22 October 2020 Morning Session Analysis

Pound skyrocketed amid optimism of Brexit’s talk.

Pound sterling which acting as the major currencies in the FX market was managed to extend its gains while hitting the highest level in seven weeks amid Brexit talk set to resume, lifting up the market optimism toward a deal could be sealed before the end of transition period. According to Bloomberg, negotiator from both sides are ready to have further formal negotiation on today while holding an aim to secure a deal by mid of November. This decision was came after a crucial call between Britain’s chief negotiator David Frost and EU counterpart Michel Barnier. Moreover, both sides were working hard in securing a deal as to avoid disruptive finale to the Brexit that would deteriorate the economy health UK. Nonetheless, it is clear that a significant gap still remains between EU and UK in the most difficult areas such as fisheries and level of competitive playing field. Despite a little change of hard tone was seem from both sides, yet it is seemingly that a compromise would not be achieved in the short run. During Asian early trading session, the pair of GBP/USD retraced by 0.07% to 1.3135.

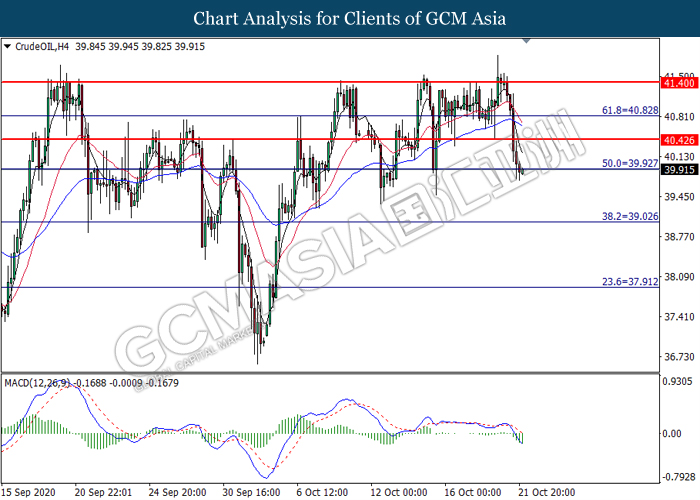

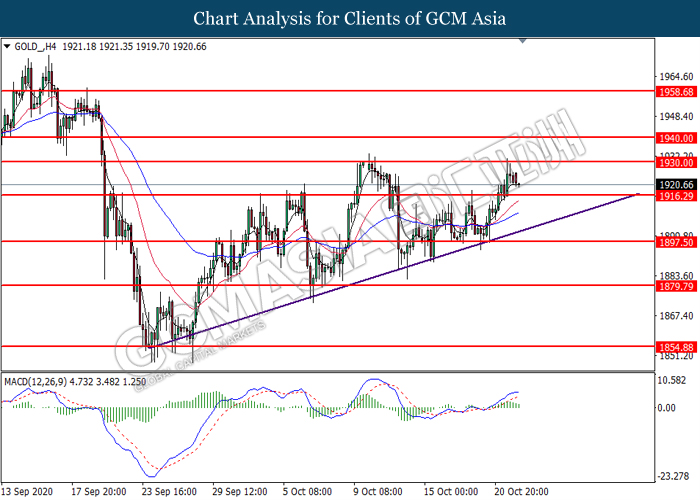

In the commodities market, the crude oil price depreciated by 0.35% to $39.90 per barrel following a lower-than-expected draw in US inventories level. According to EIA, US crude oil inventories level has reduced -1.001M barrel, missing the economist forecast at -1.021M, this disappointing data has dragged down the appeal of this black commodity market. Besides, gold price dropped by 0.15% to $1921.00 per troy ounce after hitting the highest level in 10 days amid rebound of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:25 UK BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 898K | 860K | – |

| 22:00 | USD – Existing Home Sales (Sep) | 6.00M | 6.30M | – |

Technical Analysis

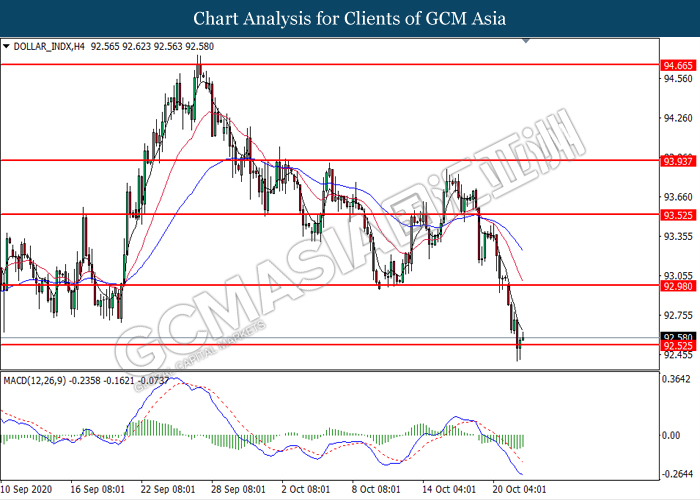

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from support level at 92.50. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend it rebound toward the resistance level at 93.00.

Resistance level: 93.00, 93.55

Support level: 92.50, 92.10

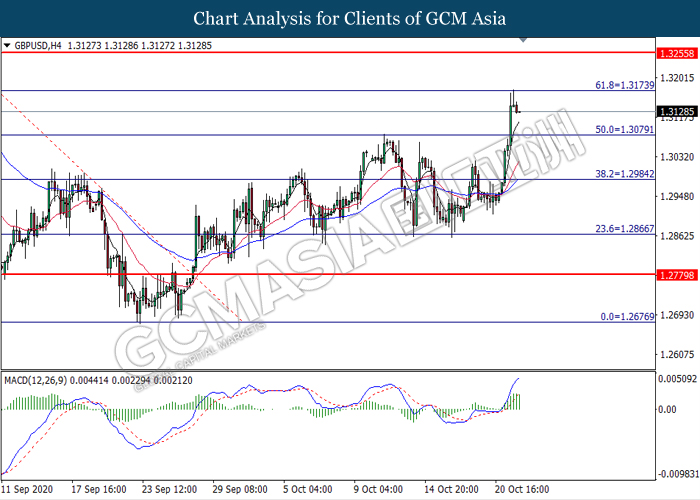

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3175. MACD which illustrates diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3080.

Resistance level: 1.3175, 1.3255

Support level: 1.3080, 1.2985

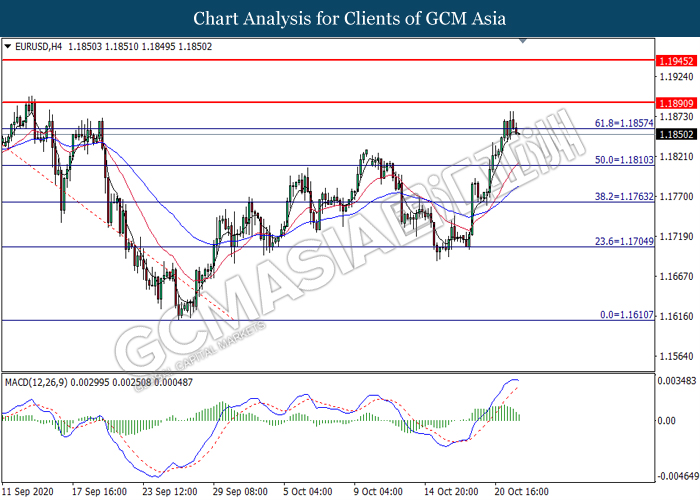

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1855. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 1.1810.

Resistance level: 1.1855, 1.1890

Support level: 1.1810, 1.1765

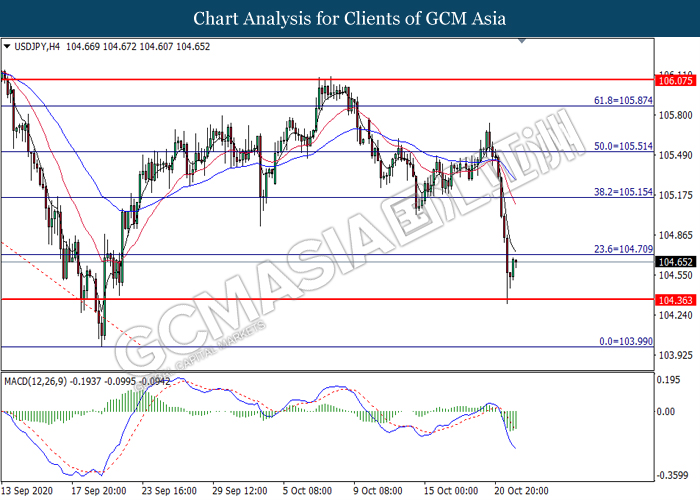

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level at 104.70. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound toward the resistance level at 104.70.

Resistance level: 104.70, 105.15

Support level: 104.35, 104.00

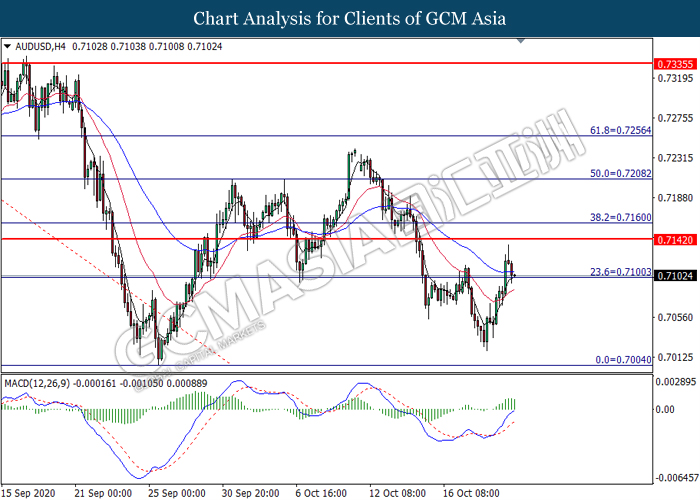

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7100. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7140, 0.7160

Support level: 0.7100, 0.7005

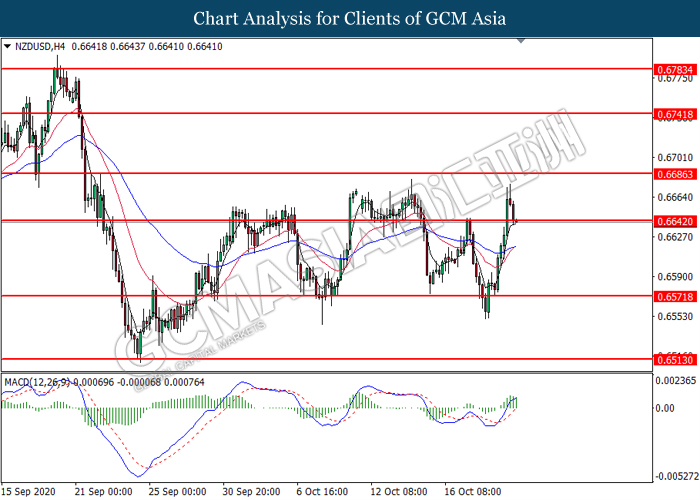

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it successfully breakout below the support level at 0.6640.

Resistance level: 0.6685,0.6740

Support level: 0.6640, 0.6570

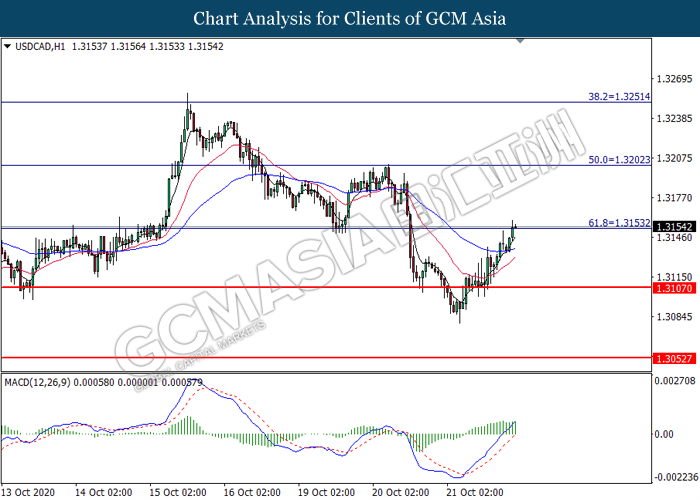

USDCAD, H1: USDCAD was traded higher while currently testing the resistance level at 1.3155. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.3155.

Resistance level: 1.3155, 1.3200

Support level: 1.3105, 1.3055

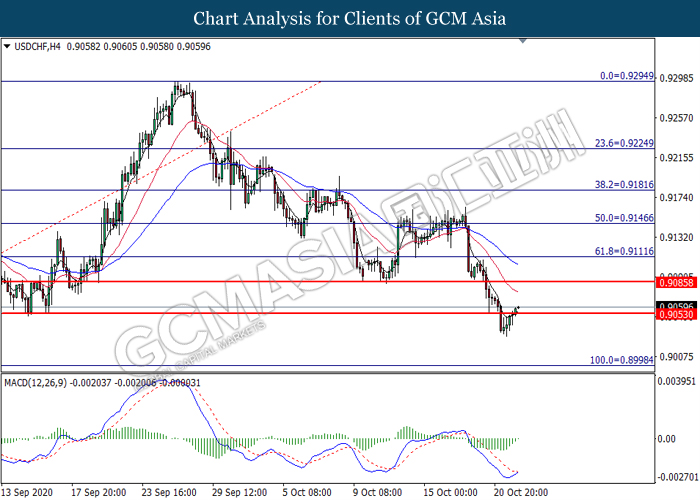

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9055. MACD which display diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 0.9085.

Resistance level: 0.9085, 0.9110

Support level: 0.9055, 0.9000

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 39.95. MACD which illustrate bearish bias momentum signal suggest the commodity to extend its losses toward the support level at 39.05.

Resistance level: 39.95, 40.45

Support level: 39.05, 37.90

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1930.00. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its losses toward the support level at 1916.30.

Resistance level: 1930.00, 1940.00

Support level: 1916.30, 1897.50