23 June 2020 Afternoon Session Analysis

Aussie fell amid uncertainty between US – China.

The Aussie dollar which traded against the greenback and other currency pairs have slipped during late Asian session as the worsening tension between U.S and China continue to pressure the market. Earlier today, White House advisor Peter Navarro have stated that the trade deal between the U.S and China is over. Navarro told Fox News: “It’s over, they came here on January 15th to sign that trade deal, and that was a full two months after they knew the virus was out and about,”. The market reaction was swift towards the news and prompt sellers to drag down the value. However, US Economic Advisor Larry Kudlow later clarifies that US-China trade deal still remain intact, which caused a confusion among investors. Still, the possibility of trade deal termination could lead to the revival of the trade war between the world’s two biggest economies, thus the uncertainty was weigh on market risk sentiment. At the time of writing, AUD/USD fell 0.05% to 0.6923.

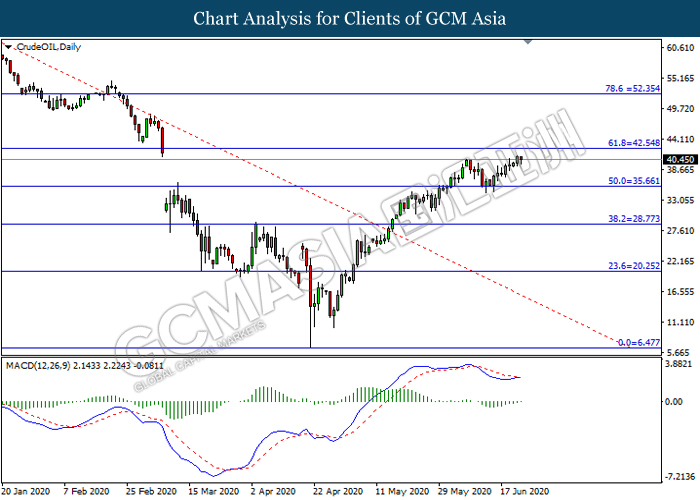

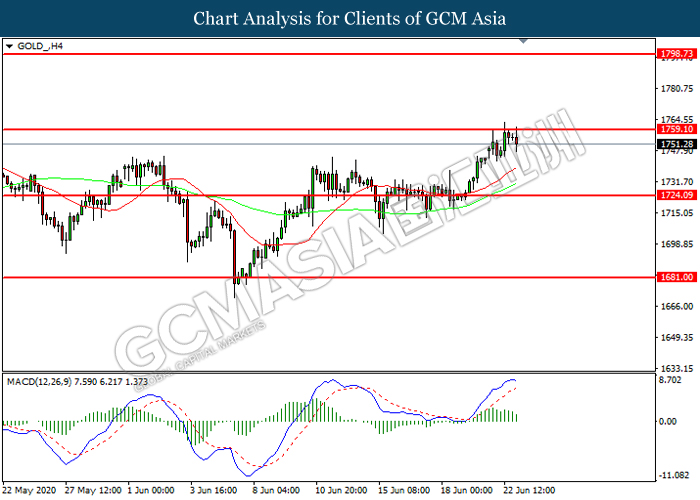

In the commodities market, crude oil price remains strong and edge higher 0.18% to $40.60 per barrel as of writing following demand recovery optimism. Following the reopening of some U.S states and countries around the world after lockdowns, demand for fuel returns as streets such as New York were clogged with traffic. Airlines such as Delta Airlines also resume its flights which prompt for more fuel demand, thus pushing the price. On the other hand, gold price retreats 0.27% to $1749.90 a troy ounce at the time of writing amid rebound in dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Jun) | 36.6 | 41.5 | – |

| 16:30 | GBP – Composite PMI | 30.0 | – | – |

| 16:30 | GBP – Manufacturing PMI | 40.7 | – | – |

| 16:30 | GBP – Services PMI | 29.0 | – | – |

| 22:00 | USD – New Home Sales (May) | 623K | 640K | – |

Technical Analysis

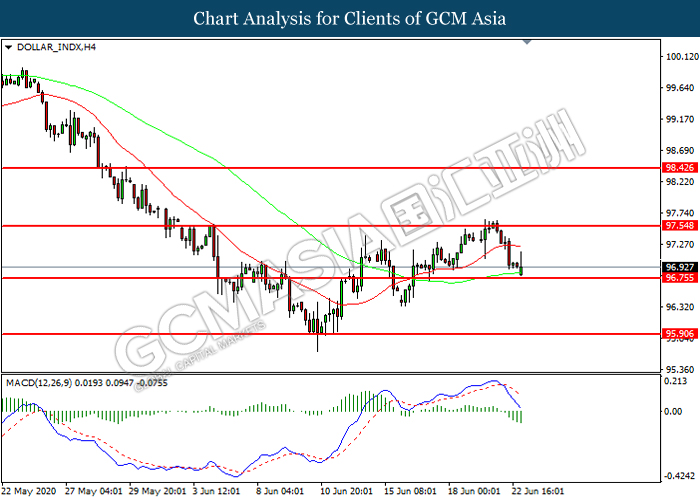

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 96.75. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 97.55, 98.45

Support level: 96.75, 95.90

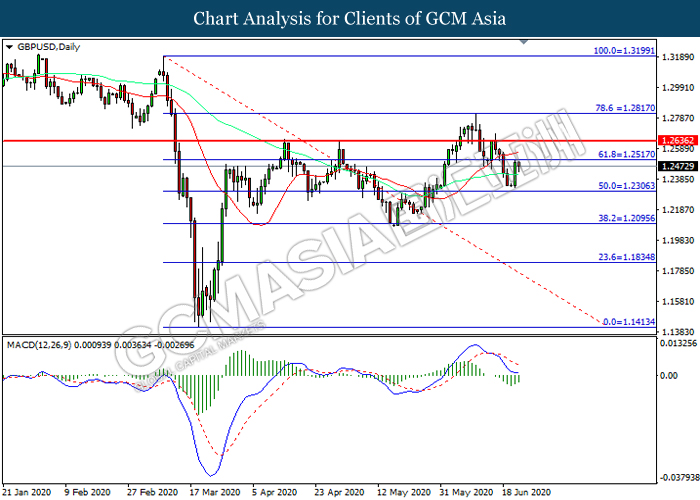

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2515. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2635, 1.2815

Support level: 1.2095, 1.2305

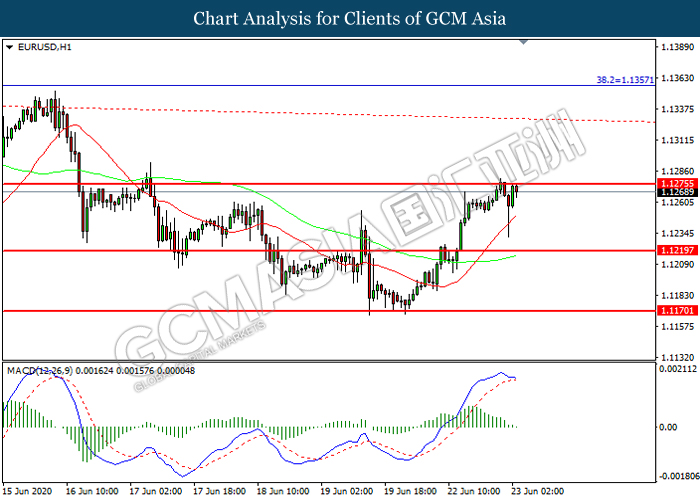

EURUSD, H1: EURUSD was traded higher while currently testing the resistance level at 1.1275. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1225, 1.1355

Support level: 1.1220, 1.1170

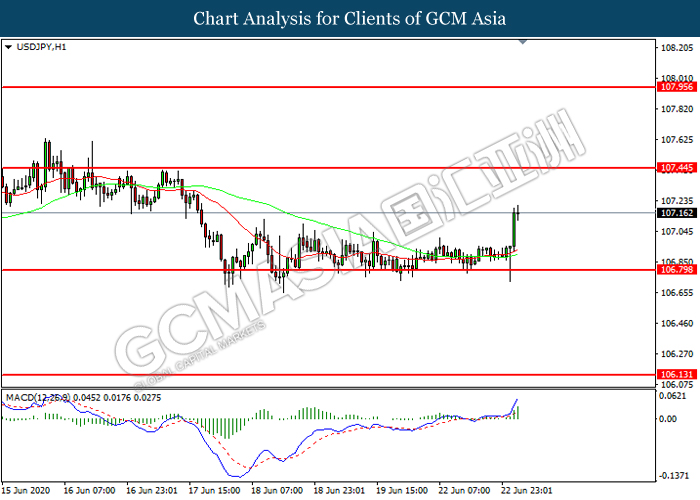

USDJPY, H1: USDJPY was traded higher following prior rebound from the support level at 106.80. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 107.45.

Resistance level: 107.45, 107.95

Support level: 106.80, 106.15

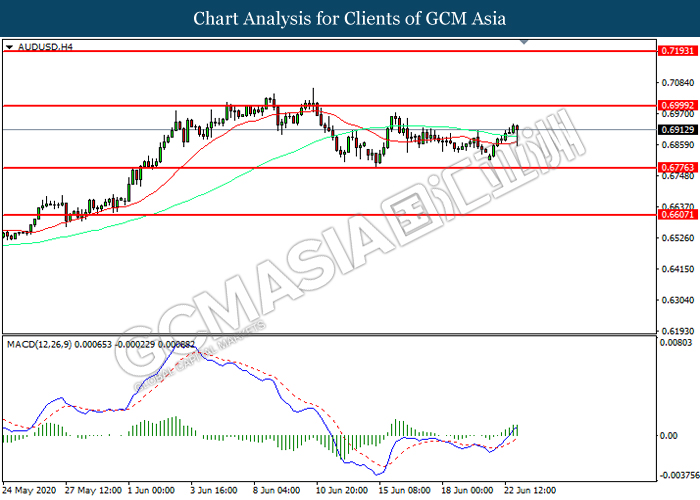

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6775. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7000.

Resistance level: 0.7000, 0.7195

Support level: 0.6775, 0.6605

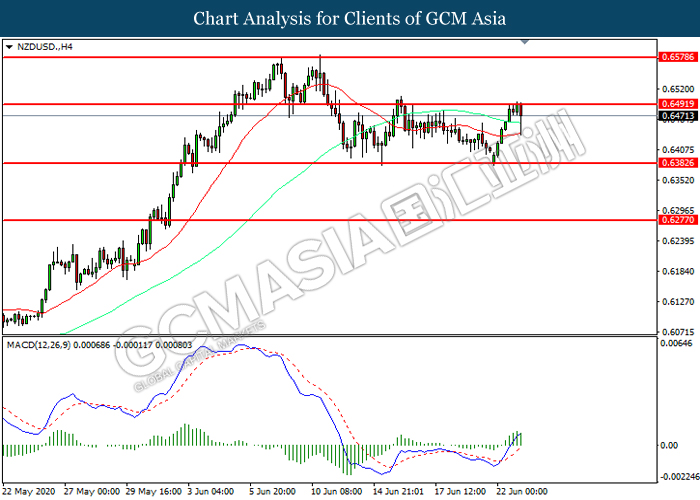

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6490. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6490, 0.6580

Support level: 0.6385, 0.6275

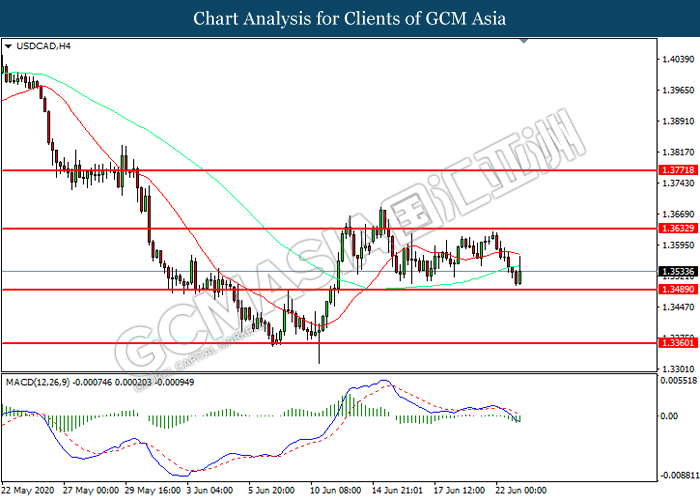

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3490. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3635, 1.3770

Support level: 1.3490, 1.3360

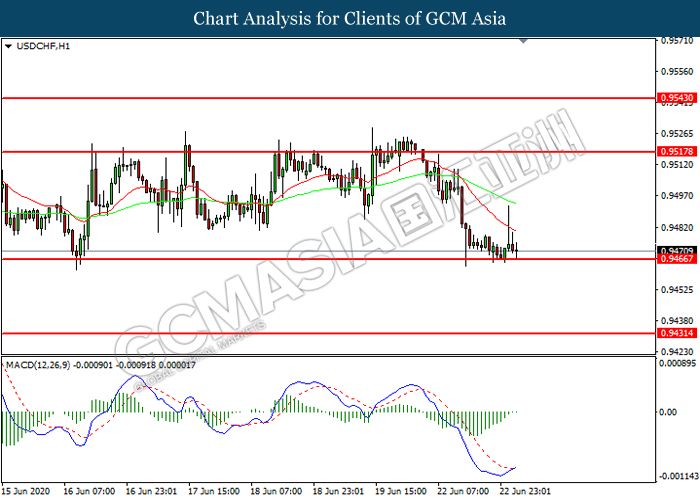

USDCHF, H1: USDCHF was traded lower while currently testing the support level at 0.9465. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9515, 0.9545

Support level: 0.9465, 0.9430

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 42.55. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 42.55, 52.35

Support level: 35.65, 28.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1759.10. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1759.10, 1798.75

Support level: 1724.10, 1681.00