23 July 2021 Morning Session Analysis

Dollar slumped over the bearish data.

The Dollar Index which traded against a basket of six major currency pairs slumped over the backdrop of the string of bearish economic data yesterday. According to Department of Labor, U.S. Initial Jobless Claims notched up significantly from the previous reading of 368K to 419K, worse than the market forecast at 350K. Besides, U.S Existing Home Sales came in at 5.86M, which also weaker than market expectation at 5.90M. As both economic data fared worse than expectation, which dialed down the market optimism toward the economic progression in United States. Market participants expected that the Federal Reserve would likely to extend its expansionary monetary policy plan to boost up the economic momentum. Nonetheless, the losses experienced by the US Dollar was limited amid risk-off sentiment in the FX market following many countries reported a spiking number of Delta Variant. As of writing, the Dollar Index depreciated by 0.04% to 92.80.

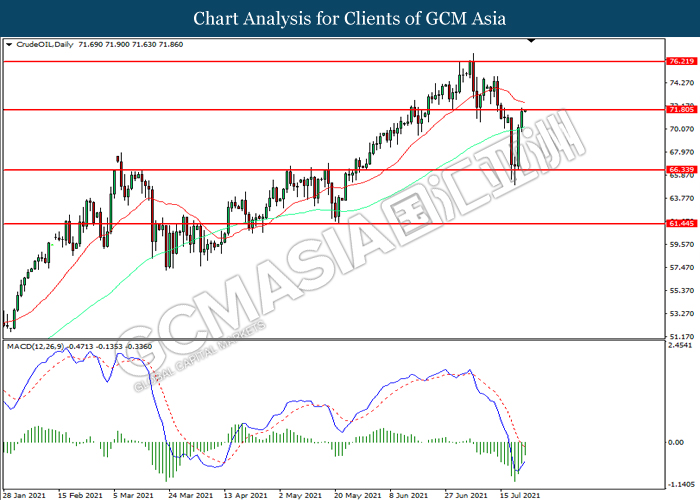

In the commodities market, the crude oil price extends its gains by 0.18% to 72.15 per barrel as of writing. The continued signs of global economic recovery from the Covid-19 pandemic due to the rapid process of the vaccination program had spurred positive prospect for this black-commodity. On the other hand, the gold price surged 0.01% to $1807.12 per troy ounces amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | -1.40% | 0.50% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul) | 65.1 | 64.1 | – |

| 16:30 | GBP – Manufacturing PMI | 63.9 | 62.7 | – |

| 16:30 | GBP – Services PMI | 62.4 | 62 | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | -7.20% | -2.00% | – |

Technical Analysis

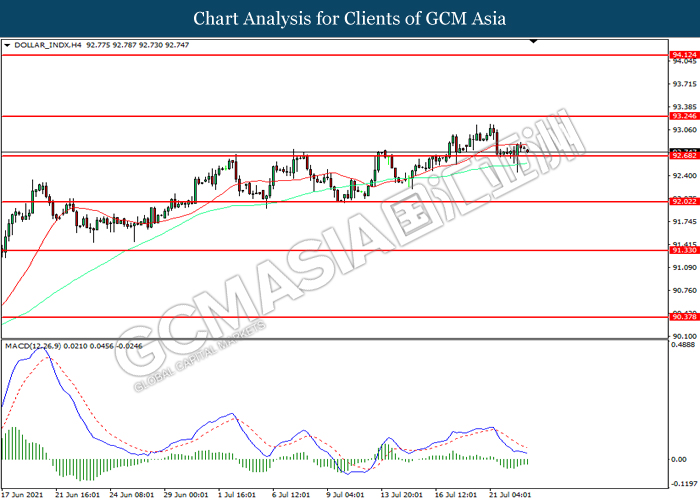

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 92.70. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 93.25, 94.10

Support level: 92.70, 92.00

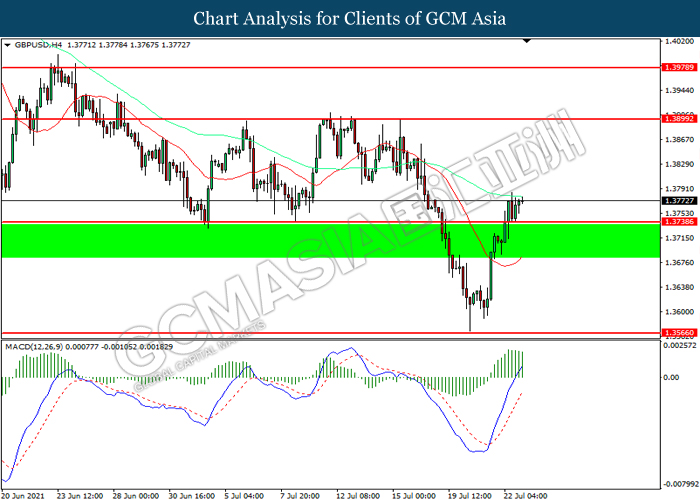

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3740. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3900, 1.3980

Support level: 1.3740, 1.3565

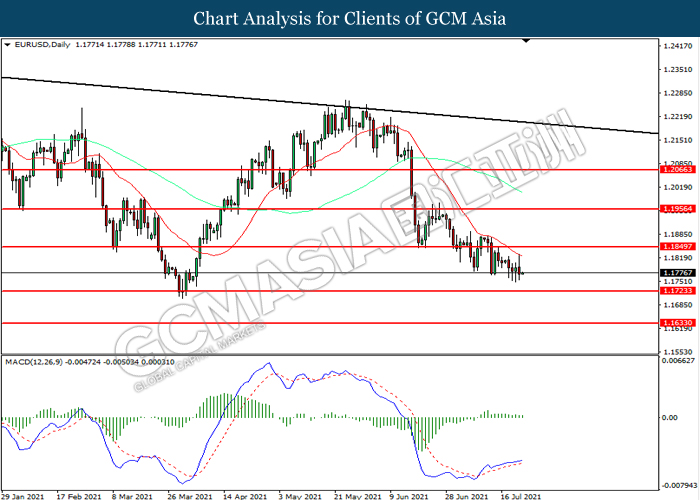

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1850. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.1725.

Resistance level: 1.1850, 1.1955

Support level: 1.1725, 1.1635

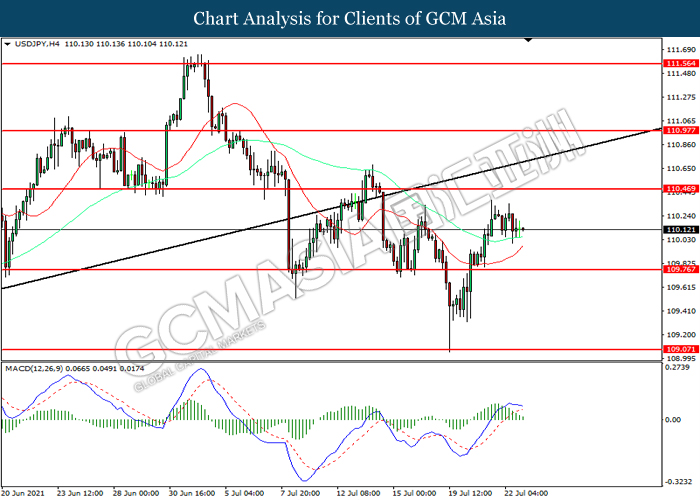

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 109.75. However, MACD which illustrated increasing diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 110.45, 110.95

Support level: 109.75, 109.05

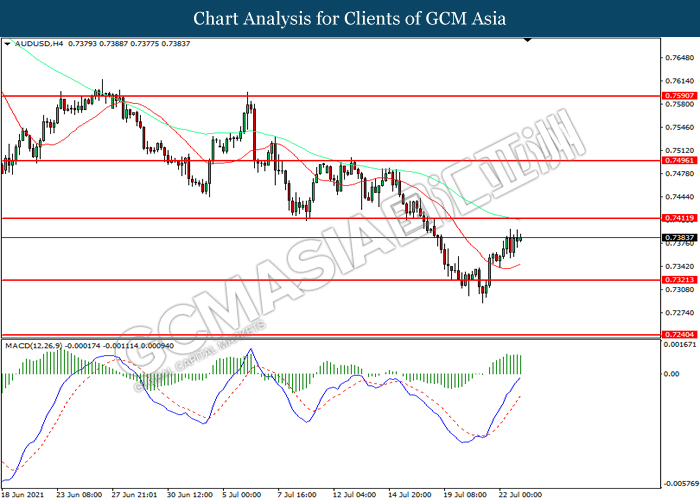

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7320. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7410.

Resistance level: 0.7410, 0.7495

Support level: 0.7320, 0.7240

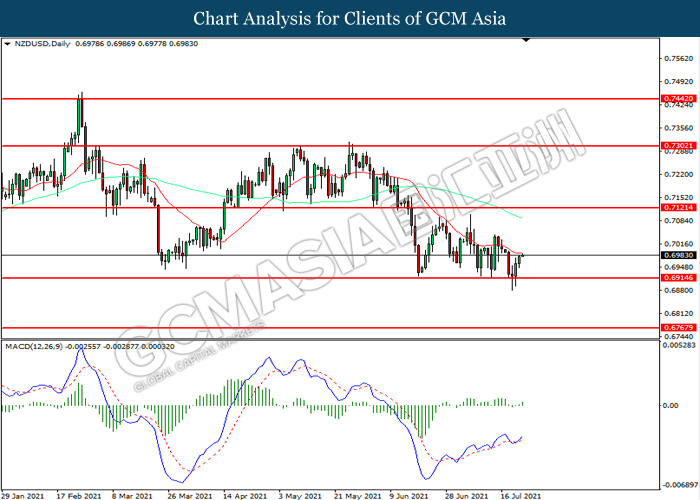

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6915. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7120.

Resistance level: 0.7120, 0.7305

Support level: 0.6915, 0.6770

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.2585. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2585, 1.2770

Support level: 1.2440, 1.2275

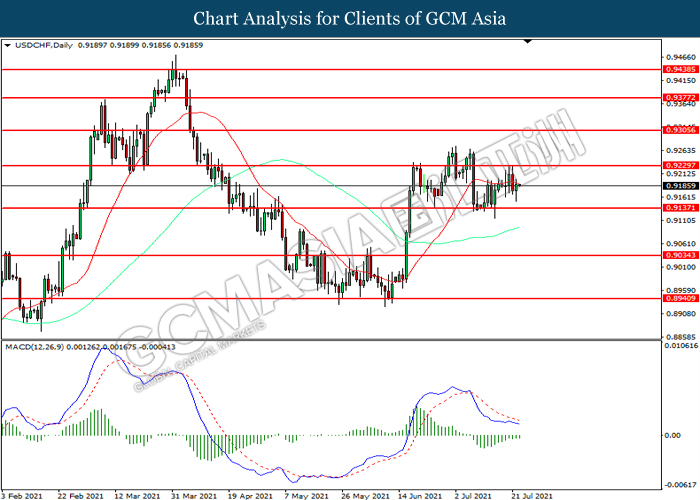

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9230. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9135.

Resistance level: 0.9230, 0.9305

Support level: 0.9135, 0.9035

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 71.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 71.80, 76.20

Support level: 66.35, 61.45

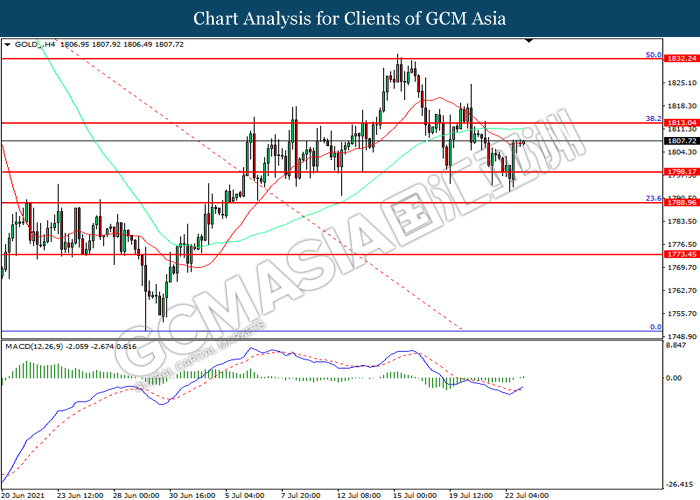

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1798.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1813.05.

Resistance level: 1813.05, 1832.25

Support level: 1798.15, 1788.95