23 March 2023 Afternoon Session Analysis

UK inflations soars, GBP bounce back to January level.

The British Pound is one the most popular traded currency bounce back to the January level after the UK inflation soared. The UK inflation is expected to move sharply lower at the end of Q2, due to lower energy costs, and inflation is expected to hit 2.9% at the end of the year by the Office for Budget Responsibility (OBR). However, the headline inflation of the UK broke a three-month downtrend and rose in February, rising to 10.4% compared to 10.1% in January and market expectations of 9.9%. While the core inflation rose to 6.2% from 5.8% above market expectations. According to the Office for National Statistics (ONS), price increases in restaurants, hotels, food and non-alcoholic beverages, and clothing and footwear are primarily attributed to the annual inflation rate. An out-of-expectations data prompted the Bank of England (BoE) might more aggressively hike interest rate as the labor market remains resilient amid 50 years lower unemployment rate. Investors are awaiting a more clear signal from BoE’s upcoming monetary policy decision today. As of writing, the GBP/USD gained 0.53% to $1.2329.

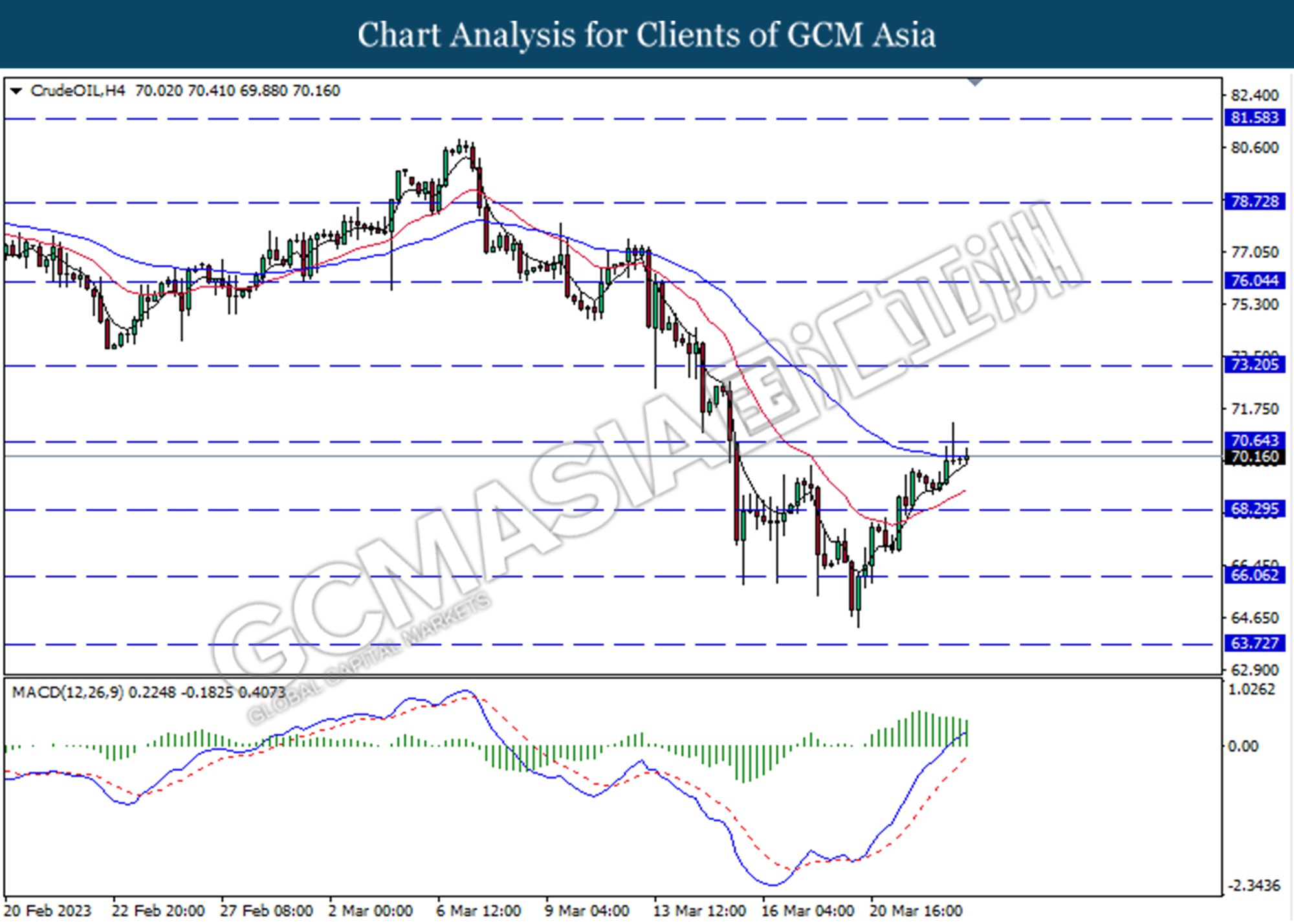

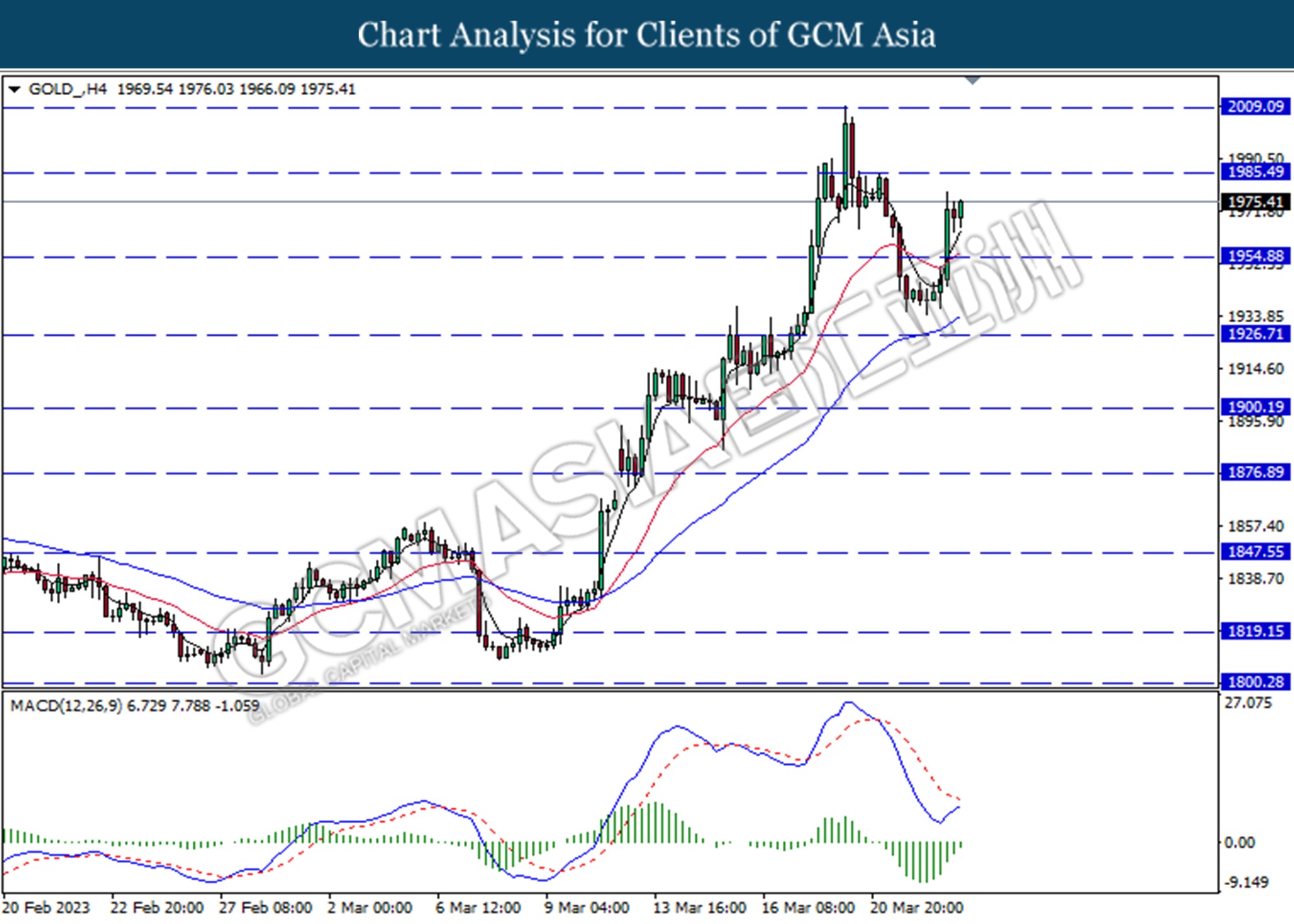

In the commodity market, the crude oil price dropped by 1.16% to $70.07 per barrel as of writing on weak Fed signals and OPEC uncertainty. According to Reuters, OPEC countries are likely to keep output changed during the April meeting and will maintain the previously announced 2 million barrel per day cut. Besides, the gold price rose by 1.65% to $1981.75 per troy ounce as of writing as the dollar sinks in value.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:00 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Tentative GBP BOE Inflation Letter

20:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | 1.00% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 4.00% | 4.25% | – |

| 20:00 | USD – Building Permits | 1.339M | – | – |

| 20:30 | USD – Initial Jobless Claims | 192K | 199K | – |

| 22:00 | USD – New Home Sales (Feb) | 670K | 648K | – |

Technical Analysis

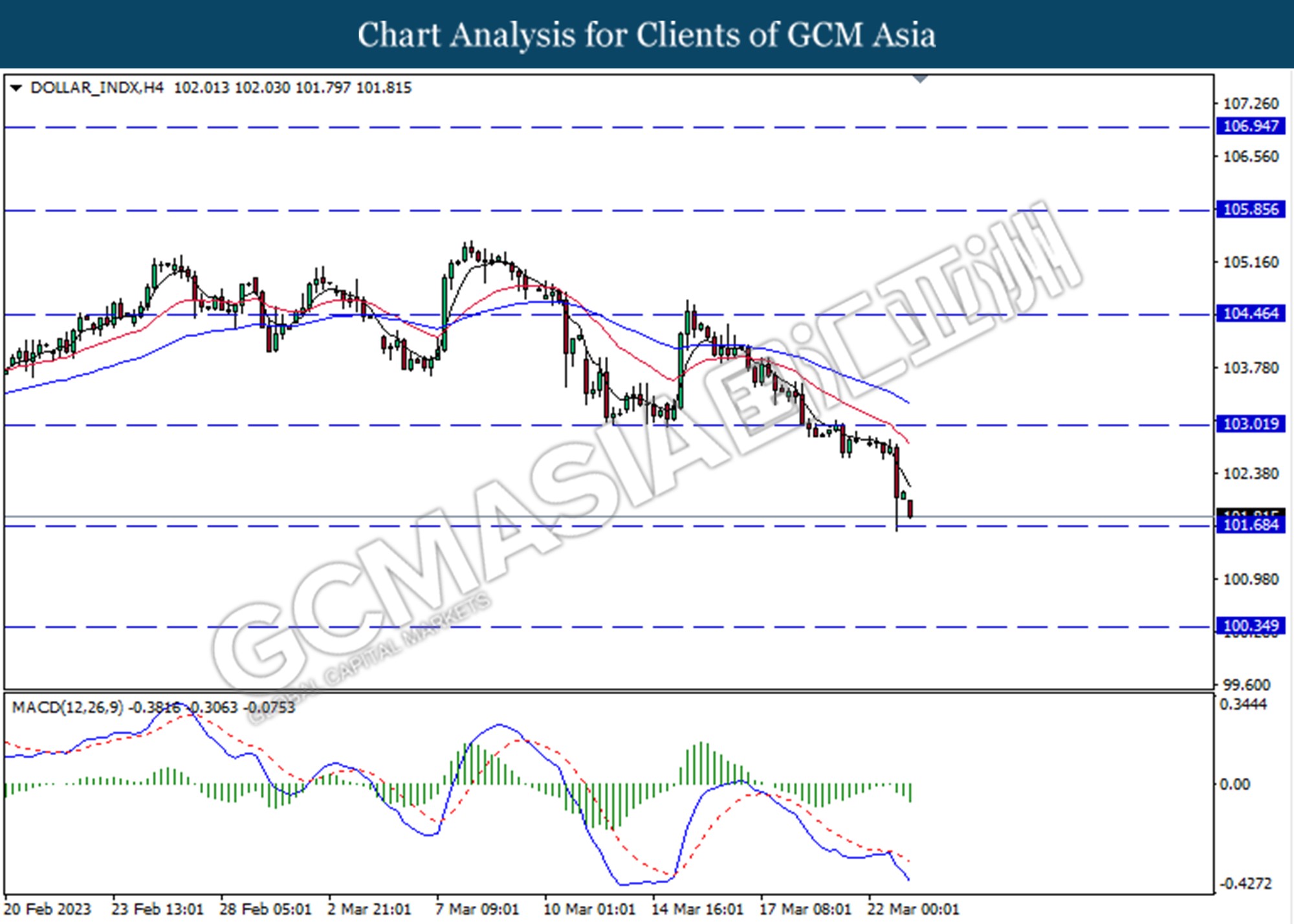

DOLLAR_INDX, H4: Dollar index was traded lower following a retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index to extend its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

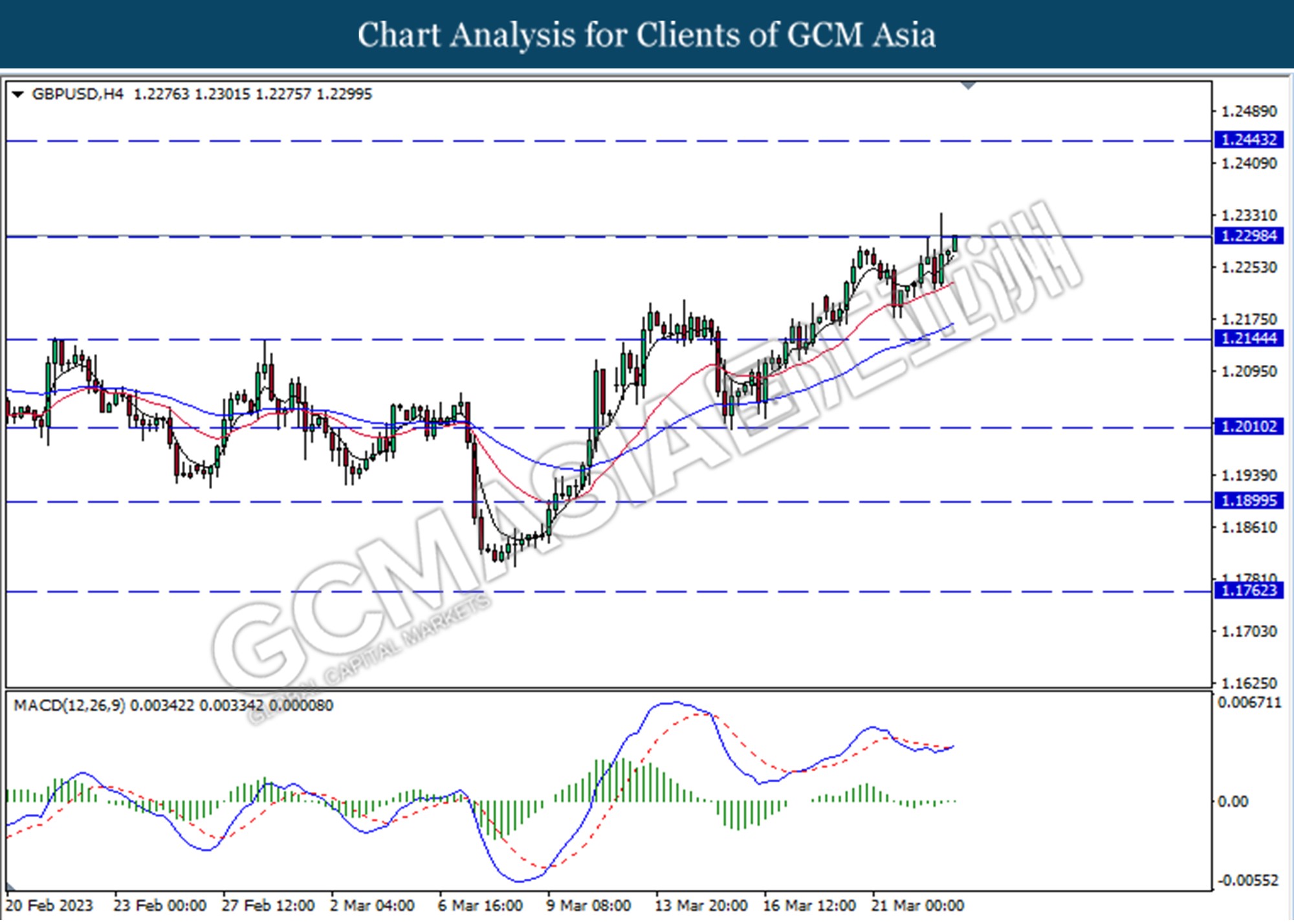

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2300. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

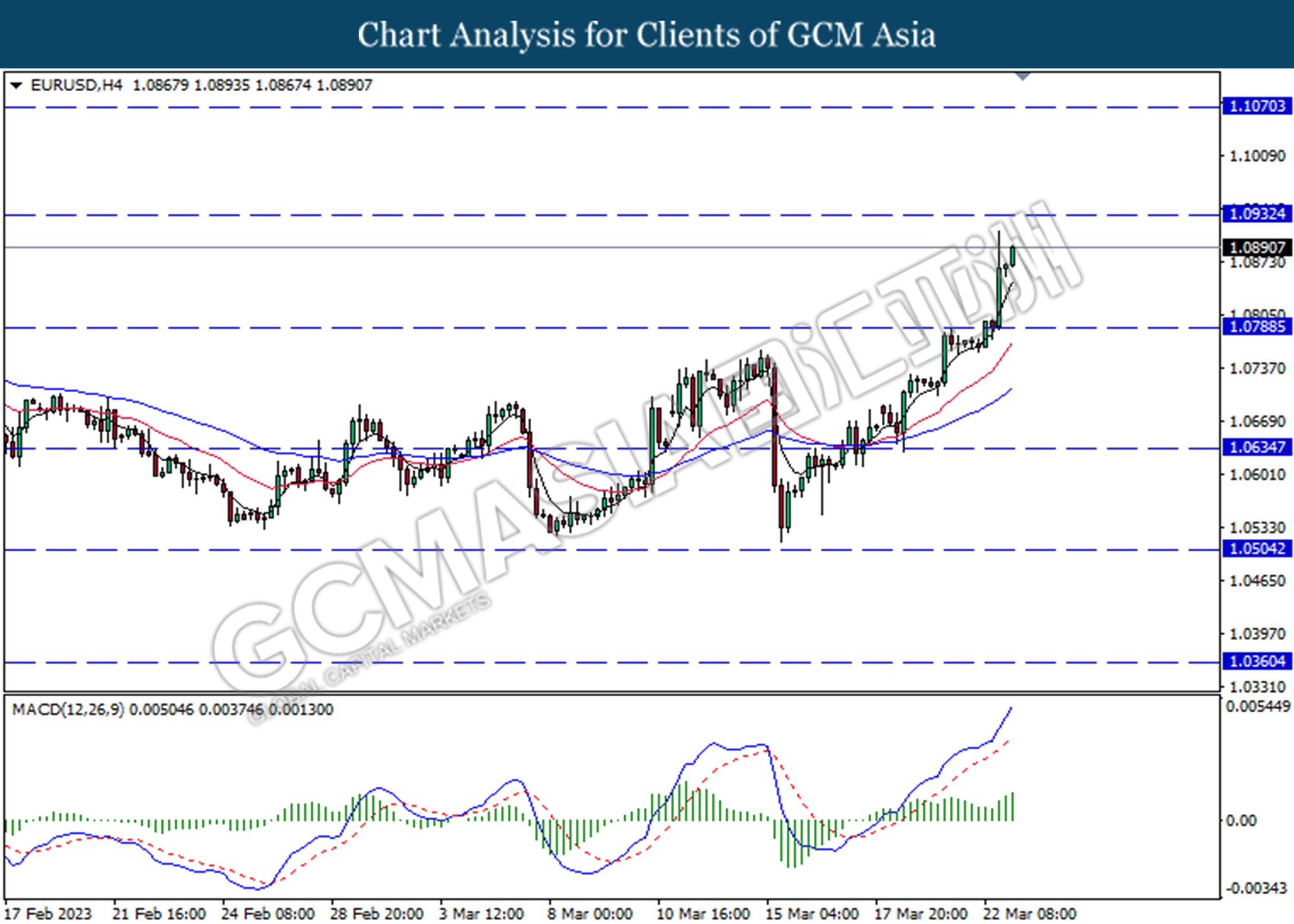

EURUSD, H4: EURUSD was traded higher following a prior break above the resistance level at 1.0790. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

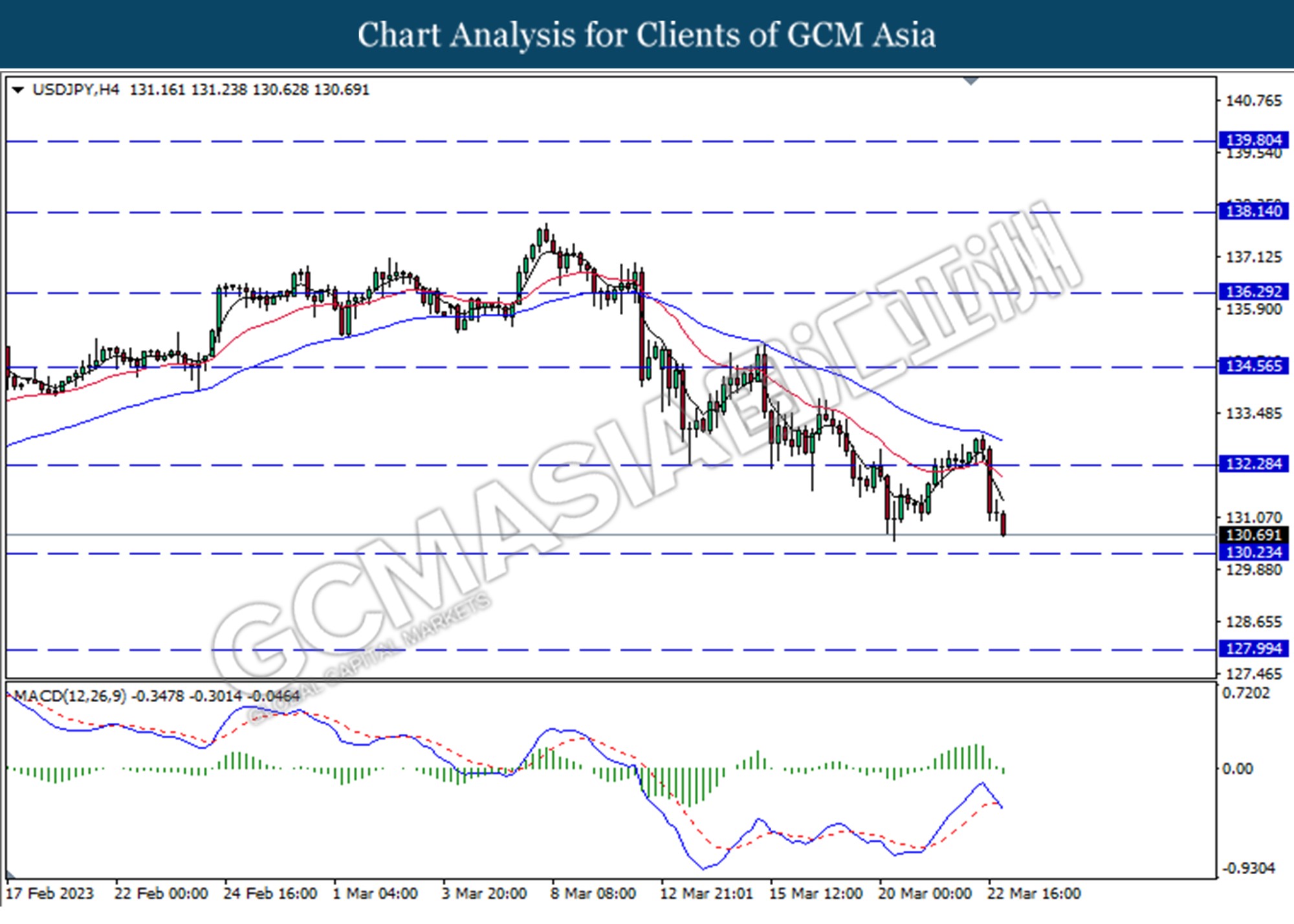

USDJPY, H4: USDJPY was traded lower following a prior break below the previous support level at 132.30. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 130.25.

Resistance level: 132.30, 134.60

Support level: 130.25, 128.00

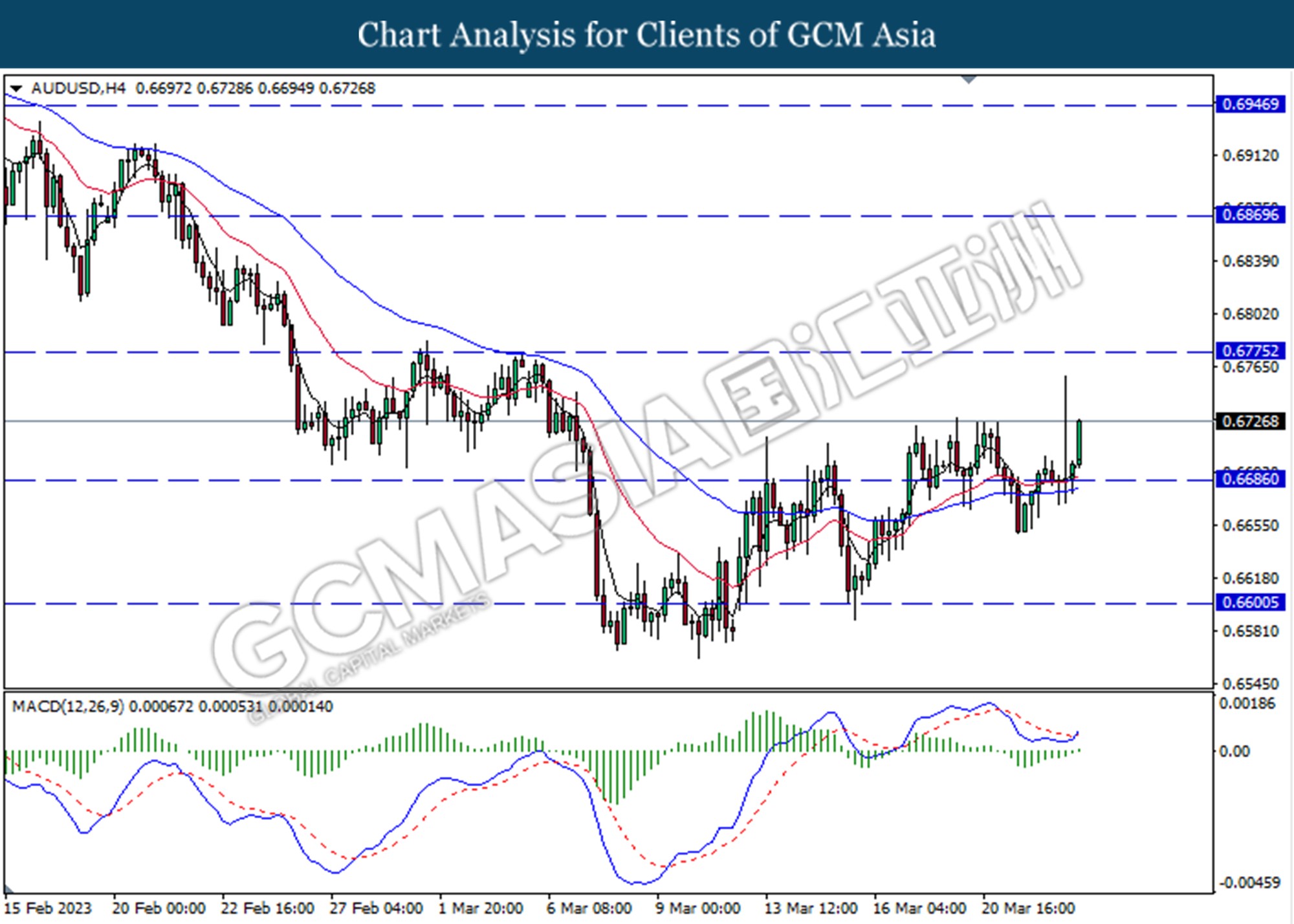

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6685. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

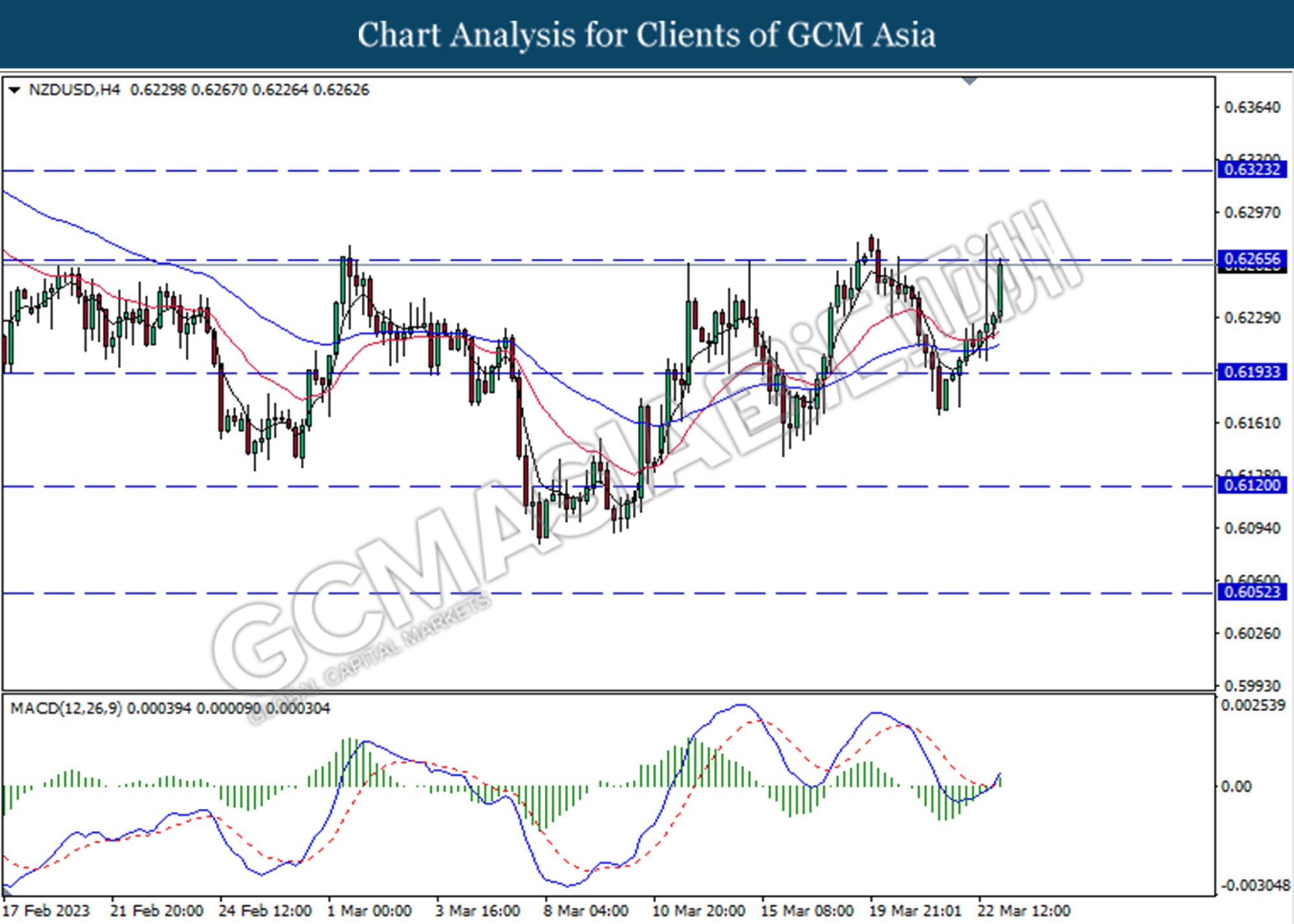

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains if breaks above the resistance level.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

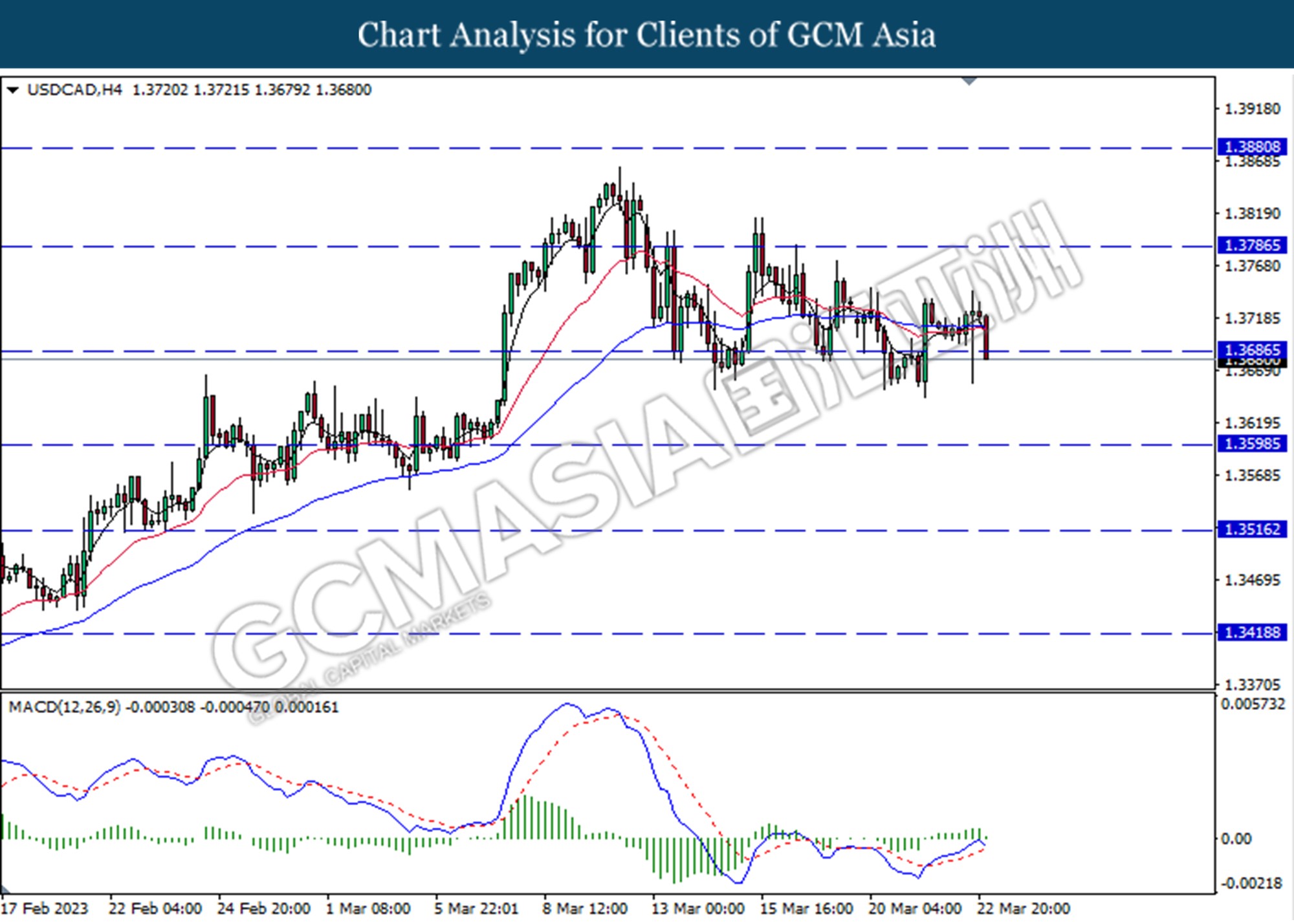

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3685. MACD which illustrated diminishing bullish momentum suggests the pair extend its losses toward the support level at 1.3600.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

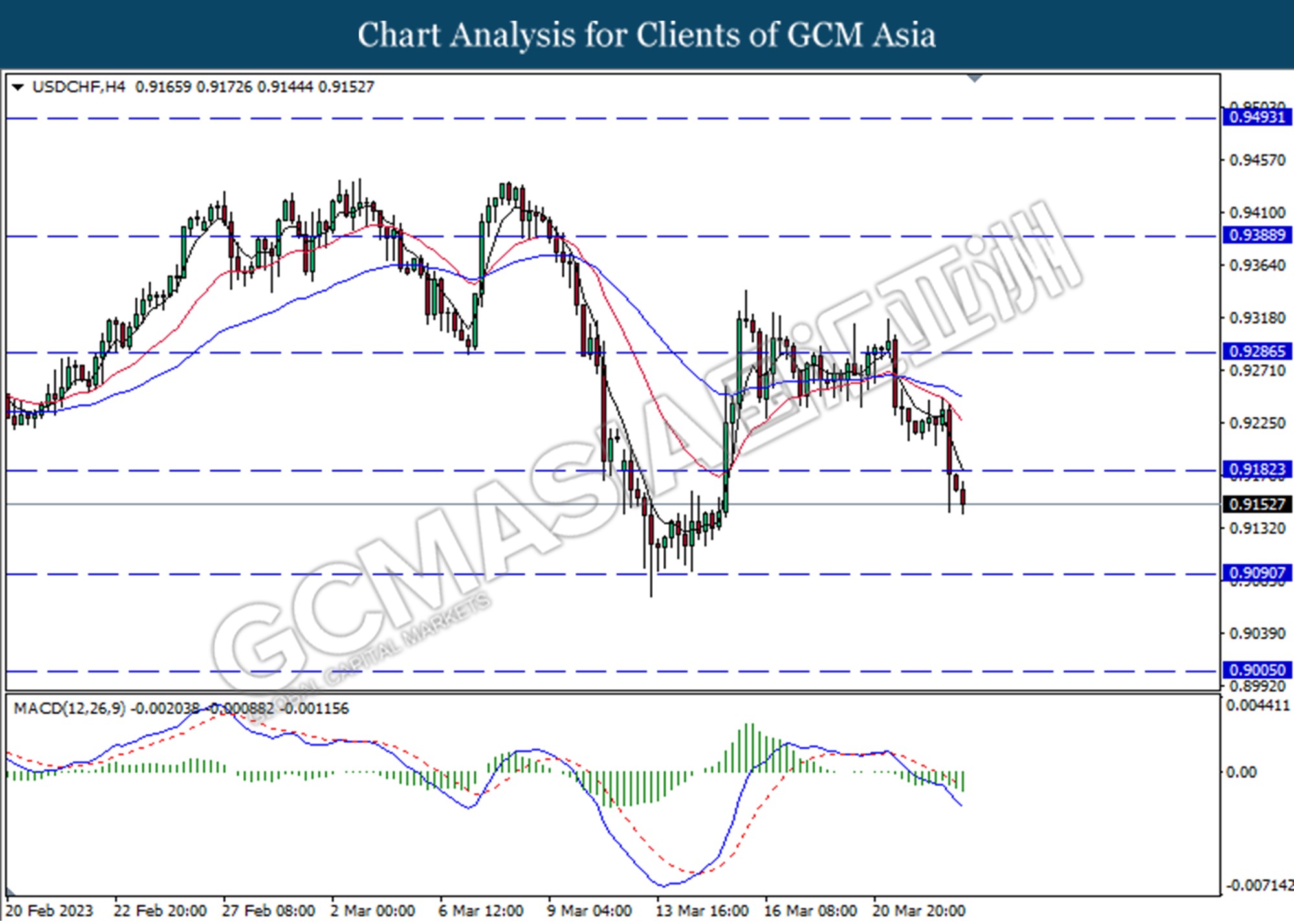

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9182. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9090.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 68.30, 66.05

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 1954.90. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 1985.50.

Resistance level: 1954.90, 1985.50

Support level: 1926.70, 1900.20