24 March 2017 Daily Analysis

Dollar-bull dominates ahead of Congress vote.

Greenback remained resilient during early Asian hours as a dramatic inter-party showdown looms the US later tonight where final votes will be tallied in order to replace Obama-era’s healthcare law after falling short during yesterday’s Congress. Republican leaders failed to garner enough support to pass the amendment bill and instead focusing on other priorities and leaving the Obamacare in place for now. Investors’ will place their focus on Trump’s ability to allow other key policies to pass through the Congress such as tax reform while final vote on the healthcare bill would remain as the key event for tonight. The dollar index was up 0.16% and last seen at 99.92 this morning. Otherwise, pound sterling edged slightly lower, down 0.27% to 1.2487. Sterling was under pressure after Bank of England’s member Gertjan Vlieghe gave dovish comments where he believes that higher inflation does not necessarily reflect to an interest rate hike.

In the commodities market, crude oil price edges up, supported by a draw in Saudi exports to the United States while still remain pressured as investors ponder for further market indication on US shale industry. Gold price was down 0.1% to $1,243.60 amid firmer dollar ahead of Congress vote during North American session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Event

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 05:45 | NZD – Trade Balance (MoM) (Feb) | -257M | 160M | -18M |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 56.8 | 56.5 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.0% | 0.5% | – |

| 20:30 | CAD – CPI (MoM) (Feb) | 0.5% | – | – |

| 02:00 | Crude Oil – Baker Hughes Oil Rig Count | 631 | – | – |

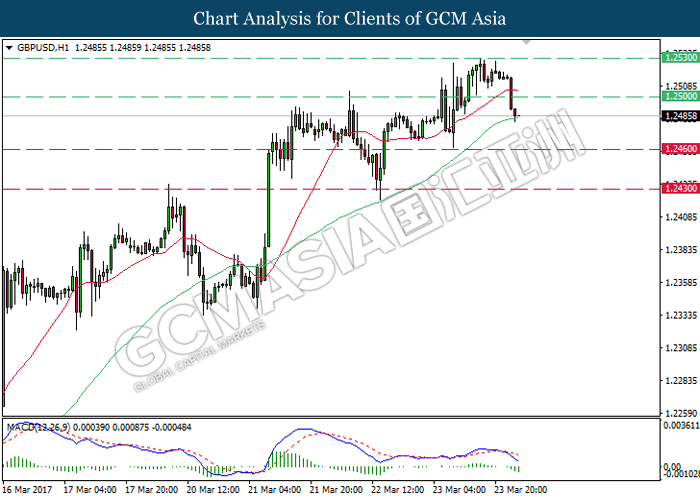

GBPUSD

GBPUSD, H1: GBPUSD was traded lower following a retrace from the previous high of 1.2530 while recently testing near the 60-moving average line (green). A successful closure below this line would suggest GBPUSD to advance further down towards the target support level of 1.2460.

Resistance level: 1.2500, 1.2530

Support level: 1.2460, 1.2430

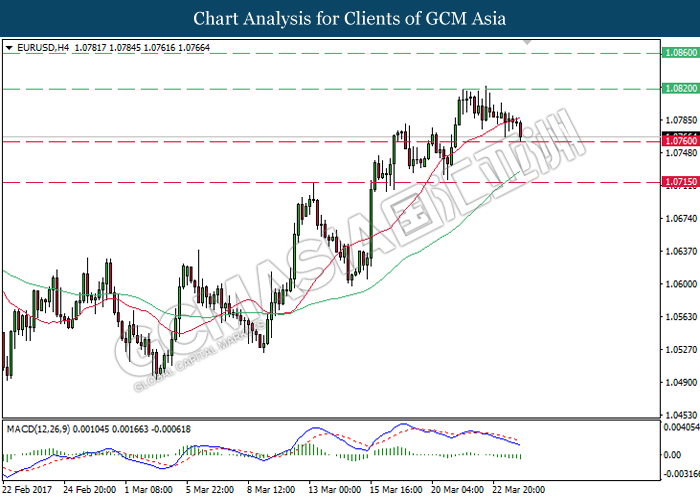

EURUSD

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level of 1.0820 while recently closing below the 20-moving average line (red). With regards to the MACD histogram which illustrates downward signal and momentum, a closure below the support level of 1.0760 would suggest EURUSD to move further downwards thereafter.

Resistance level: 1.0820, 1.0860

Support level: 1.0760, 1.0715

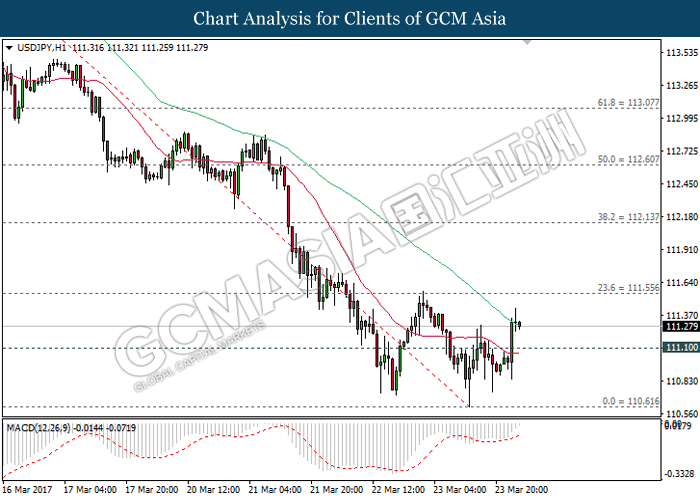

USDJPY

USDJPY, H1: USDJPY was traded higher following prior closure above both moving average line. Referring to the indicator from MACD which continues to hover outside of downward momentum, USDJPY may extend its retracement period and continue to be traded higher in the short-term. Otherwise, long-term trend direction still suggests the extension of downtrend.

Resistance level: 111.55, 112.15

Support level: 111.10, 110.60

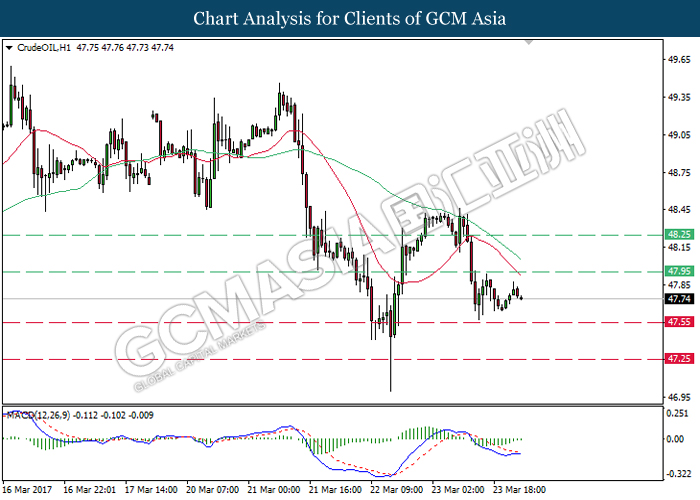

CrudeOIL

CrudeOIL, H1: Crude oil price was traded lower following a retracement before the 20-moving average line (red). However, as the downward signal line in MACD histogram continues to narrow sideways, crude oil price may be traded higher in the short-term as technical correction. Otherwise, long-term trend direction still suggests an ongoing downtrend as both moving average line extends its expansion while heading downwards.

Resistance level: 47.95, 48.25

Support level: 47.55, 47.25

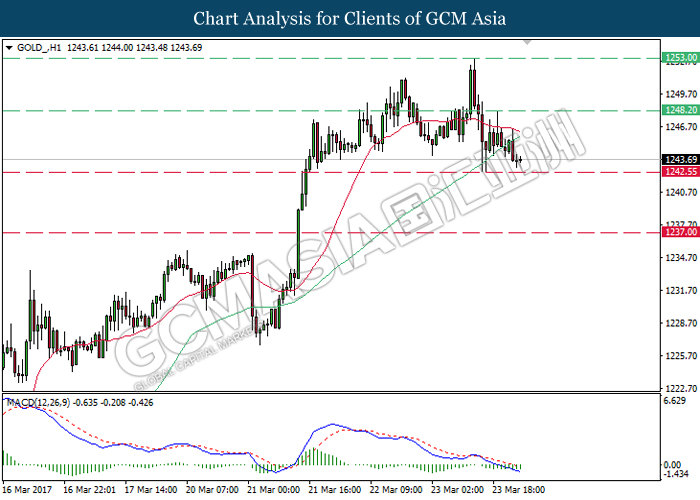

GOLD

GOLD_, H1: Gold price was traded lower following prior retracement from the 20-moving average line. As the MACD histogram continues to illustrate downward signal while both moving average line continues to narrow upwards and may form an imminent death cross, gold price is expected to extend its losses after breaking the support level of 1242.55.

Resistance level: 1248.20, 1253.00

Support level: 1242.55, 1237.00