24 May 2023 Morning Session Analysis

Greenback surged as US services showed significant growth.

The dollar index, which was traded against a basket of six major currencies, extended its gains following the release of a series of mixed economic data yesterday. According to the Markit, the US Services PMI data improved from 53.6 to 55.1, far better than the consensus forecast at 52.6, signaling a strong expansion in service sector output in the month of May. The decent improvement of US services sector was mainly attributed to the greater demand from both the new and existing clients, where the new orders recorded the fastest rate of increase since April 2022. It is noteworthy to mention that the services sector contributed more than 70% to the GDP of the US. Hence, the continued expansion in the US services sector hinted a further growth in the US economy throughout the month of May despite the risk of default heightened. However, the gains of the dollar index were limited by the Manufacturing PMI. Over the same period, the S&P Global Manufacturing PMI fell to 48.5 from 50.2, indicating a contraction in manufacturing activity. Besides, the absence of a debt ceiling deal also continued to weigh on the market sentiment even as the US President Joe Biden said that the talks were productive. As of writing, the dollar index rose 0.31% to 103.50.

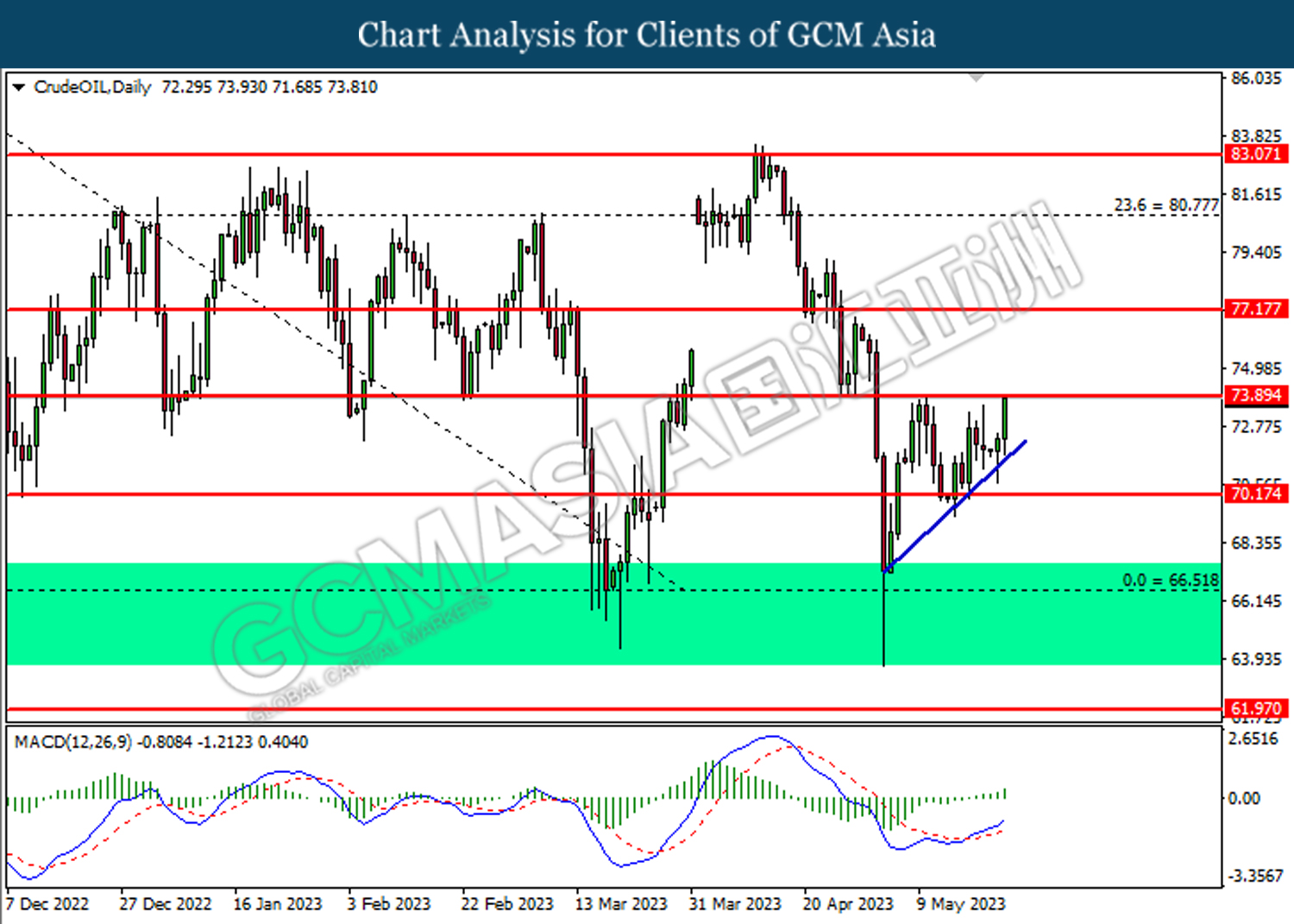

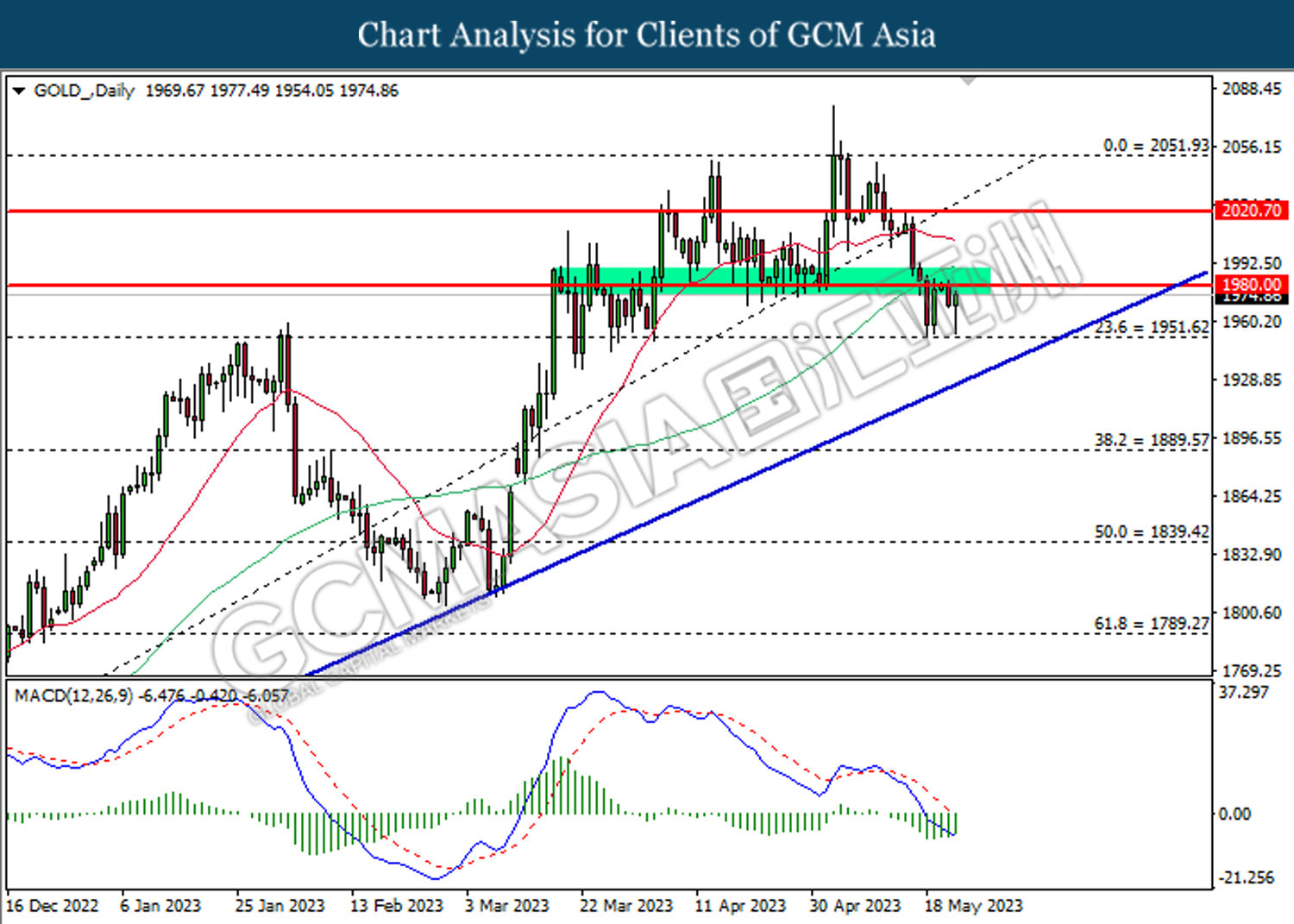

In the commodities market, crude oil prices were up by 1.00% to $72.90 per barrel as the API Weekly Crude Oil Inventories data showed a huge draw this morning. According to API, US oil inventories level dropped -6.799M while the consensus forecast was 0.525M. Besides, gold prices edged up by 0.09% to $1976.85 per troy ounce as the risk of default heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Press Conference

17:30 GBP BoE Gov Bailey Speaks

21:00 GBP BoE Gov Bailey Speaks

02:00 USD FOMC Meeting Minutes

(25th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Apr) | 10.1% | 8.3% | – |

| 16:00 | EUR – German Ifo Business Climate Index (May) | 93.6 | 93.0 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 5.040M | -0.920M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

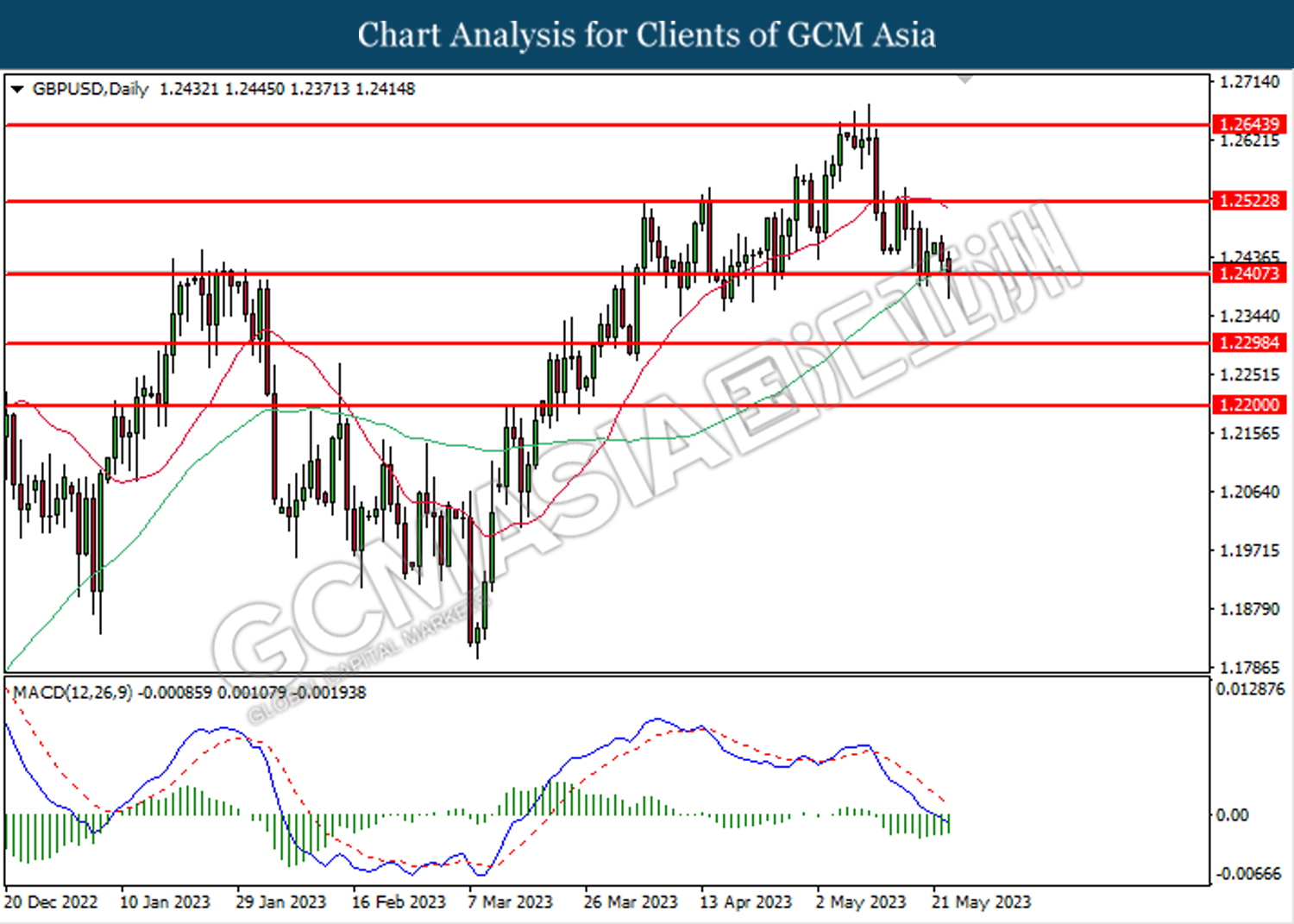

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

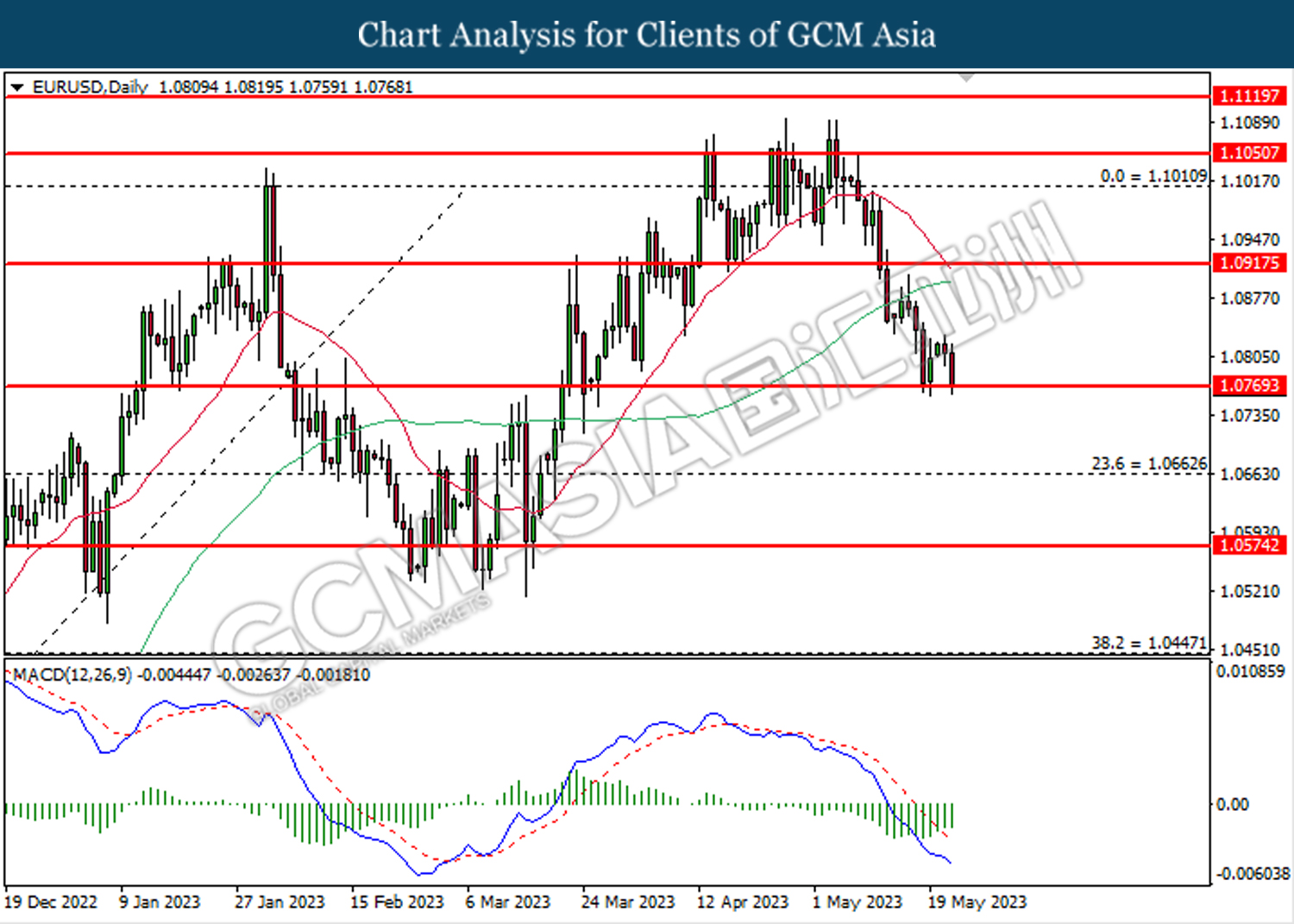

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

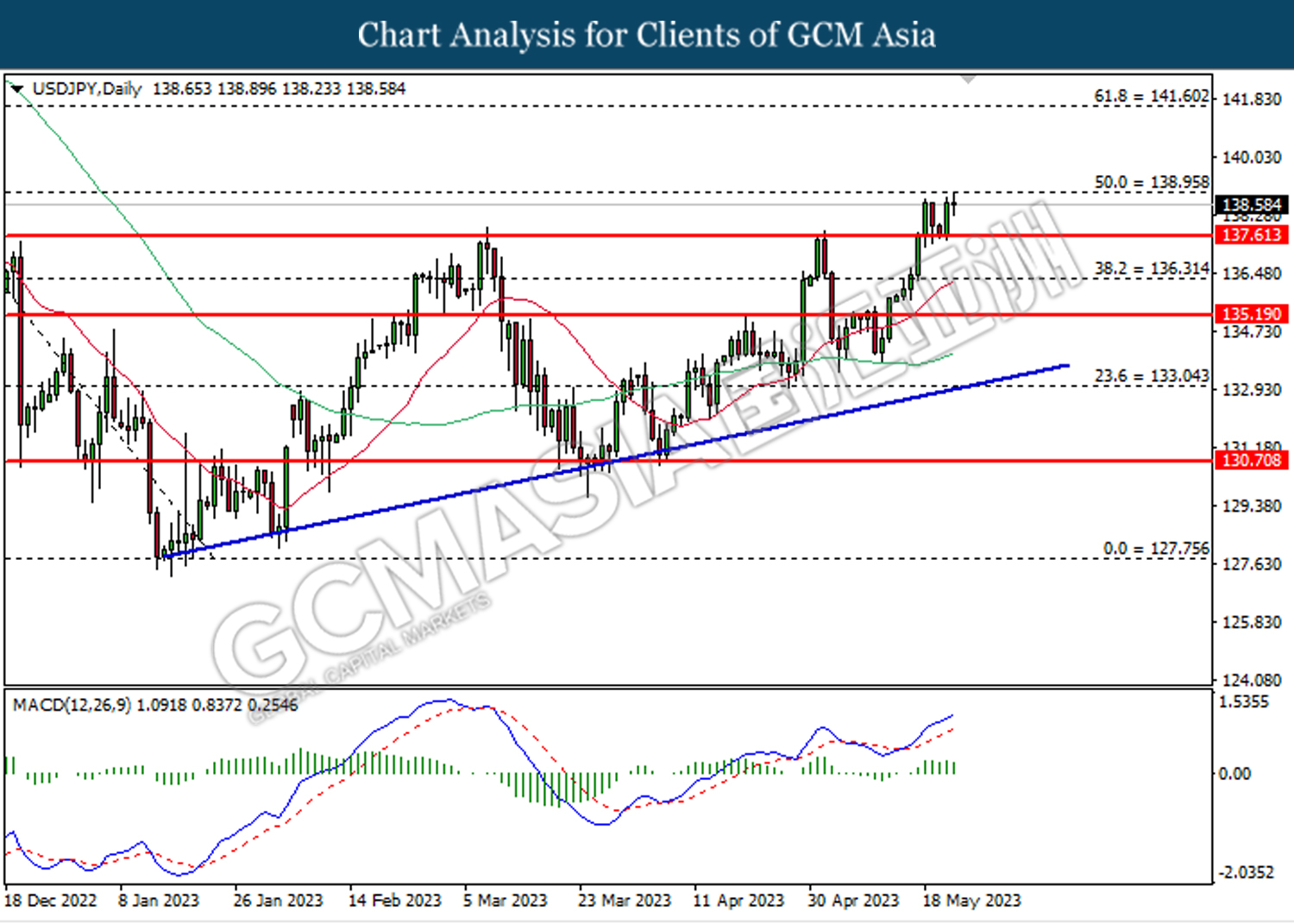

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 137.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.95.

Resistance level: 138.95, 141.60

Support level: 137.60, 136.30

AUDUSD, Daily: AUDUSD was traded lower while currently testing the upward trend line. However, MACD which illustrated bearish momentum suggest the pair to undergo technical correction.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

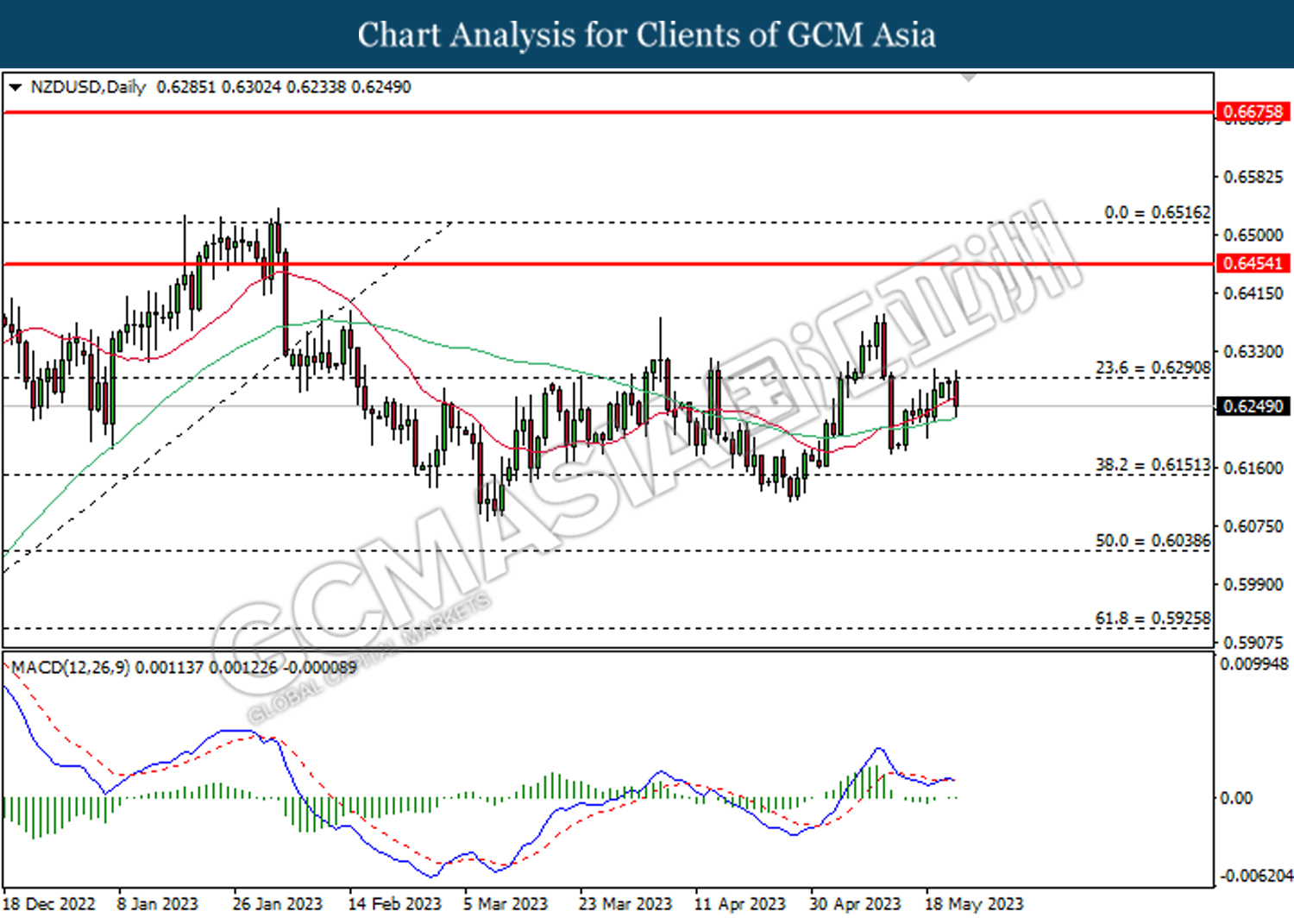

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

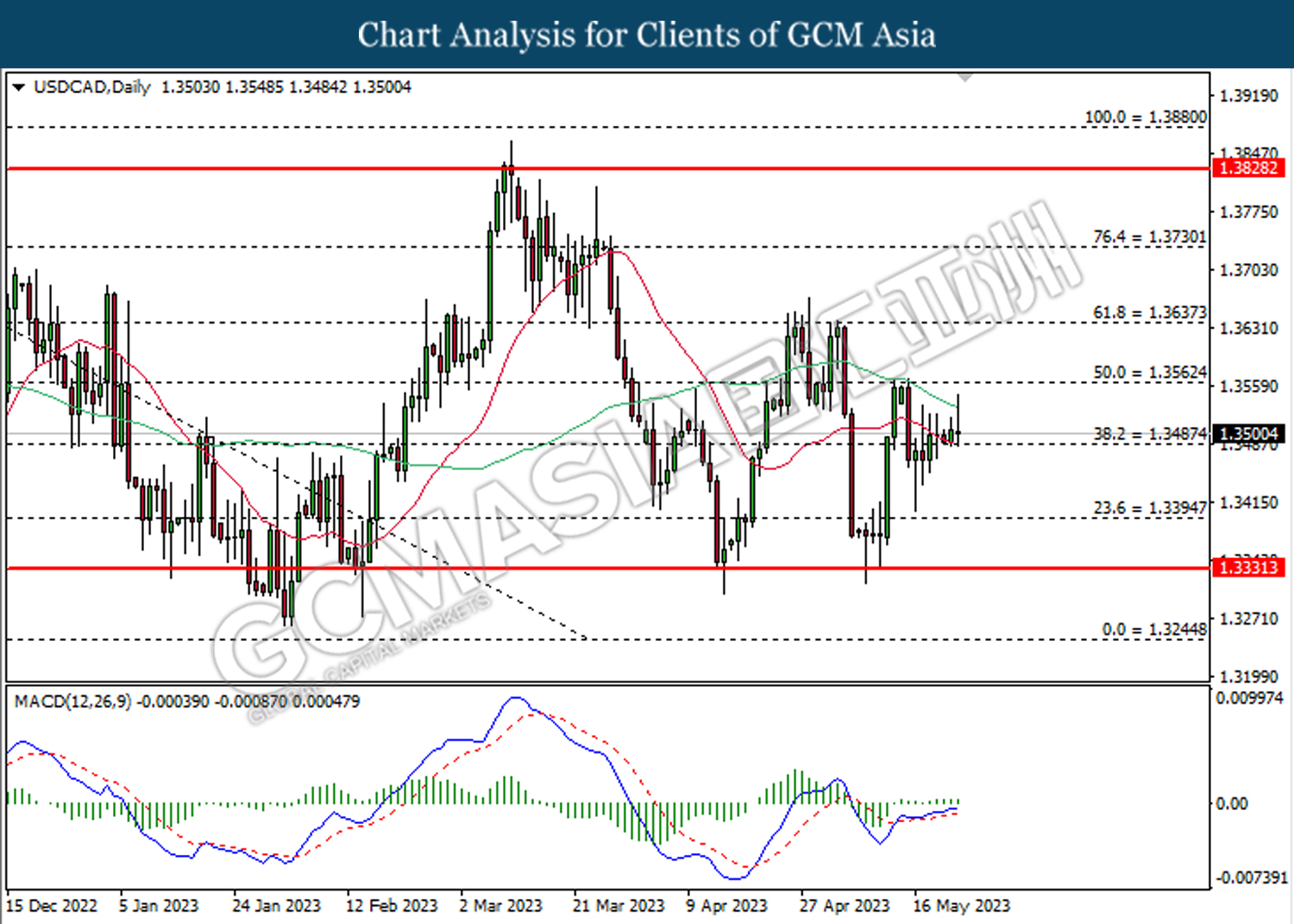

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3485. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3560.

Resistance level: 1.3560, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1980.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55