23 November 2022 Morning Session Analysis

Dollar dipped following the recovery of market risk sentiment.

The dollar index, which gauges its value against a basket of six major currencies, waned its gains after a day of strong gains, which was due to the deteriorating Covid-19 situation in China that urged investors shied away from the riskier currencies. Recently, the resurgence of Covid-19 has boosted the number of new COVID-19 cases in China, with record-high daily infections prompting new lockdown measures in several economic hubs, including Beijing and Shanghai. Besides, China has reported the first Covid-19-related death after six months’ time, raising market fears over the possibility of a stricter lockdown would be implemented by the China government in order to curb the spread of the virus. Despite the heightening of market worries, the market participants looked past the flare-ups of high Covid-19 cases in China while waiting for the announcement of the FOMC Meeting Minutes. The Fed’s hawkish stance on the rate-hike plan is expected to remain under the dollar, but a view of a slower pace of rate hike from the Fed’s members is not ruled out. As of writing, the dollar index declined -0.64% to 107.15.

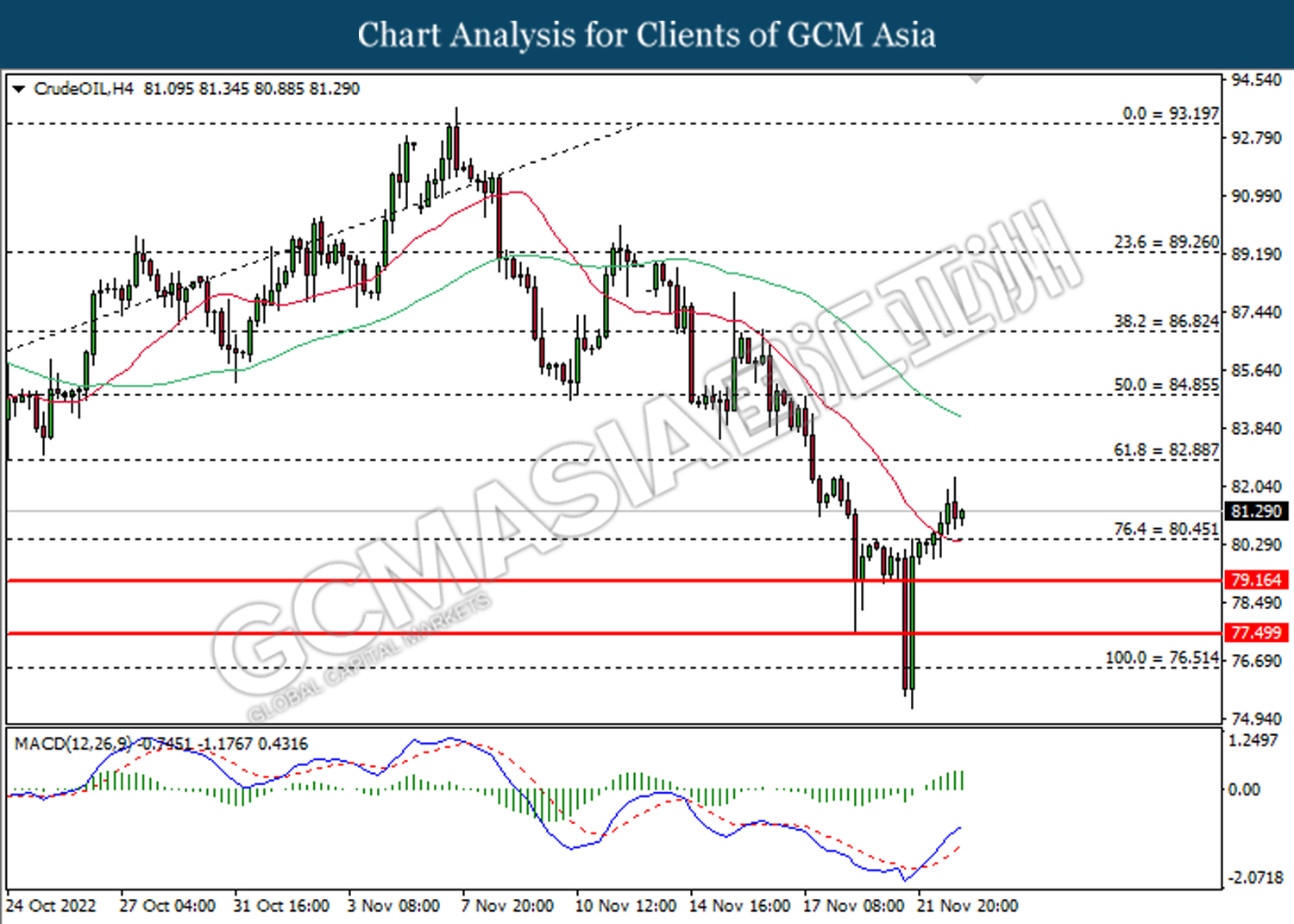

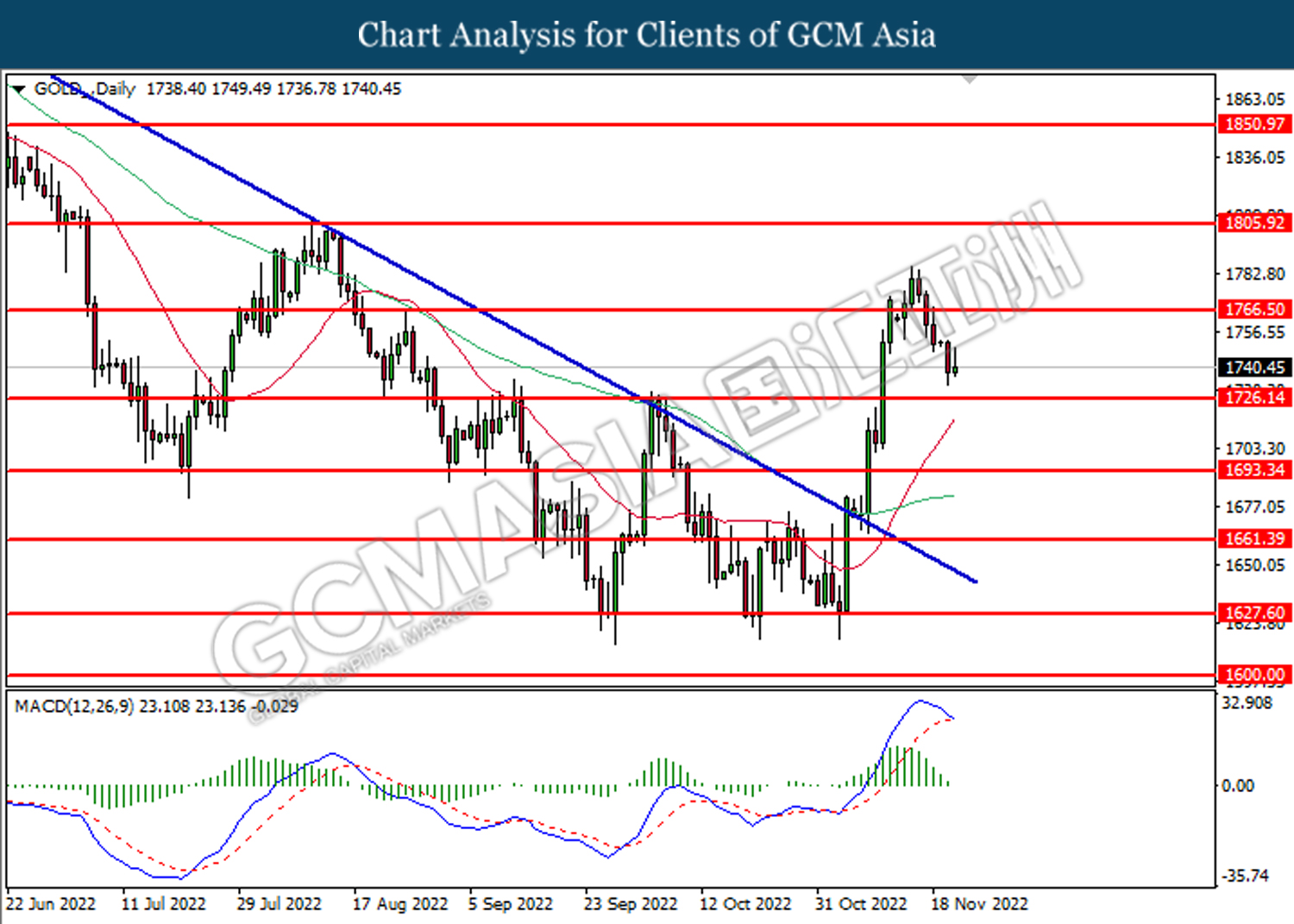

In the commodities market, the crude oil price jumped by 1.12% to $81.90 per barrel as the API reported another crude draw over the past week. Besides, the gold prices edged up by 0.05% to $1740.00 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Nov) | 45.1 | 45.2 | – |

| 17:30 | GBP – Composite PMI | 48.2 | 47.2 | – |

| 17:30 | GBP – Manufacturing PMI | 46.2 | 45.7 | – |

| 17:30 | GBP – Services PMI | 48.8 | 48.0 | – |

| 21:00 | USD – Building Permits | 1.526M | – | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Oct) | -0.5% | 0.1% | – |

| 21:30 | USD – Initial Jobless Claims | 222K | 225K | – |

| 23:00 | USD – New Home Sales (Oct) | 603K | 570K | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -5.400M | -1.055M | – |

Technical Analysis

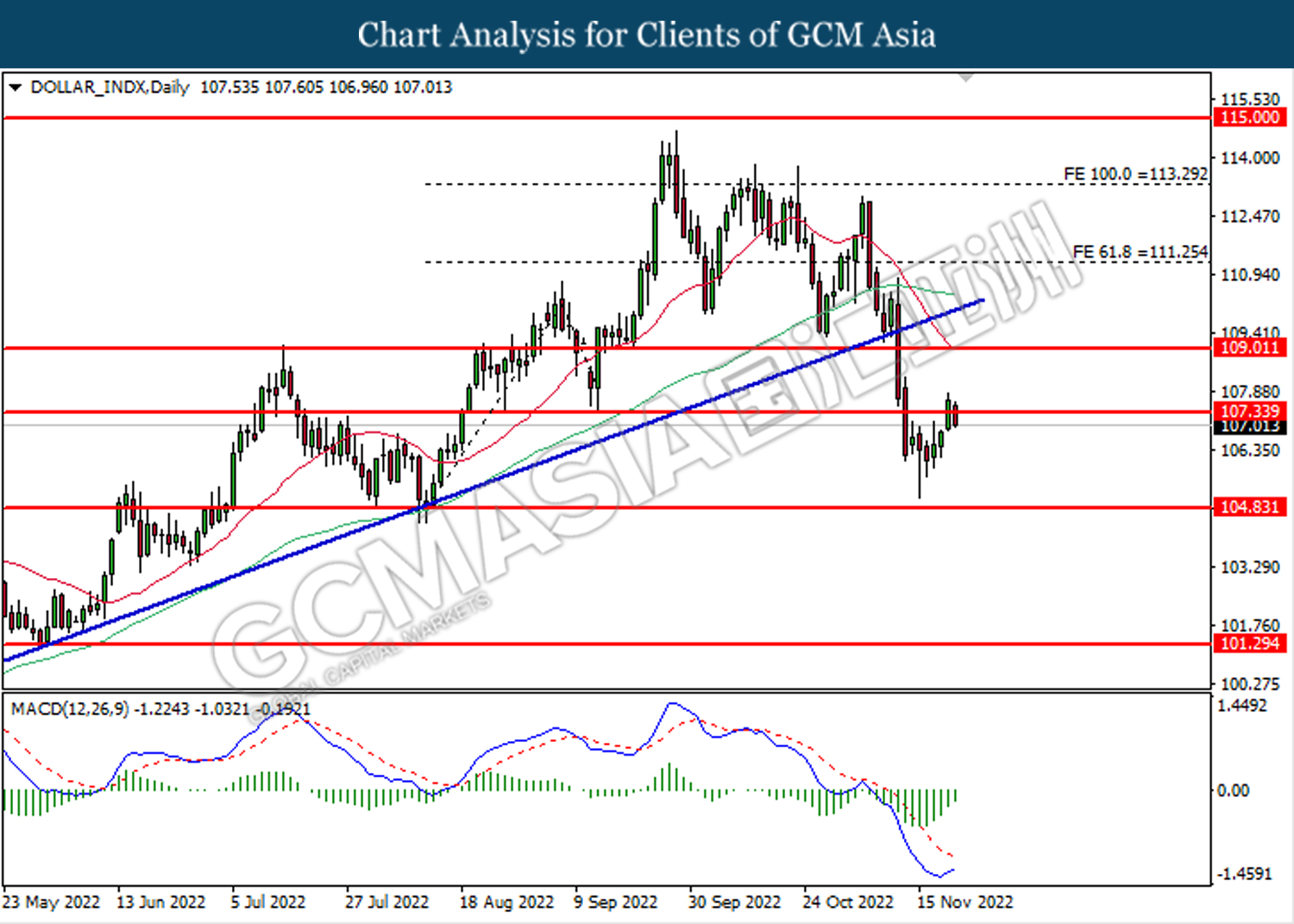

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

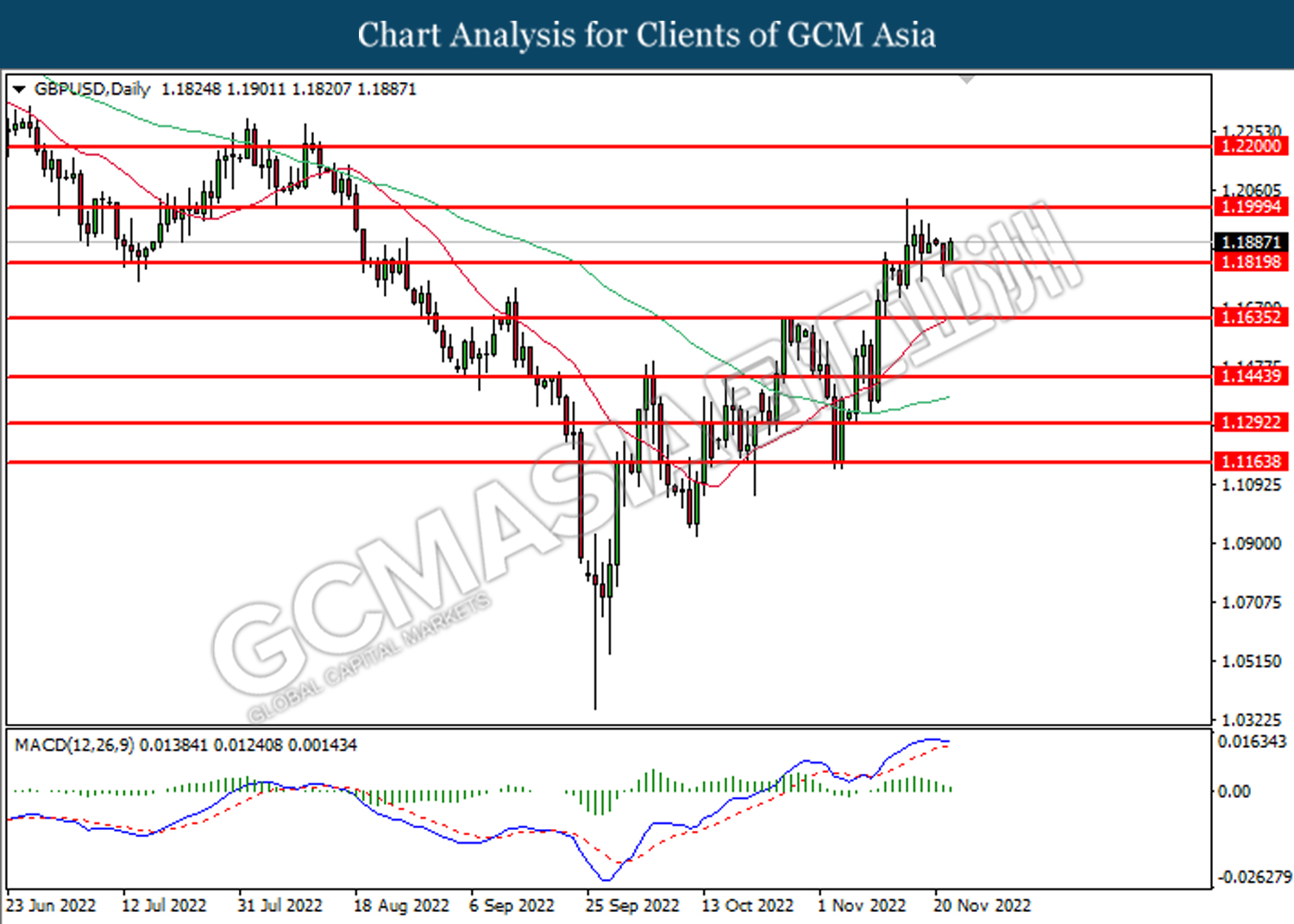

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1820. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

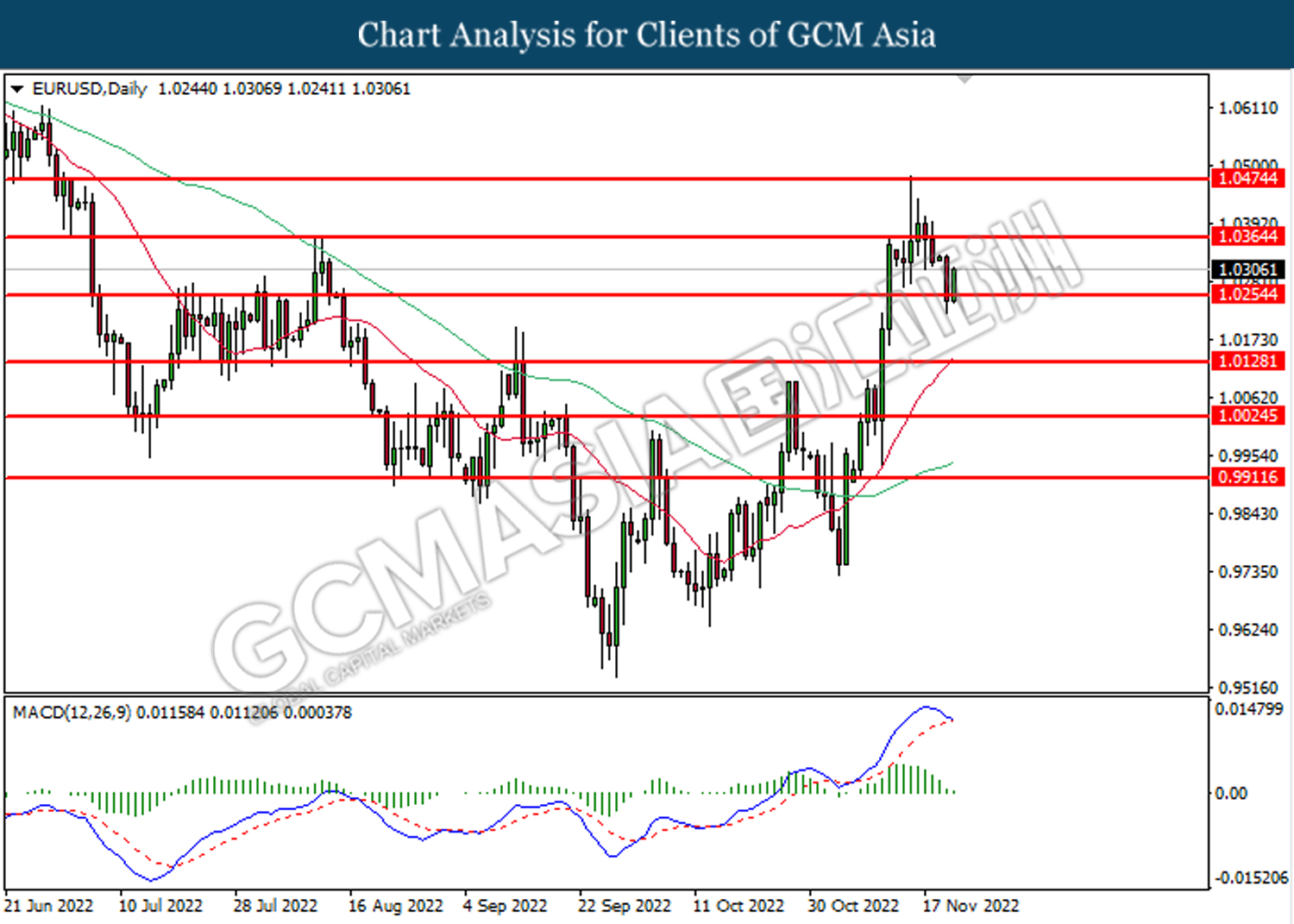

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0255. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

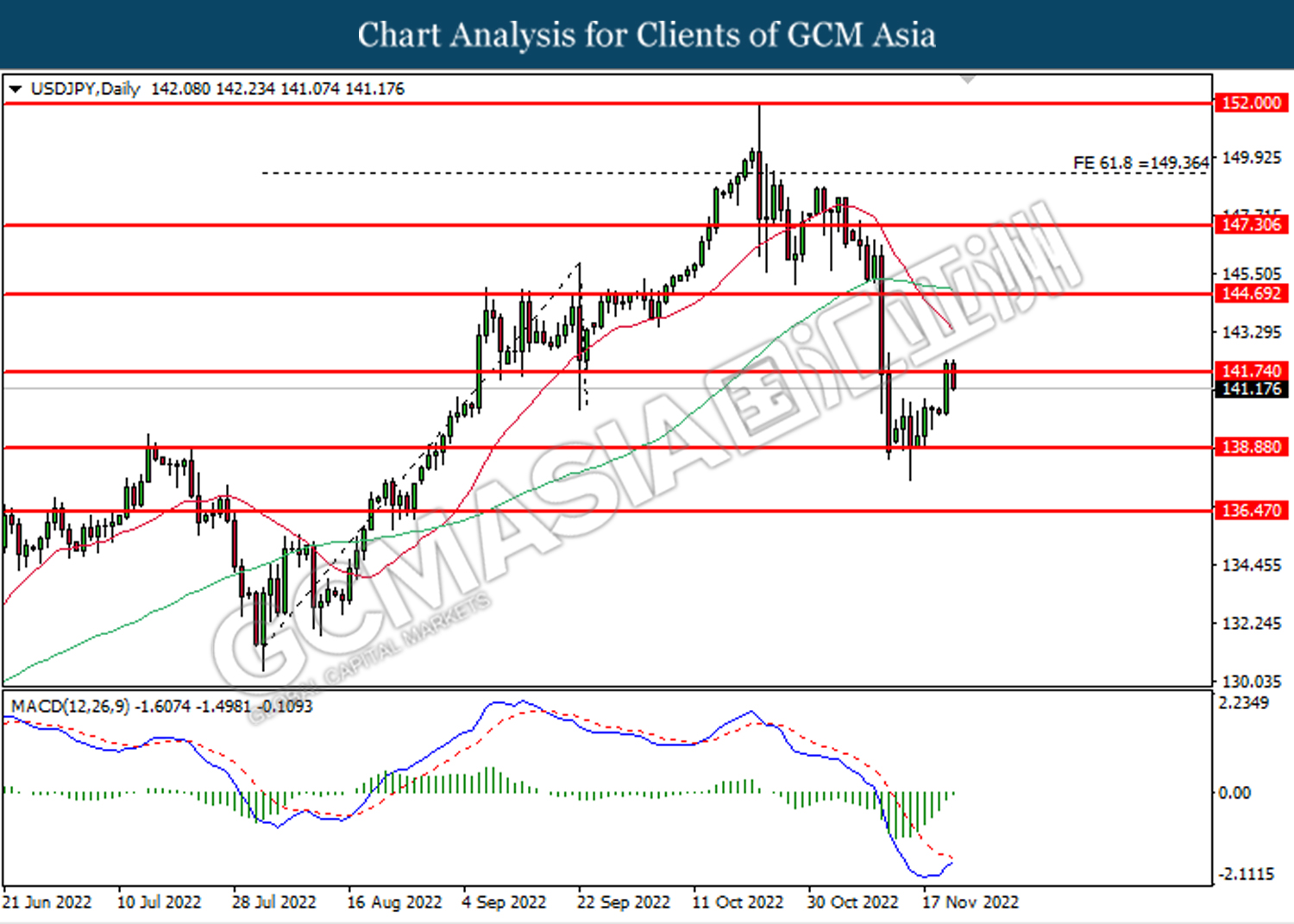

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 141.75. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

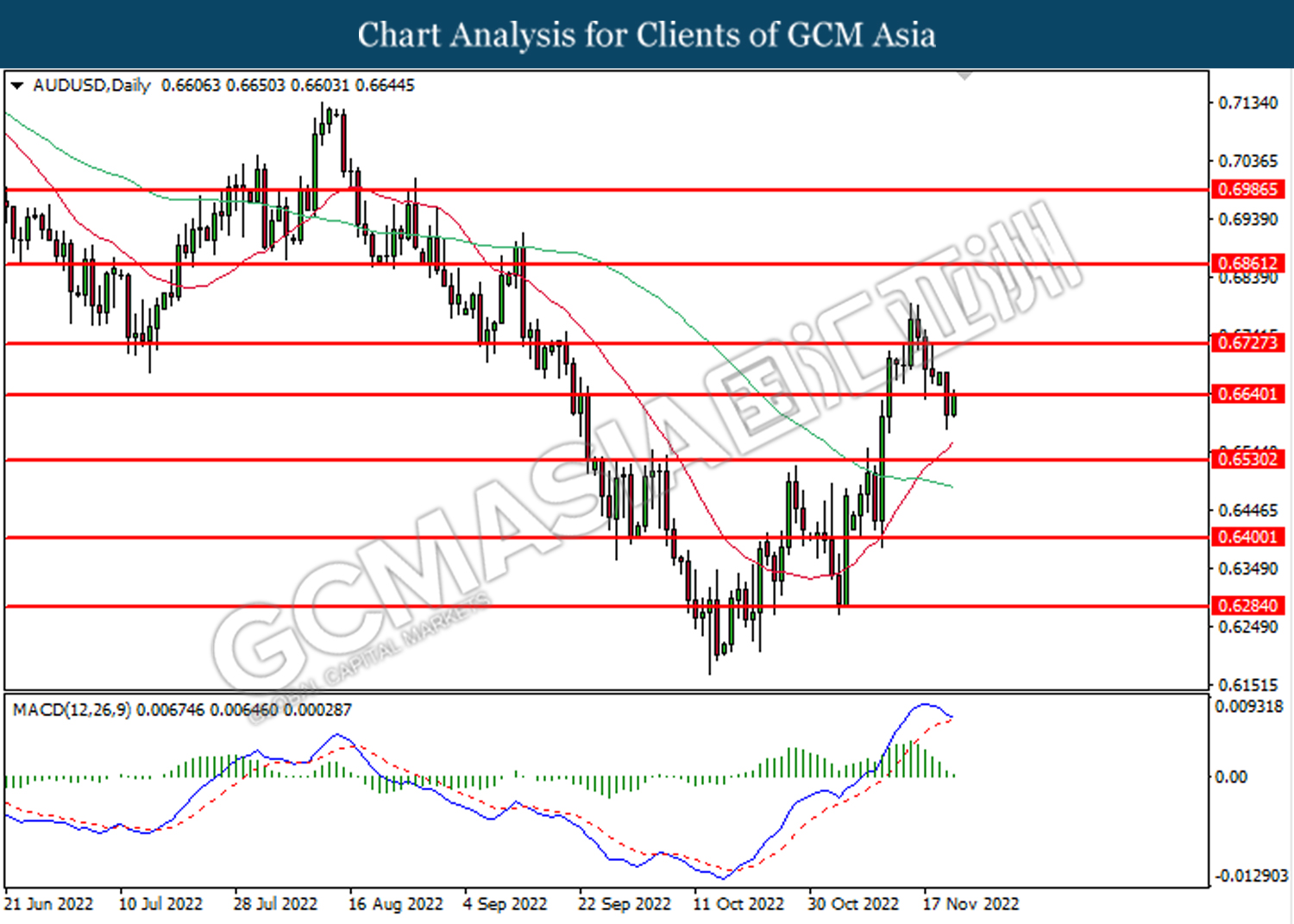

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6640. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6640, 0.6725

Support level: 0.6530, 0.6400

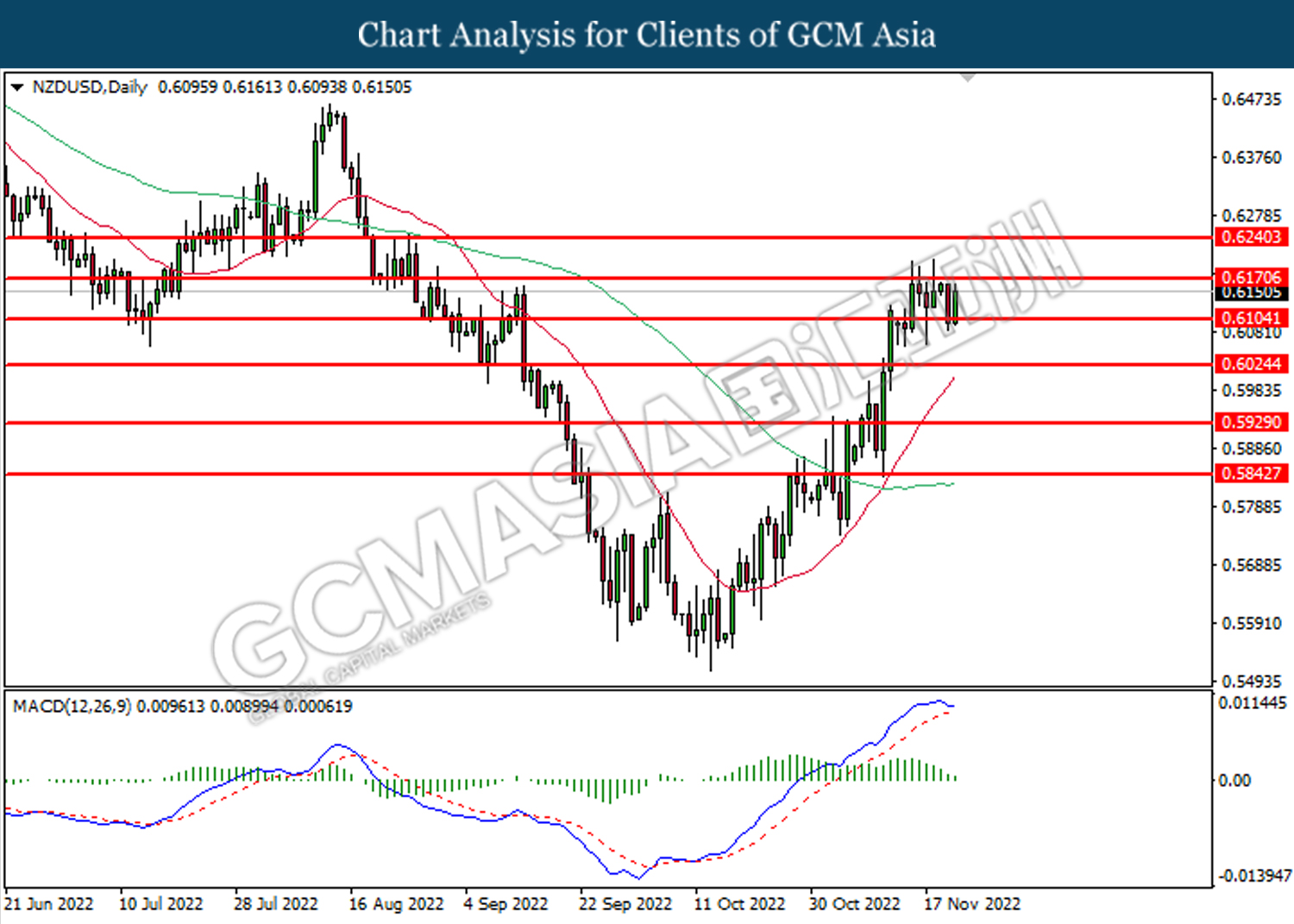

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6105. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

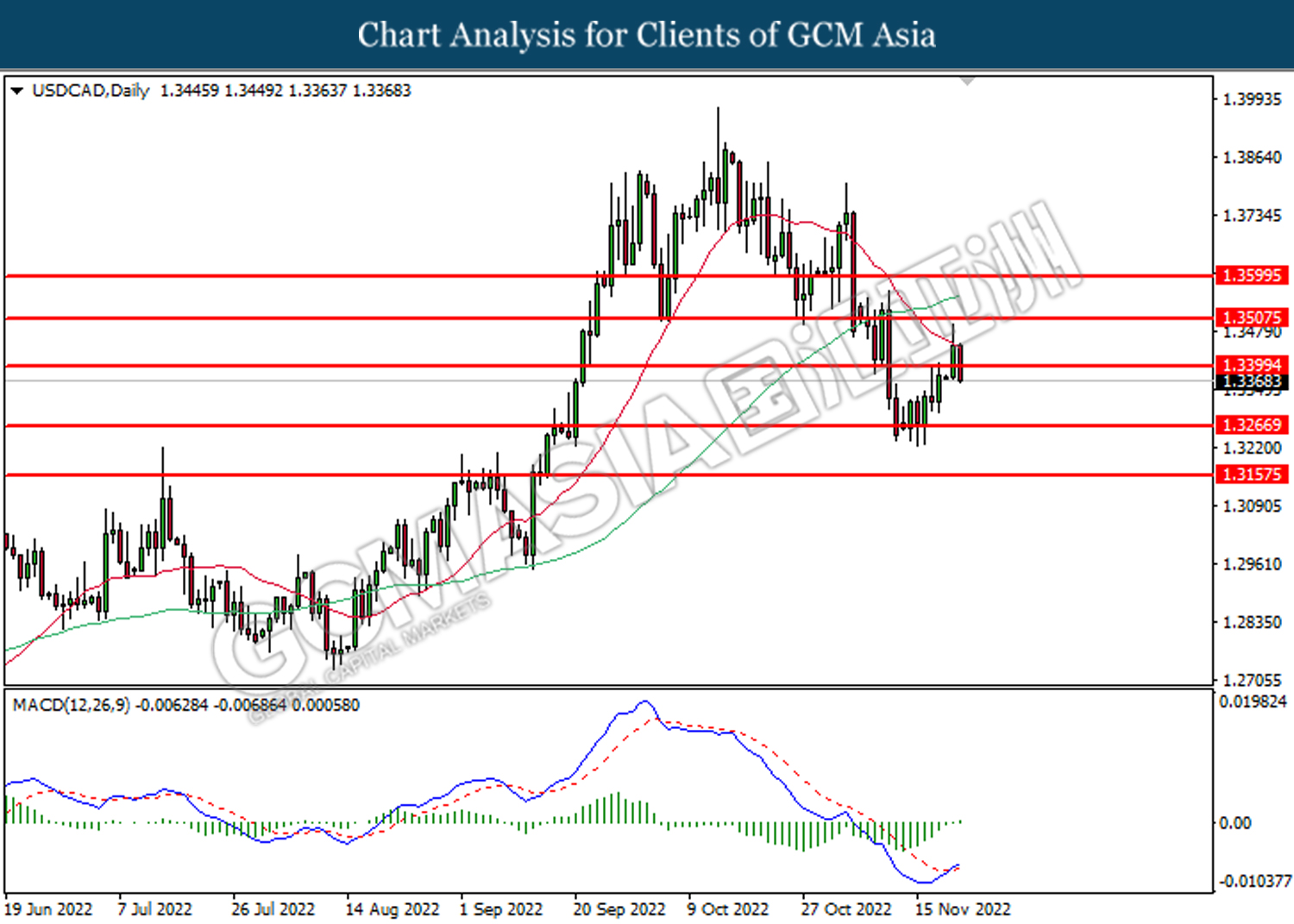

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

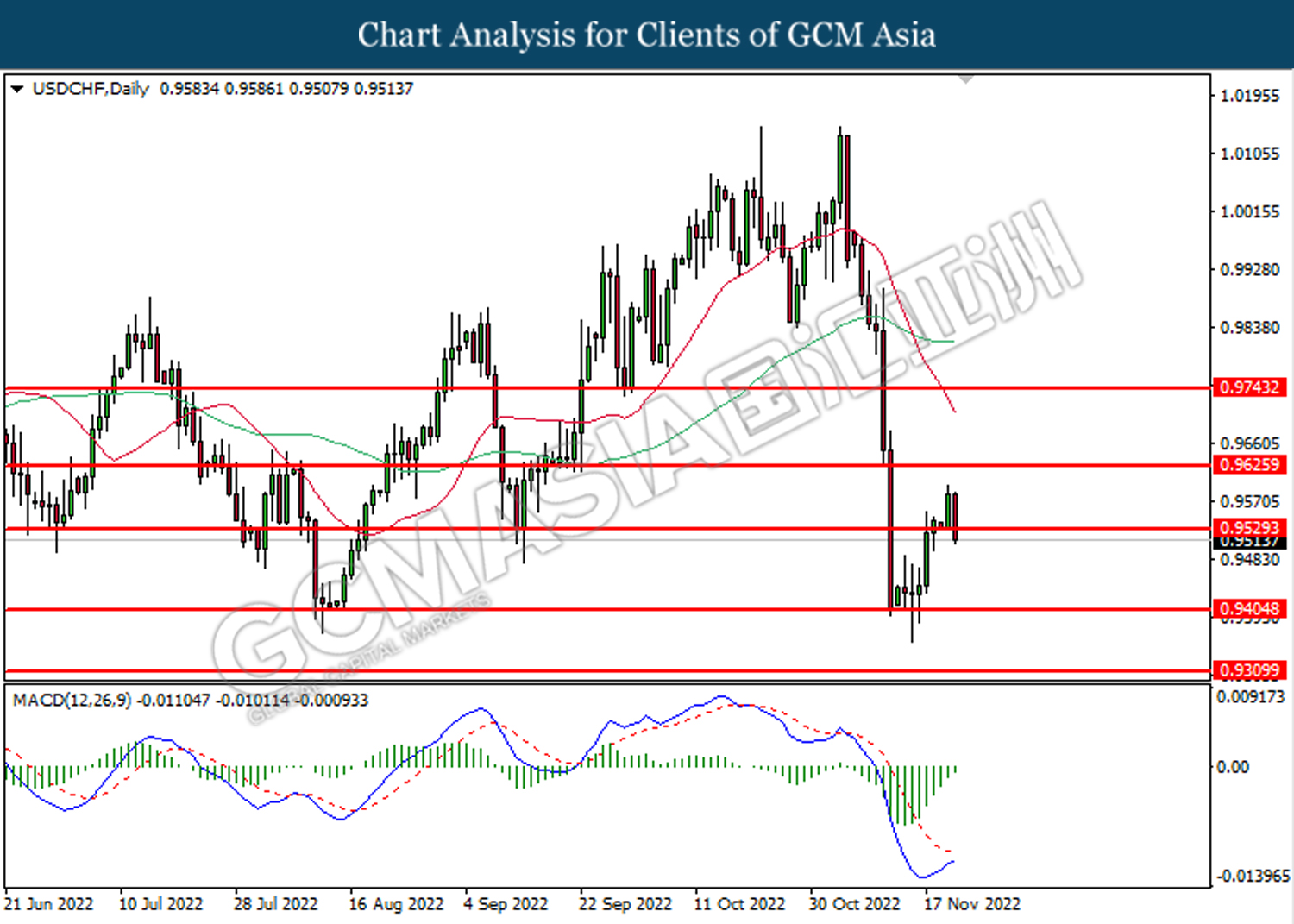

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9530. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 80.45. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 82.90.

Resistance level: 82.90, 84.85

Support level: 80.45, 79.15

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1766.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35