23 March 2023 Morning Session Analysis

US Dollar plunged as rate hike might come to the end.

The Dollar Index which traded against a basket of sis major currencies slumped on Thursday after Fed released its interest rate decision. Earlier of the day, the US central bank decided to raise its cash rate by 25 basis point to 5.00%, which achieved the anticipation of consensus. After that, the following Press Conference that presented by Fed Chairman has given some clues on future rate hike path. The Federal Reserve Chair Jerome Powell has claimed that it might be one more rate hike would be implemented by the end of 2023. However, he also signaled that could represent an initial stopping point for the rate hike path. Prior to that, the bankruptcy of Silicon Valley Bank (SVB) and Signature Bank had shown that the recession in the US was becoming more serious, whereas another historical financial crisis would likely to occur. With that, Fed officials decided to scale down the rate hike pace in order to avoid the exacerbation of banking crisis, while dragging down the appeal of US Dollar. Nonetheless, it is note-worthy that the inflation fight does not over, said Jerome Powell. As of writing, the Dollar Index depreciated by 0.69% to 102.18.

In the commodity market, the crude oil price dropped by 1.16% to $70.07 per barrel as of writing following the crude oil inventories shown a stockpiles. According to EIA, the US Crude Oil Inventories increased by 1.117M barrels, which exceeding the market consensus. On the other hand, the gold price rose by 1.23% to $1970.50 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:00 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Tentative GBP BOE Inflation Letter

20:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | 1.00% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 4.00% | 4.25% | – |

| 20:00 | USD – Building Permits | 1.339M | – | – |

| 20:30 | USD – Initial Jobless Claims | 192K | 199K | – |

| 22:00 | USD – New Home Sales (Feb) | 670K | 648K | – |

Technical Analysis

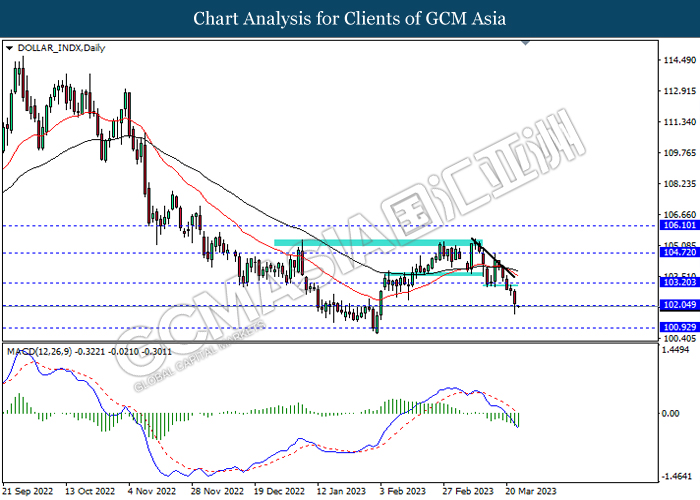

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses of successfully breakout the support level.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

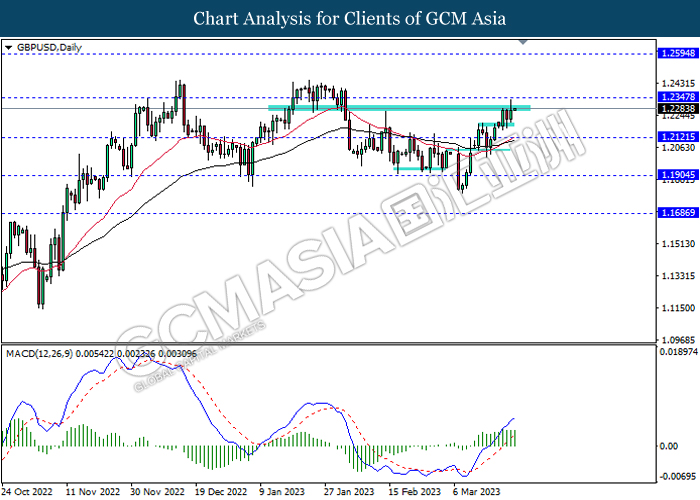

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

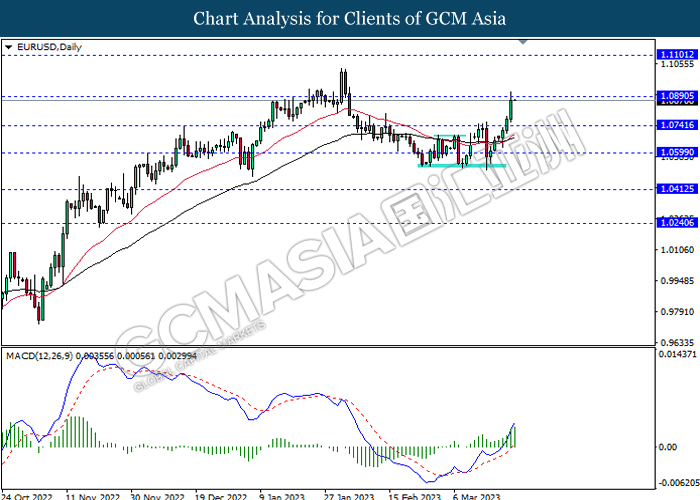

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

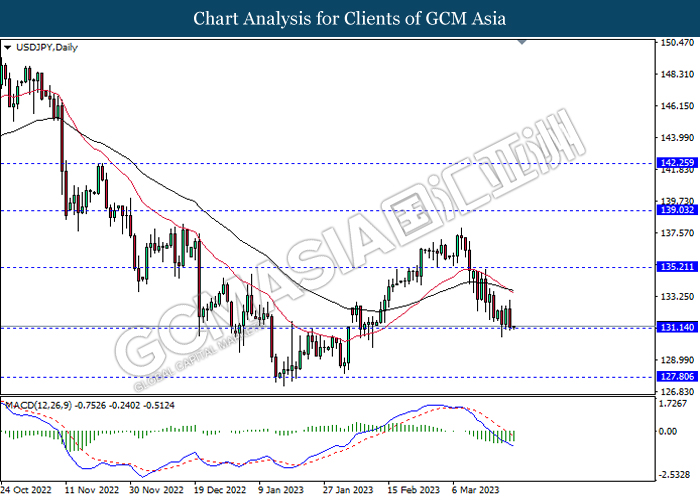

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

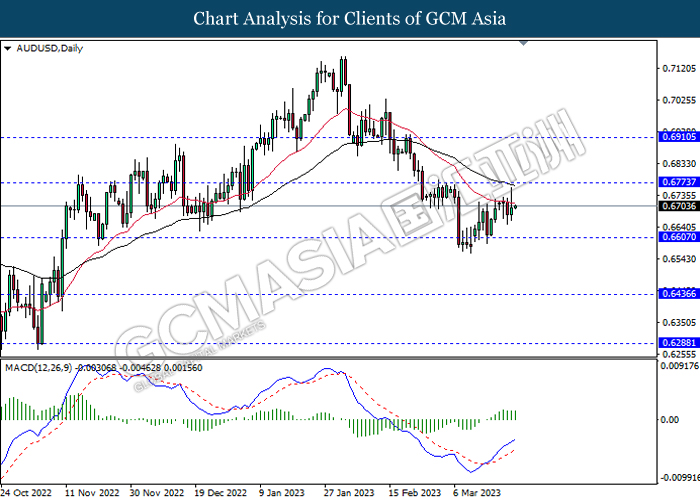

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

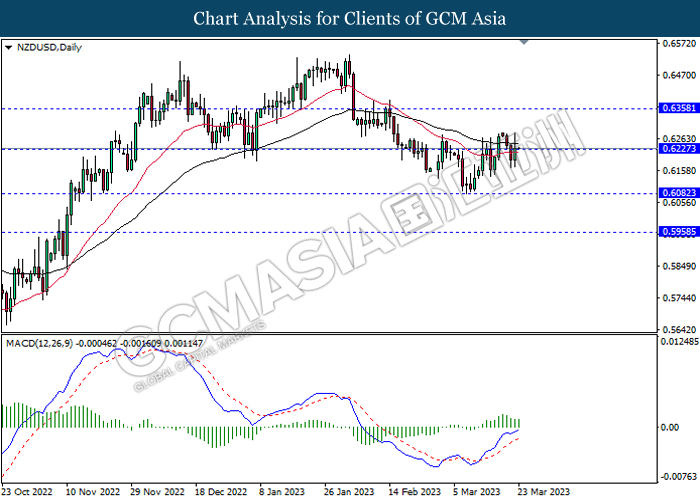

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

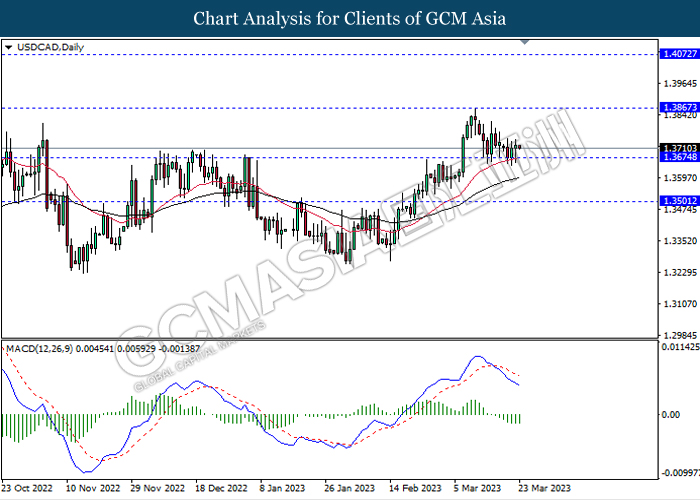

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

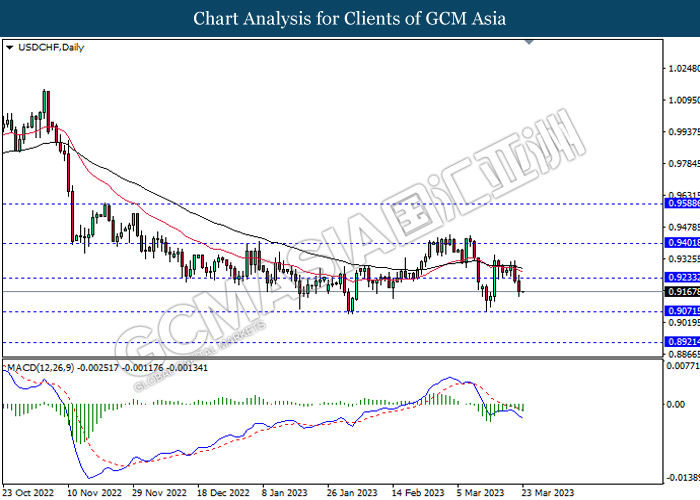

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

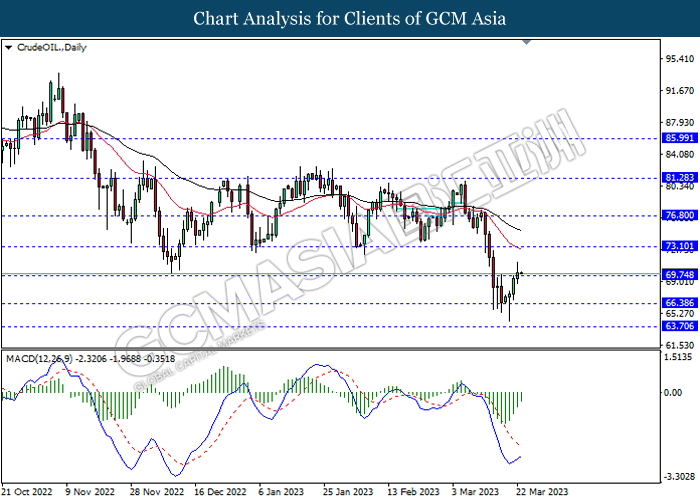

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 73.10, 76.80

Support level: 69.75, 66.40

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1987.85, 2042.65

Support level: 1948.50, 1897.85