22 October 2020 Afternoon Session Analysis

Dollar reversing loses while eyes on U.S stimulus.

During late Asian session, the dollar which measured its value against a basket of six major currency pair have slowly recoup its losses and rebound as the market continue to focus on the U.S congress development on passing the latest stimulus. Recently, the dollar sank to its lowest level since September 2 after U.S President Donald Trump and House of Representative Speaker Nancy Pelosi have made positive remarks that increasing the hopes of U.S stimulus before Nov 3. However, that optimism is now slowly fading due to opposition from Senate Republicans which reduces the chances of the stimulus being passed before election. Pelosi also stated that while she remains optimistic, she also admitted that the stimulus is highly unlikely to be passed before the U.S heading for polls. Following the latest development, the greenback manages to limit its losses. Meanwhile, market will continue to focus on further development and upcoming presidential debate between Donald Trump and Joe Biden. At the time of writing, dollar index rose 0.19% to 92.73.

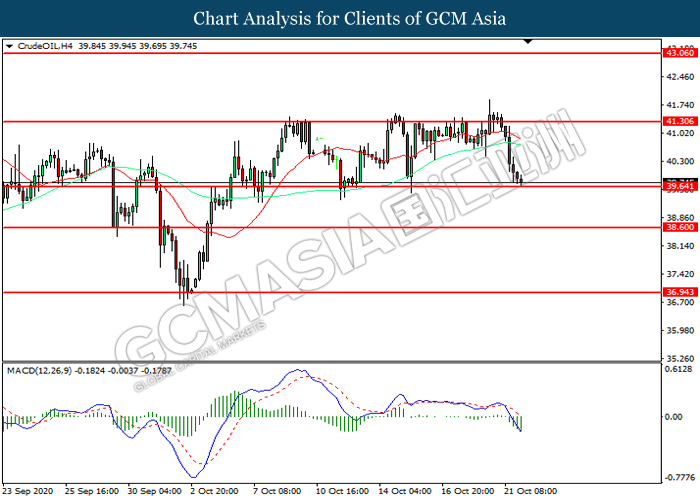

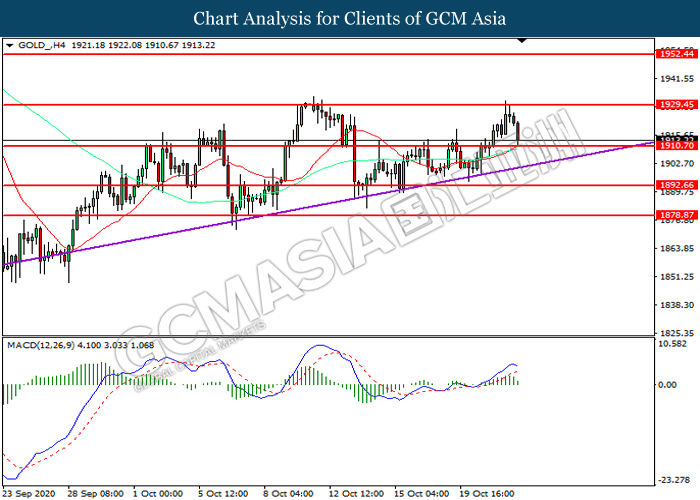

In the commodities market, crude oil price extends losses and plunged 0.50% to $39.75 per barrel at the time of writing following weak demand outlook. With COVID-19 infections in the U.S and Europe continue to hit daily record, lockdowns and travel clampdown from China once again could diminished the fuel demand, which weigh on the oil price. On top of that, scepticism on stimulus package also added further to the worsening outlook as President Donald Trump accused Democrats of holding up a compromise deal. On the other hand, gold price slips 0.55% to $1913.95 a troy ounce at the time of writing amid rebound in dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:25 UK BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 898K | 860K | – |

| 22:00 | USD – Existing Home Sales (Sep) | 6.00M | 6.30M | – |

Technical Analysis

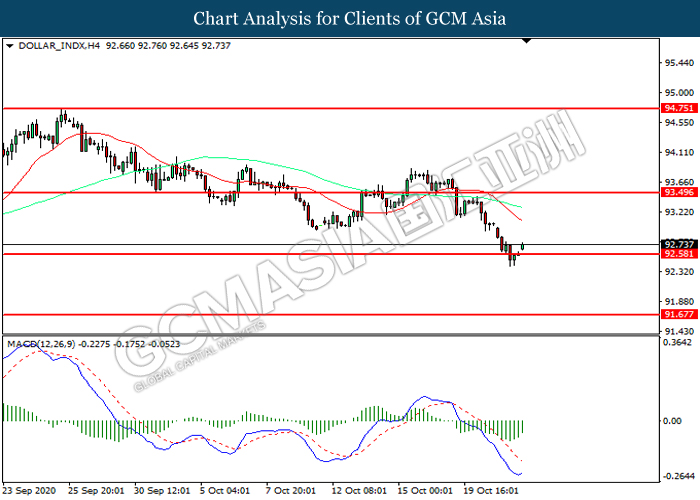

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 92.60. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 94.50, 94.75

Support level: 92.60, 91.65

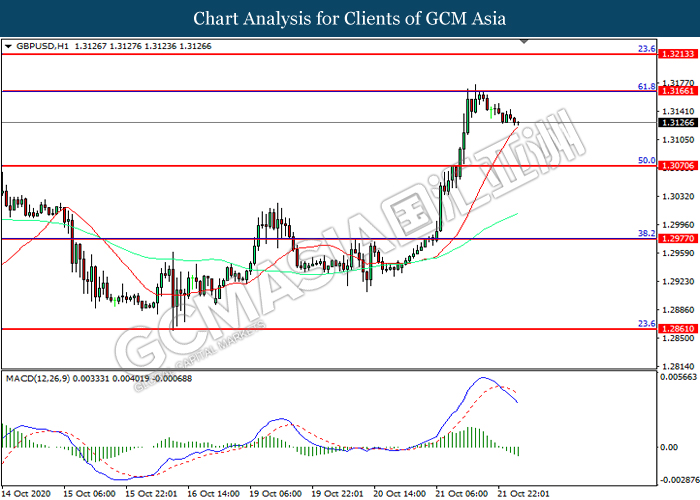

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level at 1.3165. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3070.

Resistance level: 1.3165, 1.3215

Support level: 1.3070, 1.2975

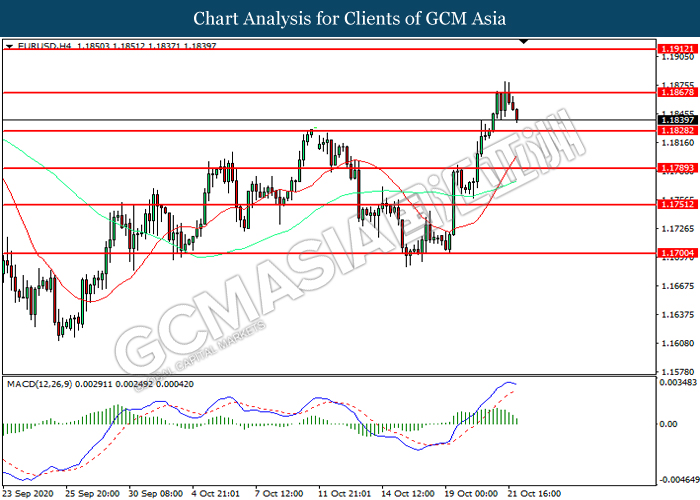

EURUSD, H4: EURUSD was traded lower following prior retracement form the resistance level at 1.1865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.1830.

Resistance level: 1.1865, 1.1910

Support level: 1.1830, 1.1790

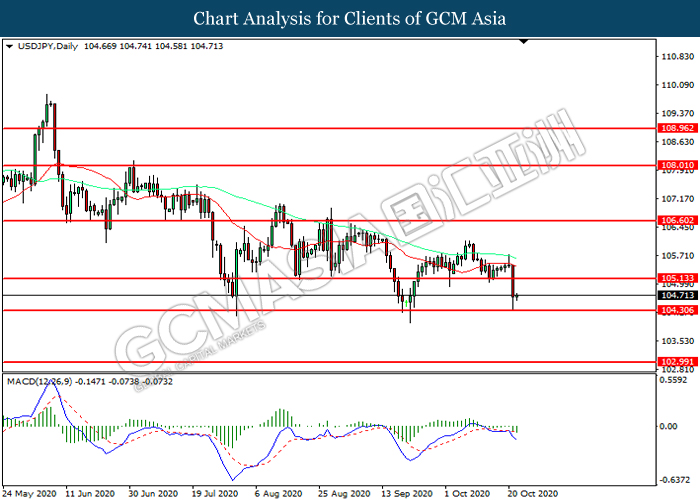

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 104.30. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 105.15, 106.60

Support level: 104.30, 103.00

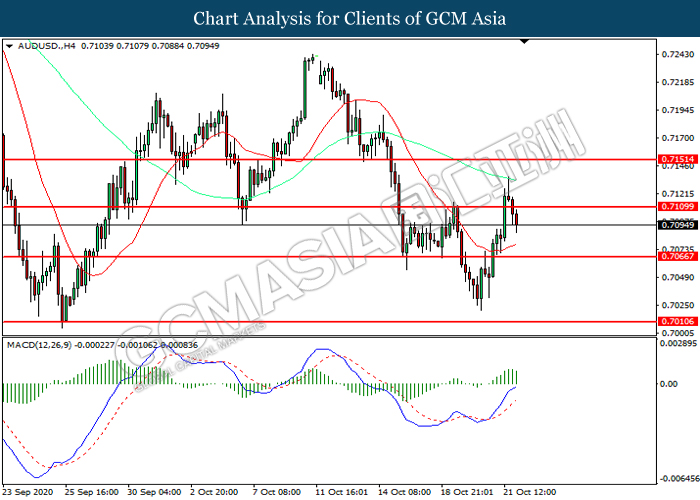

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7110. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.7065.

Resistance level: 0.7110, 0.7150

Support level: 0.7065, 0.7010

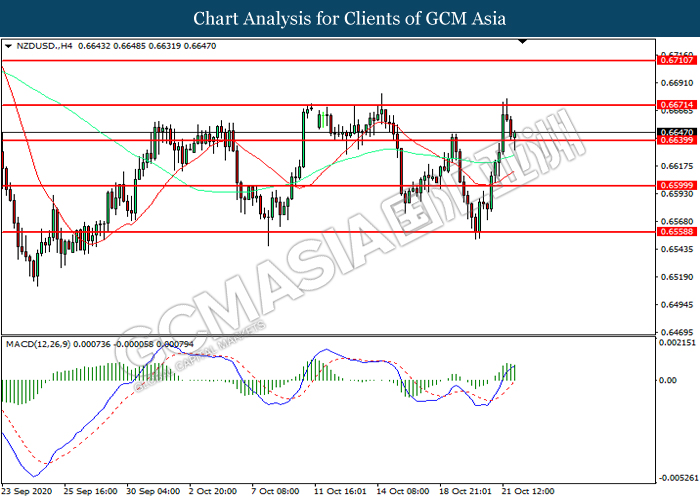

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6670, 0.6710

Support level: 0.6640, 0.6600

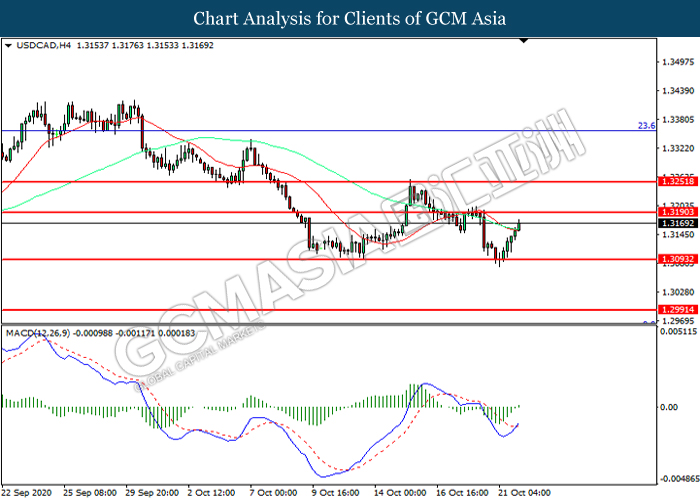

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3190. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3190, 1.3250

Support level: 1.3095, 1.2990

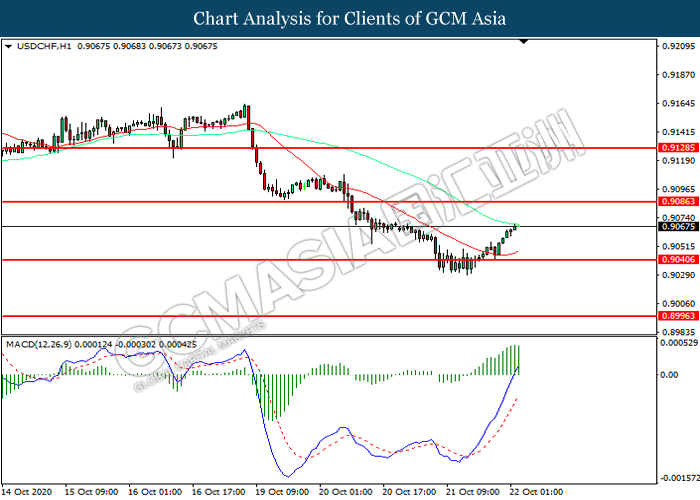

USDCHF, H1: USDCHF was traded higher following prior rebound from the support level at 0.9040. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9085.

Resistance level: 0.9085, 0.9130

Support level: 0.9040, 0.8995

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 39.65. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 41.30, 43.05

Support level: 39.65, 38.60

GOLD_, H4: Gold price was traded lower while currently testing the support level ta 1910.70. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1929.45, 1952.45

Support level: 1910.70, 1892.65