24 June 2020 Afternoon Session Analysis

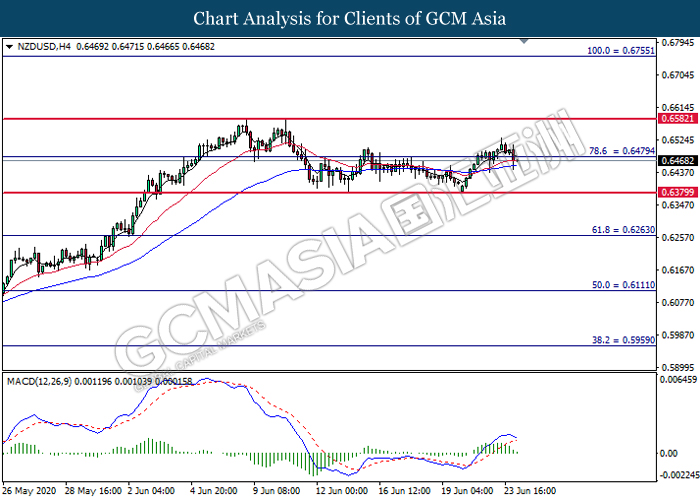

Kiwi fell amid dovish RBNZ.

During late Asian session, the New Zealand Kiwi which traded against the greenback and other currency pair have plummet after RBNZ leaves its door open for additional stimulus. According to RBNZ, the official cash rate remain unchanged at a record low of 0.25% as widely expected for the second month. However, its meeting minutes have expressed a dovish tone which showed the board members believe that possible negative outcomes from the global pandemic remain severe and larger than any near-term upside surprises. The central bank stated that it is prepared to use additional monetary policy tolls as required and committed to review asset purchase program. On top of that, the RBNZ also expressed its concern on the Kiwi value where it stated that the rising exchange rate have put pressure on the export earnings. At the time of writing, NZD/USD fell 0.26% to 0.6470.

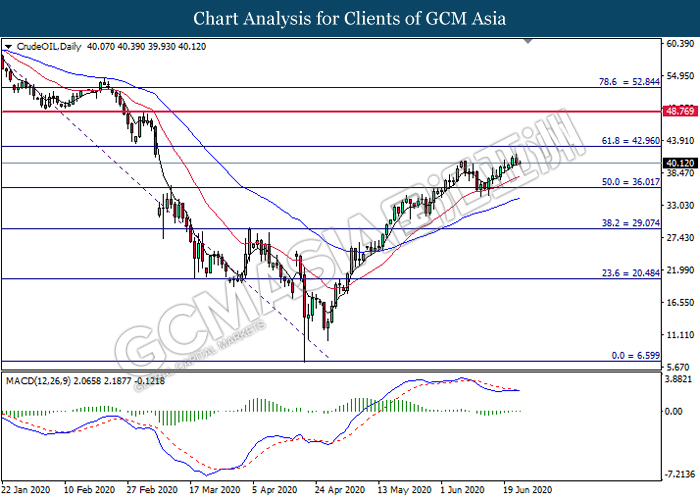

In the commodities market, crude oil price retreats 0.09% to $40.09 per barrel as of writing following increasing build concerns and growing unease of price growing too much. As API recently report higher than expected stockpiles, market are also forecasting the same results for the upcoming EIA crude oil report. On top of that, Growing unease among some that the market had gone up too much in too short a time have also weigh on the sentiment. On the other hand, gold price rose 0.05% to $1767.99 a troy ounce at the time of writing following dollar weakness which prompt higher demand for the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | Euro – German Ifo Business Climate Index (Jun) | 79.5 | 85.0 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.215M | -0.152M | – |

Technical Analysis

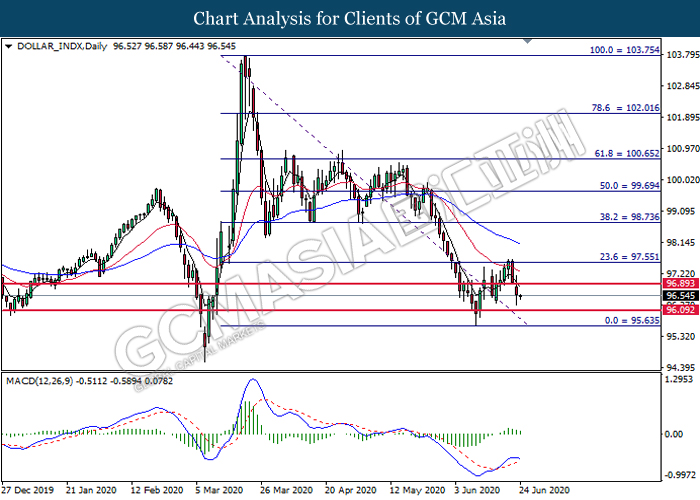

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 96.90. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 96.10.

Resistance level: 96.90, 97.55

Support level: 96.10, 95.65

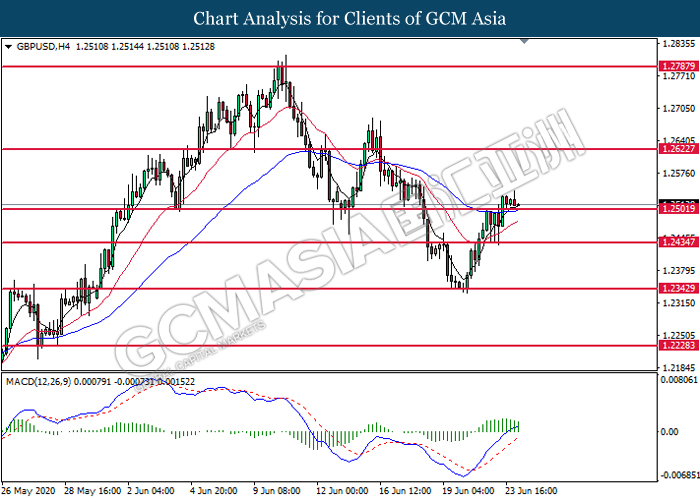

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2500. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2500.

Resistance level: 1.2625, 1.2790

Support level: 1.2500, 1.2435

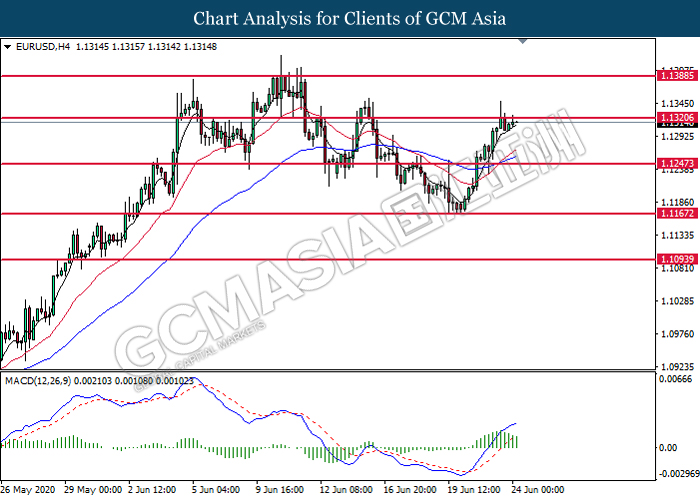

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1320. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to undergo technical retracement toward the support level at 1.1245.

Resistance level: 1.1320, 1.1390

Support level: 1.1245, 1.1165

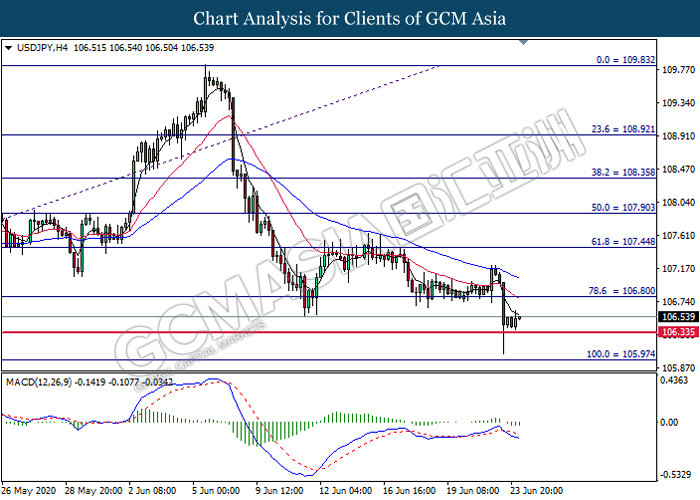

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 106.35. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound toward the resistance level at 106.80.

Resistance level: 106.80, 107.45

Support level: 106.35, 105.95

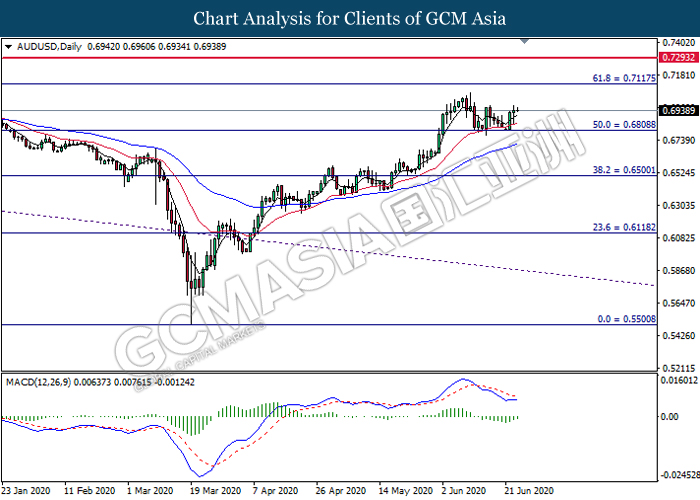

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6810. MACD which display diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 0.7115.

Resistance level: 0.7115, 0.7295

Support level: 0.6810, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level at 0.6480. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 0.6380.

Resistance level: 0.6480, 0.6580

Support level: 0.6380, 0.6265

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3500. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 1.3675.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3355

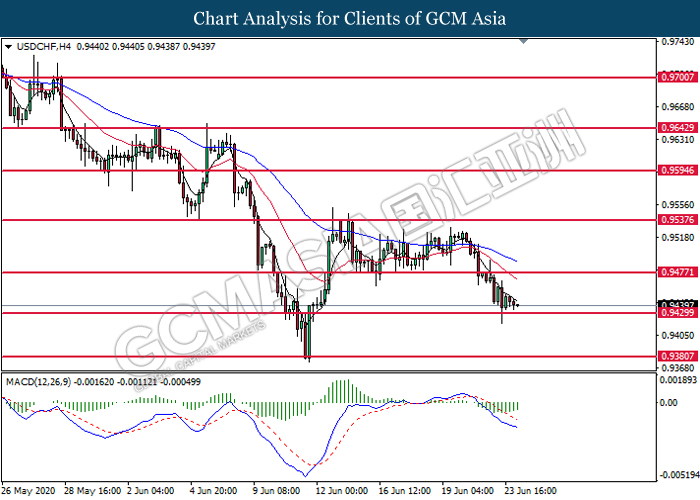

USDCHF, H4: USDCHF was traded lower while currently testing near the support level at 0.9430. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to undergo technical correction toward the resistance level at 0.9475.

Resistance level: 0.9475, 0.9540

Support level: 0.9430, 0.9380

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 36.00. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains toward the resistance level at 42.95.

Resistance level: 42.95, 48.75

Support level: 36.00, 29.05

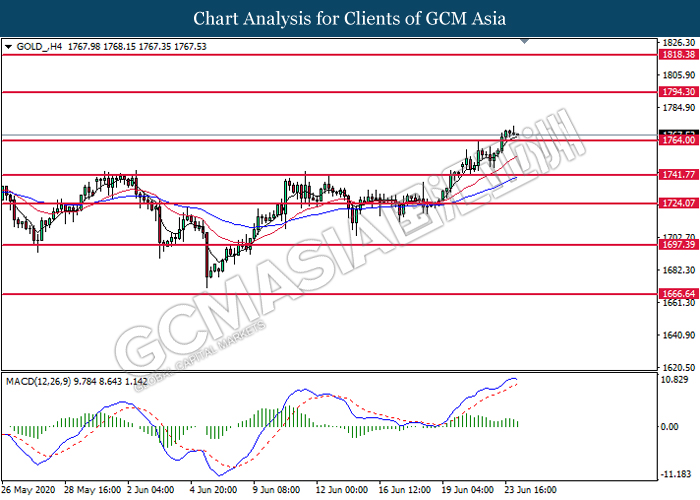

GOLD_, H4: Gold price was traded lower following prior retracement from the higher level. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its downward momentum toward the support level at 1764.00.

Resistance level: 1794.30, 1818.40

Support level: 1764.00, 1741.75