23 May 2023 Afternoon Session Analysis

The Japanese Yen strengthened after upbeat PMI data.

The Japanese Yen traded against the greenback was strengthened after upbeat PMI data. Following a strong Q1 GDP reading recently, May recent data in service PMI and manufacturing PMI continued to indicate an expansion. The May service PMI grew to 56.3 from 55.4 in April, while the economists expect the reading to decline to 55.2 after the peak of the 2023 cherry blossom season had passed in May. According to Markit Economics report, despite the cherry blossom season has passed, a survey in May reflected a sustained growth in private consumption and tourism section amid tourism recovery after COVID-19. Meanwhile, the manufacturing PMI revise from contraction to expansion for the first time after six months. The reading marks at 50.8 as the market expects the same figures of 49.5 as the prior month. Growth in Japan’s manufacturing sector was boosted by improving supply chain conditions and higher demand in commodity-producing sectors. As a result, the PMI priced index signal that inflation will be elevated in May. It could also bring the BOJ governor to an early end to monetary easing. As of writing, the USDJPY was tickled down by -0.01% to 138.59.

In the commodities market, crude oil prices extended gains by 0.12% to $72.16 per barrel as EIA expects demand to exceed supply in the following months. Besides, gold prices slipped by -0.74% to $1957.28 per troy ounce amid the dollar strengthened after investors optimists on debt ceiling talks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI | 54.9 | 54.6 | – |

| 16:30 | GBP – Manufacturing PMI | 47.8 | 48.0 | – |

| 16:30 | GBP – Services PMI | 55.9 | 55.5 | – |

| 20:00 | USD – Building Permits | 1.430M | 1.416M | – |

| 21:45 | USD – Manufacturing PMI (May) | 50.2 | 50.0 | – |

| 21:45 | USD – Services PMI (May) | 53.6 | 52.6 | – |

| 22:00 | USD – New Home Sales (Apr) | 683K | 663K | – |

Technical Analysis

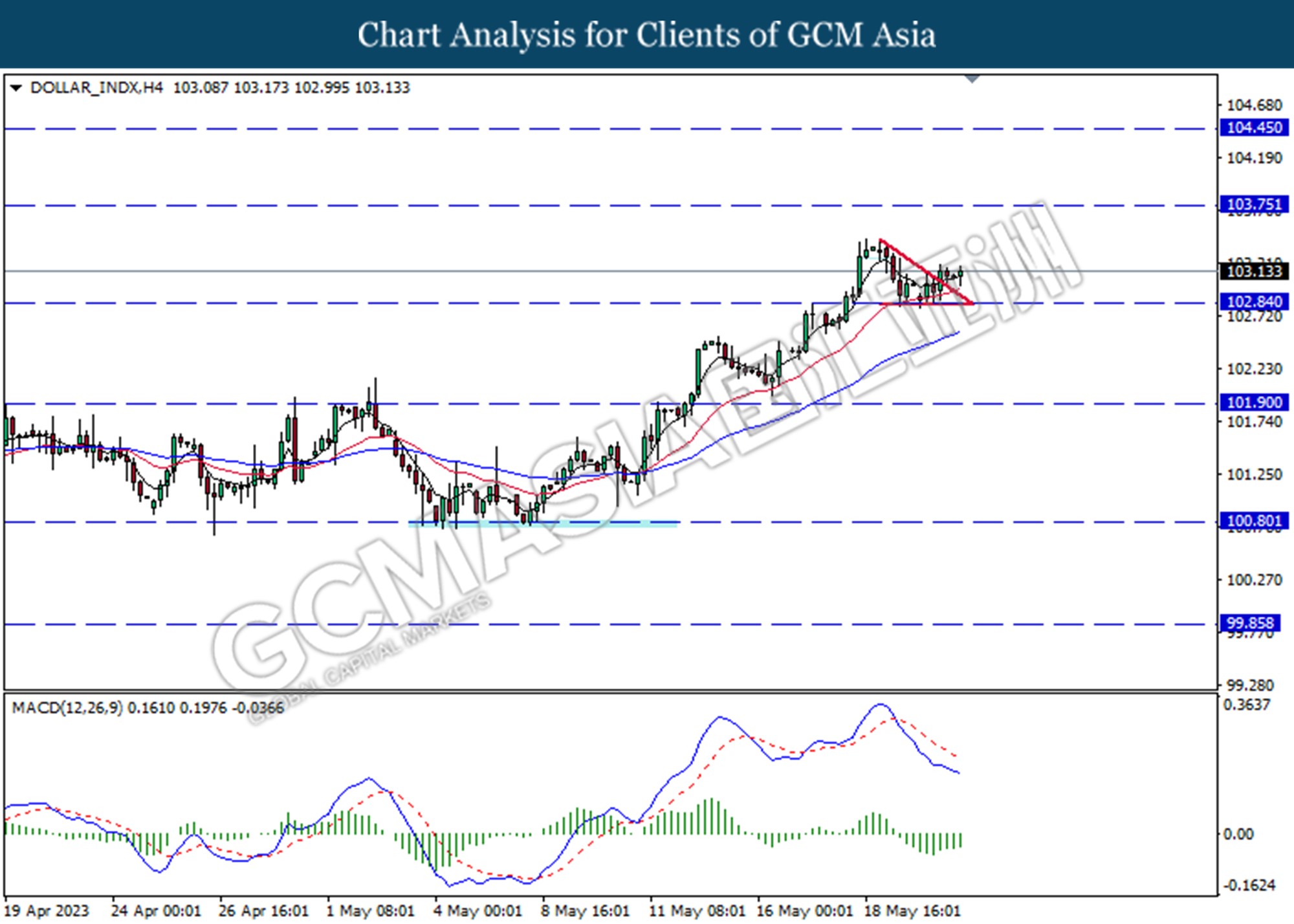

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from support level at 102.85. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 103.75.

Resistance level: 103.75, 104.45

Support level: 102.85, 101.90

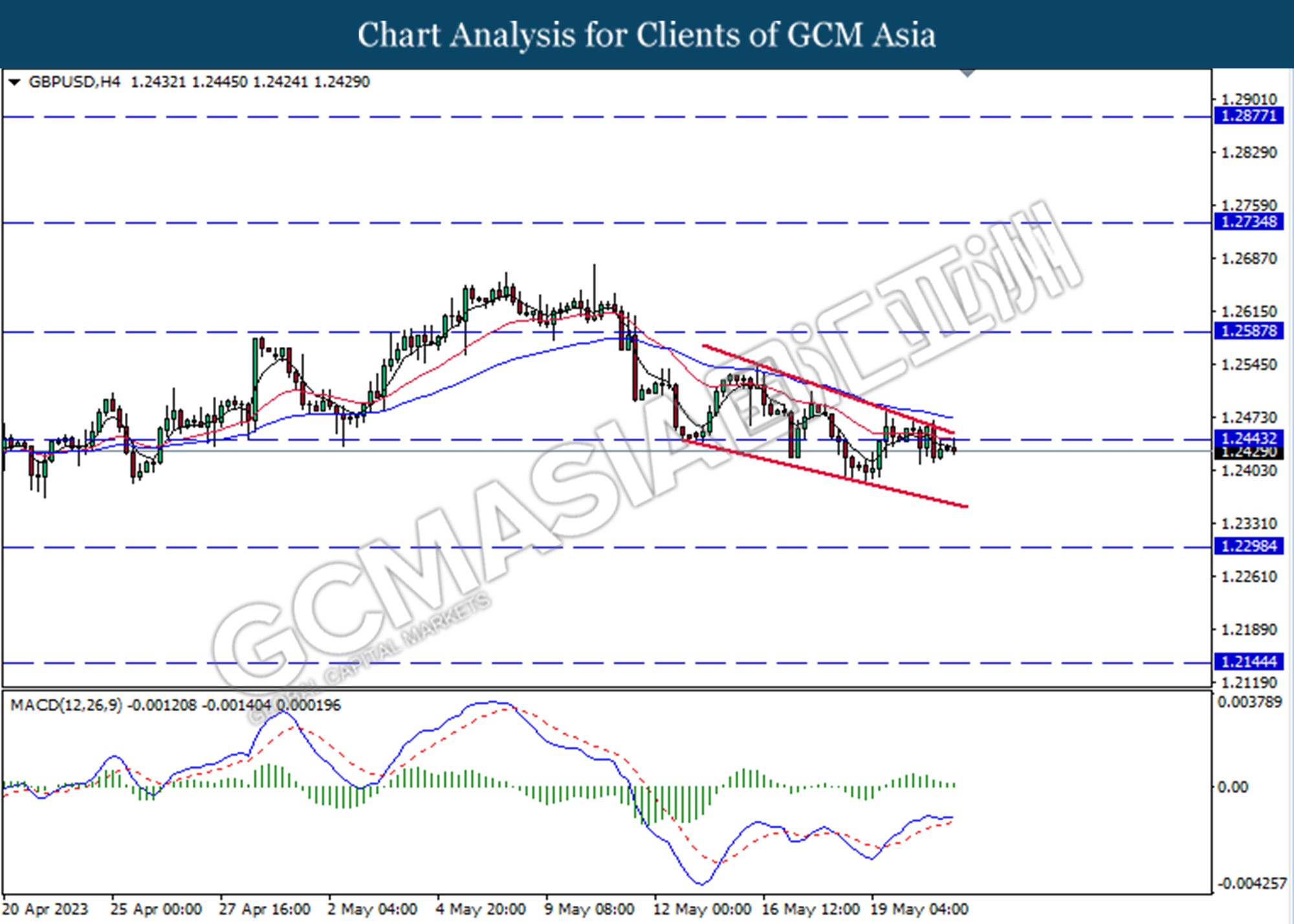

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2445. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

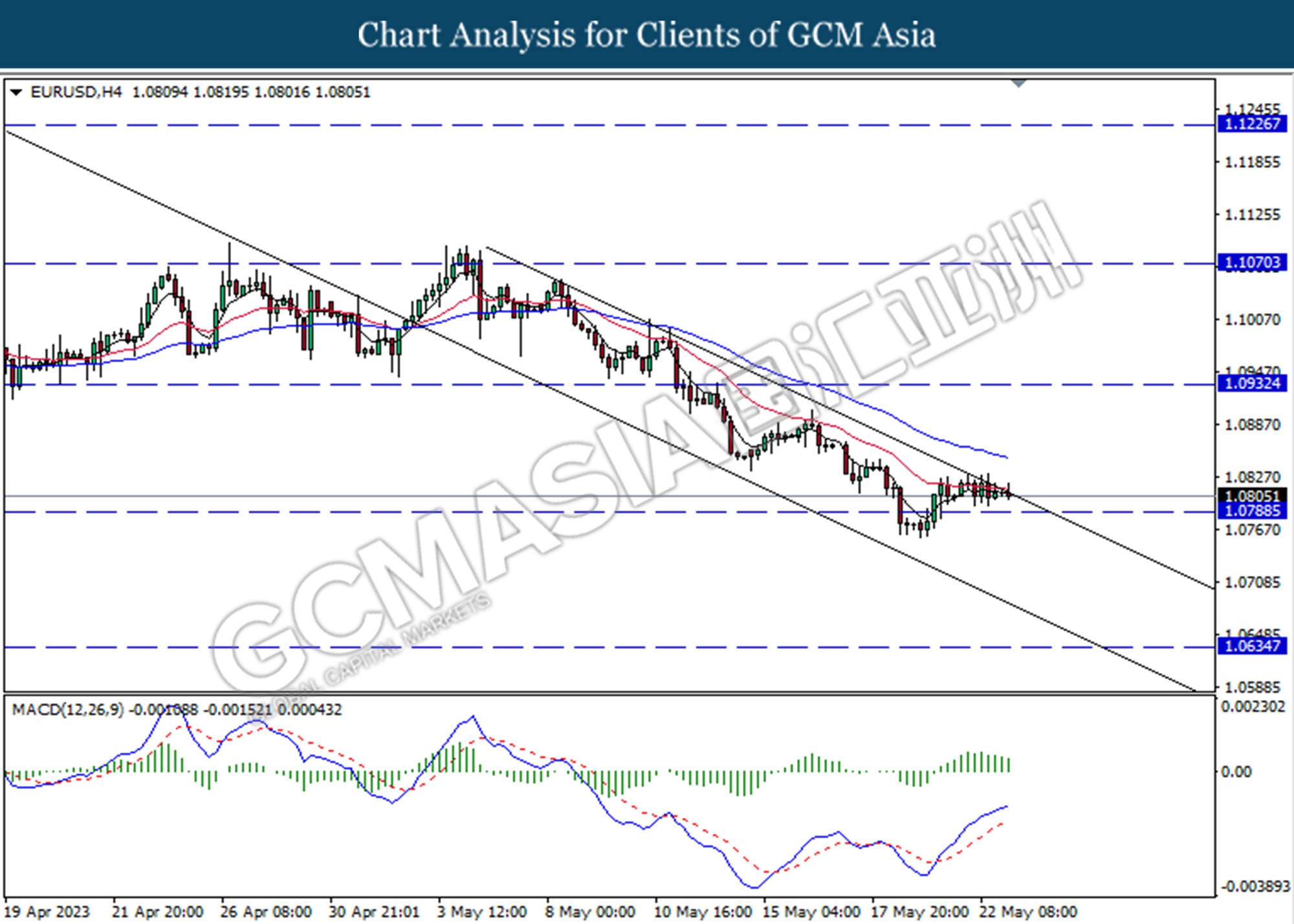

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.0790.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

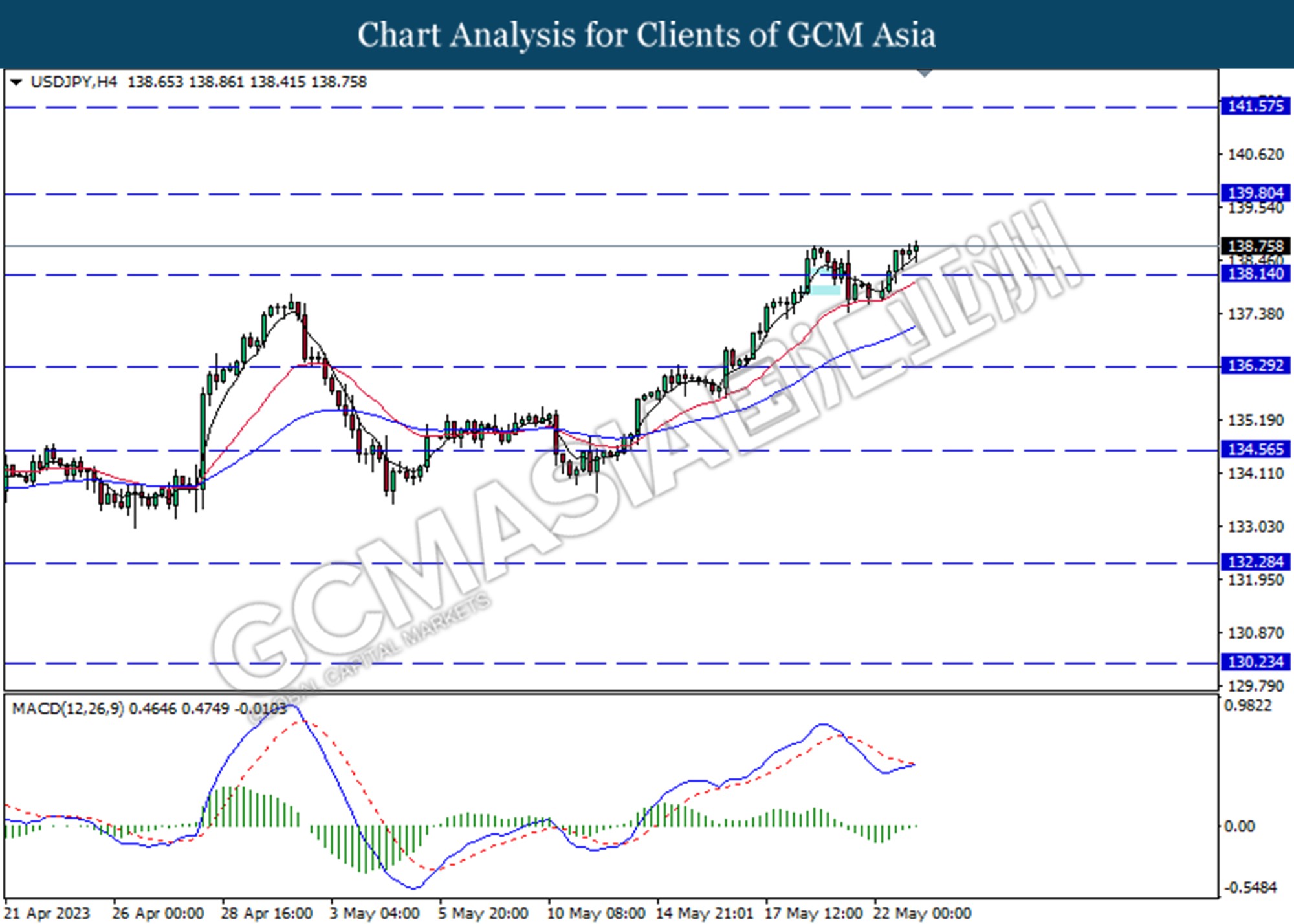

USDJPY, H4: USDJPY was traded higher following the prior breaks above the previous resistance level at 138.15. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 139.80.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

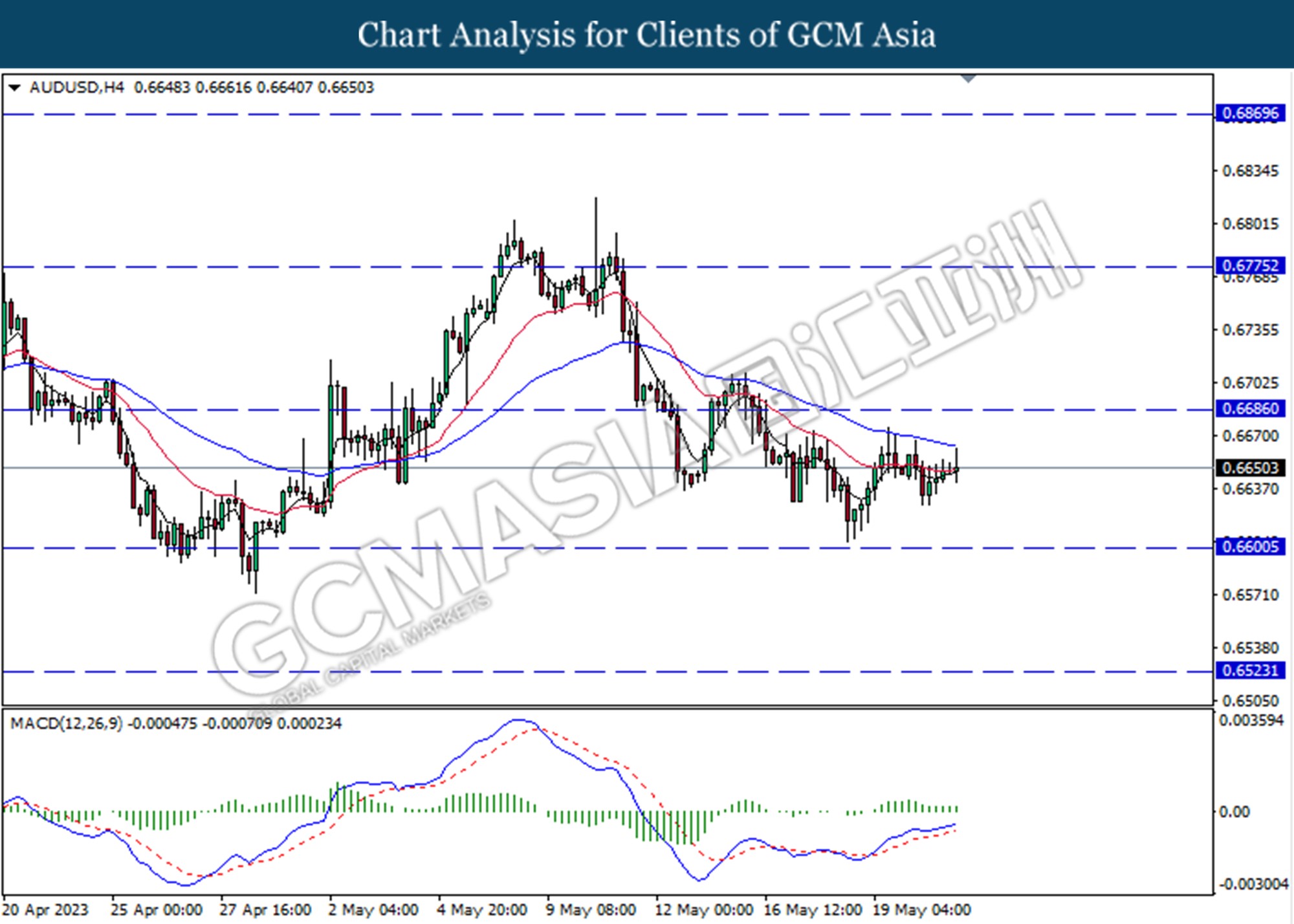

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6685, 0.6775

Support level: 0,6600, 0.6525

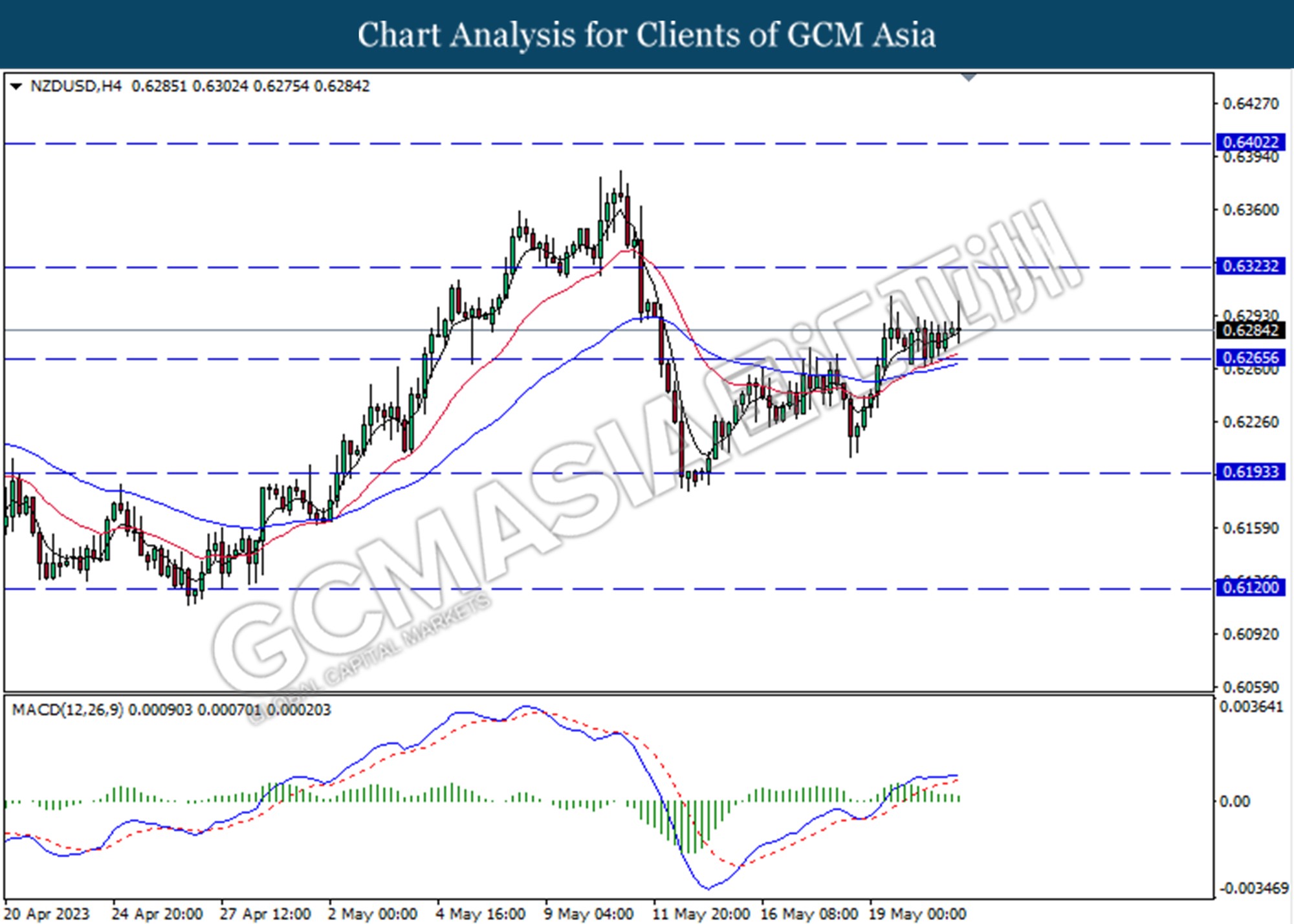

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6265. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

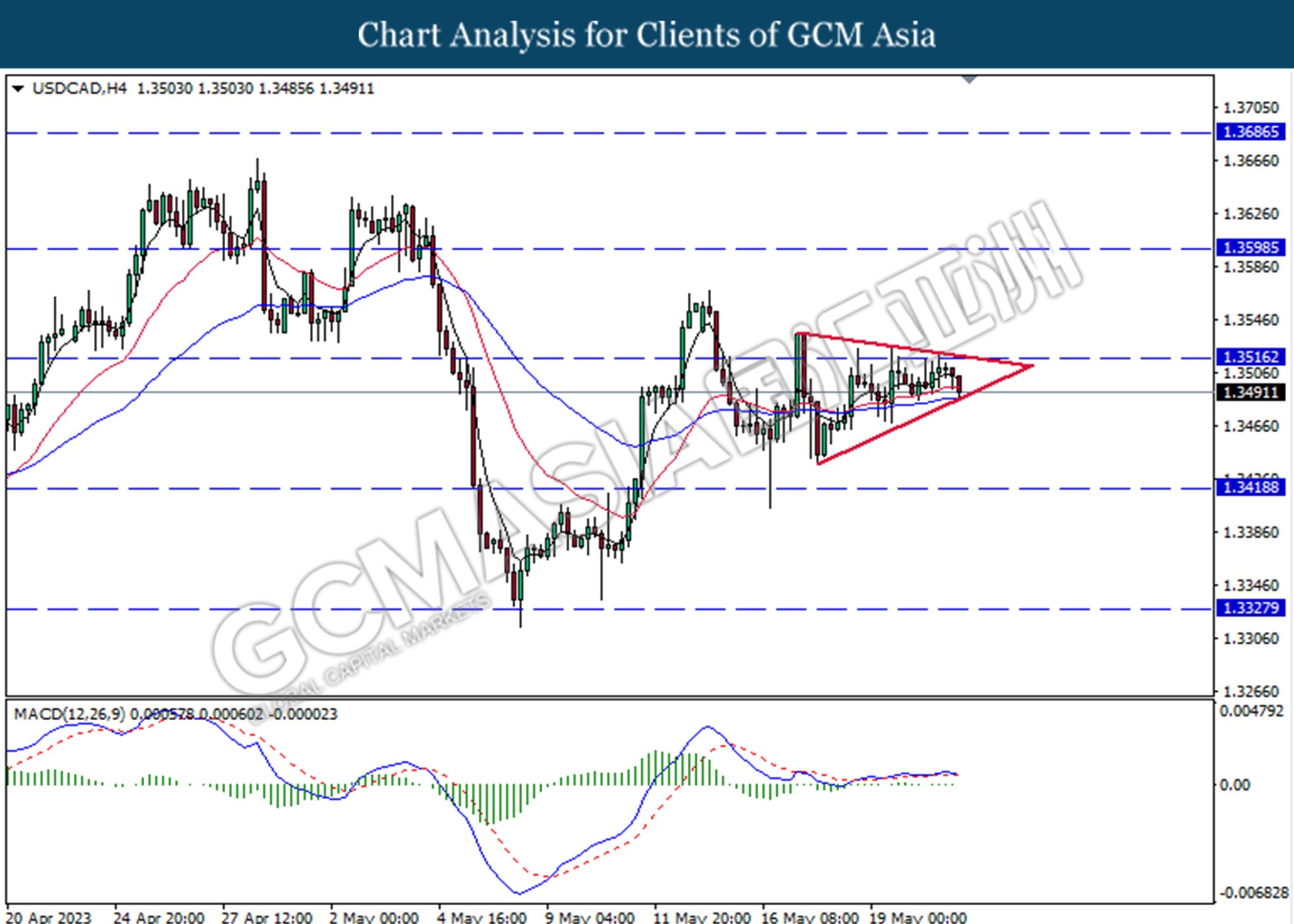

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3515. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

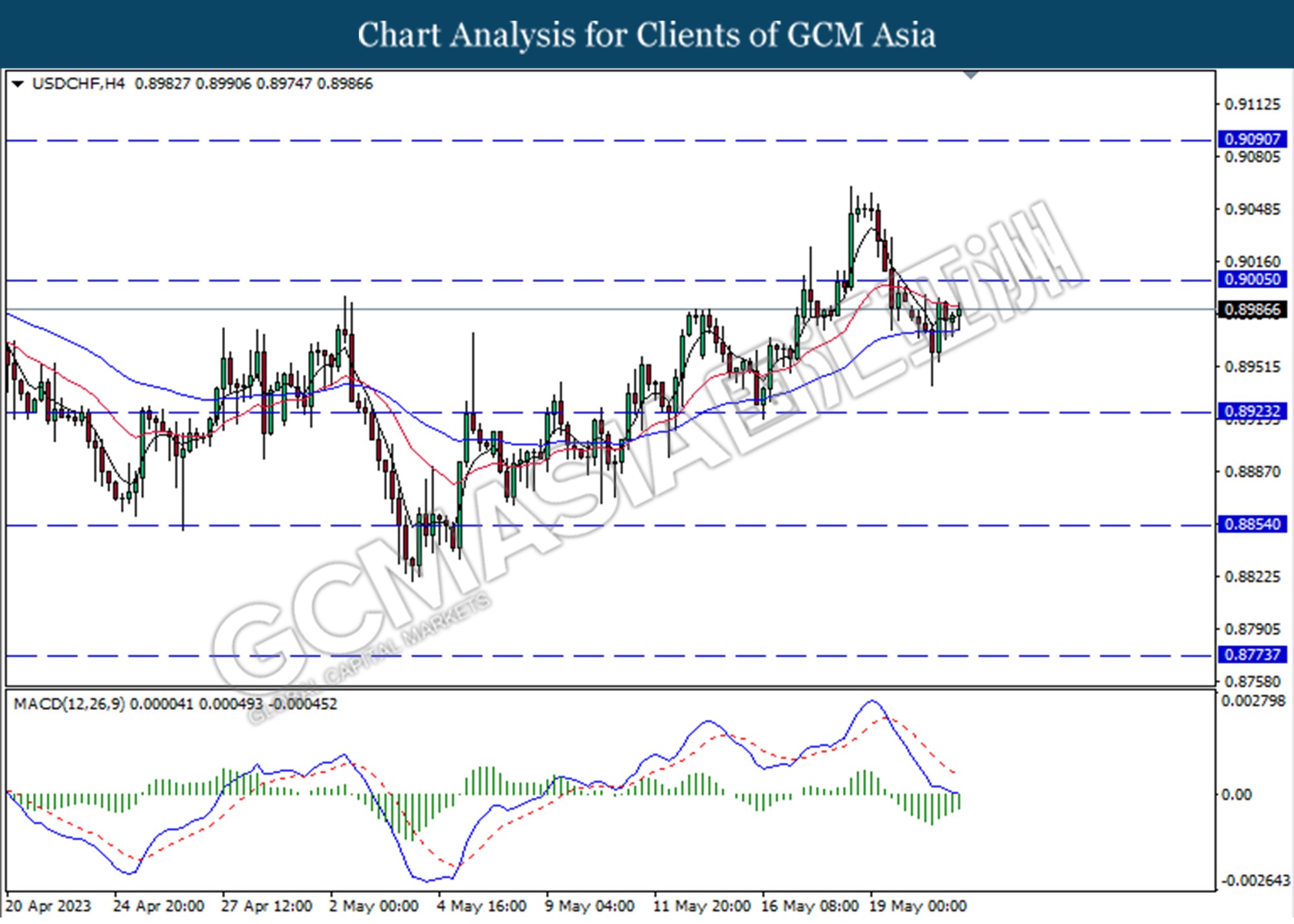

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.9005.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level at 73.20.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

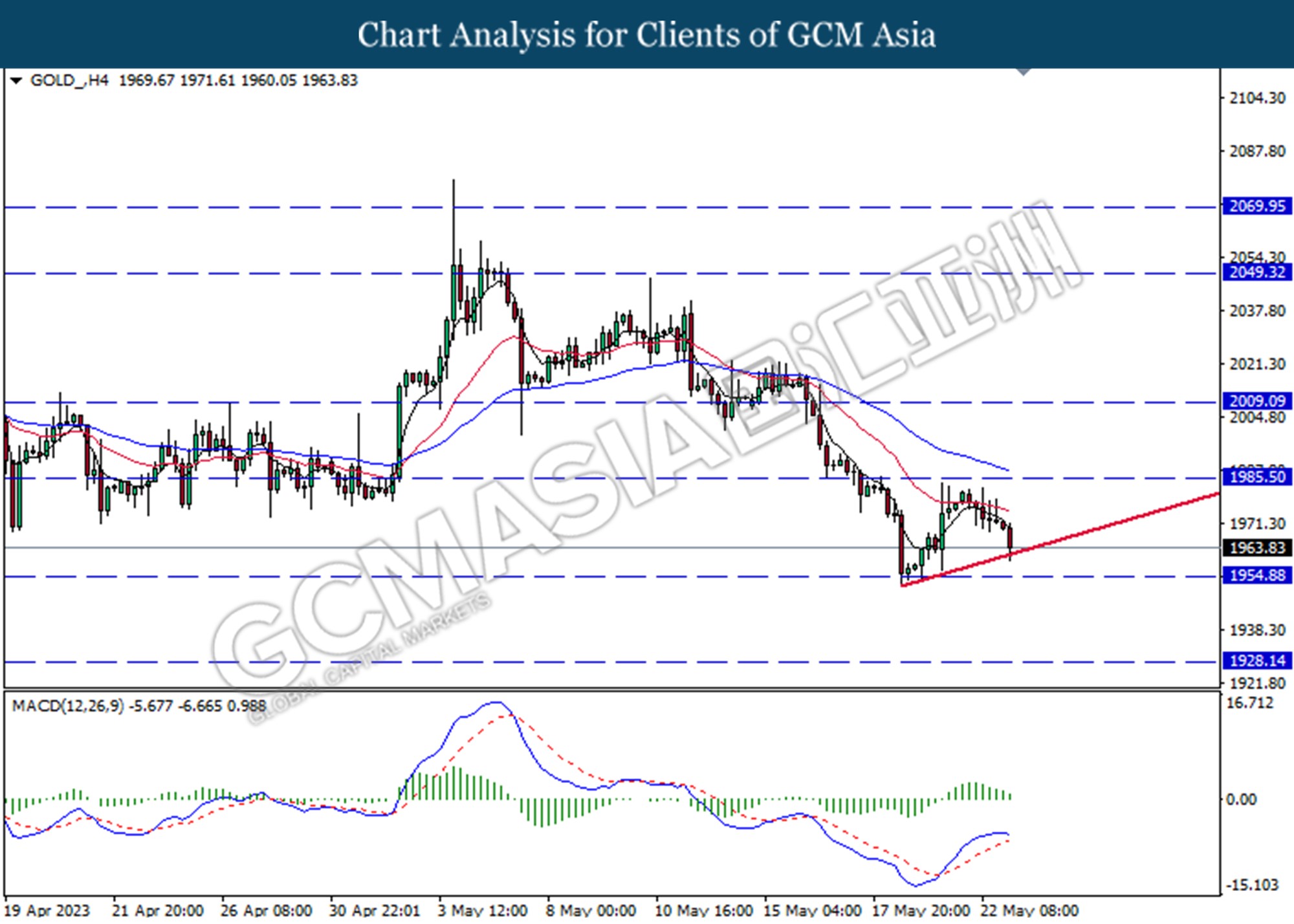

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 1954.90.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15