23 October 2020 Afternoon Session Analysis

Pound plummets as no-deal Brexit remains high.

During late Asian session, the pound sterling which traded against the dollar and other currency pairs have fell as experts warned the display of brinkmanship from the U.K on the negotiation may triggered an accidental no-deal Brexit risk. Following latest development, EU Brexit negotiator Michael Barnier is seeking to intensify talks with his British counterpart David Frost on Thursday to find a solution to key sticking points state aid and fisheries. As U.K determine to take control over access to its waters rather than stick with EU policy, fisheries remained the as the key issue that stalling the progress of a trade deal. With just months to go until the transition period ends, the U.K. appears unwilling to allow talks to run past the year-end deadline. The tough stance from UK could risk an accidental no-deal Brexit as the clock ticks down toward the end of the year, thus weighing on the current sentiment and dragging the currency price lower. At the time of writing, GBP/USD fell 0.08% to 1.3068

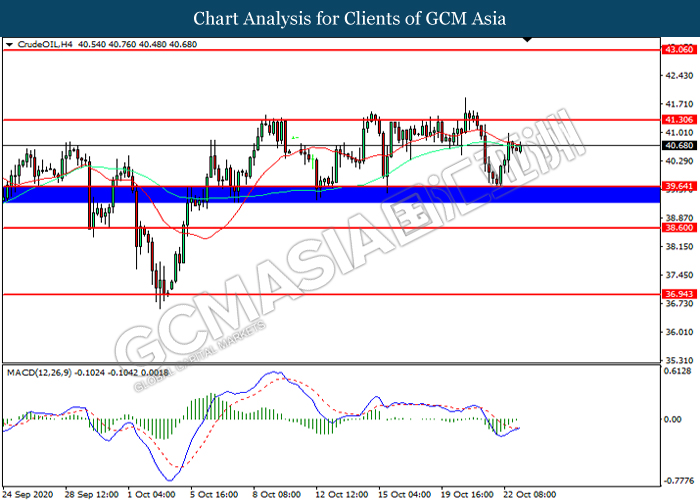

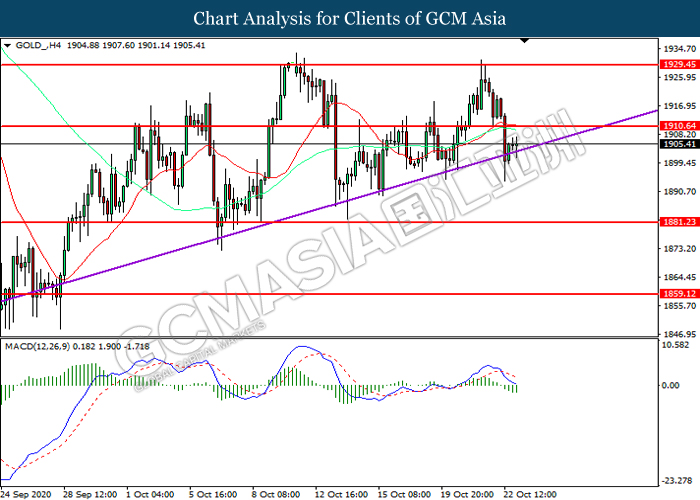

In the commodities market, crude oil price gains 0.32% to $40.69 per barrel as of writing amid optimism on U.S stimulus and potential output cut extension from Russia. U.S. House Speaker Nancy Pelosi stated that the two sides were nearing an economic stimulus package, boosting expectations that demand for crude oil could improve. At the same time, market also continue to react positively towards Russia’s willingness to ease further output if necessary. On the other hand, gold price plunged 0.09% to $1906.31 a troy ounce at the time of writing following the dollar strength and rebound from its seven-week low.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM)(Sep) | 0.8% | 0.4% | – |

| 16:00 | EUR – German Manufacturing PMI (Oct) | 56.4 | 55.1 | – |

| 16:00 | EUR – German Ifo Business Climate Index (Oct) | 93.4 | 93.8 | – |

| 16:30 | GBP – Composite PMI (Oct) | 55.7 | 55.6 | – |

| 16:30 | GBP – Manufacturing PMI (Oct) | 54.1 | 54.3 | – |

| 16:30 | GBP – Services PMI (Oct) | 56.1 | 55.0 | – |

Technical Analysis

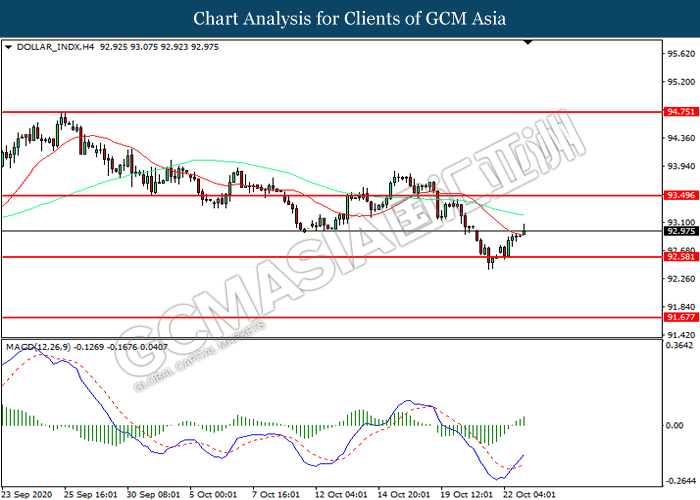

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 92.60. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 93.50.

Resistance level: 93.50, 94.75

Support level: 92.60, 91.65

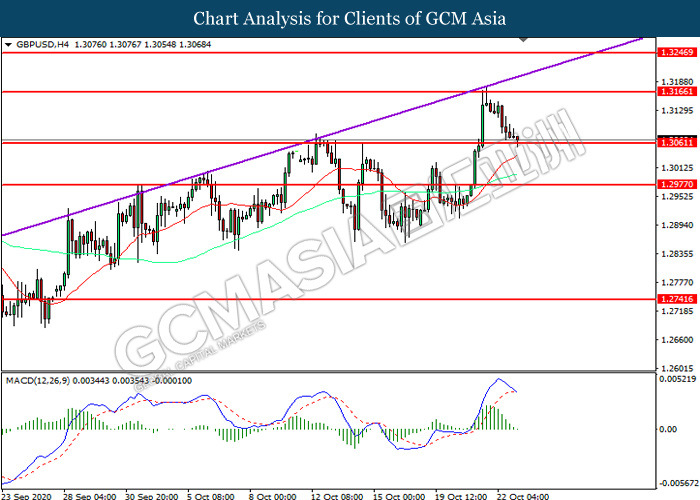

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level at 1.3060. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3165, 1.3245

Support level: 1.3060, 1.2975

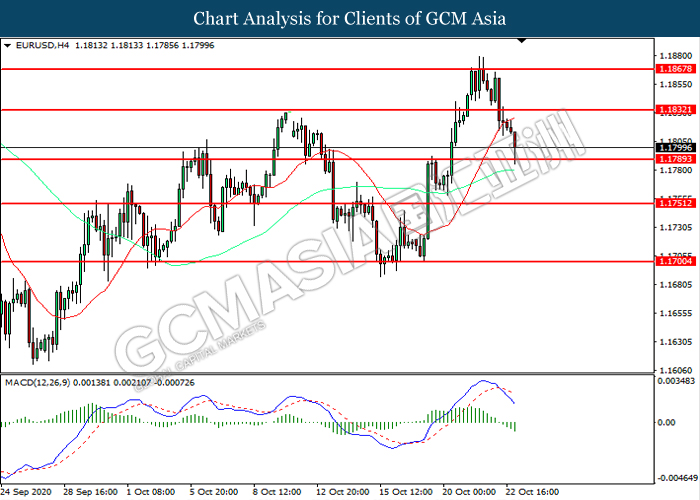

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1790. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1830, 1.1865

Support level: 1.1790, 1.1750

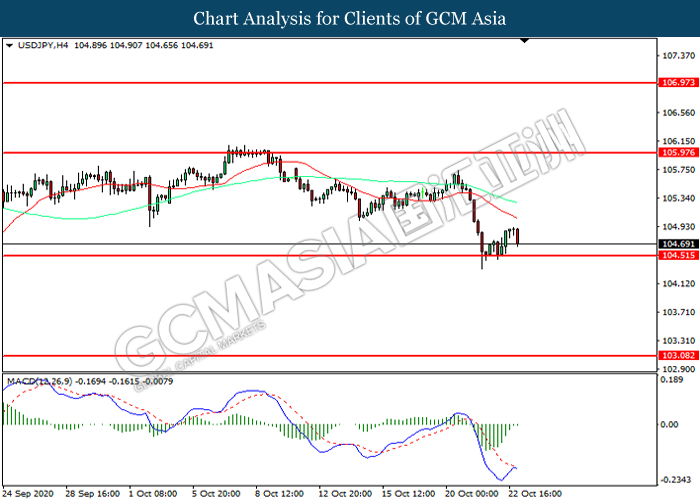

USDJPY, H4: USDJPY was traded lower while currently near the support level at 104.50. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 105.95, 106.95

Support level: 104.50, 103.10

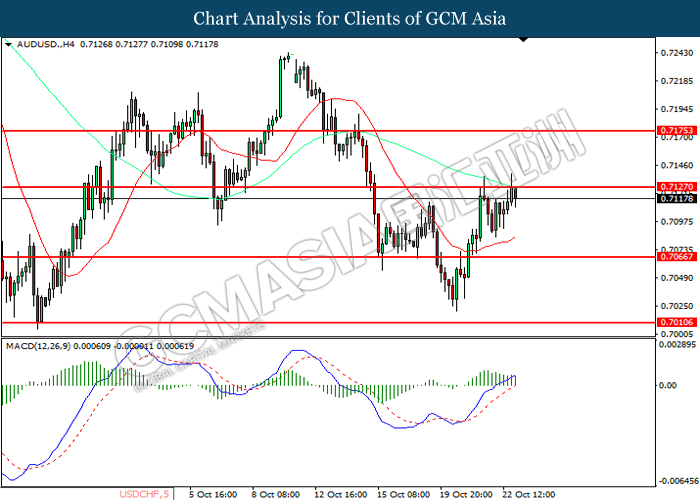

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it succe4ssfully breakout above the resistance level.

Resistance level: 0.7125, 0.7175

Support level: 0.7065, 0.7010

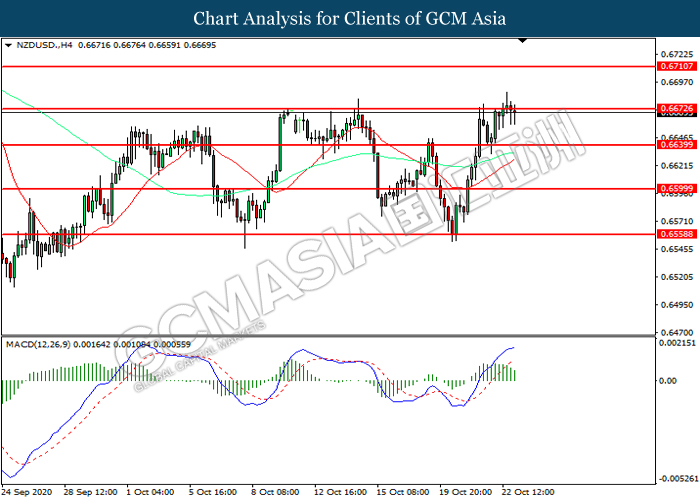

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6675. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6675, 0.6710

Support level: 0.6640, 0.6600

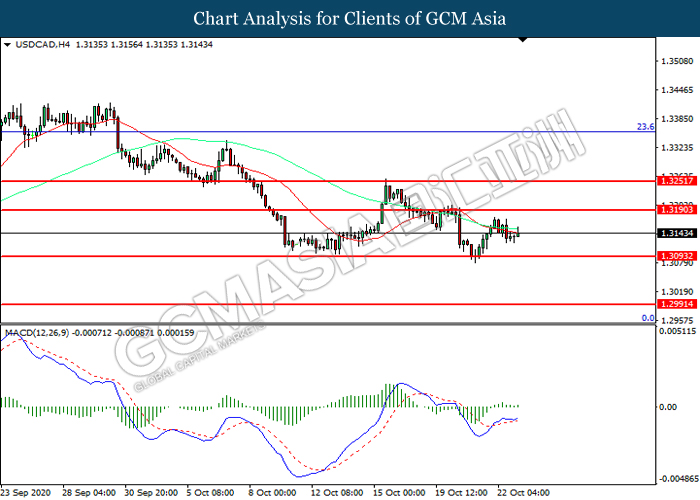

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3190. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3250

Support level: 1.3095, 1.2990

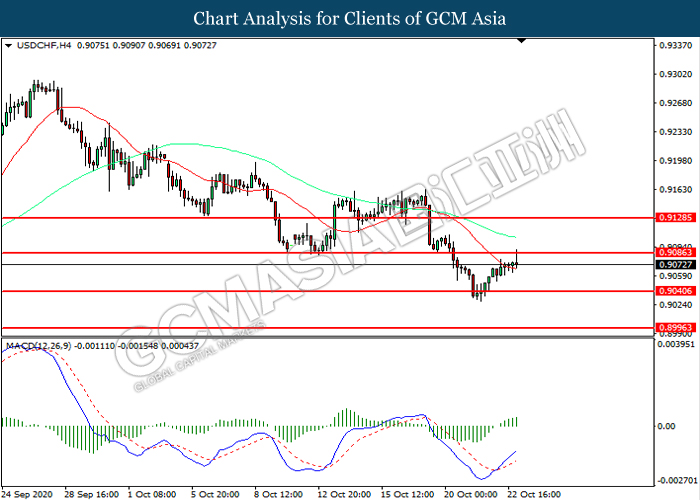

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9085. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9185, 0.9230

Support level: 0.9040, 0.8995

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 39.65. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 41.30.

Resistance level: 41.30, 43.05

Support level: 39.65, 38.60

GOLD_, H4: Gold price was traded higher following prior rebound from the upward trend line. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1910.65, 1929.45

Support level: 1881.25, 1859.10