23 July 2021 Afternoon Session Analysis

Euro slips following dovish ECB.

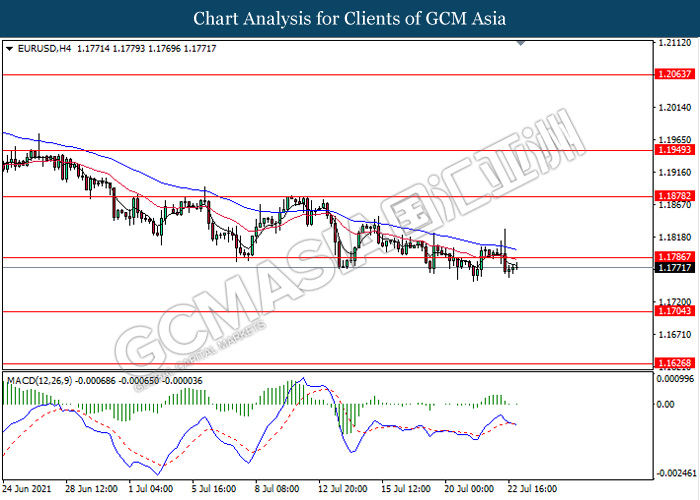

The Euro which traded against the dollar and other currency pair have fell after ECB delivered a dovish note on meeting. As expected, the ECB has maintained its interest rates and monetary policy settings unchanged. However, the ECB has announced new guidelines for monetary policy by allowing inflation to hover above the 2% target for a longer period of time. The action was taken after the ECB expect that the rise in inflation was temporary and they wanted to ensure that all aspects of the economy had recovered significantly before implementing monetary policy tightening. In a press conference, ECB President Christine Lagarde commented that the recent increase in coronavirus cases would be a major threat to the momentum economic recovery in the EU. Therefore, they will continue to relax policy for a longer period before tightening monetary policy. At the time of writing, EUR/USD fell 0.03% to 1.1775.

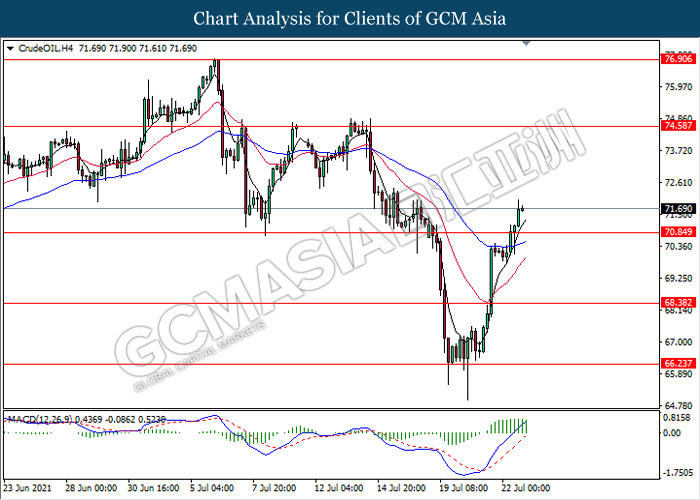

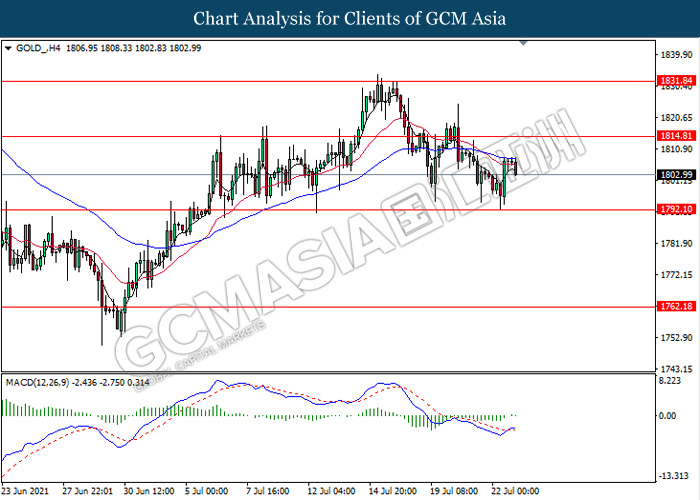

In the commodities market, crude oil price rose 0.16% to $71.62 per barrel as of writing following optimism towards rising demand and tightening global market. Investors continue to bet on the broader positive fundamentals following rollout of vaccine that permits economies to reopen. Besides that, Baker Hughes expects the crude oil demand will continue to rise in the second half of 2021 until next year. On the other hand, gold price fell 0.06% to $1803.22 a troy ounce at the time of writing following dollar rebound.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | -1.40% | 0.50% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul) | 65.1 | 64.1 | – |

| 16:30 | GBP – Manufacturing PMI | 63.9 | 62.7 | – |

| 16:30 | GBP – Services PMI | 62.4 | 62 | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | -7.20% | -2.00% | – |

Technical Analysis

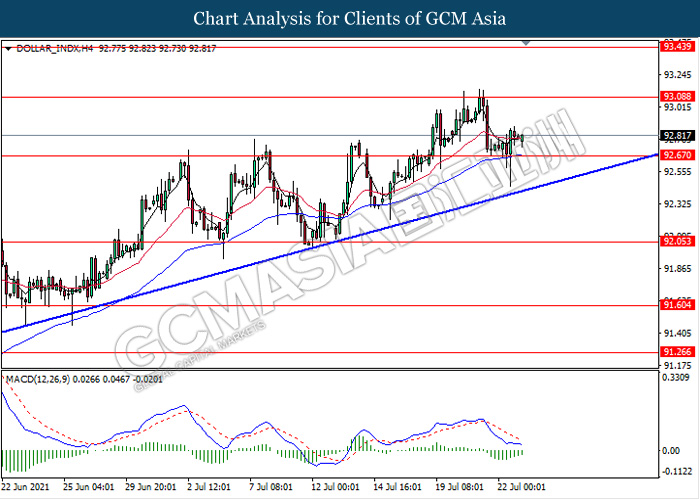

DOLLAR_INDX, H4: Dollar index was traded higher following recent rebound from the support level 92.65. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend its rebound towards the resistance level 93.10.

Resistance level: 93.10, 93.45

Support level: 92.70, 92.05

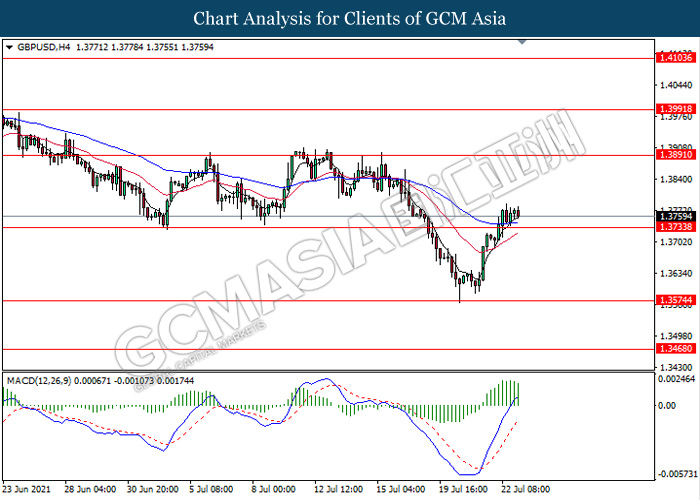

GBPUSD, H4: GBPUSD was traded flat while currently testing the support level 1.3735. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower after it breaks below the support level.

Resistance level: 1.3890, 1.3990

Support level: 1.3735, 1.3575

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1785. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.1705.

Resistance level: 1.1785, 1.1880

Support level: 1.1705, 1.1625

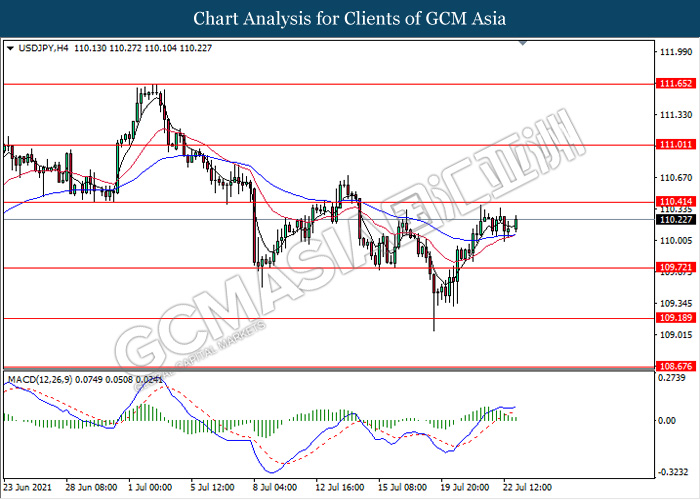

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 110.40. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower towards the support level 109.70.

Resistance level: 110.40, 111.00

Support level: 109.70, 109.20

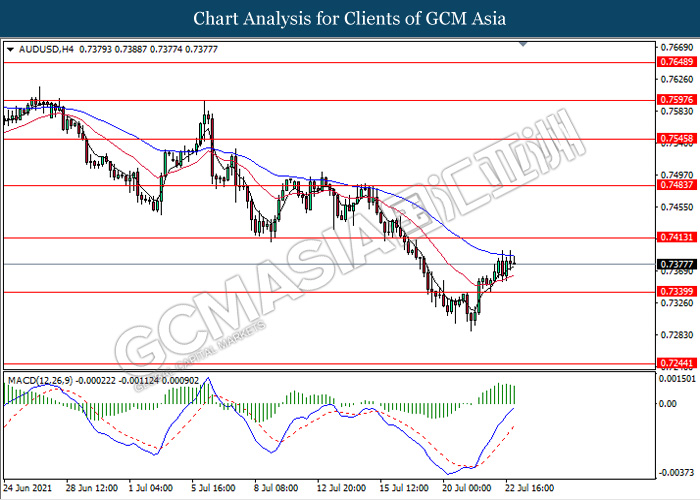

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level 0.7340. MACD which illustrate bullish momentum signal suggest the pair to extend its gains towards the resistance level 0.7415.

Resistance level: 0.7415, 0.7485

Support level: 0.7340, 0.7245

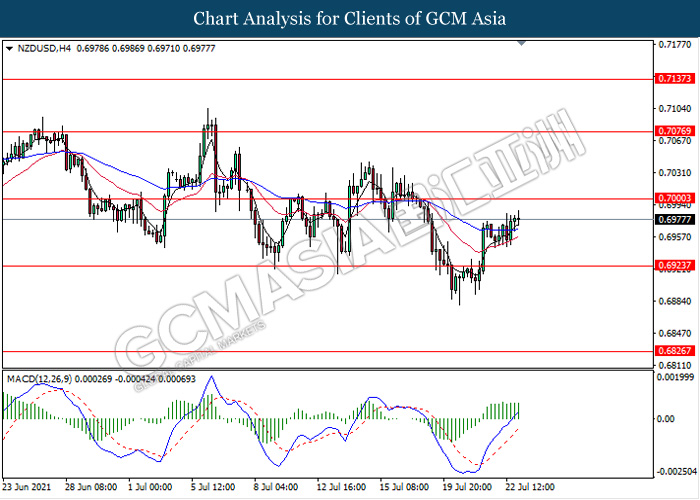

NZDUSD, H4: NZDUSD was traded higher while currently testing near the resistance level 0.7000. MACD which illustrate persistent bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.7000, 0.7075

Support level: 0.6925, 0.6825

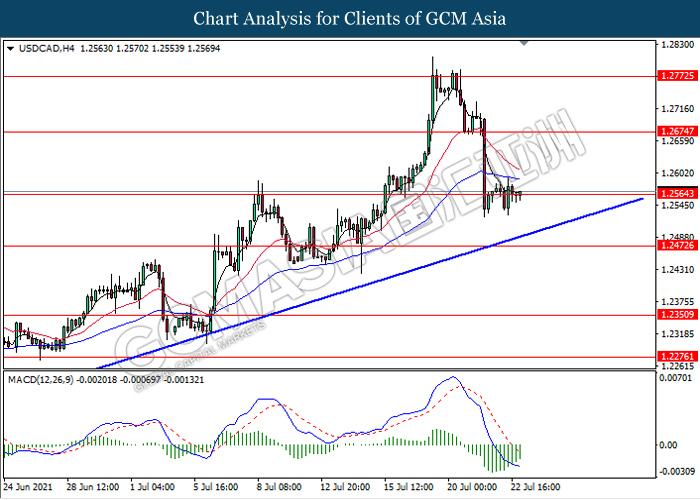

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.2565. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher as a technical correction towards the resistance level 1.2675.

Resistance level: 1.2675, 1.2770

Support level: 1.2565, 1.2470

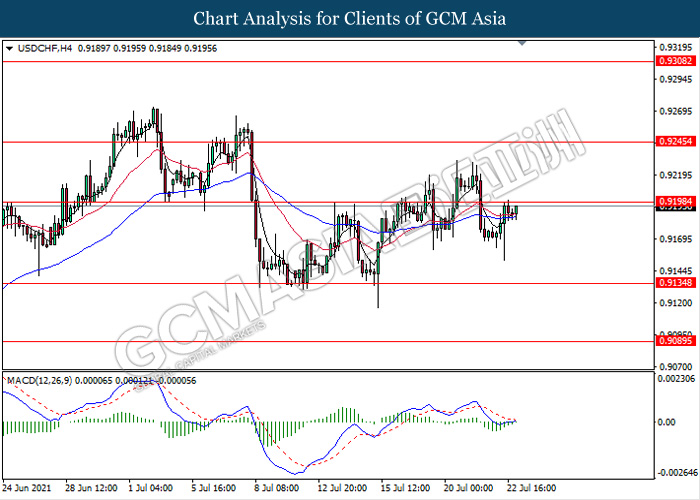

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9200. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9200, 0.9245

Support level: 0.9135, 0.9090

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level 70.85. MACD which illustrate persistent bullish momentum signal suggest the commodity to extend its gains towards the resistance level 74.60.

Resistance level: 74.60, 76.90

Support level: 70.85, 68.40

GOLD_, H4: Gold price was traded higher following prior rebound from the resistance level 1792.10. MACD which illustrate bullish bias signal with the formation of golden cross suggest the commodity to extend its gains towards the resistance level 1814.80.

Resistance level: 1814.80, 1831.85

Support level: 1792.10, 1762.20