23 March 2017 Daily Analysis

Sterling flats following terrorism fright.

Great British Pound drifted lower this morning following overnight’s terrorist incident near the House of Parliament in London where five people were killed and forty others were injured. The initial reports drove sterling to daily lows against the dollar and euro, while subsequent development emerged that the assailant had been shot dead and no further reports of other separate incidents has further supported the sterling to be traded flat for the day. Pairing of GBP/USD was down 0.10% to $1.2472 during Asian trading hours. Otherwise, the greenback nudged up from seven-weeks low while upside remains limited as investors questioned the progress of US President Donald Trump’s economic policies ahead of a key House vote later today. Furthermore, overnight’s weaker-than-expected existing home sales has added further pressure to the downside. Dollar index was up 0.13% and last quoted at 99.55.

As for the commodities, crude oil price rebounded in Asia as market shrugged off downbeat supply data which has increased by 5 million barrels last week. Meanwhile, gold price eases by 0.19% to $1,246.89 as market participants look over to US politics over healthcare for further risk direction.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:45 USD Fed Chair Yellen Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Retail Sales (MoM) (Feb) | -0.3% | 0.4% | – |

| 20:30 | USD – Initial Jobless Claims | 241K | 240K | – |

| 22:00 | USD – New Home Sales (Feb) | 555K | 565K | – |

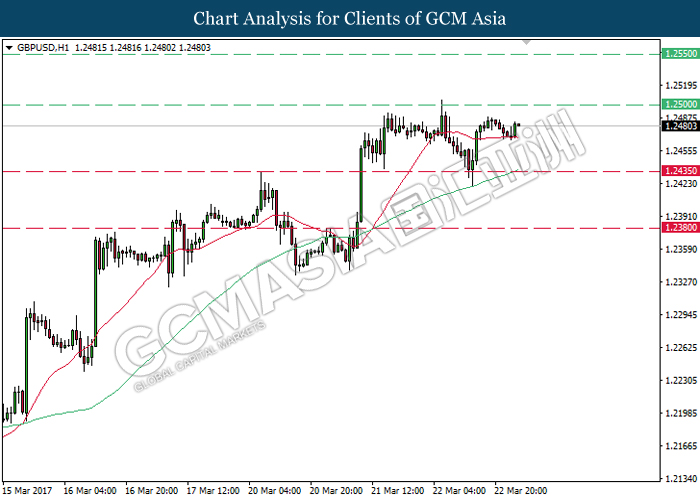

GBPUSD

GBPUSD, H1: GBPUSD was traded higher following recent rebound from the 20-moving average line (red). It is expected to advance further upwards and retest at the strong resistance level of 1.2500. A closure above this level would signal the extension of upward momentum for GBPUSD.

Resistance level: 1.2550, 1.2500

Support level: 1.2435, 1.2380

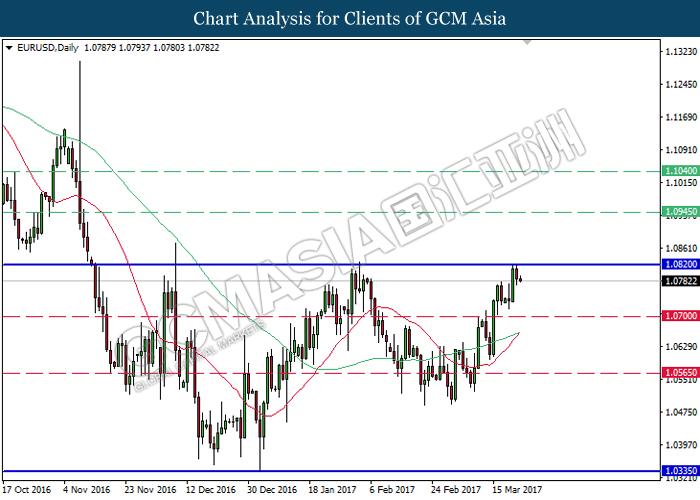

EURUSD

EURUSD, Daily: EURUSD has shaped a head and shoulders formation while recently it has retraced from the neckline of 1.0820. In the short-term, EURUSD is expected to drift lower as brief technical correction. Otherwise, long-term trend direction suggests EURUSD to advance further up and retest near the neckline of 1.0820.

Resistance level: 1.0820, 1.0945, 1.1040

Support level: 1.0700, 1.0565, 1.0335

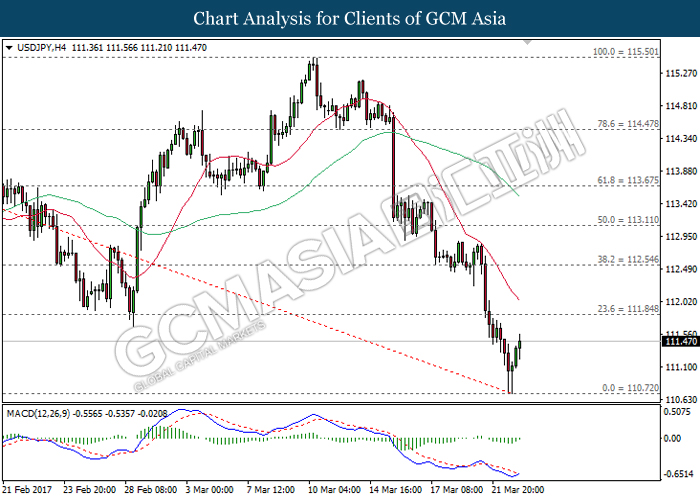

USDJPY

USDJPY, H4: USDJPY was traded higher following a successful rebound near the support level of 100.70. With regards to the downward signal line from MACD histogram which begins narrow upwards, USDJPY is expected to be traded higher in the short-term as technical correction. Otherwise, long-term trend direction still suggests USDJPY to extend its downtrend due to downward expansion of both MA lines.

Resistance level: 114.85, 112.55

Support level: 110.70, 110.15

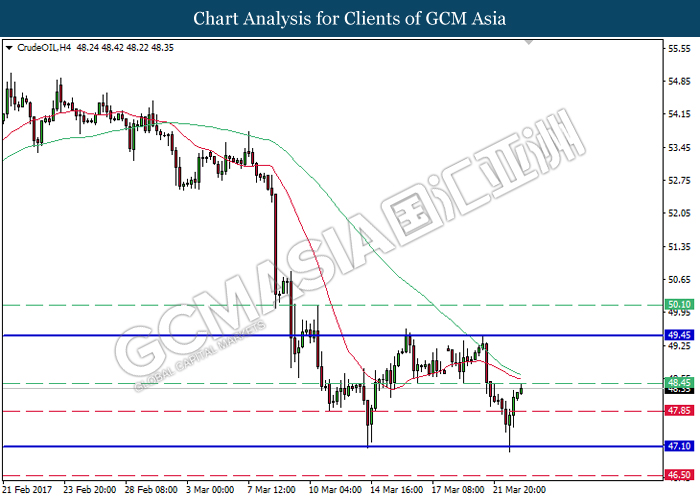

CrudeOIL

CrudeOIL, H4: Crude oil price has shaped a double bottom formation following prior rebound from the strong support level near 47.10. A successful closure above the resistance level of 48.45 would suggest crude oil price to advance towards the neckline at 49.45 thereafter.

Resistance level: 48.45, 49.45, 50.10

Support level: 47.85, 47.10, 46.50

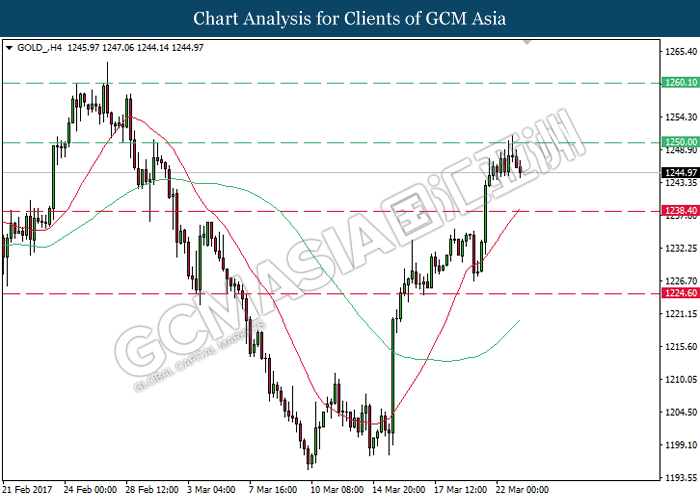

GOLD

GOLD_, H4: Gold price was traded lower following prior unsuccessful attempt to close higher than the strong resistance level of 1250.00. Thus, recent retracement would suggest gold price to experience brief retracement period and could be traded lower in the short-term. Long-term trend direction still suggests gold price to extend its uptrend due to upward expansion of both MA lines.

Resistance level: 1250.00, 1260.10

Support level: 1238.40, 1224.60