23 December 2020 Morning Session Analysis

Dollar surged amid Congress passes the stimulus plan.

Dollar index which gauges its value against a basket of six major currencies managed to recover part of its previous losses after US Congress achieved a consensus to passes the economic relief plan for the American and local businesses which hit hard by the ongoing pandemic. After weeks of negotiation between the two biggest political parties, a $900 billion bipartisan stimulus plan had eventually unveiled by the US government with 359 – 53 votes in House while the Senate passed the bill by a margin of 92 – 6. In the economic relief package, it includes jobless benefit for the unemployed American, additional loans for local small businesses, another $600 direct payment, funds to support the distribution of Covid-19 vaccines and a bevy of other provisions. The long awaiting stimulus plan are expected to save the US economy from further recession in time as the previous plans are set to expire at the end of the year. As of now, the bill will be sent to US President Donald Trump, who is expected to sign it into law in the coming days. During Asian early trading session, dollar index rose by 0.63% to 90.60.

In the commodities market, the crude oil price down by 0.04% to $46.75 per barrel as of writing amid a surprise stockpile in US crude oil inventories. According to the API, US Weekly Crude Oil Stock increased 2.700M, missing the economist forecast at -3.250M, indicating that the supply glut issue continues haunting this black commodity. Besides, gold price rose 0.07% to $1862.05 a troy ounce as heightening of market concern over the new strain of virus in UK.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 885K | 885K | – |

| 21:30 | CAD – GDP (MoM)(Oct) | 0.8% | 0.3% | – |

| 23:00 | USD – New Home Sales (Nov) | 999K | 995K | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.135M | -3.186M | – |

Technical Analysis

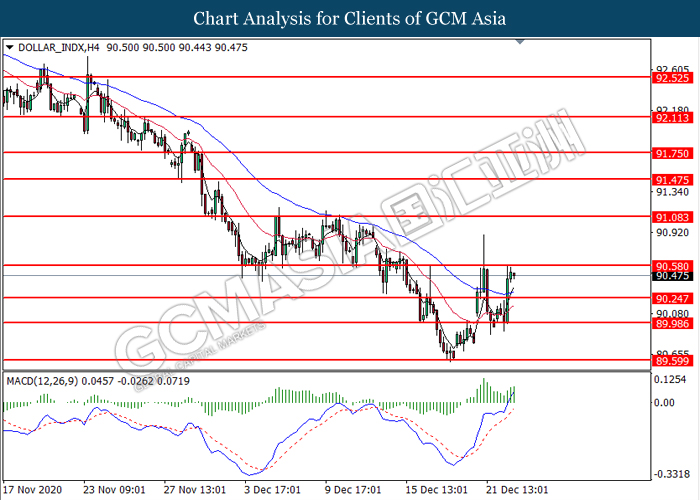

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 90.60. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level at 90.60.

Resistance level: 90.60, 91.10

Support level: 90.25, 90.00

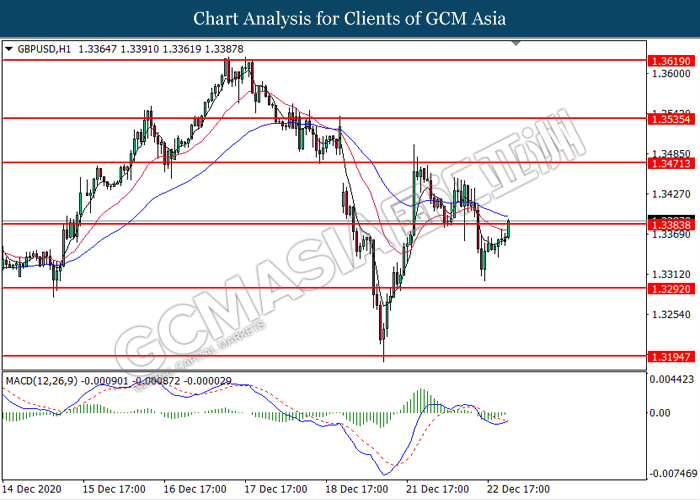

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.3385. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3385, 1.3470

Support level: 1.3290, 1.3195

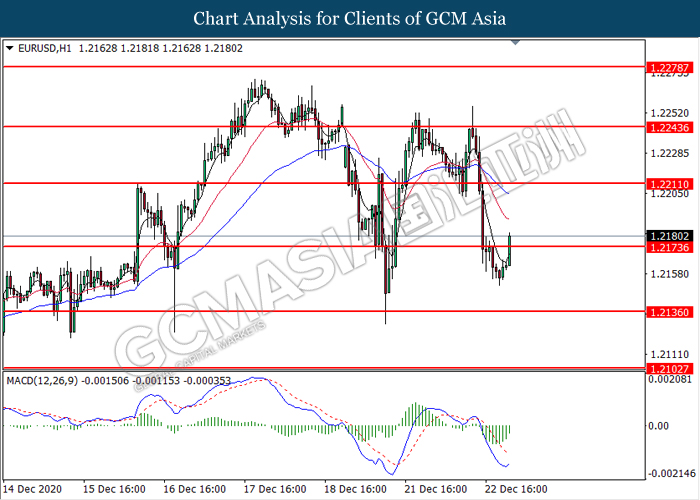

EURUSD, H1: EURUSD was traded higher while currently testing the resistance level at 1.2175. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.2175.

Resistance level: 1.2175, 1.2210

Support level: 1.2135, 1.2105

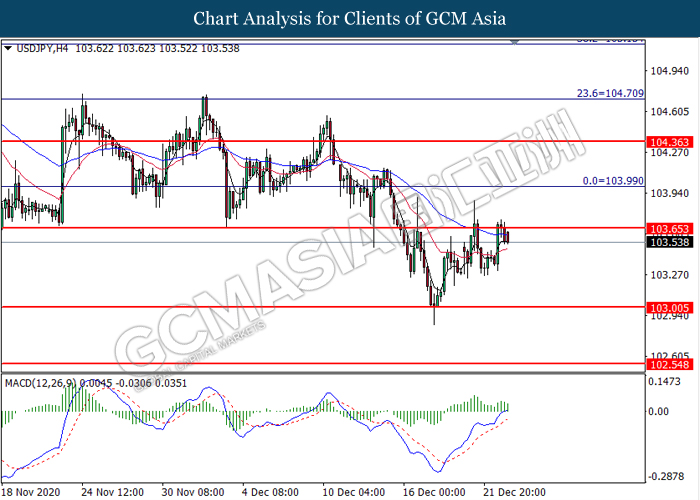

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 103.65. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower toward the support level at 103.00.

Resistance level: 103.65, 104.00

Support level: 103.00, 102.55

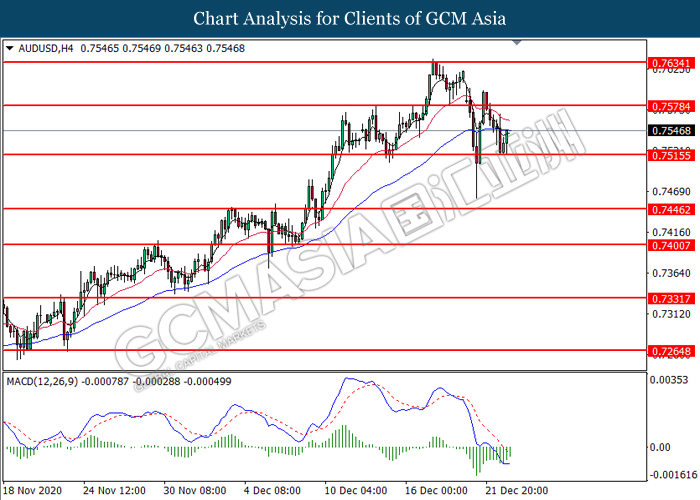

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7515. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7580.

Resistance level: 0.7580, 0.7635

Support level: 0.7515, 0.7445

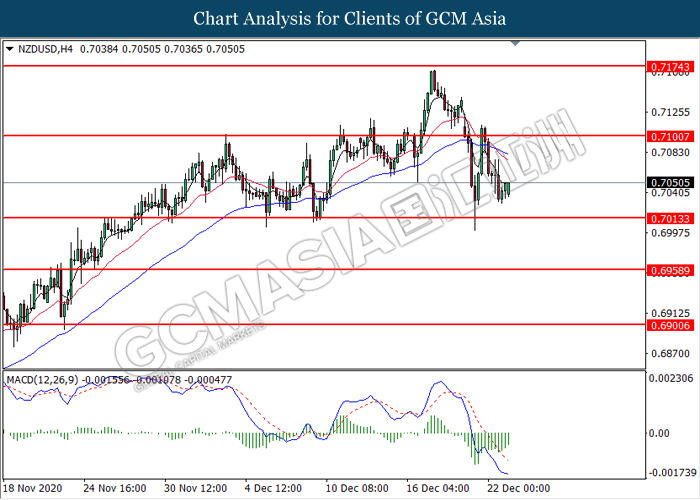

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7100.

Resistance level: 0.7100, 0.7175

Support level: 0.7015, 0.6960

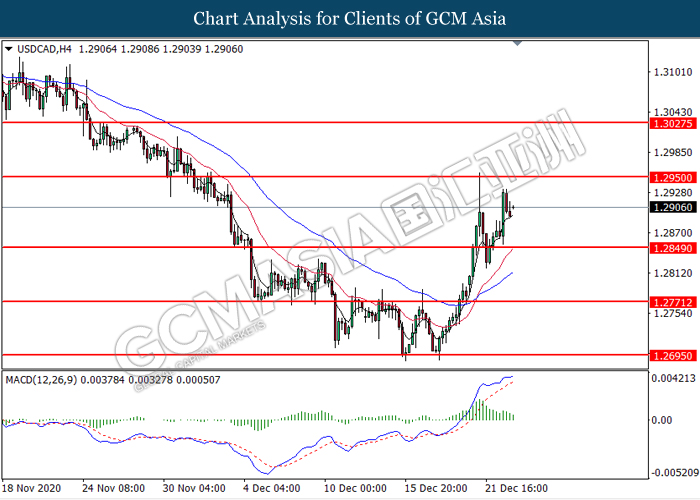

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2850. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2950, 1.3025

Support level: 1.2850, 1.2770

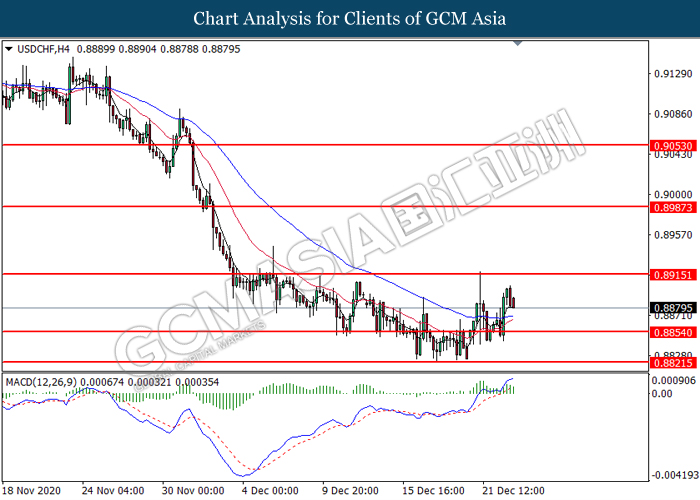

USDCHF, H4: USDCHF was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term toward the support level at 0.8855.

Resistance level: 0.8915, 0.8985

Support level: 0.8855, 0.8820

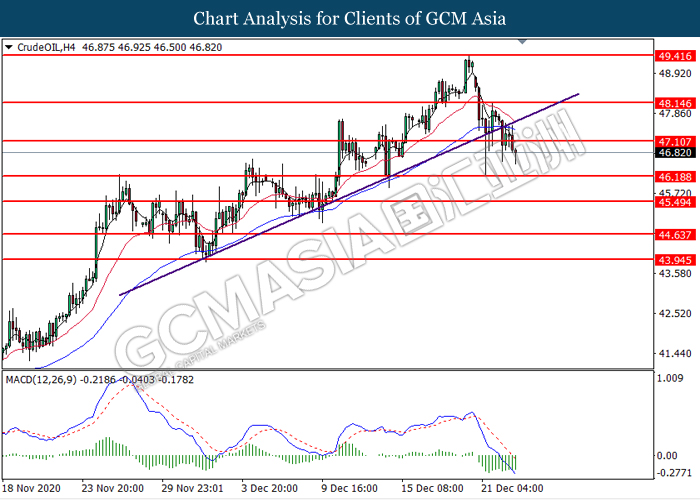

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 47.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 46.20.

Resistance level: 47.10, 48.15

Support level: 46.20, 45.50

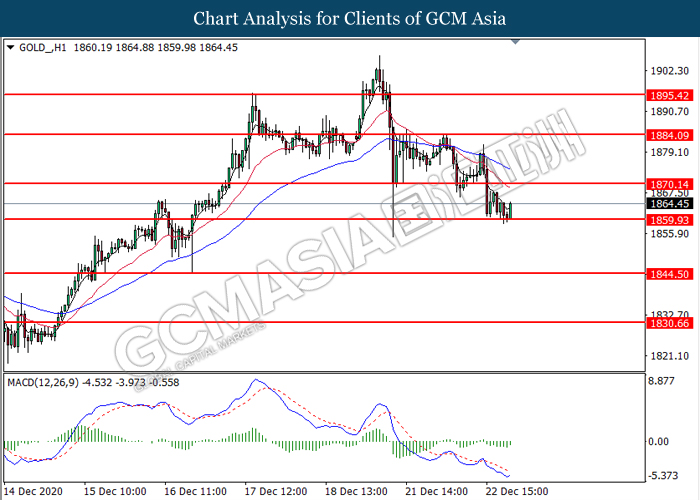

GOLD_, H1: Gold price was traded higher following prior rebound from the support level at 1859.95. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1870.15.

Resistance level: 1870.15, 1884.10

Support level: 1859.95, 1844.50