24 March 2023 Morning Session Analysis

US Dollar jumped as optimistic jobless claims report released.

The Dollar Index which traded against a basket of six major currencies regained its luster on yesterday following the positive economic data has dialed up the market optimism toward the economic progression in the US. According to the US Department of Labor, the US Initial Jobless Claims had notched down from the previous reading of 192K to 191K, missing the consensus forecast of 197K. In other words, the number of unemployment has reduced throughout last week, as well as indicating that the US labor market remained resilient amid the background of bank collapse. With that, it would likely to add the odds of further rate hike from Fed in the next meeting. On the other hand, the speech from the US Treasury Secretary has gathered the confident of investors upon US banking sector. According to CNBC, the US Treasury Secretary Janet Yellen claimed that the emergency federal action to support Silicon Valley Bank and Signature Bank customers would be deployed again in the future if necessary, which diminishing the market fears against the banking crisis that driven by aggressive rate hike plan. As of writing, the Dollar Index edged up by 0.03% to 102.27.

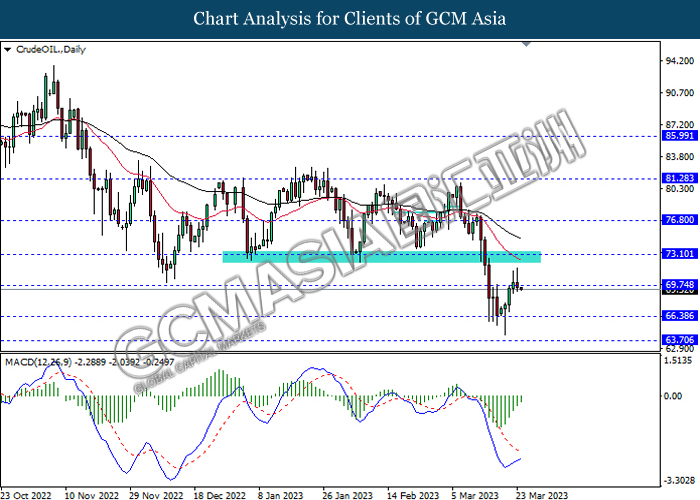

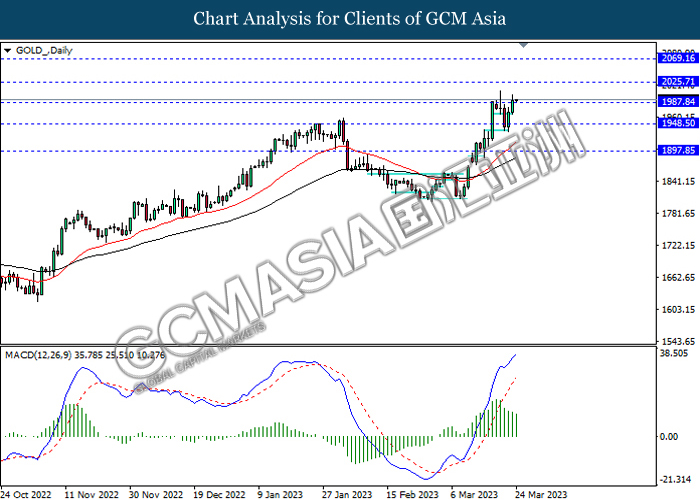

In the commodity market, the crude oil price depreciated by 0.64% to $69.51 per barrel as of writing following the OPEC might stick to its 2 million production cut that implemented last year. In addition, the gold price eased by 0.10% to $1990.60 per tory ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

21:30 USD FOMC Member Bullard Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Feb) | 0.5% | 0.2% | – |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 46.3 | 47.0 | – |

| 17:00 | EUR – S&P Global Composite PMI (Mar) | 52.0 | 52.0 | – |

| 17:30 | GBP – Composite PMI | 53.1 | 52.7 | – |

| 17:30 | GBP – Manufacturing PMI | 49.3 | 50.0 | – |

| 17:30 | GBP – Services PMI | 53.5 | 53.0 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.8% | 0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jan) | -0.6% | 0.6% | – |

| 21:45 | USD – S&P Global Composite PMI (Mar) | 50.1 | 47.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

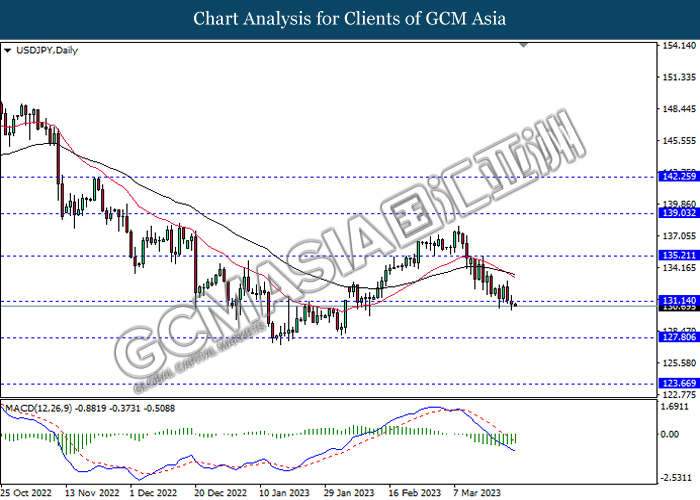

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.15, 135.20

Support level: 127.80, 123.65

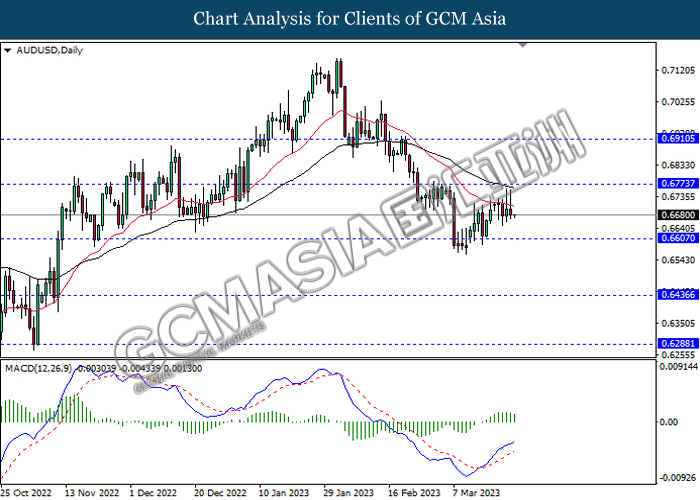

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

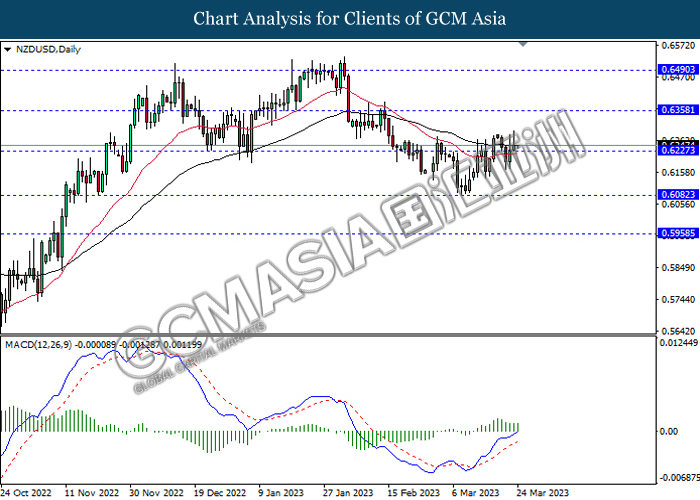

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

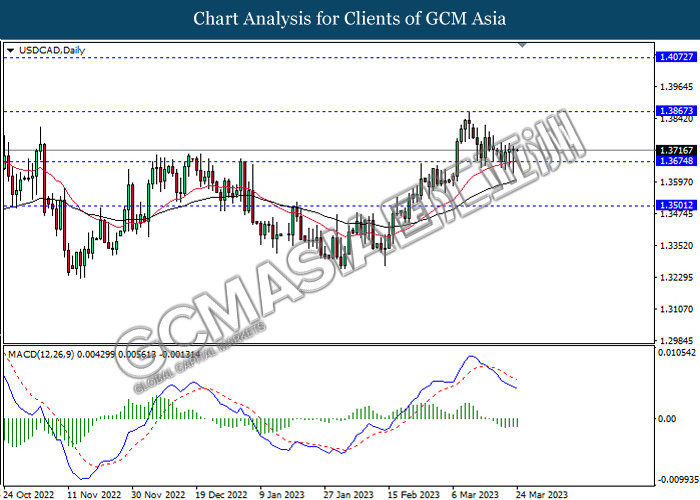

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

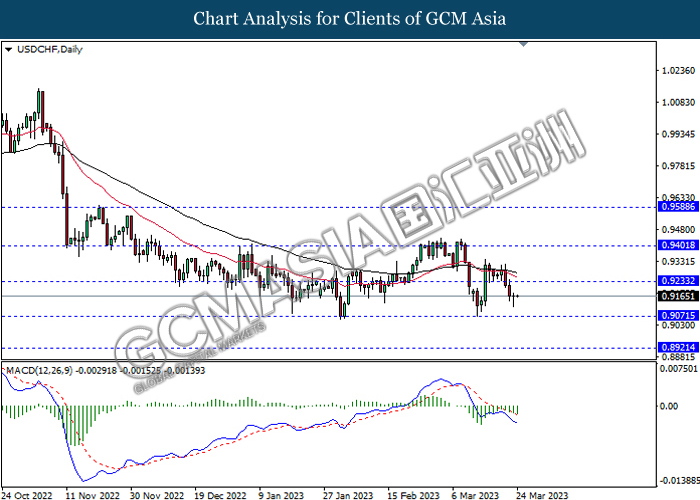

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 69.75, 73.10

Support level: 66.40, 63.70

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50