

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.3740. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3740, 1.3900

Support level: 1.3565, 1.3415

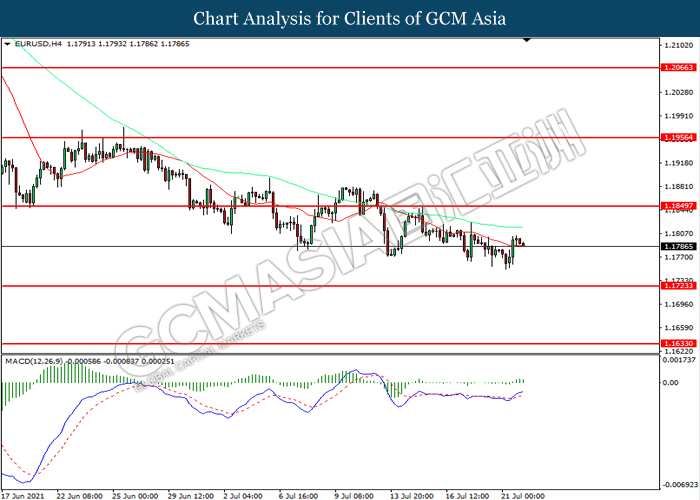

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1850. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.1725.

Resistance level: 1.1850, 1.1955

Support level: 1.1725, 1.1635

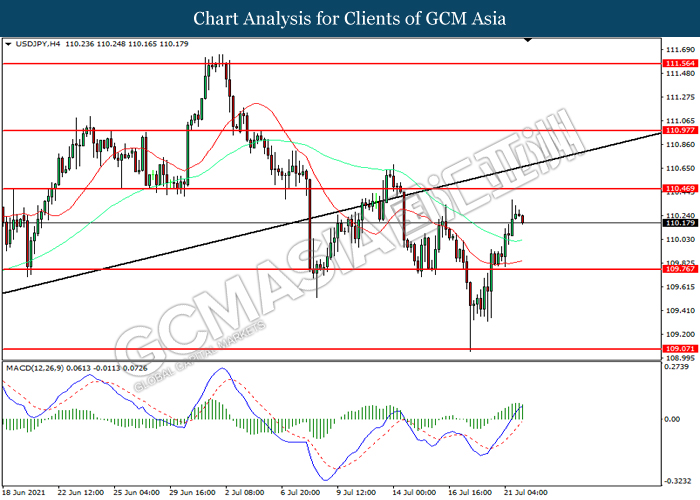

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 109.75. However, MACD which illustrated increasing diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 110.45, 110.95

Support level: 109.75, 109.05

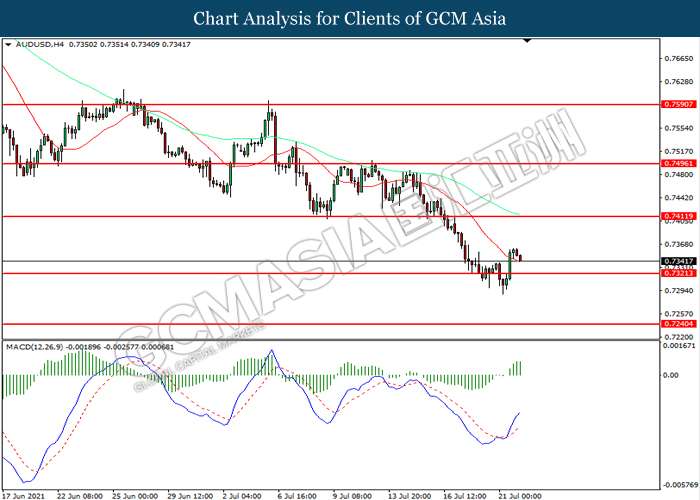

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7320. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7410.

Resistance level: 0.7410, 0.7495

Support level: 0.7320, 0.7240

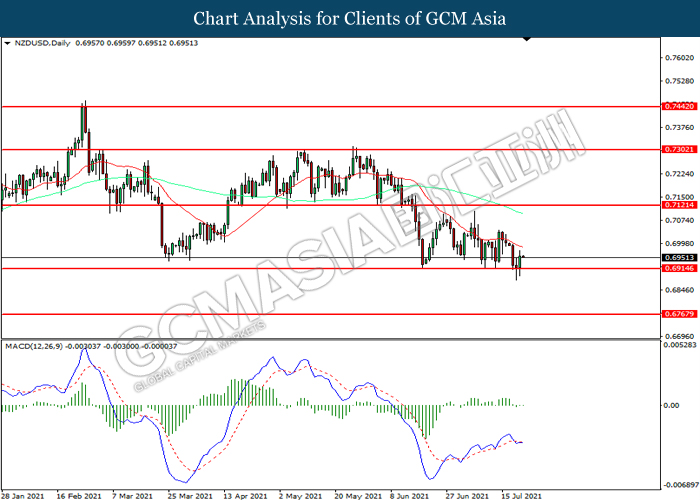

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6915. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7120, 0.7305

Support level: 0.6915, 0.6770

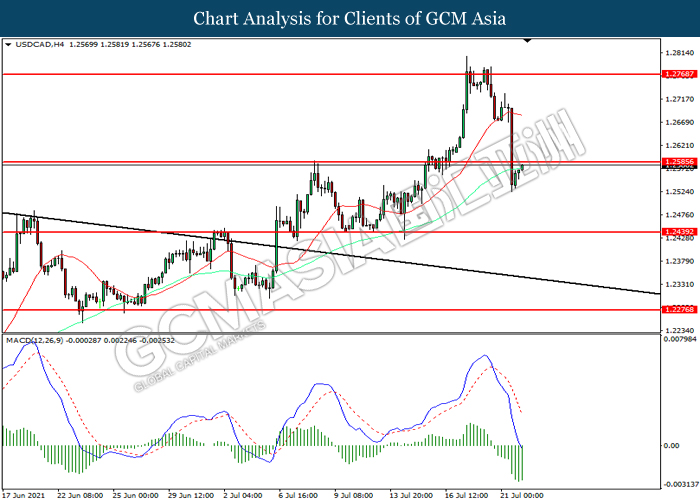

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2585. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2585, 1.2770

Support level: 1.2440, 1.2275

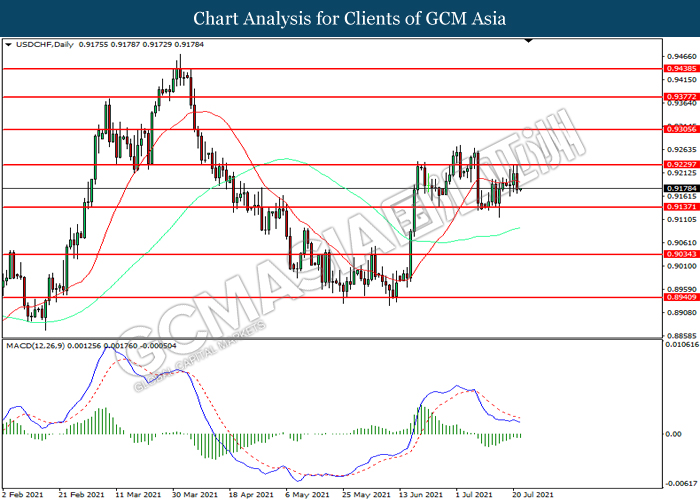

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9230. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9135.

Resistance level: 0.9230, 0.9305

Support level: 0.9135, 0.9035

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 70.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 70.15, 76.20

Support level: 66.35, 61.45

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1813.05. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1788.95.

Resistance level: 1813.05, 1820.85

Support level: 1800.25, 1788.95