23 December 2020 Afternoon Session Analysis

Pound struggling as Brexit talk remain in deadlock.

During late Asian session, the pound sterling which traded against the dollar and other currency pairs remains weak and fell as investors continue to concern over prospect of no deal Brexit amid with ongoing differences in fisheries. According to sources from EU diplomat, despite with most issues are close to being agreed, fishing quotas remain “difficult to bridge”. Despite with U.K have improved their offer on fisheries recently, EU remains firm and rejected the offer as it was higher than their demand that no more than 25% reduction should be imposed. With the deadline getting closer, the prospect of hard Brexit is increasing where both sides could witness an increase in tax and cost without any trade deal by the end of the year, thus weighing negatively on the pound sterling. At the time of writing, GBP/USD fell 0.03% to 1.3401.

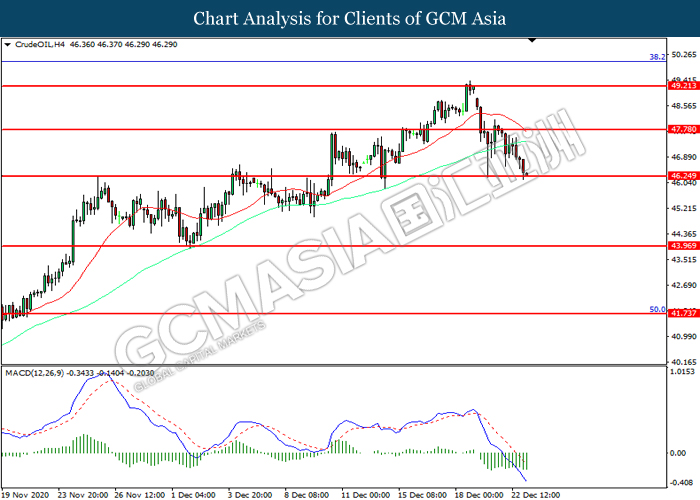

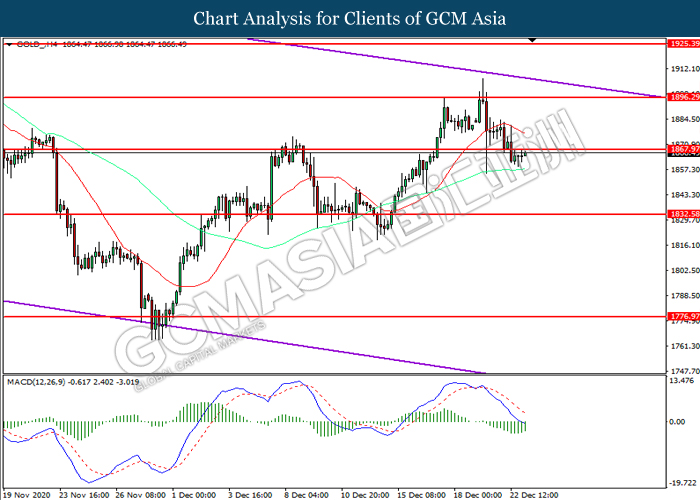

In the commodities market, crude oil price plunged 0.81% to $46.35 per barrel as of writing concerns over supply and Donald Trump not sign the COVID-19 relief bill. As of now, sentiment continue to be pressured by recent data from API showed an unexpected increase in crude supply. On top of that, the prospect of the commodity fell further after Donald Trump threatening to not sign the coronavirus relief bill which could affect the recovery of U.S economy and fuel demand. On the other hand, gold price rose 0.28% to $1865.35 a troy ounce at the time of writing following dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 885K | 885K | – |

| 21:30 | CAD – GDP (MoM)(Oct) | 0.8% | 0.3% | – |

| 23:00 | USD – New Home Sales (Nov) | 999K | 995K | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.135M | -3.186M | – |

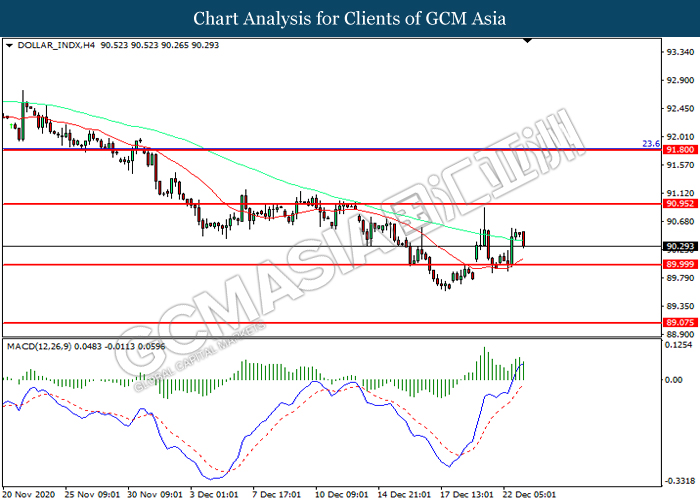

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 90.00. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 90.95, 91.80

Support level: 90.00, 89.05

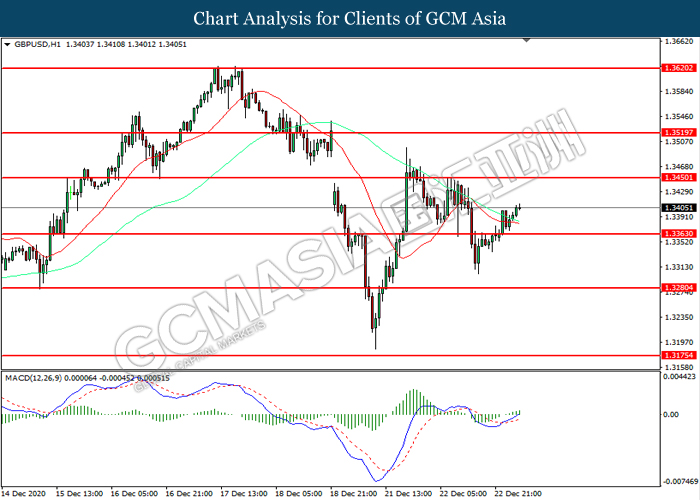

GBPUSD, H1: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3365. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3450.

Resistance level: 1.3450, 1.3520

Support level: 1.3365, 1.3280

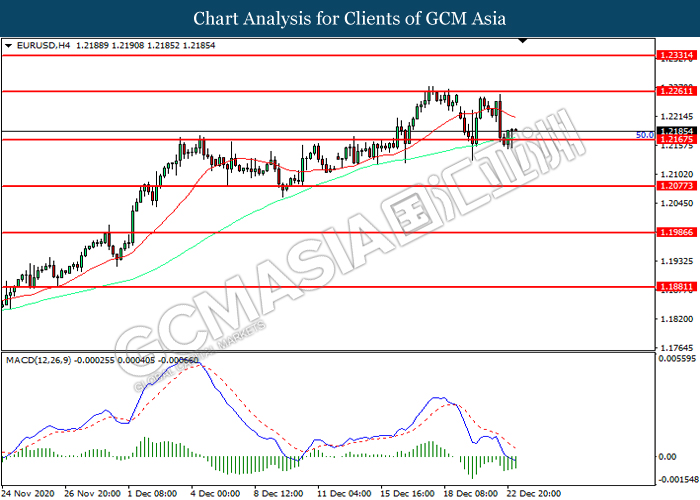

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.2165. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2260, 1.2330

Support level: 1.2165, 1.2075

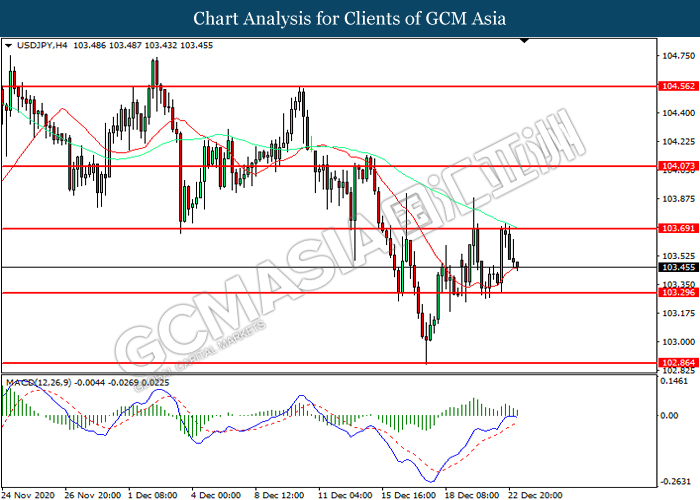

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 103.70. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 103.30.

Resistance level: 103.70, 104.05

Support level: 103.30, 102.85

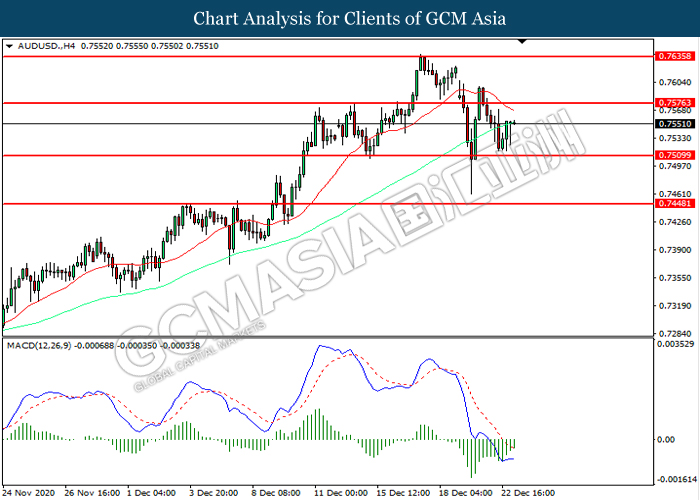

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7510. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7575.

Resistance level: 0.7575, 0.7635

Support level: 0.7510, 0.7450

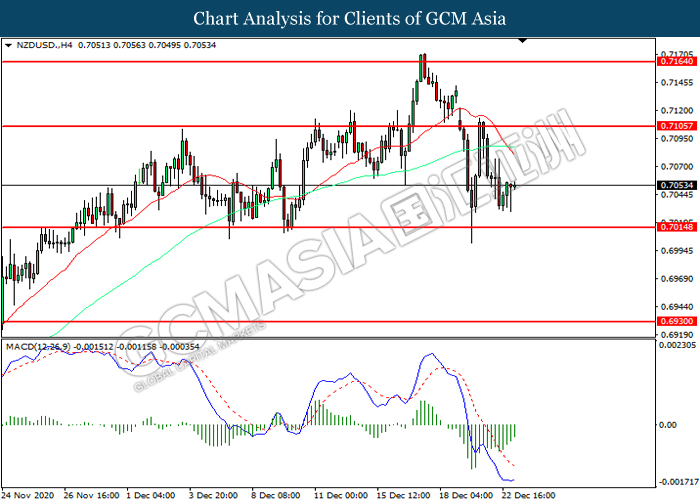

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.7105. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7105, 0.7165

Support level: 0.7015, 0.6930

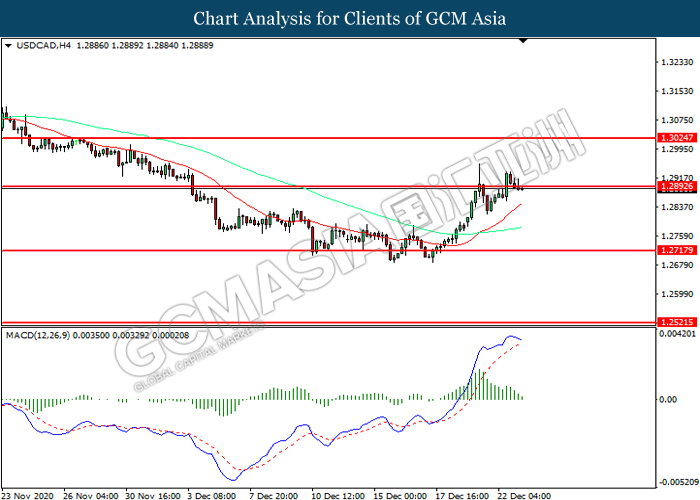

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.2895. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.2720.

Resistance level: 1.2895, 1.3025

Support level: 1.2720, 1.2520

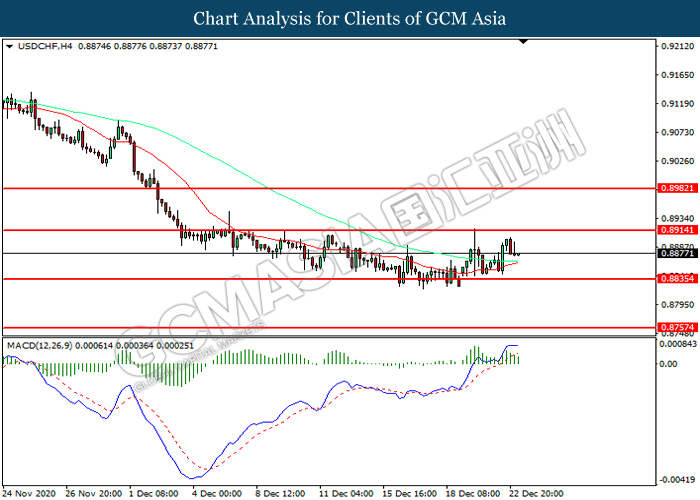

USDCHF, H4: USDCHF was traded lower while following prior retracement from the resistance level at 0.8915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.8835.

Resistance level: 0.8915, 0.8980

Support level: 0.8835, 0.8755

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 46.25. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 47.80, 49.20

Support level: 46.25, 43.95

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1867.95. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1867.95, 1896.30

Support level: 1832.60, 1776.95