24 January 2022 Morning Session Analysis

US Dollar was traded flat, investors are eyeing on FOMC meeting.

The Dollar Index which traded against a basket of six major currency slumped amid technical correction while investors are still waiting for crucial Federal Reserve meeting in this week for more clarity on the outlook for rate hikes in short-term basis. The expectation for the Fed to tighten the monetary policy at faster pace than previously anticipated had caused the US Treasury yield to increase significantly earlier last week. Market participants are pricing in as many as four rate hikes in the year of 2022 while expecting the Fed to start trimming its $8 trillion-plus balance sheet within months. Contractionary monetary policy as well as rate hike in future will diminish the money circulation in the US financial market, which spurring bullish momentum on the US Dollar. As of writing, the Dollar Index depreciated by 0.10% to 95.65.

In the commodities market, the crude oil price appreciated by 0.33% to $85.45 per barrel as of writing. The oil market edged higher following the U.S energy firms this week cut oil rigs for the first time in 13 weeks. According to Baker Hughes, U.S. oil rigs fell by one to 491 this week. On the other hand, the gold price depreciated by 0.26% to $1834.75 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Jan) | 57.4 | 57.0 | – |

| 17:30 | GBP – Composite PMI | 53.6 | – | – |

| 17:30 | GBP – Manufacturing PMI | 57.9 | 57.7 | |

| 17:30 | GBP – Services PMI | 53.6 | 53.9 |

Technical Analysis

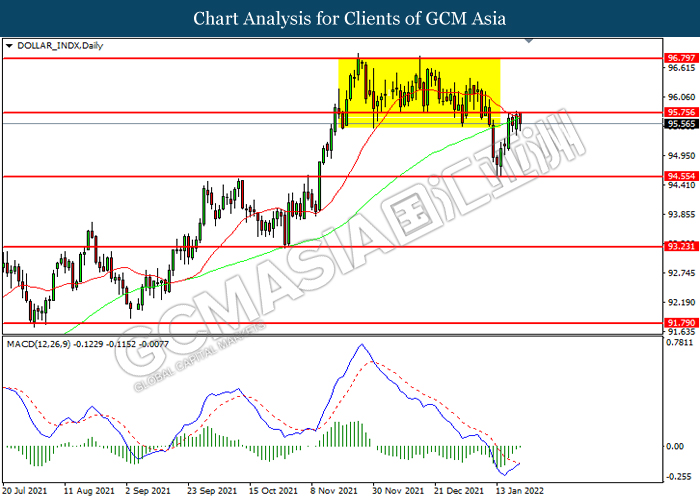

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.75. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

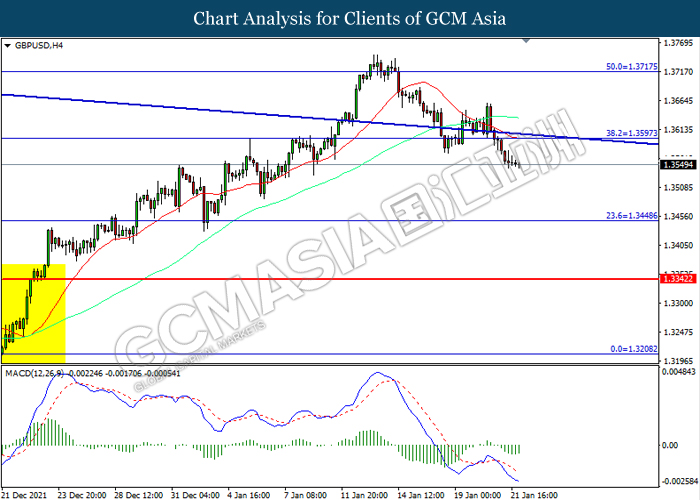

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

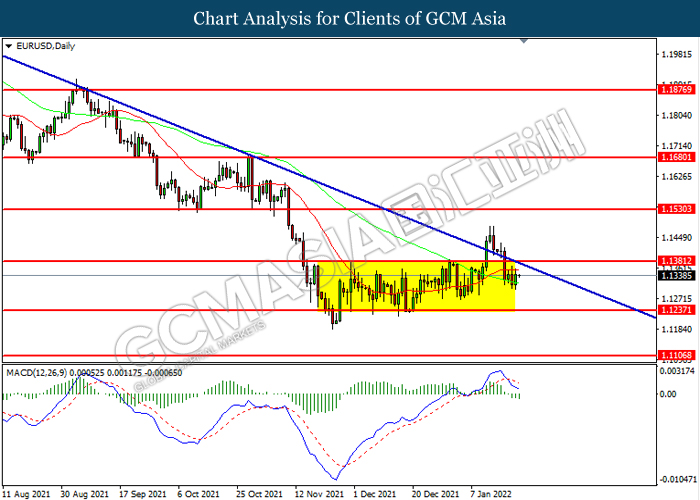

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

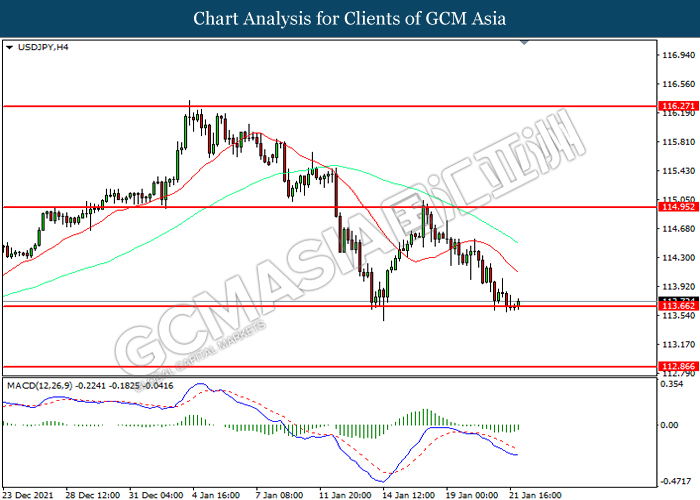

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

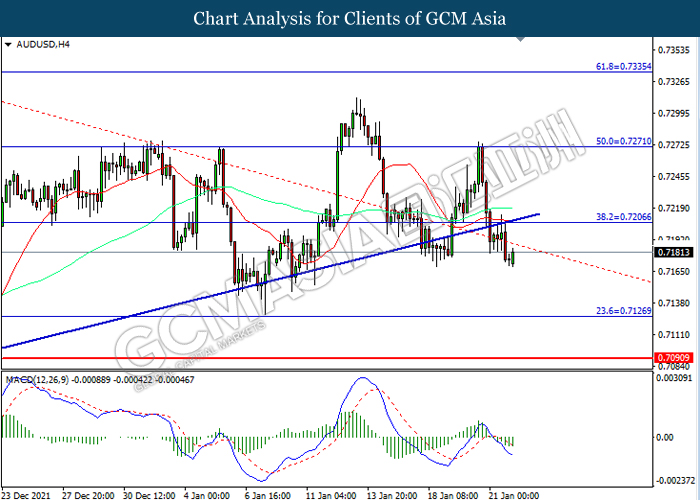

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

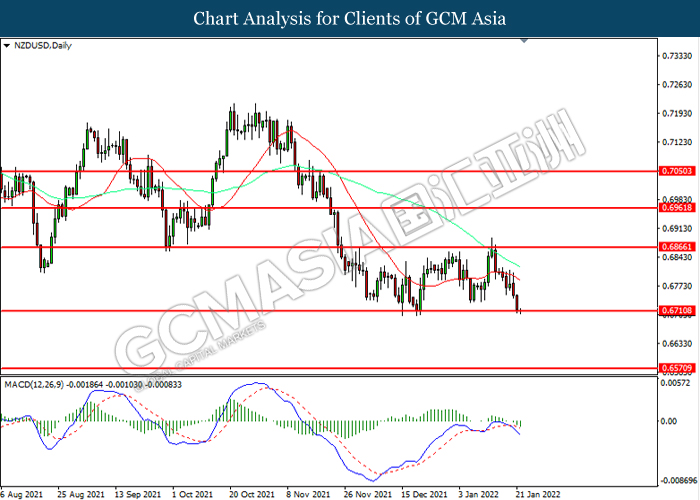

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

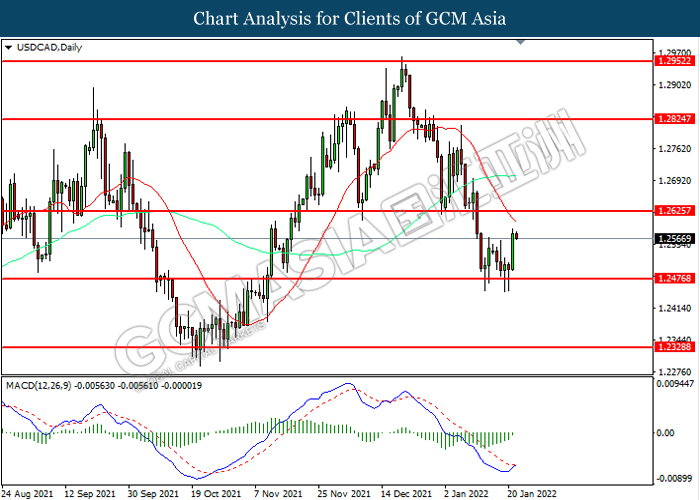

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2475. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2625.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9095. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

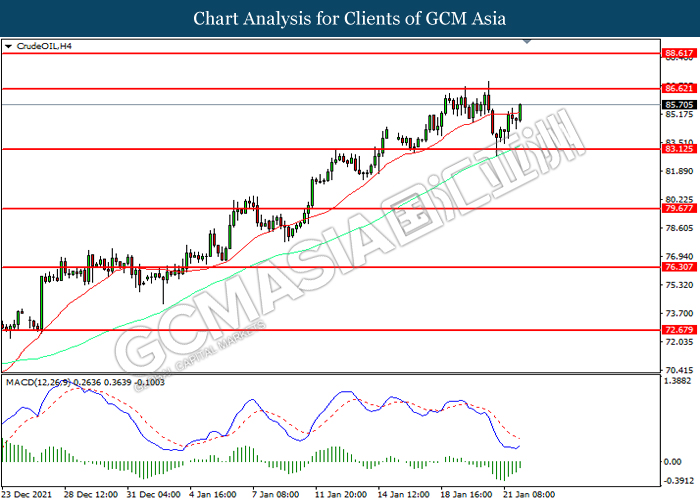

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 83.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 86.60

Resistance level: 86.60, 88.60

Support level: 83.15, 79.70

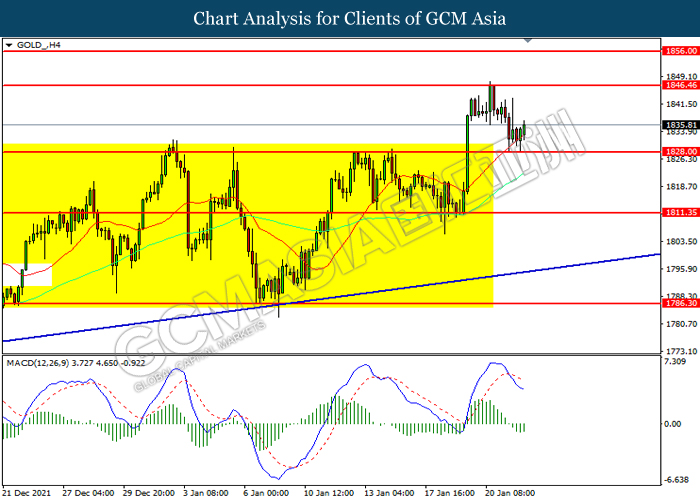

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1828.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1846.45, 1856.00

Support level: 1828.00, 1811.35