24 January 2022 Afternoon Session Analysis

Pound dipped amid bearish data.

The Pound Sterling slumped over the backdrop of bearish economic data on last Friday, dialed down the market optimism toward the economic progression in the United Kingdom. According to Office for National Statistics, UK Retail Sales for last month notched down significantly from the previous reading of 1.0% to -3.7%, missing the market forecast at -0.6% due to the spiking numbers of the Omicron variant continue to weigh down the economic momentum in the United Kingdom. Nonetheless, economist still predicted that the Bank of England was still likely to increase the interest rates for a second time in two months in February in order to combat the high inflation rate. According to the latest inflation data, British consumer price inflation had hit a nearly 30-year high of 5.4% for the year of 2021. Rising energy prices and labor cost due to supply constraint had continue to increase the inflation risk in future. Nonetheless, investors would continue to scrutinize the latest updates with regards of the monetary policy decision to gauge the likelihood movement for the Pound Sterling. As of writing, GBP/USD appreciated by 0.02% to 1.3556.

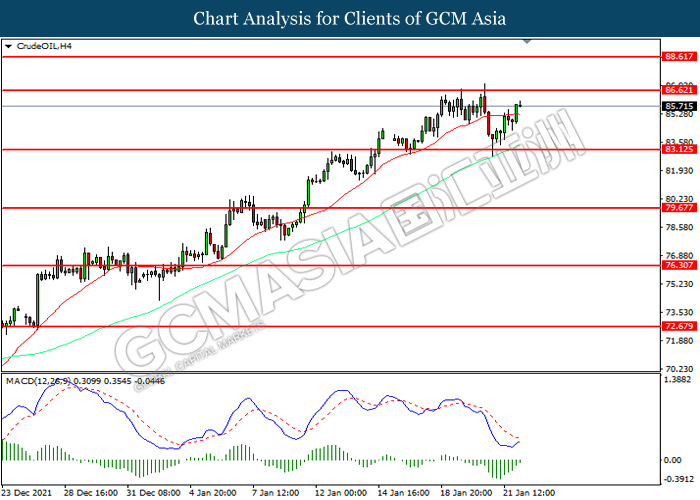

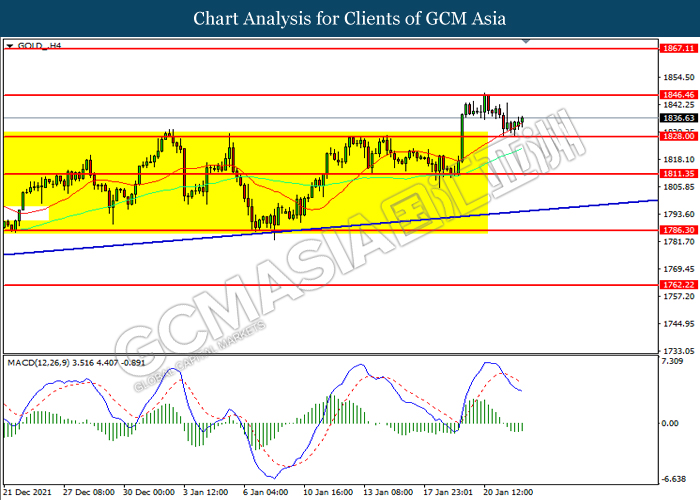

In the commodities market, the crude oil price surged 1.32% to $86.56 per barrel as of writing amid rising geopolitical tensions in Eastern Europe and the Middle East had heightened concerns for the supply disruption in future, while OPEC and its allies continued to struggle to raise their output due to lack of capacity. On the other hand, the gold price was traded flat at $1835.75 per troy ounces as of writing as market participants are still eyeing on the monetary policy decision from Federal Reserve before entering the gold market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Jan) | 57.4 | 57.0 | – |

| 17:30 | GBP – Composite PMI | 53.6 | – | – |

| 17:30 | GBP – Manufacturing PMI | 57.9 | 57.7 | – |

| 17:30 | GBP – Services PMI | 53.6 | 53.9 | – |

Technical Analysis

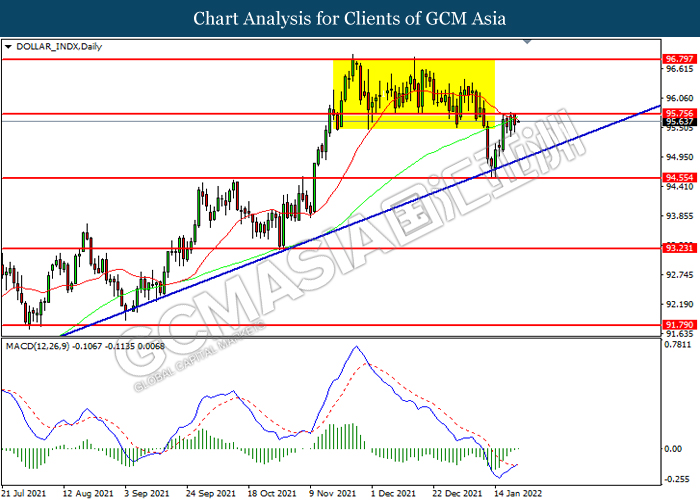

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.75. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

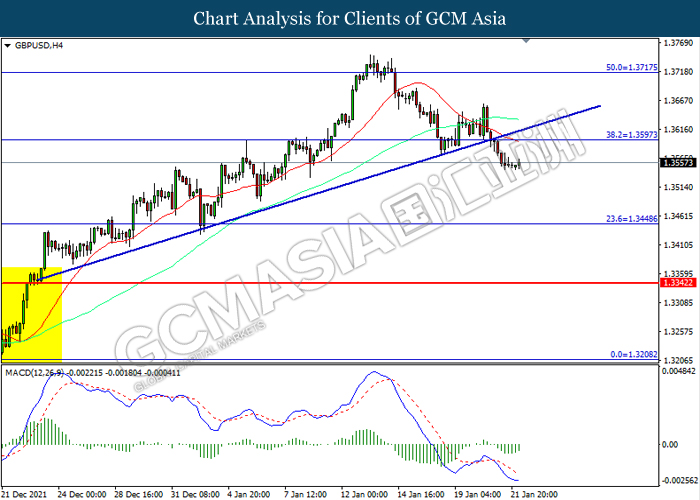

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

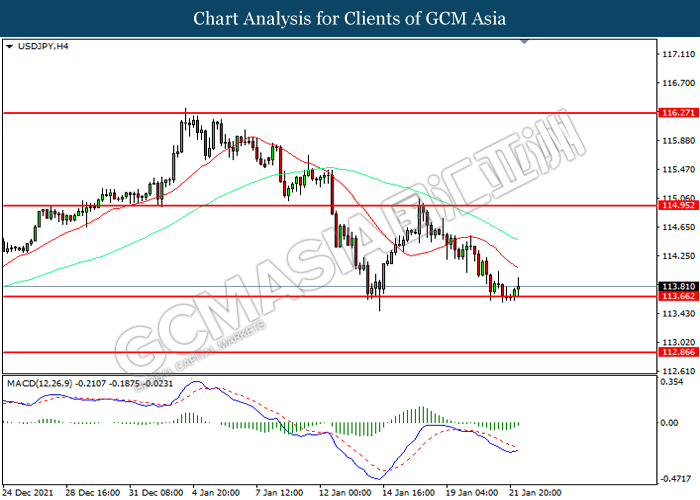

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

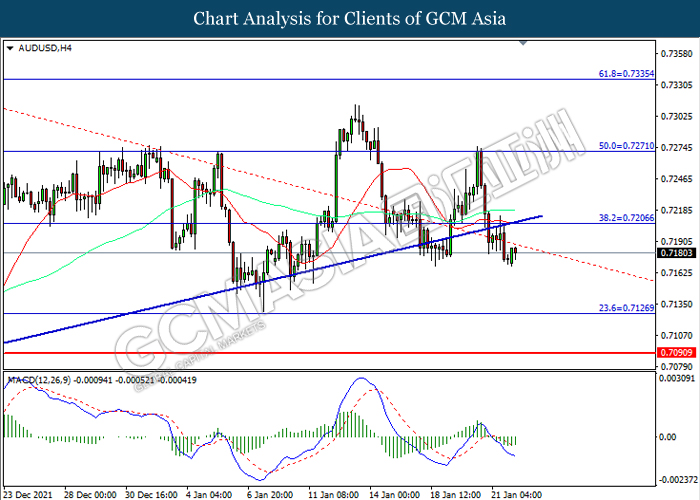

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

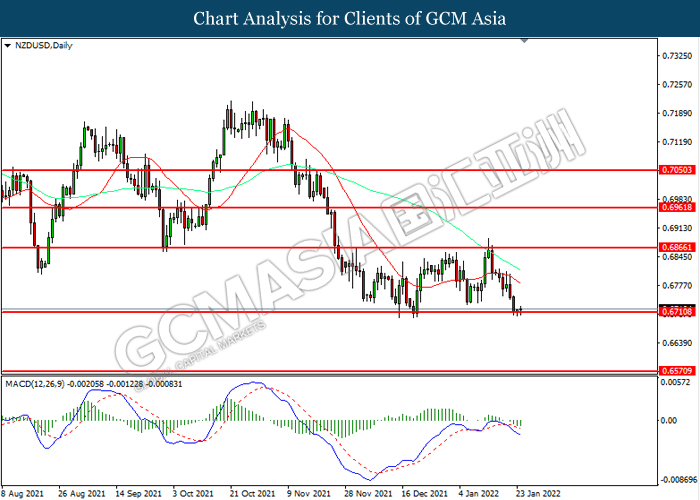

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

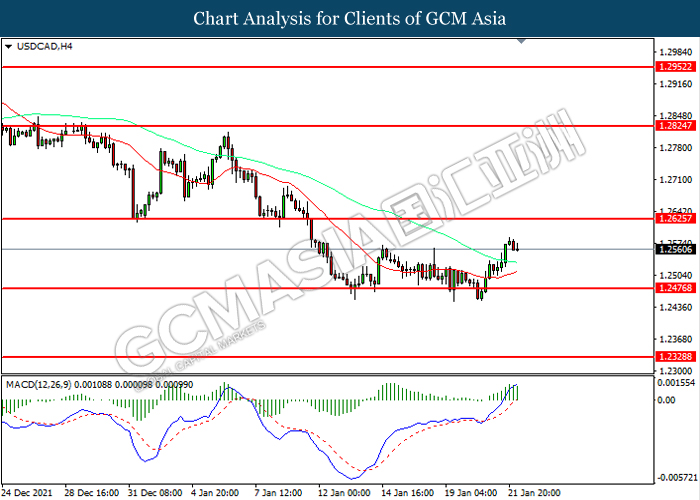

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2475. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2625.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9095. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 83.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 86.60

Resistance level: 86.60, 88.60

Support level: 83.15, 79.70

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1828.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1846.45, 1856.00

Support level: 1828.00, 1811.35