23 June 2022 Afternoon Session Analysis

Pound Sterling slumped amid stagflation risk continue to linger in market.

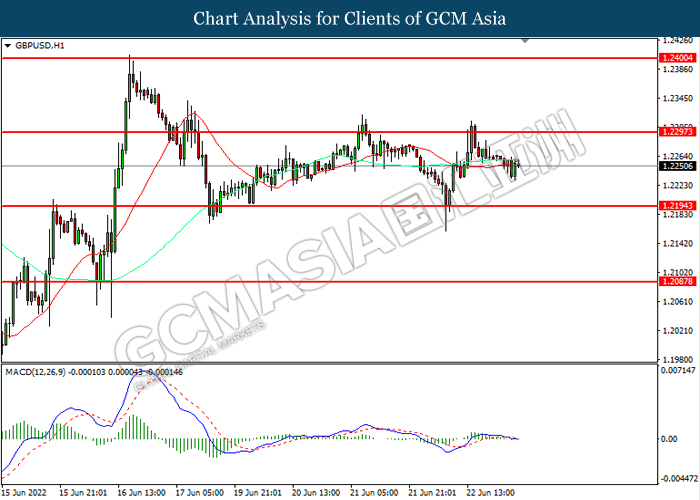

The GBP/USD retreated following UK inflation hit new record high in May, spurring further stagflation risk in future while dragging down the appeal for the Pound Sterling. According to Office for National Statistics, UK Consumer Price Index notched up significantly from the previous reading of 9.0% to 9.1%, aligned with market expectations from economists. UK’s Office for National Statistics claimed that they predicted the inflation rate in UK would reach nearly 11% in January. Besides, economists have also flagged signs of a tightening of labor market conditions and recession risk in the UK region. Nonetheless, investors would continue to scrutinize the latest data from the UK region to receive further trading signal. On the other hand, riskier asset such as the Australia Dollar received bearish momentum yesterday amid the rising worries about the risk of a global recession and expectation upon the aggressive rate hike from the global central bank continue to stoke a shift in sentiment toward safe-haven asset. As of writing, GBP/USD depreciated by 0.07% to 1.2255 while AUD/USD slumped 0.40% to 0.6895.

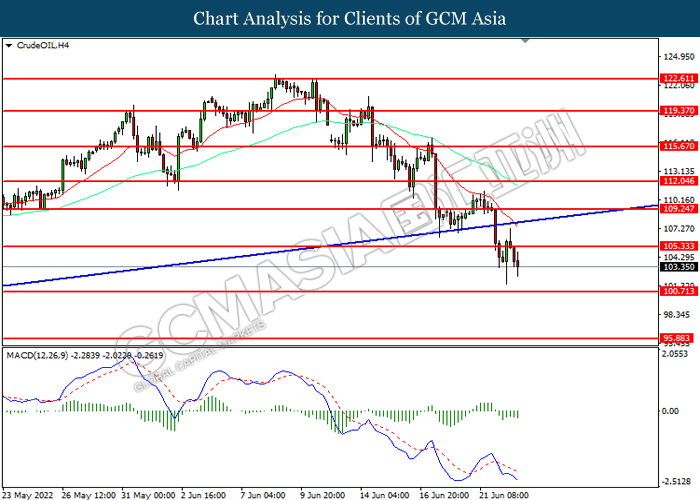

In the commodities market, the crude oil price slumped 0.80% to $103.55 per barrel as of writing amid the global recession risk continue to weigh down the appeal for this black-commodity. On the other hand, the gold price slumped 0.19% to $1834.20 per troy ounces as of writing amid tightening monetary policy from the global central bank sparked selloff on the gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Jun) | 54.8 | 54.0 | – |

| 16:30 | GBP – Composite PMI (Jun) | 51.8 | 51.8 | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 54.6 | 54.6 | – |

| 16:30 | GBP – Services PMI (Jun) | 51.8 | 51.8 | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 225K | – |

Technical Analysis

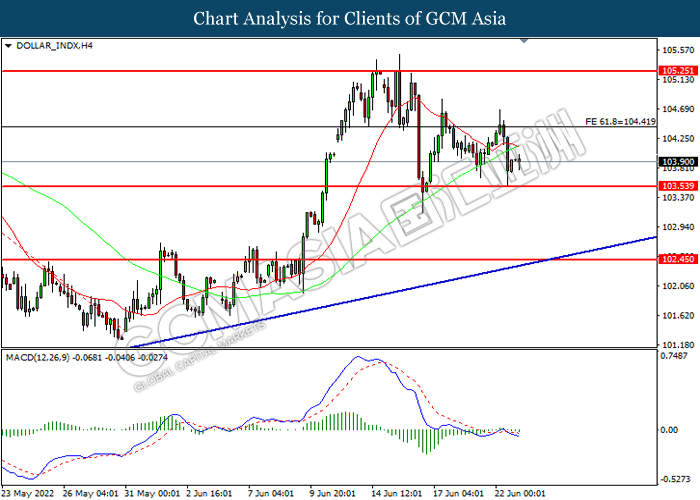

DOLLAR_INDX, H4: Dollar index was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2295, 1.2400

Support level: 1.2195, 1.2085

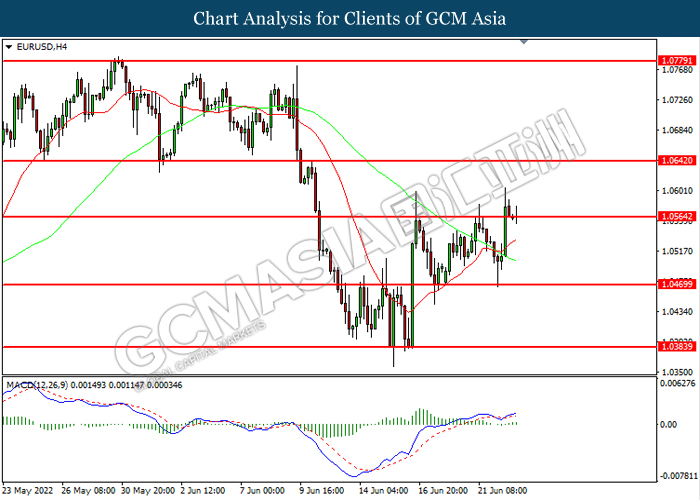

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0565, 1.0640

Support level: 1.0490, 1.0385

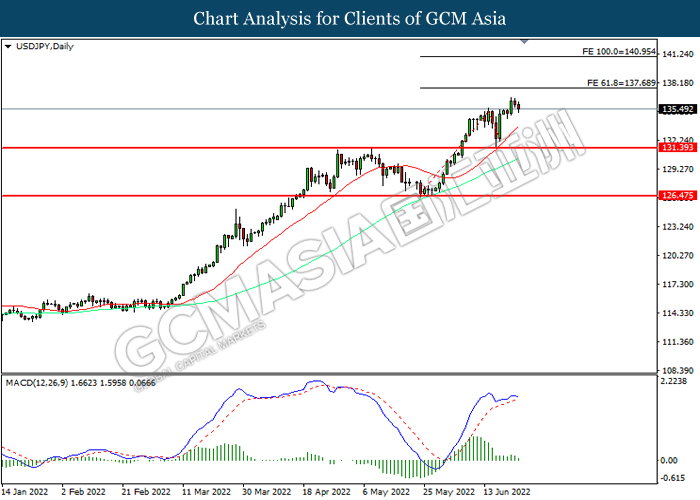

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.70, 140.95

Support level: 131.40, 126.45

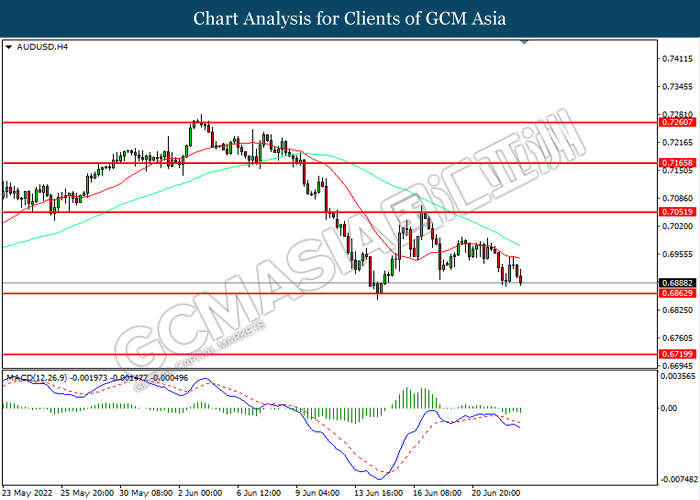

AUDUSD, H4: AUDUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

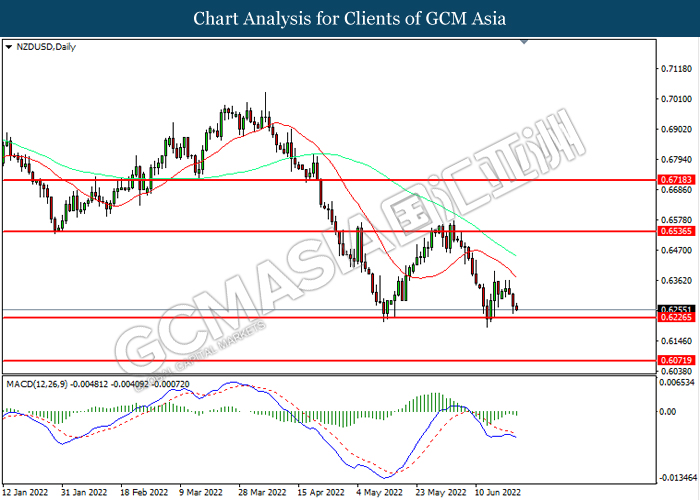

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

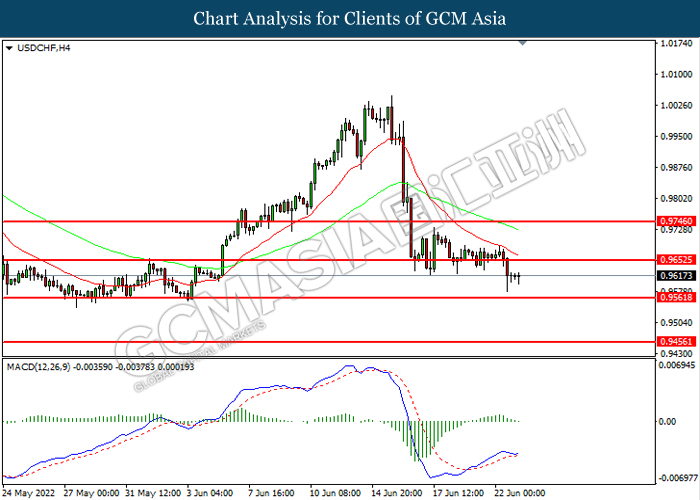

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9655, 0.9745

Support level: 0.9560, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 105.35, 109.25

Support level: 100.70, 95.90

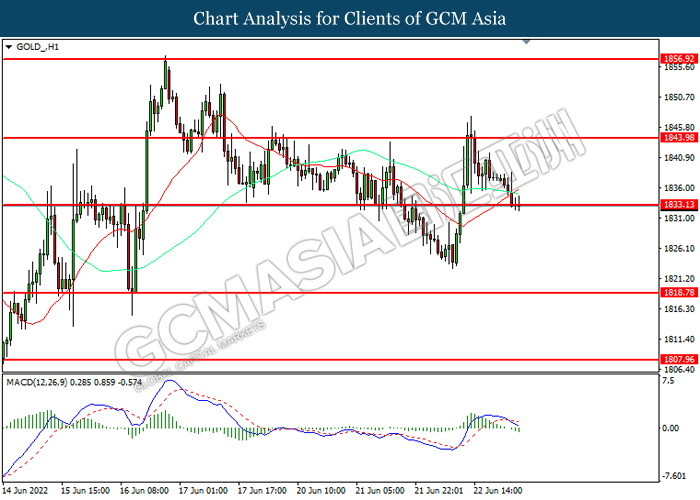

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout the support level.

Resistance level: 1844.00, 1856.90

Support level: 1835.15, 1818.80