23 October 2020 Morning Session Analysis

Dollar rebound amid likelihood of stimulus aid remained uncertain.

Dollar index which gauge its value against a basket of six major currencies ticked up after hitting the lowest level in seven weeks as market participants turned sceptical of a possible deal which costing trillions of dollars. In the recent talk, negotiators were making progress over sealing a new stimulus plan, aiming to be launched before the US Presidential Election, said by US House Speaker Nancy Pelosi. Despite, even if the stimulus package successfully breakthrough the impasses between Democrats and Republican, it is highly unlikely that House of Senate will allow the plan to be implemented as the Republican are dominating majority of the votes in Senate level while they have repeatedly rejected sort of trillion dollar plan. As of now, Senate Majority Leader Mitch Mc Connell still insisting that he does not want brings large stimulus bill to the Senate floor before the election. Besides, an upbeat labour data has managed to further uplift the gains of dollar yesterday. According to the Department of Labor, US Initial Jobless Claims was came in at 787K, lower than the economist forecast of 870K, reflecting a lower number of American filing for unemployment insurance claims, yet they are still awaiting for further financial assistance from new round of stimulus aid.

In the commodities market, the crude oil price appreciated by 0.02% to $40.58 per barrel as the possibility of extension on OPEC’s oil production cut plan heightened. According to Russian President Vladimir Putin, Russia does not rule out the possibility that OPEC+ could extend its current 7.7 million barrels cut per day into next year. Besides, gold price rose 0.08% to $1905.65 per troy ounce amid uncertainty of US stimulus aid.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM)(Sep) | 0.8% | 0.4% | – |

| 16:00 | EUR – German Manufacturing PMI (Oct) | 56.4 | 55.1 | – |

| 16:00 | EUR – German Ifo Business Climate Index (Oct) | 93.4 | 93.8 | – |

| 16:30 | GBP – Composite PMI (Oct) | 55.7 | 55.6 | – |

| 16:30 | GBP – Manufacturing PMI (Oct) | 54.1 | 54.3 | – |

| 16:30 | GBP – Services PMI (Oct) | 56.1 | 55.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.00. MACD which illustrate bullish bias momentum signal suggest the dollar to extend it gains after it successfully breakout above the resistance level at 93.00.

Resistance level: 93.00, 93.55

Support level: 92.50, 92.10

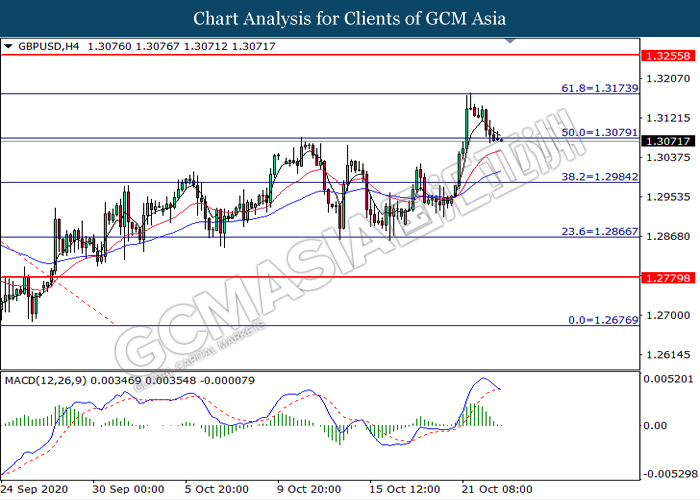

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3080. MACD which illustrates diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2985.

Resistance level: 1.3080, 1.3175

Support level: 1.2985, 1.2865

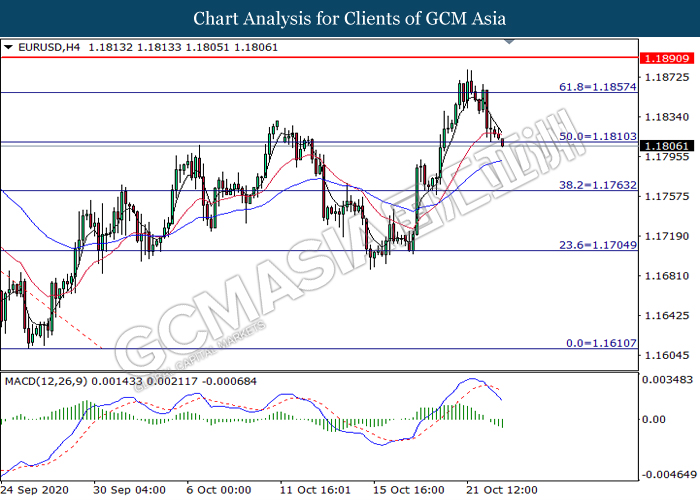

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1810. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses after it successfully breakout below the support level at 1.1810.

Resistance level: 1.1855, 1.1890

Support level: 1.1810, 1.1765

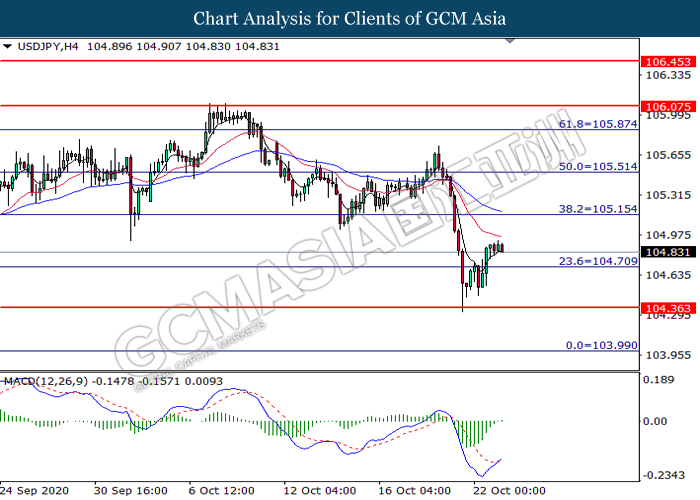

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 104.70. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 105.15.

Resistance level: 105.15, 105.50

Support level: 104.70, 104.35

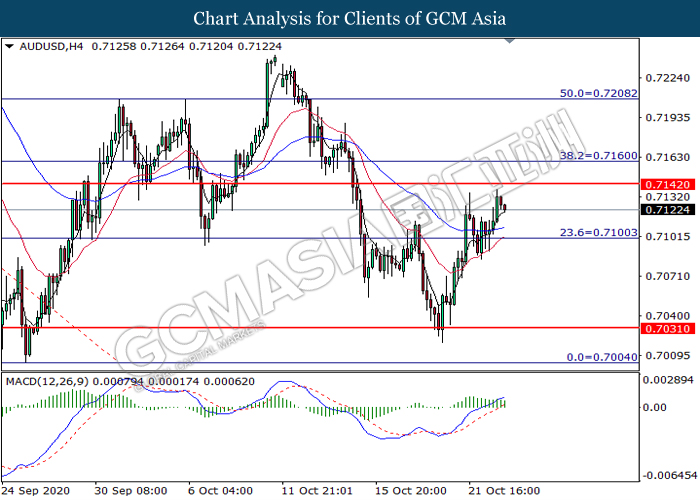

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7140. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.7100.

Resistance level: 0.7140, 0.7160

Support level: 0.7100, 0.7005

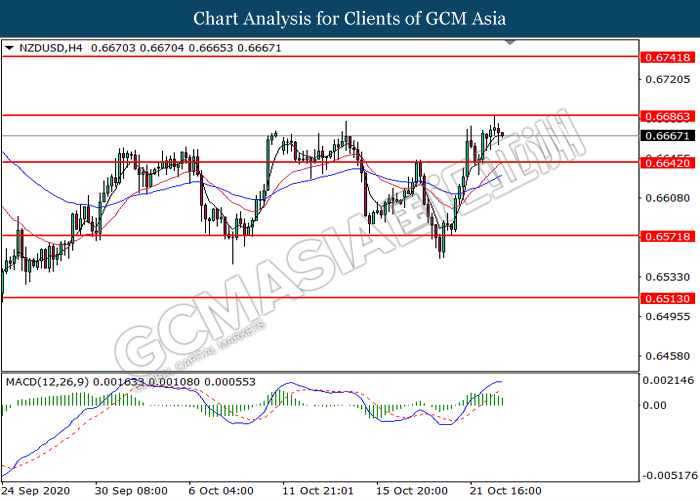

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6685. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6685,0.6740

Support level: 0.6640, 0.6570

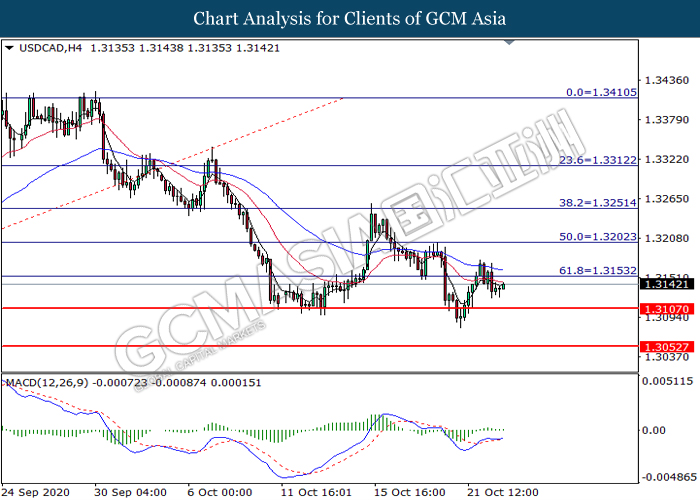

USDCAD, H1: USDCAD was traded higher following prior rebound from the lower level. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.3155.

Resistance level: 1.3155, 1.3200

Support level: 1.3105, 1.3055

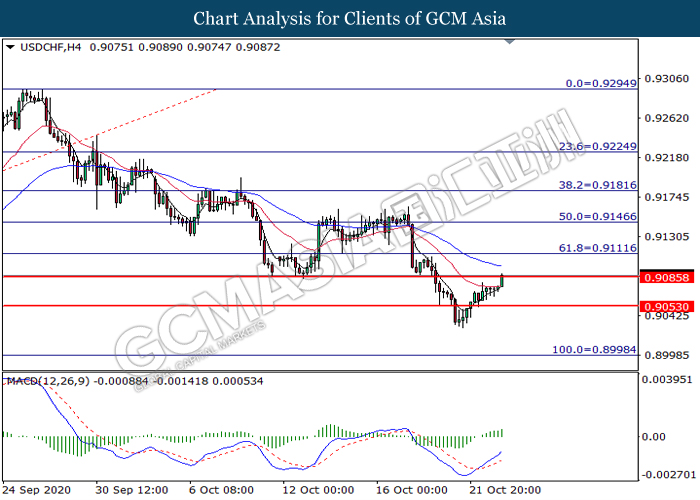

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9085. MACD which display bullish bias momentum signal suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.9085.

Resistance level: 0.9085, 0.9110

Support level: 0.9055, 0.9000

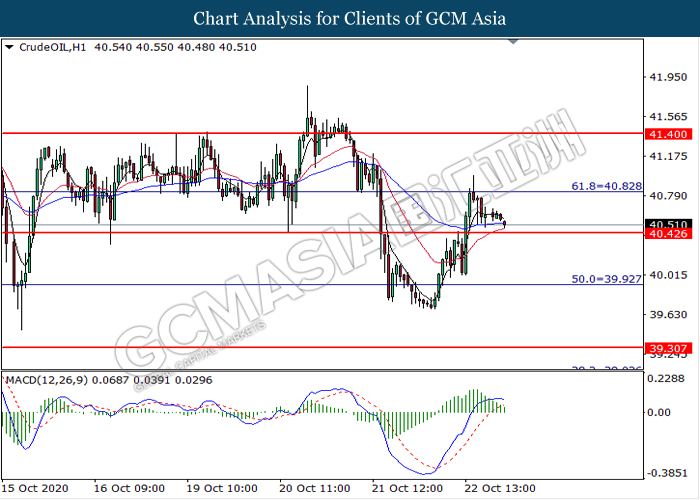

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 40.85. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its losses toward the support level at 40.45.

Resistance level: 40.85, 41.40

Support level: 40.45, 39.95

GOLD_, H4: Gold price was traded lower following prior breakout below the upward trendline. MACD which illustrate bearish bias momentum signal suggest the commodity to extend its losses toward the support level at 1897.50.

Resistance level: 1915.30, 1930.00

Support level: 1897.50, 1879.80