22 December 2020 Afternoon Session Analysis

Aussie fell despite strong Retail Sales data.

During late Asian session, the Aussie dollar which traded against the dollar and other currency pairs have fell as market ignores upbeat reading of Retails Sales while taking hint from risk-off mood. According to the Australian Bureau of Statistics, retail sales in Australia have improved greatly to 7%, better than previous reading of 1.4%. The data also shown growth for the third consecutive month and marking the biggest increase since early July. Despite that, market fails to cheer the positive data as overall trading sentiment in the market remains dull due to worsening coronavirus. As of now, Investors are digesting the news of a new and deadlier coronavirus strain in the U.K and cause over 40 countries to restrict any travel with U.K. Market will now wait for the formal announcement of the U.S Covid-19 aid package to determine further direction for the pair. At the time of writing, AUD/USD fell 0.16% to 0.7570.

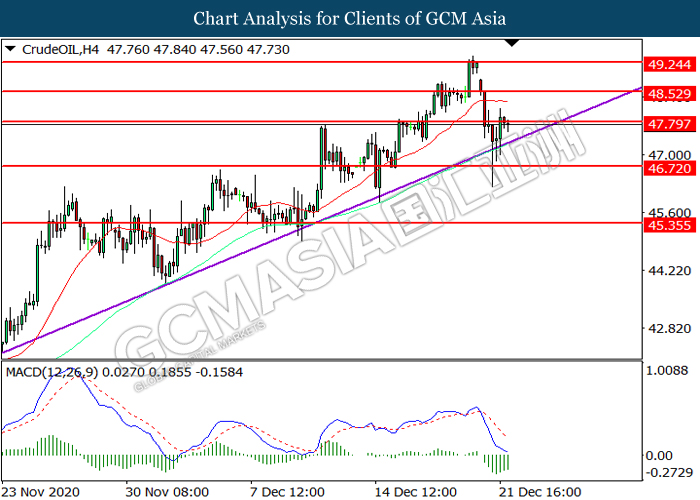

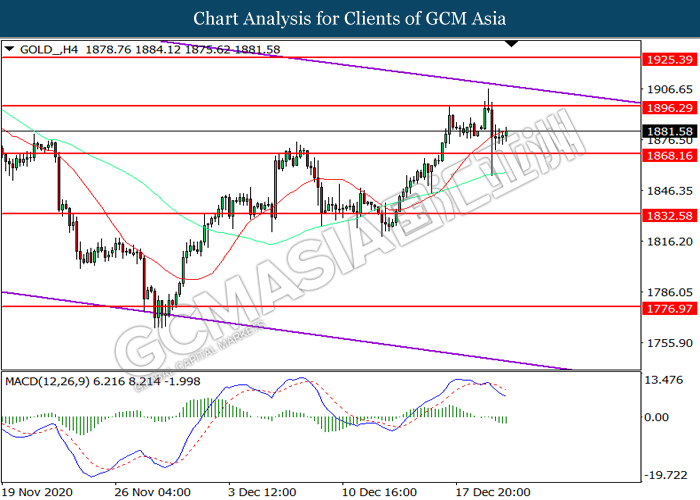

In the commodities market, crude oil price remains weak and slips 0.06% to $47.78 per barrel at the time of writing following ongoing concerns over demand outlook. The spread of highly-infectious new strain of coronavirus has continued to sparked fears of another global clampdown in travel which in turn affecting the demand for fuel consumption. On the other hand, gold price rose 0.37% to $1883.70 a troy ounce at the time of writing following decreasing risk appetite in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (QoQ)(Q3) | -19.8% | 15.5% | – |

| 21:30 | USD – GDP (QoQ)(Q3) | -31.4% | 33.1% | – |

| 23:00 | USD – CB Consumer Confidence (Dec) | 96.1 | 97.0 | – |

| 23:00 | USD – Existing Home Sales (Nov) | 6.85M | 6.70M | – |

| 05:30

(22nd) |

CrudeOIL – API Weekly Crude Oil Stock | 1.973M | – | – |

Technical Analysis

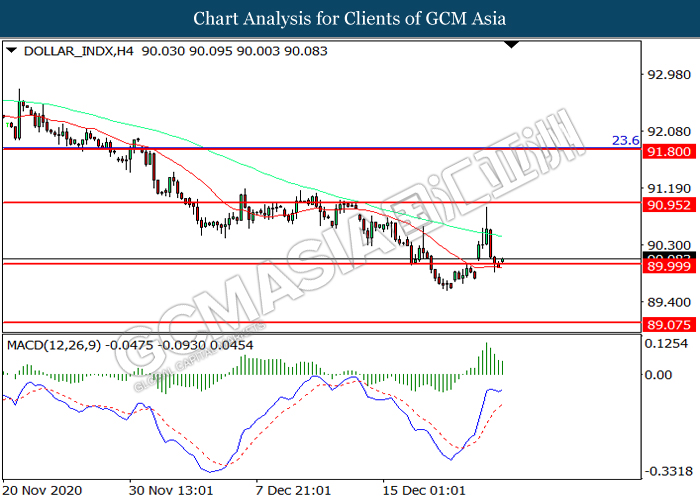

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 90.00. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 90.95, 91.80

Support level: 90.00, 89.05

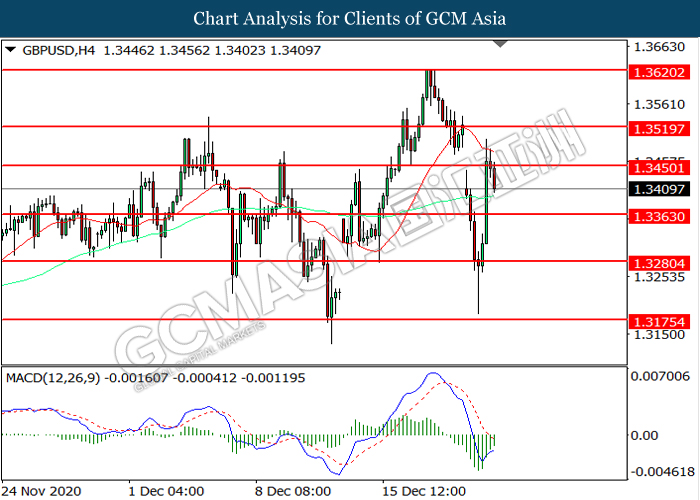

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3450. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3450, 1.3520

Support level: 1.3365, 1.3280

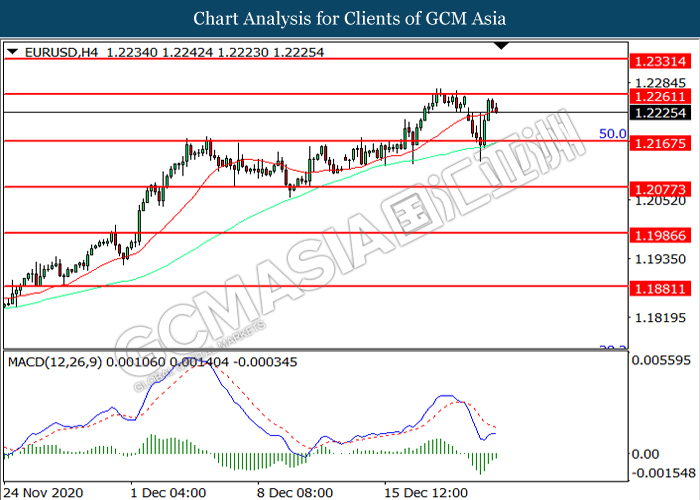

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.2260. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2260, 1.2330

Support level: 1.2165, 1.2075

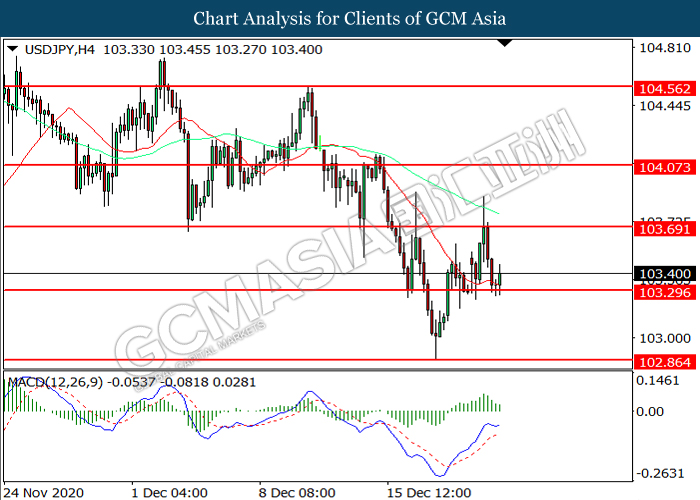

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 103.30. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 103.70, 104.05

Support level: 103.30, 102.85

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7575. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7575, 0.7635

Support level: 0.7510, 0.7450

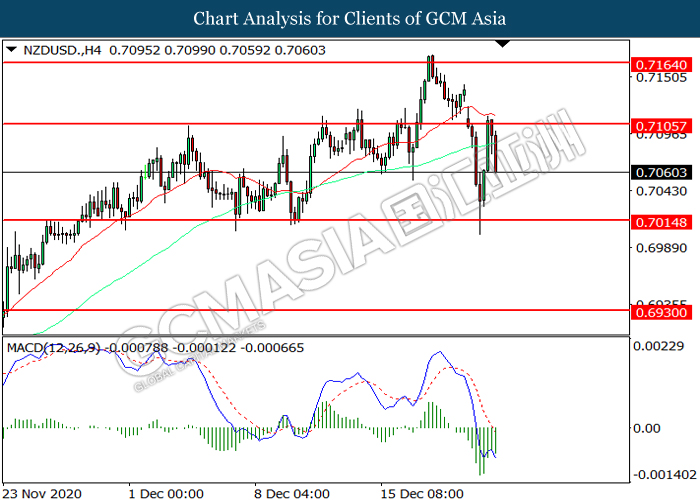

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.7105. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7105, 0.7165

Support level: 0.7015, 0.6930

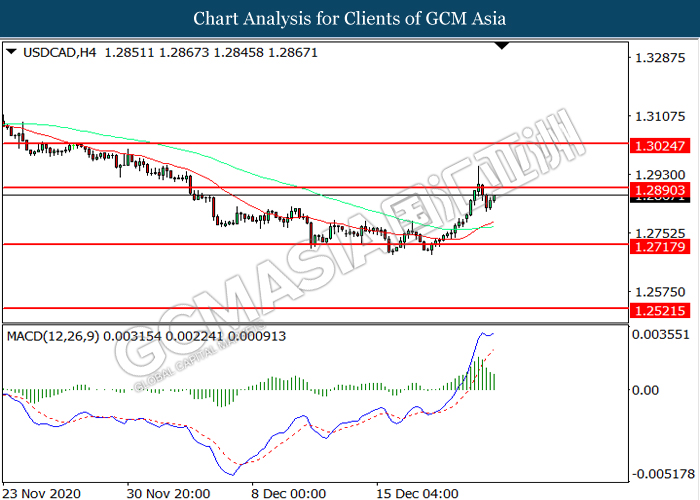

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.2890. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.2720.

Resistance level: 1.2890, 1.3025

Support level: 1.2720, 1.2520

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.8835. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.8915, 0.8980

Support level: 0.8835, 0.8755

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 47.80 MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 47.80, 48.55

Support level: 46.70, 45.35

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1868.15. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1896.30, 1925.40

Support level: 1868.15, 1832.60